444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The MEA confectionery market represents one of the most dynamic and rapidly evolving segments within the Middle East and Africa region’s food and beverage industry. This comprehensive market encompasses a diverse range of sweet products including chocolates, candies, gums, jellies, and traditional confectionery items that cater to varied consumer preferences across different cultural backgrounds. The region’s confectionery landscape is characterized by a unique blend of international brands and local manufacturers who understand the specific taste preferences and dietary requirements of Middle Eastern and African consumers.

Market dynamics in the MEA region are influenced by several key factors including rising disposable incomes, urbanization trends, growing youth population, and increasing exposure to global confectionery brands through digital media and international travel. The market demonstrates robust growth potential with a projected CAGR of 6.2% over the forecast period, driven primarily by expanding retail infrastructure and evolving consumer lifestyles across major metropolitan areas.

Regional variations play a significant role in shaping market trends, with Gulf Cooperation Council (GCC) countries showing preference for premium chocolate products, while North African markets demonstrate strong demand for traditional sweets and affordable candy options. The market’s resilience is evident through its ability to adapt to local tastes while incorporating international flavors and innovative product formulations.

The MEA confectionery market refers to the comprehensive ecosystem of sweet food products manufactured, distributed, and consumed across the Middle East and Africa regions. This market encompasses various product categories including chocolate confectionery, sugar confectionery, gum and jellies, and traditional regional sweets that reflect local cultural preferences and dietary habits.

Confectionery products in this context include both mass-market and premium offerings that serve different consumer segments, from everyday treats to special occasion gifts and ceremonial sweets. The market definition extends beyond simple candy products to include sophisticated chocolate creations, artisanal confections, and health-conscious alternatives that cater to evolving consumer demands for better-for-you options.

Market scope covers the entire value chain from raw material sourcing and manufacturing to retail distribution and consumer consumption patterns. This includes both domestic production facilities and imported products that compete in local markets, creating a complex competitive landscape that balances international expertise with local market knowledge.

Strategic analysis of the MEA confectionery market reveals a sector experiencing significant transformation driven by demographic shifts, economic development, and changing consumer preferences. The market benefits from a young population base with 65% of consumers under the age of 35, creating substantial demand for innovative and trendy confectionery products that align with modern lifestyle choices.

Key growth drivers include expanding retail infrastructure, increasing penetration of organized retail formats, and growing consumer awareness of premium and artisanal confectionery options. The market demonstrates particular strength in chocolate confectionery segments, which account for the largest share of total confectionery consumption across most MEA countries.

Competitive landscape features a mix of multinational corporations and regional players, with international brands leveraging their global expertise while local manufacturers capitalize on their understanding of traditional flavors and cultural preferences. The market shows increasing consolidation trends as larger players acquire regional brands to expand their market presence and distribution networks.

Future prospects indicate continued growth momentum supported by economic diversification efforts across the region, rising tourism industry, and increasing adoption of western lifestyle patterns among urban consumers. The market is expected to benefit from ongoing infrastructure development and expanding middle-class population segments.

Consumer behavior analysis reveals several critical insights that shape the MEA confectionery market landscape:

Demographic advantages represent the primary driving force behind MEA confectionery market growth. The region’s youthful population structure, with a median age significantly below global averages, creates a natural consumer base for confectionery products. This demographic dividend is particularly pronounced in countries like Saudi Arabia, UAE, Egypt, and Nigeria, where young consumers demonstrate strong affinity for both traditional and international confectionery brands.

Economic development across key MEA markets has resulted in rising disposable incomes and improved living standards, enabling consumers to allocate larger portions of their budgets to discretionary spending categories including confectionery products. The growing middle class in countries like Turkey, South Africa, and Morocco represents a substantial market opportunity for both premium and mass-market confectionery offerings.

Urbanization trends continue to reshape consumption patterns across the region, with urban consumers showing greater exposure to international brands and willingness to experiment with new flavors and product formats. The expansion of modern retail formats including hypermarkets, supermarkets, and convenience stores has improved product accessibility and created opportunities for impulse purchases.

Tourism industry growth in destinations like Dubai, Istanbul, and Cape Town has created additional demand channels for confectionery products, both from visiting tourists and through the hospitality sector. Hotels, restaurants, and tourist attractions increasingly feature local and international confectionery options as part of their service offerings.

