444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The MEA general aviation market represents a dynamic and rapidly evolving sector within the Middle East and Africa aviation industry. This market encompasses private aircraft operations, business jets, charter services, flight training, and recreational flying activities across diverse geographical regions. General aviation in the MEA region has experienced substantial growth driven by increasing business activities, tourism development, and infrastructure investments.

Regional dynamics indicate that the MEA general aviation market is experiencing robust expansion, with growth rates reaching 8.2% CAGR in key segments. The market benefits from strategic geographical positioning, connecting Europe, Asia, and Africa, making it a crucial hub for international business aviation. Wealthy individuals and corporations increasingly rely on private aviation for efficient transportation across the region’s vast territories.

Infrastructure development across major cities like Dubai, Riyadh, Cairo, and Johannesburg has significantly enhanced general aviation capabilities. Modern FBOs (Fixed Base Operators), advanced maintenance facilities, and upgraded airports support the growing demand for private aviation services. The region’s economic diversification efforts, particularly in the Gulf states, have created favorable conditions for general aviation growth.

Market penetration varies significantly across different MEA countries, with the UAE and Saudi Arabia leading in terms of fleet size and operational sophistication. South Africa maintains a strong position in the African continent, while emerging markets like Egypt and Morocco show promising growth potential. The sector’s expansion is supported by regulatory improvements and government initiatives promoting aviation industry development.

The MEA general aviation market refers to the comprehensive ecosystem of non-commercial aviation activities operating within the Middle East and Africa regions, encompassing private aircraft ownership, charter operations, flight training services, and recreational flying activities that serve individual and corporate transportation needs.

General aviation in the MEA context includes various aircraft categories from single-engine piston aircraft to sophisticated business jets and turboprops. This market segment operates independently from scheduled commercial airlines, providing flexible, on-demand transportation solutions for business executives, high-net-worth individuals, government officials, and specialized mission requirements such as medical evacuation and cargo transport.

Operational scope encompasses diverse activities including corporate transportation, air taxi services, pilot training, aircraft maintenance and repair, aerial surveying, agricultural aviation, and emergency services. The market serves both domestic and international routes, facilitating business connectivity across the region’s major economic centers and remote locations where commercial airline service may be limited.

Regional characteristics define the MEA general aviation market through unique geographical challenges, regulatory environments, and economic conditions. The vast distances between cities, desert terrain, and varying infrastructure levels create specific operational requirements that distinguish this market from other global regions.

Market dynamics in the MEA general aviation sector reflect strong growth momentum driven by economic expansion, infrastructure development, and increasing demand for flexible transportation solutions. The region’s strategic position as a global business hub continues to attract international aviation activities, supporting market expansion across multiple segments.

Key growth drivers include rising business aviation demand, tourism sector development, and government initiatives supporting aviation industry growth. The market benefits from 65% of regional wealth being concentrated in Gulf Cooperation Council countries, creating substantial demand for luxury transportation services. Corporate aviation adoption rates have increased significantly as businesses seek efficient connectivity solutions.

Technology integration plays a crucial role in market evolution, with advanced avionics, sustainable aviation fuels, and digital flight planning systems enhancing operational efficiency. The introduction of next-generation aircraft with improved fuel efficiency and reduced environmental impact supports long-term market sustainability.

Competitive landscape features established international operators alongside emerging regional players, creating diverse service offerings across different market segments. Strategic partnerships between aircraft manufacturers, service providers, and regional governments facilitate market development and infrastructure enhancement.

Future prospects indicate continued expansion supported by mega-events, economic diversification programs, and increasing regional connectivity requirements. The market’s resilience during global challenges demonstrates its fundamental importance to regional economic activities and business operations.

Strategic positioning of the MEA general aviation market reveals several critical insights that define its current trajectory and future potential. The region’s unique geographical advantages and economic characteristics create distinct opportunities for market participants.

Market maturation varies significantly across different MEA countries, with established markets in the Gulf region showing sophisticated service offerings while emerging markets present substantial growth potential. This diversity creates opportunities for tailored market approaches and strategic positioning.

Economic prosperity across key MEA regions serves as the primary driver for general aviation market expansion. The concentration of wealth in Gulf states, combined with growing business activities across Africa, creates substantial demand for private aviation services. High-net-worth individuals and corporations increasingly recognize the value proposition of general aviation for time-sensitive transportation needs.

