444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The MEA bath and shower products market represents a dynamic and rapidly evolving segment within the broader personal care industry across the Middle East and Africa region. This market encompasses a comprehensive range of products including body washes, shower gels, bar soaps, bath salts, bubble baths, and specialized cleansing formulations designed for daily hygiene and wellness routines. Market dynamics in the MEA region are characterized by increasing urbanization, rising disposable incomes, and growing awareness of personal hygiene standards, particularly accelerated by recent global health concerns.

Regional diversity plays a crucial role in shaping market preferences, with countries like the UAE, Saudi Arabia, and South Africa leading consumption patterns while emerging markets in sub-Saharan Africa show significant growth potential. The market demonstrates robust expansion with a projected CAGR of 6.2% over the forecast period, driven by demographic shifts toward younger populations and increasing adoption of premium personal care products. Consumer behavior in the region reflects a growing preference for natural and organic formulations, with approximately 38% of consumers actively seeking sulfate-free and paraben-free alternatives.

Distribution channels have evolved significantly, with traditional retail maintaining strong presence while e-commerce platforms experience accelerated growth, particularly in urban centers. The market benefits from strategic positioning as a bridge between European and Asian beauty trends, creating unique opportunities for both international brands and local manufacturers to establish strong market presence through culturally relevant product offerings.

The MEA bath and shower products market refers to the comprehensive ecosystem of personal cleansing and bathing products specifically designed for consumers across Middle Eastern and African territories. This market encompasses liquid and solid cleansing formulations, therapeutic bath additives, and specialized shower care products that cater to diverse cultural preferences, climate considerations, and skin care requirements prevalent throughout the region.

Product categories within this market include traditional bar soaps, modern liquid body washes, premium shower gels, exfoliating scrubs, moisturizing bath oils, aromatherapy bath products, and culturally significant cleansing formulations such as black soap and traditional herbal preparations. Market significance extends beyond basic hygiene needs to encompass wellness, relaxation, and cultural practices deeply rooted in regional traditions.

Geographic scope covers major economies including Saudi Arabia, UAE, Egypt, South Africa, Nigeria, Kenya, and Morocco, each contributing unique consumer preferences and market dynamics. The market serves diverse demographic segments from budget-conscious consumers seeking essential cleansing products to affluent customers demanding luxury formulations with premium ingredients and sophisticated packaging.

Strategic positioning of the MEA bath and shower products market reveals a sector experiencing transformative growth driven by urbanization, demographic transitions, and evolving consumer sophistication. The market demonstrates resilience and adaptability, successfully navigating economic fluctuations while maintaining steady expansion across diverse regional markets with varying economic conditions and consumer purchasing power.

Key growth drivers include increasing awareness of personal hygiene importance, rising middle-class populations, and growing influence of social media on beauty and wellness trends. Approximately 42% of market growth stems from premium and super-premium product segments, indicating consumer willingness to invest in higher-quality formulations. Innovation trends focus heavily on natural ingredients, sustainable packaging, and products specifically formulated for regional climate conditions and water quality variations.

Competitive landscape features a balanced mix of international giants and regional specialists, with local brands capturing significant market share through culturally relevant formulations and competitive pricing strategies. Distribution evolution shows traditional retail channels maintaining dominance while digital platforms gain momentum, particularly among younger demographics who represent 55% of total market consumption.

Future prospects indicate continued expansion with particular strength in emerging African markets where infrastructure development and economic growth create new opportunities for market penetration and brand establishment.

Consumer preferences across the MEA region demonstrate distinct patterns that differentiate this market from global trends. Cultural considerations significantly influence product formulation and marketing approaches, with Islamic halal certification becoming increasingly important for market acceptance. The following insights provide strategic understanding of market dynamics:

Market segmentation reveals distinct consumer clusters with varying needs, preferences, and purchasing behaviors, creating opportunities for targeted product development and marketing strategies that resonate with specific demographic and psychographic profiles.

