444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The mattress market in Japan represents a dynamic and evolving segment within the country’s home furnishing industry, characterized by unique consumer preferences, technological innovations, and cultural sleeping traditions. Japanese consumers demonstrate distinct preferences for sleep solutions that blend traditional comfort concepts with modern ergonomic design, creating a sophisticated market landscape that differs significantly from Western counterparts.

Market dynamics in Japan’s mattress industry reflect the nation’s aging population, urbanization trends, and increasing health consciousness among consumers. The market experiences steady growth driven by 7.2% annual expansion in premium segment adoption, with particular emphasis on space-efficient designs suitable for compact living environments typical of Japanese homes.

Consumer behavior patterns indicate a strong preference for high-quality, durable mattresses that incorporate advanced materials and technologies. Japanese buyers increasingly prioritize sleep quality as a health investment, leading to 42% growth in demand for specialized sleep solutions including memory foam, hybrid constructions, and temperature-regulating materials.

Regional variations across Japan’s major metropolitan areas show distinct purchasing patterns, with Tokyo and Osaka markets leading innovation adoption while rural areas maintain stronger preferences for traditional Japanese sleeping arrangements. The market demonstrates 65% urban concentration in premium mattress sales, reflecting higher disposable income and space optimization needs in city environments.

The mattress market in Japan refers to the comprehensive ecosystem of sleep surface products, manufacturing, distribution, and retail activities specifically tailored to Japanese consumer preferences and living conditions. This market encompasses traditional Western-style mattresses, Japanese futon adaptations, hybrid sleep solutions, and innovative materials designed for optimal comfort and space efficiency.

Market definition includes various mattress types ranging from basic spring constructions to advanced memory foam systems, latex alternatives, and hybrid designs that combine multiple comfort technologies. The Japanese market particularly emphasizes products that address specific cultural needs such as floor sleeping compatibility, compact storage solutions, and materials suitable for high humidity environments.

Industry scope covers domestic manufacturing, international imports, specialized retail channels, and emerging direct-to-consumer distribution models. The market integrates traditional Japanese bedding concepts with modern sleep science, creating unique product categories that serve both conventional bed users and those maintaining traditional floor sleeping practices.

Japan’s mattress market demonstrates remarkable resilience and innovation, driven by demographic shifts, health awareness trends, and evolving lifestyle preferences among Japanese consumers. The market exhibits strong growth potential despite economic challenges, with premium segments showing particularly robust expansion as consumers prioritize sleep quality investments.

Key market drivers include an aging population seeking enhanced comfort solutions, urbanization creating demand for space-efficient designs, and increasing awareness of sleep’s impact on health and productivity. The market benefits from 38% consumer willingness to invest in premium sleep solutions, indicating strong value recognition for quality mattress products.

Technological advancement plays a crucial role in market evolution, with manufacturers incorporating smart materials, temperature regulation systems, and ergonomic designs specifically adapted for Japanese body types and sleeping preferences. Innovation focus areas include antimicrobial treatments, moisture management, and modular designs suitable for flexible living spaces.

Competitive landscape features both established international brands and specialized Japanese manufacturers, creating a diverse market environment that encourages continuous innovation and consumer choice expansion. Market leaders demonstrate strong adaptation to local preferences while maintaining global quality standards.

Consumer preferences in Japan’s mattress market reveal sophisticated demands for products that balance comfort, durability, and space efficiency. Japanese buyers demonstrate strong brand loyalty once satisfied, creating opportunities for companies that successfully address specific cultural and practical needs.

Market segmentation reveals distinct consumer groups with varying needs, from young professionals seeking convenience to elderly consumers prioritizing health benefits. Understanding these segments enables targeted product development and marketing strategies that resonate with specific demographic groups.

Demographic transformation serves as a primary driver for Japan’s mattress market, with an aging population creating increased demand for specialized sleep solutions that address age-related comfort and health needs. The growing elderly demographic seeks mattresses that provide enhanced support, pressure relief, and ease of movement during sleep.

Health consciousness among Japanese consumers drives significant market expansion as sleep quality becomes recognized as a crucial component of overall wellness. Medical research highlighting sleep’s impact on productivity, mental health, and longevity motivates consumers to invest in premium mattress solutions that promise better rest quality.

Urbanization trends create unique market opportunities as city dwellers require space-efficient sleep solutions that maximize comfort within limited living areas. The demand for multifunctional and compact mattress designs grows as urban housing costs encourage smaller living spaces and flexible furniture arrangements.

