444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The MEA freeze-dried food market represents a rapidly expanding segment within the broader food processing industry across the Middle East and Africa region. Freeze-drying technology has emerged as a critical preservation method that maintains nutritional value while extending shelf life, making it particularly valuable in regions with challenging climate conditions and developing cold chain infrastructure. The market encompasses various product categories including fruits, vegetables, meat, seafood, dairy products, and complete meal solutions.

Market dynamics in the MEA region are driven by increasing urbanization, growing awareness of food security, and rising demand for convenient, long-lasting food products. The technology removes moisture through sublimation, preserving the original structure and nutritional content of food items while achieving shelf lives of up to 25 years under proper storage conditions. This preservation method has gained significant traction among consumers seeking healthy, convenient meal options and emergency food supplies.

Regional adoption varies significantly across MEA countries, with the Gulf Cooperation Council (GCC) nations leading in terms of market penetration and technological advancement. Countries like the United Arab Emirates, Saudi Arabia, and Qatar demonstrate higher adoption rates of 35-40% compared to other regional markets, driven by higher disposable incomes and greater awareness of food preservation technologies.

The MEA freeze-dried food market refers to the commercial ecosystem encompassing the production, distribution, and consumption of freeze-dried food products across Middle Eastern and African countries. Freeze-drying, also known as lyophilization, is a dehydration process that removes water from frozen food through sublimation, transforming ice directly into vapor without passing through the liquid phase.

This preservation method maintains the cellular structure of food items, preserving their original shape, texture, and nutritional content while achieving remarkable shelf stability. The process involves three critical phases: freezing the product to temperatures below -40°C, creating a vacuum environment, and applying controlled heat to facilitate sublimation. The result is a lightweight, shelf-stable product that retains 95-98% of its original nutritional value.

Market significance extends beyond simple food preservation, encompassing applications in emergency preparedness, military rations, space exploration, outdoor recreation, and everyday consumer convenience. The technology addresses specific regional challenges including extreme temperatures, limited refrigeration infrastructure, and the need for long-term food storage in areas prone to supply chain disruptions.

The MEA freeze-dried food market demonstrates robust growth potential driven by evolving consumer preferences, technological advancements, and increasing investment in food processing infrastructure. Key market drivers include rising urbanization rates, growing middle-class populations, and heightened awareness of food security issues across the region.

Market segmentation reveals diverse applications spanning consumer retail, food service, military and defense, and industrial sectors. Fruit and vegetable segments dominate current market share, accounting for approximately 45% of total market volume, followed by meat and seafood products. The retail segment shows particularly strong growth momentum, supported by expanding modern trade channels and e-commerce platforms.

Regional distribution highlights the GCC countries as primary growth engines, while North African markets including Egypt, Morocco, and South Africa present significant expansion opportunities. MarkWide Research analysis indicates that technological adoption rates vary considerably across the region, with developed markets showing penetration rates of 25-30% compared to emerging markets at 5-10%.

Competitive dynamics feature a mix of international players and regional specialists, with companies focusing on product innovation, distribution network expansion, and strategic partnerships with local distributors. Investment in research and development remains crucial for market participants seeking to develop region-specific products and applications.

Consumer behavior analysis reveals shifting preferences toward convenient, healthy food options that align with busy lifestyles and health-conscious choices. The following insights characterize current market dynamics:

Multiple factors contribute to the expanding MEA freeze-dried food market, creating a favorable environment for sustained growth across various market segments and applications.

Urbanization and lifestyle changes represent primary growth drivers, with rapid urban population growth creating demand for convenient food solutions. Urban consumers increasingly seek products that align with fast-paced lifestyles while maintaining nutritional quality. The growing number of working professionals and dual-income households drives demand for time-saving meal solutions that don’t compromise on health benefits.

Food security concerns play an increasingly important role in market development, particularly in regions prone to supply chain disruptions or extreme weather events. Governments and organizations recognize freeze-dried foods as valuable components of strategic food reserves and emergency preparedness programs. This recognition has led to increased procurement and stockpiling activities across multiple MEA countries.

