444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The MEA compressed natural gas dispenser market represents a rapidly evolving segment within the region’s alternative fuel infrastructure landscape. This market encompasses the distribution and installation of specialized dispensing equipment designed to deliver compressed natural gas to vehicles across the Middle East and Africa region. Market dynamics indicate substantial growth potential driven by increasing environmental consciousness, government initiatives promoting cleaner transportation fuels, and rising fuel costs that make CNG an attractive alternative.

Regional adoption of compressed natural gas dispensers has accelerated significantly, with countries like Iran, Egypt, and Nigeria leading the deployment of CNG infrastructure. The market benefits from abundant natural gas reserves in the region, making CNG a cost-effective and readily available fuel source. Growth projections suggest the market will expand at a robust CAGR of 8.2% over the forecast period, supported by increasing fleet conversions and new vehicle registrations equipped with CNG capabilities.

Infrastructure development initiatives across the MEA region have created favorable conditions for CNG dispenser market expansion. Government subsidies, regulatory support for alternative fuels, and partnerships between public and private sectors are driving investment in CNG refueling stations. The market encompasses various dispenser types, from single-hose units for smaller stations to multi-hose systems capable of serving multiple vehicles simultaneously, addressing diverse operational requirements across the region.

The MEA compressed natural gas dispenser market refers to the commercial ecosystem encompassing the manufacturing, distribution, installation, and maintenance of specialized fuel dispensing equipment designed to deliver compressed natural gas to vehicles across Middle East and Africa territories. These dispensers are engineered to safely handle high-pressure natural gas storage and delivery, incorporating advanced safety systems, pressure regulation mechanisms, and user-friendly interfaces for efficient vehicle refueling operations.

Compressed natural gas dispensers serve as critical infrastructure components that bridge the gap between CNG storage facilities and end-user vehicles. They feature sophisticated pressure management systems, flow control mechanisms, and safety protocols to ensure reliable and secure fuel delivery. The market encompasses various configurations including fast-fill dispensers for commercial fleets, time-fill systems for overnight refueling, and combination units that accommodate both passenger vehicles and heavy-duty commercial applications.

Market momentum in the MEA compressed natural gas dispenser sector reflects a convergence of environmental, economic, and strategic factors driving adoption across diverse applications. The market demonstrates strong fundamentals supported by increasing recognition of CNG as a viable alternative to conventional petroleum fuels, particularly in commercial transportation and public transit applications.

Key growth drivers include government mandates promoting cleaner transportation fuels, with 72% of regional governments implementing supportive policies for alternative fuel infrastructure development. The market benefits from abundant natural gas resources in the region, creating cost advantages that make CNG dispensers attractive investments for fuel retailers and fleet operators. Technology advancement in dispenser design has improved reliability, reduced maintenance requirements, and enhanced user experience, contributing to broader market acceptance.

Regional variations in market development reflect different stages of CNG infrastructure maturity, with established markets in Iran and Egypt demonstrating advanced deployment patterns while emerging markets in sub-Saharan Africa show significant growth potential. The market encompasses diverse stakeholder groups including equipment manufacturers, fuel retailers, fleet operators, and government agencies, each contributing to the overall ecosystem development.

Strategic market insights reveal several critical trends shaping the MEA compressed natural gas dispenser landscape:

Market segmentation analysis indicates that fast-fill dispensers represent the largest segment, accounting for approximately 68% market share due to their suitability for commercial applications and public refueling stations. The growing emphasis on fleet efficiency and operational convenience continues to drive demand for advanced dispenser technologies.

Environmental regulations across the MEA region are creating compelling drivers for compressed natural gas dispenser adoption. Government initiatives aimed at reducing vehicular emissions and improving air quality in urban areas are mandating the use of cleaner fuels, with CNG emerging as a preferred alternative. Regulatory compliance requirements are pushing fleet operators and fuel retailers to invest in CNG infrastructure, creating sustained demand for dispensing equipment.

