444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The MEA hair care market represents a dynamic and rapidly evolving sector within the Middle East and Africa region, encompassing a diverse range of products designed to address the unique hair care needs of consumers across varied climatic conditions and cultural preferences. This comprehensive market includes shampoos, conditioners, hair oils, styling products, treatments, and specialized formulations tailored to different hair types and textures prevalent in the region.

Market dynamics in the MEA region are characterized by increasing consumer awareness about hair health, rising disposable incomes, and growing influence of international beauty trends. The market demonstrates significant growth potential, with industry analysts projecting a robust CAGR of 6.2% over the forecast period. This growth trajectory is supported by expanding retail infrastructure, digital commerce penetration, and evolving consumer preferences toward premium and natural hair care solutions.

Regional diversity plays a crucial role in shaping market demand, with countries like Saudi Arabia, UAE, South Africa, and Egypt leading consumption patterns. The market benefits from a young demographic profile, with approximately 65% of the population under 35 years of age, driving demand for innovative and trend-focused hair care products. Additionally, increasing urbanization rates across the region, currently at 68%, contribute to higher product adoption and brand awareness.

The MEA hair care market refers to the comprehensive ecosystem of hair care products, services, and solutions specifically designed and distributed across the Middle East and Africa regions. This market encompasses all consumer products intended for hair cleansing, conditioning, styling, treatment, and maintenance, ranging from basic daily care items to specialized therapeutic and cosmetic formulations.

Market scope includes both mass-market and premium segments, covering traditional formulations as well as innovative products incorporating advanced ingredients and technologies. The market serves diverse consumer needs across different hair types, from straight and wavy to curly and coily textures, while addressing specific regional challenges such as humidity, heat exposure, and water quality variations that affect hair health and appearance.

Geographic coverage spans major economies including Saudi Arabia, United Arab Emirates, Egypt, South Africa, Nigeria, Morocco, and other emerging markets within the MEA region. The market definition encompasses retail channels, professional salon products, and direct-to-consumer offerings, reflecting the multi-faceted nature of hair care product distribution and consumption patterns across these diverse markets.

Strategic market positioning within the MEA hair care sector reveals a landscape characterized by significant growth opportunities, driven by demographic advantages, increasing beauty consciousness, and expanding retail accessibility. The market demonstrates resilience and adaptability, with local and international brands competing to capture market share through product innovation, targeted marketing, and distribution expansion.

Key growth drivers include rising female workforce participation, increasing social media influence on beauty trends, and growing awareness of hair care as an essential component of personal grooming. The market benefits from cultural emphasis on appearance and grooming, with hair care representing a significant portion of personal care spending across the region. Consumer preferences are shifting toward products offering multiple benefits, natural ingredients, and solutions addressing specific regional hair care challenges.

Market segmentation reveals strong performance across multiple product categories, with shampoos and conditioners maintaining dominant positions while specialized treatments and styling products show accelerated growth. The premium segment demonstrates particular strength, growing at approximately 8.5% annually, indicating consumer willingness to invest in higher-quality hair care solutions. E-commerce penetration continues expanding, representing 22% of total sales and providing brands with direct consumer engagement opportunities.

Consumer behavior analysis reveals several critical insights shaping the MEA hair care market landscape. The following key insights demonstrate the market’s evolution and growth potential:

Economic prosperity across key MEA markets serves as a fundamental driver for hair care market expansion. Rising GDP per capita, particularly in Gulf Cooperation Council countries, enables consumers to allocate higher spending toward personal care and beauty products. This economic growth translates into increased purchasing power and willingness to experiment with premium hair care solutions.

Demographic advantages significantly contribute to market growth, with the region’s young population driving demand for innovative and trendy hair care products. The growing female workforce participation rate, currently at 35% regionally, creates additional demand for professional grooming products and time-efficient hair care solutions. Urbanization trends further amplify market potential by concentrating consumers in areas with better retail access and higher beauty consciousness.

