444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The MEA compressor market represents a dynamic and rapidly expanding sector across the Middle East and Africa region, driven by substantial industrial growth, infrastructure development, and increasing energy demands. Compressor systems serve as critical components in various applications including oil and gas operations, manufacturing processes, refrigeration systems, and power generation facilities throughout the region.

Market dynamics indicate robust growth potential, with the region experiencing a 6.8% CAGR driven by expanding industrial activities and modernization initiatives. The market encompasses diverse compressor technologies including reciprocating, rotary screw, centrifugal, and scroll compressors, each serving specific industrial requirements across different sectors.

Regional characteristics of the MEA compressor market reflect the unique economic landscape, with oil-rich nations driving significant demand for industrial compressors while emerging economies focus on infrastructure development. The market benefits from substantial investments in petrochemical industries, construction activities, and renewable energy projects, creating diverse opportunities for compressor manufacturers and suppliers.

Technology adoption patterns show increasing preference for energy-efficient and environmentally sustainable compressor solutions, with end-users prioritizing operational efficiency and reduced environmental impact. This trend aligns with regional sustainability initiatives and regulatory frameworks promoting cleaner industrial practices.

The MEA compressor market refers to the comprehensive ecosystem of compressor manufacturing, distribution, and service activities across the Middle East and Africa region, encompassing various compressor types designed to increase the pressure of gases and vapors for industrial, commercial, and residential applications.

Compressor systems function by mechanically reducing the volume of gas while increasing its pressure, enabling efficient transportation, storage, and utilization of compressed air and gases across diverse industrial processes. These systems play fundamental roles in manufacturing operations, energy production, refrigeration cycles, and pneumatic applications throughout the MEA region.

Market scope includes stationary and portable compressors, ranging from small-scale residential units to large industrial installations capable of handling substantial gas volumes. The market encompasses both original equipment manufacturing and aftermarket services, including maintenance, repair, and component replacement activities.

Strategic analysis of the MEA compressor market reveals significant growth opportunities driven by industrial expansion, infrastructure development, and technological advancement across the region. The market demonstrates strong fundamentals supported by increasing energy demands, manufacturing growth, and modernization initiatives in key economies.

Key growth drivers include expanding oil and gas operations, growing manufacturing sectors, increasing construction activities, and rising demand for energy-efficient solutions. The market benefits from substantial government investments in infrastructure projects and industrial diversification programs across various MEA countries.

Technology trends show increasing adoption of smart compressor systems with IoT integration, predictive maintenance capabilities, and enhanced energy efficiency features. End-users demonstrate growing preference for variable speed drive compressors, which offer 35% energy savings compared to traditional fixed-speed units.

Competitive landscape features both international manufacturers and regional players, with companies focusing on localization strategies, service network expansion, and technology partnerships to capture market opportunities. The market structure supports diverse business models including direct sales, distribution partnerships, and comprehensive service agreements.

Market intelligence reveals several critical insights shaping the MEA compressor market landscape:

Primary growth drivers propelling the MEA compressor market include robust industrial expansion, infrastructure development initiatives, and increasing energy demands across the region. These fundamental factors create sustained demand for various compressor technologies and applications.

Industrial growth represents the most significant market driver, with expanding manufacturing sectors requiring compressed air systems for production processes, pneumatic equipment operation, and quality control applications. The region’s industrial diversification efforts beyond traditional oil and gas sectors create new market segments for compressor manufacturers.

Infrastructure development projects across MEA countries generate substantial demand for construction-related compressor applications, including pneumatic tools, concrete spraying equipment, and material handling systems. Government investments in transportation, utilities, and urban development projects sustain long-term market growth.

Energy sector expansion continues driving demand for specialized compressor systems in oil and gas operations, power generation facilities, and renewable energy projects. The region’s strategic importance in global energy markets ensures continued investment in energy infrastructure requiring advanced compressor technologies.

