444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The MEA energy management software market represents a rapidly expanding sector within the Middle East and Africa region, driven by increasing energy costs, sustainability initiatives, and digital transformation across industries. Energy management software solutions are becoming essential tools for organizations seeking to optimize energy consumption, reduce operational costs, and meet environmental compliance requirements. The market encompasses comprehensive software platforms that monitor, analyze, and control energy usage across various sectors including manufacturing, commercial buildings, healthcare, and government facilities.

Regional dynamics in the MEA market are particularly influenced by the region’s unique energy landscape, characterized by abundant oil and gas resources alongside growing renewable energy investments. Countries like the United Arab Emirates, Saudi Arabia, and South Africa are leading adoption efforts, implementing smart energy solutions to diversify their energy portfolios and improve efficiency. The market is experiencing robust growth at a CAGR of 12.3%, reflecting the increasing recognition of energy management as a critical business function.

Government initiatives across the MEA region are significantly contributing to market expansion, with various national energy strategies promoting the adoption of energy efficiency technologies. The integration of Internet of Things (IoT) sensors, artificial intelligence, and cloud computing technologies is transforming traditional energy management approaches, enabling real-time monitoring and predictive analytics capabilities that deliver substantial operational improvements.

The MEA energy management software market refers to the comprehensive ecosystem of digital solutions designed to monitor, control, and optimize energy consumption across various industries within the Middle East and Africa region. These sophisticated software platforms integrate multiple functionalities including energy monitoring, demand forecasting, cost analysis, and automated control systems to help organizations achieve optimal energy efficiency and cost reduction.

Energy management software encompasses a wide range of applications from basic energy monitoring tools to advanced enterprise-level platforms that incorporate machine learning algorithms and predictive analytics. These solutions enable organizations to track energy usage patterns, identify inefficiencies, implement automated controls, and generate comprehensive reports for regulatory compliance and strategic decision-making purposes.

The market includes both standalone software solutions and integrated platforms that connect with existing building management systems, industrial control systems, and enterprise resource planning software. Modern energy management platforms leverage cloud computing, mobile accessibility, and advanced data visualization to provide stakeholders with actionable insights for improving energy performance and achieving sustainability goals.

Market dynamics in the MEA energy management software sector are characterized by accelerating digital transformation initiatives and increasing focus on energy efficiency across multiple industries. The region’s unique position as both a major energy producer and consumer creates distinctive opportunities for software solutions that can optimize energy usage while supporting economic diversification efforts. Key market drivers include rising energy costs, stringent environmental regulations, and growing awareness of sustainability benefits among enterprises.

Technology advancement is reshaping the competitive landscape, with cloud-based solutions gaining 78% market preference due to their scalability, cost-effectiveness, and ease of implementation. The integration of artificial intelligence and machine learning capabilities is enabling more sophisticated energy optimization strategies, while mobile applications are improving accessibility and user engagement across different organizational levels.

Regional variations in market development reflect different economic priorities and regulatory environments, with Gulf Cooperation Council countries leading in terms of technology adoption and investment in smart energy infrastructure. The market is witnessing increased participation from both international software providers and regional technology companies, creating a competitive environment that benefits end-users through improved functionality and competitive pricing.

Strategic insights reveal several critical trends shaping the MEA energy management software market landscape:

Rising energy costs across the MEA region serve as a primary catalyst for energy management software adoption, with organizations seeking technological solutions to reduce operational expenses and improve cost predictability. The volatility in global energy markets has heightened awareness of the need for sophisticated monitoring and control systems that can respond dynamically to changing energy prices and consumption patterns.

Government sustainability initiatives are creating regulatory frameworks that mandate energy efficiency improvements and carbon emission reductions across various industries. Countries like the UAE and Saudi Arabia have implemented national energy strategies that include specific targets for energy efficiency improvements, driving demand for software solutions that can track and report progress toward these goals.

Digital transformation acceleration is enabling organizations to integrate energy management into broader operational technology ecosystems, creating synergies with existing business systems and processes. The increasing availability of high-speed internet connectivity and cloud computing infrastructure across the region is facilitating the deployment of sophisticated energy management platforms that were previously technically or economically unfeasible.

