444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The MEA functional beverages market represents a rapidly evolving sector within the Middle East and Africa region, characterized by increasing consumer awareness of health and wellness benefits. This dynamic market encompasses a diverse range of beverages fortified with vitamins, minerals, probiotics, antioxidants, and other functional ingredients designed to provide specific health benefits beyond basic nutrition. The region’s growing middle class, coupled with rising disposable incomes and changing lifestyle patterns, has created substantial demand for functional beverages across various categories including energy drinks, sports drinks, enhanced water, and probiotic beverages.

Market dynamics in the MEA region are influenced by several key factors, including urbanization trends, increasing health consciousness, and the growing prevalence of lifestyle-related health conditions. The market is experiencing robust growth driven by consumer preference for convenient, on-the-go nutrition solutions that align with busy lifestyles. Regional preferences vary significantly, with Middle Eastern countries showing strong demand for premium functional beverages, while African markets demonstrate growing interest in affordable, locally-relevant formulations.

Innovation trends within the MEA functional beverages market include the development of culturally-appropriate flavors, halal-certified products, and beverages incorporating traditional regional ingredients known for their health benefits. The market growth rate is projected at approximately 8.5% CAGR over the forecast period, reflecting strong consumer adoption and expanding distribution networks across both urban and rural areas.

The MEA functional beverages market refers to the commercial sector encompassing the production, distribution, and consumption of beverages that provide health benefits beyond basic hydration and nutrition within the Middle East and Africa regions. These beverages are specifically formulated with bioactive compounds, vitamins, minerals, herbs, and other functional ingredients that target specific health concerns or wellness goals.

Functional beverages in the MEA context include products designed to enhance energy levels, support immune function, improve digestive health, promote mental clarity, aid in weight management, and address various nutritional deficiencies common in the region. The market encompasses both ready-to-drink products and concentrated formulations that consumers can prepare at home, catering to diverse economic segments and consumption preferences across the heterogeneous MEA market landscape.

Strategic analysis of the MEA functional beverages market reveals a sector poised for significant expansion, driven by demographic shifts, economic development, and evolving consumer health consciousness. The market demonstrates strong growth potential across multiple product categories, with energy drinks and enhanced water products leading consumption volumes. Regional variations in consumer preferences, regulatory frameworks, and distribution infrastructure create both opportunities and challenges for market participants.

Key growth drivers include increasing urbanization rates of approximately 65% in Middle Eastern countries and 42% in African nations, rising disposable incomes, and growing awareness of preventive healthcare benefits. The market is characterized by a mix of international brands and emerging local players, with successful companies focusing on culturally-relevant product development and strategic distribution partnerships.

Market segmentation reveals distinct consumer preferences across different age groups, income levels, and geographic regions. Young adults aged 18-35 represent the largest consumer segment, accounting for approximately 58% of total consumption, while health-conscious consumers over 35 show the highest growth in premium product adoption. The competitive landscape includes both multinational corporations and regional specialists, creating a dynamic environment for innovation and market expansion.

Consumer behavior analysis reveals several critical insights driving the MEA functional beverages market. The following key insights shape market development and strategic planning:

Demographic transformation serves as a primary driver for the MEA functional beverages market, with rapidly growing urban populations seeking convenient health solutions. The region’s young demographic profile, with over 60% of the population under 30 years, creates substantial demand for energy-boosting and performance-enhancing beverages that align with active lifestyles and career demands.

Economic development across the MEA region has resulted in increased disposable income and changing consumption patterns. Rising middle-class populations in countries like UAE, Saudi Arabia, South Africa, and Nigeria demonstrate growing willingness to invest in premium health products, driving demand for high-quality functional beverages with proven health benefits.

Health awareness campaigns by governments and healthcare organizations have significantly increased consumer understanding of nutrition’s role in disease prevention. This awareness translates into growing demand for beverages fortified with vitamins, minerals, and other functional ingredients that support immune system health, digestive wellness, and overall vitality.

