444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The MEA freeze-dried fruits and vegetables market represents a rapidly expanding segment within the broader food processing industry across the Middle East and Africa region. This innovative preservation technology has gained significant traction among consumers seeking nutritious, convenient, and long-lasting food options. Freeze-drying technology removes moisture from fresh produce while maintaining essential nutrients, flavors, and textures, making it an ideal solution for the region’s challenging climate conditions and growing demand for healthy snacking alternatives.

Market dynamics in the MEA region are particularly influenced by increasing urbanization, rising disposable incomes, and growing health consciousness among consumers. The technology offers substantial benefits including extended shelf life of up to 25-30 years when properly stored, retention of 97% of nutritional value, and significant weight reduction making products ideal for export and distribution across vast geographical areas. Regional growth is further supported by government initiatives promoting food security and agricultural diversification programs.

Key market drivers include the region’s strategic position as a trade hub connecting Europe, Asia, and Africa, creating opportunities for both domestic consumption and re-export activities. The market demonstrates strong potential with growing adoption rates of 15-20% annually in urban centers, particularly in the UAE, Saudi Arabia, and South Africa. Consumer preferences are shifting toward premium, organic, and sustainably produced freeze-dried products, driving innovation and investment in advanced processing technologies.

The MEA freeze-dried fruits and vegetables market refers to the commercial ecosystem encompassing the production, processing, distribution, and consumption of dehydrated produce using sublimation technology across Middle Eastern and African countries. This specialized market involves the transformation of fresh fruits and vegetables through a sophisticated preservation process that removes moisture content while maintaining cellular structure, nutritional integrity, and original flavors.

Freeze-drying technology, also known as lyophilization, operates by freezing products to extremely low temperatures and then reducing surrounding pressure to allow frozen water to sublimate directly from solid to vapor phase. This process creates lightweight, shelf-stable products that retain superior nutritional profiles compared to traditional drying methods. The resulting products serve multiple applications including direct consumption as healthy snacks, ingredients for food manufacturing, emergency food supplies, and specialized dietary products.

Market scope encompasses various product categories including tropical fruits like mangoes, pineapples, and dates, alongside vegetables such as tomatoes, peppers, and leafy greens. The technology addresses critical regional challenges including food waste reduction, seasonal availability limitations, and the need for nutritious food options in remote or arid areas where fresh produce access is limited.

Strategic market positioning of freeze-dried fruits and vegetables in the MEA region reflects a convergence of technological advancement, consumer demand evolution, and regional economic development priorities. The market demonstrates robust growth potential driven by increasing health awareness, expanding retail infrastructure, and growing export opportunities to international markets seeking high-quality preserved produce.

Key growth catalysts include rising per capita income levels, urbanization trends reaching 68% in Gulf countries, and government investments in food processing infrastructure. The market benefits from the region’s abundant agricultural resources, particularly in countries like Egypt, Morocco, and Kenya, which serve as primary raw material suppliers for freeze-drying operations. Technology adoption is accelerating among food processors seeking to add value to agricultural outputs and reduce post-harvest losses.

Competitive landscape features a mix of international technology providers, regional food processors, and emerging local players investing in freeze-drying capabilities. Market differentiation occurs through product quality, organic certifications, innovative packaging solutions, and strategic partnerships with retail chains and food service providers. Investment trends show increasing capital allocation toward sustainable processing technologies and expansion of production capacities to meet growing domestic and export demand.

Consumer behavior analysis reveals significant shifts in purchasing patterns, with health-conscious consumers increasingly prioritizing nutritional value, convenience, and product authenticity. The market demonstrates strong growth in premium segments, with organic freeze-dried products commanding 25-30% price premiums over conventional alternatives.

Primary growth drivers in the MEA freeze-dried fruits and vegetables market stem from multiple interconnected factors that create a favorable environment for market expansion. Health consciousness trends represent the most significant driver, with consumers increasingly seeking nutritious alternatives to traditional processed snacks and convenience foods.

Economic development across the region contributes substantially to market growth, with rising disposable incomes enabling consumers to purchase premium food products. The expanding middle class, particularly in Gulf countries and urban centers across Africa, demonstrates willingness to pay higher prices for quality, convenience, and health benefits associated with freeze-dried products. Urbanization rates exceeding 60% in key markets create concentrated consumer bases with modern shopping preferences.