Economic advantages of compressed natural gas compared to conventional fuels represent a significant market driver. The abundant natural gas reserves in the region provide cost stability and pricing advantages that make CNG an attractive fuel option. Fuel cost savings of up to 40% compared to diesel are driving commercial fleet conversions, directly impacting dispenser demand. These economic benefits are particularly pronounced in countries with substantial natural gas production capabilities.

Infrastructure development initiatives supported by government investment and private sector partnerships are accelerating market growth. National energy strategies emphasizing fuel diversification and energy security are promoting CNG infrastructure development. Public-private partnerships are facilitating the establishment of CNG refueling networks, creating opportunities for dispenser manufacturers and suppliers to expand their market presence across the region.

Technology advancement in CNG vehicle manufacturing is expanding the addressable market for dispensers. Improved engine efficiency, enhanced vehicle performance, and broader model availability are increasing consumer and commercial acceptance of CNG vehicles. This growing vehicle population creates corresponding demand for refueling infrastructure, driving dispenser market expansion.

High initial investment requirements for CNG dispenser installation represent a significant market restraint. The specialized nature of compressed natural gas handling equipment requires substantial capital expenditure for dispensers, storage systems, and safety infrastructure. Installation costs can be prohibitive for smaller fuel retailers, limiting market penetration in certain segments and geographic areas where financial resources are constrained.

Technical complexity associated with CNG dispenser operation and maintenance creates barriers to adoption. The high-pressure nature of compressed natural gas requires specialized training for operators and maintenance personnel. Skill shortages in technical expertise for CNG equipment management can limit market growth, particularly in regions where alternative fuel infrastructure is relatively new and support ecosystems are underdeveloped.

Safety concerns related to high-pressure gas handling continue to influence market adoption rates. While modern dispensers incorporate comprehensive safety systems, perceived risks associated with compressed natural gas storage and dispensing can create hesitation among potential adopters. Regulatory compliance requirements for safety protocols and equipment certification can add complexity and cost to market entry for new participants.

Infrastructure limitations in natural gas pipeline networks restrict market development in certain regions. Areas lacking adequate natural gas supply infrastructure face challenges in establishing economically viable CNG refueling stations. Geographic constraints related to gas availability and transportation costs can limit market expansion opportunities, particularly in remote or underdeveloped areas of the MEA region.

Fleet electrification trends paradoxically create opportunities for CNG dispensers as an intermediate solution for heavy-duty applications where electric alternatives remain limited. Commercial transportation sectors including logistics, public transit, and waste management present substantial opportunities for CNG dispenser deployment. The growing recognition of CNG as a bridge fuel toward full electrification creates market opportunities for dispenser manufacturers.

Smart city initiatives across the MEA region are incorporating alternative fuel infrastructure as key components of sustainable urban development. Municipal partnerships for public transportation electrification and fleet conversion create opportunities for large-scale dispenser deployments. These initiatives often include government funding and regulatory support that facilitate market entry and expansion for equipment suppliers.

Export market potential exists for countries with established CNG infrastructure to support neighboring regions in developing their alternative fuel capabilities. Regional cooperation initiatives and technology transfer programs create opportunities for market expansion beyond domestic boundaries. Countries with advanced CNG dispenser manufacturing capabilities can leverage their expertise to serve broader regional markets.

Technology integration opportunities exist in developing smart dispensers with IoT connectivity, predictive maintenance capabilities, and integrated payment systems. Digital transformation in fuel retail operations creates demand for advanced dispenser technologies that can provide operational insights, remote monitoring, and enhanced user experiences. These technological enhancements can command premium pricing and create competitive advantages for manufacturers.

Supply chain dynamics in the MEA compressed natural gas dispenser market reflect a complex interplay between international manufacturers, regional distributors, and local service providers. Global suppliers are establishing regional partnerships to address local market requirements and regulatory compliance needs. The market demonstrates increasing localization of manufacturing and assembly operations to reduce costs and improve service delivery capabilities.

Competitive dynamics are intensifying as market growth attracts new entrants and existing players expand their regional presence. Price competition is balanced against quality and service considerations, with customers increasingly valuing total cost of ownership over initial purchase price. The market shows consolidation trends as larger players acquire regional specialists to enhance their market coverage and technical capabilities.

