444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The MEA aviation market represents one of the most dynamic and rapidly evolving sectors within the Middle East and Africa region, encompassing commercial aviation, cargo transportation, aircraft manufacturing, and supporting infrastructure. This comprehensive market spans across diverse economies from the oil-rich Gulf states to emerging African nations, each contributing unique growth drivers and market dynamics. Regional connectivity has become increasingly crucial as governments prioritize aviation infrastructure development to support economic diversification and tourism growth.

Market expansion in the MEA region has been particularly robust, with passenger traffic growing at approximately 6.2% annually over the past five years. The region’s strategic geographical position as a bridge between Europe, Asia, and Africa has positioned it as a critical aviation hub for international transit. Hub airports in Dubai, Doha, and Istanbul have emerged as major global transit points, facilitating both passenger and cargo movements across continents.

Infrastructure investment continues to drive market growth, with governments allocating substantial resources to airport expansion, fleet modernization, and technological advancement. The region’s commitment to becoming a global aviation center has resulted in significant capacity increases and service quality improvements. Cargo operations have particularly benefited from the region’s position in global trade routes, with freight volumes experiencing consistent growth.

The MEA aviation market refers to the comprehensive ecosystem of air transportation services, infrastructure, and supporting industries operating within the Middle East and Africa regions. This market encompasses passenger airlines, cargo carriers, aircraft leasing companies, maintenance providers, airport operators, and aviation technology suppliers serving the diverse needs of these rapidly developing regions.

Commercial aviation forms the core component, including scheduled passenger services, charter operations, and low-cost carriers that connect cities within the region and provide international connectivity. The market also includes cargo aviation services that support trade flows, express delivery networks, and specialized freight operations. General aviation activities, including business jets, helicopter services, and private aircraft operations, represent additional market segments with distinct growth patterns.

Supporting infrastructure encompasses airports, air traffic management systems, ground handling services, fuel supply networks, and maintenance facilities. The market extends to include aircraft manufacturing, component suppliers, training institutions, and regulatory bodies that ensure safe and efficient aviation operations across the MEA region.

Strategic positioning has established the MEA aviation market as a critical component of global air transportation networks, with the region serving as a primary transit hub connecting major world markets. The market demonstrates exceptional resilience and growth potential, driven by economic diversification initiatives, tourism development, and increasing regional integration. Government support through substantial infrastructure investments and progressive aviation policies has created favorable conditions for sustained market expansion.

Passenger traffic recovery has exceeded pre-pandemic levels in many markets, with domestic travel showing particularly strong growth rates of approximately 8.5% annually. International connectivity has expanded significantly, with new route launches and frequency increases supporting both business and leisure travel demand. Cargo operations have experienced remarkable growth, benefiting from e-commerce expansion and supply chain diversification trends.

Fleet modernization initiatives across the region have accelerated, with airlines investing in fuel-efficient aircraft to reduce operational costs and environmental impact. The adoption of digital technologies has enhanced operational efficiency, passenger experience, and safety standards throughout the aviation value chain. Sustainability initiatives are gaining momentum, with airports and airlines implementing environmental management programs and exploring sustainable aviation fuel options.

Regional dynamics reveal distinct growth patterns across different MEA markets, with Gulf Cooperation Council countries leading in infrastructure development and service quality, while African markets show strong potential for capacity expansion and route development. MarkWide Research analysis indicates that hub-and-spoke models continue to dominate long-haul operations, while point-to-point services are expanding for regional routes.

Economic diversification strategies across MEA countries have identified aviation as a key enabler of non-oil economic growth, leading to substantial government investments in airport infrastructure and airline development. Tourism promotion initiatives have created strong demand for air connectivity, with countries developing comprehensive strategies to attract international visitors and support domestic tourism growth.

Population growth and urbanization trends throughout the region are generating increased demand for air travel services, particularly for domestic and regional routes. Rising disposable income levels in many markets are making air travel more accessible to broader population segments, supporting passenger traffic growth. Business development and international trade expansion require enhanced air connectivity for both passenger and cargo services.

Geographic advantages position the MEA region as a natural transit hub for intercontinental travel, creating opportunities for airlines to develop profitable hub operations. Infrastructure investment programs are expanding airport capacity and improving service quality, supporting increased traffic volumes. Regulatory improvements and bilateral aviation agreements are opening new markets and reducing operational restrictions for airlines.

Economic volatility in some regional markets creates uncertainty for aviation investments and can impact travel demand patterns. Geopolitical tensions occasionally affect route planning and operational costs, requiring airlines to maintain flexible network strategies. Infrastructure limitations in certain markets constrain capacity growth and service quality improvements.

Regulatory complexity across different countries can create operational challenges for airlines seeking to expand regional networks. Skilled workforce shortages in technical and operational roles may limit growth potential in some markets. Environmental concerns are increasing pressure on the aviation industry to reduce emissions and implement sustainable practices.