Corporate sustainability commitments are influencing procurement decisions as organizations seek to demonstrate environmental responsibility to stakeholders, customers, and regulatory bodies. The growing emphasis on Environmental, Social, and Governance (ESG) reporting is creating demand for energy management software that can provide comprehensive data and analytics for sustainability reporting purposes.

High implementation costs represent a significant barrier for many organizations, particularly small and medium-sized enterprises that may lack the capital resources for comprehensive energy management software deployment. The total cost of ownership includes not only software licensing fees but also hardware infrastructure, system integration, training, and ongoing maintenance expenses that can be substantial.

Technical complexity associated with integrating energy management software into existing operational systems creates implementation challenges that require specialized expertise and can extend deployment timelines. Many organizations struggle with legacy system compatibility issues and the need for extensive customization to meet specific operational requirements.

Limited technical expertise within the region poses challenges for both software implementation and ongoing system management, as energy management platforms require specialized knowledge for optimal configuration and utilization. The shortage of qualified professionals with experience in both energy management and software systems creates a skills gap that can impede market growth.

Data security concerns are increasingly important as energy management systems collect and process sensitive operational data that could be valuable to competitors or malicious actors. Organizations must balance the benefits of cloud-based solutions with concerns about data sovereignty and cybersecurity risks, particularly in sectors with critical infrastructure components.

Renewable energy integration presents substantial opportunities for energy management software providers as the MEA region accelerates investments in solar, wind, and other renewable energy sources. The complexity of managing hybrid energy systems that combine traditional and renewable sources creates demand for sophisticated software platforms capable of optimizing energy mix decisions in real-time.

Smart city development initiatives across major urban centers in the region are creating opportunities for large-scale energy management software deployments that can optimize energy usage across multiple buildings, transportation systems, and public infrastructure. These comprehensive urban energy management projects require advanced software platforms with extensive integration capabilities.

Industrial automation expansion is driving demand for energy management software that can integrate with manufacturing execution systems and industrial IoT platforms to optimize energy consumption in production processes. The growing focus on Industry 4.0 technologies creates opportunities for energy management solutions that can contribute to overall operational efficiency improvements.

Energy trading and market participation opportunities are emerging as regional energy markets become more sophisticated and competitive, creating demand for software solutions that can support energy procurement strategies and demand response programs. Organizations are seeking platforms that can analyze market conditions and automatically adjust energy consumption to take advantage of favorable pricing conditions.

Competitive dynamics in the MEA energy management software market are characterized by a mix of established international providers and emerging regional players, creating a diverse ecosystem that serves different market segments and customer requirements. The market is experiencing consolidation as larger software companies acquire specialized energy management firms to expand their capabilities and regional presence.

Technology evolution is driving rapid changes in market dynamics, with artificial intelligence and machine learning capabilities becoming standard features rather than premium add-ons. The integration of advanced analytics capabilities is enabling software providers to differentiate their offerings through superior predictive capabilities and automated optimization features.

Customer expectations are evolving toward more comprehensive solutions that integrate energy management with broader operational management systems, creating pressure on software providers to develop platforms with extensive integration capabilities and industry-specific functionality. Organizations increasingly expect user-friendly interfaces and mobile accessibility as standard features rather than optional components.

Regulatory influences are shaping market dynamics as governments implement energy efficiency standards and carbon reporting requirements that drive demand for specific software capabilities. The regulatory environment is creating opportunities for software providers that can demonstrate compliance capabilities and provide comprehensive reporting features that meet evolving regulatory requirements.

Comprehensive market analysis for the MEA energy management software market employs a multi-faceted research approach combining primary and secondary research methodologies to ensure accuracy and completeness of market insights. The research framework incorporates quantitative data analysis, qualitative stakeholder interviews, and industry expert consultations to develop a holistic understanding of market dynamics and trends.

Primary research activities include structured interviews with key industry stakeholders including software vendors, system integrators, end-user organizations, and technology consultants across different countries within the MEA region. These interviews provide insights into market challenges, opportunities, and emerging trends that may not be captured through secondary research sources.

Secondary research components encompass analysis of industry reports, government publications, regulatory documents, and company financial statements to establish market sizing, competitive positioning, and growth trajectory assessments. The research methodology includes validation of findings through multiple independent sources to ensure reliability and accuracy of market projections.

