444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The MEA AMH (Automated Material Handling) market refers to the growing industry that involves the use of automated systems to handle, store, and transport materials within various sectors. AMH systems are designed to enhance operational efficiency, reduce costs, and improve safety in industries such as manufacturing, logistics, healthcare, and retail.

Meaning

Automated Material Handling (AMH) refers to the use of automated systems, such as robotics, conveyor belts, and automated guided vehicles (AGVs), to handle, store, and transport materials within a facility or warehouse. These systems are integrated with software and control systems to streamline operations and improve productivity.

Executive Summary

The MEA AMH market is experiencing significant growth due to the increasing need for automation in various industries. The market is driven by the rising demand for efficient material handling solutions, the need to improve supply chain operations, and the growing focus on workplace safety. AMH systems enable businesses to optimize their operations, reduce manual labor, and enhance overall productivity.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The MEA AMH market is driven by various factors such as increasing demand for operational efficiency, supply chain optimization, labor shortages, and the need for workplace safety. The market faces challenges related to high initial investment, limited awareness, integration complexities, and maintenance requirements. However, emerging markets, industry-specific solutions, aftermarket services, and collaborations present growth opportunities for market players.

Regional Analysis

The MEA AMH market can be segmented into various regions, including:

Competitive Landscape

Leading Companies in the MEA AMH Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The MEA AMH market can be segmented based on various factors, including:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a significant impact on the MEA AMH market. The outbreak disrupted global supply chains, leading to increased demand for automation solutions to ensure business continuity. The pandemic highlighted the importance of resilient and efficient supply chain operations, driving the adoption of AMH systems in various industries. AMH solutions helped businesses overcome labor shortages, maintain social distancing measures, and ensure the safe and efficient movement of goods during the crisis.

Key Industry Developments

Analyst Suggestions

Future Outlook

The MEA AMH market is expected to witness continued growth in the coming years. The increasing focus on operational efficiency, supply chain optimization, and workplace safety will drive the adoption of AMH systems across industries. Technological advancements, such as AI, robotics, and IoT integration, will further enhance the capabilities and performance of AMH solutions. Emerging markets, industry-specific solutions, and collaborations are expected to present lucrative opportunities for market players.

Conclusion

The MEA AMH market is experiencing rapid growth due to the increasing demand for automation and improved operational efficiency. AMH systems offer numerous benefits, including enhanced productivity, cost reduction, workplace safety, and supply chain optimization. While there are challenges such as high initial investment and integration complexities, the market presents significant opportunities in emerging markets, industry-specific solutions, and aftermarket services. With advancements in technology and strategic collaborations, the MEA AMH market is poised for a promising future, revolutionizing material handling practices across various sectors in the region.

What is AMH?

AMH, or Anti-Müllerian Hormone, is a substance produced by the ovaries that serves as a marker for ovarian reserve and reproductive health. It is commonly used in fertility assessments and can provide insights into a woman’s reproductive potential.

What are the key players in the MEA AMH Market?

Key players in the MEA AMH Market include companies such as Roche Diagnostics, Siemens Healthineers, and Abbott Laboratories, which are known for their diagnostic products and fertility-related testing solutions, among others.

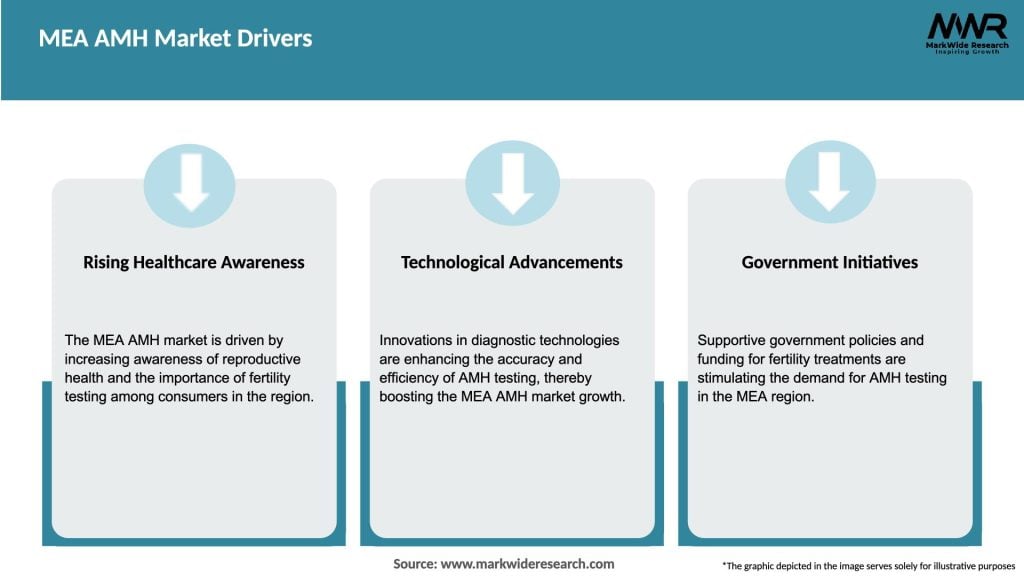

What are the growth factors driving the MEA AMH Market?

The growth of the MEA AMH Market is driven by increasing awareness of fertility issues, advancements in reproductive technologies, and a rise in the number of women seeking fertility treatments. Additionally, the growing prevalence of conditions affecting reproductive health contributes to market expansion.

What challenges does the MEA AMH Market face?

The MEA AMH Market faces challenges such as regulatory hurdles, varying reimbursement policies across regions, and the need for continuous innovation in testing methods. These factors can impact market accessibility and adoption rates.

What opportunities exist in the MEA AMH Market?

Opportunities in the MEA AMH Market include the development of new diagnostic technologies, expansion into emerging markets, and increasing partnerships between healthcare providers and diagnostic companies. These factors can enhance service delivery and patient outcomes.

What trends are shaping the MEA AMH Market?

Trends in the MEA AMH Market include the integration of digital health solutions, personalized medicine approaches in fertility treatments, and a growing emphasis on women’s health initiatives. These trends are influencing how reproductive health services are delivered and accessed.

MEA AMH Market

| Segmentation Details | Description |

|---|---|

| Product Type | Therapeutics, Diagnostics, Devices, Software |

| End User | Hospitals, Clinics, Laboratories, Homecare |

| Application | Chronic Disease Management, Preventive Care, Rehabilitation, Telehealth |

| Technology | Wearable Devices, Mobile Health Apps, Telemedicine Platforms, AI Analytics |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the MEA AMH Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at