444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The MEA demand response management systems market represents a rapidly evolving sector within the Middle East and Africa’s energy landscape, driven by increasing energy demands, grid modernization initiatives, and the urgent need for efficient power management solutions. Demand response management systems have emerged as critical infrastructure components that enable utilities and energy providers to optimize electricity consumption patterns, reduce peak demand, and enhance overall grid stability across the region.

Market dynamics in the MEA region are particularly influenced by the growing adoption of smart grid technologies, government initiatives promoting energy efficiency, and the increasing penetration of renewable energy sources. The market is experiencing robust growth, with projections indicating a compound annual growth rate of 12.4% over the forecast period, reflecting the region’s commitment to sustainable energy management practices.

Regional characteristics play a significant role in shaping market development, with countries like the United Arab Emirates, Saudi Arabia, and South Africa leading adoption efforts. The market encompasses various technology segments, including automated demand response systems, manual demand response solutions, and hybrid platforms that combine multiple functionalities to address diverse customer needs across residential, commercial, and industrial sectors.

The MEA demand response management systems market refers to the comprehensive ecosystem of technologies, software platforms, and services designed to enable utilities, grid operators, and energy consumers across the Middle East and Africa to actively manage electricity demand in real-time. These systems facilitate dynamic pricing mechanisms, load curtailment programs, and automated response protocols that help balance supply and demand while optimizing energy costs and grid reliability.

Demand response management systems encompass sophisticated software platforms that integrate with smart meters, building management systems, and industrial control systems to provide automated or semi-automated responses to grid conditions, pricing signals, and emergency situations. The technology enables participants to reduce or shift their electricity usage during peak demand periods, contributing to overall grid stability and cost optimization.

Strategic market positioning within the MEA region demonstrates significant potential for demand response management systems, driven by increasing urbanization, industrial expansion, and government mandates for energy efficiency improvements. The market is characterized by diverse technological approaches, ranging from simple load shedding programs to sophisticated automated demand response platforms that leverage artificial intelligence and machine learning capabilities.

Key growth drivers include the region’s commitment to reducing carbon emissions, with several countries implementing renewable energy targets of 30-50% by 2030, creating substantial opportunities for demand response integration. The commercial and industrial sectors represent the largest market segments, accounting for approximately 68% of total market adoption, while residential applications are gaining momentum through smart home initiatives and time-of-use pricing programs.

Competitive landscape features a mix of international technology providers and regional system integrators, with increasing collaboration between utilities, technology vendors, and regulatory bodies to establish comprehensive demand response frameworks. Market participants are focusing on developing localized solutions that address specific regional challenges, including extreme weather conditions, diverse regulatory environments, and varying levels of grid infrastructure maturity.

Market intelligence reveals several critical insights that shape the MEA demand response management systems landscape:

Primary growth catalysts propelling the MEA demand response management systems market include increasing electricity demand driven by rapid urbanization and industrial development across the region. Countries experiencing significant population growth and economic expansion are witnessing unprecedented strain on existing electrical infrastructure, creating urgent needs for demand management solutions that can optimize resource utilization without requiring massive capital investments in new generation capacity.

Government initiatives represent another crucial driver, with numerous MEA countries implementing national energy efficiency programs and smart grid modernization projects. These initiatives often include specific targets for demand response participation, regulatory frameworks that support utility implementation, and financial incentives for both utilities and consumers to adopt demand response technologies.

Economic factors play a significant role, as utilities and large energy consumers seek cost-effective alternatives to traditional peak capacity solutions. The ability to reduce peak demand charges, optimize time-of-use pricing benefits, and avoid costly infrastructure upgrades makes demand response management systems increasingly attractive to various market participants across the region.

Environmental considerations are driving adoption as countries work toward carbon reduction commitments and sustainable energy goals. Demand response systems enable higher renewable energy integration while reducing reliance on fossil fuel-based peaking power plants, aligning with regional sustainability objectives and international climate commitments.

Implementation challenges present significant barriers to market growth, particularly in regions with limited existing smart grid infrastructure or outdated metering systems. The complexity of integrating demand response management systems with legacy utility systems often requires substantial technical expertise and coordination efforts that can delay project timelines and increase implementation costs.

Regulatory uncertainties in some MEA countries create hesitation among potential investors and technology providers. Inconsistent policy frameworks, unclear compensation mechanisms for demand response participants, and evolving regulatory requirements can complicate business case development and long-term planning efforts for market participants.