Cultural and social factors play crucial roles in driving market expansion. Traditional emphasis on personal grooming and appearance, combined with increasing exposure to international beauty standards through social media and entertainment, creates sustained demand for hair care products. Religious and cultural practices that emphasize hair care and coverage contribute to consistent product usage patterns across diverse consumer segments.

Technological advancement in product formulations and manufacturing processes enables brands to develop solutions specifically addressing regional hair care challenges. Innovation in ingredients, packaging, and application methods attracts consumers seeking effective and convenient hair care solutions. Additionally, digital commerce growth provides brands with expanded reach and direct consumer engagement opportunities.

Economic volatility in certain MEA markets poses challenges for consistent market growth, particularly in regions dependent on commodity exports. Currency fluctuations and inflation pressures can impact consumer spending on non-essential items, including premium hair care products. Political instability in some markets creates uncertainty for brand investment and expansion strategies.

Regulatory complexities across different MEA countries create barriers for product registration, marketing, and distribution. Varying standards for cosmetic products, labeling requirements, and import regulations increase compliance costs and market entry complexity for both local and international brands. Halal certification requirements in certain markets add additional regulatory considerations for product formulation and marketing.

Infrastructure limitations in rural and remote areas restrict market penetration and product accessibility. Limited retail infrastructure, particularly in parts of Africa, constrains distribution reach and consumer access to diverse hair care options. Cold chain requirements for certain products and logistics challenges in remote areas further limit market expansion potential.

Cultural sensitivities and traditional preferences in some markets may resist adoption of modern hair care products or international beauty standards. Conservative attitudes toward personal care marketing and product positioning require careful brand strategy development. Additionally, preference for traditional and homemade hair care solutions in certain communities limits commercial product adoption.

Digital transformation presents significant opportunities for market expansion and consumer engagement. E-commerce growth, social media marketing, and digital beauty consultations enable brands to reach previously inaccessible consumer segments. Mobile commerce adoption, particularly among younger demographics, creates new channels for product discovery, education, and purchase.

Product innovation opportunities exist in developing specialized formulations addressing specific regional needs, such as products for hard water conditions, extreme heat protection, and culturally relevant ingredients. Natural and organic product segments show substantial growth potential, with consumers increasingly seeking clean beauty alternatives. Customization and personalization trends offer opportunities for brands to develop tailored solutions for individual hair types and concerns.

Market expansion potential remains significant in underserved regions and demographic segments. Rural market penetration, male grooming segment development, and premium product category expansion present growth opportunities. Professional salon channel development and beauty service integration offer additional revenue streams and brand positioning opportunities.

Partnership and collaboration opportunities with local distributors, beauty professionals, and cultural influencers can accelerate market penetration and brand acceptance. Strategic alliances with retail chains, online platforms, and beauty service providers enable expanded market reach and consumer touchpoints. Additionally, sustainability initiatives and social responsibility programs can enhance brand reputation and consumer loyalty.

Supply chain evolution within the MEA hair care market reflects increasing sophistication and efficiency improvements. Local manufacturing capabilities are expanding, reducing import dependency and enabling more competitive pricing strategies. Regional distribution networks are becoming more robust, with improved logistics infrastructure supporting better product availability and faster market response times.

Competitive intensity continues escalating as both international and local brands compete for market share. Price competition remains significant in mass-market segments, while premium segments focus on differentiation through innovation, quality, and brand positioning. MarkWide Research analysis indicates that market consolidation trends are emerging, with larger players acquiring local brands to expand regional presence and consumer reach.

Consumer empowerment through digital platforms and social media is reshaping brand-consumer relationships. Direct feedback mechanisms, online reviews, and social media engagement enable consumers to influence product development and brand strategies. This dynamic creates opportunities for responsive brands while challenging those unable to adapt quickly to changing consumer preferences and expectations.

Regulatory harmonization efforts across certain MEA regions are gradually reducing compliance complexity and facilitating cross-border trade. Standardization initiatives in product safety, labeling, and marketing claims help streamline market entry processes. However, regional variations in regulatory approaches continue requiring tailored compliance strategies for different markets.

