444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The Managed Video as a Service market represents a transformative segment within the broader cloud services industry, delivering comprehensive video infrastructure solutions through managed service providers. This rapidly evolving market encompasses video streaming, content delivery, video analytics, and integrated communication platforms that enable organizations to leverage professional-grade video capabilities without maintaining complex in-house infrastructure.

Market dynamics indicate substantial growth momentum driven by increasing demand for remote collaboration tools, digital transformation initiatives, and the proliferation of video-centric business applications. The market demonstrates particularly strong expansion in sectors including healthcare, education, enterprise communications, and media broadcasting, with organizations seeking scalable video solutions that reduce operational complexity while enhancing user experience.

Growth trajectories show the market expanding at a compound annual growth rate of 12.4%, reflecting robust adoption across diverse industry verticals. This growth is primarily attributed to the increasing integration of artificial intelligence in video processing, enhanced bandwidth availability, and the growing preference for subscription-based service models over traditional capital expenditure approaches.

Regional distribution reveals North America maintaining approximately 42% market share, followed by Europe at 28% and Asia-Pacific at 22%. The remaining 8% is distributed across Latin America, Middle East, and Africa, with emerging markets showing accelerated adoption rates as digital infrastructure continues to mature.

The Managed Video as a Service market refers to the comprehensive ecosystem of cloud-based video solutions delivered through managed service providers, encompassing video streaming infrastructure, content delivery networks, video analytics platforms, and integrated communication services that enable organizations to deploy professional-grade video capabilities without maintaining complex technical infrastructure.

Service components within this market include video encoding and transcoding services, content delivery optimization, real-time streaming protocols, video analytics and intelligence, storage and archiving solutions, and integrated collaboration platforms. These services are typically delivered through subscription-based models that provide scalable, on-demand access to enterprise-grade video infrastructure.

Key differentiators from traditional video solutions include managed infrastructure maintenance, automatic scaling capabilities, integrated security features, multi-platform compatibility, and professional support services. This approach enables organizations to focus on core business objectives while leveraging sophisticated video technologies through expert-managed platforms.

Market positioning demonstrates the Managed Video as a Service sector as a critical enabler of digital transformation initiatives across multiple industries. The market’s evolution reflects the fundamental shift from on-premises video infrastructure to cloud-native, service-oriented delivery models that provide enhanced flexibility, scalability, and cost-effectiveness.

Adoption patterns reveal particularly strong growth in enterprise communications, with 68% of organizations reporting improved collaboration efficiency through managed video services. Healthcare and education sectors show accelerated implementation rates, driven by telemedicine requirements and remote learning initiatives that demand reliable, high-quality video infrastructure.

Technology integration trends highlight the increasing incorporation of artificial intelligence and machine learning capabilities, with 54% of service providers offering AI-powered video analytics as standard features. This integration enables advanced functionalities including automated content tagging, real-time transcription, sentiment analysis, and predictive bandwidth optimization.

Competitive landscape features a diverse ecosystem of established cloud service providers, specialized video technology companies, and telecommunications operators, each offering differentiated service portfolios targeting specific market segments and use cases.

Strategic insights reveal several fundamental trends shaping the Managed Video as a Service market landscape:

Primary growth drivers propelling the Managed Video as a Service market include the accelerating digital transformation initiatives across industries, with organizations recognizing video communication as essential infrastructure rather than optional technology. The shift toward remote and hybrid work models has fundamentally altered communication requirements, creating sustained demand for reliable, scalable video solutions.

Technological advancement serves as a significant catalyst, particularly the widespread availability of high-speed internet connectivity and the maturation of cloud computing platforms. These infrastructure improvements enable sophisticated video services that were previously limited to large enterprises with substantial technical resources.

Cost optimization considerations drive adoption as organizations seek to reduce capital expenditure while maintaining access to cutting-edge video technologies. Managed services eliminate the need for specialized technical staff, ongoing maintenance costs, and periodic infrastructure upgrades, providing predictable operational expenses.

Regulatory compliance requirements in sectors such as healthcare, finance, and education create demand for professionally managed video solutions that incorporate appropriate security measures, data protection protocols, and audit capabilities. Service providers offer compliance expertise that individual organizations would find challenging to develop internally.