Competition intensity among regional carriers and international airlines can pressure profit margins and limit pricing flexibility. Currency fluctuations affect operational costs and revenue streams for airlines operating across multiple markets. Security requirements and compliance costs continue to increase operational complexity and expenses.

Untapped markets throughout Africa present significant growth opportunities for both passenger and cargo services, with many routes remaining underserved or unserved. Digital transformation initiatives offer potential for operational efficiency improvements and enhanced customer experience delivery. Sustainable aviation technologies and practices present opportunities for market differentiation and regulatory compliance.

Cargo specialization opportunities exist in pharmaceuticals, perishables, and e-commerce logistics, where the region’s geographic position provides competitive advantages. Maintenance services can be expanded to serve international carriers, leveraging cost advantages and strategic location benefits. Training and education services for aviation professionals represent growing market opportunities.

Public-private partnerships can accelerate infrastructure development and service expansion while sharing investment risks and expertise. Regional integration initiatives may create opportunities for enhanced connectivity and operational efficiency. Tourism development programs across the region will generate sustained demand for air transportation services.

Competitive landscape evolution shows increasing collaboration between regional carriers and international airlines through codeshare agreements and strategic partnerships. Market consolidation trends are emerging as smaller carriers seek partnerships or merger opportunities to achieve operational scale and network reach. Technology adoption is accelerating across all market segments, with airlines and airports investing in digital solutions to improve efficiency and customer satisfaction.

Capacity management has become increasingly sophisticated, with airlines using advanced revenue management systems and dynamic pricing strategies to optimize load factors and profitability. Route development strategies are evolving to include more secondary cities and underserved markets, supported by improved aircraft economics and market demand analysis.

Service differentiation efforts are intensifying as carriers seek to distinguish their offerings through premium services, loyalty programs, and unique route networks. Cost optimization initiatives continue to focus on fuel efficiency, operational productivity, and technology-enabled process improvements. Safety standards and regulatory compliance remain paramount concerns, driving continuous investment in training, equipment, and procedures.

Comprehensive analysis of the MEA aviation market employs multiple research methodologies to ensure accuracy and completeness of market insights. Primary research includes structured interviews with industry executives, airport operators, airline management teams, and regulatory officials across key markets in the region. Secondary research encompasses analysis of industry reports, government publications, airline financial statements, and airport traffic statistics.

Data collection processes involve systematic gathering of operational statistics, financial performance metrics, and market trend indicators from authoritative sources. Market segmentation analysis examines passenger traffic patterns, cargo volumes, fleet compositions, and route network developments across different market segments and geographic regions.

Quantitative analysis techniques are applied to identify growth trends, market share distributions, and performance correlations. Qualitative assessment methods evaluate strategic initiatives, competitive positioning, and market development opportunities. Validation processes ensure data accuracy through cross-referencing multiple sources and expert review procedures.

Gulf Cooperation Council countries continue to lead regional aviation development, with the UAE, Qatar, and Saudi Arabia maintaining approximately 45% market share in international passenger traffic. These markets benefit from substantial infrastructure investments, strategic geographic positioning, and government support for aviation sector development. Hub operations in Dubai, Doha, and emerging hubs in Riyadh and Abu Dhabi serve as primary drivers of regional growth.

North African markets demonstrate strong recovery momentum, with Egypt, Morocco, and Tunisia showing robust domestic and international traffic growth. These markets benefit from tourism development initiatives and improved political stability. Infrastructure modernization projects are enhancing capacity and service quality across major airports in the region.

Sub-Saharan Africa represents the highest growth potential segment, with markets like Nigeria, Kenya, and South Africa leading development efforts. Regional connectivity improvements and new airline launches are stimulating market growth, though infrastructure constraints remain challenging in some markets. Cargo operations show particular strength in supporting trade flows and economic development initiatives.

Levant region markets are experiencing gradual recovery, with Jordan and Lebanon working to restore international connectivity and service levels. MWR data indicates that these markets are focusing on niche segments and specialized services to rebuild their aviation sectors.

Market leadership in the MEA aviation sector is characterized by a mix of established flag carriers, rapidly growing Gulf-based airlines, and emerging low-cost carriers. Strategic positioning varies significantly across different market segments and geographic regions, with each carrier developing distinct competitive advantages.

Competitive strategies emphasize network expansion, service quality improvements, and operational efficiency gains. Partnership development through airline alliances and codeshare agreements enables carriers to extend their reach while sharing costs and risks.

Market segmentation analysis reveals distinct patterns across passenger services, cargo operations, and supporting services. Passenger aviation dominates overall market activity, representing approximately 75% of total operations, while cargo services account for 20% and general aviation comprises the remaining 5%.

