444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The MEA engineering plastics market represents a dynamic and rapidly evolving sector within the Middle East and Africa region, characterized by substantial growth potential and increasing industrial applications. Engineering plastics have emerged as critical materials across diverse industries, offering superior mechanical properties, chemical resistance, and thermal stability compared to conventional plastics. The region’s expanding manufacturing base, coupled with significant infrastructure development projects, has created a robust demand environment for high-performance plastic materials.

Market dynamics in the MEA region are driven by accelerating industrialization, particularly in countries like Saudi Arabia, UAE, South Africa, and Egypt. The automotive sector’s expansion, growing electronics manufacturing, and increasing adoption of lightweight materials in aerospace applications have positioned engineering plastics as essential components in modern manufacturing processes. The market demonstrates impressive growth trajectories, with adoption rates increasing by approximately 8.5% annually across key industrial segments.

Regional diversification plays a crucial role in market development, with the Gulf Cooperation Council (GCC) countries leading in terms of consumption volume, while African nations show promising growth potential. The market encompasses various polymer types including polyamides, polycarbonates, polyoxymethylene, and thermoplastic polyesters, each serving specific industrial applications with unique performance characteristics.

The MEA engineering plastics market refers to the comprehensive ecosystem of high-performance polymer materials designed to replace traditional materials like metals, ceramics, and conventional plastics in demanding applications across the Middle East and Africa region. These specialized materials exhibit superior mechanical strength, thermal resistance, and chemical stability, making them ideal for critical industrial applications.

Engineering plastics distinguish themselves from commodity plastics through their enhanced properties, including higher melting points, improved dimensional stability, and exceptional durability under stress. The market encompasses the entire value chain from raw material production and processing to end-user applications across automotive, electronics, aerospace, healthcare, and industrial machinery sectors.

Market scope includes both thermoplastic and thermosetting engineering polymers, with thermoplastics dominating due to their recyclability and processing advantages. The regional market structure reflects diverse economic conditions, regulatory environments, and industrial development stages across different MEA countries, creating unique opportunities and challenges for market participants.

Strategic positioning of the MEA engineering plastics market reveals significant growth momentum driven by industrial diversification initiatives and infrastructure development programs across the region. The market benefits from favorable government policies promoting manufacturing sector growth, particularly in Saudi Arabia’s Vision 2030 and UAE’s industrial strategy frameworks.

Key market drivers include the automotive industry’s expansion, with vehicle production increasing by approximately 12% annually in key markets, creating substantial demand for lightweight, durable plastic components. The electronics sector’s growth, fueled by digitalization initiatives and smart city projects, contributes significantly to market expansion through increased demand for high-performance plastic housings and components.

Competitive landscape features a mix of global players and regional manufacturers, with international companies establishing local production facilities to serve growing demand while reducing logistics costs. The market demonstrates resilience despite economic fluctuations, supported by essential applications in critical industries and ongoing infrastructure development projects across the region.

Future prospects indicate continued growth potential, with sustainability trends driving demand for recyclable engineering plastics and bio-based alternatives. The market’s evolution toward high-value applications and specialized grades positions it favorably for long-term expansion, supported by increasing industrial sophistication and technological advancement across MEA countries.

Market segmentation reveals distinct patterns across different polymer types and applications, providing valuable insights for strategic decision-making:

Industrial diversification across MEA countries serves as a primary market driver, with governments actively promoting manufacturing sector development to reduce dependence on oil revenues. Saudi Arabia’s NEOM project and UAE’s industrial strategy create substantial demand for advanced materials, including engineering plastics for construction, transportation, and technology applications.

Automotive sector expansion significantly drives market growth, with major manufacturers establishing production facilities across the region. The shift toward electric vehicles and lightweight design requirements increases demand for high-performance plastics that offer weight reduction benefits while maintaining structural integrity and safety standards.

Infrastructure development programs across the region create sustained demand for engineering plastics in construction applications, including pipes, fittings, and structural components. Smart city initiatives and urban development projects require advanced materials that offer durability, weather resistance, and long-term performance in challenging environmental conditions.

Electronics manufacturing growth, driven by digitalization initiatives and increasing consumer electronics demand, creates significant opportunities for engineering plastics suppliers. The materials’ excellent electrical properties, dimensional stability, and processing characteristics make them ideal for electronic housings, connectors, and internal components.

Healthcare sector development across MEA countries drives demand for medical-grade engineering plastics used in devices, equipment, and pharmaceutical packaging. The materials’ biocompatibility, sterilization resistance, and regulatory compliance capabilities position them as essential components in modern healthcare applications.

