444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The MEA aseptic packaging market represents a rapidly expanding segment within the Middle East and Africa region, driven by increasing consumer demand for shelf-stable products and enhanced food safety standards. Aseptic packaging technology has emerged as a critical solution for preserving product quality while extending shelf life without refrigeration requirements. The market encompasses various packaging formats including cartons, bottles, pouches, and bags designed to maintain sterile conditions throughout the supply chain.

Regional dynamics indicate significant growth potential, with the market experiencing robust expansion at a CAGR of approximately 8.2% driven by urbanization trends and changing consumer preferences. Food and beverage manufacturers across the MEA region are increasingly adopting aseptic packaging solutions to meet growing demand for convenient, long-lasting products. The technology’s ability to preserve nutritional value while eliminating the need for preservatives aligns with rising health consciousness among consumers.

Market penetration varies significantly across different MEA countries, with Gulf Cooperation Council nations leading adoption rates at approximately 45% market share, followed by North African markets showing accelerated growth patterns. The packaging format diversity includes liquid cartons, flexible pouches, and rigid containers, each serving specific product categories and consumer preferences throughout the region.

The MEA aseptic packaging market refers to the comprehensive ecosystem of sterile packaging solutions designed to preserve product integrity and extend shelf life without refrigeration across Middle East and Africa regions. Aseptic packaging technology involves sterilizing both the packaging material and the product separately before combining them in a sterile environment, creating packages that can maintain product quality for extended periods at ambient temperatures.

This technology encompasses multiple packaging formats including multilayer cartons, flexible pouches, plastic bottles, and composite containers specifically engineered to prevent contamination while preserving taste, nutritional value, and texture. The process involves sophisticated sterilization methods using heat, chemicals, or radiation to eliminate harmful microorganisms from both product and packaging materials.

Market applications span across dairy products, fruit juices, liquid foods, pharmaceuticals, and personal care items, with each category requiring specific packaging configurations and barrier properties. The technology enables manufacturers to distribute products across vast geographical distances without cold chain requirements, making it particularly valuable in regions with challenging logistics infrastructure.

The MEA aseptic packaging market demonstrates exceptional growth momentum driven by evolving consumer lifestyles, expanding retail infrastructure, and increasing awareness of food safety standards. Market expansion is particularly pronounced in urban centers where convenience-oriented consumption patterns drive demand for shelf-stable products with extended storage capabilities.

Key growth drivers include rising disposable incomes, expanding organized retail sector, and growing preference for packaged foods among younger demographics. The market benefits from technological advancements in barrier materials, improved filling equipment, and enhanced sterilization processes that deliver superior product protection while reducing packaging costs.

Regional variations show UAE and Saudi Arabia leading market adoption with approximately 38% combined market share, while emerging markets in Africa present significant untapped potential. The competitive landscape features both international packaging giants and regional players developing localized solutions to meet specific market requirements and regulatory standards.

Future prospects indicate continued expansion supported by infrastructure development, increasing foreign investment in food processing, and growing export opportunities for packaged products. The market’s evolution toward sustainable packaging solutions and smart packaging technologies positions it for long-term growth across diverse industry verticals.

Market dynamics reveal several critical insights shaping the MEA aseptic packaging landscape. Consumer behavior analysis indicates increasing preference for convenient, ready-to-consume products that maintain quality without refrigeration requirements, particularly among urban populations and working professionals.

Market segmentation reveals liquid cartons dominating with approximately 42% market share, followed by flexible pouches gaining traction in emerging applications. The insights demonstrate strong correlation between economic development levels and aseptic packaging adoption rates across different MEA sub-regions.

Primary market drivers propelling the MEA aseptic packaging market include fundamental shifts in consumer behavior, demographic changes, and infrastructure development across the region. Urbanization trends significantly influence packaging demand as city dwellers increasingly seek convenient, long-lasting food and beverage options that fit busy lifestyles.

Economic factors play a crucial role, with rising disposable incomes enabling consumers to purchase premium packaged products. The expanding middle class across Gulf states and North Africa creates substantial market opportunities for manufacturers offering quality aseptic packaging solutions. Retail sector growth further amplifies demand as modern trade channels require products with extended shelf life for efficient inventory management.

Health consciousness among consumers drives preference for products preserved without chemical preservatives, making aseptic packaging an attractive alternative. The technology’s ability to maintain nutritional value while ensuring food safety aligns with growing awareness of health and wellness trends across the region.