Data validation processes involve cross-referencing information from multiple sources and conducting follow-up interviews with industry experts to confirm key findings and assumptions. The research approach includes regular updates to account for rapidly changing market conditions and emerging technology developments that could impact market dynamics.

Gulf Cooperation Council countries represent the most mature segment of the MEA energy management software market, with the United Arab Emirates and Saudi Arabia leading adoption efforts through comprehensive smart city initiatives and national energy efficiency programs. These countries benefit from strong government support, advanced telecommunications infrastructure, and significant financial resources for technology investments, resulting in 45% regional market share.

South Africa demonstrates strong market potential driven by energy security challenges and the need for efficient management of limited electricity resources. The country’s well-developed industrial base and regulatory framework supporting energy efficiency create favorable conditions for energy management software adoption, particularly in manufacturing and mining sectors.

North African markets including Egypt, Morocco, and Tunisia are experiencing growing interest in energy management solutions as these countries implement economic diversification strategies and renewable energy development programs. The region’s focus on industrial development and urban growth is creating demand for sophisticated energy management capabilities.

East African countries such as Kenya and Ethiopia represent emerging opportunities as these markets develop industrial capacity and urban infrastructure. While current adoption levels remain limited, the rapid economic growth and increasing energy access in these markets suggest significant future potential for energy management software solutions.

Market leadership in the MEA energy management software sector is distributed among several categories of providers, each serving different market segments and customer requirements:

Regional competitors are gaining market share through specialized solutions and local market knowledge, while international providers leverage global experience and comprehensive product portfolios to serve large enterprise customers with complex requirements.

By Deployment Model:

By Organization Size:

By Industry Vertical:

Cloud-based energy management solutions are experiencing the strongest growth trajectory, driven by their ability to provide rapid deployment, automatic updates, and scalable functionality without significant upfront infrastructure investments. Organizations appreciate the flexibility to start with basic monitoring capabilities and gradually expand to more sophisticated optimization features as their energy management maturity develops.

Manufacturing sector applications represent the most technically sophisticated segment of the market, requiring integration with production systems and real-time optimization capabilities that can respond to changing production schedules and energy prices. These solutions often include advanced features such as load forecasting, demand response automation, and energy-intensive process optimization.

Building management integration is becoming increasingly important as organizations seek comprehensive facility management platforms that combine energy management with security, HVAC control, and maintenance management functions. The convergence of building systems is creating opportunities for software providers that can offer integrated platforms rather than standalone energy management tools.

Mobile accessibility features are becoming essential differentiators as facility managers and energy professionals require real-time access to energy data and control capabilities from mobile devices. The most successful platforms provide intuitive mobile interfaces that enable quick decision-making and remote system management capabilities.

Cost reduction benefits represent the most immediate and measurable value proposition for organizations implementing energy management software, with typical users achieving 15-25% energy cost savings within the first year of deployment. These savings result from improved visibility into energy consumption patterns, identification of inefficient equipment, and optimization of energy procurement strategies.

Operational efficiency improvements extend beyond direct energy savings to include enhanced equipment reliability, reduced maintenance costs, and improved facility comfort conditions. Energy management software enables predictive maintenance strategies that prevent costly equipment failures and optimize maintenance scheduling based on actual usage patterns rather than arbitrary time intervals.

Regulatory compliance advantages help organizations meet increasingly stringent environmental reporting requirements and energy efficiency standards without significant administrative burden. Automated data collection and reporting capabilities reduce the time and resources required for compliance activities while improving accuracy and consistency of regulatory submissions.

Sustainability leadership positioning enables organizations to demonstrate environmental responsibility to stakeholders, customers, and regulatory bodies through comprehensive energy performance tracking and carbon footprint reporting. This positioning can provide competitive advantages in procurement processes and enhance corporate reputation among environmentally conscious consumers and partners.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration is transforming energy management software capabilities, enabling predictive analytics, automated optimization, and intelligent decision-making that can respond to complex energy scenarios without human intervention. Machine learning algorithms are becoming sophisticated enough to identify subtle energy consumption patterns and recommend optimization strategies that human operators might overlook.

Edge computing adoption is enabling real-time energy management decisions at the facility level while reducing dependence on cloud connectivity and improving system responsiveness. This trend is particularly important for industrial applications where millisecond response times can impact production efficiency and energy optimization effectiveness.

