444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The MEA food sweeteners market represents a dynamic and rapidly evolving sector within the broader Middle East and Africa food ingredients industry. This market encompasses a diverse range of natural and artificial sweetening solutions designed to meet the growing consumer demand for healthier food alternatives while maintaining taste preferences. Market dynamics in the MEA region are particularly influenced by increasing health consciousness, rising diabetes prevalence, and changing dietary patterns across urban populations.

Regional growth patterns indicate that the MEA food sweeteners market is experiencing robust expansion, driven by urbanization trends and increasing disposable income levels. The market demonstrates a compound annual growth rate (CAGR) of 6.2%, reflecting strong consumer adoption of sugar alternatives across various food and beverage applications. Key market drivers include government initiatives promoting healthier eating habits, growing awareness of obesity-related health issues, and expanding food processing industries throughout the region.

Product diversification within the MEA food sweeteners market spans multiple categories, including artificial sweeteners like aspartame and sucralose, natural alternatives such as stevia and monk fruit, and sugar alcohols including xylitol and erythritol. The market’s geographical distribution shows significant concentration in major economies including Saudi Arabia, UAE, South Africa, and Egypt, which collectively account for approximately 68% of regional market share.

The MEA food sweeteners market refers to the comprehensive ecosystem of natural and artificial sweetening agents specifically designed for food and beverage applications across Middle Eastern and African countries. This market encompasses the production, distribution, and consumption of various sweetening solutions that serve as alternatives to traditional sugar, catering to health-conscious consumers and specialized dietary requirements.

Market scope includes multiple product categories ranging from high-intensity artificial sweeteners to natural plant-based alternatives, each offering unique functional properties and applications. The market serves diverse end-user segments including food manufacturers, beverage producers, pharmaceutical companies, and direct consumers seeking healthier lifestyle choices. Technological advancement in sweetener formulation and processing has expanded the market’s potential, enabling manufacturers to develop products that closely mimic sugar’s taste profile while providing additional health benefits.

Regional characteristics of the MEA food sweeteners market reflect unique cultural preferences, regulatory frameworks, and economic conditions that influence product adoption and market penetration. The market’s definition extends beyond simple sugar substitution to encompass functional ingredients that enhance food products while addressing specific health concerns prevalent in the region, including diabetes management and weight control initiatives.

Strategic market positioning within the MEA food sweeteners sector reveals a landscape characterized by increasing consumer sophistication and growing demand for healthier food alternatives. The market demonstrates remarkable resilience and growth potential, supported by favorable demographic trends and evolving consumer preferences toward reduced-sugar products. Key performance indicators suggest sustained market expansion with natural sweeteners gaining 42% market preference among health-conscious consumers.

Competitive dynamics showcase a diverse ecosystem of international and regional players competing across multiple product segments and distribution channels. Market leaders are investing heavily in research and development to create innovative sweetening solutions that address specific regional taste preferences while meeting stringent regulatory requirements. Innovation trends focus on developing clean-label products with enhanced functionality and improved taste profiles.

Market opportunities are particularly pronounced in the natural sweeteners segment, where consumer demand for plant-based alternatives continues to accelerate. The beverage industry represents the largest application segment, accounting for significant market share, followed by confectionery and bakery applications. Growth projections indicate continued market expansion driven by urbanization, rising health awareness, and increasing penetration of processed food products across the region.

Consumer behavior analysis reveals several critical insights that shape the MEA food sweeteners market landscape. Primary market drivers include increasing prevalence of lifestyle diseases, growing awareness of sugar-related health risks, and rising demand for functional food products that support wellness objectives.

Primary growth catalysts within the MEA food sweeteners market stem from multiple interconnected factors that create sustained demand for sugar alternatives. The most significant driver involves the region’s escalating health crisis, particularly the rising incidence of diabetes and obesity, which has prompted both consumers and healthcare professionals to advocate for reduced sugar consumption.

Demographic transitions across the MEA region contribute substantially to market growth, with urbanization rates reaching 73% in Gulf countries and continuing to rise across Africa. Urban populations demonstrate higher awareness of health issues and greater willingness to adopt premium food products, including advanced sweetening solutions. Economic development in key markets has increased consumer purchasing power, enabling broader adoption of specialized food ingredients.

Regulatory initiatives implemented by various MEA governments have created favorable market conditions through sugar taxation, mandatory labeling requirements, and public health campaigns promoting reduced sugar consumption. These policy measures have accelerated consumer acceptance of sweetener alternatives while encouraging food manufacturers to reformulate products using alternative sweetening solutions.