Raw material costs present significant challenges for market participants, with petroleum-based feedstock price volatility directly impacting production costs and profit margins. The region’s dependence on imported raw materials exposes manufacturers to currency fluctuations and supply chain disruptions that can affect market stability.

Technical expertise limitations in certain MEA countries constrain market development, particularly in advanced processing techniques and application development. The shortage of skilled technicians and engineers familiar with engineering plastics processing requirements creates barriers to market expansion and technology adoption.

Regulatory complexities across different MEA countries create challenges for market participants, with varying standards, certification requirements, and import procedures affecting business operations. The lack of harmonized regulations across the region complicates market entry strategies and increases compliance costs for manufacturers.

Competition from alternatives including metals, ceramics, and advanced composites limits market penetration in certain applications. Traditional materials’ established supply chains and customer familiarity create resistance to engineering plastics adoption, particularly in conservative industries and applications.

Economic volatility in some MEA countries affects industrial investment and infrastructure development, creating uncertainty in demand patterns. Political instability and economic sanctions in certain regions limit market access and investment opportunities for international players.

Sustainability initiatives create substantial opportunities for bio-based and recycled engineering plastics, with increasing environmental awareness driving demand for eco-friendly alternatives. Companies developing sustainable solutions can capture premium market segments and align with regional sustainability goals and international environmental standards.

Local manufacturing development presents significant opportunities for establishing regional production facilities, reducing logistics costs and improving supply chain reliability. Government incentives and industrial zone development programs support foreign investment in manufacturing capabilities, creating favorable conditions for market expansion.

Emerging applications in renewable energy, water treatment, and advanced manufacturing create new market segments with substantial growth potential. Solar energy projects, desalination plants, and 3D printing applications require specialized engineering plastics with unique performance characteristics.

Technology partnerships with regional manufacturers and research institutions offer opportunities for developing customized solutions and establishing market presence. Collaborative approaches enable knowledge transfer, local expertise development, and market-specific product development initiatives.

Digital transformation across industries creates demand for advanced materials in IoT devices, sensors, and smart infrastructure applications. The growing emphasis on Industry 4.0 and smart manufacturing requires engineering plastics with enhanced electrical properties and connectivity features.

Supply chain evolution significantly influences market dynamics, with companies establishing regional distribution networks and local partnerships to improve service levels and reduce delivery times. The development of regional supply chains enhances market responsiveness and creates competitive advantages for early movers in key markets.

Technology advancement drives continuous market evolution, with new polymer formulations and processing techniques expanding application possibilities. Advanced compounding technologies enable customized material properties, creating opportunities for specialized applications and premium pricing strategies.

Customer sophistication increases across the region as industries mature and technical expertise develops, leading to more demanding specifications and quality requirements. This trend drives market evolution toward higher-value products and specialized solutions, benefiting companies with advanced technical capabilities.

Competitive intensity varies across different market segments and geographic regions, with established players facing challenges from new entrants and alternative materials. Market dynamics favor companies with strong technical support capabilities, local presence, and comprehensive product portfolios.

Regulatory evolution continues to shape market development, with increasing emphasis on environmental compliance, product safety, and quality standards. Companies must adapt to changing regulatory requirements while maintaining competitiveness and profitability in dynamic market conditions.

Comprehensive analysis of the MEA engineering plastics market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research involves extensive interviews with industry executives, technical experts, and key stakeholders across different market segments and geographic regions.

Data collection encompasses both quantitative and qualitative research approaches, including structured surveys, in-depth interviews, and focus group discussions with market participants. Secondary research involves analysis of industry reports, company financial statements, trade statistics, and regulatory documentation from relevant authorities.

Market sizing methodology utilizes bottom-up and top-down approaches to validate findings and ensure consistency across different data sources. Industry expert consultations and cross-referencing with multiple data sources enhance the reliability of market estimates and growth projections.

Regional analysis involves detailed examination of market conditions, regulatory environments, and competitive landscapes across different MEA countries. Country-specific research ensures accurate representation of local market dynamics and growth drivers affecting the engineering plastics sector.

Validation processes include peer review by industry experts and cross-verification with multiple data sources to ensure research quality and reliability. Continuous monitoring of market developments and regular updates maintain the relevance and accuracy of research findings.

Gulf Cooperation Council countries dominate the MEA engineering plastics market, with Saudi Arabia and UAE leading in terms of consumption volume and industrial applications. The region’s advanced petrochemical infrastructure, substantial industrial investments, and diversification initiatives create favorable conditions for market growth and development.

Saudi Arabia represents the largest individual market within the MEA region, driven by Vision 2030 initiatives and massive infrastructure development projects. The country’s automotive assembly operations, electronics manufacturing, and construction activities generate substantial demand for engineering plastics across multiple application segments.

