444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The MEA card-based access control market represents a rapidly expanding security technology sector across the Middle East and Africa region. This sophisticated market encompasses electronic access control systems that utilize various card technologies including proximity cards, smart cards, and contactless cards to manage and monitor entry to buildings, facilities, and secure areas. Market dynamics indicate robust growth driven by increasing security concerns, digital transformation initiatives, and stringent regulatory compliance requirements across diverse industries.

Regional adoption of card-based access control systems has accelerated significantly, with the market experiencing a compound annual growth rate of 8.2% over recent years. The technology’s integration with modern security infrastructure has become essential for organizations seeking comprehensive access management solutions. Key sectors driving demand include commercial real estate, healthcare facilities, educational institutions, government buildings, and industrial complexes throughout the MEA region.

Technological advancement continues to shape market evolution, with innovations in contactless technology, mobile integration, and cloud-based management systems enhancing system capabilities. The market benefits from increasing awareness of security vulnerabilities and the need for sophisticated access control mechanisms that provide detailed audit trails and real-time monitoring capabilities.

The MEA card-based access control market refers to the comprehensive ecosystem of electronic security systems that utilize card technologies to authenticate and authorize access to physical spaces across the Middle East and Africa region. These systems replace traditional mechanical keys with electronic cards containing embedded chips, magnetic stripes, or proximity sensors that communicate with card readers to grant or deny access based on programmed credentials.

Core functionality encompasses user authentication, access logging, time-based restrictions, and integration with broader security management systems. The technology enables organizations to maintain detailed records of facility access, implement flexible security policies, and respond quickly to security incidents. System components typically include card readers, access control panels, management software, and various card technologies ranging from basic proximity cards to advanced smart cards with encryption capabilities.

Market scope extends beyond simple door access to include elevator control, parking management, time and attendance tracking, and integration with video surveillance systems. The technology serves as a foundation for comprehensive security ecosystems that protect assets, personnel, and sensitive information across diverse organizational environments.

Strategic market positioning reveals the MEA card-based access control market as a critical component of the region’s expanding security technology landscape. The market demonstrates strong growth momentum driven by urbanization, infrastructure development, and heightened security awareness across both public and private sectors. Technology adoption rates have increased substantially, with organizations recognizing the operational efficiency and security benefits of electronic access control systems.

Key market drivers include regulatory compliance requirements, which account for approximately 35% of implementation decisions, along with operational efficiency improvements and enhanced security capabilities. The market benefits from increasing integration with Internet of Things (IoT) technologies and cloud-based management platforms that enable remote monitoring and centralized control across multiple facilities.

Competitive landscape features both international technology providers and regional system integrators working collaboratively to deliver comprehensive access control solutions. Market participants focus on developing user-friendly interfaces, mobile integration capabilities, and scalable architectures that accommodate growing organizational needs. Future prospects remain highly positive, supported by continued infrastructure investment and digital transformation initiatives across the MEA region.

Market intelligence reveals several critical insights shaping the MEA card-based access control landscape:

Market maturation indicators suggest increasing sophistication in buyer requirements, with emphasis on total cost of ownership, system reliability, and vendor support capabilities. Technology evolution continues toward more intelligent systems that provide predictive analytics and automated security responses.

Security imperatives serve as the primary catalyst for card-based access control adoption across the MEA region. Organizations face increasing threats from unauthorized access, internal security breaches, and regulatory non-compliance, driving demand for sophisticated access management solutions. Threat landscape evolution has made traditional lock-and-key systems inadequate for modern security requirements.

Regulatory compliance requirements significantly influence market growth, particularly in sectors such as healthcare, finance, and government where data protection and facility security standards mandate electronic access control systems. Compliance frameworks increasingly require detailed audit trails, user authentication records, and real-time monitoring capabilities that only electronic systems can provide effectively.

Operational efficiency benefits drive adoption as organizations recognize the administrative advantages of electronic access control. The technology eliminates key management complexities, reduces security personnel requirements, and provides comprehensive reporting capabilities. Cost optimization through reduced security staffing and improved operational control creates compelling business cases for system implementation.

