444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The MEA halal food and beverage market represents one of the most dynamic and rapidly expanding sectors within the Middle East and Africa region. This comprehensive market encompasses a wide range of products that comply with Islamic dietary laws, serving the growing Muslim population across diverse geographical territories. Market dynamics indicate substantial growth momentum driven by increasing consumer awareness, religious adherence, and expanding distribution networks throughout the region.

Regional expansion has been particularly notable in key markets including Saudi Arabia, UAE, Egypt, Nigeria, and South Africa, where halal certification has become increasingly standardized. The market demonstrates robust growth patterns with a projected compound annual growth rate of 8.2% CAGR through the forecast period. Consumer preferences continue to evolve toward premium halal products, organic alternatives, and innovative food solutions that maintain strict compliance with Islamic dietary requirements.

Industry transformation has been accelerated by technological advancements in food processing, improved supply chain management, and enhanced certification processes. The market benefits from strong government support across multiple MEA countries, with regulatory frameworks increasingly favoring halal food production and distribution. Investment flows into the sector have intensified, with both domestic and international companies recognizing the significant opportunities within this specialized market segment.

The MEA halal food and beverage market refers to the comprehensive ecosystem of food and drink products that comply with Islamic dietary laws (Shariah) and are produced, processed, and distributed within the Middle East and Africa region. Halal certification ensures that products meet strict religious requirements, including specific animal slaughter methods, ingredient sourcing, and processing standards that align with Islamic principles.

Market scope encompasses various product categories including meat and poultry, dairy products, processed foods, beverages, confectionery, and bakery items. The definition extends beyond mere ingredient compliance to include entire supply chain management, from sourcing and manufacturing to packaging and distribution. Certification bodies play crucial roles in validating halal compliance through rigorous auditing processes and ongoing monitoring systems.

Geographic coverage spans across diverse markets within the MEA region, each with unique regulatory requirements, consumer preferences, and market characteristics. The market serves not only Muslim consumers but also increasingly attracts non-Muslim consumers who associate halal products with quality, safety, and ethical production practices. Market evolution continues to expand the definition to include sustainability, organic production, and premium quality standards alongside traditional halal requirements.

Strategic positioning of the MEA halal food and beverage market reveals exceptional growth potential driven by demographic trends, religious observance, and expanding consumer awareness. The market demonstrates strong fundamentals with increasing penetration rates across urban and rural areas, supported by improved distribution infrastructure and enhanced product availability.

Key growth drivers include rising Muslim population demographics, increasing disposable income levels, and growing demand for premium halal products. The market benefits from 65% consumer preference for certified halal products over conventional alternatives, indicating strong brand loyalty and trust in halal certification systems. Innovation trends focus on product diversification, packaging improvements, and technology integration throughout the value chain.

Competitive landscape features both established multinational corporations and emerging regional players, creating dynamic market conditions that foster innovation and competitive pricing. The market shows resilient performance despite economic fluctuations, with consistent demand patterns supporting steady growth trajectories. Investment opportunities remain abundant across various market segments, from traditional food categories to emerging health-conscious and organic product lines.

Market intelligence reveals several critical insights that define the current landscape and future trajectory of the MEA halal food and beverage sector. Consumer behavior analysis indicates increasing sophistication in product selection, with quality, taste, and nutritional value becoming equally important alongside halal compliance.

Primary growth drivers propelling the MEA halal food and beverage market encompass demographic, economic, and cultural factors that create sustained demand for halal-certified products. Population dynamics represent the most significant driver, with the Muslim population in the MEA region continuing to expand at substantial rates, creating an ever-growing consumer base for halal products.

Economic prosperity across key MEA markets has resulted in increased disposable income levels, enabling consumers to prioritize quality and certification over price considerations. This economic evolution has transformed the market from basic necessity fulfillment to premium product consumption. Urbanization trends have further accelerated market growth by concentrating populations in areas with better distribution networks and retail infrastructure.