United Arab Emirates demonstrates strong market growth supported by advanced manufacturing capabilities, strategic location advantages, and business-friendly policies. Dubai and Abu Dhabi serve as regional hubs for distribution and processing activities, with growing demand from aerospace, automotive, and electronics sectors.

South Africa leads the African continent in engineering plastics consumption, with established automotive and electronics industries driving demand. The country’s advanced manufacturing base and technical expertise create opportunities for local processing and value-added applications.

Egypt and Morocco show promising growth potential with expanding manufacturing sectors and increasing foreign investment in industrial development. These markets benefit from strategic locations, competitive labor costs, and improving infrastructure supporting industrial growth.

Market distribution across the region shows GCC countries accounting for approximately 65% of total consumption, while North African markets contribute 25% and sub-Saharan Africa represents 10% of regional demand, reflecting different levels of industrial development and economic conditions.

Market leadership in the MEA engineering plastics sector features a combination of global chemical companies and regional players, each leveraging different competitive advantages to capture market share and establish strong positions across various application segments.

Competitive strategies focus on local presence development, technical support enhancement, and application-specific solution development. Companies invest in regional distribution networks, technical centers, and customer support capabilities to differentiate their offerings and build long-term relationships with key customers.

Market consolidation trends include strategic partnerships, joint ventures, and acquisition activities aimed at expanding geographic coverage and enhancing technical capabilities. Regional players often partner with global companies to access advanced technologies and expand their product portfolios.

By Product Type:

By End-Use Industry:

By Processing Method:

Automotive Applications dominate the MEA engineering plastics market, with vehicle manufacturers increasingly adopting lightweight materials to improve fuel efficiency and reduce emissions. Under-the-hood components require high-temperature resistant materials like polyamide and polyphenylene oxide, while interior applications utilize polycarbonate and ABS blends for aesthetic and functional requirements.

Electronics Segment shows rapid growth driven by consumer electronics demand and industrial digitalization initiatives. Housing applications require materials with excellent dimensional stability and flame retardancy, while connector applications demand precise molding capabilities and long-term reliability under electrical stress.

Industrial Applications encompass diverse requirements from chemical processing equipment to mechanical components, with material selection based on specific performance requirements including chemical resistance, mechanical strength, and temperature stability. Specialty grades command premium pricing due to customized property profiles and technical support requirements.

Construction Sector utilizes engineering plastics for pipes, fittings, and structural components that offer superior durability and weather resistance compared to traditional materials. Infrastructure projects across the region create substantial demand for high-performance plastic materials in demanding applications.

Healthcare Applications require strict compliance with medical device regulations and biocompatibility standards, creating opportunities for specialized grades and custom formulations. Medical device manufacturing growth across the region drives demand for certified materials with documented performance characteristics.

Manufacturers benefit from engineering plastics through improved product performance, weight reduction, and design flexibility that enable innovative solutions and competitive advantages. Cost optimization opportunities arise from reduced assembly complexity, elimination of secondary operations, and improved manufacturing efficiency through advanced processing techniques.

End Users gain significant advantages including enhanced product durability, reduced maintenance requirements, and improved performance characteristics that justify premium pricing and create customer loyalty. Sustainability benefits from recyclable materials and energy-efficient production processes align with corporate environmental goals and regulatory requirements.

Suppliers enjoy stable demand patterns from essential applications and opportunities for value-added services including technical support, custom formulations, and application development assistance. Market expansion potential exists through new application development and geographic market penetration strategies.

Investors benefit from market growth potential, stable cash flows from essential applications, and opportunities for portfolio diversification across different industry segments and geographic regions. Long-term growth prospects remain favorable due to industrial development trends and increasing material sophistication requirements.

Regional Economies benefit from industrial development, technology transfer, and employment creation associated with engineering plastics manufacturing and processing operations. Value chain development creates multiplier effects supporting related industries and service providers throughout the region.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Integration emerges as a dominant trend with increasing demand for recyclable and bio-based engineering plastics. MarkWide Research indicates that sustainable material adoption rates are growing at 20% annually as companies respond to environmental regulations and corporate sustainability commitments across the region.

Digitalization Impact drives demand for engineering plastics in IoT devices, sensors, and smart infrastructure applications. The materials’ excellent electrical properties and processing capabilities make them ideal for next-generation electronic applications requiring miniaturization and enhanced performance characteristics.

Lightweighting Initiatives across automotive and aerospace industries accelerate engineering plastics adoption as manufacturers seek to reduce weight while maintaining structural integrity and safety standards. Advanced polymer formulations enable significant weight reductions compared to traditional materials.