Comprehensive data collection methodologies were employed to ensure accurate and representative market analysis. Primary research included consumer surveys, industry expert interviews, and retail channel assessments across major MEA markets. Secondary research encompassed industry reports, government statistics, trade association data, and company financial disclosures to provide comprehensive market understanding.

Market sizing approaches utilized multiple validation methods, including top-down and bottom-up analyses, to ensure accuracy and reliability. Consumer spending patterns, retail sales data, and import/export statistics were analyzed to develop comprehensive market perspectives. Regional variations in consumption patterns, pricing structures, and distribution channels were carefully considered in the analysis framework.

Qualitative research components included focus group discussions, in-depth interviews with industry stakeholders, and observational studies of consumer behavior in retail environments. These methodologies provided insights into consumer preferences, purchasing decisions, and brand perceptions that quantitative data alone cannot capture.

Data validation processes ensured research accuracy through triangulation of multiple data sources, expert review panels, and statistical verification methods. Regional market experts provided local context and validation of findings to ensure cultural and market-specific accuracy. Continuous monitoring and updating of data sources maintain research relevance and accuracy over time.

Gulf Cooperation Council markets, including Saudi Arabia, UAE, Kuwait, and Qatar, represent the most mature and affluent segments within the MEA hair care market. These markets demonstrate strong preference for premium and luxury hair care products, with consumers willing to invest in high-quality formulations and international brands. The region accounts for approximately 42% of total MEA market value, despite representing a smaller population base.

North African markets, particularly Egypt, Morocco, and Tunisia, show significant growth potential driven by large population bases and increasing urbanization. These markets demonstrate strong cultural traditions in hair care, creating opportunities for products that blend traditional ingredients with modern formulations. Consumer price sensitivity remains higher compared to Gulf markets, creating demand for value-oriented product positioning.

Sub-Saharan Africa represents the largest growth opportunity, with markets like South Africa, Nigeria, and Kenya leading regional development. The region’s diverse hair textures and types create demand for specialized product formulations. Local manufacturing capabilities are expanding, enabling more competitive pricing and culturally relevant product development. Market penetration rates remain relatively low, indicating substantial expansion potential.

Levantine markets, including Lebanon, Jordan, and Syria, demonstrate resilience despite regional challenges. These markets show sophisticated consumer preferences and strong beauty culture traditions. However, economic and political instabilities create market volatility and require flexible business strategies. E-commerce adoption is accelerating, providing alternative distribution channels during challenging periods.

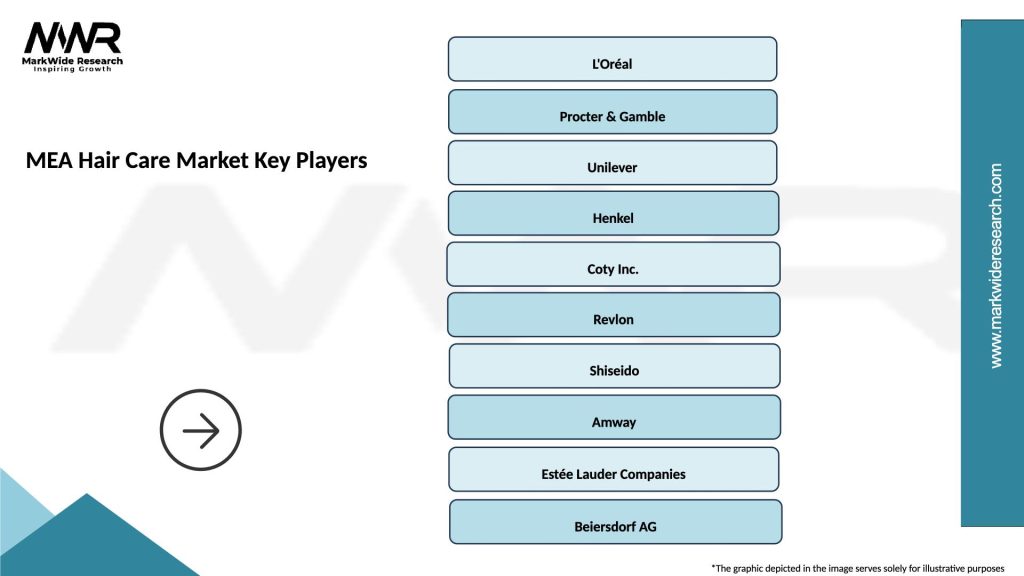

Market leadership within the MEA hair care sector is characterized by a mix of international beauty conglomerates and strong regional players. The competitive environment demonstrates increasing intensity as brands compete across multiple dimensions including product innovation, pricing strategies, distribution expansion, and marketing effectiveness.