Digital transformation initiatives across the MEA region accelerate market growth as organizations modernize their security infrastructure. Integration capabilities with other business systems, including human resources, visitor management, and building automation, create synergistic value propositions that justify investment in advanced access control technologies.

Implementation costs represent a significant barrier to market adoption, particularly for small and medium-sized organizations with limited capital budgets. The total investment required for comprehensive card-based access control systems, including hardware, software, installation, and training, can be substantial. Budget constraints often delay implementation decisions or result in scaled-back system deployments that may not fully address security requirements.

Technical complexity challenges organizations lacking internal IT expertise or dedicated security management resources. System integration with existing infrastructure, ongoing maintenance requirements, and user training needs can overwhelm organizations without proper technical support. Integration difficulties with legacy systems and diverse technology environments create additional implementation hurdles.

Cultural resistance to technology adoption in certain market segments slows growth, particularly in traditional industries or regions where manual processes remain prevalent. Change management challenges associated with transitioning from familiar key-based systems to electronic alternatives require careful planning and user education initiatives.

Infrastructure limitations in some MEA markets, including unreliable power supply and limited network connectivity, create operational challenges for electronic access control systems. Environmental factors such as extreme temperatures, dust, and humidity can affect system reliability and increase maintenance requirements, particularly in harsh regional climates.

Smart city initiatives across the MEA region create substantial opportunities for card-based access control integration into broader urban security and management systems. Government investments in intelligent infrastructure development provide platforms for comprehensive access control deployments that serve multiple municipal functions. Urban development projects increasingly incorporate advanced security technologies as standard infrastructure components.

Mobile integration opportunities represent a significant growth avenue as smartphones become ubiquitous across the region. The convergence of mobile technology with traditional card-based systems enables innovative solutions that enhance user convenience while maintaining security effectiveness. Smartphone penetration rates exceeding 75% in key MEA markets support mobile credential adoption.

Cloud-based solutions offer opportunities to address cost and complexity concerns while providing scalable access control capabilities. Software-as-a-Service (SaaS) models reduce upfront investment requirements and provide ongoing system updates and support. Cloud adoption enables smaller organizations to access enterprise-grade access control capabilities previously available only to large enterprises.

Vertical market specialization creates opportunities for tailored solutions addressing specific industry requirements. Healthcare facilities, educational institutions, and industrial complexes each have unique access control needs that specialized solutions can address more effectively than generic systems. Industry-specific features and compliance capabilities command premium pricing and create competitive differentiation.

Competitive intensity continues to increase as both international technology providers and regional system integrators vie for market share. The market demonstrates healthy competition across different technology segments, with vendors differentiating through feature sets, pricing strategies, and service capabilities. Market consolidation trends suggest larger players acquiring specialized providers to expand their solution portfolios.

Technology evolution drives market dynamics as new capabilities emerge and customer expectations evolve. The integration of artificial intelligence, machine learning, and advanced analytics into access control systems creates new value propositions and competitive advantages. Innovation cycles accelerate as vendors respond to changing security threats and user requirements.

Customer sophistication increases as organizations gain experience with access control technologies and develop more specific requirements. Buyers increasingly evaluate total cost of ownership, system scalability, and integration capabilities rather than focusing solely on initial purchase price. Procurement processes become more rigorous as organizations recognize the strategic importance of access control systems.

Partnership ecosystems evolve as technology providers collaborate with system integrators, consultants, and service providers to deliver comprehensive solutions. Channel strategies emphasize local market knowledge and ongoing support capabilities that international vendors may lack independently.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the MEA card-based access control market. Primary research includes structured interviews with industry executives, technology providers, system integrators, and end-user organizations across key regional markets. Survey methodologies capture quantitative data on market trends, technology preferences, and implementation challenges.

Secondary research incorporates analysis of industry reports, regulatory documents, company financial statements, and technology specifications to validate primary findings and provide comprehensive market context. Data triangulation techniques ensure consistency across multiple information sources and enhance overall research reliability.

Market modeling utilizes statistical analysis and forecasting techniques to project future market trends and growth patterns. Historical data analysis identifies cyclical patterns and structural changes that influence market development. Scenario analysis evaluates potential market outcomes under different economic and technological conditions.