Technological advancement in freeze-drying equipment and processes has improved product quality while reducing production costs. Modern freeze-drying systems offer better energy efficiency, shorter processing times, and enhanced product consistency. These improvements make freeze-dried products more accessible to broader consumer segments and enable manufacturers to achieve improved profit margins.

Rising disposable incomes in key MEA markets enable consumers to purchase premium food products, including freeze-dried options that typically command higher prices than conventional preserved foods. The expanding middle class demonstrates increasing willingness to invest in quality food products that offer convenience and nutritional benefits.

Several challenges constrain market growth and adoption rates across the MEA freeze-dried food market, requiring strategic approaches from industry participants to overcome barriers and unlock market potential.

High production costs remain a significant constraint, as freeze-drying equipment requires substantial capital investment and ongoing operational expenses. The energy-intensive nature of the freeze-drying process contributes to elevated production costs, making it challenging for manufacturers to achieve competitive pricing compared to alternative preservation methods. These cost factors can limit market penetration, particularly in price-sensitive market segments.

Limited consumer awareness in many MEA markets restricts demand growth, as consumers may lack understanding of freeze-drying benefits compared to traditional preservation methods. Educational initiatives and marketing investments are required to communicate the value proposition of nutritional preservation and extended shelf life. This awareness gap is particularly pronounced in emerging markets where traditional food preservation methods remain dominant.

Infrastructure limitations in certain regions create challenges for market development, including inadequate cold storage facilities, unreliable power supply, and limited distribution networks. These infrastructure constraints can impact product quality during storage and transportation, potentially affecting consumer confidence in freeze-dried food products.

Regulatory complexities across different MEA countries create compliance challenges for manufacturers seeking regional market expansion. Varying food safety standards, labeling requirements, and import regulations can increase operational complexity and costs for companies operating across multiple markets.

Significant opportunities exist for market expansion and innovation within the MEA freeze-dried food sector, driven by evolving consumer needs and technological developments.

E-commerce expansion presents substantial growth opportunities, as online retail channels enable manufacturers to reach consumers directly while providing detailed product information and educational content. The growing penetration of internet connectivity and smartphone adoption across MEA markets creates favorable conditions for digital commerce growth. Online platforms allow companies to showcase product benefits and build consumer awareness more effectively than traditional retail channels.

Product innovation opportunities abound in developing region-specific freeze-dried products that incorporate local flavors, traditional recipes, and cultural preferences. Companies that successfully adapt international freeze-drying technology to create culturally relevant products can capture significant market share and build strong brand loyalty among local consumers.

Industrial applications offer substantial growth potential beyond consumer markets, including food service, hospitality, and institutional sectors. Hotels, restaurants, and catering companies increasingly recognize the benefits of freeze-dried ingredients for menu consistency and inventory management. Military and defense applications also present opportunities for specialized product development.

Partnership opportunities with local distributors, retailers, and food manufacturers can accelerate market penetration while reducing operational risks. Strategic alliances enable international freeze-dried food companies to leverage local market knowledge and established distribution networks for faster market entry and expansion.

Complex interactions between various market forces shape the MEA freeze-dried food landscape, creating both challenges and opportunities for industry participants.

Supply chain dynamics play a crucial role in market development, with successful companies building robust networks that ensure product quality and availability across diverse geographic markets. The integration of advanced logistics solutions and temperature-controlled storage facilities enables manufacturers to maintain product integrity throughout the distribution process. Companies investing in supply chain optimization achieve competitive advantages through improved product quality and reduced operational costs.

Technology adoption patterns vary significantly across different market segments and geographic regions, influencing overall market growth trajectories. Early adopters in urban markets drive initial demand growth, while broader market penetration requires targeted education and marketing initiatives. The demonstration effect from successful early adoption helps accelerate technology acceptance in secondary markets.

Competitive dynamics intensify as more companies recognize market opportunities and invest in freeze-drying capabilities. This competition drives innovation in product development, packaging solutions, and marketing approaches while potentially pressuring profit margins. Companies that establish strong brand recognition and distribution networks early in market development cycles achieve sustainable competitive advantages.

Regulatory evolution continues to shape market dynamics as governments develop more comprehensive frameworks for freeze-dried food products. Progressive regulatory environments that recognize the safety and nutritional benefits of freeze-drying technology facilitate market growth, while restrictive regulations can constrain development opportunities.