Customer awareness and engagement remain challenging in many markets where consumers have limited understanding of demand response concepts or benefits. Cultural factors, language barriers, and varying levels of technological literacy can impede successful program implementation and customer participation rates, particularly in residential market segments.

Technical limitations including inadequate telecommunications infrastructure, cybersecurity concerns, and interoperability issues between different technology platforms can restrict system effectiveness and scalability. These challenges are particularly pronounced in rural or remote areas where communication networks may be unreliable or unavailable.

Emerging opportunities within the MEA demand response management systems market are substantial, particularly as countries accelerate smart city initiatives and digital transformation programs. The integration of artificial intelligence, machine learning, and advanced analytics presents opportunities to develop more sophisticated and effective demand response solutions that can predict and respond to grid conditions with unprecedented accuracy.

Industrial sector expansion offers significant growth potential, especially in manufacturing-intensive economies where large energy consumers can provide substantial demand response capacity. The development of sector-specific solutions for industries such as aluminum smelting, petrochemicals, and mining could unlock considerable market opportunities while providing valuable grid services.

Renewable energy integration creates new market segments as utilities seek solutions to manage the variability and intermittency associated with solar and wind power generation. Demand response management systems that can provide fast-responding grid services and storage-like capabilities represent high-value opportunities for technology providers and system integrators.

Cross-border collaboration and regional market integration initiatives could expand market opportunities by enabling demand response resources to provide services across national boundaries, creating larger and more liquid markets for demand response services throughout the MEA region.

Dynamic market forces shaping the MEA demand response management systems landscape include the interplay between technological advancement, regulatory evolution, and changing customer expectations. The market is experiencing a transition from simple load shedding programs to sophisticated automated systems that can provide multiple grid services while minimizing customer impact and maximizing economic benefits.

Competitive dynamics are intensifying as international technology providers establish regional presence while local companies develop specialized solutions tailored to specific market needs. This competition is driving innovation in areas such as user experience design, system integration capabilities, and cost-effective deployment models that can serve diverse customer segments across the region.

Technology convergence is creating new market dynamics as demand response management systems increasingly integrate with energy storage, electric vehicle charging infrastructure, and distributed energy resources. This convergence is expanding the scope and value proposition of demand response solutions while creating new partnership opportunities between different technology providers.

Market maturation varies significantly across different MEA countries, with some markets showing advanced adoption patterns while others remain in early development stages. This variation creates opportunities for knowledge transfer, best practice sharing, and scalable solution development that can accelerate market growth across the entire region.

Comprehensive research approach employed for analyzing the MEA demand response management systems market incorporates multiple data collection methodologies, including primary research through industry expert interviews, utility surveys, and technology provider consultations. This primary research is complemented by extensive secondary research utilizing industry reports, regulatory filings, and market intelligence databases to ensure comprehensive market coverage.

Data validation processes include cross-referencing information from multiple sources, conducting follow-up interviews to clarify findings, and employing statistical analysis techniques to identify trends and patterns within the collected data. The research methodology emphasizes both quantitative analysis of market metrics and qualitative assessment of market dynamics, competitive positioning, and future growth prospects.

Regional analysis framework considers the unique characteristics of different MEA sub-regions, including economic development levels, regulatory environments, utility structures, and customer demographics. This framework enables accurate assessment of market opportunities and challenges specific to different geographic areas within the broader MEA region.

Forecasting methodology combines historical market data with forward-looking indicators such as planned utility investments, regulatory policy changes, and economic growth projections to develop realistic market growth scenarios and trend analysis for the forecast period.

Gulf Cooperation Council countries represent the most advanced segment of the MEA demand response management systems market, with the United Arab Emirates and Saudi Arabia leading adoption efforts through comprehensive smart grid initiatives and national energy efficiency programs. These markets benefit from strong government support, advanced telecommunications infrastructure, and sophisticated utility operations that facilitate demand response implementation. The GCC region accounts for approximately 42% of regional market activity, driven by large-scale commercial and industrial demand response programs.

North African markets including Egypt, Morocco, and Tunisia are experiencing growing interest in demand response solutions, particularly as these countries expand renewable energy capacity and modernize their electrical grids. Government initiatives promoting energy efficiency and grid modernization are creating favorable conditions for demand response adoption, with Morocco’s renewable energy program serving as a regional model for integrated demand response implementation.