Customization Demand increases as industries require specialized material properties for specific applications, driving development of custom compounds and specialty grades. Technical support and application development services become increasingly important competitive differentiators in the market.

Regional Manufacturing expansion continues as companies establish local production facilities to serve growing demand while reducing logistics costs and improving supply chain reliability. Government incentives and industrial zone development support this trend across multiple MEA countries.

Advanced Processing technologies enable new applications and improved material properties, with 3D printing and additive manufacturing creating opportunities for specialized engineering plastic grades designed for these emerging production methods.

Capacity Expansion initiatives across the region include major investments in production facilities and processing capabilities. SABIC’s expansion of specialty plastics production in Saudi Arabia demonstrates commitment to serving growing regional demand while leveraging integrated petrochemical operations for cost advantages.

Technology Partnerships between global suppliers and regional manufacturers facilitate knowledge transfer and local capability development. These collaborations enable access to advanced technologies while building local expertise and market presence across different MEA countries.

Sustainability Initiatives include development of recycling programs and bio-based material alternatives. Companies invest in circular economy solutions and sustainable production processes to meet increasing environmental requirements and customer expectations for eco-friendly materials.

Application Development programs focus on new market segments and specialized applications, with companies establishing technical centers and application laboratories to support customer needs and develop innovative solutions for emerging requirements.

Regulatory Compliance initiatives ensure products meet evolving safety and environmental standards across different markets. Companies invest in certification processes and quality systems to maintain market access and competitive positioning in regulated industries.

Digital Transformation includes implementation of Industry 4.0 technologies in manufacturing operations, improving efficiency and quality while enabling customization capabilities and responsive customer service throughout the supply chain.

Market Entry Strategy should prioritize establishing local presence through partnerships or direct investment, as regional relationships and technical support capabilities prove critical for success in MEA markets. Companies should focus on building comprehensive service networks and application development capabilities to differentiate their offerings.

Product Portfolio development should emphasize sustainable materials and specialized grades that command premium pricing while meeting specific customer requirements. Investment in bio-based alternatives and recycled content materials positions companies favorably for future market evolution and regulatory changes.

Geographic Focus should prioritize GCC countries for immediate market development while building long-term positions in emerging African markets with strong growth potential. Different market entry strategies may be required for different regions based on local conditions and competitive landscapes.

Technology Investment in advanced processing capabilities and application development resources enables companies to serve sophisticated customer requirements and capture high-value market segments. Technical support capabilities become increasingly important competitive differentiators as markets mature.

Supply Chain optimization should balance cost efficiency with supply security, considering regional production capabilities and logistics infrastructure. Companies should develop flexible supply chain strategies that can adapt to changing market conditions and customer requirements.

Sustainability Integration should be incorporated into all aspects of business strategy, from product development to manufacturing operations, as environmental considerations become increasingly important for customer selection and regulatory compliance across the region.

Long-term growth prospects for the MEA engineering plastics market remain highly favorable, supported by continued industrial development, infrastructure investment, and technological advancement across the region. MWR projects sustained growth momentum with expanding applications and increasing material sophistication driving market evolution.

Industry transformation toward sustainability and digitalization will reshape market dynamics, creating opportunities for companies with advanced capabilities and innovative solutions. The integration of circular economy principles and smart manufacturing technologies will define competitive advantages in future market conditions.

Regional integration initiatives and economic cooperation programs will facilitate market access and business development across borders, creating larger addressable markets and economies of scale for regional operations. Harmonization of standards and regulations may simplify market entry and expansion strategies.

Technology advancement will continue driving market evolution, with new polymer formulations, processing techniques, and application possibilities expanding market potential. Advanced materials with enhanced properties will enable new applications and create premium market segments.

Market maturation will lead to increased customer sophistication and demand for specialized solutions, favoring companies with strong technical capabilities and comprehensive service offerings. Competition will intensify, requiring continuous innovation and customer focus to maintain competitive positions.

Growth projections indicate continued market expansion at robust rates across key segments, with sustainability-focused products and emerging applications driving above-average growth. The market’s evolution toward higher-value applications and specialized solutions supports optimistic long-term prospects for industry participants.

The MEA engineering plastics market represents a dynamic and rapidly evolving sector with substantial growth potential driven by industrial diversification, infrastructure development, and technological advancement across the region. Market fundamentals remain strong, supported by expanding automotive production, growing electronics manufacturing, and increasing adoption of high-performance materials in critical applications.

