444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The MEA fruit and vegetable ingredients market represents a dynamic and rapidly expanding sector within the broader food processing industry across the Middle East and Africa region. This comprehensive market encompasses a diverse range of processed fruit and vegetable components, including concentrates, purees, powders, extracts, and dried ingredients that serve as essential building blocks for various food and beverage applications. The region’s strategic geographic position, coupled with increasing consumer awareness regarding health and nutrition, has positioned the MEA fruit and vegetable ingredients market as a significant growth driver in the global food ingredients landscape.

Market dynamics indicate robust expansion driven by rising demand for natural and organic food products, with the sector experiencing a compound annual growth rate of 6.8% over the forecast period. The market benefits from abundant local agricultural resources, particularly in countries like Egypt, Morocco, Turkey, and South Africa, which serve as major suppliers of raw materials for ingredient processing. Additionally, the region’s growing food processing industry and increasing export opportunities to European and Asian markets have further strengthened the market’s foundation.

Regional diversity plays a crucial role in market development, with different countries specializing in various fruit and vegetable ingredients based on their climatic conditions and agricultural strengths. The Middle East region demonstrates particular expertise in date-based ingredients and citrus concentrates, while African nations excel in tropical fruit ingredients and vegetable powders. This geographical advantage enables the region to maintain a competitive market position with approximately 15% global market share in specific ingredient categories.

The MEA fruit and vegetable ingredients market refers to the comprehensive ecosystem of processed agricultural products derived from fruits and vegetables that are utilized as functional components in food and beverage manufacturing, nutraceuticals, and other industrial applications across the Middle East and Africa region. These ingredients undergo various processing techniques including dehydration, concentration, extraction, and fermentation to create value-added products that enhance flavor, nutrition, color, and functionality in end-use applications.

Ingredient categories within this market span from basic concentrated juices and purees to sophisticated functional extracts and bioactive compounds. The market encompasses both conventional and organic ingredient variants, catering to diverse consumer preferences and regulatory requirements across different countries in the MEA region. Processing technologies range from traditional sun-drying methods to advanced freeze-drying and spray-drying techniques, enabling manufacturers to preserve nutritional content while extending shelf life and improving functionality.

Market participants include agricultural producers, ingredient processors, distributors, and end-use manufacturers who collectively form an integrated value chain. The sector serves multiple industries including food and beverages, dietary supplements, cosmetics, and pharmaceuticals, with each application requiring specific ingredient specifications and quality standards. This diversified demand base contributes to market stability and growth potential across various economic cycles.

Strategic market positioning of the MEA fruit and vegetable ingredients sector reflects a mature yet evolving industry characterized by increasing sophistication in processing technologies and expanding application portfolios. The market demonstrates resilience through its integration with global supply chains while maintaining strong regional identity through indigenous fruit and vegetable varieties that offer unique flavor profiles and nutritional benefits.

Growth trajectory analysis reveals consistent expansion driven by multiple factors including urbanization, changing dietary patterns, and increased focus on health and wellness among regional consumers. The market benefits from a growing health consciousness rate of 42% among urban populations, leading to increased demand for natural and minimally processed ingredients. Export opportunities continue to expand, with regional suppliers gaining recognition for quality and reliability in international markets.

Investment landscape shows significant capital inflow into processing infrastructure and technology upgrades, enabling manufacturers to meet international quality standards and expand production capacity. Government initiatives supporting agricultural development and food processing have created favorable conditions for market growth, with several countries implementing policies to promote value-added agricultural exports. The sector’s contribution to regional food security and economic development positions it as a strategic priority for continued investment and development.

Market segmentation reveals distinct patterns in ingredient preferences and applications across different MEA countries, with the following key insights emerging from comprehensive market analysis:

Consumer behavior patterns indicate increasing preference for clean-label ingredients and transparency in sourcing and processing methods. This trend drives manufacturers to invest in traceability systems and sustainable processing practices, creating competitive advantages for companies that can demonstrate environmental and social responsibility.

Health and wellness trends serve as the primary catalyst for market expansion, with consumers increasingly seeking natural alternatives to synthetic additives and preservatives. The growing awareness of the connection between diet and health outcomes drives demand for nutrient-dense fruit and vegetable ingredients that can enhance the nutritional profile of processed foods while maintaining taste and functionality.

Food industry evolution toward clean-label products creates substantial opportunities for natural fruit and vegetable ingredients. Manufacturers across various food categories are reformulating products to meet consumer expectations for transparency and naturalness, leading to increased adoption of fruit and vegetable-based colors, flavors, and functional ingredients. This trend particularly benefits the MEA region due to its diverse agricultural base and traditional knowledge of fruit and vegetable processing.

