444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The MEA facility management market represents a rapidly evolving sector encompassing comprehensive property and infrastructure management services across the Middle East and Africa regions. This dynamic market includes integrated facility services, maintenance operations, security management, cleaning services, and energy management solutions for commercial, residential, and industrial properties. Market growth is driven by increasing urbanization, expanding commercial real estate developments, and growing awareness of operational efficiency benefits.

Regional dynamics show the UAE, Saudi Arabia, and South Africa leading market adoption, with 12.5% annual growth in integrated facility management services. The market encompasses diverse service categories including hard services such as HVAC maintenance, electrical systems, and structural repairs, alongside soft services covering cleaning, security, landscaping, and catering operations. Digital transformation initiatives are reshaping traditional facility management approaches, with IoT-enabled solutions and predictive maintenance technologies gaining significant traction.

Industry consolidation continues as international facility management companies establish stronger regional presence through strategic partnerships and acquisitions. The market benefits from increasing outsourcing trends, with organizations recognizing 25% cost savings potential through professional facility management services. Sustainability initiatives and green building certifications are driving demand for energy-efficient facility management solutions across the region.

The MEA facility management market refers to the comprehensive ecosystem of professional services dedicated to maintaining, operating, and optimizing physical facilities and infrastructure across Middle Eastern and African territories. This market encompasses integrated service delivery models that combine technical maintenance, operational support, and strategic facility optimization to enhance building performance and occupant experience.

Facility management services include both hard services focusing on technical building systems and soft services addressing occupant comfort and operational efficiency. The market covers diverse property types from commercial office buildings and retail centers to industrial facilities, healthcare institutions, educational campuses, and residential complexes. Service integration represents a key market characteristic, with providers offering bundled solutions that streamline facility operations under single-source management contracts.

Technology integration defines modern facility management approaches, incorporating building management systems, computerized maintenance management software, and mobile workforce management platforms. The market emphasizes performance-based service delivery, focusing on measurable outcomes including energy efficiency improvements, operational cost reductions, and enhanced occupant satisfaction levels.

Market expansion across the MEA facility management sector reflects increasing recognition of professional facility services as strategic business enablers rather than operational necessities. The market demonstrates robust growth momentum driven by rapid urbanization, expanding commercial real estate portfolios, and evolving workplace requirements following global business transformation trends.

Service diversification continues as facility management providers expand beyond traditional maintenance services to include specialized offerings such as workplace experience management, sustainability consulting, and digital facility optimization. Technology adoption accelerates with 35% of facilities implementing smart building technologies and predictive maintenance solutions to enhance operational efficiency and reduce lifecycle costs.

Regional leadership emerges from the Gulf Cooperation Council countries, particularly the UAE and Saudi Arabia, where large-scale infrastructure development projects and Vision 2030 initiatives drive substantial facility management demand. Market consolidation trends favor established international providers while creating opportunities for specialized local service companies to capture niche market segments through targeted service offerings.

Future growth prospects remain strong, supported by continued economic diversification efforts, expanding healthcare and education infrastructure, and increasing focus on operational efficiency across public and private sector facilities throughout the region.

Market dynamics reveal several critical insights shaping the MEA facility management landscape:

Urbanization acceleration across MEA regions creates substantial demand for professional facility management services as new commercial, residential, and mixed-use developments require comprehensive operational support. Population growth and economic diversification initiatives drive construction activity, expanding the addressable market for facility management providers across multiple property categories.

Operational efficiency focus motivates organizations to outsource non-core facility functions to specialized service providers, enabling internal resource concentration on primary business activities. Cost optimization pressures encourage facility management adoption as organizations seek predictable operational expenses and improved budget control through professional service contracts.

Technology advancement enables sophisticated facility management solutions that deliver enhanced performance monitoring, predictive maintenance capabilities, and improved occupant experiences. Digital transformation initiatives across industries create demand for technology-enabled facility management services that integrate with broader organizational systems and processes.

Regulatory compliance requirements increase complexity of facility operations, driving demand for specialized expertise in building codes, safety regulations, and environmental standards. Sustainability mandates and green building certifications require professional facility management support to achieve and maintain performance targets.