Regulatory dynamics continue to shape market development through evolving safety standards, environmental requirements, and fuel quality specifications. Harmonization efforts across regional markets are creating opportunities for standardized product offerings while reducing compliance complexity for manufacturers. The regulatory environment generally supports market growth through incentives and mandates favoring alternative fuel adoption.

Technology dynamics are driving continuous innovation in dispenser design, safety systems, and operational efficiency. Digital integration is becoming increasingly important, with dispensers incorporating advanced monitoring, payment processing, and fleet management capabilities. The market shows growing demand for modular and scalable solutions that can adapt to changing operational requirements and expansion needs.

Comprehensive market analysis for the MEA compressed natural gas dispenser market employs a multi-faceted research approach combining primary and secondary data sources. Primary research includes structured interviews with industry stakeholders, equipment manufacturers, fuel retailers, fleet operators, and regulatory officials across key markets in the region. This approach ensures current market insights and validates secondary research findings through direct industry engagement.

Secondary research encompasses analysis of industry reports, government publications, trade association data, and company financial statements to establish market baselines and trend analysis. Data triangulation methods are employed to verify information accuracy and ensure comprehensive market coverage. The research methodology incorporates both quantitative and qualitative analysis techniques to provide balanced market insights.

Regional market analysis considers country-specific factors including regulatory environments, economic conditions, natural gas availability, and infrastructure development status. Comparative analysis across different MEA markets provides insights into development patterns and growth opportunities. The methodology accounts for varying market maturity levels and development stages across the region.

Forecasting methodology incorporates multiple scenario analysis considering various growth drivers and market constraints. Statistical modeling techniques are applied to historical data to establish trend patterns and project future market development. The approach considers both optimistic and conservative growth scenarios to provide realistic market projections and risk assessment.

Middle East markets demonstrate the most advanced development in compressed natural gas dispenser adoption, with Iran leading regional deployment with approximately 35% of total installations. The country’s extensive natural gas reserves and government support for CNG vehicle conversion have created a mature market for dispensing equipment. UAE and Saudi Arabia are emerging as significant markets driven by diversification initiatives and environmental sustainability goals.

North African markets show substantial growth potential, with Egypt representing the largest market opportunity in the subregion. Government initiatives promoting CNG adoption in public transportation and commercial fleets are driving infrastructure development. Algeria and Morocco are developing their CNG infrastructure capabilities, creating opportunities for dispenser manufacturers and suppliers to establish market presence.

Sub-Saharan African markets represent emerging opportunities with Nigeria leading regional development efforts. Natural gas abundance in Nigeria creates favorable conditions for CNG infrastructure development, though market development remains in early stages. South Africa shows growing interest in alternative fuel infrastructure as part of broader energy transition initiatives.

Regional variations in market development reflect different stages of infrastructure maturity, regulatory support, and economic conditions. Market penetration rates vary significantly across countries, with established markets showing 15-20% annual growth while emerging markets demonstrate higher growth potential but from smaller bases. Cross-border cooperation initiatives are creating opportunities for regional market integration and technology transfer.

Market leadership in the MEA compressed natural gas dispenser sector is characterized by a mix of international manufacturers and regional specialists. The competitive landscape reflects diverse approaches to market development, with some companies focusing on technology leadership while others emphasize cost competitiveness and local market knowledge.

Competitive strategies focus on technology differentiation, local market adaptation, and comprehensive service offerings. Strategic partnerships with regional distributors and service providers are common approaches for international manufacturers seeking to establish market presence. The competitive environment emphasizes total cost of ownership value propositions rather than purely price-based competition.

By Technology:

By Application:

By Pressure Rating:

By End User:

Fast-fill dispensers dominate the market segment with approximately 68% market share, driven by their versatility and suitability for commercial applications. These units provide rapid refueling capabilities essential for commercial fleet operations where vehicle downtime must be minimized. Technology advancement in fast-fill systems has improved reliability and reduced maintenance requirements, making them increasingly attractive for high-volume applications.