Expert validation processes involve review of research findings by industry specialists and academic researchers to ensure accuracy and completeness. Peer review mechanisms provide additional quality assurance and identify potential research gaps or methodological improvements.

United Arab Emirates leads regional market development with the highest adoption rates and most sophisticated implementations. The country’s focus on smart city development and advanced infrastructure creates favorable conditions for access control technology deployment. Dubai and Abu Dhabi serve as regional technology hubs that influence broader MEA market trends and standards.

Saudi Arabia represents the largest market opportunity within the MEA region, driven by Vision 2030 initiatives and massive infrastructure development projects. Government investments in security technology and regulatory compliance requirements support strong market growth. NEOM and other megaprojects incorporate advanced access control systems as integral infrastructure components.

South Africa dominates the African market segment with 38% regional market share, benefiting from established technology infrastructure and sophisticated security requirements. The country’s mature commercial real estate sector and regulatory environment support advanced access control implementations. Economic challenges create price sensitivity that influences technology selection decisions.

Egypt and Nigeria emerge as high-growth markets with increasing adoption rates driven by urbanization and infrastructure development. These markets show preference for cost-effective solutions that provide essential access control capabilities without advanced features. Local system integrators play crucial roles in market development and customer support.

Gulf Cooperation Council countries collectively demonstrate strong market growth supported by oil revenues and government infrastructure investments. Regional coordination on security standards and technology specifications creates opportunities for standardized solutions across multiple markets.

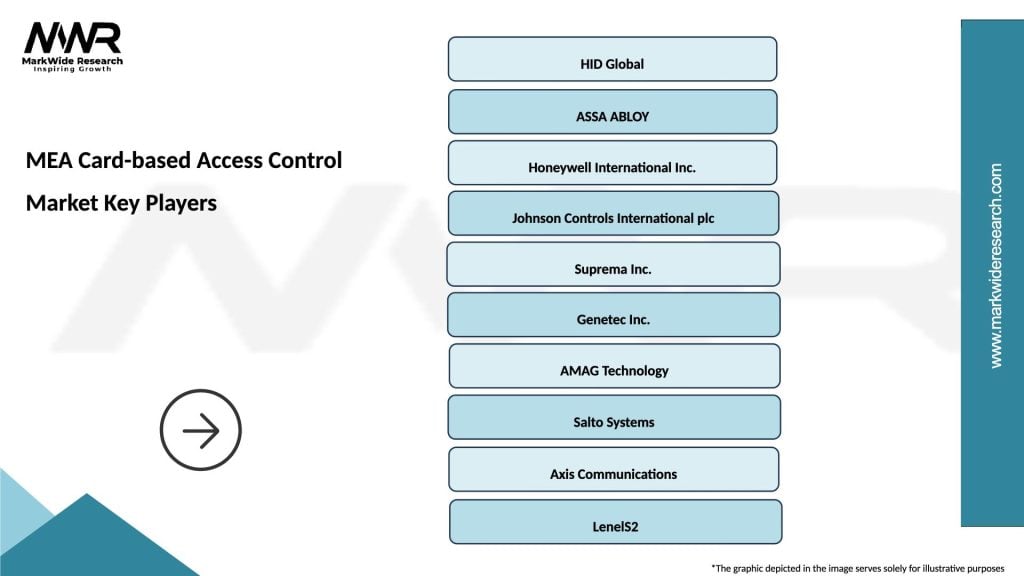

Market leadership is distributed among several key players, each with distinct competitive advantages and market positioning strategies:

Competitive strategies emphasize technology innovation, local market presence, and comprehensive service capabilities. Vendors increasingly focus on solution integration, mobile technologies, and cloud-based management platforms to differentiate their offerings. Partnership networks with regional system integrators provide crucial local market access and ongoing customer support.

Market positioning varies from premium technology providers focusing on advanced features to cost-effective solution providers targeting price-sensitive market segments. Value propositions increasingly emphasize total cost of ownership, system reliability, and scalability rather than initial purchase price alone.

