444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The MEA and India CNG and LPG vehicle market is witnessing significant growth due to increasing concerns about environmental pollution and the need for cleaner and sustainable transportation solutions. Compressed Natural Gas (CNG) and Liquefied Petroleum Gas (LPG) are alternative fuels that offer several advantages over conventional gasoline and diesel, including lower emissions and reduced fuel costs. The market is experiencing robust growth as governments and regulatory bodies promote the adoption of CNG and LPG vehicles to mitigate the adverse effects of vehicular pollution. This market overview provides a comprehensive analysis of the MEA and India CNG and LPG vehicle market, including key market insights, drivers, restraints, opportunities, and market dynamics.

Meaning

CNG and LPG are gaseous fuels used as alternatives to traditional gasoline and diesel fuels in vehicles. CNG is primarily composed of methane and is stored in high-pressure cylinders, while LPG is a mixture of propane and butane and is stored in liquid form. Both fuels offer cleaner combustion and lower emissions compared to conventional fuels. CNG and LPG vehicles have gained popularity in recent years due to their environmental benefits, cost-effectiveness, and availability. These fuels can be used in various types of vehicles, including passenger cars, buses, and commercial vehicles, providing a viable solution for reducing air pollution and dependence on fossil fuels.

Executive Summary

The MEA and India CNG and LPG vehicle market are witnessing substantial growth due to increasing awareness about environmental sustainability and the advantages offered by CNG and LPG as alternative fuels. The market has been driven by supportive government policies and incentives, growing infrastructure for CNG and LPG refueling stations, and increasing consumer demand for cleaner and more economical transportation options. The market is highly competitive, with several key players operating in the region, including vehicle manufacturers, fuel suppliers, and infrastructure developers. The market offers significant opportunities for industry participants and stakeholders to capitalize on the growing demand for CNG and LPG vehicles and contribute to a greener and more sustainable future.