Industry transformation within the food and beverage sector has driven significant demand for innovative sweetening solutions. Manufacturers are increasingly focused on developing products that meet consumer expectations for taste, health benefits, and clean-label ingredients. This trend has created substantial opportunities for sweetener suppliers to develop customized solutions for specific applications and regional preferences.

Significant challenges within the MEA food sweeteners market include consumer skepticism regarding artificial sweeteners, regulatory complexities across different countries, and price sensitivity in certain market segments. Taste perception issues remain a primary concern, as many consumers report dissatisfaction with the aftertaste or flavor profile of certain sweetener alternatives compared to traditional sugar.

Regulatory barriers present substantial obstacles for market expansion, particularly regarding approval processes for new sweetener ingredients and varying safety standards across MEA countries. These regulatory inconsistencies create compliance challenges for manufacturers and limit the availability of certain sweetener products in specific markets. Import restrictions and tariff structures further complicate market access for international suppliers.

Economic constraints in certain MEA markets limit consumer adoption of premium sweetener products, particularly in price-sensitive segments where traditional sugar remains the preferred option due to cost considerations. Supply chain challenges including limited local production capabilities and dependence on imports create pricing pressures and availability issues for certain sweetener categories.

Cultural resistance to artificial ingredients and preference for traditional sweetening methods in certain communities pose adoption challenges. Educational initiatives and gradual market development strategies are required to overcome these cultural barriers and build consumer confidence in sweetener alternatives.

Emerging opportunities within the MEA food sweeteners market are particularly pronounced in the natural sweeteners segment, where consumer demand continues to outpace supply capabilities. The growing popularity of plant-based alternatives such as stevia, monk fruit, and date-based sweeteners presents significant expansion potential for manufacturers willing to invest in regional production facilities and distribution networks.

Innovation opportunities exist in developing sweetener blends that combine multiple ingredients to achieve optimal taste profiles while maintaining health benefits. Functional sweeteners that provide additional nutritional benefits, such as prebiotic properties or vitamin fortification, represent a growing market segment with substantial commercial potential.

Market expansion opportunities are evident in underserved geographical areas, particularly in sub-Saharan Africa where urbanization and economic development are creating new consumer segments interested in healthier food alternatives. E-commerce growth provides additional distribution channels that can reach previously inaccessible markets and consumer segments.

Partnership opportunities with local food manufacturers, healthcare organizations, and government agencies can accelerate market penetration while building consumer trust and awareness. Educational initiatives that promote understanding of sweetener benefits and proper usage can expand market acceptance and drive long-term growth.

Complex market interactions within the MEA food sweeteners sector reflect the interplay between consumer preferences, regulatory environments, technological advancement, and competitive pressures. Supply chain dynamics are particularly important, as the region’s dependence on imported raw materials creates both opportunities and vulnerabilities for market participants.

Competitive pressures continue to intensify as both international and regional players expand their presence across MEA markets. This competition drives innovation in product development, pricing strategies, and distribution approaches while benefiting consumers through improved product quality and availability. Market consolidation trends are evident as larger companies acquire specialized sweetener manufacturers to expand their product portfolios.

Technology adoption plays a crucial role in market dynamics, with advanced processing techniques enabling the development of improved sweetener formulations that better replicate sugar’s functional properties. Digital transformation in marketing and distribution channels has enhanced market reach and consumer engagement, particularly among younger demographic segments.

Economic fluctuations across MEA markets create varying demand patterns and pricing pressures that require flexible business strategies. Currency volatility and commodity price changes affect both production costs and consumer purchasing decisions, influencing overall market dynamics and growth patterns.

Comprehensive research approaches employed in analyzing the MEA food sweeteners market combine quantitative and qualitative methodologies to provide accurate market insights and projections. Primary research involves extensive surveys and interviews with industry stakeholders including manufacturers, distributors, retailers, and end consumers across key MEA markets.

Data collection strategies encompass multiple sources including industry reports, government publications, trade association data, and proprietary databases maintained by leading market research organizations. MarkWide Research utilizes advanced analytical tools and methodologies to ensure data accuracy and reliability while providing actionable insights for market participants.

Market segmentation analysis employs statistical modeling techniques to identify key market segments, growth patterns, and competitive dynamics. Geographic analysis considers regional variations in consumer preferences, regulatory environments, and economic conditions that influence market development across different MEA countries.

Validation processes include cross-referencing multiple data sources, expert consultations, and trend analysis to ensure research findings accurately reflect current market conditions and future growth prospects. Forecasting models incorporate various economic and demographic variables to provide reliable market projections and scenario analysis.