Lifestyle changes associated with urbanization, including increased work stress, sedentary occupations, and time constraints, create demand for convenient nutritional solutions. Functional beverages offer busy consumers an efficient way to address nutritional gaps and maintain energy levels throughout demanding daily schedules.

Economic volatility in certain MEA regions creates challenges for consistent market growth, as functional beverages are often considered discretionary purchases during periods of economic uncertainty. Currency fluctuations and inflation can impact both production costs and consumer purchasing power, affecting market expansion in price-sensitive segments.

Regulatory complexity across different MEA countries presents significant challenges for manufacturers seeking regional market penetration. Varying food safety standards, labeling requirements, and import regulations create barriers to entry and increase compliance costs for both international and regional players.

Cultural barriers and traditional beverage preferences in some markets limit acceptance of new functional beverage categories. Conservative consumer attitudes toward unfamiliar ingredients or foreign brands can slow market adoption, particularly in rural areas where traditional beverages maintain strong cultural significance.

Infrastructure limitations in certain African markets affect distribution efficiency and product quality maintenance. Inadequate cold chain logistics, unreliable electricity supply, and limited retail infrastructure can restrict market reach and increase operational costs for functional beverage manufacturers.

Digital transformation presents significant opportunities for functional beverage brands to reach consumers through e-commerce platforms, social media marketing, and direct-to-consumer sales channels. The growing internet penetration rate of approximately 67% in Middle Eastern countries and 43% in African nations creates new avenues for brand building and customer engagement.

Local ingredient integration offers opportunities for product differentiation and cultural relevance. Incorporating traditional herbs, fruits, and other indigenous ingredients known for their health benefits can create unique product propositions that resonate with local consumers while commanding premium pricing.

Partnership opportunities with healthcare providers, fitness centers, and wellness clinics can create new distribution channels and enhance product credibility. Strategic alliances with local distributors and retailers can accelerate market penetration while reducing operational complexities in diverse regional markets.

Export potential exists for successful regional brands to expand beyond their home markets, leveraging cultural similarities and established distribution networks. Cross-border trade agreements and improving logistics infrastructure create opportunities for regional market expansion and economies of scale.

Supply chain evolution in the MEA functional beverages market reflects changing consumer demands and technological advancement. Manufacturers are investing in local production facilities to reduce costs, improve freshness, and enhance supply chain resilience. This localization trend supports job creation while enabling more responsive customer service and product customization.

Innovation cycles are accelerating as companies compete for market share through product differentiation. Research and development investments focus on creating beverages that address specific regional health concerns, such as vitamin D deficiency in certain Middle Eastern populations or iron deficiency in various African communities.

Competitive intensity is increasing as both international brands and local players recognize the market potential. This competition drives continuous improvement in product quality, packaging innovation, and marketing effectiveness, ultimately benefiting consumers through better products and competitive pricing.

Consumer education initiatives by industry participants are expanding market awareness and driving category growth. Educational campaigns about functional ingredients and their health benefits help consumers make informed purchasing decisions while building brand loyalty and category credibility.

Comprehensive market analysis for the MEA functional beverages market employs multiple research methodologies to ensure accuracy and reliability. Primary research includes consumer surveys, industry expert interviews, and retailer feedback collection across key markets in the Middle East and Africa regions. This approach provides direct insights into consumer preferences, purchasing behaviors, and market trends.

Secondary research encompasses analysis of industry reports, government statistics, trade publications, and company financial statements to establish market context and validate primary research findings. Data triangulation techniques ensure consistency and reliability across different information sources and research methodologies.

Market modeling utilizes statistical analysis and forecasting techniques to project future market trends and growth patterns. Economic indicators, demographic data, and historical consumption patterns inform predictive models that account for regional variations and market-specific factors affecting the functional beverages sector.

Quality assurance protocols include data verification, expert review, and cross-referencing with established industry benchmarks. This rigorous approach ensures that market insights and projections accurately reflect current conditions and provide reliable guidance for strategic decision-making.