Major international players maintain significant market presence through comprehensive product portfolios and extensive distribution networks:

Regional and local competitors demonstrate strong market knowledge and cultural relevance, often outperforming international brands in specific segments or geographic areas. These companies leverage local ingredient sourcing, cultural understanding, and competitive pricing to maintain market positions.

Emerging competition from direct-to-consumer brands and niche players focusing on natural, organic, and specialized formulations is intensifying market dynamics. These brands often utilize digital marketing and e-commerce channels to reach consumers directly, bypassing traditional retail distribution systems.

Product category segmentation reveals diverse market composition with varying growth rates and consumer preferences across different hair care solutions:

By Product Type:

By Price Range:

By Distribution Channel:

Shampoo category dominance reflects fundamental consumer need for hair cleansing solutions, with market evolution toward specialized formulations addressing specific hair types and concerns. Anti-dandruff shampoos maintain strong performance across the region, while sulfate-free and natural formulations show accelerated growth. Color-safe and damage repair shampoos gain popularity as hair coloring and styling practices increase.

Conditioning products demonstrate growing sophistication as consumers understand the importance of hair moisture and protection. Leave-in conditioners and hair masks show particularly strong growth, with consumers seeking intensive care solutions for damaged or chemically treated hair. Deep conditioning treatments gain popularity in markets with harsh climate conditions requiring additional hair protection.

Hair oil segment represents unique regional strength, combining traditional hair care practices with modern product innovation. Argan oil, coconut oil, and specialized oil blends maintain strong consumer preference. Modern formulations incorporating lightweight textures and additional benefits like heat protection expand market appeal beyond traditional users.

Styling products category shows dynamic growth driven by increasing fashion consciousness and social media influence. Heat protection products gain importance as styling tool usage increases. Texturizing products, curl enhancers, and anti-frizz solutions address specific regional hair care needs related to humidity and climate conditions.

Treatment products represent the premium end of the market, with consumers increasingly willing to invest in specialized solutions for hair concerns. Protein treatments, scalp care products, and hair growth solutions show strong growth potential. Professional-grade treatments for home use gain popularity as consumers seek salon-quality results.

Manufacturers and brands benefit from expanding market opportunities, growing consumer base, and increasing willingness to pay premium prices for quality hair care solutions. The diverse regional market provides opportunities for product differentiation, local ingredient incorporation, and culturally relevant marketing strategies. Growing e-commerce channels enable direct consumer relationships and improved margin structures.

Retailers and distributors gain from increasing consumer traffic, higher basket values, and growing product category importance within personal care sections. Hair care products typically offer attractive margins and consistent repeat purchase patterns. Expanding premium segments provide opportunities for category upgrading and improved profitability.

Consumers benefit from increasing product variety, improved formulations, and better accessibility to quality hair care solutions. Competitive market dynamics drive innovation and value improvement, while digital channels provide better product information and purchasing convenience. Educational content and professional advice become more accessible through digital platforms.

Professional service providers including salons and beauty professionals gain from growing consumer interest in hair care and professional treatments. Retail product sales provide additional revenue streams, while professional expertise becomes increasingly valued by consumers seeking personalized solutions. Partnership opportunities with brands enable access to training, products, and marketing support.