Workforce expectations for modern workplace environments drive facility management innovation in areas such as space optimization, indoor air quality management, and occupant comfort systems. Business continuity requirements emphasize reliable facility operations and emergency preparedness capabilities.

Economic volatility in certain MEA regions creates budget constraints that limit facility management investment and delay service contract expansions. Oil price fluctuations particularly impact Gulf region markets where economic conditions directly influence commercial real estate activity and facility management demand.

Skilled workforce shortages challenge facility management providers in recruiting and retaining qualified technical personnel, particularly for specialized building systems and emerging technologies. Training requirements and certification costs add operational complexity for service providers expanding across diverse regional markets.

Cultural adaptation needs require facility management companies to customize service approaches for different regional preferences and business practices. Language barriers and local regulation variations create operational challenges for international providers entering new MEA markets.

Technology infrastructure limitations in certain areas restrict implementation of advanced facility management solutions and digital service delivery models. Connectivity issues and power reliability concerns impact smart building technology adoption and remote monitoring capabilities.

Competition intensity from local service providers and new market entrants creates pricing pressures and margin compression for established facility management companies. Service commoditization risks emerge as basic facility services become increasingly standardized across the market.

Smart city initiatives across MEA regions create substantial opportunities for technology-enabled facility management services supporting urban infrastructure optimization and citizen service delivery. Government modernization programs drive demand for professional facility management in public sector buildings and infrastructure projects.

Healthcare expansion presents significant growth opportunities as regional governments invest in medical infrastructure requiring specialized facility management expertise. Educational facility development creates demand for comprehensive campus management services supporting academic institution operations.

Industrial diversification efforts across oil-dependent economies generate facility management opportunities in manufacturing, logistics, and technology sectors. Free zone developments and special economic areas require integrated facility services to support business attraction and retention objectives.

Sustainability consulting emerges as high-value opportunity area as organizations seek expertise in energy efficiency, waste reduction, and environmental compliance. Green building certification support services address growing demand for sustainable facility operations and performance verification.

Data analytics services represent emerging opportunity as facility management providers leverage IoT data and performance metrics to deliver strategic insights and optimization recommendations. Workplace transformation consulting addresses evolving office design and space utilization requirements following remote work adoption trends.

Competitive dynamics in the MEA facility management market reflect ongoing consolidation trends as international service providers acquire local companies to expand regional presence and service capabilities. Market fragmentation remains significant, with numerous small and medium-sized providers serving specific geographic areas or specialized service niches.

Service evolution continues as traditional facility management expands to include strategic consulting, workplace optimization, and technology integration services. Value proposition shifts from cost reduction focus toward comprehensive facility performance optimization and occupant experience enhancement.

Technology disruption accelerates market transformation through artificial intelligence, machine learning, and predictive analytics applications that enhance service delivery efficiency and effectiveness. Digital platforms enable new service delivery models and improve client communication and reporting capabilities.

Partnership strategies become increasingly important as facility management providers collaborate with technology companies, equipment manufacturers, and specialized service providers to deliver comprehensive solutions. Strategic alliances enable market expansion and service capability enhancement without significant capital investment.

Customer expectations evolve toward integrated service delivery, real-time performance monitoring, and proactive issue resolution. Service level agreements increasingly emphasize outcome-based performance metrics rather than activity-based service specifications.

Primary research methodologies employed comprehensive stakeholder interviews with facility management service providers, property owners, and end-user organizations across key MEA markets. Survey instruments captured quantitative data on service utilization patterns, technology adoption rates, and market growth projections from industry participants.

Secondary research incorporated analysis of industry reports, government publications, and regulatory documentation to establish market context and validate primary research findings. Market sizing methodologies utilized multiple data sources and triangulation techniques to ensure accuracy and reliability of growth projections and trend analysis.

Regional analysis covered major MEA markets including the UAE, Saudi Arabia, Qatar, Kuwait, South Africa, Nigeria, and Egypt through targeted research activities and local market expert consultations. Sector analysis examined facility management adoption across commercial real estate, healthcare, education, industrial, and government segments.

Technology assessment evaluated emerging trends in smart building systems, IoT applications, and digital facility management platforms through vendor interviews and solution demonstrations. Competitive analysis included detailed profiling of major international and regional facility management providers operating across MEA markets.