Demographic transformation serves as the primary catalyst for market expansion, with rapidly growing urban populations across the MEA region driving increased demand for modern personal care products. Urbanization rates exceeding 65% in key markets create concentrated consumer bases with higher disposable incomes and greater exposure to international beauty and wellness trends.

Economic development across the region contributes significantly to market growth, as improving living standards enable consumers to prioritize personal care and wellness beyond basic necessities. Rising middle class populations in countries like Nigeria, Kenya, and Morocco demonstrate increasing willingness to invest in premium bath and shower products that offer enhanced experiences and perceived value.

Health and hygiene awareness has intensified dramatically, particularly following global health concerns that emphasized the importance of proper personal hygiene practices. This awareness translates directly into increased consumption frequency and willingness to invest in higher-quality cleansing products. Educational initiatives by governments and health organizations further reinforce these behavioral changes.

Cultural evolution within younger demographics creates openness to new product categories and formulations while maintaining respect for traditional values. Social media influence plays a crucial role in driving product discovery and brand awareness, with beauty influencers and wellness advocates promoting premium bath and shower products to engaged audiences across the region.

Economic volatility across various MEA markets creates challenges for consistent market growth, as fluctuating currencies and economic uncertainties impact consumer purchasing power and spending priorities. Price sensitivity remains a significant constraint, particularly in emerging markets where consumers must balance personal care investments against essential needs like food, housing, and education.

Infrastructure limitations in certain regions restrict market penetration and product availability, particularly in rural areas where distribution networks remain underdeveloped. Water scarcity issues in several MEA countries influence consumer behavior regarding bath and shower product usage, potentially limiting market expansion in water-stressed regions.

Regulatory complexities across different countries create barriers for international brands seeking regional expansion, as varying standards for product safety, labeling requirements, and import regulations increase compliance costs and market entry timelines. Cultural sensitivities require careful navigation, as inappropriate marketing messages or product formulations can result in consumer rejection and brand damage.

Competition from traditional alternatives remains strong in certain market segments, where consumers continue to prefer traditional soaps and cleansing methods passed down through generations. Supply chain challenges including raw material availability and transportation costs impact product pricing and availability, particularly for premium formulations requiring specialized ingredients.

Untapped rural markets present significant expansion opportunities as infrastructure development and economic growth reach previously underserved areas. Mobile commerce and innovative distribution strategies can overcome traditional barriers to market penetration, enabling brands to reach consumers in remote locations through digital platforms and local partnerships.

Product innovation opportunities abound in developing formulations specifically tailored to regional preferences, climate conditions, and cultural requirements. Natural and organic segments show particular promise, with consumers increasingly seeking products featuring indigenous ingredients and traditional formulations enhanced with modern technology and safety standards.

Premium market expansion offers substantial growth potential as affluent consumer segments seek luxury experiences and are willing to pay premium prices for superior quality, unique formulations, and prestigious brand associations. Spa and wellness tourism growth in the region creates opportunities for hotel amenity products and retail sales to international visitors.

Sustainability initiatives present opportunities for brands to differentiate through eco-friendly packaging, refillable containers, and environmentally responsible manufacturing processes. Partnership opportunities with local retailers, beauty salons, and wellness centers can accelerate market penetration and brand building while providing valuable consumer insights and feedback.

Supply and demand equilibrium in the MEA bath and shower products market reflects complex interactions between consumer preferences, economic conditions, and competitive pressures. Demand patterns show seasonal variations with peak consumption during summer months when increased bathing frequency drives higher product usage rates.

Competitive intensity varies significantly across price segments, with premium markets showing less price competition and greater focus on brand differentiation, while mass market segments experience intense price pressure and promotional activities. Brand positioning strategies must balance international appeal with local relevance to achieve optimal market penetration and consumer acceptance.