Technological advancement in compressor design and control systems enables improved efficiency, reliability, and environmental performance, encouraging replacement of older equipment and adoption of modern solutions. Digital transformation initiatives across industries promote integration of smart compressor systems with IoT capabilities.

Market challenges facing the MEA compressor market include economic volatility, high initial investment costs, and technical complexity associated with advanced compressor systems. These restraints require strategic approaches from market participants to maintain growth momentum.

Economic fluctuations in oil-dependent economies create uncertainty in capital investment decisions, potentially delaying compressor procurement and infrastructure projects. Currency volatility and commodity price fluctuations impact project financing and equipment affordability across the region.

High capital costs associated with advanced compressor systems present barriers for small and medium enterprises, limiting market penetration in certain segments. The substantial initial investment required for energy-efficient compressor technologies may discourage adoption despite long-term operational benefits.

Technical complexity of modern compressor systems requires specialized knowledge for operation, maintenance, and troubleshooting, creating challenges in regions with limited technical expertise. Skills gaps in local workforce may hinder adoption of advanced compressor technologies and impact service quality.

Infrastructure limitations in certain MEA regions affect compressor market development, including inadequate power supply reliability, transportation networks, and service infrastructure. These constraints may limit market expansion in emerging economies within the region.

Significant opportunities exist within the MEA compressor market, driven by emerging applications, technological innovation, and regional development initiatives. These opportunities enable market participants to expand their presence and capture new revenue streams.

Renewable energy integration creates substantial opportunities for specialized compressor applications in energy storage systems, hydrogen production, and grid stabilization projects. The region’s increasing focus on renewable energy development opens new market segments for compressor manufacturers.

Industrial automation trends across MEA manufacturing sectors generate demand for advanced compressor systems with integrated control capabilities, remote monitoring features, and predictive maintenance functions. Industry 4.0 adoption drives requirements for smart compressor solutions.

Service market expansion presents lucrative opportunities for comprehensive maintenance programs, performance optimization services, and equipment modernization projects. The growing installed base of compressor systems creates sustained demand for aftermarket services and support.

Localization initiatives by governments and industrial companies create opportunities for regional manufacturing, assembly operations, and technology transfer partnerships. Local production capabilities can reduce costs and improve market responsiveness for compressor suppliers.

Market dynamics within the MEA compressor sector reflect complex interactions between supply and demand factors, technological evolution, and regional economic conditions. Understanding these dynamics enables stakeholders to make informed strategic decisions and capitalize on emerging trends.

Supply chain considerations play crucial roles in market dynamics, with manufacturers balancing global sourcing strategies against local content requirements and delivery time constraints. Regional supply chain development initiatives aim to reduce dependency on imports and improve market responsiveness.

Demand patterns vary significantly across different MEA countries, influenced by economic development levels, industrial structure, and government policies. Oil-rich nations demonstrate strong demand for industrial compressors, while emerging economies focus on basic infrastructure and manufacturing applications.

Technology evolution continues reshaping market dynamics, with digitalization trends enabling new business models including equipment-as-a-service offerings and performance-based contracts. These innovations create value for both suppliers and end-users through improved efficiency and reduced total cost of ownership.

Competitive dynamics intensify as international manufacturers establish regional presence while local players develop capabilities and market knowledge. This competition drives innovation, improves service quality, and creates value for end-users through diverse solution options.

Comprehensive research methodology employed for analyzing the MEA compressor market incorporates multiple data sources, analytical techniques, and validation processes to ensure accuracy and reliability of market insights and projections.

Primary research activities include extensive interviews with industry executives, technical experts, and end-users across various MEA countries to gather firsthand insights on market trends, challenges, and opportunities. These interactions provide qualitative insights complementing quantitative data analysis.

Secondary research encompasses analysis of industry reports, company financial statements, government publications, and trade association data to establish market baselines and validate primary research findings. This approach ensures comprehensive coverage of market dynamics and competitive landscape.

Data validation processes involve cross-referencing multiple sources, conducting expert reviews, and applying statistical analysis techniques to ensure data accuracy and reliability. MarkWide Research employs rigorous quality control measures throughout the research process to maintain high standards of market intelligence.