Economic volatility in several MEA markets poses significant challenges for confectionery manufacturers and retailers. Currency fluctuations, inflation pressures, and political instability in certain regions can impact consumer purchasing power and create uncertainty in demand forecasting. These economic headwinds particularly affect imported confectionery products that face additional cost pressures from currency devaluation.

Health concerns related to sugar consumption and obesity rates are increasingly influencing consumer behavior and government policies across the region. Rising awareness of diabetes and other lifestyle-related health issues has led some consumers to reduce their confectionery consumption, while regulatory authorities in several countries are considering or implementing sugar taxes and labeling requirements.

Supply chain complexities present ongoing challenges for confectionery companies operating across the diverse MEA region. Varying import regulations, customs procedures, and distribution infrastructure quality can create operational inefficiencies and increase costs. The need to maintain product quality and freshness across long supply chains in hot climates adds additional complexity and expense.

Cultural sensitivities and religious considerations require careful product formulation and marketing approaches. Halal certification requirements, restrictions on certain ingredients, and cultural taboos around specific flavors or marketing messages can limit product development options and require significant investment in compliance and certification processes.

Health-focused innovation presents substantial opportunities for confectionery manufacturers willing to invest in product development. The growing demand for sugar-free, organic, and functional confectionery products creates space for premium-positioned offerings that combine indulgence with health benefits. Products incorporating superfruits, probiotics, and natural sweeteners are gaining traction among health-conscious consumers.

E-commerce expansion offers significant growth potential as internet penetration and digital payment adoption continue to increase across MEA markets. Online platforms enable confectionery brands to reach consumers in remote areas and provide personalized shopping experiences. The COVID-19 pandemic has accelerated e-commerce adoption, creating lasting changes in consumer shopping behavior.

Premium market development represents a key opportunity as affluent consumer segments continue to expand across the region. Luxury confectionery products, artisanal chocolates, and limited-edition offerings can command premium pricing while building brand loyalty among high-value customers. The growing culture of experiential consumption supports demand for unique and Instagram-worthy confectionery products.

Local flavor integration provides opportunities for product differentiation and market penetration. Confectionery products incorporating traditional Middle Eastern and African flavors like dates, rose water, cardamom, and baobab can appeal to both local consumers seeking familiar tastes and international consumers interested in authentic regional experiences.

Competitive intensity in the MEA confectionery market continues to increase as both international and regional players vie for market share. Global confectionery giants leverage their brand recognition, distribution networks, and product innovation capabilities, while local manufacturers compete through competitive pricing, cultural relevance, and agile response to market trends. This dynamic creates a complex competitive environment that benefits consumers through increased choice and innovation.

Technology adoption is transforming various aspects of the confectionery value chain, from manufacturing automation and quality control to digital marketing and direct-to-consumer sales channels. Advanced manufacturing technologies enable greater product customization and efficiency, while digital platforms provide new opportunities for brand engagement and customer relationship management.

Regulatory evolution across MEA markets is creating both challenges and opportunities for confectionery companies. While health-focused regulations may impose additional compliance costs, they also create opportunities for companies that proactively develop healthier product alternatives. Standardization of food safety and quality regulations across regional trade blocs can reduce complexity and costs for multi-market operations.

Consumer sophistication continues to evolve as MEA consumers become more knowledgeable about ingredients, production methods, and brand values. This trend drives demand for transparency, sustainability, and ethical sourcing practices, creating opportunities for companies that can effectively communicate their commitment to responsible business practices.

Comprehensive data collection for this market analysis involved multiple research approaches to ensure accuracy and reliability of findings. Primary research included extensive surveys and interviews with industry stakeholders across key MEA markets, encompassing manufacturers, distributors, retailers, and consumers to gather firsthand insights into market trends and dynamics.

Secondary research incorporated analysis of industry reports, trade publications, government statistics, and company financial statements to validate primary findings and provide historical context. MarkWide Research analysts conducted thorough examination of market data from multiple sources to identify patterns and trends that inform strategic recommendations.

Market segmentation analysis employed both quantitative and qualitative methodologies to understand consumer preferences across different demographic groups, geographic regions, and product categories. Focus group discussions and consumer behavior studies provided deeper insights into purchasing motivations and brand loyalty factors.