Sustainability reporting automation is becoming a standard feature as organizations face increasing pressure to demonstrate environmental responsibility through comprehensive carbon footprint tracking and sustainability metrics. Automated ESG reporting capabilities are reducing administrative burden while improving accuracy and consistency of sustainability communications.

User experience enhancement is driving software providers to invest in intuitive interfaces, mobile accessibility, and self-service capabilities that enable non-technical users to effectively utilize energy management platforms. The democratization of energy management tools is expanding the potential user base within organizations and improving overall system adoption rates.

Strategic partnerships between software providers and regional system integrators are accelerating market penetration by combining global technology expertise with local market knowledge and implementation capabilities. These collaborations are particularly important in the MEA region where cultural and regulatory nuances require specialized understanding for successful project delivery.

Technology acquisitions are reshaping the competitive landscape as larger software companies acquire specialized energy management firms to expand their capabilities and market reach. Recent acquisitions have focused on companies with strong artificial intelligence capabilities, IoT integration expertise, and industry-specific solutions that complement existing product portfolios.

Government digitization initiatives across the region are creating opportunities for large-scale energy management software deployments in public sector facilities and infrastructure projects. According to MarkWide Research analysis, government sector adoption is expected to accelerate significantly as digital transformation programs mature and demonstrate measurable benefits.

Renewable energy project integration is driving demand for energy management software that can optimize hybrid energy systems combining traditional and renewable sources. The complexity of managing variable renewable energy generation requires sophisticated forecasting and optimization capabilities that are becoming standard features in advanced energy management platforms.

Market entry strategies for new participants should focus on developing specialized solutions for specific industry verticals rather than attempting to compete directly with established comprehensive platforms. Niche market positioning can provide opportunities to build customer relationships and demonstrate value before expanding to broader market segments.

Technology investment priorities should emphasize artificial intelligence capabilities, mobile accessibility, and cloud-native architectures that can scale efficiently as customer requirements evolve. Organizations that invest in these foundational technologies will be better positioned to adapt to changing market demands and customer expectations.

Partnership development with regional system integrators and technology consultants is essential for successful market penetration, particularly for international software providers seeking to establish presence in the MEA region. Local partnerships provide market knowledge, customer relationships, and implementation capabilities that are difficult to develop independently.

Customer education initiatives should focus on demonstrating clear return on investment and providing comprehensive training programs that address the regional skills gap in energy management and software systems. MWR research indicates that organizations with comprehensive training programs achieve 35% higher user adoption rates and faster time-to-value realization.

Market growth projections indicate continued expansion driven by increasing energy costs, regulatory requirements, and technology advancement across the MEA region. The market is expected to maintain strong growth momentum with projected CAGR of 11.8% over the next five years, supported by government sustainability initiatives and corporate energy efficiency commitments.

Technology evolution will continue to enhance energy management software capabilities, with artificial intelligence, edge computing, and IoT integration becoming standard features rather than premium add-ons. The convergence of energy management with broader operational technology platforms will create more comprehensive solutions that address multiple facility management requirements simultaneously.

Regional market maturation will create opportunities for more sophisticated energy management solutions as organizations progress beyond basic monitoring to advanced optimization and predictive capabilities. The development of regional expertise and support infrastructure will facilitate broader market adoption and enable more complex deployment scenarios.

Sustainability focus intensification will drive demand for energy management software that can support comprehensive environmental reporting and carbon reduction strategies. Organizations will increasingly seek platforms that can integrate energy management with broader sustainability initiatives and provide comprehensive ESG reporting capabilities for stakeholder communications.

The MEA energy management software market represents a dynamic and rapidly expanding sector with significant opportunities for growth and innovation. The combination of rising energy costs, government sustainability initiatives, and advancing technology capabilities creates a favorable environment for continued market development and customer adoption across diverse industry sectors.

Strategic success factors for market participants include developing comprehensive solutions that address specific regional requirements, building strong local partnerships, and investing in advanced technology capabilities that differentiate their offerings in an increasingly competitive marketplace. The organizations that can effectively combine global technology expertise with regional market knowledge will be best positioned to capitalize on emerging opportunities.