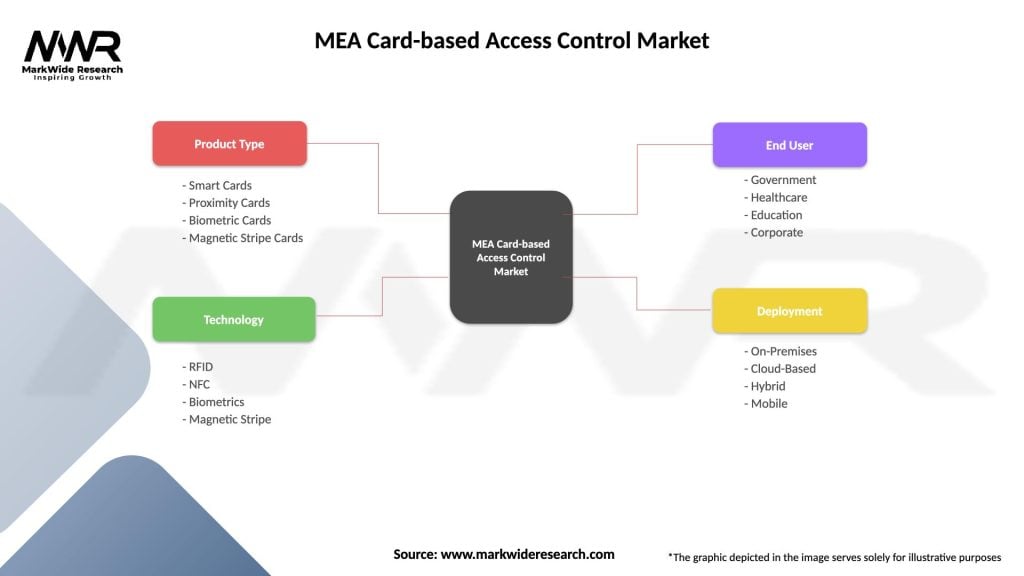

Technology segmentation reveals distinct market preferences across different card technologies and system architectures:

By Card Technology:

By Application Sector:

By System Architecture:

Proximity card systems maintain market leadership due to their proven reliability and cost-effectiveness in MEA environmental conditions. These systems offer operational efficiency improvements of 45% compared to traditional key-based systems while providing essential security features. Technology maturity ensures widespread vendor support and competitive pricing across the regional market.

Smart card implementations show accelerating growth in high-security applications where advanced authentication and multi-application capabilities justify higher costs. These systems enable integration with payment systems, time and attendance tracking, and other organizational functions. ROI calculations demonstrate compelling value propositions for organizations requiring comprehensive identity management solutions.

Commercial real estate applications drive the largest market segment, with property managers recognizing access control as essential infrastructure for tenant satisfaction and building security. Tenant requirements increasingly include sophisticated access control capabilities as standard building amenities. Property values benefit from comprehensive security infrastructure that attracts quality tenants.

Government sector implementations emphasize compliance with security standards and detailed audit capabilities. These applications often require specialized features such as anti-passback controls, visitor management integration, and emergency lockdown capabilities. Procurement processes typically involve rigorous evaluation criteria and long-term service requirements.

Healthcare facilities represent a specialized market segment with unique requirements for patient privacy, emergency access, and integration with clinical systems. Regulatory compliance drives technology selection decisions, with emphasis on systems that support HIPAA and other healthcare-specific requirements.

End-user organizations realize substantial operational and security benefits from card-based access control implementations. Security enhancement provides comprehensive protection against unauthorized access while maintaining detailed audit trails for compliance and investigation purposes. Organizations report security incident reduction of 60% following system implementation.

Administrative efficiency improvements eliminate key management complexities and reduce security personnel requirements. Automated access control enables flexible scheduling, temporary access provisioning, and real-time monitoring capabilities that manual systems cannot provide. Operational cost savings typically offset system investment within two to three years of implementation.

Technology providers benefit from growing market demand and opportunities for recurring revenue through maintenance contracts and system upgrades. Market expansion across the MEA region provides substantial growth opportunities for established vendors and emerging technology companies. Innovation investments in mobile integration and cloud-based solutions create competitive advantages and premium pricing opportunities.