Religious awareness and adherence to Islamic dietary laws have intensified among younger generations, who demonstrate stronger commitment to halal consumption patterns. Educational initiatives by religious institutions and community organizations have enhanced understanding of halal requirements, leading to more informed consumer choices. Government support through favorable policies, subsidies, and regulatory frameworks has created an enabling environment for market expansion.

Technological advancement in food processing, packaging, and distribution has improved product quality, shelf life, and availability of halal products. International trade facilitation and improved logistics networks have expanded market reach and reduced costs, making halal products more accessible to broader consumer segments across the region.

Operational challenges within the MEA halal food and beverage market present significant constraints that impact growth potential and market development. Certification complexity remains a primary restraint, with varying standards and requirements across different countries creating confusion and increased compliance costs for manufacturers and distributors.

Supply chain limitations in certain regions restrict product availability and increase distribution costs, particularly in remote areas where infrastructure development lags behind urban centers. Economic volatility in some MEA markets affects consumer purchasing power and creates uncertainty for long-term investment planning in the halal food sector.

Regulatory inconsistencies across different countries within the MEA region create barriers to cross-border trade and complicate market entry strategies for international companies. Quality control challenges in maintaining consistent halal standards throughout complex supply chains require significant investment in monitoring and verification systems.

Competition from conventional products continues to pressure market share, particularly in price-sensitive segments where consumers may prioritize cost over certification. Limited awareness in certain demographic segments about the benefits and importance of halal certification constrains market penetration in some areas. Skilled workforce shortages in halal food processing and certification create operational bottlenecks that limit production capacity and market expansion capabilities.

Emerging opportunities within the MEA halal food and beverage market present substantial potential for growth and innovation across multiple dimensions. Export expansion represents a significant opportunity, with growing global demand for halal products creating new revenue streams for MEA-based producers and manufacturers.

Product innovation in health-conscious and organic halal products addresses evolving consumer preferences for nutritious, sustainable food options. Technology integration offers opportunities to enhance supply chain transparency, improve certification processes, and develop direct-to-consumer distribution channels through digital platforms.

Market penetration in underserved regions within the MEA area presents growth opportunities, particularly in rural areas where improved distribution networks could unlock significant demand. Premium positioning strategies can capture higher-value market segments willing to pay premium prices for superior quality and enhanced product features.

Strategic partnerships between local and international companies can leverage complementary strengths in market knowledge, distribution networks, and product development capabilities. Government initiatives supporting halal industry development create opportunities for public-private partnerships and access to favorable financing terms. Tourism integration with the growing halal tourism sector opens new channels for product promotion and market expansion.

Market dynamics within the MEA halal food and beverage sector reflect complex interactions between supply-side capabilities, demand-side preferences, and regulatory environments. Competitive intensity has increased significantly as both domestic and international players recognize the market potential and invest in capacity expansion and product development.

Price dynamics show interesting patterns, with premium halal products commanding higher margins while basic categories face pressure from conventional alternatives. Innovation cycles have accelerated, with companies introducing new products at faster rates to capture emerging consumer trends and preferences. Distribution evolution continues to transform market access, with traditional retail channels complemented by modern trade formats and digital platforms.

Consumer behavior demonstrates increasing sophistication, with buyers becoming more discerning about product quality, ingredient transparency, and brand reputation. Seasonal variations create predictable demand patterns, particularly during religious observances and cultural celebrations that drive increased consumption of specific halal products.

Supply chain dynamics have evolved toward greater integration and efficiency, with companies investing in vertical integration strategies to ensure quality control and cost optimization. Regulatory evolution continues to shape market conditions, with harmonization efforts across the region gradually reducing barriers to trade and investment. According to MarkWide Research analysis, these dynamic factors contribute to market resilience and sustained growth momentum across diverse economic conditions.