Competitive intelligence gathering involved systematic monitoring of competitor activities, product launches, pricing strategies, and market positioning across the MEA region. This analysis helps identify competitive gaps and opportunities for market entry or expansion strategies.

Gulf Cooperation Council (GCC) countries represent the most lucrative segment of the MEA confectionery market, accounting for approximately 42% of regional consumption. The UAE and Saudi Arabia lead in terms of market sophistication and consumer spending power, with strong demand for premium chocolate products and international brands. Qatar and Kuwait show similar patterns, while Oman and Bahrain demonstrate growing market potential as their economies diversify.

North Africa presents a diverse market landscape with Egypt serving as the largest consumer base due to its substantial population. Morocco and Tunisia show strong growth potential driven by improving economic conditions and increasing tourism. The region demonstrates preference for traditional sweets alongside growing acceptance of international confectionery brands, particularly among urban consumers.

Turkey occupies a unique position as a bridge between European and Middle Eastern markets, with sophisticated consumer preferences and strong domestic confectionery manufacturing capabilities. The country serves as both a significant consumer market and a production hub for regional distribution, benefiting from its strategic location and established food processing infrastructure.

Sub-Saharan Africa represents an emerging opportunity with countries like South Africa, Nigeria, and Kenya showing increasing confectionery consumption. While price sensitivity remains a key factor, growing urbanization and rising incomes are creating opportunities for both affordable and premium confectionery products. Local flavor preferences and cultural considerations play important roles in product acceptance.

Market leadership in the MEA confectionery sector is characterized by a mix of global multinational corporations and strong regional players who have built significant market presence through strategic investments and local market understanding.

By Product Type:

By Distribution Channel:

By Consumer Demographics:

Chocolate Confectionery dominates the MEA market with approximately 48% market share, driven by increasing consumer sophistication and preference for premium products. Milk chocolate remains the most popular variety, while dark chocolate is gaining traction among health-conscious consumers. Filled chocolates and pralines show strong growth in GCC markets where consumers demonstrate willingness to pay premium prices for quality and innovation.

Traditional Sweets maintain cultural significance across MEA markets, with products like Turkish delight, halva, and date-based confections serving both local consumption and tourist markets. These products benefit from authenticity and cultural heritage, creating opportunities for premium positioning and export potential to diaspora communities worldwide.

Sugar-Free and Healthy Options represent the fastest-growing category segment, with 23% annual growth as consumers increasingly seek indulgence without guilt. Products incorporating natural sweeteners, added vitamins, and functional ingredients are gaining market acceptance, particularly among diabetic consumers and health-conscious demographics.

Seasonal Products create significant revenue spikes during religious festivals and cultural celebrations. Ramadan-specific products, Eid gift boxes, and Christmas-themed confectionery generate substantial sales volumes and higher margins through limited-time availability and premium packaging.

Manufacturers benefit from the MEA confectionery market’s growth potential through expanding consumer base, increasing purchasing power, and opportunities for product innovation. The region’s young demographics provide a natural market for new product launches and brand building initiatives. Local production facilities can reduce costs and improve supply chain efficiency while meeting growing demand for fresh, high-quality products.

Retailers gain from confectionery products’ high turnover rates, attractive margins, and impulse purchase characteristics. The category serves as a traffic driver for retail locations while providing opportunities for cross-merchandising and seasonal promotions. Premium confectionery products enhance store image and attract affluent customer segments.

Distributors benefit from the fragmented nature of MEA markets, which creates opportunities for specialized distribution services and local market expertise. The need for temperature-controlled logistics and rapid distribution creates barriers to entry that protect established distribution networks.

Investors find attractive opportunities in the MEA confectionery market through its defensive characteristics during economic downturns, consistent cash flow generation, and potential for consolidation. The market’s growth trajectory and increasing consumer sophistication support long-term value creation potential.

Strengths:

Weaknesses:

Opportunities:

Threats:

Premiumization continues to reshape the MEA confectionery landscape as consumers increasingly seek high-quality, artisanal, and luxury confectionery products. This trend is particularly pronounced in GCC markets where consumers demonstrate willingness to pay premium prices for superior ingredients, innovative flavors, and sophisticated packaging. Craft chocolate makers and boutique confectionery brands are gaining market share through emphasis on quality and exclusivity.