Business connectivity requirements drive significant market demand as companies expand operations across the region. The need for efficient transportation between major business centers, remote project sites, and international destinations supports charter services and corporate aircraft acquisition. Multinational corporations operating in the region rely heavily on general aviation for executive transportation and operational efficiency.

Tourism sector growth contributes substantially to market expansion, particularly in destinations like Dubai, Qatar, and South Africa. Luxury tourism segments demand premium transportation services, while adventure tourism in remote locations requires specialized aviation capabilities. The development of mega-tourism projects across the region creates additional demand for general aviation services.

Infrastructure development initiatives across MEA countries enhance general aviation capabilities and market accessibility. Government investments in airport infrastructure, FBO facilities, and maintenance capabilities reduce operational barriers and support market growth. Smart city projects and economic zones increasingly incorporate aviation infrastructure as essential components.

Regulatory improvements facilitate market development through streamlined certification processes, enhanced safety standards, and improved operational frameworks. Progressive aviation policies in countries like the UAE and Saudi Arabia create favorable environments for general aviation operations and international partnerships.

High operational costs represent a significant constraint for MEA general aviation market expansion. Fuel prices, maintenance expenses, insurance costs, and regulatory compliance requirements create substantial financial barriers for market entry and sustained operations. Economic volatility in certain regions can impact demand for discretionary aviation services.

Regulatory complexity across different MEA countries creates operational challenges for cross-border flights and regional expansion. Varying certification requirements, permit processes, and safety standards complicate fleet deployment and service delivery. Bureaucratic procedures can delay aircraft registration and operational approvals, impacting business efficiency.

Infrastructure limitations in certain regions restrict general aviation operations and market development. Inadequate FBO facilities, limited maintenance capabilities, and insufficient fuel availability at smaller airports constrain operational flexibility. Remote locations often lack essential support services required for safe and efficient general aviation operations.

Skilled personnel shortage affects various aspects of general aviation operations, from pilots and maintenance technicians to air traffic controllers and ground support staff. The specialized nature of general aviation requires extensive training and certification, creating workforce development challenges. Brain drain to international markets further exacerbates personnel shortages.

Security concerns in certain regions impact general aviation operations and market confidence. Political instability, terrorism threats, and regional conflicts can restrict flight operations and deter international operators from entering specific markets. Insurance premiums may increase significantly for operations in high-risk areas.

Emerging market penetration presents substantial opportunities for general aviation expansion across underserved MEA regions. Countries like Morocco, Kenya, and Nigeria show growing economic activity and infrastructure development that could support increased general aviation operations. First-mover advantages exist for operators willing to establish early presence in these developing markets.

Sustainable aviation initiatives create opportunities for operators adopting environmentally friendly technologies and practices. The growing emphasis on carbon neutrality and sustainable development goals opens markets for electric aircraft, sustainable aviation fuels, and efficient operational practices. Government incentives may support adoption of cleaner aviation technologies.

Digital transformation opportunities include advanced flight planning systems, predictive maintenance technologies, and customer experience platforms. Integration of artificial intelligence and data analytics can optimize operations, reduce costs, and enhance service quality. Digital booking platforms and mobile applications can expand market reach and improve customer accessibility.

Public-private partnerships offer opportunities for infrastructure development and market expansion. Collaboration between government agencies and private operators can accelerate airport development, training programs, and regulatory framework improvements. Joint ventures can facilitate technology transfer and market entry strategies.

Specialized service segments present niche opportunities including medical aviation, cargo transport, aerial surveying, and emergency services. The growing demand for specialized missions creates revenue diversification opportunities for general aviation operators. Development of dedicated service capabilities can establish competitive advantages in specific market segments.

Supply and demand dynamics in the MEA general aviation market reflect complex interactions between economic conditions, regulatory environments, and infrastructure capabilities. The market experiences cyclical patterns influenced by oil prices, economic growth rates, and geopolitical stability. Demand elasticity varies significantly across different customer segments and geographical regions.