Comprehensive research approach employed in analyzing the MEA halal food and beverage market incorporates multiple data collection methods and analytical frameworks to ensure accuracy and reliability of insights. Primary research includes extensive interviews with industry stakeholders, including manufacturers, distributors, retailers, and consumers across key markets within the MEA region.

Secondary research encompasses analysis of industry reports, government publications, trade association data, and academic studies related to halal food markets and consumer behavior. Market surveys conducted across diverse demographic segments provide quantitative insights into consumer preferences, purchasing patterns, and brand perceptions.

Data triangulation methods ensure consistency and validation of findings through cross-referencing multiple sources and analytical approaches. Statistical analysis employs advanced modeling techniques to identify trends, correlations, and predictive patterns within the market data. Expert consultations with industry specialists, religious authorities, and certification bodies provide qualitative insights into market dynamics and future developments.

Regional analysis methodology accounts for cultural, economic, and regulatory differences across various MEA markets, ensuring localized insights while maintaining regional perspective. Longitudinal studies track market evolution over time, identifying cyclical patterns and long-term trends that inform strategic recommendations and market projections.

Regional market distribution across the MEA halal food and beverage sector reveals distinct characteristics and growth patterns that reflect local economic conditions, cultural preferences, and regulatory environments. Gulf Cooperation Council countries demonstrate the highest per-capita consumption rates and premium product preferences, driven by strong economic conditions and sophisticated consumer bases.

Saudi Arabia leads the regional market with 28% market share, benefiting from large population size, strong purchasing power, and comprehensive halal certification infrastructure. The kingdom’s Vision 2030 initiatives have further accelerated market development through strategic investments and regulatory improvements. United Arab Emirates serves as a crucial hub for regional distribution and international trade, with Dubai and Abu Dhabi functioning as gateway markets for the broader region.

North African markets, including Egypt, Morocco, and Algeria, represent significant growth opportunities with large Muslim populations and improving economic conditions. Egypt accounts for 18% regional market share, driven by its substantial population base and growing food processing industry. Sub-Saharan Africa markets, particularly Nigeria and South Africa, show strong growth potential with 22% combined market share and increasing consumer awareness of halal certification benefits.

Levantine markets including Jordan, Lebanon, and Palestine demonstrate resilience despite regional challenges, with strong cultural ties to halal consumption patterns. Market integration across the region continues to improve through trade agreements, standardized certification processes, and enhanced logistics networks that facilitate cross-border commerce and investment flows.

Competitive structure within the MEA halal food and beverage market features a diverse mix of multinational corporations, regional champions, and specialized halal food companies. Market leadership positions are contested across different product categories, with no single company dominating the entire market spectrum.

Competitive strategies focus on product innovation, distribution network expansion, and strategic acquisitions to strengthen market positions. Brand building efforts emphasize quality, authenticity, and religious compliance to build consumer trust and loyalty. Pricing competition varies by segment, with premium categories showing less price sensitivity compared to basic commodity products.

Market segmentation within the MEA halal food and beverage sector reveals distinct categories based on product type, distribution channel, price positioning, and consumer demographics. Product-based segmentation provides the primary framework for market analysis and strategic planning.

By Product Category:

By Distribution Channel:

By Price Positioning:

Meat and poultry represents the largest and most established category within the MEA halal food market, accounting for substantial market share due to cultural dietary preferences and religious requirements. Fresh meat dominates consumption patterns, though processed meat products show strong growth potential as urbanization increases demand for convenience foods.

Dairy products demonstrate consistent growth across the region, with traditional products like yogurt and cheese maintaining strong demand alongside innovative dairy alternatives. Functional dairy products enriched with vitamins, probiotics, and other health benefits show particular promise among health-conscious consumers.

Processed foods category exhibits the highest growth rates as busy lifestyles drive demand for convenient, ready-to-consume halal products. Frozen foods segment within processed categories shows exceptional growth potential, particularly in urban markets with adequate cold chain infrastructure. Snack foods represent an emerging opportunity with younger consumers driving demand for halal-certified snacking options.