Health and Wellness Integration represents a fundamental shift in product development strategies across the region. Manufacturers are responding to consumer demand for healthier indulgence options through sugar reduction, natural ingredient incorporation, and functional benefit addition. Products featuring superfruits, probiotics, and plant-based ingredients are gaining traction among health-conscious consumers.

Digital Transformation is revolutionizing how confectionery brands engage with consumers and distribute products. Social media marketing, influencer partnerships, and e-commerce platforms are becoming essential components of brand strategies. MWR analysis indicates that digital channels now influence 67% of confectionery purchase decisions among younger consumers in urban MEA markets.

Sustainability Focus is emerging as a key differentiator as consumers become more environmentally conscious. Sustainable sourcing practices, eco-friendly packaging, and carbon footprint reduction initiatives are increasingly important for brand reputation and consumer preference, particularly among educated urban consumers.

Manufacturing Expansion across the MEA region has accelerated as international confectionery companies establish local production facilities to serve growing demand while reducing costs and improving supply chain efficiency. Recent investments in Turkey, Egypt, and UAE have created regional manufacturing hubs that serve multiple markets and reduce dependence on imports.

Strategic Acquisitions and partnerships have reshaped the competitive landscape as global players seek to strengthen their regional presence through local brand acquisition and distribution partnerships. These transactions provide access to established distribution networks, local market knowledge, and consumer relationships that are difficult to build organically.

Product Innovation has intensified with companies launching region-specific flavors, formats, and packaging solutions. Recent innovations include date-filled chocolates, rose-flavored confections, and halal-certified premium products that cater to local preferences while maintaining international quality standards.

Retail Channel Evolution continues with expansion of modern retail formats and growth of e-commerce platforms. Major retailers are dedicating increased shelf space to confectionery products while online platforms are creating new opportunities for direct-to-consumer sales and personalized product offerings.

Market Entry Strategy for new players should focus on understanding local consumer preferences and cultural nuances while leveraging global best practices in product development and marketing. Successful market entry requires significant investment in local partnerships, distribution networks, and brand building activities that resonate with regional consumers.

Product Portfolio Optimization should balance international appeal with local relevance through careful flavor selection, packaging design, and pricing strategies. Companies should invest in consumer research to understand preference variations across different MEA markets and develop targeted product lines accordingly.

Digital Investment is essential for long-term success as younger consumers increasingly rely on digital channels for product discovery and purchase decisions. MarkWide Research recommends allocating at least 15% of marketing budgets to digital initiatives including social media marketing, influencer partnerships, and e-commerce platform development.

Supply Chain Resilience should be prioritized through diversified sourcing strategies, local production capabilities, and robust distribution networks. Companies should invest in temperature-controlled logistics and inventory management systems to maintain product quality in challenging climate conditions.

Growth Trajectory for the MEA confectionery market remains positive with projected expansion driven by favorable demographics, economic development, and evolving consumer preferences. The market is expected to benefit from continued urbanization, rising middle-class populations, and increasing exposure to international brands and flavors through digital media and travel.

Innovation Focus will likely center on health-conscious product development, sustainable packaging solutions, and personalized confectionery offerings. Companies that successfully balance indulgence with health benefits while maintaining cultural relevance are positioned to capture disproportionate market share growth.

Channel Evolution will continue with e-commerce platforms gaining importance alongside traditional retail formats. The integration of online and offline channels through omnichannel strategies will become increasingly important for reaching diverse consumer segments across the region’s varied market conditions.

Consolidation Trends are expected to continue as larger players seek to strengthen their market positions through strategic acquisitions and partnerships. This consolidation will likely result in more efficient distribution networks, improved product innovation capabilities, and enhanced competitive positioning against regional and local competitors.

The MEA confectionery market presents compelling opportunities for growth and investment despite facing certain challenges related to economic volatility and evolving health consciousness among consumers. The region’s young demographics, rising disposable incomes, and cultural affinity for sweet products create a strong foundation for sustained market expansion across diverse product categories and consumer segments.