Middle Eastern markets demonstrate the highest per-capita consumption of functional beverages within the MEA region, driven by higher disposable incomes and strong health consciousness. The UAE and Saudi Arabia lead regional consumption, with premium energy drinks and enhanced water products showing particularly strong performance. These markets account for approximately 45% of total MEA functional beverage consumption.

North African countries including Egypt, Morocco, and Tunisia show growing interest in affordable functional beverages that address common nutritional deficiencies. The market in this sub-region is characterized by price sensitivity and preference for locally-produced products that incorporate familiar flavors and ingredients.

Sub-Saharan Africa represents the fastest-growing segment of the MEA functional beverages market, with South Africa, Nigeria, and Kenya leading adoption rates. This region shows approximately 12% annual growth in functional beverage consumption, driven by urbanization, economic development, and increasing health awareness among middle-class consumers.

Gulf Cooperation Council countries maintain the highest market penetration rates for premium functional beverages, with sophisticated distribution networks and strong consumer acceptance of international brands. These markets serve as entry points for global brands seeking to establish MEA regional presence.

Market leadership in the MEA functional beverages sector is distributed among several key players, each with distinct competitive advantages and market positioning strategies. The competitive environment includes both multinational corporations and emerging regional specialists:

Product category segmentation reveals distinct consumer preferences and market opportunities across different functional beverage types. Energy drinks maintain the largest market share, followed by enhanced water products and sports beverages. Each category serves specific consumer needs and occasions:

By Product Type:

By Distribution Channel:

Energy drinks category demonstrates the strongest market performance across the MEA region, driven by high caffeine content and marketing focused on performance enhancement. This category benefits from strong brand loyalty and premium pricing acceptance, particularly among urban consumers aged 18-35. Innovation focuses on natural caffeine sources and reduced sugar formulations to address health concerns.

Enhanced water products show the highest growth potential, appealing to health-conscious consumers seeking hydration with added nutritional benefits. This category includes vitamin-enhanced waters, electrolyte beverages, and pH-balanced products that address specific health concerns while maintaining the refreshing qualities of traditional water.

Sports beverages perform particularly well in Gulf countries where fitness culture and outdoor activities are popular. These products focus on electrolyte replacement and performance recovery, with formulations adapted to hot climate conditions prevalent in the Middle East region.

Probiotic beverages represent an emerging category with significant growth potential as consumer awareness of gut health increases. These products often incorporate traditional fermented ingredients familiar to regional consumers, creating cultural relevance while delivering modern health benefits.

Manufacturers benefit from the MEA functional beverages market through diversified revenue streams and premium pricing opportunities. The growing market provides platforms for innovation, brand building, and expansion into new geographic territories. Companies can leverage regional preferences to develop unique products that command higher margins than traditional beverages.

Retailers gain from functional beverages through improved profit margins and increased customer traffic. These products often serve as destination categories that drive store visits and encourage additional purchases. The premium nature of many functional beverages enhances overall basket value and customer satisfaction.

Consumers receive convenient access to nutritional supplementation and health benefits through enjoyable beverage formats. Functional beverages offer alternatives to traditional supplements while providing hydration and taste satisfaction. The variety of available products allows consumers to address specific health concerns and lifestyle needs.

Healthcare systems potentially benefit from increased consumer focus on preventive health measures through functional beverage consumption. These products can contribute to addressing nutritional deficiencies and supporting overall population health when consumed as part of balanced diets.

Strengths:

Weaknesses:

Opportunities:

Threats:

Natural ingredient focus represents a dominant trend across the MEA functional beverages market, with consumers increasingly seeking products made with recognizable, plant-based components. This trend drives innovation in botanical extracts, natural sweeteners, and organic certifications that appeal to health-conscious consumers willing to pay premium prices for perceived quality and safety benefits.

Personalization trends are emerging as brands develop products targeting specific demographic groups, health conditions, and lifestyle needs. Customized formulations for different age groups, gender-specific nutritional requirements, and regional health concerns create opportunities for market segmentation and premium positioning.