Future market development will be characterized by increasing sophistication of energy management solutions, broader adoption across different industry sectors, and integration with emerging technologies such as artificial intelligence and IoT platforms. The market’s evolution toward comprehensive sustainability management platforms will create new opportunities for software providers that can deliver integrated solutions addressing multiple environmental and operational requirements simultaneously.

What is MEA Energy Management Software?

MEA Energy Management Software refers to digital tools and platforms designed to monitor, control, and optimize energy consumption in various sectors, including industrial, commercial, and residential applications. These solutions help organizations improve energy efficiency, reduce costs, and meet sustainability goals.

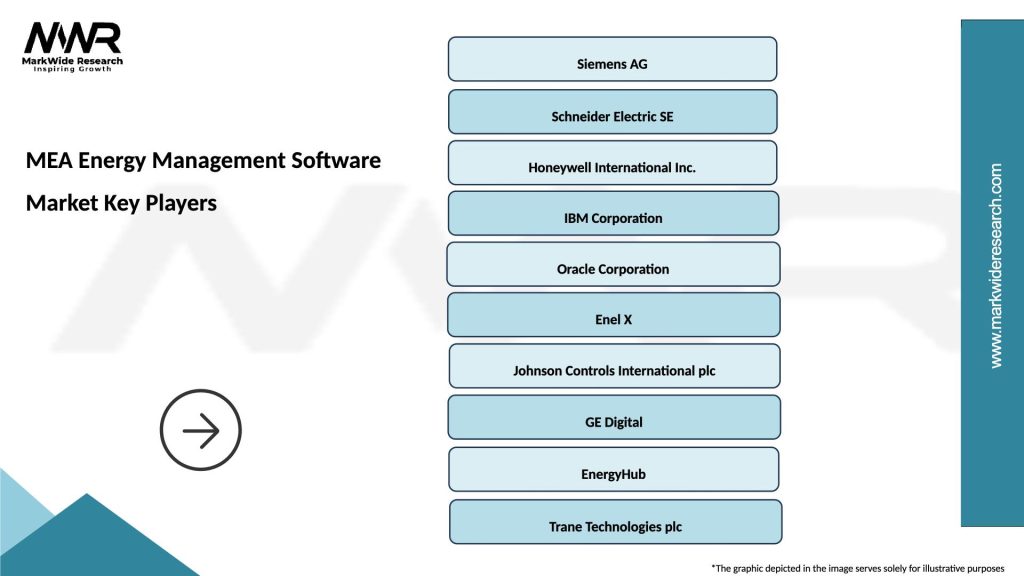

What are the key players in the MEA Energy Management Software Market?

Key players in the MEA Energy Management Software Market include Siemens, Schneider Electric, and Honeywell, among others. These companies offer a range of solutions that cater to different energy management needs across various industries.

What are the main drivers of the MEA Energy Management Software Market?

The main drivers of the MEA Energy Management Software Market include the increasing demand for energy efficiency, the rising costs of energy, and the growing emphasis on sustainability and regulatory compliance. Organizations are adopting these solutions to optimize their energy usage and reduce their carbon footprint.

What challenges does the MEA Energy Management Software Market face?

Challenges in the MEA Energy Management Software Market include the high initial investment costs and the complexity of integrating these systems with existing infrastructure. Additionally, there may be a lack of skilled personnel to manage and analyze the data generated by these software solutions.

What opportunities exist in the MEA Energy Management Software Market?

Opportunities in the MEA Energy Management Software Market include the growing adoption of IoT and AI technologies, which can enhance energy management capabilities. Furthermore, the increasing focus on renewable energy sources presents avenues for software solutions that can manage diverse energy inputs effectively.

What trends are shaping the MEA Energy Management Software Market?

Trends shaping the MEA Energy Management Software Market include the integration of advanced analytics and machine learning for predictive maintenance and energy forecasting. Additionally, there is a shift towards cloud-based solutions that offer scalability and flexibility for users.

MEA Energy Management Software Market

| Segmentation Details | Description |

|---|---|

| Deployment | On-Premise, Cloud-Based, Hybrid, SaaS |

| End User | Utilities, Commercial Buildings, Industrial Facilities, Residential Users |

| Solution | Energy Monitoring, Demand Response, Analytics, Optimization |

| Application | Energy Efficiency, Renewable Integration, Load Management, Carbon Management |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the MEA Energy Management Software Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at