Beverages sector benefits from hot climate conditions across much of the MEA region, with fruit juices and functional drinks showing strong performance. Energy drinks and sports beverages represent growing segments, particularly among younger demographics. Traditional beverages with cultural significance maintain steady demand while modern formulations attract new consumer segments.

Bakery products show regional variations in preferences, with traditional bread types maintaining dominance while Western-style baked goods gain popularity in urban areas. Artisanal bakery products command premium prices and show strong growth in affluent market segments.

Industry participants in the MEA halal food and beverage market enjoy numerous strategic advantages that enhance profitability and competitive positioning. Market access to a large and growing Muslim consumer base provides sustainable demand foundation for long-term business planning and investment strategies.

Premium pricing opportunities exist for certified halal products, as consumers demonstrate willingness to pay higher prices for religious compliance and quality assurance. Brand differentiation through halal certification creates competitive advantages and builds consumer loyalty in increasingly crowded market segments.

Export potential extends market reach beyond regional boundaries, with global halal food demand creating opportunities for MEA-based producers to access international markets. Government support through favorable policies, tax incentives, and infrastructure development reduces operational costs and regulatory barriers.

Supply chain integration opportunities allow companies to capture value across multiple stages of production and distribution, improving margins and quality control. Innovation incentives drive product development and technological advancement, creating first-mover advantages in emerging product categories.

Stakeholder benefits extend to consumers through improved product quality, greater variety, and enhanced accessibility of halal-certified products. Economic development in rural areas occurs through agricultural integration and food processing investments that create employment and income opportunities. Religious compliance assurance provides peace of mind for Muslim consumers while attracting quality-conscious non-Muslim consumers.

Strengths:

Weaknesses:

Opportunities:

Threats:

Health and wellness trends significantly influence the MEA halal food and beverage market, with consumers increasingly seeking products that combine religious compliance with nutritional benefits. Organic halal products represent a rapidly growing trend, as health-conscious consumers prioritize natural ingredients and sustainable production methods alongside halal certification.

Convenience food evolution drives innovation in ready-to-eat and easy-preparation halal products that cater to busy urban lifestyles. Premium positioning trends show consumers willing to pay higher prices for superior quality, authentic ingredients, and enhanced packaging that reflects product value and religious compliance.

Technology adoption accelerates across the value chain, with blockchain technology being explored for supply chain transparency and certification verification. E-commerce growth transforms distribution patterns, with online platforms becoming increasingly important for product discovery and purchase, particularly among younger consumers.

Sustainability focus emerges as a significant trend, with companies adopting environmentally friendly packaging, sustainable sourcing practices, and reduced carbon footprint operations. Localization strategies gain importance as companies adapt global products to local tastes, preferences, and cultural requirements while maintaining halal compliance.

Functional foods trend continues to expand, with halal products enriched with vitamins, minerals, probiotics, and other health-promoting ingredients gaining popularity. Artisanal and craft food movements influence consumer preferences toward small-batch, traditional production methods that emphasize authenticity and quality craftsmanship.

Regulatory harmonization efforts across MEA countries aim to standardize halal certification processes and reduce trade barriers, facilitating easier market access and cross-border commerce. Investment announcements by major food companies indicate continued confidence in market growth potential and long-term profitability.

Technology partnerships between food companies and technology providers focus on improving supply chain transparency, certification processes, and consumer engagement through digital platforms. Capacity expansion projects across the region demonstrate industry commitment to meeting growing demand and capturing market opportunities.

Certification body developments include establishment of new accreditation organizations and mutual recognition agreements that streamline certification processes. Research and development investments by leading companies focus on product innovation, nutritional enhancement, and processing technology improvements.

Strategic acquisitions and partnerships reshape competitive landscape as companies seek to strengthen market positions, expand geographic reach, and enhance product portfolios. Infrastructure development projects, including cold storage facilities and distribution centers, improve market accessibility and reduce operational costs.