By Service Type:

By Route Type:

Passenger aviation demonstrates strong growth momentum across all market segments, with international services showing particular strength in connecting the region to global markets. Premium services continue to attract high-yield passengers, while economy class volumes drive overall traffic growth. Business travel recovery has been robust, supported by economic activity increases and trade development.

Cargo operations have experienced exceptional growth, with e-commerce expansion and supply chain diversification driving demand for air freight services. Express delivery services show the highest growth rates, benefiting from digital commerce expansion and time-sensitive shipment requirements. Specialized cargo including pharmaceuticals and perishables represents high-value market segments.

Maintenance services are expanding rapidly to support growing fleet requirements and increasing aircraft utilization rates. Component services and engine maintenance represent particularly strong growth areas. Training services for pilots, technicians, and other aviation professionals are experiencing increased demand as the industry expands.

Airlines benefit from the region’s strategic geographic position, enabling efficient hub-and-spoke operations and competitive transit services. Cost advantages in fuel, labor, and infrastructure provide operational benefits compared to many other global markets. Government support through infrastructure investment and favorable policies creates enabling environments for business growth.

Airports gain from increasing passenger and cargo volumes, supporting revenue growth and justifying continued infrastructure investment. Retail opportunities and commercial development provide additional revenue streams beyond aeronautical services. Hub development strategies create competitive advantages and attract international airline partners.

Passengers enjoy improved connectivity options, competitive pricing, and enhanced service quality as market competition intensifies. Business travelers benefit from frequent services and premium amenities on key routes. Tourism development creates more affordable and convenient travel options for leisure passengers.

Economic stakeholders benefit from aviation’s contribution to GDP growth, employment creation, and trade facilitation. Tourism industries gain from improved accessibility and marketing opportunities. Logistics providers benefit from enhanced cargo connectivity and specialized services.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation is reshaping aviation operations across the MEA region, with airlines and airports implementing advanced technologies to improve efficiency and customer experience. Artificial intelligence and machine learning applications are optimizing route planning, maintenance scheduling, and revenue management. Mobile technology adoption is enhancing passenger services through digital check-in, boarding passes, and real-time information systems.

Sustainability initiatives are gaining momentum as environmental awareness increases and regulatory requirements evolve. Fuel efficiency improvements through fleet modernization and operational optimization are reducing environmental impact and operating costs. Sustainable aviation fuel adoption is beginning to emerge in leading markets, though availability and cost remain challenges.

Low-cost carrier expansion continues to stimulate market growth and increase accessibility for price-sensitive passengers. Hybrid business models combining low-cost operations with premium service options are emerging as carriers seek to capture diverse market segments. Regional connectivity improvements are supporting economic integration and trade development across the MEA region.

Infrastructure expansion projects across the region are significantly increasing airport capacity and improving service quality. New terminal facilities in major hubs are incorporating advanced technology and sustainable design principles. Runway extensions and additional facilities are enabling airports to handle larger aircraft and increased traffic volumes.

Fleet modernization initiatives are accelerating as airlines replace older aircraft with fuel-efficient models. Order announcements for new aircraft demonstrate confidence in long-term market growth and commitment to operational efficiency. Cargo aircraft additions are supporting expanding freight operations and specialized services.

Partnership developments including new codeshare agreements and strategic alliances are enhancing network connectivity and operational efficiency. Joint ventures between regional and international carriers are creating new market opportunities and service improvements. MarkWide Research indicates that these partnerships are becoming increasingly important for competitive positioning.

Strategic focus on underserved African markets presents significant growth opportunities for airlines willing to invest in route development and capacity building. Infrastructure partnerships with governments and international organizations can accelerate market development while sharing investment risks and expertise.

Technology investment should prioritize customer-facing applications and operational efficiency improvements that provide measurable returns on investment. Data analytics capabilities should be enhanced to support better decision-making in route planning, pricing, and capacity management.

Sustainability programs should be developed proactively to address environmental concerns and prepare for future regulatory requirements. Workforce development initiatives are essential to address skill shortages and support industry growth. Regional cooperation on regulatory harmonization and infrastructure development can benefit all market participants.

Long-term growth prospects for the MEA aviation market remain highly positive, with passenger traffic expected to grow at approximately 7.2% annually over the next decade. Economic development initiatives across the region will continue to drive demand for air transportation services, while tourism growth supports leisure travel expansion.

Infrastructure development will continue to be a key enabler of market growth, with major airport expansion projects scheduled for completion in the coming years. Technology integration will accelerate, improving operational efficiency and passenger experience while reducing costs. Sustainability initiatives will become increasingly important as environmental regulations evolve and stakeholder expectations change.