Economic development across the MEA region contributes to market growth through improved infrastructure, increased disposable income, and expanding food processing capabilities. Government initiatives promoting agricultural value addition and export diversification create favorable conditions for ingredient manufacturers to expand operations and access new markets. Additionally, foreign direct investment in food processing facilities brings advanced technologies and international market connections to regional producers.

Urbanization patterns throughout the region drive changes in food consumption habits, with urban consumers showing greater willingness to pay premium prices for high-quality, convenient food products. This demographic shift creates demand for processed foods that incorporate fruit and vegetable ingredients, supporting market growth across multiple application segments.

Supply chain challenges pose significant constraints to market development, particularly regarding seasonal availability of raw materials and quality consistency. Climate variability and water scarcity issues in certain regions can impact agricultural production, leading to supply disruptions and price volatility that affect ingredient manufacturers’ ability to maintain stable operations and competitive pricing.

Infrastructure limitations in some MEA countries restrict the development of advanced processing facilities and cold chain logistics necessary for maintaining ingredient quality. Limited access to reliable electricity, transportation networks, and storage facilities can increase operational costs and reduce competitiveness compared to more developed markets. These infrastructure gaps particularly impact smaller processors and rural agricultural communities.

Regulatory complexity across different MEA countries creates compliance challenges for manufacturers seeking to operate in multiple markets. Varying food safety standards, labeling requirements, and import/export regulations increase administrative burden and costs, particularly for companies attempting to scale operations across borders. Harmonization of regulatory frameworks remains an ongoing challenge that impacts market efficiency.

Technical expertise shortages in advanced processing technologies and quality control systems limit some manufacturers’ ability to meet international standards and compete effectively in premium market segments. Skills development and technology transfer initiatives are essential for addressing these capacity constraints and enabling broader market participation.

Export market expansion presents substantial growth opportunities as international demand for natural and exotic fruit and vegetable ingredients continues to rise. The MEA region’s unique agricultural biodiversity offers competitive advantages in supplying ingredients that are difficult to source elsewhere, creating opportunities for premium pricing and long-term supply partnerships with global food manufacturers.

Value-added processing opportunities enable manufacturers to capture higher margins by developing specialized ingredients with enhanced functionality. Investment in research and development for bioactive compound extraction, microencapsulation technologies, and custom ingredient formulations can differentiate regional suppliers and create sustainable competitive advantages in global markets.

Organic certification and sustainable production practices offer pathways to premium market segments where consumers are willing to pay higher prices for environmentally responsible products. The region’s traditional farming practices and biodiversity provide natural advantages for organic production, while growing international demand for sustainable ingredients creates market opportunities for certified producers.

Strategic partnerships with international food companies and ingredient distributors can accelerate market access and technology transfer. Collaborative arrangements enable regional manufacturers to leverage global marketing networks and technical expertise while providing international partners with reliable supply sources and unique ingredient offerings.

Competitive landscape evolution reflects increasing consolidation among larger processors while maintaining space for specialized niche players focusing on unique ingredients or specific market segments. Market leaders invest heavily in processing technology and quality systems to maintain competitive advantages, while smaller companies differentiate through specialized products or regional expertise.

Technology adoption accelerates across the industry as manufacturers recognize the importance of efficiency improvements and quality consistency in maintaining competitiveness. Advanced processing equipment, automation systems, and quality control technologies enable producers to achieve productivity improvements of 18% while reducing waste and improving product consistency.

Supply chain integration becomes increasingly important as manufacturers seek to control quality and costs throughout the value chain. Vertical integration strategies, including direct relationships with agricultural producers and investment in processing facilities, enable companies to ensure consistent raw material supply and maintain quality standards while reducing dependency on external suppliers.

Market segmentation continues to evolve as consumer preferences become more sophisticated and application-specific requirements drive demand for customized ingredient solutions. This trend creates opportunities for manufacturers to develop specialized products while requiring increased technical capabilities and market knowledge to serve diverse customer needs effectively.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and completeness of market insights. Primary research includes extensive interviews with industry participants across the value chain, from agricultural producers to end-use manufacturers, providing firsthand insights into market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, government statistics, trade publications, and company financial statements to establish market baselines and validate primary research findings. Data triangulation techniques ensure consistency and reliability of market estimates and projections across different information sources.

Market modeling utilizes statistical analysis and econometric techniques to project future market trends and quantify the impact of various market drivers and restraints. Scenario analysis considers multiple potential market development paths, enabling stakeholders to understand risk factors and prepare for different market conditions.