Government initiatives supporting food security and agricultural value addition provide significant market stimulus. Many MEA countries have implemented policies encouraging food processing investments, technology transfer, and export promotion programs. Infrastructure development including cold chain logistics, modern retail facilities, and improved transportation networks facilitates market growth and product distribution efficiency.

Climate considerations unique to the MEA region make freeze-dried products particularly attractive. The technology’s ability to preserve foods without refrigeration addresses challenges related to high temperatures, humidity variations, and limited cold storage infrastructure in many areas. Export opportunities to international markets seeking authentic, high-quality preserved fruits and vegetables from the region drive commercial investment and production capacity expansion.

Significant market constraints limit the rapid expansion of freeze-dried fruits and vegetables across the MEA region, with high initial capital investment requirements representing the primary barrier for potential market entrants. Equipment costs for industrial freeze-drying systems can be prohibitive for small and medium-sized enterprises, limiting market participation to well-capitalized companies or those with access to substantial financing.

Energy consumption associated with freeze-drying processes presents ongoing operational challenges, particularly in regions where electricity costs are high or supply reliability is inconsistent. The technology requires significant energy inputs for freezing, vacuum creation, and extended processing cycles, impacting production economics and environmental sustainability considerations. Technical expertise requirements for operating sophisticated freeze-drying equipment create human resource challenges in markets with limited specialized training programs.

Consumer awareness levels remain relatively low in many MEA markets, requiring substantial marketing investments to educate consumers about product benefits, usage applications, and value propositions compared to fresh or traditionally dried alternatives. Price sensitivity among consumers, particularly in price-conscious markets, limits adoption rates as freeze-dried products typically command premium pricing due to processing costs and technology investments.

Regulatory frameworks in some MEA countries lack specific guidelines for freeze-dried food products, creating uncertainty for manufacturers regarding compliance requirements, labeling standards, and export documentation. Supply chain complexities including limited availability of high-quality raw materials, seasonal production variations, and logistics challenges in remote areas constrain consistent production and market development efforts.

Emerging opportunities in the MEA freeze-dried fruits and vegetables market present substantial potential for growth and innovation across multiple dimensions. Export market development represents the most significant opportunity, with international demand for authentic, high-quality preserved produce from the region showing strong growth trends, particularly in European and Asian markets seeking premium ingredients and snacking products.

Product innovation opportunities include development of region-specific flavors, organic certifications, and specialized formulations targeting health-conscious consumers, athletes, and outdoor enthusiasts. The growing functional foods segment creates opportunities for freeze-dried products enhanced with additional nutrients, probiotics, or specialized health benefits. Private label partnerships with major retail chains offer market entry opportunities for manufacturers seeking to establish market presence without extensive brand building investments.

Technology advancement opportunities include adoption of more energy-efficient freeze-drying systems, automation technologies, and sustainable packaging solutions that address environmental concerns while reducing operational costs. Strategic partnerships with agricultural producers, research institutions, and international technology providers can accelerate market development and improve competitive positioning.

Niche market segments including baby food applications, pet food ingredients, pharmaceutical applications, and specialized dietary products offer high-value opportunities for differentiation and premium pricing. E-commerce expansion provides direct-to-consumer sales channels that bypass traditional retail limitations and enable market reach expansion across the region’s diverse geographical markets.

Complex market dynamics shape the MEA freeze-dried fruits and vegetables landscape through interactions between supply-side capabilities, demand-side preferences, and external environmental factors. Supply chain evolution demonstrates increasing sophistication as regional producers invest in vertical integration strategies, quality control systems, and traceability technologies to meet international standards and consumer expectations.

Competitive intensity varies significantly across different market segments and geographical areas, with premium organic products experiencing less price competition compared to conventional freeze-dried offerings. Market consolidation trends show larger players acquiring smaller operations to achieve economies of scale, expand product portfolios, and strengthen distribution networks. Innovation cycles are accelerating as companies invest in research and development to create differentiated products and improve processing efficiency.

Seasonal dynamics influence raw material availability, pricing, and production scheduling, with manufacturers developing strategies to manage supply variability through diversified sourcing, contract farming arrangements, and inventory management systems. Currency fluctuations impact export competitiveness and import costs for equipment and packaging materials, requiring sophisticated financial risk management approaches.

Regulatory evolution across MEA countries shows increasing alignment with international food safety standards, creating opportunities for compliant producers while raising barriers for non-compliant operations. Consumer education efforts by industry participants and government agencies are gradually improving market awareness and acceptance, with adoption rates showing steady improvement in urban markets and among younger demographic segments.