Integration capabilities with existing business systems and workflows enhance productivity and user adoption, making video services more valuable when seamlessly incorporated into established operational processes.

Implementation challenges present significant barriers to market expansion, particularly for organizations with complex legacy systems or specific integration requirements. The transition from existing video infrastructure to managed services often requires careful planning and may involve temporary operational disruptions.

Bandwidth limitations in certain geographic regions or organizational environments constrain the effectiveness of video services, particularly for high-definition content or large-scale deployments. While global connectivity continues to improve, inconsistent internet infrastructure remains a limiting factor in some markets.

Data sovereignty concerns affect adoption in organizations with strict data residency requirements or regulatory constraints that limit cloud service utilization. Some industries or government entities require on-premises data processing that conflicts with typical managed service delivery models.

Vendor dependency risks create hesitation among organizations concerned about long-term service availability, pricing stability, or the ability to migrate between service providers. These concerns are particularly relevant for mission-critical video applications that require guaranteed availability.

Security perceptions continue to influence decision-making, despite significant improvements in cloud security capabilities. Some organizations remain cautious about transmitting sensitive video content through third-party managed services, preferring perceived control of on-premises solutions.

Emerging market expansion presents substantial growth opportunities as developing regions invest in digital infrastructure and organizations seek cost-effective video solutions. These markets often lack established video infrastructure, making managed services particularly attractive for rapid deployment.

Industry vertical specialization offers significant potential for service providers developing tailored solutions for specific sectors. Healthcare telemedicine, educational remote learning, manufacturing training, and retail customer engagement represent distinct market segments with unique requirements and substantial growth potential.

Edge computing integration creates opportunities for enhanced service delivery through distributed processing capabilities that reduce latency and improve user experience. This technological advancement enables new applications in real-time video analytics, augmented reality, and interactive media.

Artificial intelligence integration opens possibilities for advanced video processing capabilities including automated content analysis, intelligent bandwidth optimization, real-time translation, and predictive maintenance. These AI-powered features can differentiate service offerings and justify premium pricing.

Partnership ecosystems enable service providers to expand capabilities through strategic alliances with complementary technology vendors, system integrators, and industry specialists. These partnerships can accelerate market penetration and enhance service portfolios.

Competitive dynamics within the Managed Video as a Service market reflect the convergence of multiple technology sectors, including cloud computing, telecommunications, and video technology. This convergence creates both opportunities and challenges as traditional boundaries between service categories become increasingly blurred.

Technology evolution continues to reshape market dynamics, with emerging standards for video compression, streaming protocols, and network optimization influencing service delivery capabilities. According to MarkWide Research analysis, organizations implementing managed video services report 35% improvement in video quality consistency compared to self-managed solutions.

Customer expectations drive continuous service enhancement, with users demanding seamless experiences across multiple devices and platforms. This pressure encourages innovation in user interface design, integration capabilities, and performance optimization.

Pricing models evolve to accommodate diverse customer requirements, ranging from usage-based billing to comprehensive subscription packages. Flexible pricing approaches enable service providers to address different market segments while maintaining profitability.

Regulatory influences shape service development, particularly regarding data protection, content security, and industry-specific compliance requirements. Service providers must balance regulatory compliance with operational efficiency and competitive positioning.

Research approach for analyzing the Managed Video as a Service market employs comprehensive methodologies combining primary research through industry expert interviews, customer surveys, and vendor assessments with secondary research utilizing industry reports, financial analyses, and technology trend evaluations.

Data collection processes include structured interviews with service providers, technology vendors, and end-user organizations across multiple industry verticals and geographic regions. This primary research provides insights into adoption patterns, implementation challenges, and future requirements that quantitative data alone cannot capture.

Market sizing methodologies utilize bottom-up analysis based on service provider revenues, customer deployment data, and industry adoption rates. Cross-validation through top-down analysis ensures accuracy and consistency in market assessments.

Trend analysis incorporates technology roadmaps, regulatory developments, and competitive intelligence to identify emerging opportunities and potential market disruptions. This forward-looking analysis enables stakeholders to anticipate market evolution and strategic positioning requirements.