Success factors in this dynamic market include deep understanding of local preferences, investment in quality and innovation, development of efficient distribution networks, and effective digital marketing strategies that resonate with increasingly sophisticated consumers. Companies that can balance global expertise with local relevance while maintaining competitive pricing and high product quality are best positioned to capture market opportunities.

Future market leaders will likely be those organizations that embrace sustainability, health-conscious innovation, and digital transformation while preserving the cultural authenticity and indulgence characteristics that define the confectionery category. The market’s evolution toward premiumization and health-focused products creates opportunities for differentiation and margin enhancement across the competitive landscape.

What is Confectionery?

Confectionery refers to a category of food items that are primarily made of sugar and are often sweet in taste. This includes candies, chocolates, and other sweet treats that are popular across various cultures and age groups.

What are the key players in the MEA Confectionery Market?

Key players in the MEA Confectionery Market include companies like Mars, Nestlé, and Mondelez International, which are known for their diverse product offerings in chocolates and candies, among others.

What are the growth factors driving the MEA Confectionery Market?

The MEA Confectionery Market is driven by factors such as increasing disposable incomes, changing consumer preferences towards premium products, and the growing trend of gifting confectionery items during festivals and celebrations.

What challenges does the MEA Confectionery Market face?

Challenges in the MEA Confectionery Market include rising health consciousness among consumers, which leads to a demand for healthier alternatives, and regulatory pressures regarding sugar content and labeling.

What opportunities exist in the MEA Confectionery Market?

Opportunities in the MEA Confectionery Market include the expansion of e-commerce platforms for better distribution, the introduction of innovative flavors and healthier options, and the potential for growth in emerging markets.

What trends are shaping the MEA Confectionery Market?

Trends in the MEA Confectionery Market include a shift towards organic and natural ingredients, the rise of vegan confectionery products, and the increasing popularity of artisanal and handcrafted sweets.

MEA Confectionery Market

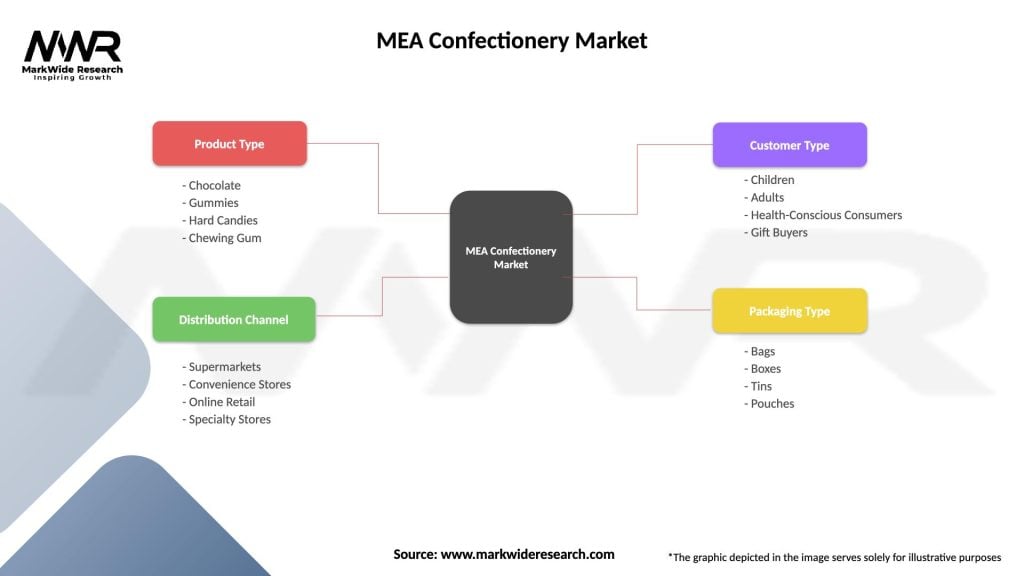

| Segmentation Details | Description |

|---|---|

| Product Type | Chocolate, Gummies, Hard Candies, Chewing Gum |

| Distribution Channel | Supermarkets, Convenience Stores, Online Retail, Specialty Stores |

| Customer Type | Children, Adults, Health-Conscious Consumers, Gift Buyers |

| Packaging Type | Bags, Boxes, Tins, Pouches |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the MEA Confectionery Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at