Comprehensive research approaches underpin accurate market analysis and forecasting for the MEA freeze-dried food market, incorporating multiple data sources and analytical methodologies to ensure reliable insights.

Primary research activities include extensive interviews with industry stakeholders, including manufacturers, distributors, retailers, and consumers across key MEA markets. These interviews provide valuable insights into market dynamics, consumer preferences, and industry challenges that quantitative data alone cannot capture. Survey methodologies target representative consumer samples to understand purchasing behavior, brand preferences, and willingness to pay for freeze-dried products.

Secondary research encompasses analysis of industry reports, government statistics, trade publications, and company financial statements to build comprehensive market understanding. This research approach enables validation of primary research findings while providing historical context and trend analysis. Data triangulation techniques ensure accuracy and reliability of market insights and projections.

Market modeling employs sophisticated analytical techniques to project future market trends and identify growth opportunities. These models incorporate multiple variables including demographic changes, economic indicators, technological developments, and regulatory factors. Scenario analysis helps stakeholders understand potential market outcomes under different conditions and develop appropriate strategic responses.

Quality assurance processes ensure research accuracy through peer review, data validation, and cross-referencing with multiple sources. Regular updates and revisions maintain research relevance as market conditions evolve and new information becomes available.

Geographic diversity across the MEA region creates distinct market characteristics and growth opportunities that require tailored approaches for successful market development.

Gulf Cooperation Council (GCC) markets lead regional development with the highest adoption rates and market penetration. The United Arab Emirates demonstrates particularly strong growth, with market penetration rates of approximately 40% among urban consumers. Saudi Arabia follows closely with significant investments in food processing infrastructure and growing consumer awareness. These markets benefit from higher disposable incomes, advanced retail infrastructure, and government support for food security initiatives.

North African markets present substantial growth opportunities despite currently lower adoption rates. Egypt represents the largest potential market by population, while Morocco and Tunisia show increasing interest in modern food preservation technologies. Market penetration rates in these countries currently range from 8-15%, indicating significant room for expansion as awareness and infrastructure develop.

Sub-Saharan African markets remain largely untapped but offer long-term growth potential as economic development progresses. South Africa leads this region with the most developed food processing industry and consumer awareness. Countries like Nigeria, Kenya, and Ghana show emerging interest in freeze-dried products, particularly for emergency preparedness applications.

Regional variations in consumer preferences, regulatory environments, and infrastructure capabilities require customized market entry strategies. Companies achieving success across multiple MEA markets typically adapt their product offerings, pricing strategies, and distribution approaches to local conditions while maintaining consistent quality standards.

The competitive environment features a diverse mix of international corporations, regional specialists, and emerging local players, each bringing unique strengths and market approaches.

Competitive strategies focus on product innovation, distribution network expansion, and strategic partnerships with local companies. Market leaders invest heavily in research and development to create products that meet specific regional preferences while maintaining the quality and convenience benefits of freeze-drying technology.

Market segmentation reveals diverse applications and product categories that serve different consumer needs and market segments across the MEA region.

By Product Type:

By Application:

By Distribution Channel:

Detailed analysis of major product categories reveals distinct market dynamics, consumer preferences, and growth opportunities within each segment.

Fruits and Vegetables Category dominates market volume due to consumer familiarity and perceived health benefits. Strawberries and apples lead in terms of consumer acceptance, while exotic fruits show growing demand among premium market segments. This category benefits from clear nutritional messaging and versatile applications including snacking, baking, and cereal additions. Seasonal availability of fresh produce drives consistent demand for freeze-dried alternatives.

Meat and Seafood Products represent the highest value segment despite lower volume, with applications spanning outdoor recreation, emergency preparedness, and gourmet cooking. Chicken and beef products show strongest market acceptance, while seafood options appeal to coastal markets and premium consumer segments. This category requires careful handling and storage to maintain quality and safety standards.

Complete Meal Solutions emerge as a high-growth category targeting busy urban consumers seeking convenient, nutritious meal options. Products in this category typically combine multiple freeze-dried ingredients to create balanced nutritional profiles while maintaining authentic flavors. Success in this segment requires significant investment in recipe development and consumer education.