Innovation cycles in the market demonstrate accelerating pace, with brands introducing new formulations, packaging innovations, and marketing approaches to maintain competitive advantage. Consumer loyalty patterns show increasing sophistication, with approximately 47% of consumers willing to switch brands for superior product performance or better value propositions.

Market consolidation trends indicate potential for strategic acquisitions and partnerships as companies seek to expand geographic reach and product portfolios. Regulatory evolution continues to shape market dynamics, with increasing emphasis on product safety, environmental impact, and consumer protection creating both challenges and opportunities for market participants.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the MEA bath and shower products market. Primary research includes extensive consumer surveys, retailer interviews, and industry expert consultations across key markets to gather firsthand insights into purchasing behaviors, preferences, and market trends.

Secondary research encompasses analysis of industry reports, government statistics, trade publications, and company financial statements to establish market baselines and identify growth patterns. Data triangulation methods ensure accuracy by cross-referencing information from multiple sources and validating findings through independent verification processes.

Market segmentation analysis utilizes demographic, psychographic, and behavioral data to identify distinct consumer clusters and their specific needs, preferences, and purchasing patterns. Competitive intelligence gathering includes monitoring of competitor activities, pricing strategies, product launches, and marketing campaigns to understand market dynamics and competitive positioning.

Quantitative analysis employs statistical modeling and forecasting techniques to project market growth, identify trends, and assess the impact of various market drivers and restraints. Qualitative insights from focus groups, in-depth interviews, and cultural analysis provide context for quantitative findings and ensure cultural sensitivity in market interpretation.

Gulf Cooperation Council countries lead the MEA bath and shower products market, with the UAE and Saudi Arabia representing the largest consumption centers. Consumer sophistication in these markets drives demand for premium and luxury products, with approximately 58% market share concentrated in the super-premium segment. Retail infrastructure in GCC countries supports diverse distribution channels including hypermarkets, specialty beauty stores, and rapidly growing e-commerce platforms.

North African markets including Egypt, Morocco, and Tunisia demonstrate strong growth potential driven by large populations and increasing urbanization. Cultural preferences in these markets favor products incorporating traditional ingredients and formulations, creating opportunities for brands that successfully blend heritage with modern innovation. Price sensitivity remains higher compared to GCC markets, requiring strategic positioning and value-oriented product offerings.

Sub-Saharan Africa represents the fastest-growing regional segment, with countries like Nigeria, South Africa, and Kenya showing robust market expansion. Economic development and infrastructure improvements create new opportunities for market penetration, while diverse cultural preferences require localized product development and marketing approaches. Distribution challenges in rural areas present both obstacles and opportunities for innovative market entry strategies.

Market maturity levels vary significantly across the region, with GCC countries showing mature market characteristics while many African markets remain in early development stages with substantial growth potential. Regional trade agreements and economic cooperation initiatives facilitate market expansion and cross-border commerce opportunities.

Market leadership in the MEA bath and shower products sector reflects a diverse competitive environment featuring international corporations, regional champions, and emerging local brands. Strategic positioning varies significantly across competitors, with some focusing on premium segments while others target mass market opportunities through competitive pricing and wide distribution.

Competitive strategies emphasize brand differentiation through unique formulations, cultural relevance, and targeted marketing campaigns that resonate with specific consumer segments. Innovation focus includes development of climate-appropriate formulations, sustainable packaging solutions, and products featuring regional ingredients and traditional formulations.

Market share distribution shows increasing fragmentation as new entrants and niche brands capture specific segments, while established players maintain overall market leadership through scale advantages and distribution strength.

Product type segmentation reveals distinct market dynamics across different bath and shower product categories. Liquid body washes represent the fastest-growing segment, driven by consumer preferences for convenience, hygiene, and premium formulations. Traditional bar soaps maintain significant market share, particularly in price-sensitive segments and rural markets where cultural preferences favor solid cleansing products.

