444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The MEA Banking as a Service market represents a transformative shift in the financial services landscape across the Middle East and Africa region. This innovative approach to banking infrastructure is revolutionizing how financial institutions, fintech companies, and non-banking entities deliver banking services to consumers and businesses. The market encompasses a comprehensive ecosystem of API-driven banking solutions, enabling organizations to integrate banking functionalities without the need for traditional banking licenses or extensive infrastructure investments.

Regional dynamics in the MEA region present unique opportunities for Banking as a Service adoption, driven by increasing smartphone penetration rates of 78% across major markets and a growing demand for digital financial services. The market is experiencing robust growth momentum, with digital banking adoption accelerating at unprecedented rates across countries like the UAE, Saudi Arabia, South Africa, and Nigeria.

Market expansion is being fueled by regulatory support for open banking initiatives, increasing fintech investments, and the rising demand for embedded finance solutions. The region’s young demographic profile, with 65% of the population under 35 years, creates a favorable environment for innovative banking service models that prioritize convenience, accessibility, and digital-first experiences.

The MEA Banking as a Service market refers to the comprehensive ecosystem of cloud-based banking infrastructure and services that enable third-party organizations to offer banking products and services through APIs and white-label solutions. This model allows companies to integrate banking functionalities such as payments, lending, account management, and compliance services into their existing platforms without developing these capabilities in-house or obtaining banking licenses.

Banking as a Service operates through a layered architecture where licensed banks provide the regulatory foundation and core banking infrastructure, while technology providers offer the APIs, user interfaces, and integration capabilities. This enables businesses across various sectors including e-commerce, telecommunications, retail, and fintech to embed banking services seamlessly into their customer journeys.

Key components of the MEA Banking as a Service ecosystem include payment processing, account management, compliance and KYC services, lending solutions, and financial data analytics. The model democratizes access to banking infrastructure, allowing smaller organizations to compete with established financial institutions by offering sophisticated banking services without significant upfront investments.

Market dynamics in the MEA Banking as a Service sector indicate strong growth potential driven by digital transformation initiatives and regulatory modernization across the region. The market is characterized by increasing collaboration between traditional banks, fintech companies, and technology providers, creating a vibrant ecosystem of innovation and service delivery.

Growth drivers include the rising demand for embedded finance solutions, with 42% of businesses in the region expressing interest in integrating banking services into their platforms. The market benefits from supportive regulatory frameworks, particularly in countries like the UAE and Saudi Arabia, which have implemented comprehensive fintech and open banking regulations.

Competitive landscape features a mix of global technology providers, regional banks, and specialized fintech companies offering Banking as a Service solutions. The market is witnessing increased investment in infrastructure development, with cloud adoption rates reaching 68% among financial institutions in key MEA markets.

Future prospects remain highly positive, with the market expected to benefit from continued digital transformation, increasing smartphone penetration, and growing consumer acceptance of digital banking services. The integration of emerging technologies such as artificial intelligence and blockchain is expected to further enhance service capabilities and market growth potential.

Strategic insights reveal several critical factors shaping the MEA Banking as a Service market landscape:

Digital transformation initiatives across the MEA region serve as the primary catalyst for Banking as a Service market growth. Government-led digitization programs and smart city initiatives are creating substantial demand for integrated financial services that can be embedded into various digital platforms and applications.

Regulatory support from central banks and financial authorities is accelerating market development through the implementation of open banking frameworks and fintech-friendly regulations. Countries like the UAE, Saudi Arabia, and South Africa have established comprehensive regulatory sandboxes that enable Banking as a Service providers to test and deploy innovative solutions.

Rising fintech adoption is driving demand for Banking as a Service solutions, with fintech penetration rates reaching 73% in leading MEA markets. This trend is supported by increasing venture capital investments and government initiatives to promote financial technology innovation.

Consumer expectations for seamless, integrated financial experiences are pushing businesses across sectors to embed banking services into their platforms. The demand for instant payments, digital wallets, and embedded lending solutions is creating significant opportunities for Banking as a Service providers.

Cost optimization pressures on traditional banks are encouraging partnerships with Banking as a Service providers to reduce operational expenses and accelerate time-to-market for new products. This trend is particularly pronounced in markets with high competition and margin pressure.