Geographic distribution of the MEA food sweeteners market reveals significant variations in market maturity, consumer preferences, and growth potential across different regions. Gulf Cooperation Council (GCC) countries lead market development with 45% regional market share, driven by high disposable incomes, health consciousness, and advanced retail infrastructure.

Saudi Arabia represents the largest individual market within the MEA region, characterized by strong government support for health initiatives and growing consumer awareness of diabetes prevention. The market benefits from substantial food processing industry presence and increasing adoption of international food standards. United Arab Emirates demonstrates the highest per-capita consumption of sweetener products, reflecting its cosmopolitan population and premium product preferences.

South Africa leads the African continent in sweetener adoption, with well-established distribution networks and growing health consciousness among urban populations. The market shows 8.1% annual growth driven by expanding middle-class demographics and increasing availability of imported sweetener products. Egypt presents significant growth potential due to its large population base and developing food processing sector.

North African markets including Morocco, Tunisia, and Algeria demonstrate emerging opportunities for sweetener adoption, particularly in urban centers where Western dietary influences are increasing. Sub-Saharan Africa represents the fastest-growing regional segment, with urbanization and economic development creating new consumer segments interested in healthier food alternatives.

Market leadership within the MEA food sweeteners sector is distributed among several international and regional players, each focusing on specific product categories and geographical markets. Competitive strategies emphasize product innovation, strategic partnerships, and localized marketing approaches that address regional consumer preferences and regulatory requirements.

Competitive differentiation strategies include development of region-specific product formulations, investment in local production facilities, and establishment of strategic partnerships with regional food manufacturers and distributors.

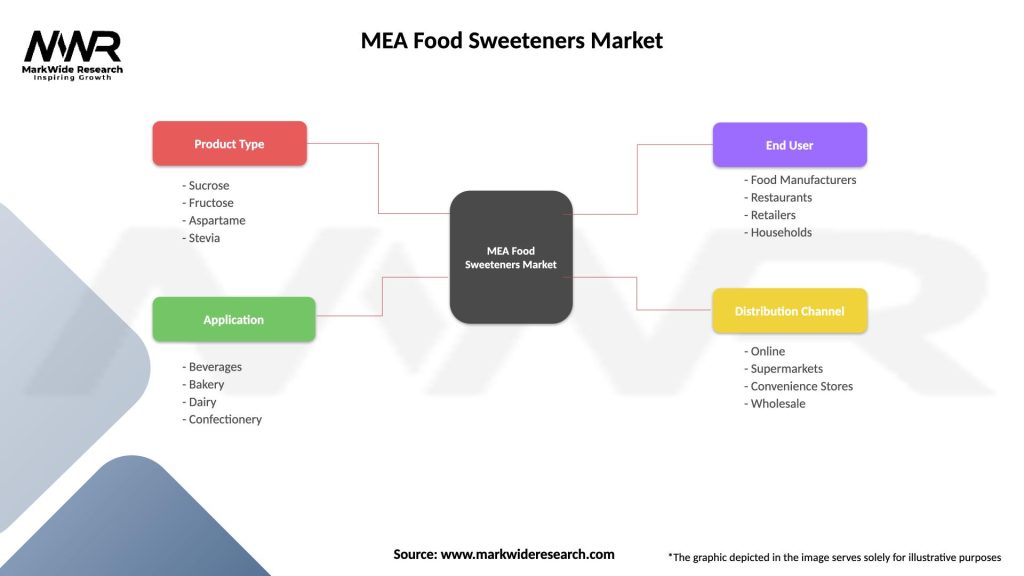

Market segmentation within the MEA food sweeteners sector reflects diverse product categories, application areas, and consumer segments that drive demand patterns and growth opportunities. Product-based segmentation provides the primary framework for understanding market dynamics and competitive positioning across different sweetener categories.

By Product Type:

By Application:

By Distribution Channel:

Artificial sweeteners maintain dominant market position due to their established presence, cost-effectiveness, and proven functionality across diverse applications. Aspartame leads this category with widespread acceptance in beverage applications, while sucralose gains popularity in baking applications due to its heat stability and sugar-like taste profile.

Natural sweeteners represent the fastest-growing category, driven by consumer preference for clean-label ingredients and perceived health benefits. Stevia-based products dominate this segment with 78% category share, supported by improved taste formulations and regulatory approvals across MEA markets. Monk fruit sweeteners show emerging potential, particularly in premium product applications.