Data validation processes ensured research accuracy through cross-referencing multiple sources and expert review of findings and conclusions. Quality assurance protocols maintained research integrity throughout data collection, analysis, and reporting phases.

United Arab Emirates leads the MEA facility management market with 28% regional market share, driven by Dubai and Abu Dhabi’s extensive commercial real estate portfolios and ongoing infrastructure development projects. Service sophistication reaches highest levels in the UAE, with advanced technology integration and comprehensive service offerings becoming market standards.

Saudi Arabia represents the fastest-growing regional market, supported by Vision 2030 initiatives and massive infrastructure investments in NEOM, Qiddiya, and other mega-projects. Government sector facility management opportunities expand significantly as public sector modernization programs advance across the kingdom.

South Africa maintains strong market position with 15% regional share, benefiting from established commercial real estate markets in Johannesburg and Cape Town. Economic challenges create opportunities for cost-effective facility management solutions that deliver measurable operational improvements.

Qatar demonstrates robust growth in facility management adoption, particularly in preparation for and following major international events. Infrastructure legacy from World Cup developments creates ongoing facility management demand across sports, hospitality, and transportation sectors.

Egypt emerges as significant growth market with expanding commercial developments in Cairo and new administrative capital projects driving facility management demand. Market development accelerates as international providers establish local presence to capture emerging opportunities.

Nigeria shows increasing facility management adoption in Lagos and Abuja commercial markets, with economic diversification efforts supporting service sector growth and professional facility management recognition.

Market leadership reflects diverse competitive dynamics with international facility management giants competing alongside established regional providers and emerging local specialists. Service differentiation becomes critical as providers seek competitive advantages through technology integration, specialized expertise, and comprehensive service portfolios.

Major international players include:

Competitive strategies emphasize technology integration, service innovation, and strategic partnerships to enhance market position and service capabilities. Market consolidation continues as larger providers acquire specialized companies to expand service portfolios and geographic coverage.

Service Type Segmentation:

End-User Segmentation:

Geographic Segmentation:

By Technology Integration:

Smart Building Solutions demonstrate highest growth potential with IoT-enabled systems, predictive maintenance platforms, and automated building management systems gaining rapid adoption. Digital transformation initiatives drive demand for technology-enabled facility management services that provide real-time monitoring, data analytics, and performance optimization capabilities.

Traditional Services maintain substantial market presence but face pressure to incorporate technology enhancements and digital service delivery models. Service evolution toward hybrid approaches combining traditional expertise with modern technology platforms becomes market standard.

By Contract Type:

Integrated Facility Management contracts show strongest growth momentum as organizations prefer single-source service providers for comprehensive facility operations. Total Facility Management approaches gain popularity for their ability to streamline operations and improve cost predictability.

Single Service Contracts remain important for specialized requirements but face competitive pressure from integrated service providers offering comprehensive solutions. Bundled Services create value through operational synergies and simplified vendor management.

By Industry Vertical:

Healthcare Sector demonstrates exceptional growth as medical facility complexity requires specialized facility management expertise. Regulatory compliance and infection control requirements drive demand for professional facility services in healthcare environments.

Commercial Real Estate maintains largest market share with ongoing office building developments and retail facility expansions across MEA regions. Workplace transformation trends create new service opportunities in space optimization and occupant experience management.

For Property Owners:

For Occupants and Tenants:

For Service Providers:

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital Transformation Acceleration reshapes facility management through IoT integration, artificial intelligence applications, and mobile workforce management platforms. Smart building technologies enable predictive maintenance, energy optimization, and enhanced occupant experiences through data-driven facility operations.

Sustainability Integration becomes central to facility management service delivery as organizations pursue environmental goals and regulatory compliance. Green building certifications drive demand for specialized expertise in energy efficiency, waste reduction, and sustainable facility operations.

Workplace Transformation influences facility management approaches as hybrid work models and flexible office designs require adaptive space management and technology support. Occupant experience focus emphasizes comfort, safety, and productivity enhancement through professional facility services.

Service Consolidation trends favor integrated facility management providers offering comprehensive solutions over fragmented service delivery models. Single-source contracting simplifies vendor management while enabling operational synergies and cost optimization.