Infrastructure challenges in certain MEA regions, particularly regarding cold chain logistics, create strong demand for ambient temperature storage solutions. Climate considerations make refrigeration expensive and unreliable in many areas, positioning aseptic packaging as a practical solution for product distribution and storage.

Market constraints affecting the MEA aseptic packaging sector include high initial capital investments required for establishing aseptic packaging facilities and acquiring specialized equipment. Technology complexity presents barriers for smaller manufacturers who may lack technical expertise or financial resources to implement sophisticated aseptic packaging systems.

Raw material costs represent significant challenges, particularly for advanced barrier materials and specialized packaging components that often require importation. Currency fluctuations across MEA countries can impact packaging material costs, affecting overall product pricing and market competitiveness.

Regulatory variations between different MEA countries create compliance complexities for manufacturers operating across multiple markets. Quality standards and certification requirements differ significantly, requiring substantial investment in meeting diverse regulatory frameworks and obtaining necessary approvals.

Consumer perception in certain traditional markets may favor fresh products over packaged alternatives, limiting adoption rates for aseptic packaging solutions. Cultural preferences and established consumption patterns can slow market penetration, particularly in rural areas where traditional food preparation methods remain prevalent.

Competition from alternative packaging technologies and preservation methods creates market pressure, while environmental concerns regarding packaging waste and recyclability pose growing challenges for industry participants.

Significant opportunities exist within the MEA aseptic packaging market, driven by untapped potential in emerging African markets and expanding applications across diverse industry sectors. E-commerce growth creates new distribution channels requiring packaging solutions that ensure product integrity during extended shipping periods without refrigeration.

Pharmaceutical sector expansion presents substantial opportunities as healthcare infrastructure development across MEA countries increases demand for sterile packaging solutions for liquid medications, vaccines, and nutritional supplements. The sector’s stringent quality requirements align well with aseptic packaging capabilities.

Export market development offers growth potential as MEA manufacturers seek to expand their reach to international markets. Aseptic packaging technology enables products to meet international quality standards while maintaining shelf stability during long-distance transportation.

Sustainability initiatives create opportunities for developing eco-friendly packaging solutions using recyclable materials and reduced environmental impact designs. Innovation in barrier materials and packaging formats can address specific regional requirements while improving cost-effectiveness.

Strategic partnerships between international technology providers and regional manufacturers can accelerate market development while reducing implementation costs. Government initiatives supporting food processing and packaging industries provide favorable conditions for market expansion across multiple MEA countries.

Market dynamics within the MEA aseptic packaging sector reflect complex interactions between technological advancement, consumer preferences, and regional economic conditions. Supply chain evolution demonstrates increasing sophistication as manufacturers invest in advanced packaging equipment and quality control systems to meet growing demand.

Competitive pressures drive continuous innovation in packaging materials, processing efficiency, and cost optimization strategies. Market consolidation trends show larger players acquiring regional capabilities while smaller companies focus on niche applications and specialized product segments.

Technology transfer from developed markets accelerates adoption of advanced aseptic packaging solutions across MEA countries. Local adaptation of international technologies enables manufacturers to address specific regional requirements while maintaining global quality standards.

Investment patterns indicate growing confidence in long-term market potential, with capacity expansion projects increasing by approximately 23% year-over-year across major MEA markets. The dynamics reveal strong correlation between economic stability and packaging industry investment levels.

Market maturity levels vary significantly across the region, with Gulf states showing advanced adoption patterns while African markets demonstrate early-stage growth characteristics. Cross-border trade influences packaging requirements as manufacturers seek solutions compatible with diverse regulatory environments.

Comprehensive research methodology employed for analyzing the MEA aseptic packaging market incorporates multiple data collection approaches and analytical frameworks to ensure accuracy and reliability. Primary research involves extensive interviews with industry executives, packaging manufacturers, technology providers, and end-user companies across key MEA markets.

Secondary research encompasses analysis of industry reports, regulatory documents, trade publications, and company financial statements to establish market baseline and identify growth trends. Market sizing calculations utilize bottom-up and top-down approaches to validate findings and ensure consistency across different market segments.

Regional analysis methodology incorporates country-specific economic indicators, demographic data, and regulatory frameworks to understand market variations across different MEA sub-regions. Competitive landscape assessment involves detailed analysis of key market participants, their product portfolios, and strategic initiatives.

Data validation processes include cross-referencing multiple sources, expert consultations, and statistical analysis to ensure research accuracy. Forecasting models incorporate historical trends, current market conditions, and projected economic scenarios to develop reliable growth projections.

