444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The MEA food cans market represents a dynamic and rapidly evolving sector within the Middle East and Africa region’s packaging industry. This market encompasses the production, distribution, and utilization of metal containers specifically designed for food preservation and storage across diverse applications including processed foods, beverages, and specialty culinary products. The region’s unique demographic trends, urbanization patterns, and evolving consumer preferences are driving substantial growth in demand for convenient, shelf-stable food packaging solutions.

Market dynamics in the MEA region reflect a complex interplay of traditional food consumption patterns and modern lifestyle demands. The food cans market is experiencing robust expansion, with growth rates reaching 6.2% CAGR across key regional markets. This growth trajectory is supported by increasing urban populations, rising disposable incomes, and growing awareness of food safety and preservation benefits offered by metal packaging solutions.

Regional variations within the MEA food cans market demonstrate significant diversity in consumption patterns and market maturity levels. The Gulf Cooperation Council countries lead in terms of per capita consumption and technological adoption, while African markets show tremendous potential for expansion driven by population growth and economic development initiatives. The market’s resilience is further enhanced by the essential nature of food packaging and the superior barrier properties of metal containers.

The MEA food cans market refers to the comprehensive ecosystem of metal container manufacturing, distribution, and consumption specifically focused on food packaging applications within the Middle East and Africa region. This market encompasses various types of metal containers including aluminum cans, tinplate cans, and steel containers designed for preserving and storing food products while maintaining nutritional value, flavor, and safety standards.

Food cans in this context represent sophisticated packaging solutions that provide superior barrier protection against light, oxygen, and moisture while offering extended shelf life capabilities. The market includes diverse product categories ranging from beverage cans and processed food containers to specialty packaging for traditional regional cuisines and imported food products. These containers serve critical functions in food distribution networks, enabling efficient supply chain management and reducing food waste across the region.

Strategic positioning of the MEA food cans market reflects strong fundamentals driven by demographic trends, economic development, and changing consumer behaviors. The market demonstrates resilience through its essential role in food security and distribution infrastructure, with metal packaging offering unparalleled protection and preservation capabilities that align with regional climate challenges and storage requirements.

Growth drivers include rapid urbanization affecting 68% of the regional population by projected timelines, increasing female workforce participation leading to demand for convenient food solutions, and expanding retail infrastructure supporting packaged food distribution. The market benefits from technological advancements in can manufacturing, improved recycling capabilities, and growing environmental consciousness among consumers and manufacturers.

Market segmentation reveals diverse opportunities across product types, applications, and geographic regions. Beverage cans maintain the largest market share, while processed food containers show the fastest growth rates. The competitive landscape features both international manufacturers and regional players, creating a dynamic environment for innovation and market expansion.

Consumer behavior analysis reveals significant shifts in food consumption patterns across the MEA region, with increasing preference for convenient, ready-to-consume products driving demand for canned food solutions. The market demonstrates strong correlation between urbanization rates and food can consumption, with metropolitan areas showing 45% higher per capita usage compared to rural regions.

Urbanization trends represent the primary catalyst for MEA food cans market expansion, with rapid migration to urban centers creating demand for convenient, shelf-stable food products. Urban consumers demonstrate higher propensity for packaged foods due to lifestyle constraints, working patterns, and access to modern retail formats. This demographic shift supports sustained market growth across multiple product categories.

Economic development across the region contributes to increased purchasing power and evolving food consumption patterns. Rising middle-class populations seek quality, convenient food options that align with busy lifestyles while maintaining nutritional standards. The correlation between economic growth and packaged food consumption remains strong, with developing markets showing accelerated adoption rates.

Food safety awareness drives consumer preference for professionally packaged products that ensure hygiene and quality standards. Metal containers provide superior protection against contamination, extending shelf life and maintaining product integrity throughout distribution networks. This factor becomes particularly important in regions with challenging climate conditions and limited cold storage infrastructure.

Retail infrastructure expansion facilitates broader distribution of canned food products, making them accessible to previously underserved markets. Modern retail formats including supermarkets, hypermarkets, and convenience stores create favorable environments for packaged food sales, supporting market penetration and brand development initiatives.

Raw material costs present significant challenges for food can manufacturers, with aluminum and steel price volatility affecting production economics and profit margins. Fluctuating commodity prices create uncertainty in pricing strategies and can impact market competitiveness, particularly for price-sensitive consumer segments. These cost pressures require careful supply chain management and strategic sourcing approaches.

Cultural preferences for fresh, locally sourced foods in certain market segments create resistance to canned food adoption. Traditional cooking practices and cultural associations with fresh ingredients can limit market penetration in specific demographic groups. Overcoming these preferences requires targeted marketing strategies and product development that respects local culinary traditions.