Comprehensive research approach employed for analyzing the MEA freeze-dried fruits and vegetables market incorporates multiple data collection methodologies, analytical frameworks, and validation processes to ensure accuracy and reliability of market insights. Primary research activities include structured interviews with industry executives, technology providers, distributors, and key customers across major MEA markets to gather firsthand insights on market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, government statistics, trade publications, company financial statements, and regulatory documents to establish market context and validate primary research findings. Quantitative analysis utilizes statistical modeling techniques to project market trends, assess growth patterns, and identify key performance indicators across different market segments and geographical regions.

Market segmentation analysis employs multiple criteria including product type, application, distribution channel, and geographical location to provide detailed insights into market structure and dynamics. Competitive intelligence gathering involves systematic monitoring of key market participants, their strategies, product offerings, and market positioning to understand competitive landscape evolution.

Data validation processes include cross-referencing multiple sources, expert panel reviews, and statistical consistency checks to ensure research quality and reliability. Analytical frameworks incorporate both qualitative and quantitative methodologies to provide comprehensive market understanding while accounting for regional variations and market-specific factors that influence freeze-dried fruits and vegetables market development across the MEA region.

Gulf Cooperation Council countries lead the MEA freeze-dried fruits and vegetables market with the highest consumption rates and most developed retail infrastructure. United Arab Emirates serves as the regional hub with approximately 35% market share, driven by diverse expatriate population, high disposable incomes, and well-established modern retail channels. Saudi Arabia represents the largest single country market with growing health consciousness and government support for food security initiatives.

North African markets demonstrate strong production capabilities with countries like Egypt and Morocco emerging as key suppliers of raw materials and finished freeze-dried products. These markets benefit from abundant agricultural resources, favorable climate conditions for fruit and vegetable production, and strategic geographical positioning for export to European markets. Market penetration rates in urban areas reach 12-15% with significant growth potential in rural markets.

Sub-Saharan Africa shows emerging market characteristics with South Africa leading adoption rates and serving as a gateway for market development across the broader region. Kenya and Ghana demonstrate growing interest in freeze-drying technology for value addition to agricultural exports, particularly tropical fruits with high international demand. Infrastructure development remains a key challenge but government initiatives and international partnerships are improving market access and distribution capabilities.

Regional trade dynamics show increasing intra-regional commerce with Gulf countries importing raw materials from North and Sub-Saharan Africa for processing and re-export to international markets. Economic integration efforts and trade facilitation measures are improving market connectivity and reducing barriers to cross-border commerce in freeze-dried products.

Market competition in the MEA freeze-dried fruits and vegetables sector features a diverse mix of international technology providers, regional food processors, and emerging local players pursuing different strategic approaches to market development and competitive positioning.

Competitive strategies emphasize product differentiation through organic certifications, innovative packaging, and premium positioning targeting health-conscious consumers. Strategic partnerships with international technology providers enable access to advanced freeze-drying equipment and technical expertise while reducing capital investment requirements.

Product segmentation in the MEA freeze-dried fruits and vegetables market demonstrates clear differentiation based on raw material types, processing methods, and target applications. Fruit segments dominate market volume with tropical varieties including mangoes, pineapples, bananas, and dates showing strongest consumer acceptance and premium pricing potential.

By Product Type:

By Application:

By Distribution Channel:

Tropical fruits category demonstrates the strongest market performance with products like freeze-dried mangoes, pineapples, and papayas commanding premium prices and showing consistent demand growth. Consumer preference for authentic regional flavors drives demand for locally sourced and processed tropical varieties, with organic certifications adding significant value premiums of 20-25% over conventional products.

Citrus fruits segment shows emerging potential with freeze-dried oranges, lemons, and grapefruits gaining acceptance in both direct consumption and ingredient applications. Processing innovations have improved flavor retention and texture quality, making citrus freeze-dried products more appealing to consumers seeking vitamin C-rich snacking options. Export opportunities for citrus products are expanding as international markets recognize quality advantages of MEA-produced freeze-dried citrus.

Vegetable categories demonstrate strong growth in convenience-focused applications with freeze-dried tomatoes, peppers, and onions showing particular success in food service and manufacturing segments. Nutritional retention advantages make freeze-dried vegetables attractive for health-conscious consumers and food manufacturers seeking to enhance product nutritional profiles without compromising shelf stability.

Specialty categories including herbs, spices, and exotic fruits represent high-value niche segments with significant growth potential. Premium positioning and limited availability create opportunities for substantial profit margins while serving discerning consumers seeking unique flavors and authentic regional products. Innovation opportunities in this segment include development of proprietary blends and customized formulations for specific market applications.