Strategic opportunities exist for companies that can establish strong regional presence, develop comprehensive technical support capabilities, and invest in sustainable solutions that meet evolving customer requirements and regulatory standards. The market’s evolution toward specialization and customization favors players with advanced technical capabilities and application development expertise.

Regional diversity creates both opportunities and challenges, requiring tailored strategies for different markets while leveraging economies of scale and shared resources across the broader MEA region. Success factors include local partnerships, technical excellence, and commitment to long-term market development and customer relationship building.

The MEA engineering plastics market is positioned for continued growth and evolution, offering attractive opportunities for industry participants who can navigate regional complexities while delivering innovative solutions that meet the demanding requirements of modern industrial applications across this dynamic and promising market region.

What is Engineering Plastics?

Engineering plastics are a group of plastic materials that have superior mechanical and thermal properties compared to standard plastics. They are commonly used in applications such as automotive components, electrical housings, and industrial machinery due to their strength and durability.

What are the key players in the MEA Engineering Plastics Market?

Key players in the MEA Engineering Plastics Market include BASF, DuPont, and SABIC, which are known for their innovative solutions and extensive product portfolios in engineering plastics. These companies focus on various applications, including automotive, electronics, and consumer goods, among others.

What are the growth factors driving the MEA Engineering Plastics Market?

The growth of the MEA Engineering Plastics Market is driven by increasing demand for lightweight materials in the automotive industry, advancements in manufacturing technologies, and the rising need for high-performance materials in electronics and consumer products.

What challenges does the MEA Engineering Plastics Market face?

The MEA Engineering Plastics Market faces challenges such as fluctuating raw material prices, environmental regulations regarding plastic use, and competition from alternative materials like metals and composites, which can limit market growth.

What opportunities exist in the MEA Engineering Plastics Market?

Opportunities in the MEA Engineering Plastics Market include the growing trend towards sustainability, which encourages the development of bio-based engineering plastics, and the increasing adoption of electric vehicles that require advanced materials for lightweighting and performance.

What trends are shaping the MEA Engineering Plastics Market?

Trends shaping the MEA Engineering Plastics Market include the rise of smart materials that respond to environmental changes, the integration of recycling technologies to enhance sustainability, and the development of high-performance polymers for specialized applications in aerospace and medical devices.

MEA Engineering Plastics Market

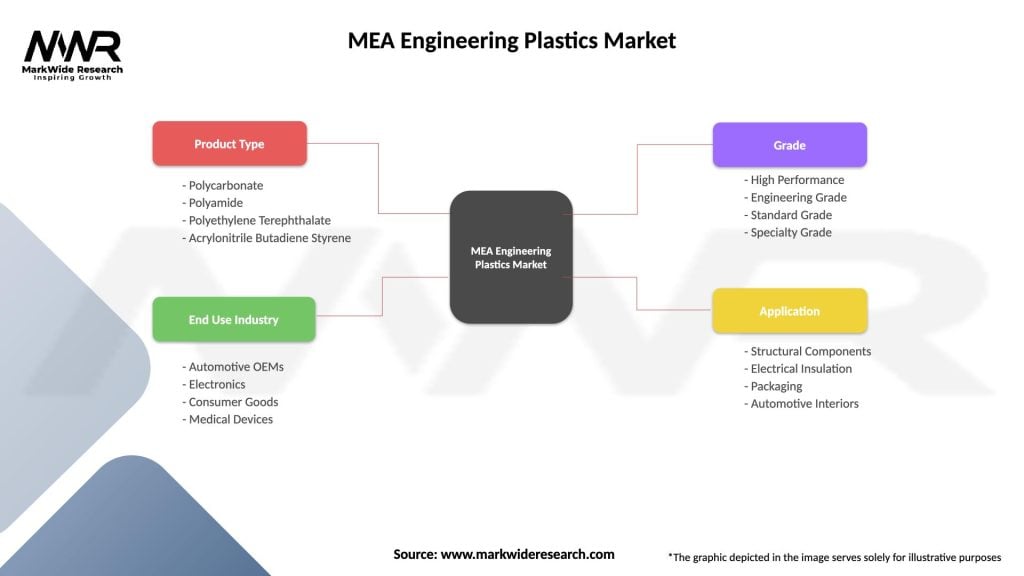

| Segmentation Details | Description |

|---|---|

| Product Type | Polycarbonate, Polyamide, Polyethylene Terephthalate, Acrylonitrile Butadiene Styrene |

| End Use Industry | Automotive OEMs, Electronics, Consumer Goods, Medical Devices |

| Grade | High Performance, Engineering Grade, Standard Grade, Specialty Grade |

| Application | Structural Components, Electrical Insulation, Packaging, Automotive Interiors |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the MEA Engineering Plastics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at