Environmental concerns regarding packaging waste and recycling infrastructure limitations pose challenges for market growth. While metal containers offer excellent recyclability, inadequate collection and processing systems in some regions create environmental impact concerns. Addressing these issues requires investment in recycling infrastructure and consumer education programs.

Competition from alternatives including flexible packaging, glass containers, and fresh food options creates market pressure. Alternative packaging formats may offer cost advantages or specific functional benefits that appeal to certain consumer segments. The market must continuously innovate to maintain competitive positioning against these alternatives.

Product innovation presents substantial opportunities for market expansion through development of specialized can formats, enhanced functionality, and improved sustainability features. Advanced coating technologies, easy-open mechanisms, and portion-controlled packaging options can address evolving consumer needs while differentiating products in competitive markets.

Geographic expansion into underserved markets offers significant growth potential, particularly in African countries experiencing economic development and infrastructure improvements. These markets demonstrate strong demographic trends and increasing urbanization rates that support packaged food adoption. Strategic market entry approaches can capture first-mover advantages in emerging markets.

E-commerce integration creates new distribution channels and consumer touchpoints, enabling direct-to-consumer sales and subscription-based models. Online platforms can reach previously inaccessible consumer segments while providing valuable data insights for product development and marketing optimization. The growing digital commerce infrastructure supports this opportunity.

Sustainability initiatives offer differentiation opportunities through eco-friendly packaging solutions, improved recycling programs, and circular economy approaches. Consumers increasingly value environmentally responsible products, creating market advantages for companies that demonstrate genuine sustainability commitments. These initiatives can also support regulatory compliance and corporate social responsibility objectives.

Supply chain complexity characterizes the MEA food cans market, with manufacturers navigating diverse regulatory environments, infrastructure limitations, and cultural preferences across multiple countries. Successful market participants develop flexible supply chain strategies that accommodate regional variations while maintaining operational efficiency and product quality standards.

Competitive intensity varies significantly across market segments and geographic regions, with established international brands competing against local manufacturers and private label products. Market dynamics favor companies that can balance global expertise with local market knowledge, offering products that meet specific regional requirements while leveraging economies of scale.

Technological advancement drives continuous improvement in manufacturing processes, product functionality, and sustainability performance. Innovation in can design, coating technologies, and production efficiency creates competitive advantages while addressing evolving consumer expectations. Companies investing in research and development maintain stronger market positions.

Regulatory evolution influences market development through food safety standards, packaging regulations, and environmental requirements. Staying ahead of regulatory changes requires proactive compliance strategies and engagement with regulatory authorities. Companies that anticipate and adapt to regulatory trends gain competitive advantages while avoiding compliance risks.

Comprehensive analysis of the MEA food cans market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes extensive interviews with industry stakeholders, manufacturers, distributors, and end-users across key markets within the region. This approach provides firsthand insights into market dynamics, challenges, and opportunities from diverse perspectives.

Secondary research encompasses analysis of industry reports, government statistics, trade publications, and company financial statements to establish market baselines and validate primary research findings. Data triangulation techniques ensure consistency and reliability of market intelligence while identifying potential gaps or inconsistencies in available information.

Market modeling utilizes statistical analysis and forecasting techniques to project future market trends and growth patterns. Economic indicators, demographic data, and consumption patterns inform quantitative models that support strategic planning and investment decisions. Scenario analysis considers various market conditions and their potential impacts on growth trajectories.

Expert validation involves consultation with industry experts, academic researchers, and market specialists to verify findings and interpretations. This peer review process enhances the credibility and accuracy of market analysis while incorporating diverse viewpoints and specialized knowledge that enriches overall understanding of market dynamics.

Gulf Cooperation Council countries represent the most mature segment of the MEA food cans market, with high per capita consumption rates and sophisticated retail infrastructure. These markets demonstrate 72% market penetration for canned beverages and strong growth in premium food categories. The region benefits from high disposable incomes, expatriate populations with diverse food preferences, and well-developed distribution networks.

North African markets show substantial growth potential driven by large populations, increasing urbanization, and economic development initiatives. Countries like Egypt and Morocco demonstrate growing middle-class segments that support packaged food adoption. The region’s strategic location facilitates trade relationships with European and Middle Eastern markets, creating opportunities for market expansion.

Sub-Saharan Africa represents the highest growth potential within the MEA region, with rapidly expanding urban populations and increasing economic development. Markets like Nigeria, South Africa, and Kenya show strong demographic trends supporting long-term market growth. Infrastructure development and rising disposable incomes create favorable conditions for market penetration.