Technology integration accelerates market growth through innovative materials and smart features that appeal to tech-savvy Japanese consumers. Advanced memory foams, cooling gels, and responsive materials that adapt to body temperature and movement patterns attract consumers seeking cutting-edge sleep technology.

Lifestyle changes including longer working hours and increased stress levels drive demand for mattresses that promote faster sleep onset and deeper rest cycles. Consumers increasingly view quality mattresses as essential tools for managing modern life’s demands and maintaining optimal performance.

Economic pressures present significant challenges for Japan’s mattress market, as deflationary trends and stagnant wages limit consumer spending on non-essential home furnishings. Price sensitivity increases among middle-income consumers, creating pressure on manufacturers to balance quality with affordability.

Cultural preferences for traditional sleeping arrangements continue to limit market expansion in certain demographic segments, particularly among older consumers who maintain preferences for futon-based sleep systems. This cultural attachment to traditional bedding reduces the addressable market for Western-style mattresses.

Space constraints in Japanese homes create practical limitations for mattress adoption, as many residences lack dedicated bedroom space for permanent bed installations. The prevalence of multipurpose rooms and compact living arrangements restricts demand for larger, fixed mattress solutions.

Import dependencies expose the market to currency fluctuations and supply chain disruptions, particularly affecting international brands that rely on overseas manufacturing. Exchange rate volatility impacts pricing strategies and profit margins for imported mattress products.

Regulatory compliance requirements for safety standards, material certifications, and environmental regulations increase operational costs for manufacturers and importers. Strict Japanese quality standards, while ensuring consumer protection, create barriers for new market entrants and increase product development expenses.

Digital transformation creates substantial opportunities for mattress companies to reach Japanese consumers through innovative online channels and virtual shopping experiences. The growing acceptance of e-commerce for furniture purchases opens new distribution possibilities and reduces traditional retail overhead costs.

Customization services present significant growth potential as Japanese consumers increasingly seek personalized products that address individual comfort preferences and physical requirements. Advanced manufacturing technologies enable mass customization of firmness, materials, and dimensions to meet specific customer needs.

Health and wellness trends offer opportunities for mattress companies to develop specialized products targeting specific health conditions such as back pain, sleep disorders, and circulation issues. Partnerships with healthcare providers and sleep specialists can create new market segments and distribution channels.

Sustainable materials development addresses growing environmental consciousness among Japanese consumers, creating opportunities for eco-friendly mattress alternatives using renewable resources, recycled materials, and biodegradable components. Green certifications and environmental messaging resonate strongly with environmentally aware consumers.

Smart technology integration enables the development of connected mattresses that monitor sleep patterns, adjust firmness automatically, and integrate with home automation systems. The Japanese market’s technology adoption rate of 72% indicates strong potential for smart sleep solutions.

Supply chain evolution in Japan’s mattress market reflects changing consumer expectations and technological capabilities, with manufacturers adapting production processes to meet demands for customization, sustainability, and rapid delivery. Local production facilities gain importance as companies seek to reduce import dependencies and improve responsiveness to market changes.

Competitive intensity increases as both domestic and international players vie for market share through product innovation, pricing strategies, and distribution channel expansion. The market demonstrates 23% competitive fragmentation with numerous brands competing across different price segments and consumer demographics.

Consumer education becomes increasingly important as mattress technology advances and buyers seek guidance on selecting appropriate products for their specific needs. Companies invest in educational content, sleep consultations, and trial programs to help consumers make informed purchasing decisions.

Distribution channel diversification accelerates as traditional furniture retailers face competition from specialized mattress stores, online platforms, and direct-to-consumer brands. Multi-channel strategies become essential for reaching diverse consumer segments and maximizing market penetration.

Innovation cycles shorten as manufacturers respond to rapidly evolving consumer preferences and technological possibilities. Continuous product development and feature enhancement become necessary for maintaining competitive positioning in the dynamic Japanese market.

Primary research methodologies employed in analyzing Japan’s mattress market include comprehensive consumer surveys, retailer interviews, and manufacturer consultations to gather firsthand insights into market trends, preferences, and challenges. Direct engagement with industry stakeholders provides authentic perspectives on market dynamics and future opportunities.

Secondary research incorporates analysis of industry reports, government statistics, trade publications, and company financial statements to establish market context and validate primary findings. Historical data analysis reveals long-term trends and cyclical patterns that inform market projections and strategic recommendations.

Market segmentation analysis utilizes demographic data, purchasing behavior studies, and psychographic profiling to identify distinct consumer groups and their specific mattress preferences. This segmentation approach enables targeted analysis of market opportunities and competitive positioning strategies.