Sub-Saharan Africa presents emerging opportunities, with South Africa leading regional development through utility-scale demand response programs and regulatory frameworks that support customer participation. Other markets including Nigeria, Kenya, and Ghana are beginning to explore demand response applications as part of broader grid modernization and energy access initiatives, though adoption remains in early stages compared to other regional markets.

Market distribution across the MEA region reflects varying levels of economic development, regulatory maturity, and utility infrastructure capabilities. According to MarkWide Research analysis, commercial and industrial applications dominate current market activity, representing 73% of total demand response capacity across the region, while residential programs are gaining momentum in more developed markets.

Market leadership in the MEA demand response management systems sector is characterized by a diverse ecosystem of international technology providers, regional system integrators, and specialized software developers. The competitive landscape includes both established utility software companies and emerging technology startups focused on innovative demand response applications.

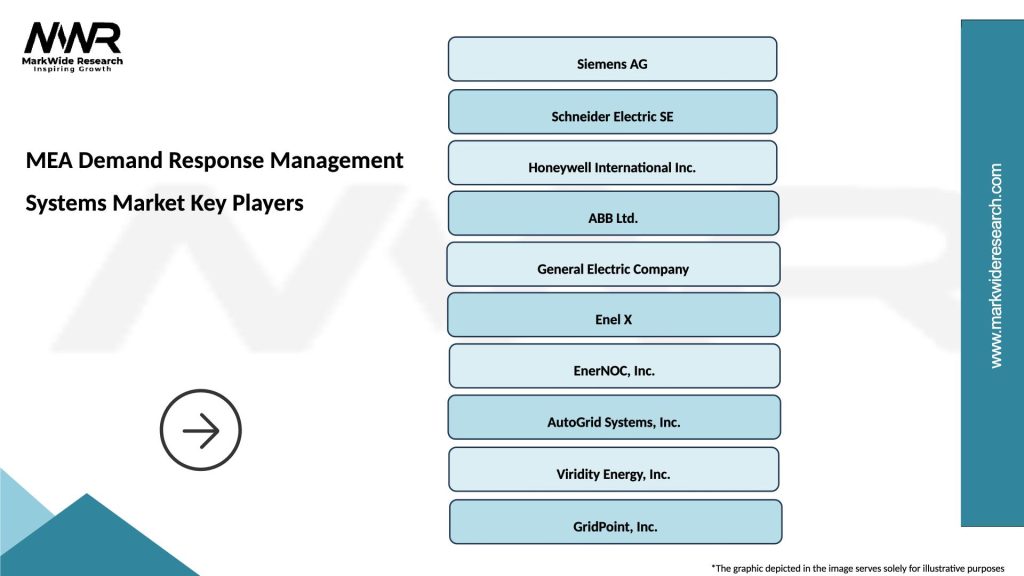

Key market participants include:

Competitive strategies focus on developing localized solutions that address specific regional requirements, establishing strategic partnerships with utilities and system integrators, and investing in advanced technologies such as artificial intelligence and machine learning to enhance system performance and customer value propositions.

Technology segmentation within the MEA demand response management systems market encompasses several distinct categories:

By Technology:

By Application:

By Service Type:

By End-User:

Automated demand response systems represent the fastest-growing segment within the MEA market, driven by increasing utility requirements for fast-responding grid services and customer preferences for minimal-impact demand management solutions. These systems leverage advanced communication technologies and intelligent control algorithms to provide seamless demand response capabilities while maintaining customer comfort and operational efficiency.

Commercial sector applications demonstrate the highest adoption rates, particularly in office buildings, retail facilities, and hospitality establishments where demand response can be implemented without significantly impacting customer experience. Building automation system integration enables sophisticated load management strategies that optimize energy costs while maintaining operational requirements.

Industrial demand response offers the largest individual customer opportunities, with energy-intensive industries such as aluminum smelting, cement production, and petrochemical processing providing substantial demand response capacity. These applications often require customized solutions that integrate with existing process control systems while maintaining production quality and safety requirements.

Residential market development is accelerating through smart home initiatives and time-of-use pricing programs, though adoption rates remain lower than commercial and industrial segments. The integration of demand response with home energy management systems, electric vehicle charging, and distributed solar generation is creating new opportunities for residential customer engagement.