Levant region markets face unique challenges due to political instability and economic pressures, but demonstrate resilience and recovery potential. These markets maintain cultural preferences for quality food products and show adaptability to changing market conditions. Strategic approaches that address local challenges while leveraging regional strengths can capture market opportunities.

Market leadership in the MEA food cans sector features a combination of international corporations and regional specialists, each bringing distinct competitive advantages and market positioning strategies. The competitive environment encourages innovation, quality improvement, and customer service excellence while maintaining price competitiveness across diverse market segments.

Strategic positioning varies among competitors, with some focusing on technological innovation and premium products while others emphasize cost leadership and broad market coverage. Successful companies develop balanced approaches that combine global expertise with local market knowledge, creating sustainable competitive advantages.

Product-based segmentation reveals distinct market dynamics across different can types and applications. Beverage cans maintain the largest market share due to high consumption rates and established distribution networks, while food cans show strong growth potential driven by changing lifestyle patterns and urbanization trends.

By Material Type:

By Application:

By End-User:

Beverage cans category demonstrates the strongest market performance with consistent growth across carbonated soft drinks, juices, and energy drinks. Consumer preference for portable, convenient beverage packaging drives sustained demand, while marketing innovations including limited editions and promotional campaigns enhance brand engagement. The category benefits from established supply chains and consumer acceptance.

Food cans segment shows accelerating growth driven by urbanization and lifestyle changes. Ready-to-eat meals, soups, and preserved foods gain popularity among working professionals and busy families. Product innovation focuses on healthier formulations, authentic flavors, and convenient packaging formats that address evolving consumer needs.

Specialty applications represent emerging opportunities in premium and niche markets. Organic foods, gourmet products, and traditional recipes adapted to canned formats appeal to specific consumer segments willing to pay premium prices for quality and convenience. These categories offer higher margins and differentiation opportunities for manufacturers.

Industrial applications serve food service and institutional markets requiring large-volume packaging solutions. Restaurants, hotels, and catering services utilize canned products for operational efficiency and cost management. This segment values reliability, consistency, and competitive pricing over consumer-oriented features.

Manufacturers benefit from growing market demand, technological advancement opportunities, and expanding geographic reach. The MEA region offers attractive growth prospects with developing markets, increasing urbanization, and rising disposable incomes supporting long-term business expansion. Investment in regional manufacturing capabilities can capture market opportunities while reducing logistics costs.

Retailers gain from improved inventory management, extended shelf life, and reduced waste through canned food products. Metal packaging enables efficient supply chain operations, reduces storage requirements, and minimizes product loss due to spoilage. The category’s stability and consumer acceptance support reliable revenue streams and profit margins.

Consumers enjoy convenience, food safety, and product variety through canned food options. Metal packaging preserves nutritional value, extends shelf life, and provides protection against contamination. The availability of diverse products enables consumers to access international cuisines and specialty foods regardless of geographic location.

Distributors leverage efficient logistics, reduced handling requirements, and improved inventory turnover through canned products. Metal containers withstand transportation stresses, require minimal special handling, and offer excellent stacking properties for warehouse optimization. These advantages translate to operational efficiency and cost savings throughout the distribution network.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as a dominant trend with manufacturers investing in eco-friendly production processes, improved recycling programs, and circular economy initiatives. According to MarkWide Research analysis, companies implementing comprehensive sustainability strategies show 23% higher consumer preference scores compared to traditional approaches. This trend influences product development, marketing strategies, and corporate positioning.

Smart packaging technologies gain traction through integration of QR codes, NFC chips, and interactive features that enhance consumer engagement and provide product information. These innovations create opportunities for brand differentiation, consumer education, and supply chain transparency. The technology adoption rate reaches 18% penetration in premium product categories.

Health-conscious formulations drive product development toward reduced sodium, organic ingredients, and functional foods that address wellness trends. Manufacturers adapt traditional recipes and develop new products that align with health-conscious consumer preferences while maintaining taste and convenience benefits. This trend particularly influences the processed food segment.

Portion control packaging responds to consumer demand for appropriate serving sizes and reduced food waste. Smaller can formats and multi-pack options provide flexibility while addressing portion control concerns. This trend supports premium pricing strategies and appeals to health-conscious consumers managing caloric intake.

Manufacturing capacity expansion across the MEA region reflects growing market confidence and demand projections. Major manufacturers invest in new production facilities and equipment upgrades to serve expanding markets while improving operational efficiency. These investments demonstrate long-term commitment to regional market development and create employment opportunities.