Regulatory complexity across different MEA jurisdictions presents significant challenges for Banking as a Service providers seeking to operate across multiple markets. Varying compliance requirements, licensing frameworks, and data protection regulations create barriers to seamless regional expansion.

Infrastructure limitations in certain markets, particularly regarding internet connectivity and digital payment systems, constrain the deployment and adoption of Banking as a Service solutions. Rural and underbanked regions face particular challenges in accessing these advanced financial services.

Security concerns related to data protection and cybersecurity pose ongoing challenges for Banking as a Service adoption. Financial institutions and regulators maintain stringent requirements for data handling and security protocols, which can complicate service integration and deployment.

Legacy system integration challenges at traditional banks create technical barriers to Banking as a Service implementation. Many established financial institutions operate on outdated core banking systems that require significant upgrades to support modern API-based service delivery models.

Skills shortage in areas such as API development, cloud architecture, and financial technology limits the pace of market development. The specialized nature of Banking as a Service solutions requires expertise that is often scarce in the regional talent pool.

Embedded finance expansion presents substantial opportunities for Banking as a Service providers to penetrate new market segments. E-commerce platforms, ride-sharing services, and retail chains are increasingly seeking to integrate financial services, creating demand for flexible, scalable banking infrastructure.

SME banking solutions represent a significant growth opportunity, as small and medium enterprises across the MEA region require accessible, cost-effective banking services. Banking as a Service providers can address this market gap by offering tailored solutions that meet the specific needs of SME customers.

Cross-border payment services offer opportunities for regional expansion, particularly given the increasing trade and remittance flows within the MEA region. Banking as a Service providers can leverage their infrastructure to facilitate seamless international transactions and currency exchange services.

Islamic banking integration presents unique opportunities in MEA markets with significant Muslim populations. Banking as a Service providers can develop Sharia-compliant solutions that address the specific requirements of Islamic finance while leveraging modern technology infrastructure.

Government digitization initiatives create opportunities for Banking as a Service providers to support public sector financial services, including social benefit distribution, tax collection, and government payment systems.

Competitive dynamics in the MEA Banking as a Service market are characterized by intense innovation and strategic partnerships. Traditional banks are increasingly collaborating with fintech companies and technology providers to enhance their service offerings and maintain competitive positioning in the evolving financial services landscape.

Technology evolution continues to reshape market dynamics, with artificial intelligence, machine learning, and blockchain technologies being integrated into Banking as a Service platforms. These technological advancements are enabling more sophisticated risk assessment, fraud detection, and personalized service delivery capabilities.

Customer behavior shifts toward digital-first banking experiences are influencing service development priorities. Banking as a Service providers are focusing on user experience optimization, mobile-first design, and seamless integration capabilities to meet evolving customer expectations.

Regulatory evolution is creating both opportunities and challenges, with new frameworks for open banking and digital currencies emerging across the region. Banking as a Service providers must remain agile to adapt to changing regulatory requirements while maintaining compliance across multiple jurisdictions.

Investment flows into the sector are increasing, with venture capital and private equity firms recognizing the growth potential of Banking as a Service solutions. This influx of capital is supporting innovation, infrastructure development, and market expansion initiatives.

Comprehensive market analysis for the MEA Banking as a Service market employs a multi-faceted research approach combining primary and secondary research methodologies. The research framework incorporates quantitative data analysis, qualitative insights from industry experts, and trend analysis across key market segments and geographic regions.

Primary research involves extensive interviews with Banking as a Service providers, traditional banks, fintech companies, regulatory authorities, and end-users across major MEA markets. This approach ensures direct insights into market dynamics, challenges, opportunities, and future trends from key stakeholders.

Secondary research encompasses analysis of industry reports, regulatory publications, financial statements, and market data from reputable sources. This includes examination of central bank publications, fintech industry studies, and technology provider documentation to ensure comprehensive market coverage.

Data validation processes involve cross-referencing information from multiple sources, conducting expert reviews, and applying statistical analysis techniques to ensure accuracy and reliability of market insights. The methodology includes regular updates to reflect evolving market conditions and emerging trends.

Geographic coverage spans major MEA markets including the UAE, Saudi Arabia, South Africa, Nigeria, Egypt, and Kenya, with analysis of regulatory environments, market maturity levels, and growth potential across different countries and sub-regions.