Sustainability initiatives are gaining importance as environmental consciousness grows among MEA consumers. Brands are investing in eco-friendly packaging, sustainable sourcing practices, and carbon footprint reduction to appeal to environmentally-aware consumers and comply with evolving regulatory requirements.

Digital integration transforms how functional beverage brands engage with consumers through social media marketing, influencer partnerships, and e-commerce platforms. According to MarkWide Research analysis, digital marketing investments by functional beverage companies have increased by approximately 40% annually as brands recognize the importance of online consumer engagement.

Manufacturing localization has accelerated as international brands establish production facilities within the MEA region to reduce costs, improve supply chain efficiency, and enhance product freshness. This trend supports local economic development while enabling more responsive customer service and product customization for regional preferences.

Strategic partnerships between international brands and local distributors are reshaping market dynamics, combining global expertise with regional market knowledge. These collaborations facilitate market entry while reducing operational risks and regulatory compliance challenges for international companies.

Product innovation cycles are shortening as companies respond to rapidly evolving consumer preferences and competitive pressures. New product launches focus on addressing specific regional health concerns, incorporating traditional ingredients, and meeting cultural dietary requirements such as halal certification.

Regulatory harmonization efforts across certain MEA regions are simplifying market entry and expansion processes for functional beverage manufacturers. Standardized labeling requirements and mutual recognition agreements reduce compliance costs while facilitating cross-border trade.

Market entry strategies should prioritize cultural adaptation and local partnership development to ensure successful penetration of MEA functional beverages markets. Companies should invest in understanding regional taste preferences, health concerns, and consumption patterns before launching products. MWR recommends focusing on pilot programs in key urban markets before expanding to rural areas.

Product development should emphasize natural ingredients, cultural relevance, and specific health benefits that resonate with regional consumer needs. Successful brands will incorporate traditional ingredients known for their health properties while maintaining modern product formats and convenience features that appeal to busy urban consumers.

Distribution strategies must account for infrastructure variations across different MEA markets, with flexible approaches that combine modern retail channels in urban areas with traditional trade networks in rural regions. E-commerce platforms offer significant growth opportunities, particularly for reaching younger, tech-savvy consumers.

Marketing approaches should leverage digital platforms while respecting cultural sensitivities and local communication preferences. Educational campaigns about functional ingredients and health benefits can help build category awareness and consumer confidence in new products.

Long-term growth prospects for the MEA functional beverages market remain highly positive, supported by favorable demographic trends, economic development, and increasing health consciousness. The market is expected to maintain robust growth rates of approximately 8.5% CAGR through the forecast period, driven by expanding middle-class populations and urbanization trends across the region.

Technology integration will increasingly influence product development, manufacturing processes, and consumer engagement strategies. Smart packaging, personalized nutrition apps, and direct-to-consumer delivery services will create new opportunities for brand differentiation and customer loyalty building.

Market consolidation may occur as successful regional brands attract acquisition interest from international companies seeking to expand their MEA presence. This consolidation could accelerate market development while providing local brands with resources for geographic expansion and product innovation.

Regulatory evolution will likely result in more standardized requirements across MEA countries, facilitating market entry and expansion for functional beverage manufacturers. Improved regulatory clarity will support increased investment in local production facilities and product development initiatives.

The MEA functional beverages market presents compelling opportunities for growth and innovation, driven by favorable demographic trends, economic development, and evolving consumer health consciousness. The market’s diversity across different countries and cultures creates both challenges and opportunities for companies willing to invest in understanding and serving regional consumer needs.

Success factors include cultural adaptation, strategic partnerships, product innovation, and flexible distribution strategies that account for infrastructure variations across the region. Companies that can effectively balance global expertise with local market knowledge will be best positioned to capture the significant growth potential in this dynamic market.

Future market development will be shaped by continued urbanization, digital transformation, and increasing focus on preventive healthcare. The functional beverages category is well-positioned to benefit from these trends, offering consumers convenient, enjoyable ways to address health and wellness needs while supporting active lifestyles in an increasingly demanding world.

What is Functional Beverages?