Quality assurance procedures include data verification through multiple sources, expert review panels, and statistical validation techniques to ensure research accuracy and reliability.

North American market leadership reflects the region’s advanced digital infrastructure, early adoption of cloud technologies, and concentration of technology vendors. The United States dominates regional activity with approximately 78% of North American market share, driven by enterprise demand and robust telecommunications infrastructure.

European market development emphasizes data protection compliance and regulatory adherence, with organizations prioritizing service providers offering GDPR-compliant solutions. Germany, United Kingdom, and France represent the largest European markets, collectively accounting for 65% of regional adoption.

Asia-Pacific expansion demonstrates the highest growth rates globally, with emerging economies investing heavily in digital transformation initiatives. China and India lead regional growth, while developed markets including Japan and Australia focus on enterprise collaboration and healthcare applications.

Latin American markets show increasing adoption driven by improved internet connectivity and growing awareness of cloud service benefits. Brazil and Mexico represent the primary regional markets, with organizations seeking cost-effective alternatives to traditional video infrastructure.

Middle East and Africa present emerging opportunities as governments and enterprises invest in digital infrastructure development. The United Arab Emirates and South Africa lead regional adoption, particularly in government and education sectors.

Market leaders in the Managed Video as a Service sector include established technology companies and specialized service providers:

Competitive strategies focus on differentiation through specialized industry solutions, advanced analytics capabilities, and comprehensive integration options. Service providers increasingly emphasize partnership ecosystems to expand service portfolios and market reach.

By Service Type:

By Deployment Model:

By Organization Size:

By Industry Vertical:

Video Streaming Services represent the largest market segment, driven by increasing demand for content delivery across multiple platforms and devices. Organizations utilize streaming services for both internal communications and external customer engagement, with 73% of enterprises reporting improved audience reach through managed streaming platforms.

Video Conferencing Solutions experienced accelerated growth following global remote work adoption, with organizations seeking reliable, scalable communication platforms. Integration with existing business applications and advanced features such as recording, transcription, and analytics drive continued adoption in this segment.

Video Analytics Platforms emerge as high-growth segments as organizations recognize the value of data-driven insights from video content. AI-powered analytics enable automated content tagging, audience behavior analysis, and performance optimization that enhance video strategy effectiveness.

Healthcare applications demonstrate particularly strong growth potential, with telemedicine adoption rates increasing significantly. MWR data indicates healthcare organizations implementing managed video services report 45% reduction in technical support requirements compared to self-managed solutions.

Educational sector adoption focuses on comprehensive learning management integration, with institutions seeking platforms that support both synchronous and asynchronous learning delivery. Advanced features including automated captioning, multi-language support, and accessibility compliance drive selection criteria.

Service Providers benefit from recurring revenue models, scalable infrastructure utilization, and opportunities for value-added service development. The managed service approach enables providers to leverage economies of scale while developing specialized expertise that commands premium pricing.

Enterprise Customers gain access to professional-grade video infrastructure without substantial capital investment or technical expertise requirements. Managed services provide predictable costs, automatic updates, and professional support that enable organizations to focus on core business objectives.

Technology Vendors expand market reach through service provider partnerships, enabling broader distribution of video technologies and platforms. This channel approach accelerates adoption while reducing direct sales and support costs.

End Users experience improved video quality, reliability, and feature availability through professionally managed platforms. Consistent user experiences across devices and locations enhance productivity and satisfaction with video-enabled business processes.

System Integrators develop new revenue opportunities through managed service partnerships and specialized implementation services. The complexity of video service integration creates demand for professional services and ongoing support.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration represents the most significant trend shaping the Managed Video as a Service market, with service providers incorporating machine learning capabilities for automated content analysis, intelligent bandwidth optimization, and predictive maintenance. These AI-powered features enhance service value while reducing operational costs.

Edge Computing Adoption enables distributed video processing that reduces latency and improves user experience for real-time applications. Service providers increasingly deploy edge infrastructure to support low-latency video services and enable new applications in augmented reality and interactive media.