Gulf Cooperation Council countries lead the MEA Banking as a Service market, with the UAE and Saudi Arabia demonstrating the highest adoption rates and most advanced regulatory frameworks. The region benefits from strong digital infrastructure, high smartphone penetration, and government support for fintech innovation, with digital payment adoption reaching 82% in urban areas.

South Africa represents the most mature Banking as a Service market in the African continent, supported by well-established banking infrastructure and progressive regulatory frameworks. The market benefits from high levels of financial inclusion initiatives and strong fintech ecosystem development, with mobile banking penetration exceeding 71%.

Nigeria demonstrates significant growth potential driven by its large population, increasing smartphone adoption, and government initiatives to promote financial inclusion. The market is characterized by rapid fintech growth and increasing collaboration between traditional banks and technology providers.

Egypt is emerging as a key market for Banking as a Service solutions, supported by government digitization initiatives and central bank reforms. The market benefits from a large unbanked population and increasing demand for accessible financial services.

Kenya continues to be a regional leader in mobile banking and digital payments, creating favorable conditions for Banking as a Service adoption. The market’s strong mobile money ecosystem provides a foundation for advanced banking service integration.

Market leadership in the MEA Banking as a Service sector is distributed among several categories of providers, each bringing unique strengths and capabilities to the market:

Competitive strategies focus on API development, partnership ecosystem building, regulatory compliance, and customer experience optimization. Market leaders are investing heavily in cloud infrastructure, artificial intelligence capabilities, and cross-border payment solutions to maintain competitive advantages.

By Service Type:

By Deployment Model:

By End-user:

Payment Services dominate the MEA Banking as a Service market, accounting for the largest share of implementations and revenue generation. This category benefits from high demand for digital payment solutions, cross-border remittances, and e-commerce integration, with payment API adoption growing at 45% annually.

Account Management services are experiencing rapid growth driven by digital banking adoption and the need for streamlined customer onboarding processes. The category is particularly strong in markets with high smartphone penetration and supportive regulatory frameworks for digital account opening.

Lending Solutions represent a high-growth category within Banking as a Service, driven by demand for embedded credit solutions and alternative lending models. Fintech companies and e-commerce platforms are increasingly integrating lending capabilities to enhance customer experiences and generate additional revenue streams.

Compliance Services are becoming increasingly critical as regulatory requirements become more stringent across MEA markets. Automated KYC and AML solutions are in high demand as organizations seek to reduce compliance costs while maintaining regulatory adherence.

Data Analytics services are emerging as a key differentiator in the Banking as a Service market, enabling organizations to leverage financial data for business intelligence, risk assessment, and customer insights. This category is expected to see significant growth as data-driven decision making becomes more prevalent.

Financial Institutions benefit from Banking as a Service through reduced operational costs, faster time-to-market for new products, and enhanced scalability. Traditional banks can leverage these solutions to modernize their infrastructure while maintaining regulatory compliance and customer relationships.

Fintech Companies gain access to banking infrastructure without the need for expensive licensing and compliance investments. This enables rapid market entry, reduced development costs, and the ability to focus on core competencies while leveraging established banking capabilities.

Enterprise Customers can integrate financial services seamlessly into their existing platforms, enhancing customer experiences and creating new revenue opportunities. E-commerce platforms, telecommunications companies, and retail organizations can offer banking services without developing internal capabilities.

End Consumers benefit from improved access to financial services, enhanced user experiences, and integrated service delivery across multiple platforms. Banking as a Service enables more convenient, accessible, and personalized financial service experiences.

Regulatory Authorities benefit from improved compliance monitoring, standardized service delivery, and enhanced financial inclusion outcomes. Banking as a Service providers often implement robust compliance frameworks that support regulatory objectives.

Technology Providers can monetize their infrastructure investments and expertise while supporting financial sector innovation. Cloud providers, API developers, and cybersecurity companies benefit from increased demand for Banking as a Service infrastructure.

Strengths:

Weaknesses:

Opportunities:

Threats:

API-first architecture is becoming the standard approach for Banking as a Service providers, enabling seamless integration with third-party platforms and applications. This trend is driving the development of comprehensive API marketplaces and developer ecosystems that facilitate rapid service deployment and customization.

Embedded finance integration is expanding beyond traditional financial services to include insurance, investment, and wealth management solutions. Organizations across various sectors are seeking to embed comprehensive financial services into their customer journeys, creating demand for holistic Banking as a Service platforms.