Analytical framework combines quantitative modeling with qualitative assessment to develop comprehensive market understanding and generate actionable insights for stakeholders. This methodology enables accurate market sizing, trend analysis, and future projections.

Regional market analysis reveals distinct characteristics and growth patterns across different MEA countries, reflecting varying economic conditions, industrial development levels, and infrastructure requirements.

Gulf Cooperation Council countries represent the largest market segment, accounting for 55% of regional demand, driven by extensive oil and gas operations, petrochemical industries, and large-scale infrastructure projects. These markets demonstrate strong preference for high-performance compressor systems with advanced features.

North African markets show growing demand for industrial compressors, supported by manufacturing expansion and infrastructure development initiatives. Countries like Egypt and Morocco demonstrate 8.2% annual growth in compressor adoption, driven by industrial diversification programs.

Sub-Saharan Africa presents emerging opportunities with increasing infrastructure investment and industrial development. Mining operations, manufacturing growth, and construction activities create demand for various compressor applications, though market development remains constrained by economic and infrastructure challenges.

South African market maintains mature characteristics with established industrial base and sophisticated compressor applications. The market demonstrates 25% preference for energy-efficient compressor systems, reflecting advanced environmental awareness and operational cost considerations.

Competitive environment within the MEA compressor market features diverse participants ranging from global industrial equipment manufacturers to specialized regional suppliers, each employing distinct strategies to capture market opportunities.

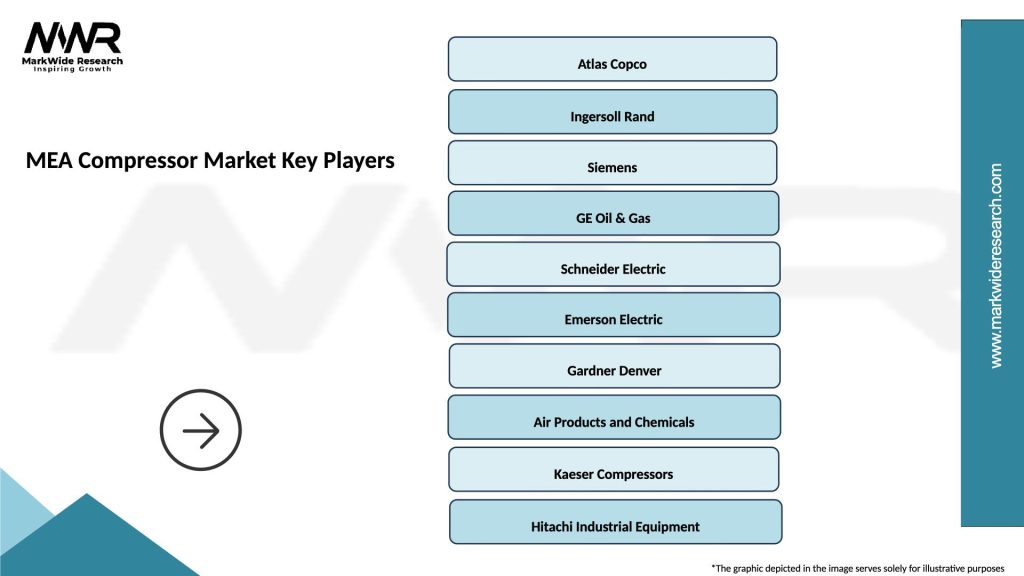

Leading market participants include:

Competitive strategies focus on localization, service excellence, technology innovation, and strategic partnerships to differentiate offerings and capture market share. Companies invest in regional manufacturing capabilities, service infrastructure, and technical support to enhance customer relationships.