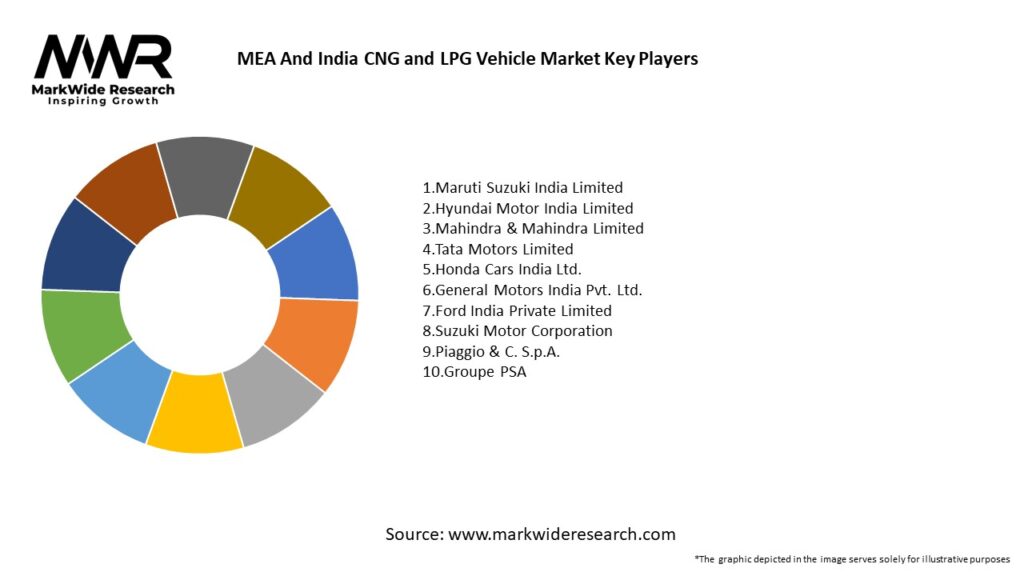

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The MEA and India CNG and LPG vehicle market are driven by a combination of factors, including government regulations, environmental concerns, fuel costs, infrastructure development, and consumer preferences. Government initiatives and policies play a crucial role in promoting the adoption of CNG and LPG vehicles by providing incentives, tax benefits, and subsidies to vehicle owners. Increasing environmental concerns and the need for cleaner transportation solutions have led to a shift towards CNG and LPG vehicles, which offer lower emissions compared to conventional fuels. Rising fuel prices and the cost-effectiveness of CNG and LPG fuels have also contributed to the market growth, as consumers seek more economical options. However, the market faces challenges such as limited availability of refueling stations, higher upfront costs, safety concerns, and the need for awareness among consumers. Nonetheless, the market offers significant opportunities for industry participants to capitalize on the growing demand and contribute to a greener and more sustainable future.

Regional Analysis

The MEA and India CNG and LPG vehicle market exhibit variations across different regions due to differences in government regulations, infrastructure development, and consumer preferences. In India, the market has witnessed significant growth in recent years, driven by supportive government policies and a growing infrastructure for CNG and LPG refueling stations. The demand for CNG and LPG vehicles is particularly high in urban areas with high pollution levels and a need for cleaner transportation solutions. In the MEA region, countries such as the United Arab Emirates, Iran, and Pakistan have shown a growing interest in CNG and LPG vehicles due to their cost-effectiveness and lower emissions. However, the market in the MEA region faces challenges related to infrastructure development and limited availability of refueling stations, which need to be addressed for further market expansion.

Competitive Landscape

Leading Companies in the MEA And India CNG and LPG Vehicle Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The MEA and India CNG and LPG vehicle market can be segmented based on vehicle type, fuel type, and region. By vehicle type, the market can be categorized into passenger cars, commercial vehicles, and others. By fuel type, the market can be divided into CNG and LPG. The regional segmentation includes countries such as India, Saudi Arabia, the UAE, Iran, Pakistan, and others.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

Industry participants and stakeholders in the MEA and India CNG and LPG vehicle market can benefit from various factors, including:

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the MEA and India CNG and LPG vehicle market. The strict lockdown measures and reduced economic activities resulted in a decline in vehicle sales and disrupted the supply chain. However, the pandemic also highlighted the importance of sustainable and cleaner transportation solutions, leading to increased government support for the adoption of CNG and LPG vehicles as part of the post-pandemic recovery plans. The market is expected to rebound and witness steady growth as economies recover and consumer demand for greener transportation options increases.

Key Industry Developments

Analyst Suggestions

Future Outlook

The MEA and India CNG and LPG vehicle market are expected to witness significant growth in the coming years. Increasing concerns about environmental pollution, rising fuel prices, and supportive government policies are expected to drive market expansion. The development of a robust infrastructure for CNG and LPG refueling stations and technological advancements in vehicle systems will further accelerate market growth. Collaboration between industry stakeholders and continuous investments in research and development will contribute to the introduction of innovative products and technologies. The future outlook for the MEA and India CNG and LPG vehicle market is promising, with ample opportunities for industry participants and stakeholders to contribute to a greener and more sustainable transportation sector.

Conclusion

The MEA and India CNG and LPG vehicle market are witnessing robust growth, driven by increasing concerns about environmental pollution and the need for sustainable transportation solutions. CNG and LPG vehicles offer several advantages over conventional fuels, including lower emissions, reduced fuel costs, and governmental incentives. However, the market faces challenges related to infrastructure development, limited availability of refueling stations, and higher upfront costs. Industry participants and stakeholders can capitalize on the market opportunities by focusing on expanding the refueling network, investing in research and development, and creating awareness among consumers. The future outlook for the market is promising, with steady growth expected in the coming years, leading to a greener and more sustainable transportation sector in the MEA and India regions.

MEA And India CNG and LPG Vehicle Market

| Segmentation Details | Information |

|---|---|

| Fuel Type | CNG Vehicles, LPG Vehicles |

| Vehicle Type | Passenger Cars, Commercial Vehicles |

| Region | Middle East & Africa, India |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the MEA And India CNG and LPG Vehicle Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at