Artificial intelligence adoption is accelerating across Banking as a Service solutions, enabling advanced fraud detection, risk assessment, and personalized service delivery. AI-powered chatbots, credit scoring algorithms, and automated compliance systems are becoming standard features in modern Banking as a Service platforms.

Blockchain integration is emerging as a key trend, particularly for cross-border payments and identity verification services. Banking as a Service providers are exploring blockchain technology to enhance security, reduce transaction costs, and improve transparency in financial transactions.

Regulatory technology (RegTech) integration is becoming increasingly important as compliance requirements become more complex. Banking as a Service providers are incorporating automated compliance monitoring, reporting, and risk management capabilities to support regulatory adherence across multiple jurisdictions.

Strategic partnerships between traditional banks and fintech companies are reshaping the competitive landscape, with major regional banks establishing dedicated Banking as a Service divisions and partnership programs. These collaborations are accelerating innovation and expanding market reach for participating organizations.

Regulatory sandbox programs launched by central banks across the MEA region are providing safe environments for Banking as a Service providers to test innovative solutions. These initiatives are supporting market development while ensuring appropriate risk management and consumer protection.

Investment acceleration in Banking as a Service infrastructure is evident through increased venture capital funding and strategic investments from established financial institutions. According to MarkWide Research analysis, investment in regional Banking as a Service companies has grown significantly, supporting platform development and market expansion.

Technology infrastructure improvements, including 5G network deployment and cloud computing adoption, are enhancing the capabilities and performance of Banking as a Service solutions. These developments are enabling more sophisticated service delivery and improved user experiences.

Cross-border expansion initiatives are increasing as Banking as a Service providers seek to leverage their platforms across multiple MEA markets. This trend is driving standardization of APIs and compliance frameworks to support regional service delivery.

Platform standardization should be prioritized by Banking as a Service providers to enable seamless cross-border operations and reduce integration complexity. Developing standardized APIs and compliance frameworks will facilitate market expansion and improve operational efficiency.

Partnership strategies should focus on building comprehensive ecosystems that include banks, fintech companies, technology providers, and regulatory authorities. Collaborative approaches will accelerate innovation and market development while ensuring sustainable competitive advantages.

Regulatory engagement is crucial for long-term success, with Banking as a Service providers advised to actively participate in regulatory discussions and contribute to policy development. Proactive engagement will help shape favorable regulatory environments and ensure compliance readiness.

Technology investment should prioritize artificial intelligence, blockchain, and advanced analytics capabilities to maintain competitive differentiation. These technologies will become increasingly important for service delivery, risk management, and customer experience optimization.

Market education initiatives are needed to increase awareness and understanding of Banking as a Service benefits among potential customers and partners. Educational programs and thought leadership activities will support market development and adoption acceleration.

Market expansion is expected to accelerate significantly over the coming years, driven by continued digital transformation initiatives and regulatory support across the MEA region. MWR projects that Banking as a Service adoption will continue growing at robust rates, supported by increasing smartphone penetration and digital payment system development.

Technology evolution will continue to enhance Banking as a Service capabilities, with artificial intelligence, blockchain, and quantum computing expected to drive next-generation service innovations. These technological advances will enable more sophisticated risk management, fraud detection, and personalized service delivery capabilities.

Regulatory harmonization efforts across the MEA region are expected to reduce compliance complexity and facilitate cross-border service delivery. Regional regulatory cooperation initiatives will support market integration and enable more efficient Banking as a Service operations.

Financial inclusion outcomes are projected to improve significantly as Banking as a Service solutions become more accessible and affordable. The technology’s ability to reduce service delivery costs will support expanded access to financial services across underserved populations.

Innovation acceleration is anticipated as competition intensifies and customer expectations continue to evolve. Banking as a Service providers will need to continuously enhance their offerings to maintain competitive positioning in the rapidly evolving financial services landscape.

The MEA Banking as a Service market represents a transformative opportunity in the regional financial services landscape, driven by digital transformation initiatives, regulatory support, and evolving customer expectations. The market’s growth trajectory is supported by strong fundamentals including increasing smartphone penetration, progressive regulatory frameworks, and growing demand for embedded finance solutions across various industry sectors.

Strategic positioning in this market requires a comprehensive understanding of regional dynamics, regulatory requirements, and technology trends. Successful Banking as a Service providers will need to balance innovation with compliance, scalability with security, and global capabilities with local market knowledge to capture the significant opportunities available across the MEA region.