Quality assurance measures throughout the research process ensure data integrity and analytical rigor, while continuous monitoring of market developments enables real-time updates to research findings and conclusions.

Regional market analysis reveals distinct patterns across MEA sub-regions, with Gulf Cooperation Council countries leading market development due to advanced infrastructure and higher consumer purchasing power. UAE and Saudi Arabia collectively represent approximately 35% of regional market share, driven by strong retail sectors and growing food processing industries.

North African markets including Egypt, Morocco, and Algeria demonstrate accelerating growth rates as economic development and urbanization drive demand for packaged products. Market penetration rates in these countries show approximately 18% annual growth as infrastructure improvements support expanded distribution networks.

Sub-Saharan Africa presents significant untapped potential with emerging markets like Nigeria, Kenya, and South Africa showing increasing adoption of aseptic packaging solutions. Economic growth and expanding middle-class populations create favorable conditions for market development despite infrastructure challenges.

Regional variations in regulatory frameworks, consumer preferences, and economic conditions require tailored market approaches. Cross-border trade patterns influence packaging requirements as manufacturers seek solutions compatible with multiple regulatory environments within the region.

Investment flows show increasing international interest in MEA packaging markets, with foreign direct investment in packaging infrastructure growing by approximately 15% annually across key regional markets.

The competitive landscape within the MEA aseptic packaging market features a diverse mix of international corporations and regional players, each leveraging distinct competitive advantages to capture market share. Market leadership patterns show established global companies maintaining strong positions while local manufacturers gain ground through specialized offerings and cost advantages.

Competitive strategies emphasize technological innovation, local manufacturing capabilities, and strategic partnerships with regional food processors. Market positioning varies from premium quality solutions to cost-effective alternatives targeting price-sensitive segments across different MEA countries.

Market segmentation within the MEA aseptic packaging sector reveals distinct categories based on packaging type, application, and material composition. By packaging type, the market divides into cartons, bottles, pouches, and bags, each serving specific product requirements and consumer preferences.

By Application:

By Material Type:

Geographic segmentation shows liquid cartons maintaining 44% market share across the region, while flexible pouches demonstrate fastest growth rates particularly in emerging African markets.

Category analysis reveals distinct market dynamics across different aseptic packaging segments within the MEA region. Liquid cartons dominate the market due to their versatility, cost-effectiveness, and consumer familiarity, particularly for dairy and juice applications.

Dairy segment insights show strong growth driven by increasing consumption of packaged milk products and growing preference for UHT milk in regions with limited cold chain infrastructure. Market adoption rates for dairy packaging show approximately 52% penetration in urban areas compared to rural markets.

Beverage category performance demonstrates robust expansion as fruit juice consumption increases across MEA countries. Premium juice segments show particular strength in Gulf markets where consumers prioritize quality and convenience over price considerations.

Pharmaceutical applications represent high-growth potential with stringent quality requirements driving demand for advanced aseptic packaging solutions. Healthcare sector expansion across MEA countries creates opportunities for specialized packaging formats and enhanced barrier properties.

Emerging applications in personal care and cosmetics show promising growth trajectories as beauty and wellness markets expand throughout the region. Innovation opportunities exist in developing packaging solutions for traditional regional products seeking modern packaging alternatives.

Industry participants in the MEA aseptic packaging market enjoy numerous strategic advantages that enhance competitive positioning and operational efficiency. Manufacturers benefit from extended product shelf life capabilities that enable broader distribution reach and reduced inventory losses due to spoilage.

Cost optimization opportunities arise from eliminated refrigeration requirements throughout the supply chain, reducing logistics expenses and enabling penetration of markets with limited cold storage infrastructure. Product quality maintenance ensures consistent taste, nutritional value, and appearance throughout extended storage periods.

Retailers gain advantages through improved inventory management, reduced storage costs, and enhanced product availability. Shelf space optimization becomes possible as products require no refrigeration, allowing flexible merchandising strategies and improved store layouts.

Consumer benefits include enhanced convenience, improved food safety, and access to nutritious products in areas with limited fresh food availability. Portability advantages make products suitable for various consumption occasions and lifestyle requirements.

Stakeholder value creation extends to supply chain partners, regulatory bodies, and environmental advocates through improved efficiency, enhanced food safety standards, and reduced food waste across the distribution network.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends within the MEA aseptic packaging market reflect evolving consumer preferences, technological advancement, and sustainability considerations. Sustainable packaging solutions gain prominence as environmental awareness increases across the region, driving demand for recyclable and biodegradable packaging materials.