Public refueling stations represent the fastest-growing application segment, expanding at 12.5% annually as CNG vehicle adoption increases among individual consumers. MarkWide Research analysis indicates that public station development is accelerating in urban areas where air quality concerns are driving alternative fuel adoption. The segment benefits from government incentives and regulatory support for alternative fuel infrastructure development.

Fleet depot applications continue to represent a stable market segment with predictable demand patterns driven by commercial fleet conversion schedules. Time-fill dispensers are particularly popular in this segment due to their cost-effectiveness for overnight refueling operations. The segment shows steady growth as more fleet operators recognize the economic benefits of CNG conversion.

High-pressure systems (3,600 PSI) account for the majority of new installations, reflecting industry standardization around higher pressure storage for improved vehicle range. Technology trends favor higher pressure systems that provide better fuel density and extended vehicle operating range, making them preferred choices for most applications.

Equipment manufacturers benefit from growing market demand driven by environmental regulations and economic advantages of CNG fuel. Revenue opportunities extend beyond initial equipment sales to include maintenance services, spare parts, and system upgrades. The market provides opportunities for technology differentiation and premium pricing for advanced features and enhanced reliability.

Fuel retailers gain competitive advantages through alternative fuel offerings that attract environmentally conscious consumers and commercial fleet customers. CNG dispensers provide opportunities for market differentiation and customer loyalty development. The technology enables retailers to participate in growing alternative fuel markets while leveraging existing site infrastructure.

Fleet operators achieve significant operational cost savings through CNG adoption, with fuel cost reductions of 30-40% compared to diesel. Environmental benefits include reduced emissions and improved corporate sustainability profiles. CNG dispensers enable fleet operators to establish energy independence and reduce exposure to petroleum fuel price volatility.

Government agencies advance environmental and energy security objectives through CNG infrastructure development. Economic benefits include job creation in alternative fuel industries and reduced dependence on petroleum imports. CNG dispenser deployment supports broader policy goals related to air quality improvement and sustainable transportation development.

Local communities benefit from improved air quality and reduced noise pollution associated with CNG vehicle adoption. Economic development opportunities arise from alternative fuel infrastructure investment and related service industries. The technology contributes to energy diversification and enhanced energy security at regional levels.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital integration represents a transformative trend in CNG dispenser technology, with manufacturers incorporating IoT connectivity, remote monitoring capabilities, and predictive maintenance features. Smart dispensers provide operational insights, automated reporting, and enhanced user experiences through mobile applications and digital payment systems. This trend is driving premium pricing opportunities and creating competitive differentiation for technology leaders.

Modular design approaches are gaining popularity as operators seek flexible solutions that can scale with demand growth. Scalable systems allow initial installations with basic configurations that can be expanded as market demand develops. This trend addresses the challenge of high initial investment by enabling phased deployment strategies that align capital expenditure with revenue generation.

Safety enhancement continues as a key trend with manufacturers developing advanced leak detection systems, automated shutdown protocols, and enhanced operator training programs. Safety innovations are addressing historical concerns about CNG handling and improving market acceptance among operators and regulatory authorities. The trend includes development of fail-safe systems and redundant safety mechanisms.

Regional manufacturing is emerging as companies establish local production capabilities to reduce costs and improve service delivery. Localization strategies include partnerships with regional manufacturers, assembly operations, and supply chain development. This trend is driven by cost optimization needs and requirements for local content in government procurement programs.

Service integration is becoming increasingly important as manufacturers expand beyond equipment sales to provide comprehensive service offerings. Service models include maintenance contracts, training programs, and operational support services. This trend creates recurring revenue opportunities and strengthens customer relationships through ongoing engagement.

Strategic partnerships between international manufacturers and regional distributors are accelerating market development across the MEA region. Recent alliances focus on combining global technology expertise with local market knowledge and service capabilities. These partnerships are facilitating market entry for international companies while providing regional partners with access to advanced technologies.

Government initiatives promoting CNG infrastructure development are creating significant market opportunities. National programs in countries like Egypt and Nigeria include substantial funding for alternative fuel infrastructure development. These initiatives often include preferential financing terms and regulatory support that facilitate private sector investment in CNG dispensers.