Agricultural producers benefit significantly from freeze-drying market development through enhanced value addition opportunities, reduced post-harvest losses, and access to premium market segments. Contract farming arrangements with freeze-drying processors provide farmers with guaranteed purchase agreements, technical support, and quality premiums for meeting specific standards. Seasonal income stabilization occurs as freeze-drying enables year-round sales of seasonal produce.

Food processors gain competitive advantages through product differentiation, extended shelf life capabilities, and access to high-value market segments. Operational benefits include reduced storage and transportation costs due to weight reduction, elimination of cold chain requirements, and ability to serve geographically dispersed markets. Innovation opportunities enable development of unique product formulations and premium positioning strategies.

Retailers and distributors benefit from improved inventory management, reduced spoilage losses, and ability to offer premium health-focused products that command higher margins. Consumer appeal of freeze-dried products supports category growth and customer loyalty development. Supply chain efficiency improvements result from extended shelf life and reduced storage requirements.

Consumers receive substantial benefits including enhanced nutritional value, convenience, portability, and access to seasonal fruits and vegetables year-round. Health advantages include retention of vitamins, minerals, and antioxidants while eliminating preservatives and artificial additives. Lifestyle benefits encompass convenient snacking options, emergency food preparedness, and authentic flavor experiences from regional specialties.

Strengths:

Weaknesses:

Opportunities:

Threats:

Organic product adoption represents the most significant trend shaping the MEA freeze-dried fruits and vegetables market, with consumers increasingly willing to pay premium prices for certified organic products. Certification programs are expanding across the region as producers recognize the value of organic positioning for both domestic and export markets. Supply chain transparency initiatives enable consumers to trace product origins and production methods, supporting premium positioning strategies.

Sustainable packaging innovations are gaining momentum as environmental consciousness grows among consumers and regulatory pressure increases for eco-friendly packaging solutions. Biodegradable materials, recyclable packaging, and reduced packaging waste initiatives are becoming competitive differentiators. Smart packaging technologies incorporating freshness indicators and QR codes for product information are emerging in premium segments.

Functional food development trends show increasing integration of freeze-dried fruits and vegetables into products targeting specific health benefits. Probiotic-enhanced products, antioxidant-rich formulations, and products designed for specific dietary requirements are gaining market acceptance. Personalized nutrition concepts are driving demand for customized freeze-dried product combinations.

Technology integration trends include adoption of artificial intelligence for quality control, blockchain for supply chain traceability, and IoT sensors for process optimization. Automation investments are improving production efficiency and consistency while reducing labor requirements. Energy efficiency improvements through advanced equipment design and renewable energy integration are addressing sustainability concerns and operational cost challenges.

Strategic investments in freeze-drying technology across the MEA region demonstrate growing industry confidence and market potential recognition. Major food processors are expanding production capacities and investing in state-of-the-art equipment to meet growing demand and improve product quality. International partnerships with technology providers are facilitating knowledge transfer and access to advanced processing capabilities.

Regulatory developments include establishment of specific standards for freeze-dried products in several MEA countries, providing clarity for manufacturers and improving consumer confidence. Export certification programs are being developed to facilitate international trade and ensure compliance with destination market requirements. Food safety initiatives are strengthening quality assurance systems and traceability capabilities.

Market expansion initiatives by leading companies include new product launches, geographic expansion, and strategic acquisitions to strengthen market position. Research and development investments are focusing on product innovation, process optimization, and development of region-specific formulations. Sustainability programs are being implemented to address environmental concerns and meet evolving consumer expectations.

Infrastructure development projects including cold storage facilities, logistics networks, and processing centers are improving market accessibility and distribution efficiency. Government support programs are providing financing assistance, technical training, and market development support for freeze-drying industry participants. Trade promotion activities are increasing international market awareness of MEA freeze-dried products and facilitating export growth.

Strategic recommendations for market participants emphasize the importance of focusing on product quality, sustainability, and consumer education to build long-term competitive advantages. Investment priorities should include advanced processing technology, quality control systems, and sustainable packaging solutions to meet evolving market requirements and regulatory standards.

Market entry strategies for new participants should consider partnership approaches with established players, focusing on niche segments, and leveraging regional agricultural advantages. MarkWide Research analysis suggests that companies entering the market should prioritize building strong supply chain relationships and investing in consumer education programs to accelerate market acceptance.