Smart packaging integration represents a growing trend with manufacturers incorporating QR codes, temperature indicators, and freshness sensors to enhance consumer engagement and product traceability. Digital connectivity enables brands to provide additional product information and build stronger customer relationships.

Premiumization trends show consumers increasingly willing to pay higher prices for superior packaging quality and enhanced convenience features. Packaging design innovation focuses on improved functionality, aesthetic appeal, and user-friendly features that differentiate products in competitive markets.

Local sourcing initiatives gain traction as manufacturers seek to reduce costs and improve supply chain resilience. Regional manufacturing expansion shows approximately 19% annual growth as companies establish local production capabilities to serve MEA markets more effectively.

Customization trends enable manufacturers to develop packaging solutions tailored to specific regional preferences, cultural requirements, and regulatory standards across different MEA countries.

Recent industry developments demonstrate accelerating innovation and investment within the MEA aseptic packaging sector. Technology partnerships between international equipment manufacturers and regional companies facilitate knowledge transfer and capability development across emerging markets.

Capacity expansion projects across Gulf states and North Africa indicate strong confidence in long-term market growth potential. Manufacturing facility investments focus on advanced automation, quality control systems, and sustainable production processes to meet growing demand efficiently.

Regulatory harmonization efforts across MEA countries aim to standardize packaging requirements and facilitate cross-border trade. Quality certification programs help manufacturers meet international standards while ensuring product safety and consumer confidence.

Research and development initiatives focus on developing packaging solutions specifically designed for regional climate conditions, consumer preferences, and product requirements. Innovation centers established across key markets accelerate technology development and market adaptation processes.

Strategic acquisitions and joint ventures reshape the competitive landscape as companies seek to expand regional presence and enhance technological capabilities. Market consolidation trends create opportunities for improved efficiency and enhanced service capabilities across the region.

Market analysis conducted by MarkWide Research indicates several strategic recommendations for industry participants seeking to capitalize on MEA aseptic packaging market opportunities. Investment prioritization should focus on emerging African markets where infrastructure development and economic growth create favorable conditions for market expansion.

Technology adaptation strategies must address specific regional requirements including climate resilience, cost optimization, and local regulatory compliance. Partnership development with regional distributors and food processors can accelerate market penetration while reducing operational risks and investment requirements.

Product portfolio diversification beyond traditional applications into pharmaceuticals, personal care, and specialty foods can drive growth and reduce market concentration risks. Sustainability initiatives should become integral to business strategy as environmental concerns influence purchasing decisions across the region.

Supply chain optimization through local sourcing and regional manufacturing capabilities can improve cost competitiveness while enhancing service levels. Digital transformation initiatives including smart packaging features and e-commerce compatibility position companies for future market evolution.

Regulatory engagement and compliance excellence ensure market access while building stakeholder confidence in product quality and safety standards throughout the MEA region.

Future market prospects for the MEA aseptic packaging sector appear highly promising, supported by fundamental demographic and economic trends driving sustained demand growth. Urbanization acceleration across the region creates expanding consumer bases seeking convenient, shelf-stable products that align with modern lifestyle requirements.

Economic development trajectories in key MEA countries support continued market expansion, with projected growth rates of approximately 9.1% CAGR expected over the next five years. Infrastructure investments in transportation, retail, and food processing sectors create favorable conditions for aseptic packaging adoption.

Technology evolution will likely focus on enhanced sustainability, improved barrier properties, and smart packaging features that provide additional consumer value. Innovation pipelines include biodegradable materials, reduced packaging weight, and enhanced recyclability to address environmental concerns.

Market maturation patterns suggest Gulf states will maintain leadership positions while African markets demonstrate accelerating growth rates. Cross-regional trade expansion will likely drive standardization of packaging requirements and quality standards across MEA countries.

Long-term outlook indicates the market will benefit from continued economic growth, expanding middle-class populations, and increasing integration with global food and beverage supply chains throughout the region.

The MEA aseptic packaging market represents a dynamic and rapidly evolving sector with substantial growth potential driven by demographic shifts, economic development, and changing consumer preferences across the region. Market fundamentals remain strong, supported by urbanization trends, infrastructure development, and increasing demand for convenient, shelf-stable products.

Strategic opportunities exist for industry participants willing to invest in technology adaptation, local partnerships, and sustainable packaging solutions that address specific regional requirements. Competitive advantages will likely accrue to companies that successfully balance innovation, cost-effectiveness, and environmental responsibility while maintaining high quality standards.