Expert validation processes involve consultation with industry experts, academic researchers, and market analysts to verify research findings and ensure alignment with observed market realities. This validation step enhances the credibility and practical applicability of research conclusions for strategic decision-making purposes.

Middle East markets demonstrate strong growth potential driven by increasing food processing activities and rising consumer spending on premium food products. Countries like the UAE and Saudi Arabia serve as important distribution hubs for the broader region while also developing domestic processing capabilities. The region benefits from strategic location advantages for accessing both Asian and European markets.

North African countries including Egypt, Morocco, and Tunisia leverage their Mediterranean climate advantages to produce high-quality citrus and vegetable ingredients. These countries have established strong export relationships with European markets and continue to invest in processing infrastructure to expand their market presence. Regional market share distribution shows North Africa accounting for approximately 45% of total MEA production.

Sub-Saharan Africa offers significant growth opportunities through its diverse agricultural base and increasing investment in food processing infrastructure. Countries like South Africa, Kenya, and Ghana are developing specialized ingredient processing capabilities while benefiting from growing domestic and regional demand for processed food products.

Gulf Cooperation Council countries focus on high-value ingredient segments and serve as important markets for premium products. These markets demonstrate strong import demand for specialized ingredients while also investing in domestic processing capabilities to reduce import dependency and capture value-added processing opportunities.

Market leadership is distributed among several key players who have established strong positions through strategic investments in processing capabilities, quality systems, and market development. The competitive environment encourages continuous innovation and efficiency improvements while maintaining focus on quality and customer service.

Competitive strategies focus on differentiation through product quality, processing innovation, and customer service excellence. Companies invest in research and development to create unique ingredient solutions while building strong relationships with both suppliers and customers throughout the value chain.

Market positioning varies among competitors, with some focusing on volume production of standard ingredients while others specialize in premium or niche products. This diversity creates a dynamic competitive environment that benefits customers through product choice and competitive pricing while encouraging continuous improvement among suppliers.

By Product Type:

By Source:

By Application:

Fruit-based ingredients dominate the market landscape, representing the largest category by volume and value. Citrus concentrates lead this segment due to abundant regional production and strong international demand. The category benefits from year-round availability through advanced storage and processing technologies, enabling consistent supply to global markets. Innovation in processing techniques continues to improve quality and functionality while reducing costs.

Vegetable ingredients show strong growth potential, particularly in savory applications and functional food segments. Tomato-based products represent the largest subcategory, followed by onion and pepper ingredients. The segment benefits from increasing demand for clean-label alternatives to synthetic flavoring and coloring agents. Processing innovations enable manufacturers to preserve nutritional content while improving functionality and shelf stability.

Organic ingredients represent a high-growth category with premium pricing opportunities. Consumer willingness to pay higher prices for certified organic products creates attractive margins for producers who can meet certification requirements. The category requires specialized handling and processing procedures but offers access to premium market segments in both domestic and export markets.

Functional ingredients with specific health benefits show the highest growth rates within the market. Products enriched with antioxidants, vitamins, and bioactive compounds command premium prices while serving the growing nutraceutical and functional food markets. This category requires advanced processing capabilities and scientific validation but offers significant value creation opportunities.

Agricultural producers benefit from increased demand for their crops and opportunities to capture higher value through direct relationships with processors. Contract farming arrangements provide income stability while enabling farmers to invest in quality improvements and sustainable production practices. Access to processing facilities creates opportunities for value addition at the farm level.

Processing companies gain competitive advantages through vertical integration and specialization in high-value ingredient segments. Investment in advanced processing technologies enables efficiency improvements and quality differentiation while reducing dependency on external suppliers. Export opportunities provide access to larger markets and premium pricing for unique regional ingredients.

Food manufacturers benefit from reliable supply sources for natural ingredients that meet clean-label requirements and consumer preferences for transparency. Regional suppliers offer competitive pricing and flexibility in product specifications while reducing supply chain complexity and transportation costs. Long-term partnerships enable collaborative product development and market expansion opportunities.

Consumers gain access to higher quality food products with improved nutritional profiles and natural ingredient compositions. The market’s focus on quality and safety standards ensures product reliability while competitive dynamics maintain reasonable pricing. Increased availability of organic and specialty ingredients provides greater choice in premium product categories.

Strengths:

Weaknesses:

Opportunities:

Threats:

Clean label movement continues to drive demand for natural fruit and vegetable ingredients as consumers increasingly scrutinize food labels and seek products with recognizable, natural ingredients. This trend benefits the MEA region’s traditional processing methods and natural ingredient focus while creating opportunities for premium positioning in global markets.