Product development focus should emphasize organic certifications, innovative packaging, and functional food applications to capture premium market segments. Geographic expansion strategies should prioritize markets with developed retail infrastructure and growing health consciousness while building distribution capabilities in emerging markets with high growth potential.

Operational excellence initiatives should focus on energy efficiency improvements, automation investments, and quality management systems to improve competitiveness and profitability. Partnership strategies with agricultural producers, technology providers, and retail partners can accelerate market development and reduce investment requirements while sharing risks and expertise.

Long-term market prospects for MEA freeze-dried fruits and vegetables remain highly positive, driven by sustained growth in health consciousness, urbanization, and disposable income levels across the region. Market maturation is expected to occur gradually with increasing consumer familiarity and acceptance of freeze-dried products leading to broader market adoption and volume growth.

Technology advancement will continue driving market development through improved processing efficiency, reduced energy consumption, and enhanced product quality. Innovation pipeline developments including new product formats, enhanced nutritional profiles, and sustainable packaging solutions will create new market opportunities and support premium positioning strategies. Automation integration will improve production scalability and cost competitiveness.

Export market development represents the most significant growth opportunity with international demand for authentic, high-quality MEA freeze-dried products expected to grow at robust rates over the forecast period. Regional trade integration will facilitate market access and reduce barriers to cross-border commerce, supporting industry growth and development.

Sustainability trends will increasingly influence market development with consumers and regulators demanding environmentally responsible production methods and packaging solutions. Circular economy principles will drive innovation in waste reduction, energy efficiency, and sustainable sourcing practices. Climate adaptation strategies will become increasingly important as the industry responds to changing environmental conditions and resource availability challenges.

The MEA freeze-dried fruits and vegetables market represents a dynamic and rapidly evolving sector with substantial growth potential driven by favorable demographic trends, increasing health consciousness, and expanding economic opportunities across the region. Market fundamentals remain strong with growing consumer acceptance, improving infrastructure, and supportive government policies creating an enabling environment for industry development and investment.

Strategic positioning for success in this market requires focus on product quality, sustainability, and consumer education while leveraging regional advantages in agricultural production and strategic geographic location. Technology adoption and innovation will continue driving market evolution, creating opportunities for differentiation and premium positioning while addressing operational challenges and cost competitiveness requirements.

Future market development will be characterized by increasing sophistication in product offerings, expanding distribution channels, and growing integration with international markets. Industry participants who invest in advanced technology, sustainable practices, and strong market relationships will be best positioned to capitalize on the significant growth opportunities emerging in the MEA freeze-dried fruits and vegetables market over the coming years.

What is Freeze-Dried Fruits and Vegetables?

Freeze-dried fruits and vegetables are food products that have had their moisture removed through a freeze-drying process, preserving their flavor, nutrients, and texture. This method allows for long shelf life and convenient storage, making them popular for various applications, including snacks and meal preparations.

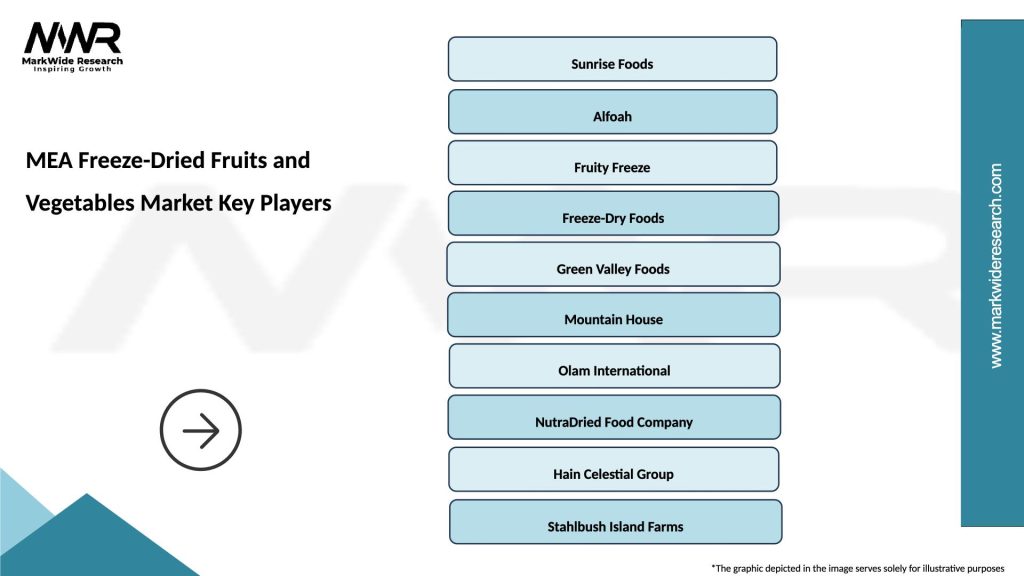

Who are the key players in the MEA Freeze-Dried Fruits and Vegetables Market?