Competitive intelligence gathering involves systematic monitoring of major market players, product launches, pricing strategies, and marketing campaigns to understand competitive dynamics and identify market gaps. Regular competitor analysis ensures comprehensive market understanding and strategic insight development.

Data validation processes include cross-referencing multiple sources, statistical analysis verification, and expert review to ensure research accuracy and reliability. Quality control measures maintain high standards for market intelligence and strategic recommendations provided to industry stakeholders.

Tokyo metropolitan area dominates Japan’s mattress market with 35% market concentration, driven by high population density, elevated income levels, and strong adoption of Western lifestyle elements. The capital region demonstrates the highest demand for premium mattresses and innovative sleep technologies, reflecting urban consumers’ willingness to invest in quality sleep solutions.

Osaka and Kansai region represents the second-largest market segment, characterized by strong commercial activity and diverse consumer demographics. This region shows balanced demand across price segments, with particular strength in mid-range mattress categories that offer good value propositions for cost-conscious consumers.

Nagoya and central Japan exhibit steady market growth supported by industrial activity and stable employment levels. The region demonstrates preference for durable, practical mattress solutions that emphasize longevity and value retention over luxury features.

Northern regions including Hokkaido show unique market characteristics influenced by climate considerations, with increased demand for mattresses featuring temperature regulation and insulation properties. Cold weather conditions drive preference for materials that provide warmth retention and comfort during extended indoor periods.

Southern regions including Kyushu demonstrate growing market potential with 18% annual growth in mattress adoption, supported by economic development and changing lifestyle preferences. These areas show increasing openness to Western-style bedding solutions while maintaining appreciation for traditional comfort concepts.

Market leadership in Japan’s mattress industry reflects a diverse competitive environment featuring established international brands, specialized Japanese manufacturers, and emerging direct-to-consumer companies. Competition intensifies across multiple dimensions including product innovation, pricing strategies, and distribution channel effectiveness.

Competitive strategies vary significantly among market participants, with international brands emphasizing global expertise and proven technologies while Japanese companies leverage local market knowledge and cultural understanding. Innovation leadership, customer service excellence, and brand trust become key differentiating factors in the competitive landscape.

By Product Type: Japan’s mattress market segments into distinct categories based on construction methods and materials, each serving specific consumer needs and preferences.

By Distribution Channel: Market segmentation reflects evolving retail landscape and changing consumer shopping preferences.

By Price Range: Market stratification based on consumer budget segments and value perceptions.

Memory foam category demonstrates exceptional growth potential in Japan’s mattress market, driven by increasing consumer awareness of pressure relief benefits and improved sleep quality. Japanese consumers particularly appreciate memory foam’s ability to contour to body shapes while providing consistent support throughout the night.

Spring mattress segment maintains traditional market strength through continuous innovation in coil technologies and comfort layers. Modern spring mattresses incorporate advanced materials and construction techniques that address historical concerns about durability and motion transfer while preserving the familiar feel preferred by many Japanese consumers.

Hybrid mattress category emerges as a compromise solution that combines multiple comfort technologies to address diverse sleep preferences within single products. These mattresses appeal to couples with different comfort needs and consumers who want comprehensive sleep solutions without choosing between different technologies.

Natural and organic mattress segments gain momentum as environmental consciousness increases among Japanese consumers. Latex, organic cotton, and bamboo-based materials attract buyers seeking sustainable sleep solutions that align with broader lifestyle values and health considerations.

Smart mattress category represents the market’s technological frontier, incorporating sensors, connectivity, and adaptive features that appeal to tech-savvy Japanese consumers. These products demonstrate 52% interest levels among younger demographics who value data-driven insights into their sleep patterns and quality.

Manufacturers benefit from Japan’s mattress market through opportunities to develop innovative products that address specific cultural preferences and living conditions. The market rewards companies that successfully adapt global technologies to local needs while maintaining high quality standards expected by Japanese consumers.

Retailers gain advantages through diverse product portfolios that serve multiple consumer segments and price points. Successful retailers leverage both traditional showroom experiences and emerging digital channels to maximize market reach and customer engagement opportunities.

Consumers receive benefits from increased product variety, improved quality standards, and competitive pricing driven by market competition. Access to advanced sleep technologies and customization options enables Japanese consumers to find mattress solutions that precisely match their individual comfort preferences and health needs.

Healthcare providers benefit from improved patient outcomes as quality mattresses contribute to better sleep health and reduced sleep-related medical issues. Partnerships with mattress manufacturers create opportunities for specialized products targeting specific health conditions and therapeutic needs.