Government initiatives supporting halal industry development include establishment of halal industrial parks, provision of financing facilities, and implementation of supportive regulatory frameworks. MWR data indicates that these developments collectively contribute to market maturation and enhanced growth prospects across the region.

Strategic recommendations for market participants emphasize the importance of comprehensive market entry strategies that account for regional diversity and local preferences. Investment priorities should focus on building robust supply chain capabilities, obtaining necessary certifications, and establishing strong distribution networks across key markets.

Product development strategies should prioritize innovation in health-conscious and convenience-oriented products while maintaining strict halal compliance. Brand positioning efforts should emphasize quality, authenticity, and religious compliance to build consumer trust and loyalty in competitive market environments.

Partnership strategies with local companies can provide valuable market knowledge, distribution access, and regulatory expertise that accelerate market entry and expansion. Technology adoption should focus on supply chain transparency, quality control, and consumer engagement to differentiate products and build competitive advantages.

Market expansion approaches should consider both geographic diversification within the MEA region and product category expansion to capture broader market opportunities. Sustainability initiatives should be integrated into business strategies to address growing consumer environmental consciousness and regulatory requirements.

Risk management strategies should address potential supply chain disruptions, regulatory changes, and economic volatility through diversification and contingency planning. Consumer engagement through digital platforms and social media can build brand awareness and loyalty among younger demographic segments driving market growth.

Long-term prospects for the MEA halal food and beverage market remain highly positive, supported by fundamental demographic trends, economic development, and increasing consumer sophistication. Market evolution is expected to continue toward premium products, innovative formulations, and enhanced convenience offerings that meet changing lifestyle requirements.

Growth projections indicate sustained expansion across all major product categories, with processed foods and beverages showing particularly strong potential. Regional integration efforts are expected to reduce trade barriers and facilitate market access, creating opportunities for companies with regional expansion strategies.

Technology integration will likely accelerate, with digital platforms, blockchain verification, and automated processing becoming standard industry practices. Sustainability requirements are expected to become more stringent, driving innovation in packaging, sourcing, and production methods.

Consumer preferences will continue evolving toward health-conscious, premium, and authentic products that combine religious compliance with modern lifestyle requirements. Export opportunities to global markets are expected to expand as international awareness and demand for halal products continue growing.

Investment flows into the sector are projected to increase, supporting capacity expansion, technology adoption, and market development initiatives. According to MarkWide Research projections, the market is positioned for sustained growth with compound annual growth rates expected to remain strong throughout the forecast period, driven by favorable demographic trends and increasing market penetration across diverse consumer segments.

Market assessment of the MEA halal food and beverage sector reveals a dynamic and rapidly expanding industry with substantial growth potential driven by favorable demographic trends, economic development, and increasing consumer awareness. Strategic positioning within this market offers significant opportunities for companies willing to invest in quality, certification, and consumer-focused innovation.

Competitive advantages in the halal food market stem from religious compliance, quality assurance, and brand trust that create sustainable differentiation in crowded market segments. Growth trajectory remains positive across all major product categories and geographic markets within the MEA region, supported by improving infrastructure and regulatory environments.

Success factors for market participants include comprehensive understanding of local preferences, robust certification processes, efficient distribution networks, and continuous innovation in product development. Future opportunities will likely emerge from technology integration, sustainability initiatives, and expansion into underserved market segments and geographic areas.

The MEA halal food and beverage market represents one of the most promising sectors within the regional food industry, offering sustainable growth potential for companies that can effectively navigate regulatory requirements, cultural preferences, and competitive dynamics while delivering high-quality products that meet evolving consumer expectations and religious compliance standards.

What is MEA Halal Food & Beverage?

MEA Halal Food & Beverage refers to food and drink products that comply with Islamic dietary laws, ensuring they are permissible for consumption by Muslims. This includes a wide range of products such as meat, dairy, snacks, and beverages that are certified halal.

