444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Marine Engine Cooling Systems Market is integral to maritime transportation, supporting various vessel types, from cargo ships and cruise liners to fishing boats and naval vessels. Efficient cooling systems are vital for engine reliability and optimal performance in the challenging marine environment. The Marine Engine Cooling Systems Market plays a crucial role in the maritime industry, ensuring the reliable and efficient operation of marine engines. Cooling systems are essential for dissipating excess heat generated during engine operation, preventing overheating, and preserving engine performance. This comprehensive guide explores the Marine Engine Cooling Systems Market, offering insights into market dynamics, key trends, applications, regional analysis, and more.

Meaning

Marine engine cooling systems refer to the technology and equipment used to regulate and manage the temperature of engines on watercraft, including ships, boats, and submarines. These systems prevent engines from overheating during operation.

Executive Summary

The Marine Engine Cooling Systems Market operates within the broader maritime industry, addressing the critical need for efficient engine cooling solutions. This executive summary provides an overview of key market trends and developments.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Dual-Fuel Engine Adoption: As LNG-fueled marine engines grow by over 10% annually, closed-loop cooling solutions with ammonia-resistant materials are in high demand.

Retrofit Opportunities: An estimated 30,000 existing vessels built before 2005 will require cooling-system upgrades over the next decade to meet new emission and efficiency standards.

Material Innovation: Duplex and super-duplex stainless steels constitute over 40% of new heat-exchanger materials, reducing biofouling and corrosion in seawater loops.

Digital Monitoring: Approximately 25% of new cooling-system installations include temperature and flow sensors with remote diagnostics, enhancing preventive maintenance and reducing downtime.

Service & Aftermarket: Spares and MRO services—gaskets, pump seals, cooler plates—represent over 35% of total market revenues, underscoring the recurring nature of maintenance.

Market Drivers

Regulatory Compliance: IMO Tier III NOₓ limits and expected future CO₂ rules drive engine upgrades—and corresponding enhancements in cooling capacity and control precision.

Engine Power Escalation: Modern marine engines exceeding 80,000 kW output require high-capacity, multi-pass heat exchangers and advanced coolant management.

Corrosion Mitigation: Demand for longer service intervals propels adoption of closed-loop systems and corrosion-resistant materials that minimize seawater exposure.

Fleet Modernization: Replacement of aging tonnage with higher-efficiency vessels includes installation of integrated propulsion and cooling packages.

Predictive Maintenance: Shipowners invest in digital monitoring to optimize cooling-system upkeep, reduce port stays, and avert unplanned breakdowns.

Market Restraints

High Capital Expenditure: Premium closed-loop systems with duplex-steel exchangers and digital controls can cost 20–30% more than basic open systems.

Complexity & Expertise: Closed-loop systems require more sophisticated installation, operation, and maintenance skills, which may be scarce in remote ports.

Biofouling Management: Open systems still face challenges with marine growth and debris, necessitating frequent cleaning and strainer maintenance.

Supply-Chain Lead Times: Custom-fabricated heat-exchanger plates and specialty pumps can have lead times of 8–12 weeks, impacting retrofit schedules.

Space Constraints: Retrofitting closed-loop cooling on existing vessels can be limited by engine-room space and pipe-routing complexities.

Market Opportunities

Hybrid-Electric Propulsion: Battery- or fuel-cell–driven hybrid vessels require integrated thermal-management systems for both engines and electric components.

Compact Microchannel Exchangers: Adoption of aluminum or titanium microchannel heat exchangers for yachts and small craft offering high efficiency in limited space.

UV & Electrocleaning: Systems integrating ultraviolet sterilization or low-energy electrochemical cleaning reduce biofouling without mechanical intervention.

Modular Retrofit Kits: Off-the-shelf cooling kits designed for popular engine models enable rapid upgrades in shipyards and dry docks.

Energy Recovery: Waste-heat-recovery units coupled to cooling loops can preheat fuel or supply accommodation heating, improving vessel efficiency.

Market Dynamics

OEM Partnerships: Engine manufacturers (e.g., MAN ES, Wärtsilä) increasingly bundle cooling systems with propulsion units under single-supplier contracts.