By Product Type:

Price segmentation shows clear differentiation between mass market, premium, and luxury segments, with each category serving distinct consumer needs and preferences. Mass market products focus on essential cleansing benefits and competitive pricing, while premium segments emphasize additional benefits like moisturizing, anti-aging, and aromatherapy properties.

Distribution channel segmentation includes hypermarkets and supermarkets, specialty beauty stores, pharmacies, online platforms, and traditional retail outlets. E-commerce growth shows particular strength among younger demographics, with approximately 28% of purchases now occurring through digital channels in major urban markets.

Body wash and shower gel category demonstrates the strongest growth trajectory, driven by consumer preferences for liquid formulations that offer superior lathering, fragrance, and skin care benefits. Premium formulations featuring natural ingredients, essential oils, and therapeutic properties command higher margins and stronger brand loyalty. Innovation focus includes sulfate-free formulations, pH-balanced products, and specialized variants for different skin types and concerns.

Traditional bar soap segment maintains cultural significance and practical advantages in water-scarce regions, with artisanal and natural variants experiencing renewed interest among environmentally conscious consumers. Black soap and other traditional African cleansing products show strong growth potential as consumers seek authentic, culturally relevant alternatives to mass-produced options.

Bath additives category represents a growing luxury segment, with products like bath salts, oils, and aromatherapy formulations appealing to consumers seeking spa-like experiences at home. Dead Sea minerals and other regional specialty ingredients create unique positioning opportunities for brands operating in the MEA market.

Men’s grooming segment shows accelerating growth as male consumers become more engaged with personal care routines and willing to invest in specialized products designed for masculine preferences and needs. Cultural considerations influence product development and marketing approaches for this expanding segment.

Manufacturers benefit from expanding market opportunities driven by demographic growth, urbanization, and increasing consumer sophistication across the MEA region. Production scalability enables efficient serving of diverse market segments while maintaining cost competitiveness and quality standards. Innovation opportunities in natural ingredients and cultural formulations provide differentiation advantages and premium positioning possibilities.

Retailers gain from growing consumer demand and increasing frequency of purchases as personal care becomes a higher priority for MEA consumers. Category expansion opportunities include premium segments, men’s grooming, and specialty products that command higher margins and stronger customer loyalty. E-commerce integration enables reaching previously underserved markets and younger demographic segments.

Distributors benefit from market expansion and infrastructure development that creates new distribution opportunities and geographic reach. Partnership opportunities with international brands seeking regional market entry provide growth potential and enhanced product portfolios for local distribution networks.

Consumers enjoy increased product variety, improved quality standards, and greater accessibility to both traditional and innovative bath and shower products. Cultural relevance in product offerings ensures that modern formulations respect traditional preferences while delivering enhanced performance and experiences.

Strengths:

Weaknesses:

Opportunities:

Threats:

Natural and organic formulations represent the dominant trend across the MEA bath and shower products market, with consumers increasingly seeking products free from harsh chemicals and synthetic additives. Indigenous ingredients like argan oil, shea butter, and traditional herbal extracts gain prominence as consumers embrace culturally relevant and environmentally sustainable options.

Sustainability initiatives drive innovation in packaging design, with brands introducing refillable containers, biodegradable packaging materials, and concentrated formulations that reduce environmental impact. Circular economy principles influence product development and supply chain management as companies respond to growing environmental consciousness among consumers.

Personalization trends emerge as brands offer customized formulations based on individual skin types, preferences, and cultural backgrounds. Digital engagement enables brands to gather consumer insights and deliver personalized product recommendations and experiences through mobile apps and online platforms.

Multi-functional products gain popularity as consumers seek efficiency and value from bath and shower products that deliver multiple benefits including cleansing, moisturizing, anti-aging, and aromatherapy properties. Wellness positioning transforms basic hygiene products into lifestyle and self-care solutions that promote physical and emotional well-being.

Strategic partnerships between international brands and local distributors accelerate market penetration and cultural adaptation of products for MEA consumers. Manufacturing investments in the region reduce costs and improve supply chain efficiency while creating local employment opportunities and supporting economic development.