What are the key companies in the MEA Halal Food & Beverage Market?

Key companies in the MEA Halal Food & Beverage Market include Al-Foah, Nestlé, and Americana Group, which are known for their extensive range of halal-certified products. These companies play a significant role in meeting the growing demand for halal food in the region, among others.

What are the growth factors driving the MEA Halal Food & Beverage Market?

The growth of the MEA Halal Food & Beverage Market is driven by increasing Muslim populations, rising awareness of halal dietary practices, and a growing demand for halal-certified products among non-Muslim consumers. Additionally, the expansion of retail channels and e-commerce is facilitating access to halal products.

What challenges does the MEA Halal Food & Beverage Market face?

The MEA Halal Food & Beverage Market faces challenges such as the lack of standardized halal certification processes and varying interpretations of halal across different regions. Additionally, competition from non-halal products can impact market growth.

What opportunities exist in the MEA Halal Food & Beverage Market?

Opportunities in the MEA Halal Food & Beverage Market include the potential for product innovation, such as plant-based halal options, and the expansion into new markets outside the traditional consumer base. There is also a growing trend towards health-conscious halal products.

What trends are shaping the MEA Halal Food & Beverage Market?

Trends shaping the MEA Halal Food & Beverage Market include the increasing popularity of online shopping for halal products, the rise of gourmet halal offerings, and a focus on sustainability in sourcing and production. These trends reflect changing consumer preferences and a desire for quality and ethical consumption.

MEA Halal Food & Beverage Market

| Segmentation Details | Description |

|---|---|

| Product Type | Meat, Dairy, Beverages, Snacks |

| Distribution Channel | Supermarkets, Online Retail, Convenience Stores, Specialty Shops |

| End User | Households, Restaurants, Catering Services, Food Manufacturers |

| Certification | Halal Certified, Non-Halal, Organic, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

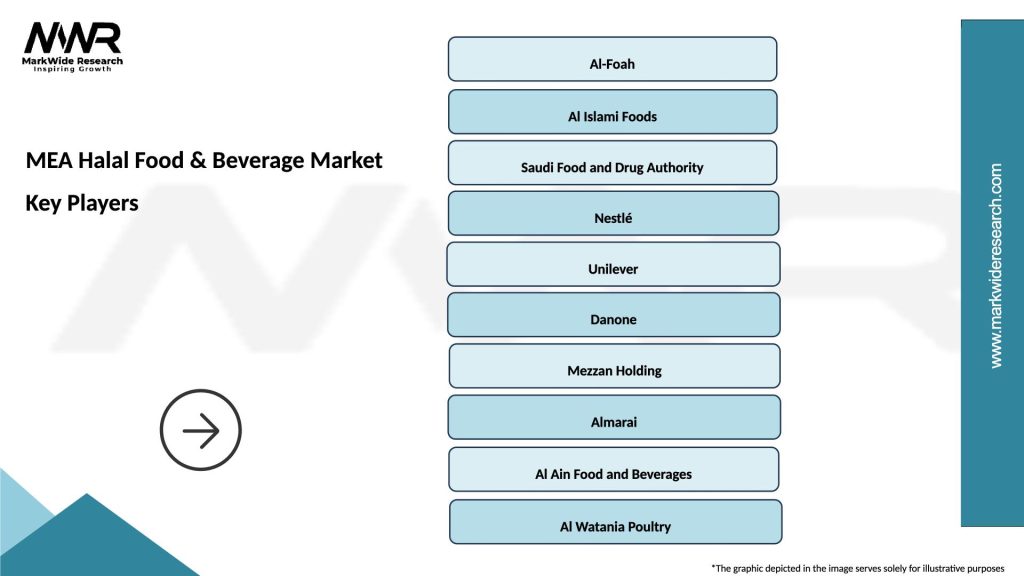

Leading companies in the MEA Halal Food & Beverage Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at