Functional beverages are drinks that offer health benefits beyond basic nutrition, often containing ingredients like vitamins, minerals, probiotics, and herbal extracts. They are designed to support various health aspects such as hydration, digestion, and energy levels.

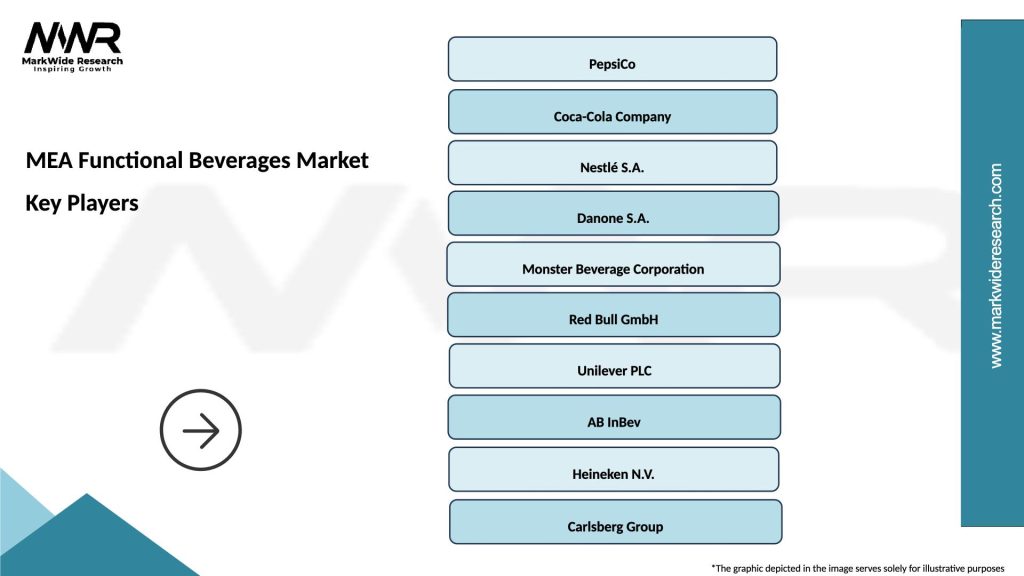

What are the key players in the MEA Functional Beverages Market?

Key players in the MEA Functional Beverages Market include companies like PepsiCo, Nestlé, and Coca-Cola, which offer a range of functional drinks targeting health-conscious consumers. These companies focus on innovation and product diversification to meet evolving consumer preferences, among others.

What are the growth factors driving the MEA Functional Beverages Market?

The MEA Functional Beverages Market is driven by increasing health awareness among consumers, a growing demand for natural ingredients, and the rise of fitness trends. Additionally, the convenience of ready-to-drink options is attracting more consumers to this segment.

What challenges does the MEA Functional Beverages Market face?

The MEA Functional Beverages Market faces challenges such as regulatory hurdles regarding health claims, competition from traditional beverages, and fluctuating raw material prices. These factors can impact product development and market entry strategies.

What opportunities exist in the MEA Functional Beverages Market?

Opportunities in the MEA Functional Beverages Market include the potential for product innovation, particularly in plant-based and organic beverages. Additionally, expanding distribution channels and targeting niche markets can enhance growth prospects.

What trends are shaping the MEA Functional Beverages Market?

Trends in the MEA Functional Beverages Market include the increasing popularity of functional drinks with added probiotics, adaptogens, and superfoods. There is also a notable shift towards sustainable packaging and clean label products that resonate with environmentally conscious consumers.

MEA Functional Beverages Market

| Segmentation Details | Description |

|---|---|

| Product Type | Energy Drinks, Sports Drinks, Functional Water, Herbal Beverages |

| End User | Fitness Enthusiasts, Health-Conscious Consumers, Athletes, Busy Professionals |

| Distribution Channel | Supermarkets, Online Retail, Health Stores, Convenience Stores |

| Ingredient Type | Vitamins, Minerals, Amino Acids, Natural Extracts |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the MEA Functional Beverages Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at