Service Network Expansion: Global service centers and authorized workshops ensure timely MRO and parts availability, crucial for ship-owners’ 24/7 operations.

Digitalization Push: Integration of cooling-system data into vessel-management systems empowers remote monitoring and condition-based interventions.

Consolidation Trends: Mergers among pump, heat-exchanger, and valve suppliers create end-to-end thermal-management portfolios.

Standards Harmonization: Adoption of ISO 10437 (marine heat exchanger standards) and DNV-GL guidelines for cooling-system design and testing improves reliability.

Regional Analysis

Asia-Pacific: Leads volume demand—over 45% share—due to robust shipbuilding in China, South Korea, and Japan, and expanding offshore fleets in Southeast Asia.

Europe: High-value retrofits and stringent North Sea operating conditions drive demand for closed-loop and duplex-steel systems.

North America: Cruise-ship and offshore wind support vessels in the Gulf of Mexico and Great Lakes markets favor advanced cooling solutions.

Middle East & Africa: LNG carrier conversions and naval vessel procurements spur cooling upgrades; MRO networks are developing in Gulf ports.

Latin America: Oilfield-service fleets in Brazil and Argentina require reliable cooling systems for harsh South Atlantic operations.

Competitive Landscape

Leading Companies in the Marine Engine Cooling Systems Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

By System Type: Open (Raw) Cooling, Closed (Freshwater) Cooling, Hybrid Systems

By Component: Heat Exchangers, Seawater Pumps, Freshwater Pumps, Valves & Thermostats, Strainers & Strainers Cleaning Systems, Sensors & Controls

By Vessel Type: Commercial (Container, Bulk Carrier, Tanker, LNG Carrier), Offshore (FPSO, Platform Supply, Drillships), Naval & Coast Guard, Yachts & Small Craft

By Distribution Channel: OEM Bundled, Aftermarket Parts & Retrofit, Marine Equipment Suppliers

By Region: Asia-Pacific, Europe, North America, Middle East & Africa, Latin America

Category-wise Insights

To gain a more detailed understanding of the market, let’s explore insights specific to each category:

Liquid cooling systems use coolant, such as water or glycol, to dissipate heat from marine engines.

Air cooling systems rely on airflow to cool marine engines, making them suitable for smaller vessels and specific applications.

Heat exchangers play a crucial role in transferring heat between the engine and the cooling medium, ensuring efficient heat dissipation.

Key Benefits for Industry Participants and Stakeholders

The Global Marine Engine Cooling Systems Market offers several benefits to industry participants and stakeholders:

SWOT Analysis

A SWOT analysis provides a concise overview of the market’s strengths, weaknesses, opportunities, and threats.

Strengths

Weaknesses

Opportunities

Threats

Market Key Trends

Staying informed about key trends is essential for industry players:

1. Green Cooling Technologies

The development and adoption of green and eco-friendly cooling technologies to align with environmental regulations.

2. Digitalization and IoT Integration

The integration of digital solutions and IoT capabilities to monitor and optimize cooling system performance.

3. Hybrid Cooling Systems

The emergence of hybrid cooling systems that combine liquid and air cooling for enhanced efficiency.

Covid-19 Impact

The COVID-19 pandemic had mixed effects on the Marine Engine Cooling Systems Market. While some sectors, like cruise liners, faced temporary setbacks, the need for reliable cooling systems remained consistent for essential maritime operations and logistics.

Key Industry Developments

Recent developments in the industry include:

Analyst Suggestions

Based on the current market landscape, here are some suggestions for industry participants:

Future Outlook

The Global Marine Engine Cooling Systems Market will continue to evolve as the maritime industry adapts to environmental regulations and the need for energy-efficient solutions. The market’s future lies in sustainable and innovative cooling technologies that support safe and efficient maritime operations.

Conclusion

The Marine Engine Cooling Systems Market serves as a critical component of the maritime industry, ensuring the reliability and efficiency of marine engines in diverse applications. As the industry navigates evolving environmental regulations and sustainability goals, businesses that prioritize innovation, eco-friendly solutions, and collaboration with regulatory bodies are well-positioned to contribute to the maritime industry’s sustainable and efficient future.

What is Marine Engine Cooling Systems?