Data Analytics Adoption enables performance-based facility management through real-time monitoring, predictive insights, and continuous optimization. Performance metrics shift toward outcome-based measurements rather than activity-based service specifications.

Regulatory Compliance Enhancement drives demand for specialized expertise in building codes, safety standards, and environmental regulations. Risk management becomes increasingly important as facility complexity and regulatory requirements expand.

Technology Platform Launches by major facility management providers introduce advanced digital solutions for building management, workforce optimization, and client communication. Mobile applications enable real-time service requests, work order tracking, and performance reporting capabilities.

Strategic Acquisitions continue as international facility management companies expand regional presence through local company purchases and partnership agreements. Market consolidation creates larger service providers with enhanced capabilities and geographic coverage.

Sustainability Certifications gain prominence as facility management providers pursue green building expertise and environmental compliance capabilities. Energy management services expand to include renewable energy integration and carbon footprint reduction programs.

Government Partnerships emerge as public sector organizations recognize facility management outsourcing benefits for operational efficiency and cost control. Public-private partnerships create opportunities for comprehensive facility management in government buildings and infrastructure.

Training Program Development addresses skilled workforce shortages through comprehensive certification programs and technical education initiatives. Industry associations promote professional standards and best practices across regional facility management markets.

Innovation Centers established by leading providers showcase emerging technologies and demonstrate advanced facility management solutions to potential clients. Research and development investments focus on artificial intelligence, robotics, and automation applications.

Technology Investment represents critical success factor for facility management providers seeking competitive differentiation and operational efficiency. MarkWide Research analysis indicates that companies investing in digital platforms and smart building technologies achieve higher client retention rates and premium pricing capabilities.

Service Portfolio Expansion should focus on high-value specialized services such as sustainability consulting, workplace optimization, and regulatory compliance management. Integrated service delivery models provide competitive advantages and improved client relationships through comprehensive facility solutions.

Regional Market Entry strategies should emphasize local partnerships and cultural adaptation to address diverse market requirements across MEA regions. Phased expansion approaches enable market learning and risk mitigation while building sustainable competitive positions.

Workforce Development initiatives must address skilled labor shortages through comprehensive training programs and competitive compensation packages. Technology adoption can partially offset workforce constraints through automation and efficiency improvements.

Partnership Strategies with technology providers, equipment manufacturers, and specialized service companies enhance service capabilities without significant capital investment. Strategic alliances enable market expansion and service innovation through collaborative approaches.

Performance Measurement systems should emphasize outcome-based metrics and client satisfaction indicators rather than traditional activity-based measurements. Data analytics capabilities enable continuous improvement and value demonstration to facility management clients.

Market expansion prospects remain robust across MEA regions, supported by continued urbanization, infrastructure development, and economic diversification initiatives. Growth acceleration is expected in healthcare, education, and government sectors as facility management adoption increases across these critical infrastructure categories.

Technology integration will continue reshaping facility management service delivery through artificial intelligence, machine learning, and advanced analytics applications. Smart building adoption is projected to reach 60% penetration in commercial properties by 2028, driving demand for technology-enabled facility management services.

Service evolution toward strategic consulting and performance optimization will create higher-value opportunities for facility management providers. Outcome-based contracting models will become more prevalent as clients seek measurable results and continuous improvement.

Regional market development will accelerate in emerging MEA markets as economic growth and infrastructure investment create new facility management opportunities. MWR projections indicate particularly strong growth potential in Egypt, Nigeria, and Morocco as these markets mature.

Sustainability focus will intensify as environmental regulations and corporate responsibility initiatives drive demand for green facility management services. Carbon neutrality goals will create opportunities for energy management and environmental compliance services.

Market consolidation will continue as larger providers acquire specialized companies and expand service capabilities. Industry maturation will favor providers with comprehensive service portfolios, advanced technology platforms, and strong regional presence.

The MEA facility management market demonstrates exceptional growth potential driven by rapid urbanization, infrastructure development, and increasing recognition of professional facility services as strategic business enablers. Market dynamics favor integrated service providers offering comprehensive solutions supported by advanced technology platforms and regional expertise.

Technology transformation continues reshaping industry standards through smart building systems, predictive maintenance capabilities, and data-driven performance optimization. Sustainability integration becomes increasingly important as environmental compliance and energy efficiency requirements drive service innovation and specialization.