Sustainability focus becomes increasingly important as consumers and businesses prioritize environmentally responsible sourcing and production practices. Regional producers who can demonstrate sustainable farming and processing methods gain competitive advantages in international markets where sustainability credentials influence purchasing decisions.

Functional food growth drives demand for ingredients with proven health benefits beyond basic nutrition. The trend toward preventive healthcare and wellness-focused consumption creates opportunities for processors who can develop and market ingredients with specific functional properties and health claims.

Processing innovation accelerates as manufacturers invest in technologies that improve efficiency, quality, and functionality while reducing environmental impact. Advanced extraction methods, microencapsulation, and preservation technologies enable the development of new ingredient categories and applications.

Supply chain transparency becomes a critical competitive factor as customers demand detailed information about ingredient sourcing, processing methods, and quality controls. Traceability systems and certification programs provide competitive advantages for suppliers who can demonstrate transparency and quality assurance throughout their operations.

Technology investments across the region focus on upgrading processing capabilities and implementing quality management systems that meet international standards. Major processors are installing advanced extraction equipment, automated packaging systems, and laboratory facilities to improve product quality and operational efficiency.

Certification programs gain momentum as producers recognize the importance of third-party validation for market access and premium positioning. International certifications for organic, halal, and quality management systems become standard requirements for export-oriented manufacturers.

Strategic partnerships between regional producers and international companies accelerate technology transfer and market access. Joint ventures and licensing agreements enable local companies to access advanced processing technologies while providing international partners with reliable supply sources and market knowledge.

Government initiatives supporting agricultural value addition and export promotion create favorable conditions for industry development. Investment incentives, infrastructure development, and trade promotion programs help manufacturers expand operations and access new markets.

Research and development activities increase as companies recognize the importance of innovation in maintaining competitiveness. Collaboration with universities and research institutions enables the development of new processing methods and ingredient applications while building technical capabilities within the industry.

Investment prioritization should focus on processing technology upgrades and quality system implementation to meet evolving market requirements and maintain competitiveness. Companies should evaluate their current capabilities against international standards and develop upgrade plans that address the most critical gaps first.

Market diversification strategies should balance domestic and export opportunities while considering the specific requirements and preferences of different market segments. Successful companies will develop flexible production capabilities that can serve multiple markets while maintaining quality consistency and cost competitiveness.

Partnership development with international companies can accelerate market access and technology transfer while providing resources for capacity expansion. Strategic alliances should focus on complementary capabilities and shared market development goals rather than simple supply relationships.

Sustainability initiatives should be integrated into business strategies as environmental and social responsibility becomes increasingly important for market access and brand positioning. Companies should develop comprehensive sustainability programs that address environmental impact, social responsibility, and economic development goals.

Innovation investment in product development and processing technologies will be essential for maintaining competitiveness and accessing premium market segments. Research and development programs should focus on creating unique value propositions that differentiate regional suppliers from international competitors.

Market expansion is expected to continue at a robust pace, driven by increasing global demand for natural ingredients and the region’s competitive advantages in agricultural production. MarkWide Research projects sustained growth across all major product categories, with particular strength in organic and functional ingredient segments.

Technology adoption will accelerate as manufacturers recognize the importance of efficiency and quality improvements for maintaining competitiveness. Advanced processing technologies, automation systems, and quality control equipment will become standard across the industry, enabling producers to meet international standards while improving profitability.

Export growth opportunities will expand as international recognition of regional ingredient quality increases and trade relationships strengthen. The region’s unique agricultural biodiversity and processing expertise position it well for capturing increased market share in global ingredient markets, particularly in premium and specialty segments.

Consolidation trends may emerge as larger companies seek to achieve economies of scale and smaller producers look for partnership opportunities. This consolidation will likely focus on complementary capabilities and geographic coverage rather than simple size expansion, creating more efficient and capable market participants.

Regulatory harmonization across the region will facilitate trade and reduce compliance costs, enabling more efficient market development and cross-border operations. Standardized quality requirements and certification processes will benefit both producers and customers through reduced complexity and improved market access.

The MEA fruit and vegetable ingredients market represents a dynamic and promising sector with substantial growth potential driven by favorable agricultural conditions, increasing global demand for natural ingredients, and strategic geographic advantages. The market’s evolution from traditional processing methods to advanced manufacturing capabilities positions regional suppliers to compete effectively in international markets while serving growing domestic demand.

Strategic opportunities abound for companies that can successfully navigate the challenges of infrastructure development, technology adoption, and quality system implementation. The region’s unique agricultural biodiversity and traditional processing knowledge provide competitive advantages that, when combined with modern technology and business practices, create sustainable value propositions for global markets.