Competitive dynamics involve established international operators, regional specialists, and emerging local players competing across various service segments. Market consolidation trends create opportunities for strategic acquisitions and partnerships. Service differentiation becomes increasingly important as operators seek competitive advantages through specialized capabilities and superior customer experiences.

Technology adoption drives operational efficiency improvements and service enhancement across the market. Advanced avionics systems, predictive maintenance technologies, and digital customer interfaces transform traditional general aviation operations. Innovation cycles create opportunities for early adopters while potentially disrupting established business models.

Regulatory evolution continues to shape market dynamics through safety standards, operational requirements, and international harmonization efforts. Progressive regulatory frameworks in leading MEA countries influence industry best practices and competitive positioning. Compliance costs and operational complexity vary significantly across different regulatory jurisdictions.

Economic interdependencies link general aviation demand to broader economic conditions, business activity levels, and wealth distribution patterns. The market’s sensitivity to economic cycles requires adaptive strategies and diversified service offerings. Risk management becomes crucial for sustained operations during economic downturns or regional instability.

Comprehensive analysis of the MEA general aviation market employs multiple research methodologies to ensure accurate and reliable insights. The research approach combines quantitative data analysis with qualitative assessments to provide holistic market understanding. Primary research involves direct engagement with industry stakeholders, operators, and regulatory authorities across the region.

Data collection encompasses various sources including industry reports, government publications, operator interviews, and market surveys. Statistical analysis of fleet registrations, flight operations, and economic indicators provides quantitative foundations for market assessments. Triangulation methods validate findings across multiple data sources and analytical approaches.

Regional segmentation analysis examines market characteristics across different MEA countries and sub-regions. Comparative analysis identifies growth patterns, competitive dynamics, and opportunity areas. Cross-regional benchmarking provides insights into best practices and development strategies.

Stakeholder engagement includes structured interviews with aircraft operators, service providers, regulatory officials, and industry associations. Expert opinions and market insights supplement quantitative data analysis. Industry validation ensures research findings align with practical market realities and operational experiences.

Analytical frameworks incorporate economic modeling, trend analysis, and scenario planning to project future market developments. Statistical techniques and forecasting models support quantitative projections and growth estimates. Sensitivity analysis examines various factors influencing market outcomes and development trajectories.

Gulf Cooperation Council countries dominate the MEA general aviation market, accounting for approximately 58% of regional operations. The UAE leads with sophisticated infrastructure, favorable regulations, and high concentration of business aviation activities. Dubai and Abu Dhabi serve as major hubs for international general aviation operations. Saudi Arabia represents the largest domestic market with significant growth potential driven by Vision 2030 initiatives.

North African markets show diverse development patterns with Egypt and Morocco leading regional growth. Cairo and Casablanca serve as important general aviation centers supporting business and tourism activities. Infrastructure investments in these countries enhance operational capabilities and market accessibility. Libya and Algeria present emerging opportunities despite current challenges.

Sub-Saharan Africa demonstrates substantial growth potential with South Africa maintaining market leadership. Johannesburg and Cape Town offer established general aviation infrastructure and services. Nigeria and Kenya represent key emerging markets with growing business aviation demand. Regional connectivity challenges create opportunities for general aviation services.

East African markets benefit from economic growth and increasing business activities. Ethiopia and Tanzania show promising development trends supported by infrastructure investments. Tourism growth in countries like Rwanda and Uganda creates demand for specialized aviation services. Regional integration efforts facilitate cross-border operations.

Market share distribution reflects economic development levels and infrastructure capabilities across different regions. The concentration of 72% of high-net-worth individuals in Gulf and South African markets drives premium service demand. Emerging markets present opportunities for market expansion and service development.

Market leadership in the MEA general aviation sector features a diverse mix of international corporations, regional specialists, and emerging local operators. The competitive environment reflects varying market maturity levels and service requirements across different geographical segments.

Strategic positioning varies among competitors with some focusing on premium services while others target cost-sensitive market segments. Service differentiation includes specialized capabilities such as medical aviation, cargo transport, and government services. Market consolidation trends create opportunities for strategic acquisitions and partnerships.

Competitive advantages derive from factors including fleet diversity, geographical coverage, service quality, and regulatory compliance capabilities. Brand reputation and safety records significantly influence customer selection and market positioning. Technology adoption and operational efficiency become increasingly important competitive factors.