Industry-Specific Solutions emerge as service providers develop specialized offerings targeting unique requirements in healthcare, education, manufacturing, and other vertical markets. These tailored solutions command premium pricing while addressing specific compliance and functionality requirements.

Security Enhancement becomes increasingly important as organizations transmit sensitive video content through managed services. Advanced encryption, zero-trust security models, and comprehensive audit capabilities address growing security requirements.

Multi-Cloud Strategies gain popularity as organizations seek to avoid vendor lock-in while optimizing performance and costs. Service providers develop capabilities supporting deployment across multiple cloud platforms and hybrid environments.

Strategic partnerships between major cloud providers and specialized video technology companies create comprehensive service portfolios that address diverse customer requirements. These alliances combine infrastructure capabilities with specialized video expertise to deliver enhanced solutions.

Acquisition activities consolidate market capabilities as established technology companies acquire specialized video service providers to expand their managed service portfolios. This consolidation trend creates more comprehensive service offerings while potentially reducing competitive options.

Technology standardization efforts focus on improving interoperability between different video platforms and services. Industry organizations work to establish common standards that facilitate integration and reduce customer implementation complexity.

Regulatory compliance initiatives address growing data protection and industry-specific requirements. Service providers invest in compliance capabilities to address healthcare, financial services, and government market requirements.

Global infrastructure expansion continues as service providers establish regional data centers and edge computing capabilities to support international customers and improve service performance.

Strategic positioning recommendations for service providers emphasize the importance of developing specialized industry expertise while maintaining broad platform capabilities. Organizations should focus on specific vertical markets where they can develop deep domain knowledge and tailored solutions.

Technology investment priorities should emphasize artificial intelligence capabilities, edge computing infrastructure, and security enhancements. These technology areas represent key differentiators that can justify premium pricing and improve customer retention.

Partnership development strategies should focus on complementary technology vendors, system integrators, and industry specialists. Strategic alliances can accelerate market penetration while expanding service capabilities without substantial internal investment.

Customer success initiatives become critical for maintaining competitive advantage in the managed services market. Proactive support, performance monitoring, and continuous optimization demonstrate ongoing value that justifies subscription costs.

Global expansion approaches should consider regional regulatory requirements, local partnership opportunities, and infrastructure capabilities. Successful international expansion requires understanding of local market dynamics and compliance requirements.

Market evolution indicates continued strong growth driven by increasing video adoption across business processes and the ongoing shift toward cloud-native infrastructure. MarkWide Research projects the market will maintain robust expansion with sustained double-digit growth rates through the forecast period.

Technology advancement will focus on artificial intelligence integration, with 85% of service providers expected to offer AI-powered video analytics within the next three years. These capabilities will enable new applications in automated content creation, real-time language translation, and predictive audience engagement.

Industry adoption patterns suggest healthcare and education sectors will continue leading growth, driven by permanent changes in service delivery models established during recent global disruptions. Manufacturing and retail sectors show increasing interest in video-enabled training and customer engagement applications.

Geographic expansion will accelerate in emerging markets as digital infrastructure continues developing and organizations seek cost-effective alternatives to traditional video infrastructure. Asia-Pacific and Latin American regions present particularly strong growth potential.

Competitive dynamics will increasingly favor service providers offering comprehensive, integrated solutions rather than point products. Organizations prefer working with fewer vendors while accessing broader capabilities through managed service relationships.

The Managed Video as a Service market represents a fundamental transformation in how organizations approach video infrastructure and capabilities. This evolution from capital-intensive, self-managed systems to flexible, subscription-based managed services reflects broader trends toward cloud adoption, operational efficiency, and focus on core business competencies.

Market dynamics demonstrate sustained growth potential driven by digital transformation initiatives, remote work adoption, and increasing recognition of video as essential business infrastructure. The integration of artificial intelligence, edge computing, and industry-specific solutions creates opportunities for continued innovation and market expansion.

Strategic implications for organizations include the need to evaluate managed video services as alternatives to traditional infrastructure approaches, considering factors such as scalability requirements, cost optimization objectives, and integration capabilities. Success in this market requires understanding of evolving customer needs, technology trends, and competitive positioning strategies that differentiate service offerings while delivering measurable business value.