Product innovation focuses on climate-appropriate formulations designed specifically for hot, arid conditions prevalent across much of the MEA region. Research and development investments in understanding regional skin care needs and preferences drive creation of targeted solutions that outperform generic international formulations.

Digital transformation initiatives include development of mobile apps, augmented reality try-on experiences, and social media marketing campaigns that engage younger demographics and drive brand awareness. E-commerce platform expansion enables brands to reach previously inaccessible markets and gather valuable consumer data for future product development.

Regulatory harmonization efforts across the region facilitate trade and reduce compliance costs for manufacturers operating in multiple MEA markets. Quality standardization initiatives improve consumer confidence and support premium product positioning strategies.

Market entry strategies should prioritize cultural sensitivity and local partnership development to ensure successful penetration of diverse MEA markets. MarkWide Research analysis indicates that brands achieving the strongest market positions invest heavily in understanding local preferences and adapting products accordingly rather than simply introducing global formulations.

Product development focus should emphasize natural ingredients, climate-appropriate formulations, and cultural relevance to differentiate from generic international offerings. Innovation investments in traditional ingredient research and modern formulation technology create sustainable competitive advantages and premium positioning opportunities.

Distribution strategy optimization requires balanced approach combining traditional retail strength with emerging digital channels to maximize market reach and consumer accessibility. Partnership development with local retailers, beauty salons, and wellness centers provides valuable market insights and accelerates brand building efforts.

Pricing strategies must reflect local economic conditions and competitive dynamics while maintaining brand positioning and margin objectives. Value proposition development should emphasize unique benefits and cultural relevance rather than competing solely on price in price-sensitive market segments.

Long-term growth prospects for the MEA bath and shower products market remain highly positive, supported by favorable demographic trends, economic development, and evolving consumer preferences toward premium personal care products. Market expansion is expected to accelerate with projected growth rates of 6.8% CAGR over the next five years, driven primarily by emerging African markets and continued premiumization in established GCC economies.

Technology integration will play an increasingly important role in product development, marketing, and distribution, with artificial intelligence and data analytics enabling more precise consumer targeting and personalized product offerings. Sustainability requirements will become more stringent, driving innovation in eco-friendly formulations and packaging solutions that meet both regulatory requirements and consumer expectations.

Market consolidation may accelerate as successful brands seek to expand geographic reach through strategic acquisitions and partnerships, while smaller players focus on niche segments and specialized product categories. MWR projections suggest that premium and super-premium segments will capture an increasing share of total market value, reaching approximately 52% of market revenue by the end of the forecast period.

Innovation focus will continue emphasizing natural ingredients, cultural authenticity, and multi-functional benefits as consumers become more sophisticated and demanding in their product expectations and brand relationships.

The MEA bath and shower products market presents compelling opportunities for growth and expansion, driven by favorable demographic trends, economic development, and evolving consumer preferences across the diverse Middle East and Africa region. Market dynamics reflect a sector in transition, with traditional preferences blending with modern innovation to create unique opportunities for brands that successfully navigate cultural sensitivities while delivering superior product performance and value.

Strategic success in this market requires deep understanding of local preferences, investment in culturally relevant product development, and flexible distribution strategies that accommodate varying infrastructure and economic conditions across different regional markets. Innovation opportunities abound in natural formulations, sustainable packaging, and products specifically designed for regional climate and cultural requirements.

Future growth will be driven by continued urbanization, rising disposable incomes, and increasing sophistication of consumer preferences, particularly among younger demographics who represent the market’s future. Competitive advantage will increasingly depend on brands’ ability to combine international quality standards with local relevance and cultural authenticity, creating products that resonate with MEA consumers’ unique needs and preferences while delivering exceptional value and experiences.

What is Bath and Shower Products?