Technology advancement in dispenser design is improving reliability, safety, and user experience. Recent innovations include enhanced pressure regulation systems, improved user interfaces, and integrated payment processing capabilities. These developments are addressing historical barriers to CNG adoption and improving the overall value proposition for operators.

Market consolidation activities are reshaping the competitive landscape as larger companies acquire regional specialists and technology developers. Acquisition strategies focus on expanding geographic coverage, enhancing technology portfolios, and strengthening service capabilities. This trend is creating stronger market players with comprehensive solution offerings.

Regulatory harmonization efforts across regional markets are creating opportunities for standardized product offerings and reduced compliance complexity. Standards development initiatives are establishing common safety requirements and operational protocols that facilitate cross-border market development and technology transfer.

Market entry strategies should prioritize partnerships with established regional distributors and service providers to leverage local market knowledge and customer relationships. MWR analysis indicates that successful market entry requires comprehensive understanding of regulatory requirements, customer preferences, and competitive dynamics specific to each country market.

Technology investment should focus on digital integration capabilities, safety enhancements, and modular design features that address evolving market requirements. Product development priorities should include IoT connectivity, predictive maintenance capabilities, and user-friendly interfaces that improve operational efficiency and customer satisfaction.

Service capability development is essential for long-term market success, with emphasis on local technical support, training programs, and maintenance services. Service strategies should include comprehensive training programs for operators and maintenance personnel to address skill shortage challenges in emerging markets.

Government engagement strategies should focus on participating in policy development processes and supporting infrastructure development initiatives. Stakeholder relationships with regulatory authorities, industry associations, and government agencies are crucial for understanding market developments and influencing favorable policy outcomes.

Regional expansion should follow a phased approach, prioritizing markets with established natural gas infrastructure and supportive regulatory environments. Market development strategies should consider local economic conditions, competitive landscapes, and growth potential when establishing market entry priorities and resource allocation.

Market growth prospects for the MEA compressed natural gas dispenser market remain positive, supported by continued government support for alternative fuels and growing recognition of CNG economic advantages. Long-term projections indicate sustained growth at 8.2% CAGR through the forecast period, driven by fleet conversion programs and infrastructure development initiatives across the region.

Technology evolution will continue toward smarter, more connected dispensers with enhanced safety features and operational capabilities. Future developments are expected to include artificial intelligence integration for predictive maintenance, advanced user interfaces, and seamless integration with fleet management systems. These technological advances will create opportunities for premium pricing and market differentiation.

Regional market development will likely show continued leadership from Middle Eastern markets while North African and sub-Saharan African markets demonstrate accelerating growth. Market maturation in established regions will drive demand for advanced features and replacement equipment, while emerging markets will focus on basic infrastructure development and capacity expansion.

Competitive landscape evolution is expected to favor companies with comprehensive solution offerings, strong service capabilities, and regional market presence. Market consolidation trends will likely continue as companies seek to achieve scale advantages and expand their geographic coverage through strategic acquisitions and partnerships.

Regulatory environment development will continue to support market growth through environmental standards, alternative fuel mandates, and infrastructure development incentives. Policy trends indicate increasing government commitment to alternative fuel adoption as part of broader environmental and energy security strategies across the region.

The MEA compressed natural gas dispenser market represents a dynamic and growing sector with substantial opportunities for equipment manufacturers, fuel retailers, and service providers. Market fundamentals remain strong, supported by abundant natural gas resources, government policy support, and compelling economic advantages that drive CNG adoption across commercial and public applications.

Growth trajectory projections indicate continued market expansion driven by fleet conversion programs, infrastructure development initiatives, and increasing environmental consciousness across the region. The market benefits from technology advancement that is addressing historical barriers to adoption while creating opportunities for premium product offerings and enhanced service delivery.

Success factors for market participants include technology leadership, comprehensive service capabilities, strategic partnerships, and deep understanding of regional market dynamics. Companies that can effectively combine global technology expertise with local market knowledge and service delivery capabilities are positioned to capture the most significant opportunities in this evolving market landscape.