Regional diversity within the MEA market requires tailored approaches that consider local economic conditions, consumer preferences, and regulatory frameworks. Success factors include technological excellence, supply chain optimization, and strong stakeholder relationships across diverse market environments.

Future success in the MEA aseptic packaging market will depend on companies’ ability to adapt to evolving market conditions while maintaining focus on quality, sustainability, and customer value creation throughout the region’s continued economic development and modernization.

What is Aseptic Packaging?

Aseptic packaging refers to a method of packaging that ensures products are sterilized and sealed in a way that prevents contamination. This technique is commonly used for food and beverage products, pharmaceuticals, and other perishable goods to extend shelf life without refrigeration.

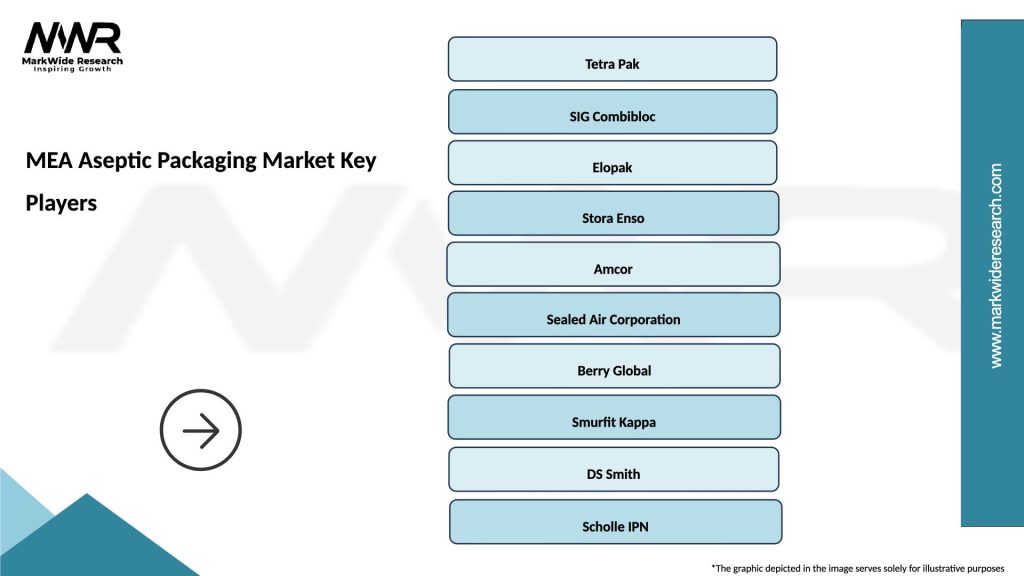

What are the key players in the MEA Aseptic Packaging Market?

Key players in the MEA Aseptic Packaging Market include Tetra Pak, SIG Combibloc, and Elopak, among others. These companies are known for their innovative packaging solutions and extensive distribution networks in the region.

What are the growth factors driving the MEA Aseptic Packaging Market?

The growth of the MEA Aseptic Packaging Market is driven by increasing demand for convenience foods, rising health awareness among consumers, and the need for longer shelf life in food products. Additionally, the expansion of the food and beverage industry in the region contributes to this growth.

What challenges does the MEA Aseptic Packaging Market face?

The MEA Aseptic Packaging Market faces challenges such as high initial investment costs and the complexity of the aseptic packaging process. Additionally, competition from alternative packaging methods can hinder market growth.

What opportunities exist in the MEA Aseptic Packaging Market?

Opportunities in the MEA Aseptic Packaging Market include the rising trend of sustainable packaging solutions and the growing demand for organic and natural food products. Innovations in packaging technology also present avenues for growth.

What trends are shaping the MEA Aseptic Packaging Market?

Trends shaping the MEA Aseptic Packaging Market include the increasing adoption of eco-friendly materials and advancements in smart packaging technologies. Additionally, the shift towards online food delivery services is influencing packaging design and functionality.

MEA Aseptic Packaging Market

| Segmentation Details | Description |

|---|---|

| Product Type | Flexible Packaging, Rigid Packaging, Pouches, Bottles |

| Material | Polyethylene, Polypropylene, Glass, Aluminum |

| End User | Pharmaceuticals, Food & Beverages, Cosmetics, Nutraceuticals |

| Technology | Hot Fill, Cold Fill, Aseptic Fill, Blow Fill Seal |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the MEA Aseptic Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at