System integrators gain access to expanding market opportunities while developing specialized expertise in access control technologies. Service revenue from installation, maintenance, and ongoing support provides stable income streams that complement equipment sales. Partnership relationships with technology providers enable access to training, certification, and marketing support programs.

Regional economies benefit from technology infrastructure development that supports business growth and attracts international investment. Security infrastructure improvements enhance overall business environment attractiveness and support economic development initiatives across the MEA region.

Strengths:

Weaknesses:

Opportunities:

Threats:

Mobile credential adoption represents the most significant trend reshaping the access control landscape, with organizations increasingly implementing smartphone-based solutions that complement or replace traditional cards. User convenience and reduced card management overhead drive adoption, while security capabilities continue to meet organizational requirements. Implementation rates for mobile credentials show 32% annual growth across the region.

Cloud-based management platforms gain traction as organizations seek to reduce IT infrastructure requirements while accessing advanced system capabilities. These solutions enable centralized management across multiple facilities and provide automatic software updates and security patches. MarkWide Research analysis indicates cloud adoption accelerating particularly among multi-location organizations.

Artificial intelligence integration emerges as a differentiating factor, with systems incorporating behavioral analytics, predictive maintenance, and automated threat detection capabilities. AI-enhanced systems provide proactive security management and reduce false alarm rates while improving overall system effectiveness.

Contactless technology adoption accelerates driven by hygiene concerns and user preference for touch-free interactions. The technology provides enhanced user experience while maintaining security effectiveness and system reliability. Contactless implementations show particular strength in healthcare and hospitality applications.

Integration convergence continues as access control systems become components of comprehensive security and building management platforms. Organizations increasingly demand unified interfaces and coordinated responses across multiple security technologies. Platform approaches create opportunities for vendors offering comprehensive security ecosystems.

Technology partnerships between international providers and regional system integrators expand market reach and enhance local support capabilities. These collaborations combine global technology expertise with regional market knowledge and customer relationships. Strategic alliances enable faster market penetration and improved customer service delivery.

Product innovations focus on enhanced security features, improved user interfaces, and expanded integration capabilities. Vendors invest heavily in research and development to address evolving customer requirements and competitive pressures. Innovation cycles accelerate as market competition intensifies and customer expectations increase.

Regulatory developments across the MEA region influence technology requirements and implementation standards. Government initiatives promoting cybersecurity and data protection create new compliance requirements that affect system design and deployment. Standards harmonization efforts facilitate cross-border implementations and technology interoperability.

Market consolidation activities include acquisitions of specialized technology providers and regional system integrators by larger security companies. These transactions aim to expand product portfolios, enhance market coverage, and achieve operational synergies. Industry structure evolution affects competitive dynamics and customer choice options.

Training and certification programs expand as vendors and industry associations recognize the importance of qualified installation and support personnel. These initiatives improve system implementation quality and customer satisfaction while supporting market growth. Professional development opportunities attract skilled technicians to the access control industry.

Market entry strategies should emphasize local partnerships and regional expertise development to navigate diverse MEA market conditions effectively. Organizations entering the market benefit from collaborating with established system integrators who understand local requirements and customer preferences. Partnership selection criteria should include technical capabilities, market presence, and service delivery capacity.

Technology investment priorities should focus on mobile integration, cloud capabilities, and artificial intelligence features that differentiate solutions in competitive markets. Vendors must balance innovation with reliability and cost-effectiveness to address diverse customer requirements. R&D allocation should reflect regional market preferences and emerging technology trends.

Customer education initiatives prove essential for market development, particularly in segments where electronic access control represents new technology adoption. Educational programs should address security benefits, operational advantages, and total cost of ownership considerations. Marketing strategies should emphasize practical benefits and successful implementation case studies.

Service capability development becomes increasingly important as customers demand comprehensive support throughout system lifecycles. Organizations should invest in local service infrastructure, technical training, and customer support capabilities. Service differentiation creates competitive advantages and supports premium pricing strategies.

Vertical market specialization offers opportunities for focused solution development and market positioning. Understanding specific industry requirements enables tailored product development and targeted marketing approaches. Industry expertise development supports consultative selling and long-term customer relationships.

