444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Marine Protection and Indemnity (P&I) Insurance market plays a crucial role in safeguarding the interests of shipowners, charterers, and other maritime industry stakeholders. P&I insurance provides coverage for liabilities and risks associated with the operation of vessels, including third-party liabilities, crew injuries, pollution incidents, and damage to cargo. It offers financial protection and peace of mind to the maritime community, ensuring that they can operate with confidence in a complex and unpredictable industry.

Meaning

Marine Protection and Indemnity (P&I) Insurance refers to a specialized form of liability insurance that covers the risks faced by shipowners and operators. It provides coverage for various aspects, including crew injuries, collision liabilities, cargo damage, pollution incidents, wreck removal, and legal expenses. P&I insurance is typically offered by mutual associations or clubs, which are owned and governed by their members.

Executive Summary

The Marine Protection and Indemnity (P&I) Insurance market has witnessed significant growth in recent years. The increasing global trade activities, stricter regulatory requirements, and rising awareness about risk management have fueled the demand for P&I insurance. Additionally, the growth of emerging markets and the expansion of the maritime industry have created new opportunities for market players.

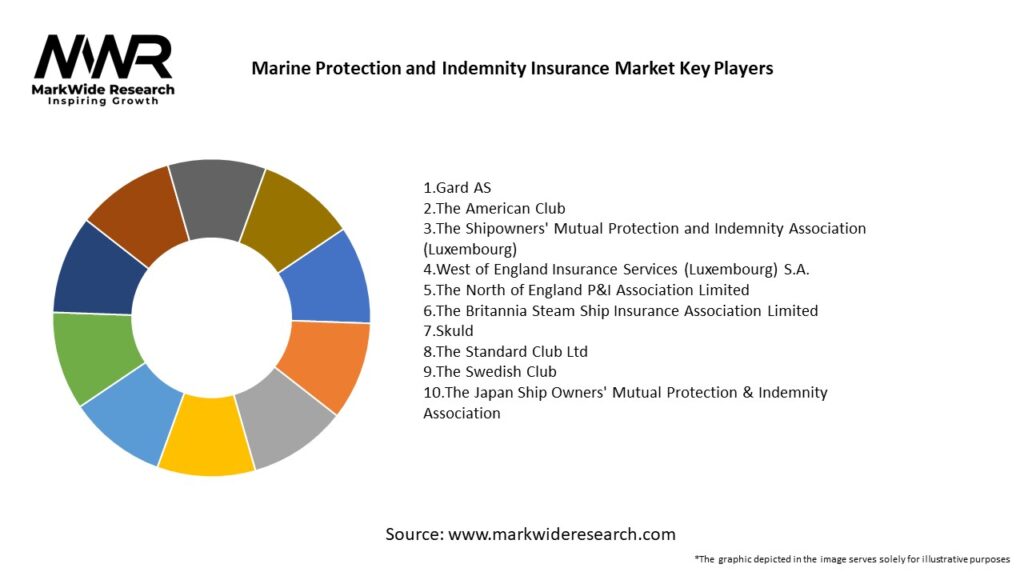

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Marine Protection and Indemnity (P&I) Insurance market is characterized by dynamic factors that shape its growth and evolution. Key dynamics include changing trade patterns, regulatory developments, market consolidation, and technological advancements. These dynamics influence market trends, customer preferences, and competitive strategies.

Regional Analysis

The P&I insurance market is global in nature, with significant regional variations in terms of market size, regulations, and industry dynamics. Major regions contributing to market growth include North America, Europe, Asia Pacific, and Latin America. Each region has its own unique characteristics and presents opportunities and challenges for market players.

In North America, the market is driven by the presence of major ports, a robust maritime industry, and strict regulatory requirements. Europe is home to several leading P&I clubs and benefits from a well-established maritime infrastructure. Asia Pacific is witnessing rapid growth due to increasing trade activities, the emergence of new shipping hubs, and the expansion of the shipbuilding industry. Latin America has significant potential for market growth, driven by its rich natural resources, growing economies, and increasing investments in port infrastructure.

Competitive Landscape

Leading Companies in the Marine Protection and Indemnity Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Marine Protection and Indemnity (P&I) Insurance market can be segmented based on various factors, including type of coverage, vessel type, and end-user. Common segments include:

Segmentation enables insurers to tailor their offerings to specific customer needs and target market segments effectively.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The Marine Protection and Indemnity (P&I) Insurance market offers several key benefits to industry participants and stakeholders:

SWOT Analysis

The SWOT analysis of the Marine Protection and Indemnity (P&I) Insurance market provides an assessment of its strengths, weaknesses, opportunities, and threats:

A thorough SWOT analysis enables market players to capitalize on their strengths, address weaknesses, explore opportunities, and mitigate threats.