Future success will depend on the ability to build robust partnership ecosystems, invest in advanced technology capabilities, and maintain agility in responding to evolving market conditions. The MEA Banking as a Service market is poised for continued expansion, offering substantial opportunities for organizations that can effectively navigate the complex but rewarding regional financial services landscape.

What is Banking as a Service?

Banking as a Service (BaaS) refers to the provision of banking services through APIs, allowing third-party companies to integrate financial services into their own products. This model enables businesses to offer banking functionalities such as payments, accounts, and loans without needing a banking license.

What are the key players in the MEA Banking as a Service Market?

Key players in the MEA Banking as a Service Market include companies like Solarisbank, Temenos, and Finastra, which provide various BaaS solutions. These companies enable financial institutions and fintechs to deliver innovative banking services efficiently, among others.

What are the growth factors driving the MEA Banking as a Service Market?

The growth of the MEA Banking as a Service Market is driven by the increasing demand for digital banking solutions, the rise of fintech startups, and the need for financial institutions to enhance customer experience. Additionally, regulatory support for digital banking initiatives is also a significant factor.

What challenges does the MEA Banking as a Service Market face?

The MEA Banking as a Service Market faces challenges such as regulatory compliance, data security concerns, and the need for robust technological infrastructure. These factors can hinder the adoption and scalability of BaaS solutions in the region.

What opportunities exist in the MEA Banking as a Service Market?

Opportunities in the MEA Banking as a Service Market include the potential for partnerships between traditional banks and fintech companies, the expansion of mobile banking services, and the growing interest in personalized financial products. These trends can lead to innovative service offerings.

What trends are shaping the MEA Banking as a Service Market?

Trends shaping the MEA Banking as a Service Market include the increasing adoption of cloud-based solutions, the rise of open banking initiatives, and the integration of artificial intelligence in financial services. These trends are transforming how banking services are delivered and consumed.

MEA Banking as a Service Market

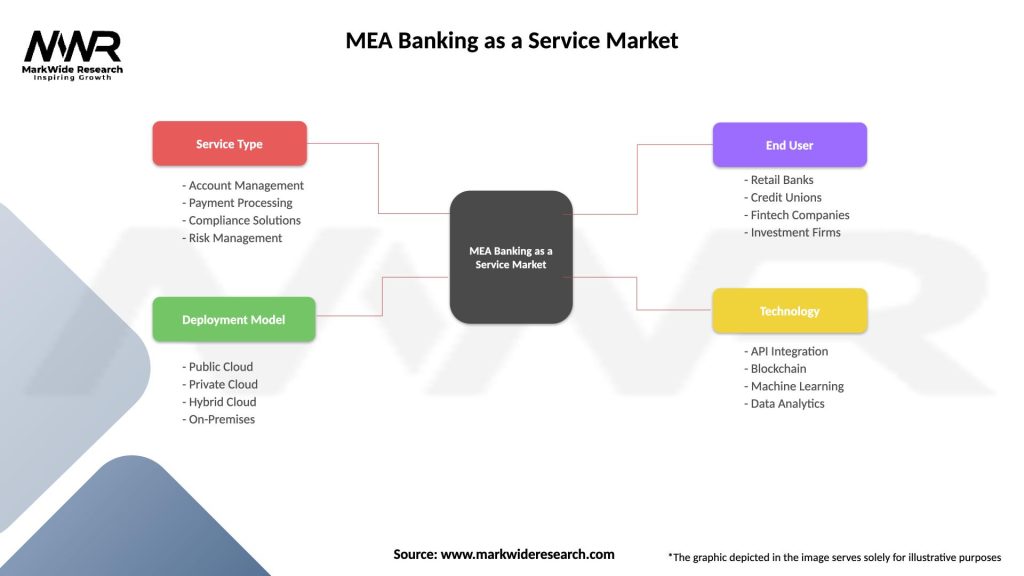

| Segmentation Details | Description |

|---|---|

| Service Type | Account Management, Payment Processing, Compliance Solutions, Risk Management |

| Deployment Model | Public Cloud, Private Cloud, Hybrid Cloud, On-Premises |

| End User | Retail Banks, Credit Unions, Fintech Companies, Investment Firms |

| Technology | API Integration, Blockchain, Machine Learning, Data Analytics |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the MEA Banking as a Service Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at