Key players in the MEA Freeze-Dried Fruits and Vegetables Market include companies like Olam International, Sun-Maid Growers of California, and Freeze-Dry Foods, among others. These companies are known for their innovative products and extensive distribution networks.

What are the main drivers of the MEA Freeze-Dried Fruits and Vegetables Market?

The main drivers of the MEA Freeze-Dried Fruits and Vegetables Market include the growing demand for healthy snacks, the convenience of long shelf-life products, and the increasing popularity of outdoor activities that require lightweight food options. Additionally, the rise in health-conscious consumers is fueling market growth.

What challenges does the MEA Freeze-Dried Fruits and Vegetables Market face?

The MEA Freeze-Dried Fruits and Vegetables Market faces challenges such as high production costs associated with the freeze-drying process and competition from other preservation methods like dehydration. Additionally, consumer preferences for fresh produce can impact market growth.

What opportunities exist in the MEA Freeze-Dried Fruits and Vegetables Market?

Opportunities in the MEA Freeze-Dried Fruits and Vegetables Market include expanding product lines to cater to diverse consumer tastes and preferences, as well as increasing distribution channels through e-commerce. The growing trend of plant-based diets also presents a significant opportunity for market expansion.

What trends are shaping the MEA Freeze-Dried Fruits and Vegetables Market?

Trends shaping the MEA Freeze-Dried Fruits and Vegetables Market include the rising popularity of organic and natural products, innovative packaging solutions that enhance shelf life, and the incorporation of freeze-dried ingredients in gourmet cooking. Additionally, sustainability practices are becoming increasingly important to consumers.

MEA Freeze-Dried Fruits and Vegetables Market

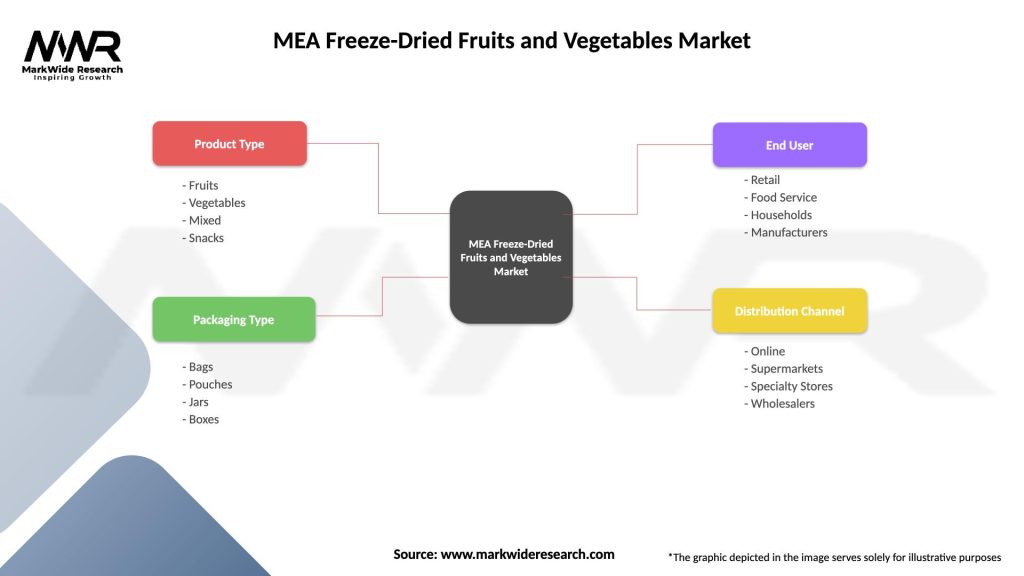

| Segmentation Details | Description |

|---|---|

| Product Type | Fruits, Vegetables, Mixed, Snacks |

| Packaging Type | Bags, Pouches, Jars, Boxes |

| End User | Retail, Food Service, Households, Manufacturers |

| Distribution Channel | Online, Supermarkets, Specialty Stores, Wholesalers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the MEA Freeze-Dried Fruits and Vegetables Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at