Sugar alcohols serve specialized market niches, particularly in diabetic-friendly products and dental health applications. Xylitol leads this category due to its dental health benefits and natural origin, while erythritol gains traction in ketogenic and low-carb product formulations.

Application-specific insights reveal that beverage applications drive the largest volume consumption, accounting for approximately 58% of total sweetener usage. Confectionery applications show strong growth potential, particularly in sugar-free and reduced-calorie product segments that appeal to health-conscious consumers.

Manufacturers benefit from the expanding MEA food sweeteners market through opportunities to develop innovative products that meet growing consumer demand for healthier alternatives. Cost optimization potential exists through strategic sourcing and local production initiatives that reduce dependence on imports while improving profit margins.

Food and beverage companies gain competitive advantages by incorporating advanced sweetening solutions that enable product differentiation and appeal to health-conscious consumers. Reformulation opportunities allow manufacturers to reduce sugar content while maintaining taste appeal, supporting compliance with regulatory requirements and consumer preferences.

Retailers benefit from expanding product categories that attract health-conscious consumers and generate higher profit margins compared to traditional sugar-based products. Market positioning opportunities exist for retailers who establish themselves as destinations for healthy food alternatives and specialty dietary products.

Consumers gain access to diverse sweetening options that support health objectives while maintaining taste satisfaction. Health benefits include reduced caloric intake, better diabetes management, and improved dental health outcomes. Product variety enables consumers to find sweetening solutions that match their specific dietary requirements and taste preferences.

Healthcare systems benefit from reduced burden of lifestyle diseases as consumers adopt healthier dietary practices supported by appropriate sweetening alternatives. Economic benefits include reduced healthcare costs associated with diabetes, obesity, and related conditions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Clean label movement represents the most significant trend shaping the MEA food sweeteners market, with consumers increasingly demanding natural ingredients and transparent labeling. This trend drives innovation in plant-based sweeteners and encourages manufacturers to develop products with minimal processing and recognizable ingredient lists.

Functional sweeteners emerge as a key trend, with products offering additional health benefits beyond calorie reduction. Prebiotic sweeteners that support digestive health and antioxidant-rich alternatives gain consumer interest, particularly among health-conscious demographics seeking multifunctional food ingredients.

Personalized nutrition trends influence sweetener selection, with consumers seeking products that align with specific dietary requirements such as ketogenic, diabetic, or weight management programs. This trend creates opportunities for specialized product formulations and targeted marketing approaches.

Sustainability focus increasingly influences consumer purchasing decisions, driving demand for environmentally responsible sweeteners with sustainable sourcing practices and minimal environmental impact. Local sourcing initiatives gain importance as consumers prefer products with reduced carbon footprints.

Digital engagement transforms how consumers discover and purchase sweetener products, with social media influence and online education playing crucial roles in product adoption and brand loyalty development.

Recent industry developments within the MEA food sweeteners market reflect accelerating innovation and strategic positioning by major market participants. Product launches focus on improved taste formulations and novel sweetener combinations that address specific consumer preferences and application requirements.

Strategic partnerships between international sweetener manufacturers and regional food companies have expanded market access and localized product development capabilities. These collaborations enable customized solutions that address regional taste preferences while leveraging global expertise in sweetener technology.

Regulatory approvals for new sweetener ingredients have expanded product options available to MEA consumers, particularly in the natural sweeteners category. Government initiatives promoting reduced sugar consumption have created additional market opportunities and regulatory support for sweetener adoption.

Investment activities include expansion of production facilities, research and development centers, and distribution networks across key MEA markets. Technology investments focus on improving sweetener functionality, taste profiles, and cost-effectiveness to enhance market competitiveness.

Sustainability initiatives by major manufacturers include development of environmentally responsible sourcing practices and packaging solutions that appeal to environmentally conscious consumers while reducing operational costs.

Strategic recommendations for MEA food sweeteners market participants emphasize the importance of localized approaches that address specific regional preferences and regulatory requirements. MWR analysis suggests that companies should prioritize natural sweetener development while maintaining cost-competitive positioning to capture growing market demand.

Market entry strategies should focus on establishing strong distribution partnerships and building consumer education programs that address taste concerns and health benefits. Investment priorities should include local production capabilities to reduce supply chain risks and improve cost competitiveness against imported alternatives.

Product development recommendations emphasize creating sweetener blends that optimize taste profiles while maintaining clean-label appeal. Innovation focus should address specific application requirements in key market segments including beverages, confectionery, and functional foods.