Market consolidation trends may accelerate as smaller carriers seek partnerships or merger opportunities to achieve competitive scale. Cargo operations are expected to maintain strong growth momentum, supported by e-commerce expansion and regional trade development. Regional integration efforts will likely create new opportunities for enhanced connectivity and operational efficiency across the MEA aviation market.

The MEA aviation market represents one of the world’s most dynamic and promising aviation regions, characterized by strong growth fundamentals, strategic geographic advantages, and substantial government support for sector development. Market expansion continues to be driven by economic diversification initiatives, tourism development, and increasing regional integration, creating sustained demand for both passenger and cargo services.

Competitive dynamics are evolving as established carriers expand their networks while new entrants challenge traditional market structures. Technology adoption and sustainability initiatives are becoming increasingly important for maintaining competitive advantage and meeting stakeholder expectations. Infrastructure investment continues to support capacity growth and service quality improvements across the region.

Future success in the MEA aviation market will depend on airlines’ ability to adapt to changing market conditions, embrace technological innovation, and develop sustainable business models that serve diverse customer needs while maintaining operational efficiency and profitability in an increasingly competitive environment.

What is Aviation?

Aviation refers to the design, development, production, and operation of aircraft. It encompasses various segments including commercial, military, and general aviation, and plays a crucial role in global transportation and logistics.

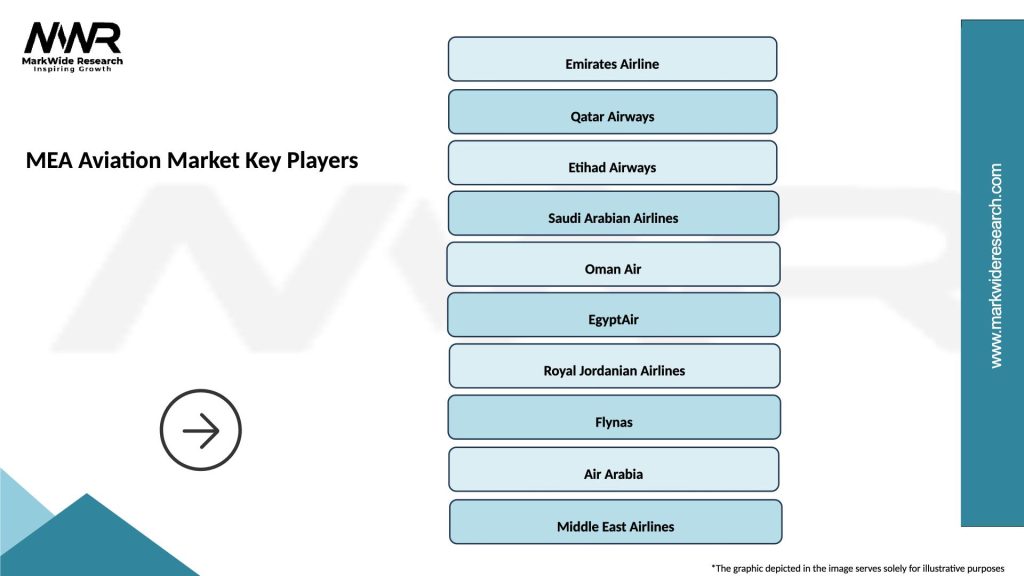

What are the key players in the MEA Aviation Market?

Key players in the MEA Aviation Market include Emirates Airlines, Qatar Airways, and Etihad Airways, among others. These companies are known for their extensive networks and modern fleets, contributing significantly to the region’s aviation growth.

What are the growth factors driving the MEA Aviation Market?

The MEA Aviation Market is driven by increasing air travel demand, expanding tourism, and investments in airport infrastructure. Additionally, the rise of low-cost carriers is making air travel more accessible to a broader audience.

What challenges does the MEA Aviation Market face?

The MEA Aviation Market faces challenges such as geopolitical tensions, fluctuating fuel prices, and regulatory hurdles. These factors can impact operational costs and overall market stability.

What opportunities exist in the MEA Aviation Market?

Opportunities in the MEA Aviation Market include the growth of air cargo services, advancements in aviation technology, and the potential for increased connectivity through new routes. These factors can enhance the region’s position as a global aviation hub.

What trends are shaping the MEA Aviation Market?

Trends in the MEA Aviation Market include the adoption of sustainable aviation practices, the integration of digital technologies for improved customer experience, and the expansion of private aviation services. These trends are influencing how airlines operate and engage with passengers.

MEA Aviation Market

| Segmentation Details | Description |

|---|---|

| Product Type | Commercial Aircraft, Business Jets, Helicopters, Drones |

| End User | Airlines, Charter Services, Cargo Operators, Government Agencies |

| Technology | Avionics, Propulsion Systems, Navigation Systems, Communication Systems |

| Application | Passenger Transport, Cargo Transport, Surveillance, Emergency Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the MEA Aviation Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at