Technology companies find opportunities to integrate smart features, sensors, and connectivity solutions into mattress products, creating new revenue streams and market differentiation possibilities. The Japanese market’s technology adoption rate supports innovation in sleep monitoring and comfort optimization systems.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as a dominant trend in Japan’s mattress market, with manufacturers increasingly incorporating eco-friendly materials, recyclable components, and sustainable production processes. Consumer demand for environmentally responsible products drives innovation in natural latex, organic fabrics, and biodegradable foam alternatives.

Smart technology adoption accelerates as mattresses integrate sensors, sleep tracking capabilities, and connectivity features that appeal to tech-savvy Japanese consumers. These innovations provide valuable sleep data and enable automatic adjustments for optimal comfort throughout the night.

Customization services gain popularity as consumers seek mattresses tailored to their specific comfort preferences, body types, and health requirements. Advanced manufacturing technologies enable mass customization of firmness levels, materials, and dimensions without significant cost premiums.

Health and wellness focus intensifies as consumers recognize sleep quality’s impact on overall health, productivity, and quality of life. Mattresses featuring therapeutic benefits, pressure relief, and ergonomic support gain market traction among health-conscious buyers.

Direct-to-consumer models disrupt traditional retail channels by offering better value propositions, convenient delivery, and trial programs that reduce purchase risk. Online-first brands demonstrate 67% customer satisfaction rates through innovative service models and customer-centric approaches.

Product innovation accelerates across Japan’s mattress industry as manufacturers introduce advanced materials, construction techniques, and comfort technologies. Recent developments include temperature-regulating foams, antimicrobial treatments, and modular designs that adapt to changing consumer needs.

Distribution evolution transforms market dynamics as traditional furniture retailers adapt to competition from online platforms and direct-to-consumer brands. Established retailers invest in omnichannel strategies that combine physical showrooms with digital convenience and enhanced customer service.

Partnership formations between mattress manufacturers and healthcare providers create new market opportunities for therapeutic and medical-grade sleep solutions. These collaborations leverage medical expertise to develop products addressing specific health conditions and sleep disorders.

Sustainability initiatives gain momentum as companies implement circular economy principles, develop recycling programs, and source materials from renewable resources. Environmental certifications and green manufacturing processes become important competitive differentiators in the conscious consumer market.

Technology integration advances through partnerships with tech companies, enabling mattresses to connect with smart home systems, health monitoring devices, and mobile applications. These integrations create comprehensive sleep ecosystems that provide holistic wellness solutions.

Market positioning strategies should emphasize unique value propositions that address specific Japanese consumer needs, cultural preferences, and living conditions. MarkWide Research analysis indicates successful companies focus on local adaptation while maintaining global quality standards and innovation capabilities.

Investment priorities should target technology integration, sustainable materials development, and distribution channel diversification to capture emerging market opportunities. Companies that balance traditional retail presence with digital innovation demonstrate stronger market performance and customer satisfaction levels.

Product development focus should address space efficiency, health benefits, and customization capabilities that resonate with Japanese consumers’ evolving lifestyle needs. Innovation in materials, construction techniques, and smart features creates competitive advantages in the sophisticated Japanese market.

Partnership strategies with healthcare providers, technology companies, and local retailers can accelerate market penetration and enhance value propositions. Strategic alliances enable companies to leverage complementary expertise and reach new customer segments effectively.

Customer engagement approaches should emphasize education, trial programs, and personalized service that build trust and confidence in mattress purchasing decisions. Japanese consumers value expert guidance and comprehensive support throughout the buying process and product ownership experience.

Market evolution in Japan’s mattress industry points toward continued growth driven by demographic trends, health consciousness, and technological advancement. The market demonstrates resilience despite economic challenges, with premium segments showing particularly strong expansion potential as consumers prioritize sleep quality investments.

Technology integration will accelerate as smart mattresses become mainstream products offering comprehensive sleep monitoring, automatic comfort adjustments, and integration with broader health and wellness ecosystems. MWR projections indicate 43% growth potential in smart mattress adoption over the next five years.

Sustainability requirements will intensify as environmental regulations tighten and consumer awareness increases, driving innovation in eco-friendly materials, circular economy practices, and sustainable manufacturing processes. Companies that proactively address environmental concerns will gain competitive advantages in the evolving market landscape.

Customization capabilities will expand through advanced manufacturing technologies and data analytics, enabling mass personalization of mattress products to meet individual consumer preferences and health requirements. This trend toward personalized sleep solutions represents significant growth opportunities for innovative companies.