Market trajectory remains strongly positive with continued growth expected across all major MEA markets. Infrastructure development, security awareness, and technology adoption trends support sustained market expansion. Growth projections indicate the market will maintain robust momentum with compound annual growth rates exceeding 8% through the forecast period.

Technology evolution will continue toward more intelligent, integrated, and user-friendly systems that provide comprehensive security management capabilities. Mobile integration, cloud-based management, and artificial intelligence features will become standard rather than premium options. Innovation focus will shift toward predictive analytics and automated response capabilities.

Market maturation will bring increased customer sophistication and more rigorous evaluation criteria for technology selection. Organizations will emphasize total cost of ownership, scalability, and integration capabilities over initial purchase price. Procurement processes will become more strategic and comprehensive in scope.

Regional development patterns suggest continued leadership from Gulf markets with accelerating growth in African markets as infrastructure development progresses. MWR forecasts indicate emerging markets will contribute increasingly to overall regional growth as economic development and urbanization continue.

Competitive landscape evolution will favor vendors offering comprehensive solutions, strong local presence, and innovative technology capabilities. Market consolidation may continue as companies seek to achieve scale and expand their solution portfolios. Success factors will include technology innovation, service excellence, and deep market understanding.

The MEA card-based access control market represents a dynamic and rapidly expanding sector within the broader regional security technology landscape. Strong fundamentals including increasing security awareness, infrastructure development, and regulatory compliance requirements support sustained market growth across diverse industry segments and geographic markets.

Technology trends toward mobile integration, cloud-based management, and artificial intelligence capabilities create opportunities for innovation and differentiation while addressing evolving customer requirements. The market benefits from mature technology foundations combined with emerging capabilities that enhance system effectiveness and user experience.

Regional diversity provides multiple growth opportunities while requiring tailored approaches that address specific market conditions, customer preferences, and regulatory environments. Success in this market demands comprehensive understanding of local requirements combined with access to advanced technology capabilities and reliable service delivery.

Future prospects remain highly favorable as the MEA region continues its infrastructure development and digital transformation journey. Organizations investing in this market with appropriate strategies, technology capabilities, and local partnerships are well-positioned to capitalize on substantial growth opportunities while contributing to enhanced security infrastructure across the region.

What is Card-based Access Control?

Card-based access control refers to a security system that uses cards to grant or restrict access to physical locations. This technology is widely used in various sectors, including corporate offices, educational institutions, and healthcare facilities to enhance security and manage entry points.

What are the key players in the MEA Card-based Access Control Market?

Key players in the MEA Card-based Access Control Market include HID Global, ASSA ABLOY, and Johnson Controls, among others. These companies are known for their innovative solutions and extensive product offerings in access control technologies.

What are the main drivers of growth in the MEA Card-based Access Control Market?

The growth of the MEA Card-based Access Control Market is driven by increasing security concerns, the rise in smart building technologies, and the demand for efficient access management solutions. Additionally, the integration of IoT in security systems is enhancing operational efficiency.

What challenges does the MEA Card-based Access Control Market face?

The MEA Card-based Access Control Market faces challenges such as high installation costs, the complexity of system integration, and potential cybersecurity threats. These factors can hinder the adoption of advanced access control systems in various sectors.

What opportunities exist in the MEA Card-based Access Control Market?

Opportunities in the MEA Card-based Access Control Market include the growing demand for mobile access solutions and the expansion of cloud-based access control systems. Additionally, increasing investments in smart city projects are expected to drive market growth.

What trends are shaping the MEA Card-based Access Control Market?

Trends in the MEA Card-based Access Control Market include the shift towards biometric authentication, the integration of AI for enhanced security analytics, and the adoption of contactless access solutions. These innovations are transforming how organizations manage access control.

MEA Card-based Access Control Market

| Segmentation Details | Description |

|---|---|

| Product Type | Smart Cards, Proximity Cards, Biometric Cards, Magnetic Stripe Cards |

| Technology | RFID, NFC, Biometrics, Magnetic Stripe |

| End User | Government, Healthcare, Education, Corporate |

| Deployment | On-Premises, Cloud-Based, Hybrid, Mobile |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the MEA Card-based Access Control Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at