Utility benefits from demand response management systems include enhanced grid reliability, reduced peak capacity requirements, and improved integration of renewable energy resources. Utilities can defer or avoid costly infrastructure investments while providing customers with opportunities to reduce energy costs and participate in grid optimization efforts.

Customer advantages encompass direct financial benefits through reduced energy costs, demand charge optimization, and participation incentives. Commercial and industrial customers can achieve operational cost reductions while contributing to grid stability and environmental sustainability objectives through their demand response participation.

System operator benefits include improved grid flexibility, enhanced emergency response capabilities, and better management of supply-demand imbalances. Demand response resources provide valuable ancillary services that support grid stability while reducing reliance on expensive peaking power plants and emergency generation resources.

Environmental stakeholders benefit from reduced carbon emissions, improved renewable energy integration, and decreased reliance on fossil fuel-based generation resources. Demand response management systems support regional sustainability goals while providing economic incentives for energy efficiency and conservation behaviors.

Technology providers gain access to growing markets with substantial long-term potential, opportunities for innovation and differentiation, and the ability to develop scalable solutions that can be deployed across multiple regional markets with varying requirements and characteristics.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration is transforming demand response management systems through predictive analytics, automated optimization, and enhanced customer engagement capabilities. AI-powered platforms can analyze consumption patterns, weather data, and grid conditions to optimize demand response strategies while minimizing customer impact and maximizing economic benefits.

Blockchain technology adoption is emerging as a trend for enabling peer-to-peer energy trading, transparent demand response transactions, and automated smart contract execution. This technology could revolutionize how demand response resources are aggregated, compensated, and verified across the MEA region.

Internet of Things expansion is driving increased connectivity and control capabilities for demand response applications. Smart appliances, industrial equipment, and building systems equipped with IoT sensors and communication capabilities enable more granular and responsive demand management strategies.

Energy storage integration represents a significant trend as battery storage systems are combined with demand response capabilities to provide enhanced grid services and customer value. This integration enables demand response resources to provide both load reduction and energy injection services depending on grid needs.

Mobile application development is improving customer engagement and participation rates through user-friendly interfaces, real-time feedback, and gamification features that encourage energy conservation behaviors and demand response participation.

Strategic partnerships between utilities, technology providers, and system integrators are accelerating market development through collaborative pilot programs, joint technology development initiatives, and shared risk deployment models. These partnerships enable faster market penetration while reducing implementation risks for all participants.

Regulatory framework evolution across multiple MEA countries is creating more favorable conditions for demand response adoption through standardized compensation mechanisms, streamlined participation requirements, and clear performance measurement criteria. Recent regulatory developments in the UAE and Saudi Arabia serve as regional models for other markets.

Technology standardization efforts are improving interoperability between different demand response platforms and utility systems, reducing integration complexity and enabling more cost-effective deployments. Industry organizations are developing common communication protocols and data exchange standards to facilitate market growth.

Pilot program expansion is providing valuable real-world experience and performance data that supports broader market adoption. Successful pilot programs in commercial buildings, industrial facilities, and residential communities are demonstrating the viability and benefits of demand response management systems across diverse applications.

Investment activity from both private and public sources is increasing, with venture capital firms, utility companies, and government agencies providing funding for demand response technology development and deployment initiatives throughout the MEA region.

Market entry strategies for technology providers should focus on establishing strong local partnerships with utilities, system integrators, and regulatory bodies to navigate complex market requirements and accelerate customer adoption. Understanding regional cultural factors, regulatory environments, and utility operational practices is essential for successful market penetration.

Technology development priorities should emphasize solutions that address specific MEA market challenges, including extreme weather conditions, diverse customer segments, and varying levels of grid infrastructure maturity. Developing modular, scalable platforms that can adapt to different market conditions will enhance competitive positioning.

Customer engagement approaches must be tailored to local market characteristics, incorporating appropriate languages, cultural considerations, and communication channels to maximize participation rates. Educational programs and demonstration projects can help build customer awareness and confidence in demand response technologies.

Regulatory engagement is crucial for market development, with industry participants encouraged to actively participate in policy development processes, provide technical expertise to regulatory bodies, and support the development of favorable market frameworks that encourage demand response adoption.

Investment focus areas should prioritize markets with strong government support, advanced utility infrastructure, and clear regulatory frameworks while maintaining flexibility to adapt to evolving market conditions and emerging opportunities across the broader MEA region.