Aircraft type segmentation reveals diverse market preferences and operational requirements across the MEA region. The segmentation reflects varying mission profiles, range requirements, and economic considerations influencing aircraft selection decisions.

By Aircraft Category:

By Operation Type:

By End User:

Business jet operations represent the most sophisticated segment of the MEA general aviation market, characterized by high-value transactions and premium service requirements. This category benefits from strong demand among corporate users and ultra-high-net-worth individuals. Long-range capabilities are particularly valued for intercontinental travel and regional connectivity.

Turboprop aircraft serve crucial roles in regional connectivity, particularly in African markets where runway limitations and operational economics favor this aircraft category. These aircraft provide cost-effective solutions for shorter routes and challenging airport conditions. The segment shows steady growth driven by regional business development and tourism activities.

Charter services dominate market revenues through flexible, on-demand transportation solutions. This category serves diverse customer needs from business travel to leisure trips and specialized missions. Service quality and operational reliability significantly influence customer preferences and market positioning within this segment.

Aircraft management services experience rapid growth as aircraft ownership becomes more complex and demanding. Professional management companies provide comprehensive services including maintenance, crew management, and regulatory compliance. Operational efficiency improvements and cost optimization drive demand for these specialized services.

Training operations support the broader aviation industry through pilot development and recurrent training programs. This segment benefits from growing aviation activities and regulatory requirements for ongoing training. International standards compliance and modern training facilities enhance market competitiveness.

Operational efficiency improvements represent primary benefits for general aviation operators through advanced technologies, optimized routing, and enhanced maintenance practices. Cost reduction opportunities emerge from economies of scale, shared services, and improved asset utilization. Digital transformation initiatives enable better resource management and customer service delivery.

Market expansion opportunities allow operators to diversify geographical presence and service offerings. Regional growth trends create new revenue streams and reduce dependence on single markets. Strategic partnerships facilitate market entry and capability enhancement while sharing risks and resources.

Regulatory advantages benefit operators maintaining high compliance standards and safety records. Progressive regulatory frameworks in leading MEA countries provide competitive advantages for compliant operators. International recognition of safety standards facilitates global operations and partnerships.

Technology integration benefits include enhanced safety, improved operational efficiency, and superior customer experiences. Advanced avionics, predictive maintenance, and digital platforms create competitive advantages. Innovation adoption positions operators for future market developments and changing customer expectations.

Stakeholder value creation encompasses various benefits for different market participants:

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability initiatives emerge as dominant trends reshaping the MEA general aviation market. Operators increasingly adopt sustainable aviation fuels, implement carbon offset programs, and invest in more efficient aircraft technologies. Environmental consciousness among customers drives demand for eco-friendly aviation solutions and transparent sustainability reporting.

Digital transformation accelerates across all market segments, encompassing flight planning systems, maintenance management, and customer experience platforms. Artificial intelligence and machine learning applications optimize operations, predict maintenance needs, and enhance safety management systems. Mobile applications and digital booking platforms improve customer accessibility and service delivery.

Fleet modernization trends favor newer, more efficient aircraft with advanced avionics and improved environmental performance. Operators replace aging fleets with next-generation aircraft offering better fuel efficiency, reduced emissions, and enhanced passenger comfort. Technology upgrades in existing aircraft extend operational life and improve competitiveness.

Service diversification expands beyond traditional charter operations to include specialized services such as medical aviation, cargo transport, and emergency response. Operators develop niche capabilities to differentiate services and capture new revenue opportunities. Integrated service offerings combine aircraft operations with ground transportation and hospitality services.

Regional integration trends facilitate cross-border operations and market expansion through harmonized regulations and bilateral agreements. Open skies policies and mutual recognition agreements reduce operational barriers and enhance market accessibility. Regional aviation organizations promote cooperation and best practice sharing among MEA countries.

Infrastructure expansion projects across the MEA region significantly enhance general aviation capabilities and market potential. Major airport developments in Dubai, Riyadh, and Cairo include dedicated general aviation facilities and improved FBO services. Smart airport initiatives integrate advanced technologies for enhanced operational efficiency and customer experience.