Marine Engine Cooling Systems are essential components in marine vessels that regulate the temperature of the engine to prevent overheating. These systems typically use water or air to dissipate heat generated during engine operation, ensuring optimal performance and longevity.

What are the key players in the Marine Engine Cooling Systems market?

Key players in the Marine Engine Cooling Systems market include companies like Wärtsilä, MAN Energy Solutions, and Caterpillar, which provide a range of cooling solutions for marine applications. These companies focus on innovation and efficiency to meet the demands of the maritime industry, among others.

What are the growth factors driving the Marine Engine Cooling Systems market?

The Marine Engine Cooling Systems market is driven by factors such as the increasing demand for efficient cooling solutions in marine vessels, advancements in cooling technologies, and the growth of the shipping industry. Additionally, regulatory requirements for emissions control are pushing for more effective cooling systems.

What challenges does the Marine Engine Cooling Systems market face?

Challenges in the Marine Engine Cooling Systems market include the high costs associated with advanced cooling technologies and the need for regular maintenance. Furthermore, the complexity of integrating these systems with existing marine engines can pose significant hurdles for manufacturers.

What opportunities exist in the Marine Engine Cooling Systems market?

Opportunities in the Marine Engine Cooling Systems market include the development of eco-friendly cooling solutions and the integration of smart technologies for better monitoring and efficiency. The rise of electric and hybrid marine vessels also presents new avenues for innovative cooling systems.

What trends are shaping the Marine Engine Cooling Systems market?

Trends in the Marine Engine Cooling Systems market include the increasing adoption of modular cooling systems and the use of advanced materials for better heat resistance. Additionally, there is a growing focus on sustainability and energy efficiency in marine engine design.

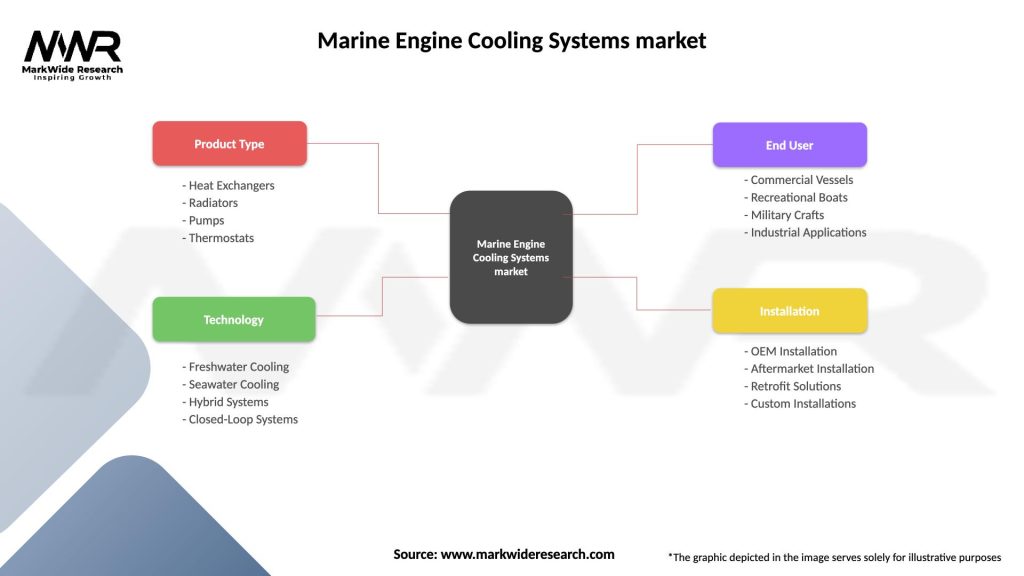

Marine Engine Cooling Systems market

| Segmentation Details | Description |

|---|---|

| Product Type | Heat Exchangers, Radiators, Pumps, Thermostats |

| Technology | Freshwater Cooling, Seawater Cooling, Hybrid Systems, Closed-Loop Systems |

| End User | Commercial Vessels, Recreational Boats, Military Crafts, Industrial Applications |

| Installation | OEM Installation, Aftermarket Installation, Retrofit Solutions, Custom Installations |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Marine Engine Cooling Systems Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at