Technology partnerships between packaging manufacturers and food companies accelerate innovation in product development and manufacturing processes. Collaborative approaches enable faster time-to-market for new products while sharing development costs and risks. These partnerships often result in exclusive product innovations and competitive advantages.

Acquisition activities consolidate market positions and expand geographic reach through strategic combinations. International companies acquire regional manufacturers to gain local market knowledge and distribution networks, while regional players seek technology and capital through partnerships with global corporations.

Sustainability certifications become increasingly important for market access and consumer acceptance. Companies pursue various environmental certifications and standards to demonstrate commitment to sustainable practices. These certifications often become prerequisites for major retail partnerships and government contracts.

Market entry strategies should prioritize understanding local consumer preferences, regulatory requirements, and distribution networks before significant investment commitments. Successful market penetration requires balanced approaches that combine global expertise with local market knowledge. Companies should consider partnerships with established regional players to accelerate market entry and reduce risks.

Product development focus should emphasize health-conscious formulations, sustainable packaging solutions, and convenient formats that address evolving consumer needs. Innovation investments should target specific market segments with clear value propositions and differentiation opportunities. Regular consumer research ensures product development aligns with market demands.

Supply chain optimization becomes critical for maintaining competitiveness in price-sensitive markets while ensuring product quality and availability. Companies should develop flexible supply chain strategies that accommodate regional variations and potential disruptions. Strategic sourcing and inventory management reduce costs while maintaining service levels.

Sustainability integration should encompass entire value chains from raw material sourcing through end-of-life recycling. Comprehensive sustainability strategies create competitive advantages while addressing regulatory requirements and consumer expectations. Investment in recycling infrastructure and consumer education programs supports long-term market development.

Growth trajectory for the MEA food cans market remains positive with sustained expansion expected across multiple market segments and geographic regions. Demographic trends, economic development, and urbanization patterns support continued market growth, while technological advancement and sustainability initiatives create new opportunities for innovation and differentiation.

Market evolution will likely emphasize sustainability, health consciousness, and convenience as primary drivers of consumer choice and product development. Companies that successfully integrate these trends into comprehensive market strategies will capture disproportionate growth opportunities. MWR projections indicate that sustainability-focused products will achieve 35% market penetration within the forecast period.

Technology integration will transform manufacturing processes, product functionality, and consumer engagement through smart packaging, advanced materials, and digital commerce platforms. These technological advances create opportunities for operational efficiency improvements and enhanced customer experiences while supporting market expansion into new segments and applications.

Regional development patterns suggest accelerating growth in African markets as economic development and infrastructure improvements create favorable conditions for packaged food adoption. Strategic positioning in these emerging markets can capture first-mover advantages and establish long-term competitive positions as markets mature and consumption patterns evolve.

The MEA food cans market presents compelling opportunities for growth and expansion driven by favorable demographic trends, economic development, and evolving consumer preferences. The market’s essential role in food security and distribution infrastructure provides stability while innovation opportunities create potential for differentiation and premium positioning. Companies that successfully navigate regional complexities while leveraging global expertise will capture the most attractive growth opportunities.

Strategic success in this market requires balanced approaches that address local market requirements while maintaining operational efficiency and competitive positioning. Investment in sustainability, innovation, and market development creates long-term competitive advantages while supporting regional economic development objectives. The market’s growth trajectory and fundamental drivers suggest continued expansion opportunities for well-positioned industry participants.

Future market leadership will belong to companies that effectively integrate sustainability, technology, and consumer-centric approaches into comprehensive market strategies. The MEA food cans market offers substantial potential for companies committed to long-term regional development and willing to invest in understanding and serving diverse market requirements across this dynamic and rapidly evolving region.

What is Food Cans?

Food cans are containers made primarily of metal, used for preserving and packaging food products. They are designed to protect food from spoilage and contamination while extending shelf life.