Investors and stakeholders benefit from market growth potential, demographic advantages, and increasing consumer spending on personal care. The market’s resilience and cultural importance provide stability, while innovation opportunities and digital transformation create growth potential. Regional expansion and market development offer attractive investment opportunities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Natural and clean beauty movement represents the most significant trend shaping the MEA hair care market, with consumers increasingly seeking products free from harsh chemicals, sulfates, and synthetic ingredients. This trend drives innovation in formulation, packaging, and marketing approaches. Brands incorporating traditional regional ingredients like argan oil, black seed oil, and henna gain competitive advantages through cultural relevance and perceived naturalness.

Personalization and customization trends are gaining momentum as consumers seek hair care solutions tailored to their specific needs, hair types, and concerns. Digital tools enabling hair analysis, personalized product recommendations, and custom formulations attract tech-savvy consumers. This trend creates opportunities for premium pricing and enhanced customer loyalty through individualized experiences.

Sustainability consciousness influences purchasing decisions, with consumers showing preference for brands demonstrating environmental responsibility. Recyclable packaging, sustainable ingredient sourcing, and carbon-neutral operations become competitive differentiators. Water conservation messaging resonates particularly well in water-scarce regions within the MEA market.

Multi-functional products gain popularity as consumers seek efficiency and value in their hair care routines. Products combining cleansing, conditioning, and treatment benefits in single formulations appeal to busy lifestyles and cost-conscious consumers. Time-saving solutions that deliver professional results at home show strong growth potential.

Social media influence continues reshaping consumer behavior, product discovery, and brand engagement. Beauty influencers, tutorial content, and user-generated reviews significantly impact purchasing decisions. Brands investing in digital content creation and influencer partnerships achieve better market penetration and consumer engagement.

Manufacturing localization initiatives are accelerating across the MEA region, with international brands establishing local production facilities to reduce costs, improve supply chain efficiency, and better serve regional markets. These investments demonstrate long-term commitment to the region and enable more competitive pricing strategies for mass-market segments.

Digital transformation within the industry encompasses e-commerce platform development, digital marketing capabilities, and data analytics implementation. MWR research indicates that brands investing in digital capabilities achieve 23% higher growth rates compared to traditional retail-focused competitors. Virtual try-on technologies and AI-powered product recommendations enhance online shopping experiences.

Regulatory harmonization efforts across Gulf Cooperation Council countries are streamlining product registration processes and reducing compliance complexity. These developments facilitate cross-border trade and enable more efficient regional distribution strategies. Similar initiatives in other regional blocs may further simplify market entry and expansion processes.

Sustainability initiatives are becoming industry standards, with major brands committing to plastic reduction, sustainable sourcing, and carbon neutrality goals. These commitments drive innovation in packaging materials, ingredient sourcing, and manufacturing processes. Consumer awareness and preference for sustainable brands continue growing across the region.

Professional channel development includes salon partnerships, professional training programs, and exclusive product lines for beauty service providers. These initiatives strengthen brand relationships with professional users while creating additional distribution channels and revenue streams. Professional endorsements enhance consumer trust and product credibility.

Market entry strategies should prioritize understanding local consumer preferences, cultural sensitivities, and regulatory requirements before launching products or expanding operations. Successful brands invest in local market research, cultural adaptation, and partnership development to ensure market acceptance and sustainable growth.

Product development focus should emphasize natural ingredients, climate-appropriate formulations, and multi-functional benefits that address specific regional hair care challenges. Innovation in packaging, application methods, and product positioning can create competitive advantages in crowded market segments.

Distribution strategy optimization requires multi-channel approaches combining traditional retail, e-commerce, and professional channels. Investment in digital capabilities, logistics infrastructure, and retailer relationships enables comprehensive market coverage and consumer accessibility.

Brand positioning recommendations include authentic cultural connection, quality emphasis, and clear value proposition communication. Brands should leverage local insights, traditional ingredients, and regional beauty standards while maintaining international quality and innovation standards.

Investment priorities should focus on digital transformation, local manufacturing capabilities, and sustainability initiatives that align with evolving consumer preferences and regulatory requirements. Long-term success requires balancing immediate market opportunities with sustainable business practices and stakeholder value creation.

Growth trajectory for the MEA hair care market remains positive, supported by favorable demographic trends, increasing beauty consciousness, and expanding retail infrastructure. The market is expected to maintain steady growth momentum, with premium segments outperforming mass-market categories. Digital commerce penetration will continue expanding, potentially reaching 35% market share within the next five years.