What is Managed Video as a Service?

Managed Video as a Service (MVaaS) refers to a cloud-based service that allows organizations to manage, store, and distribute video content without the need for extensive on-premises infrastructure. It typically includes features such as video hosting, streaming, and analytics, catering to various industries like education, entertainment, and corporate communications.

What are the key players in the Managed Video as a Service Market?

Key players in the Managed Video as a Service Market include companies like Brightcove, Kaltura, and Vimeo, which provide comprehensive video solutions for businesses. These companies offer a range of services from video hosting to live streaming and analytics, among others.

What are the growth factors driving the Managed Video as a Service Market?

The Managed Video as a Service Market is driven by the increasing demand for video content across various sectors, the rise of remote work, and the need for scalable video solutions. Additionally, advancements in cloud technology and the growing popularity of video marketing are contributing to market growth.

What challenges does the Managed Video as a Service Market face?

Challenges in the Managed Video as a Service Market include concerns over data security and privacy, the need for reliable internet connectivity, and competition from traditional video hosting solutions. These factors can hinder the adoption of MVaaS among certain organizations.

What opportunities exist in the Managed Video as a Service Market?

The Managed Video as a Service Market presents opportunities for innovation in areas such as artificial intelligence for video analytics, enhanced user engagement features, and integration with other digital marketing tools. As more businesses recognize the value of video content, the demand for MVaaS solutions is expected to grow.

What trends are shaping the Managed Video as a Service Market?

Trends in the Managed Video as a Service Market include the increasing use of live streaming for events, the integration of interactive video features, and the rise of personalized video content. These trends reflect the evolving preferences of consumers and businesses in how they engage with video.

Managed Video as a Service Market

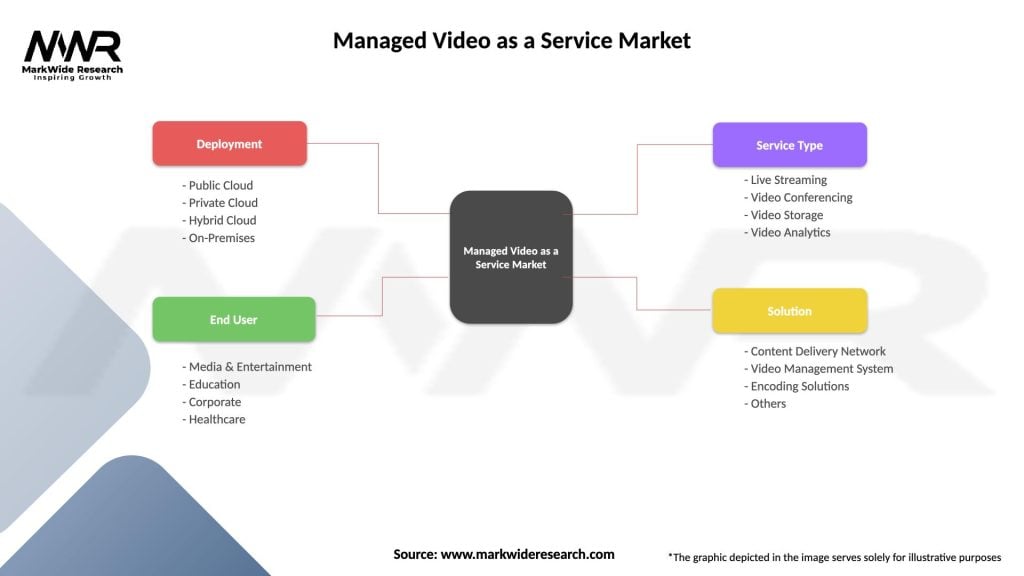

| Segmentation Details | Description |

|---|---|

| Deployment | Public Cloud, Private Cloud, Hybrid Cloud, On-Premises |

| End User | Media & Entertainment, Education, Corporate, Healthcare |

| Service Type | Live Streaming, Video Conferencing, Video Storage, Video Analytics |

| Solution | Content Delivery Network, Video Management System, Encoding Solutions, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Managed Video as a Service Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at