Future success will depend on continued investment in processing capabilities, quality systems, and market development while maintaining focus on sustainability and social responsibility. Companies that can balance these requirements while leveraging the region’s natural advantages will be well-positioned to capture the significant growth opportunities ahead in the expanding global market for natural fruit and vegetable ingredients.

What is Fruit and Vegetable Ingredients?

Fruit and vegetable ingredients refer to the various components derived from fruits and vegetables that are used in food and beverage products, including purees, concentrates, powders, and extracts. These ingredients are essential for enhancing flavor, color, and nutritional value in a wide range of applications.

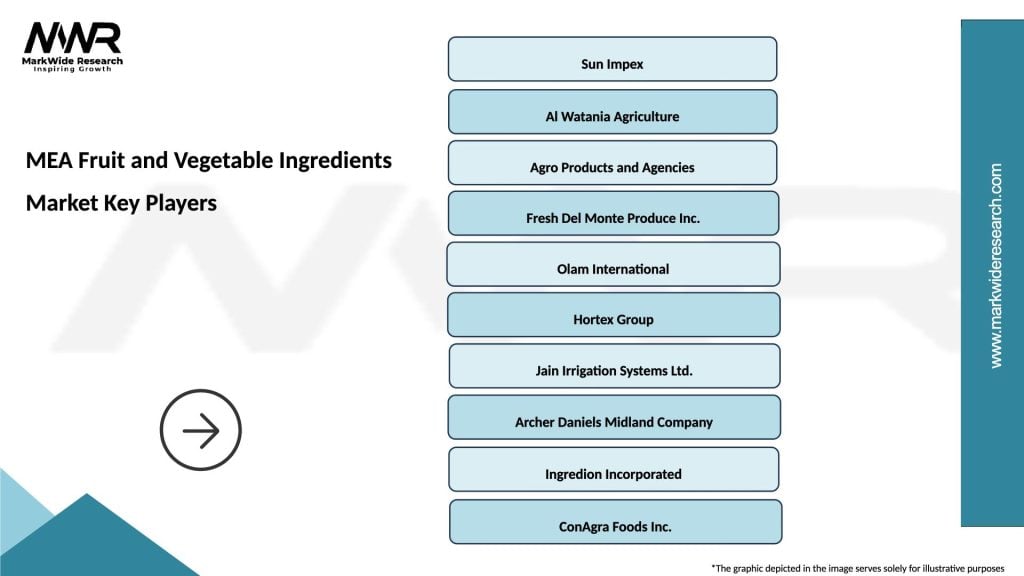

What are the key players in the MEA Fruit and Vegetable Ingredients Market?

Key players in the MEA Fruit and Vegetable Ingredients Market include companies like Olam International, SunOpta, and Archer Daniels Midland Company. These companies are known for their extensive product offerings and innovations in fruit and vegetable processing, among others.

What are the growth factors driving the MEA Fruit and Vegetable Ingredients Market?

The growth of the MEA Fruit and Vegetable Ingredients Market is driven by increasing consumer demand for natural and healthy food products, the rise in plant-based diets, and the growing trend of clean label products. Additionally, the expansion of the food and beverage industry in the region contributes to this growth.

What challenges does the MEA Fruit and Vegetable Ingredients Market face?

The MEA Fruit and Vegetable Ingredients Market faces challenges such as fluctuating raw material prices, supply chain disruptions, and stringent food safety regulations. These factors can impact production costs and availability of ingredients.

What opportunities exist in the MEA Fruit and Vegetable Ingredients Market?

Opportunities in the MEA Fruit and Vegetable Ingredients Market include the increasing popularity of functional foods, the potential for product innovation in organic and specialty ingredients, and the expansion of e-commerce channels for distribution. These trends can lead to new market entrants and product offerings.

What trends are shaping the MEA Fruit and Vegetable Ingredients Market?

Trends shaping the MEA Fruit and Vegetable Ingredients Market include the growing emphasis on sustainability and eco-friendly sourcing, the rise of plant-based alternatives, and advancements in food processing technologies. These trends are influencing consumer preferences and industry practices.

MEA Fruit and Vegetable Ingredients Market

| Segmentation Details | Description |

|---|---|

| Product Type | Purees, Concentrates, Juices, Dried Fruits |

| Application | Beverages, Bakery, Snacks, Sauces |

| End User | Food Manufacturers, Restaurants, Retailers, Caterers |

| Packaging Type | Bottles, Pouches, Tetra Packs, Cans |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the MEA Fruit and Vegetable Ingredients Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at