Dairy Products show steady growth driven by applications in food manufacturing and consumer markets. Cheese and yogurt products maintain popularity due to familiar taste profiles and versatile applications. This category benefits from growing awareness of probiotic benefits and clean label trends among health-conscious consumers.

Multiple stakeholders throughout the freeze-dried food value chain realize significant benefits from market participation and development.

Manufacturers benefit from premium pricing opportunities and growing market demand that supports sustainable business growth. Freeze-drying technology enables companies to differentiate their products while achieving higher profit margins compared to conventional food processing methods. The extended shelf life of freeze-dried products reduces inventory risks and enables broader geographic distribution without compromising quality.

Retailers and Distributors gain access to high-margin product categories that appeal to health-conscious and convenience-seeking consumers. Freeze-dried products require minimal storage space while offering extended shelf life, improving inventory turnover and reducing waste. The premium positioning of these products enhances overall category profitability and store differentiation.

Consumers receive significant value through improved nutrition retention, convenience, and food security benefits. Freeze-dried foods maintain up to 98% of original nutritional content while offering unmatched convenience and portability. The extended shelf life provides peace of mind for emergency preparedness while supporting healthier eating habits through year-round availability of nutritious options.

Food Service Operators achieve operational efficiencies through consistent ingredient quality, reduced waste, and simplified inventory management. Freeze-dried ingredients enable menu standardization across multiple locations while reducing dependency on seasonal fresh produce availability. The lightweight nature of freeze-dried products reduces transportation costs and storage requirements.

Government and Institutional Buyers benefit from reliable food security solutions that support emergency preparedness and strategic food reserves. Long-term storage capabilities make freeze-dried foods ideal for disaster relief operations and military applications where nutrition and shelf stability are critical requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Several significant trends shape the current and future development of the MEA freeze-dried food market, influencing consumer behavior and industry strategies.

Health and Wellness Focus continues to drive market growth as consumers increasingly prioritize nutritional quality in their food choices. Clean label trends favor freeze-dried products that maintain natural ingredients without artificial preservatives or additives. This trend particularly resonates with health-conscious urban consumers who seek convenient options that don’t compromise nutritional benefits.

Sustainability Consciousness influences purchasing decisions as consumers become more aware of environmental impacts. Freeze-dried foods offer sustainability benefits through reduced food waste, lower transportation costs due to reduced weight, and extended shelf life that minimizes spoilage. Companies emphasizing these environmental benefits gain competitive advantages among environmentally conscious consumers.

Convenience Culture drives demand for ready-to-eat and easy-to-prepare meal solutions that fit busy lifestyles. Single-serving packaging and instant preparation methods appeal to urban professionals and small households seeking portion control and convenience. This trend supports premium pricing for products that offer time-saving benefits.

Adventure Tourism Growth creates expanding demand for portable, lightweight food options among outdoor enthusiasts and travelers. Camping and hiking activities show increasing popularity across MEA markets, driving demand for specialized freeze-dried meal solutions that provide nutrition and taste in challenging environments.

Emergency Preparedness Awareness increases following natural disasters and supply chain disruptions, with consumers recognizing the value of long-term food storage solutions. Government initiatives and public awareness campaigns promote household emergency preparedness, creating steady demand for freeze-dried food products with extended shelf life.

Recent industry developments demonstrate the dynamic nature of the MEA freeze-dried food market and indicate future growth directions and opportunities.

Technology Advancement in freeze-drying equipment has improved energy efficiency and reduced processing times, making production more cost-effective. New generation equipment offers better temperature control, shorter cycle times, and improved product quality consistency. These technological improvements enable manufacturers to achieve better economics while maintaining product quality standards.

Product Innovation focuses on developing culturally relevant products that incorporate traditional MEA flavors and cooking methods. Companies invest in research and development to create authentic taste profiles that appeal to local consumer preferences while maintaining the benefits of freeze-drying technology. This localization strategy proves crucial for market acceptance and growth.

Distribution Network Expansion sees companies establishing partnerships with local distributors and retailers to improve market access and consumer education. Strategic alliances enable international companies to leverage local market knowledge while providing partners with access to advanced freeze-drying technology and products.