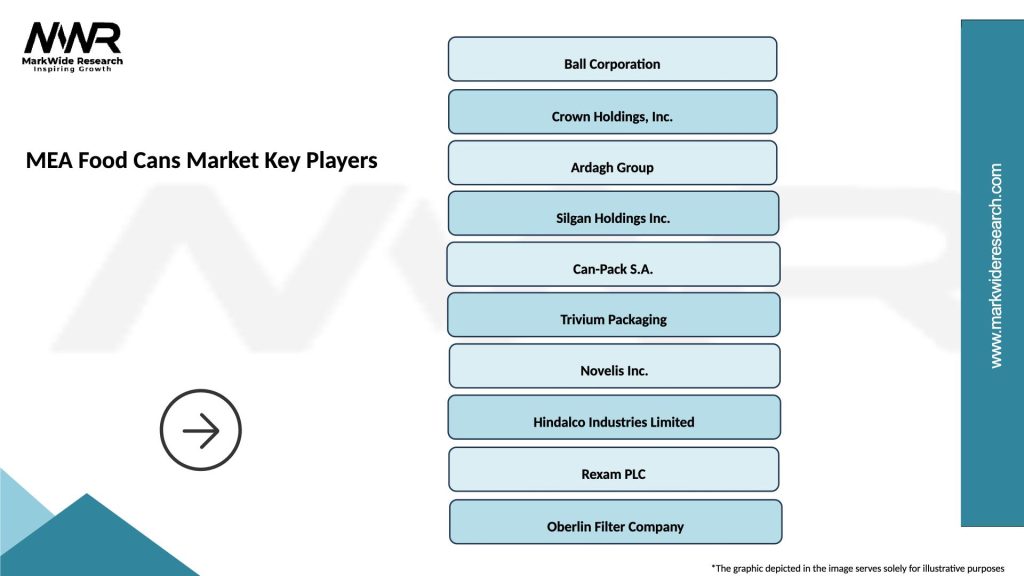

What are the key players in the MEA Food Cans Market?

Key players in the MEA Food Cans Market include Crown Holdings, Ball Corporation, and Ardagh Group, among others. These companies are known for their innovative packaging solutions and extensive distribution networks.

What are the main drivers of the MEA Food Cans Market?

The main drivers of the MEA Food Cans Market include the growing demand for convenient food packaging, increasing consumer preference for canned foods, and the rising trend of sustainable packaging solutions.

What challenges does the MEA Food Cans Market face?

The MEA Food Cans Market faces challenges such as fluctuating raw material prices, competition from alternative packaging solutions, and regulatory compliance regarding food safety standards.

What opportunities exist in the MEA Food Cans Market?

Opportunities in the MEA Food Cans Market include the expansion of the food processing industry, increasing exports of canned goods, and innovations in can design and materials to enhance sustainability.

What trends are shaping the MEA Food Cans Market?

Trends shaping the MEA Food Cans Market include the rise of eco-friendly packaging, the introduction of easy-open cans, and the growing popularity of ready-to-eat meals packaged in cans.

MEA Food Cans Market

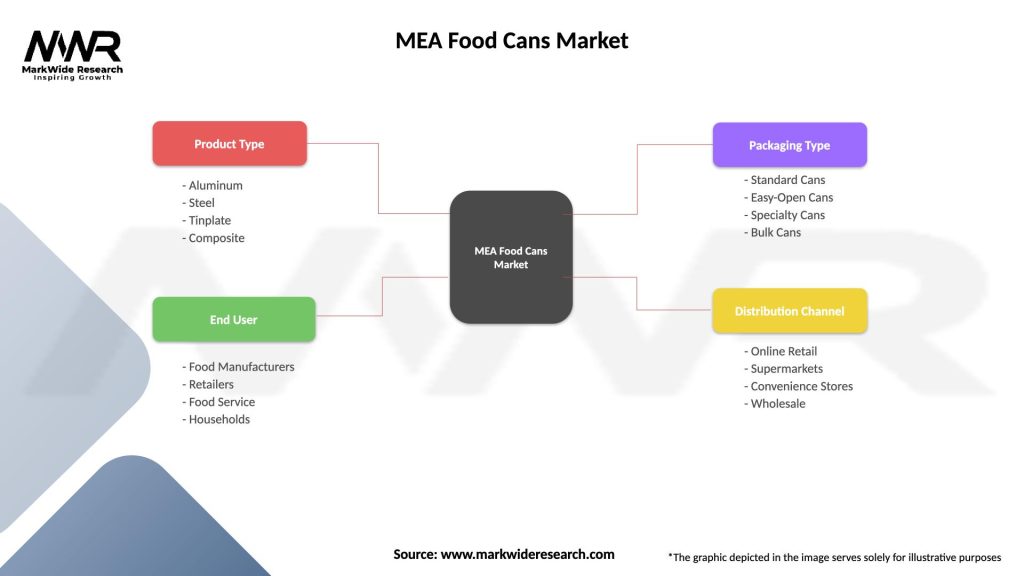

| Segmentation Details | Description |

|---|---|

| Product Type | Aluminum, Steel, Tinplate, Composite |

| End User | Food Manufacturers, Retailers, Food Service, Households |

| Packaging Type | Standard Cans, Easy-Open Cans, Specialty Cans, Bulk Cans |

| Distribution Channel | Online Retail, Supermarkets, Convenience Stores, Wholesale |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the MEA Food Cans Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at