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the Marine Protection and Indemnity (P&I) Insurance market. The maritime industry experienced disruptions due to port closures, travel restrictions, and reduced trade activities. These disruptions resulted in challenges for insurers, including increased claims, premium adjustments, and uncertainties in the global supply chain.

Shipowners and operators faced unprecedented operational and financial challenges during the pandemic. P&I insurance providers supported their clients by offering flexible coverage options, assistance with claims handling, and guidance on risk management. Insurers also adapted their underwriting processes and pricing strategies to reflect the changing risk landscape.

The pandemic highlighted the importance of risk management and contingency planning in the maritime industry. P&I insurance played a vital role in providing financial protection to industry participants during these uncertain times. The market demonstrated resilience and adaptability in the face of the pandemic, with insurers working closely with their clients to navigate the challenges and maintain the stability of the industry.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the Marine Protection and Indemnity (P&I) Insurance market is positive, driven by factors such as increasing global trade, regulatory compliance requirements, and the need for comprehensive risk management solutions. The market is expected to witness steady growth, with emerging markets playing a significant role in driving demand.

Insurers will continue to focus on customization, digital transformation, and sustainability to meet the evolving needs of industry participants. Data analytics, artificial intelligence, and blockchain technologies will play an increasingly vital role in enhancing underwriting capabilities and improving operational efficiency.

The Covid-19 pandemic has highlighted the importance of risk management and contingency planning, leading to greater awareness and demand for P&I insurance coverage. Insurers will continue to collaborate with industry stakeholders, invest in loss prevention initiatives, and adapt to changing regulatory landscapes.

In conclusion, the Marine Protection and Indemnity (P&I) Insurance market is poised for growth, driven by the vital role it plays in providing financial protection to the maritime industry. As the industry faces evolving risks and challenges, P&I insurers will play a crucial role in supporting industry participants and ensuring the stability and sustainability of the maritime sector.

Conclusion

The Marine Protection and Indemnity (P&I) Insurance market is a critical component of the maritime industry, providing essential coverage for shipowners, charterers, and operators. This specialized form of liability insurance offers financial protection against a wide range of risks, including third-party liabilities, pollution incidents, crew injuries, and cargo damage. P&I insurance ensures that industry participants can operate with confidence, knowing that they are financially protected in the event of unforeseen events.

The market has experienced steady growth, driven by factors such as increasing global trade, regulatory compliance requirements, and the need for comprehensive risk management solutions. The growth of emerging markets, technological advancements, and the expansion of services present new opportunities for market players. However, the market also faces challenges such as volatility in insurance premiums, limited coverage for catastrophic events, and increasing claims costs.

Looking ahead, the future outlook for the P&I insurance market is positive. The increasing importance of risk management, growing trade activities, and regulatory compliance requirements will continue to drive demand. Insurers that adapt to changing market dynamics, leverage technology, and focus on customer-centric solutions will be well-positioned to capitalize on the opportunities in this dynamic and essential sector of the maritime industry.

What is Marine Protection and Indemnity Insurance?

Marine Protection and Indemnity Insurance is a type of marine insurance that provides coverage for shipowners and operators against liabilities incurred in the course of operating their vessels. This includes protection against claims for damage to cargo, environmental pollution, and injuries to crew members, among other liabilities.

What are the key players in the Marine Protection and Indemnity Insurance Market?

Key players in the Marine Protection and Indemnity Insurance Market include The American Club, Gard P&I Club, and Skuld, among others. These companies offer various insurance products tailored to the needs of maritime operators and shipowners.

What are the main drivers of growth in the Marine Protection and Indemnity Insurance Market?

The growth of the Marine Protection and Indemnity Insurance Market is driven by increasing global trade, rising maritime activities, and stricter environmental regulations. Additionally, the need for comprehensive risk management solutions in the shipping industry contributes to market expansion.

What challenges does the Marine Protection and Indemnity Insurance Market face?

The Marine Protection and Indemnity Insurance Market faces challenges such as fluctuating insurance premiums, regulatory compliance complexities, and the impact of climate change on marine operations. These factors can affect the availability and affordability of coverage for shipowners.

What opportunities exist in the Marine Protection and Indemnity Insurance Market?

Opportunities in the Marine Protection and Indemnity Insurance Market include the development of innovative insurance products that address emerging risks, such as cyber threats and environmental liabilities. Additionally, expanding into developing maritime regions presents growth potential for insurers.

What trends are shaping the Marine Protection and Indemnity Insurance Market?

Trends in the Marine Protection and Indemnity Insurance Market include the increasing use of technology for risk assessment and claims processing, as well as a growing emphasis on sustainability and ESG factors. Insurers are also focusing on enhancing customer service through digital platforms.

Marine Protection and Indemnity Insurance Market

| Segmentation | Details |

|---|---|

| Type | Hull Insurance, Machinery Insurance, Cargo Insurance, Others |

| Application | Commercial Ships, Naval Ships, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Marine Protection and Indemnity Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at