Regulatory Development includes government initiatives to establish comprehensive frameworks for freeze-dried food products, addressing safety standards, labeling requirements, and quality specifications. Progressive regulations that recognize the safety and nutritional benefits of freeze-drying technology facilitate market growth and consumer confidence.

Investment Activity increases as investors recognize the growth potential of the freeze-dried food market. Private equity and venture capital investments support technology development, capacity expansion, and market development initiatives across the region.

Strategic recommendations for market participants focus on sustainable growth approaches that address current market challenges while capitalizing on emerging opportunities.

Market Education Initiatives should receive priority attention from industry participants seeking to expand consumer awareness and acceptance. Educational campaigns that demonstrate nutritional benefits, preparation methods, and versatile applications can accelerate market adoption. Companies should invest in consumer education through digital marketing, in-store demonstrations, and partnerships with nutrition professionals.

Product Localization represents a critical success factor for companies seeking sustainable market growth across diverse MEA markets. MWR analysis indicates that products incorporating local flavors and traditional recipes achieve significantly higher acceptance rates compared to standardized international offerings. Companies should invest in local market research and product development capabilities.

Distribution Strategy Optimization requires careful balance between modern trade channels and traditional retail networks. Multi-channel approaches that combine supermarket placement with e-commerce platforms and specialty stores maximize market reach while providing consumer education opportunities. Companies should prioritize partnerships with retailers committed to category development and consumer education.

Technology Investment in production efficiency and product quality improvements remains essential for long-term competitiveness. Equipment upgrades that reduce energy consumption and processing times can improve cost competitiveness while maintaining quality standards. Companies should evaluate technology investments that support scalable production growth.

Strategic Partnerships with local companies, distributors, and food service operators can accelerate market penetration while reducing operational risks. Joint ventures and licensing agreements enable technology transfer while providing local market expertise and established distribution networks.

The MEA freeze-dried food market demonstrates strong growth potential driven by favorable demographic trends, increasing consumer awareness, and technological advancement. Market projections indicate sustained growth across multiple product categories and geographic markets, with particularly strong performance expected in urban centers and developed economies.

Demographic trends support long-term market growth, including urbanization, rising disposable incomes, and growing middle-class populations across key MEA markets. Young consumer segments show higher adoption rates and willingness to experiment with innovative food products, suggesting positive long-term demand trends. The increasing number of working professionals and dual-income households creates sustained demand for convenient meal solutions.

Technology evolution will continue to improve product quality while reducing production costs, making freeze-dried foods more accessible to broader consumer segments. Equipment innovations focusing on energy efficiency and automation will help manufacturers achieve better economics and scale production to meet growing demand. Advanced packaging technologies will further extend shelf life and improve product presentation.

Market expansion opportunities exist across multiple dimensions, including geographic expansion into underserved markets, product category development, and application diversification. Emerging markets in Sub-Saharan Africa present significant long-term opportunities as economic development and infrastructure improvements progress. Industrial applications in food manufacturing and food service sectors offer substantial growth potential beyond consumer retail markets.

Regulatory environment improvements across MEA countries will facilitate market development through clearer standards and recognition of freeze-drying technology benefits. Government support for food security initiatives and emergency preparedness programs will create additional demand drivers for freeze-dried food products. International trade agreements may reduce barriers and facilitate cross-border market expansion.

The MEA freeze-dried food market represents a dynamic and rapidly evolving sector with substantial growth potential across multiple product categories and geographic markets. Market fundamentals remain strong, supported by favorable demographic trends, increasing consumer awareness, and technological advancement that continues to improve product quality while reducing costs.

Key success factors for market participants include strategic focus on consumer education, product localization, distribution network development, and continuous technology investment. Companies that successfully address current market challenges while capitalizing on emerging opportunities will achieve sustainable competitive advantages and market leadership positions.

Regional diversity across MEA markets requires tailored approaches that recognize local preferences, regulatory environments, and infrastructure capabilities. GCC markets will continue leading regional development, while North African and Sub-Saharan markets present significant expansion opportunities for companies with appropriate market entry strategies.