Innovation acceleration will drive market evolution, with brands investing in advanced formulations, sustainable packaging, and personalized solutions. Biotechnology applications, including peptides and plant stem cells, will become more prevalent in premium product formulations. Smart packaging incorporating QR codes, NFC technology, and augmented reality features will enhance consumer engagement and brand differentiation.

Market consolidation trends may intensify as larger players acquire local brands and smaller competitors to expand regional presence and consumer reach. Strategic partnerships between international brands and local distributors will become increasingly important for market penetration and cultural relevance.

Sustainability integration will transition from competitive advantage to market requirement, with consumers expecting environmental responsibility from all brands. Circular economy principles, including refillable packaging and ingredient recycling, will become standard industry practices. Carbon-neutral operations and sustainable sourcing will influence consumer purchasing decisions and brand loyalty.

Regulatory evolution will likely trend toward greater harmonization within regional blocs, simplifying compliance and facilitating trade. Safety standards and ingredient restrictions may become more stringent, requiring brands to invest in reformulation and testing capabilities. Halal certification requirements may expand beyond current markets, influencing global product development strategies.

The MEA hair care market presents compelling opportunities for growth and innovation, driven by favorable demographics, cultural importance of hair care, and increasing consumer sophistication. The market’s diversity across different countries and consumer segments requires nuanced strategies that balance global best practices with local market understanding and cultural sensitivity.

Success factors in this dynamic market include authentic brand positioning, product innovation addressing regional needs, comprehensive distribution strategies, and digital engagement capabilities. Brands that invest in understanding local consumer preferences while maintaining international quality standards are best positioned for sustainable growth and market leadership.

Future market evolution will be shaped by sustainability consciousness, digital transformation, and continued premiumization trends. The growing importance of natural ingredients, personalized solutions, and professional-quality home care products creates opportunities for differentiation and value creation. As the market matures, successful brands will be those that combine innovation, cultural relevance, and sustainable business practices to build lasting consumer relationships and market positions.

What is MEA Hair Care?

MEA Hair Care refers to a range of products and treatments designed to maintain and enhance the health and appearance of hair in the Middle East and Africa region. This includes shampoos, conditioners, styling products, and treatments tailored to various hair types and concerns.

What are the key companies in the MEA Hair Care Market?

Key companies in the MEA Hair Care Market include L’Oréal, Procter & Gamble, Unilever, and Henkel, among others. These companies offer a variety of hair care products that cater to the diverse needs of consumers in the region.

What are the main drivers of growth in the MEA Hair Care Market?

The main drivers of growth in the MEA Hair Care Market include increasing consumer awareness about hair health, rising disposable incomes, and the growing influence of social media on beauty standards. Additionally, the demand for natural and organic hair care products is also contributing to market expansion.

What challenges does the MEA Hair Care Market face?

The MEA Hair Care Market faces challenges such as intense competition among brands, fluctuating raw material prices, and varying consumer preferences across different regions. These factors can impact product availability and pricing strategies.

What opportunities exist in the MEA Hair Care Market?

Opportunities in the MEA Hair Care Market include the potential for product innovation, particularly in the areas of sustainable and eco-friendly formulations. Additionally, expanding e-commerce platforms provide brands with new avenues to reach consumers.

What trends are shaping the MEA Hair Care Market?

Trends shaping the MEA Hair Care Market include the rise of personalized hair care solutions, increased focus on scalp health, and the popularity of multi-functional products. Consumers are increasingly seeking products that address specific hair concerns while also providing additional benefits.

MEA Hair Care Market

| Segmentation Details | Description |

|---|---|

| Product Type | Shampoos, Conditioners, Hair Oils, Styling Products |

| End User | Salons, Individual Consumers, Retailers, Distributors |

| Distribution Channel | Online Retail, Supermarkets, Specialty Stores, Pharmacies |

| Formulation | Creams, Gels, Sprays, Serums |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the MEA Hair Care Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at