Bath and shower products encompass a variety of items used for personal hygiene and relaxation, including soaps, body washes, shampoos, conditioners, and bath additives. These products are designed to cleanse the body, enhance the bathing experience, and promote overall well-being.

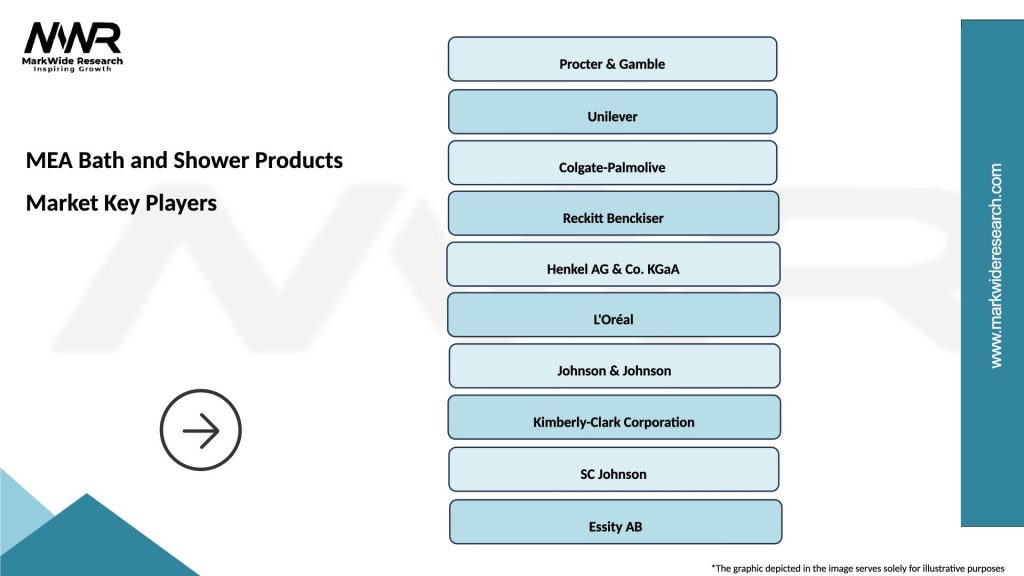

What are the key players in the MEA Bath and Shower Products Market?

Key players in the MEA Bath and Shower Products Market include Procter & Gamble, Unilever, L’Oréal, and Colgate-Palmolive, among others. These companies are known for their diverse product offerings and strong market presence in the region.

What are the growth factors driving the MEA Bath and Shower Products Market?

The growth of the MEA Bath and Shower Products Market is driven by increasing consumer awareness of personal hygiene, rising disposable incomes, and a growing trend towards premium and natural products. Additionally, the expansion of retail channels enhances product accessibility.

What challenges does the MEA Bath and Shower Products Market face?

The MEA Bath and Shower Products Market faces challenges such as intense competition among brands, fluctuating raw material prices, and changing consumer preferences towards eco-friendly products. These factors can impact profitability and market dynamics.

What opportunities exist in the MEA Bath and Shower Products Market?

Opportunities in the MEA Bath and Shower Products Market include the rising demand for organic and natural products, the growth of e-commerce platforms, and the increasing popularity of personalized skincare solutions. These trends present avenues for innovation and market expansion.

What trends are shaping the MEA Bath and Shower Products Market?

Trends shaping the MEA Bath and Shower Products Market include the shift towards sustainable packaging, the incorporation of technology in product formulations, and the rise of wellness-oriented products. Consumers are increasingly seeking products that align with their health and environmental values.

MEA Bath and Shower Products Market

| Segmentation Details | Description |

|---|---|

| Product Type | Shower Gels, Bath Oils, Body Washes, Shower Creams |

| End User | Households, Hotels, Spas, Gyms |

| Distribution Channel | Online Retail, Supermarkets, Specialty Stores, Pharmacies |

| Form | Liquid, Gel, Foam, Bar |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the MEA Bath and Shower Products Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at