Future market development will be characterized by continued product innovation, expanding applications, and growing consumer acceptance as awareness of freeze-drying benefits increases. MarkWide Research projects that companies investing in market education, product development, and strategic partnerships will capture the greatest share of market growth opportunities in this expanding sector.

What is Freeze-Dried Food?

Freeze-dried food refers to food products that have undergone a dehydration process, removing moisture while preserving flavor and nutrients. This method is commonly used for fruits, vegetables, and meals, making them lightweight and shelf-stable.

What are the key players in the MEA Freeze-Dried Food Market?

Key players in the MEA Freeze-Dried Food Market include companies like Nestlé, Kraft Heinz, and Olam International, which are known for their innovative freeze-dried products. These companies focus on expanding their product lines to cater to various consumer preferences, among others.

What are the growth factors driving the MEA Freeze-Dried Food Market?

The growth of the MEA Freeze-Dried Food Market is driven by increasing demand for convenient and long-lasting food options, rising outdoor activities, and a growing interest in healthy eating. Additionally, advancements in freeze-drying technology enhance product quality and variety.

What challenges does the MEA Freeze-Dried Food Market face?

The MEA Freeze-Dried Food Market faces challenges such as high production costs and the need for specialized equipment. Additionally, consumer awareness and acceptance of freeze-dried products can vary, impacting market penetration.

What opportunities exist in the MEA Freeze-Dried Food Market?

Opportunities in the MEA Freeze-Dried Food Market include the potential for product diversification, such as organic and gourmet freeze-dried options. There is also a growing trend towards e-commerce, allowing companies to reach a broader audience.

What trends are shaping the MEA Freeze-Dried Food Market?

Trends in the MEA Freeze-Dried Food Market include an increasing focus on sustainability and eco-friendly packaging, as well as the rise of plant-based freeze-dried products. Additionally, the popularity of meal kits and ready-to-eat options is influencing product development.

MEA Freeze-Dried Food Market

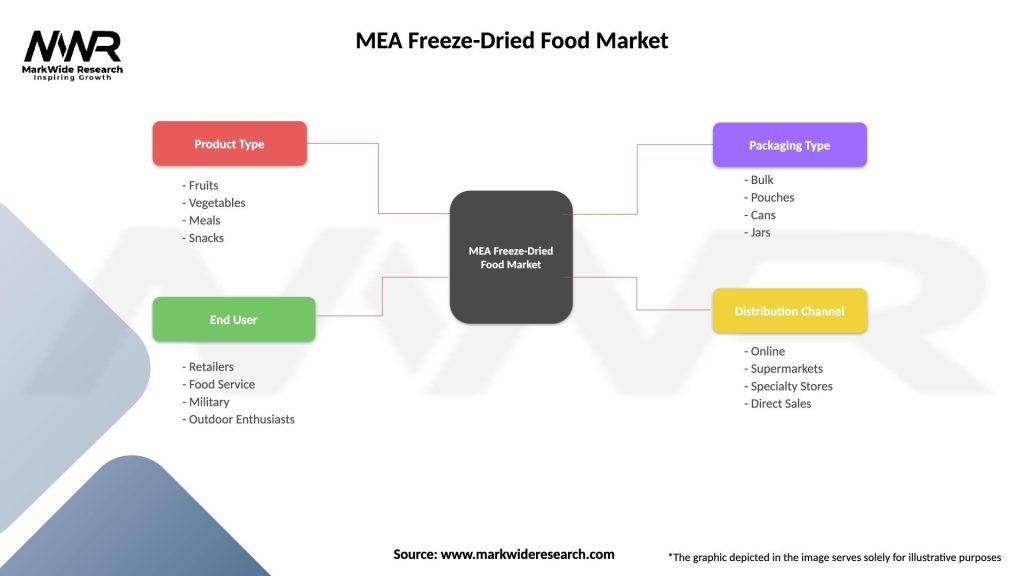

| Segmentation Details | Description |

|---|---|

| Product Type | Fruits, Vegetables, Meals, Snacks |

| End User | Retailers, Food Service, Military, Outdoor Enthusiasts |

| Packaging Type | Bulk, Pouches, Cans, Jars |

| Distribution Channel | Online, Supermarkets, Specialty Stores, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the MEA Freeze-Dried Food Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at