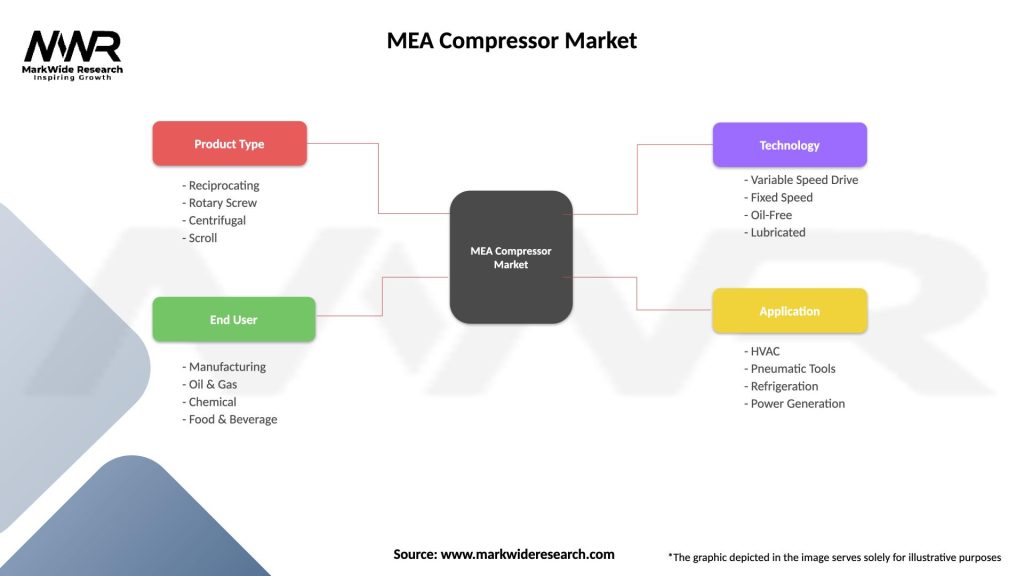

Market segmentation analysis reveals distinct categories based on technology type, application, end-user industry, and power rating, each demonstrating unique growth characteristics and market dynamics.

By Technology:

By Application:

By Power Rating:

Detailed category analysis provides comprehensive understanding of specific market segments and their unique characteristics within the MEA compressor market landscape.

Industrial Compressors represent the dominant category, driven by expanding manufacturing sectors and industrial diversification initiatives across MEA countries. This segment demonstrates strong demand for energy-efficient solutions with advanced control systems and remote monitoring capabilities.

Oil-free Compressors show increasing adoption in pharmaceutical, food processing, and electronics manufacturing applications where air quality requirements are critical. The segment benefits from 12% annual growth driven by stringent quality standards and regulatory compliance requirements.

Portable Compressors maintain steady demand in construction, mining, and maintenance applications where mobility and flexibility are essential. This category serves diverse end-users from small contractors to large infrastructure projects requiring temporary compressed air solutions.

High-pressure Compressors serve specialized applications in oil and gas operations, diving systems, and industrial processes requiring elevated pressure levels. The segment demonstrates technical complexity and higher value propositions compared to standard pressure applications.

Variable Speed Drive Compressors gain market traction due to significant energy savings and operational flexibility. These systems offer 30% energy efficiency improvement compared to fixed-speed alternatives, making them attractive for cost-conscious industrial users.

Industry participants and stakeholders in the MEA compressor market realize substantial benefits through strategic positioning, technological innovation, and comprehensive service offerings that address diverse customer requirements across the region.

Manufacturers benefit from expanding market opportunities driven by industrial growth, infrastructure development, and increasing demand for energy-efficient solutions. The diverse regional market enables portfolio diversification and risk mitigation through multiple end-user segments and applications.

End-users gain significant operational advantages through modern compressor systems including reduced energy consumption, improved reliability, lower maintenance costs, and enhanced productivity. Advanced compressor technologies enable 25% operational cost reduction through improved efficiency and reduced downtime.

Service providers capitalize on growing aftermarket opportunities through comprehensive maintenance programs, performance optimization services, and equipment modernization projects. The expanding installed base creates sustained revenue streams through long-term service contracts.