Marketing strategies should leverage digital channels and healthcare professional endorsements to build consumer trust and awareness. Educational initiatives that demonstrate proper usage and health benefits can accelerate market adoption and overcome cultural resistance to artificial ingredients.

Competitive positioning should emphasize unique value propositions such as superior taste, health benefits, or sustainability credentials that differentiate products in an increasingly crowded marketplace.

Long-term market prospects for the MEA food sweeteners sector remain highly positive, supported by sustained demographic trends, increasing health awareness, and continued economic development across the region. Growth projections indicate continued market expansion with natural sweeteners expected to capture 35% market share within the next five years.

Technological advancement will continue driving product innovation, with next-generation sweeteners offering improved functionality, taste profiles, and cost-effectiveness. Biotechnology applications may enable development of novel sweetening compounds that address current market limitations while providing enhanced consumer benefits.

Market maturation in developed MEA markets will drive focus toward emerging economies where urbanization and economic growth create new consumer segments. MarkWide Research projects that sub-Saharan African markets will demonstrate the highest growth rates, driven by expanding middle-class populations and increasing health consciousness.

Regulatory evolution is expected to support market growth through harmonized standards and streamlined approval processes that facilitate product innovation and market access. Sustainability requirements will increasingly influence product development and sourcing strategies as environmental consciousness grows among consumers and regulators.

Integration trends may lead to market consolidation as larger companies acquire specialized sweetener manufacturers to expand product portfolios and geographical reach. This consolidation could accelerate innovation while improving distribution efficiency and market penetration.

The MEA food sweeteners market represents a dynamic and rapidly evolving sector with substantial growth potential driven by increasing health consciousness, regulatory support, and expanding consumer access to innovative sweetening solutions. Market fundamentals remain strong, supported by demographic trends, economic development, and technological advancement that create sustained demand for sugar alternatives across diverse applications.

Strategic opportunities exist for market participants who can successfully navigate regional complexities while delivering products that meet specific consumer preferences and regulatory requirements. The natural sweeteners segment presents particularly attractive growth prospects, while artificial sweeteners maintain important market positions through cost-effectiveness and proven functionality.

Success factors in this market include localized product development, strong distribution partnerships, effective consumer education, and continuous innovation in taste and functionality. Companies that can address taste perception challenges while maintaining competitive pricing will be best positioned to capture growing market opportunities across the MEA region’s diverse and expanding consumer base.

What is Food Sweeteners?

Food sweeteners are substances used to enhance the sweetness of food and beverages, often serving as alternatives to sugar. They can be derived from natural sources or synthesized chemically and are commonly used in various products, including soft drinks, baked goods, and dairy items.

What are the key players in the MEA Food Sweeteners Market?

Key players in the MEA Food Sweeteners Market include companies like Cargill, Archer Daniels Midland Company, and Tate & Lyle, which are known for their extensive portfolios of sweetening solutions. These companies focus on innovation and sustainability to meet the growing demand for healthier alternatives among consumers, among others.

What are the growth factors driving the MEA Food Sweeteners Market?

The MEA Food Sweeteners Market is driven by increasing health consciousness among consumers, a rising demand for low-calorie and sugar-free products, and the growing trend of clean label ingredients. Additionally, the expansion of the food and beverage industry in the region contributes to market growth.

What challenges does the MEA Food Sweeteners Market face?

Challenges in the MEA Food Sweeteners Market include regulatory hurdles regarding the approval of new sweeteners, consumer skepticism towards artificial sweeteners, and competition from natural sweeteners. These factors can hinder market expansion and product acceptance.

What opportunities exist in the MEA Food Sweeteners Market?

Opportunities in the MEA Food Sweeteners Market include the development of innovative sweetening solutions that cater to specific dietary needs, such as keto or diabetic-friendly products. Additionally, the increasing popularity of plant-based sweeteners presents a significant growth avenue for manufacturers.

What trends are shaping the MEA Food Sweeteners Market?

Trends in the MEA Food Sweeteners Market include a shift towards natural and organic sweeteners, the rise of alternative sweetening methods, and a focus on sustainability in sourcing and production. These trends reflect changing consumer preferences for healthier and environmentally friendly options.

MEA Food Sweeteners Market

| Segmentation Details | Description |

|---|---|

| Product Type | Sucrose, Fructose, Aspartame, Stevia |

| Application | Beverages, Bakery, Dairy, Confectionery |

| End User | Food Manufacturers, Restaurants, Retailers, Households |

| Distribution Channel | Online, Supermarkets, Convenience Stores, Wholesale |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the MEA Food Sweeteners Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at