Regional opportunities span diverse markets from established Gulf economies to emerging African markets, each presenting unique growth drivers and service requirements. Market consolidation trends create opportunities for strategic expansion while emphasizing the importance of local market knowledge and cultural adaptation.

Future success in the MEA facility management market will depend on technology adoption, service innovation, and strategic positioning to capture emerging opportunities across healthcare, education, and government sectors. Professional facility management will continue evolving from operational necessity to strategic advantage, supporting organizational efficiency and occupant experience enhancement across the dynamic MEA region.

What is Facility Management?

Facility Management refers to the integrated approach to maintaining and managing buildings and their services, ensuring functionality, comfort, safety, and efficiency. It encompasses various disciplines, including maintenance, space management, and sustainability practices.

What are the key players in the MEA Facility Management Market?

Key players in the MEA Facility Management Market include companies like ISS Facility Services, JLL, and CBRE Group, which provide a range of services from property management to integrated facilities management solutions, among others.

What are the growth factors driving the MEA Facility Management Market?

The MEA Facility Management Market is driven by factors such as the increasing demand for efficient building operations, the rise in smart building technologies, and the growing emphasis on sustainability and energy efficiency in facility management practices.

What challenges does the MEA Facility Management Market face?

Challenges in the MEA Facility Management Market include the need for skilled labor, the complexity of integrating new technologies, and the varying regulatory requirements across different countries in the region.

What opportunities exist in the MEA Facility Management Market?

Opportunities in the MEA Facility Management Market include the expansion of smart city initiatives, the increasing adoption of IoT technologies for facility management, and the growing focus on health and safety standards in building management.

What trends are shaping the MEA Facility Management Market?

Trends shaping the MEA Facility Management Market include the rise of digital transformation in facility management, the integration of AI and machine learning for predictive maintenance, and a stronger focus on sustainability practices and green building certifications.

MEA Facility Management Market

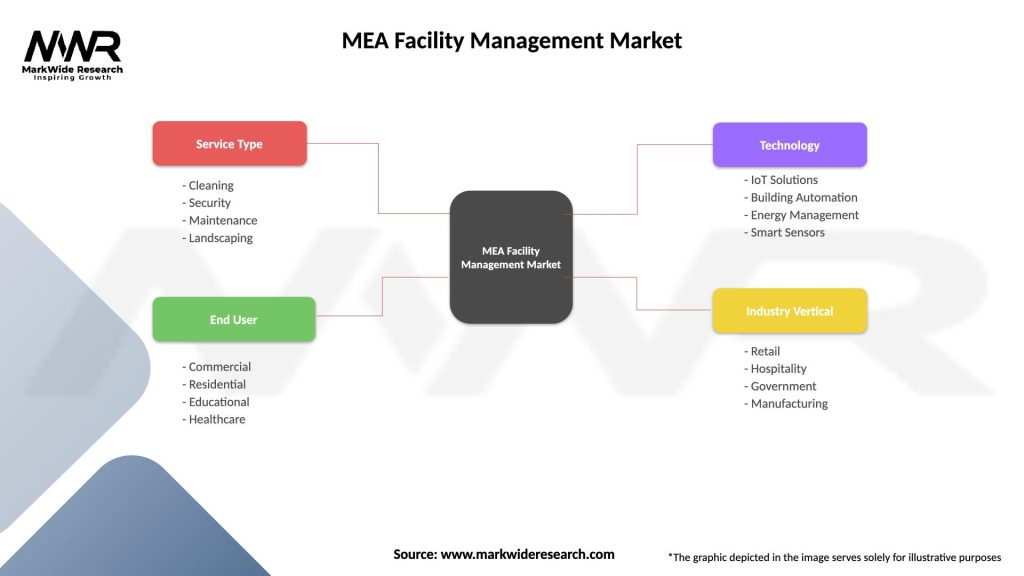

| Segmentation Details | Description |

|---|---|

| Service Type | Cleaning, Security, Maintenance, Landscaping |

| End User | Commercial, Residential, Educational, Healthcare |

| Technology | IoT Solutions, Building Automation, Energy Management, Smart Sensors |

| Industry Vertical | Retail, Hospitality, Government, Manufacturing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the MEA Facility Management Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at