Technology suppliers benefit from increasing demand for advanced components, control systems, and digital solutions that enhance compressor performance and enable remote monitoring capabilities. Integration opportunities with IoT platforms and predictive maintenance systems create additional value propositions.

Regional economies gain through industrial development, job creation, technology transfer, and improved manufacturing capabilities. Local compressor manufacturing and service operations contribute to economic diversification and reduced import dependency.

Comprehensive SWOT analysis reveals strategic positioning factors affecting the MEA compressor market development and competitive dynamics.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends shaping the MEA compressor market reflect technological advancement, environmental consciousness, and evolving customer requirements across diverse industrial applications.

Digitalization trend drives adoption of smart compressor systems with IoT connectivity, real-time monitoring, and predictive maintenance capabilities. These technologies enable 20% reduction in maintenance costs and improved operational efficiency through data-driven insights and automated optimization.

Energy efficiency focus intensifies as industrial users seek to reduce operational costs and environmental impact. Variable speed drive compressors and advanced control systems gain popularity for their ability to match compressed air supply with actual demand, eliminating waste and reducing energy consumption.

Service transformation evolves toward comprehensive solutions including performance guarantees, remote monitoring, and outcome-based contracts. Manufacturers increasingly offer equipment-as-a-service models that transfer operational risks and provide predictable cost structures for end-users.

Sustainability initiatives promote adoption of eco-friendly compressor technologies with reduced emissions, noise levels, and environmental impact. Oil-free compressors gain traction in applications requiring clean compressed air while meeting stringent environmental regulations.

Modular design trends enable flexible compressor configurations that can adapt to changing capacity requirements and operational conditions. This approach reduces initial investment costs and provides scalability for growing industrial operations.

Recent industry developments demonstrate dynamic evolution within the MEA compressor market, reflecting technological innovation, strategic partnerships, and market expansion initiatives by key participants.

Technology advancement continues with introduction of next-generation compressor systems featuring improved efficiency, reliability, and digital integration capabilities. Manufacturers invest heavily in research and development to create competitive advantages and meet evolving customer requirements.

Strategic partnerships between international manufacturers and regional distributors expand market reach and improve customer service capabilities. These collaborations enable technology transfer, local assembly operations, and enhanced technical support across MEA markets.

Manufacturing localization initiatives gain momentum as companies establish regional production facilities to reduce costs, improve delivery times, and meet local content requirements. These investments demonstrate long-term commitment to MEA markets and create employment opportunities.

Service network expansion by major manufacturers enhances customer support and aftermarket service capabilities across the region. Comprehensive service infrastructure becomes increasingly important for competitive differentiation and customer retention.

Digital platform development enables remote monitoring, predictive maintenance, and performance optimization services that add value for end-users while creating new revenue streams for manufacturers. MWR analysis indicates growing customer acceptance of digital service offerings.

Strategic recommendations for MEA compressor market participants focus on leveraging regional opportunities while addressing market challenges through innovative approaches and customer-centric strategies.

Market entry strategies should prioritize local partnerships, service infrastructure development, and technology localization to establish sustainable competitive positions. Understanding regional market dynamics and customer requirements enables more effective market penetration and growth strategies.

Product development initiatives should emphasize energy efficiency, digital integration, and application-specific solutions that address unique MEA market requirements. Customization capabilities and flexible configurations become increasingly important for competitive differentiation.

Service excellence represents a critical success factor, requiring comprehensive support infrastructure, technical expertise, and rapid response capabilities. Companies should invest in training programs, service facilities, and digital support platforms to enhance customer satisfaction.

Technology adoption strategies should balance innovation with practical implementation considerations, ensuring that advanced features provide tangible value for end-users. Gradual technology introduction with comprehensive support enables successful market adoption.

Partnership development with local distributors, service providers, and system integrators enhances market reach and customer relationships. Strategic alliances enable resource sharing, risk mitigation, and accelerated market development across diverse MEA countries.