Regulatory harmonization efforts promote standardized safety standards and operational procedures across MEA countries. The adoption of international best practices and mutual recognition agreements facilitates cross-border operations and market integration. Progressive regulatory frameworks in leading countries influence regional aviation policy development.

Technology partnerships between aircraft manufacturers, service providers, and technology companies accelerate innovation adoption in the MEA market. Collaborative development programs focus on sustainable aviation solutions, advanced avionics, and digital service platforms. Strategic alliances facilitate technology transfer and market expansion strategies.

Training program development addresses skilled personnel shortages through comprehensive education initiatives and international partnerships. Aviation academies and training centers expand capacity to meet growing demand for qualified pilots and technicians. Government support for aviation education enhances long-term market sustainability.

Market consolidation activities include strategic acquisitions, mergers, and partnership formations among market participants. Vertical integration strategies combine aircraft operations with maintenance, training, and support services. International operators expand regional presence through acquisitions and joint ventures with local partners.

Strategic market entry recommendations emphasize the importance of understanding local market dynamics and regulatory requirements before expansion. MarkWide Research analysis suggests that successful market entry requires comprehensive due diligence, local partnerships, and phased expansion strategies. Operators should prioritize markets with stable regulatory environments and strong economic fundamentals.

Investment priorities should focus on technology adoption, fleet modernization, and infrastructure development to maintain competitive advantages. Digital transformation initiatives offer significant returns through operational efficiency improvements and enhanced customer experiences. Sustainable aviation technologies position operators for future regulatory requirements and market expectations.

Risk management strategies must address economic volatility, geopolitical instability, and regulatory changes affecting market operations. Diversification across multiple markets and service segments reduces concentration risks. Contingency planning for various scenarios ensures operational continuity during challenging periods.

Partnership development creates opportunities for market expansion, capability enhancement, and risk sharing. Strategic alliances with local operators, government agencies, and technology providers facilitate market entry and operational success. Joint ventures can provide access to local market knowledge and regulatory expertise.

Customer focus strategies should emphasize service quality, safety standards, and personalized experiences to differentiate offerings in competitive markets. Brand building and reputation management become increasingly important as market competition intensifies. Customer feedback systems and continuous improvement processes enhance service delivery and market positioning.

Growth trajectory for the MEA general aviation market indicates sustained expansion driven by economic development, infrastructure investment, and increasing demand for flexible transportation solutions. MWR projections suggest continued market growth with 7.5% average annual expansion across key segments over the next decade. Regional variations will create diverse opportunities and challenges for market participants.

Technology evolution will reshape market dynamics through sustainable aviation solutions, advanced digital platforms, and autonomous flight capabilities. Electric aircraft and hybrid propulsion systems may enter commercial service within the forecast period, particularly for shorter-range missions. Artificial intelligence applications will optimize operations and enhance safety management systems.

Market maturation in established regions will drive service sophistication and competitive differentiation, while emerging markets present substantial growth opportunities. Infrastructure development will continue expanding general aviation capabilities across underserved regions. Regional integration efforts will facilitate cross-border operations and market expansion.

Regulatory evolution toward greater harmonization and international standards compliance will reduce operational barriers and enhance market accessibility. Environmental regulations will increasingly influence aircraft selection and operational practices. Progressive regulatory frameworks will support innovation adoption and market development.

Economic factors including diversification programs, tourism development, and business expansion will sustain demand growth across various market segments. The concentration of 85% of regional GDP growth in key markets will drive premium aviation services demand. Economic resilience and diversification efforts will reduce market volatility and support sustainable growth.

The MEA general aviation market represents a dynamic and rapidly evolving sector with substantial growth potential driven by economic development, infrastructure investment, and increasing demand for flexible transportation solutions. The market’s strategic geographical position, combined with progressive regulatory frameworks and significant infrastructure investments, creates favorable conditions for sustained expansion across diverse segments.

Key success factors for market participants include strategic positioning, technology adoption, operational excellence, and customer focus. The ability to navigate complex regulatory environments, manage operational costs, and deliver superior service quality will determine competitive success in this growing market. Strategic partnerships and local market knowledge become increasingly important for international operators seeking regional expansion.

Future opportunities emerge from emerging market penetration, technology innovation, service diversification, and sustainability initiatives. The market’s resilience during global challenges demonstrates its fundamental importance to regional economic activities and business operations. Long-term prospects remain positive despite cyclical challenges and operational complexities inherent in the aviation industry.