What is Compressed Natural Gas Dispenser?

A Compressed Natural Gas Dispenser is a device used to refuel vehicles powered by compressed natural gas (CNG). These dispensers are commonly found at CNG fueling stations and are designed to safely and efficiently deliver CNG to vehicles.

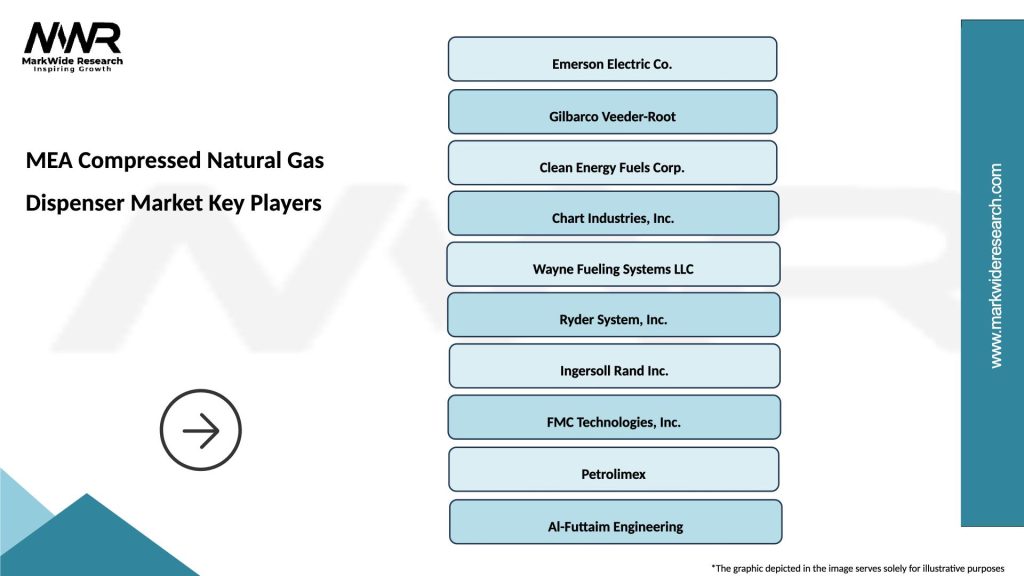

What are the key players in the MEA Compressed Natural Gas Dispenser Market?

Key players in the MEA Compressed Natural Gas Dispenser Market include companies like Clean Energy Fuels Corp, Gazprom, and Linde AG, which are known for their innovations in CNG technology and infrastructure development, among others.

What are the growth factors driving the MEA Compressed Natural Gas Dispenser Market?

The growth of the MEA Compressed Natural Gas Dispenser Market is driven by increasing demand for cleaner fuel alternatives, government initiatives promoting CNG usage, and the rising number of CNG vehicles in the region.

What challenges does the MEA Compressed Natural Gas Dispenser Market face?

Challenges in the MEA Compressed Natural Gas Dispenser Market include the high initial investment for infrastructure, limited availability of CNG refueling stations, and competition from other alternative fuel sources.

What opportunities exist in the MEA Compressed Natural Gas Dispenser Market?

Opportunities in the MEA Compressed Natural Gas Dispenser Market include the expansion of CNG infrastructure, advancements in dispenser technology, and increasing partnerships between governments and private sectors to promote CNG adoption.

What trends are shaping the MEA Compressed Natural Gas Dispenser Market?

Trends in the MEA Compressed Natural Gas Dispenser Market include the integration of smart technology in dispensers, the development of fast-fill CNG systems, and a growing focus on sustainability and reducing carbon emissions.

MEA Compressed Natural Gas Dispenser Market

| Segmentation Details | Description |

|---|---|

| Product Type | Time-Fill, Fast-Fill, Hybrid, Portable |

| Technology | Membrane Separation, Adsorption, Cryogenic, Compression |

| End User | Public Transport, Fleet Operators, Industrial Users, Gas Stations |

| Installation | On-Site, Off-Site, Mobile, Fixed |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the MEA Compressed Natural Gas Dispenser Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at