Future market prospects for the MEA compressor market appear highly promising, supported by continued industrial expansion, infrastructure development, and technological advancement across the region. MarkWide Research projects sustained growth driven by diversification initiatives and modernization programs.

Growth trajectory indicates accelerating adoption of advanced compressor technologies with digital capabilities, energy efficiency features, and environmental compliance characteristics. The market expects 15% annual increase in smart compressor system deployments over the next five years.

Technology evolution will continue reshaping market dynamics through artificial intelligence integration, advanced materials, and innovative design approaches that enhance performance while reducing environmental impact. These developments create opportunities for market participants to differentiate their offerings.

Market expansion into emerging applications including renewable energy, hydrogen production, and advanced manufacturing processes will drive additional growth opportunities. These new segments require specialized compressor solutions and create premium value propositions.

Regional development patterns suggest increasing market maturity in established economies while emerging markets present substantial growth potential. This dynamic creates opportunities for diverse market strategies and portfolio approaches across different MEA countries.

Sustainability focus will intensify, driving demand for eco-friendly compressor solutions and circular economy approaches including equipment refurbishment, component recycling, and lifecycle optimization services. Environmental considerations become increasingly important in purchasing decisions.

The MEA compressor market represents a dynamic and rapidly evolving sector with substantial growth potential driven by industrial expansion, infrastructure development, and technological innovation across the Middle East and Africa region. Market fundamentals remain strong, supported by diverse end-user applications and increasing demand for energy-efficient solutions.

Strategic opportunities abound for market participants willing to invest in regional presence, technology development, and comprehensive service capabilities. The market rewards companies that understand local requirements, provide reliable solutions, and maintain strong customer relationships through excellent service and support.

Future success in the MEA compressor market will depend on balancing technological innovation with practical implementation, developing sustainable competitive advantages, and adapting to evolving customer requirements across diverse regional markets. Companies that embrace digitalization, prioritize energy efficiency, and invest in local capabilities are positioned to capture the most significant growth opportunities in this expanding market landscape.

What is MEA Compressor?

MEA Compressor refers to a type of mechanical device used to increase the pressure of gases, particularly in applications such as refrigeration, air conditioning, and industrial processes. These compressors are essential for enhancing the efficiency of gas transport and storage.

What are the key players in the MEA Compressor Market?

Key players in the MEA Compressor Market include companies like Atlas Copco, Ingersoll Rand, and Siemens, which are known for their innovative compressor technologies and solutions. These companies focus on various applications, including oil and gas, manufacturing, and HVAC systems, among others.

What are the main drivers of the MEA Compressor Market?

The MEA Compressor Market is driven by increasing demand for energy-efficient solutions in industrial applications and the growing need for refrigeration and air conditioning systems. Additionally, advancements in compressor technology and rising industrialization in emerging economies contribute to market growth.

What challenges does the MEA Compressor Market face?

The MEA Compressor Market faces challenges such as high initial investment costs and the need for regular maintenance, which can deter small businesses from adopting these technologies. Furthermore, environmental regulations regarding emissions can impact the design and operation of compressors.

What opportunities exist in the MEA Compressor Market?

Opportunities in the MEA Compressor Market include the development of eco-friendly compressors and the integration of smart technologies for better efficiency and monitoring. The expansion of the renewable energy sector also presents new avenues for compressor applications.

What trends are shaping the MEA Compressor Market?

Current trends in the MEA Compressor Market include the shift towards energy-efficient and low-emission compressors, as well as the adoption of IoT technologies for enhanced performance monitoring. Additionally, there is a growing focus on sustainable practices within the industry.

MEA Compressor Market

| Segmentation Details | Description |

|---|---|

| Product Type | Reciprocating, Rotary Screw, Centrifugal, Scroll |

| End User | Manufacturing, Oil & Gas, Chemical, Food & Beverage |

| Technology | Variable Speed Drive, Fixed Speed, Oil-Free, Lubricated |

| Application | HVAC, Pneumatic Tools, Refrigeration, Power Generation |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the MEA Compressor Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at