Market evolution will continue reflecting broader economic trends, technological advancement, and changing customer expectations. Operators that successfully adapt to these evolving conditions while maintaining operational excellence and safety standards will capture the most significant opportunities in this expanding market. The MEA general aviation market stands positioned for continued growth and development as a crucial component of the region’s transportation infrastructure and economic development strategy.

What is General Aviation?

General Aviation refers to all civil aviation operations other than scheduled air services and non-scheduled air transport operations for remuneration or hire. It encompasses a wide range of activities, including private flying, flight training, agricultural aviation, and air ambulance services.

What are the key companies in the MEA General Aviation Market?

Key companies in the MEA General Aviation Market include Bombardier, Textron Aviation, and Embraer, which provide a variety of aircraft and services tailored to general aviation needs, among others.

What are the main drivers of the MEA General Aviation Market?

The main drivers of the MEA General Aviation Market include the increasing demand for private air travel, the growth of business aviation, and advancements in aviation technology that enhance safety and efficiency.

What challenges does the MEA General Aviation Market face?

The MEA General Aviation Market faces challenges such as regulatory hurdles, high operational costs, and limited infrastructure in certain regions, which can hinder growth and accessibility.

What opportunities exist in the MEA General Aviation Market?

Opportunities in the MEA General Aviation Market include the expansion of air taxi services, increased investment in airport infrastructure, and the rising popularity of electric and hybrid aircraft technologies.

What trends are shaping the MEA General Aviation Market?

Trends shaping the MEA General Aviation Market include the growing emphasis on sustainability, the integration of advanced avionics and automation in aircraft, and the increasing use of digital platforms for flight planning and management.

MEA General Aviation Market

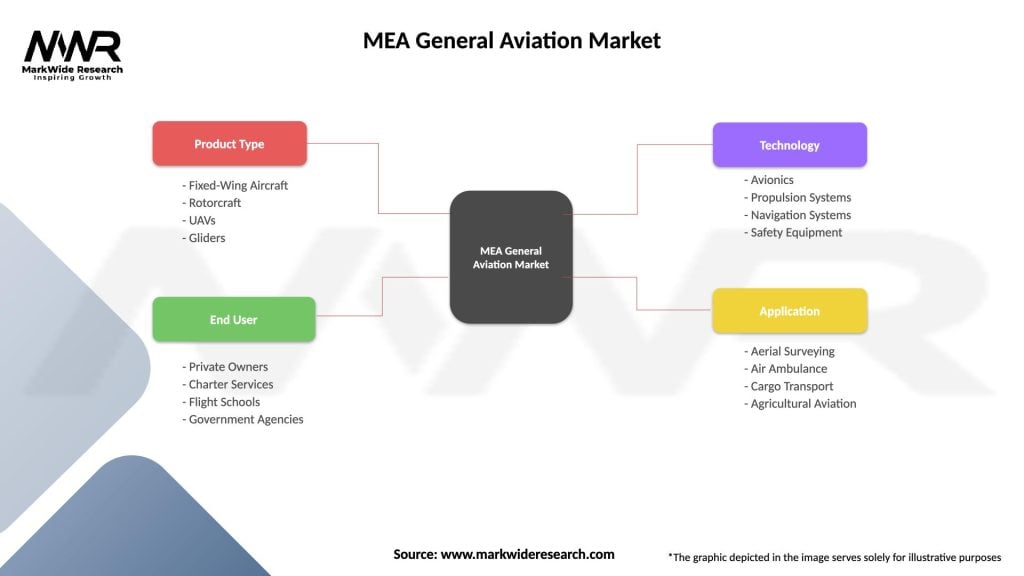

| Segmentation Details | Description |

|---|---|

| Product Type | Fixed-Wing Aircraft, Rotorcraft, UAVs, Gliders |

| End User | Private Owners, Charter Services, Flight Schools, Government Agencies |

| Technology | Avionics, Propulsion Systems, Navigation Systems, Safety Equipment |

| Application | Aerial Surveying, Air Ambulance, Cargo Transport, Agricultural Aviation |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the MEA General Aviation Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at