Distribution transformation will continue as online channels gain market share and traditional retailers adapt to omnichannel strategies. The future market will likely feature hybrid retail models that combine digital convenience with physical product experience and expert consultation services.

Japan’s mattress market presents a complex but rewarding landscape for companies that successfully navigate cultural preferences, demographic trends, and technological opportunities. The market demonstrates strong fundamentals supported by health consciousness, quality expectations, and willingness to invest in premium sleep solutions that deliver genuine value.

Success factors in this market include deep understanding of Japanese consumer needs, adaptation of global technologies to local preferences, and development of comprehensive value propositions that address practical, cultural, and aspirational requirements. Companies that balance innovation with cultural sensitivity achieve the strongest market positions and customer loyalty.

Future opportunities abound for organizations that embrace sustainability, technology integration, and customization capabilities while maintaining the quality standards and customer service excellence expected by Japanese consumers. The market rewards companies that demonstrate long-term commitment to serving local needs while contributing to the broader evolution of sleep health and wellness in Japan.

What is Mattress in Japan?

Mattress in Japan refers to the various types of bedding products designed for comfort and support during sleep, including innerspring, memory foam, and latex mattresses, tailored to meet the preferences of Japanese consumers.

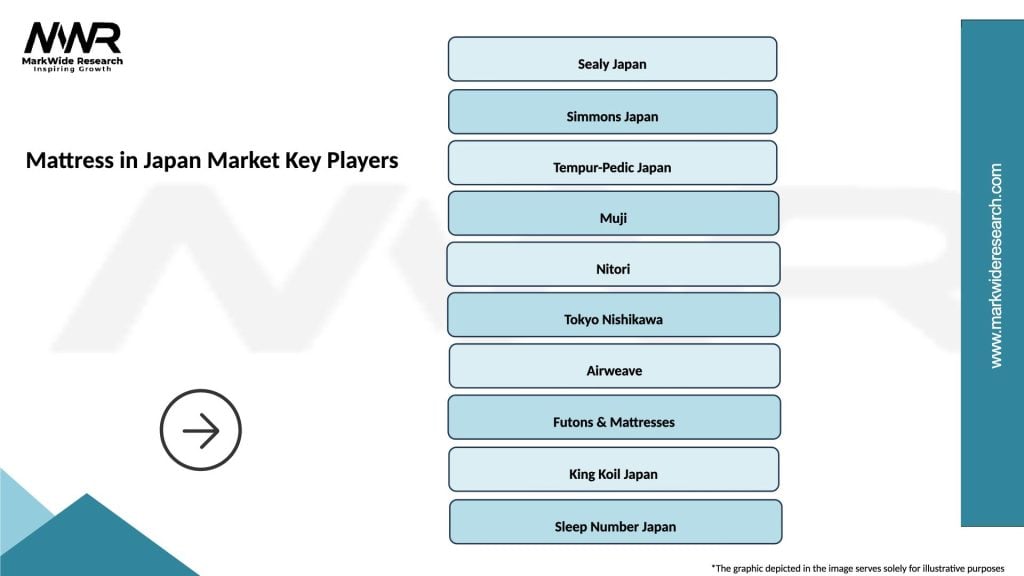

What are the key companies in the Mattress in Japan Market?

Key companies in the Mattress in Japan Market include Sealy Japan, Tempur-Pedic, Nishikawa Sangyo, and Serta, among others.

What are the growth factors driving the Mattress in Japan Market?

The growth of the Mattress in Japan Market is driven by increasing consumer awareness of sleep health, a rise in disposable income, and the growing trend of online mattress sales.

What challenges does the Mattress in Japan Market face?

Challenges in the Mattress in Japan Market include intense competition among brands, fluctuating raw material prices, and changing consumer preferences towards sustainable products.

What opportunities exist in the Mattress in Japan Market?

Opportunities in the Mattress in Japan Market include the expansion of e-commerce platforms, the introduction of smart mattresses, and the growing demand for customized sleep solutions.

What trends are shaping the Mattress in Japan Market?

Trends in the Mattress in Japan Market include the increasing popularity of eco-friendly materials, the rise of subscription-based mattress services, and innovations in sleep technology such as adjustable firmness.

Mattress in Japan Market

| Segmentation Details | Description |

|---|---|

| Product Type | Memory Foam, Innerspring, Latex, Hybrid |

| End User | Residential, Hospitality, Healthcare, Educational |

| Distribution Channel | Online Retail, Specialty Stores, Department Stores, Wholesale |

| Price Tier | Luxury, Mid-Range, Budget, Discount |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Mattress in Japan Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at