Long-term market prospects for MEA demand response management systems remain highly positive, with continued growth expected across all major market segments and geographic regions. The increasing focus on grid modernization, renewable energy integration, and energy efficiency will drive sustained demand for sophisticated demand response solutions over the next decade.

Technology evolution will continue advancing toward more autonomous, intelligent systems that can provide multiple grid services while maximizing customer value and minimizing operational complexity. Integration with emerging technologies such as artificial intelligence, blockchain, and advanced energy storage will create new capabilities and market opportunities.

Market expansion is expected to accelerate as successful pilot programs demonstrate value and regulatory frameworks mature across the region. MWR projections indicate that market penetration rates could reach 25-30% of eligible customers in leading markets by 2030, driven by improved technology capabilities and enhanced economic incentives.

Regional integration initiatives may create opportunities for cross-border demand response services and larger, more liquid markets for demand response resources. This integration could enhance the economic viability of demand response programs while providing greater grid flexibility across the broader MEA region.

Innovation acceleration will likely focus on developing solutions that can address emerging challenges such as electric vehicle integration, distributed energy resource management, and climate resilience requirements. These innovations will expand the scope and value proposition of demand response management systems while creating new market segments and opportunities.

The MEA demand response management systems market represents a dynamic and rapidly evolving sector with substantial growth potential driven by increasing energy demands, grid modernization initiatives, and supportive government policies across the region. The market’s development reflects the broader transformation of the energy sector toward more flexible, efficient, and sustainable operations that can accommodate growing renewable energy penetration while maintaining grid reliability and customer satisfaction.

Strategic opportunities abound for technology providers, utilities, and system integrators willing to invest in understanding local market requirements and developing solutions that address specific regional challenges. The successful implementation of demand response management systems requires careful consideration of technical, regulatory, and cultural factors that vary significantly across different MEA markets, emphasizing the importance of localized approaches and strong partnership strategies.

Market maturation will continue progressing at different rates across the region, with leading markets serving as models and testing grounds for innovative technologies and business models that can subsequently be adapted for deployment in emerging markets. This progression creates opportunities for knowledge transfer, best practice sharing, and scalable solution development that can accelerate overall regional market growth while maximizing the benefits of demand response management systems for all stakeholders involved in the evolving MEA energy landscape.

What is Demand Response Management Systems?

Demand Response Management Systems refer to technologies and strategies that enable the efficient management of energy consumption by adjusting demand in response to supply conditions. These systems are crucial for balancing energy loads, enhancing grid reliability, and integrating renewable energy sources.

What are the key players in the MEA Demand Response Management Systems Market?

Key players in the MEA Demand Response Management Systems Market include Siemens, Schneider Electric, and Honeywell, among others. These companies are known for their innovative solutions that enhance energy efficiency and grid management.

What are the main drivers of the MEA Demand Response Management Systems Market?

The main drivers of the MEA Demand Response Management Systems Market include the increasing demand for energy efficiency, the integration of renewable energy sources, and the need for grid stability. These factors are pushing utilities and businesses to adopt advanced demand response solutions.

What challenges does the MEA Demand Response Management Systems Market face?

Challenges in the MEA Demand Response Management Systems Market include regulatory hurdles, the complexity of integrating new technologies with existing infrastructure, and the need for consumer engagement. These factors can hinder the widespread adoption of demand response initiatives.

What opportunities exist in the MEA Demand Response Management Systems Market?

Opportunities in the MEA Demand Response Management Systems Market include the growing emphasis on smart grid technologies, advancements in IoT and AI for energy management, and increasing government incentives for energy efficiency programs. These trends are likely to drive innovation and investment in the sector.

What trends are shaping the MEA Demand Response Management Systems Market?

Trends shaping the MEA Demand Response Management Systems Market include the rise of smart home technologies, increased use of real-time data analytics for energy management, and a shift towards decentralized energy systems. These trends are transforming how energy is consumed and managed across the region.

MEA Demand Response Management Systems Market

| Segmentation Details | Description |

|---|---|

| Type | Residential, Commercial, Industrial, Agricultural |

| Technology | Automated Demand Response, Direct Load Control, Time-Based Rate Programs, Incentive-Based Programs |

| End User | Utilities, Energy Service Companies, Government Agencies, Large Enterprises |

| Solution | Software Platforms, Analytics Tools, Communication Systems, Integration Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the MEA Demand Response Management Systems Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at