444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The power generation engineering, procurement, and construction (EPC) market in Malaysia has witnessed significant growth in recent years. EPC refers to the entire process of designing, procuring materials, and constructing power generation facilities. Malaysia’s growing economy, increasing population, and rising energy demand have fueled the development of power generation projects, creating lucrative opportunities for EPC companies.

Meaning

The term EPC stands for engineering, procurement, and construction. In the context of the power generation industry, EPC refers to the comprehensive process of designing, procuring equipment and materials, and constructing power generation plants. EPC contractors are responsible for ensuring the successful completion of power projects, meeting quality standards, adhering to safety regulations, and delivering projects on time and within budget.

Executive Summary

The Malaysia Power Generation EPC market has experienced robust growth in recent years. The country’s government has been actively promoting the development of the power sector to meet the growing energy demand and support economic growth. This has led to a surge in power generation projects, presenting immense opportunities for EPC companies. However, the market also faces challenges such as regulatory complexities and environmental concerns. To capitalize on the market’s potential, EPC companies must adapt to evolving technologies, focus on sustainability, and form strategic partnerships.

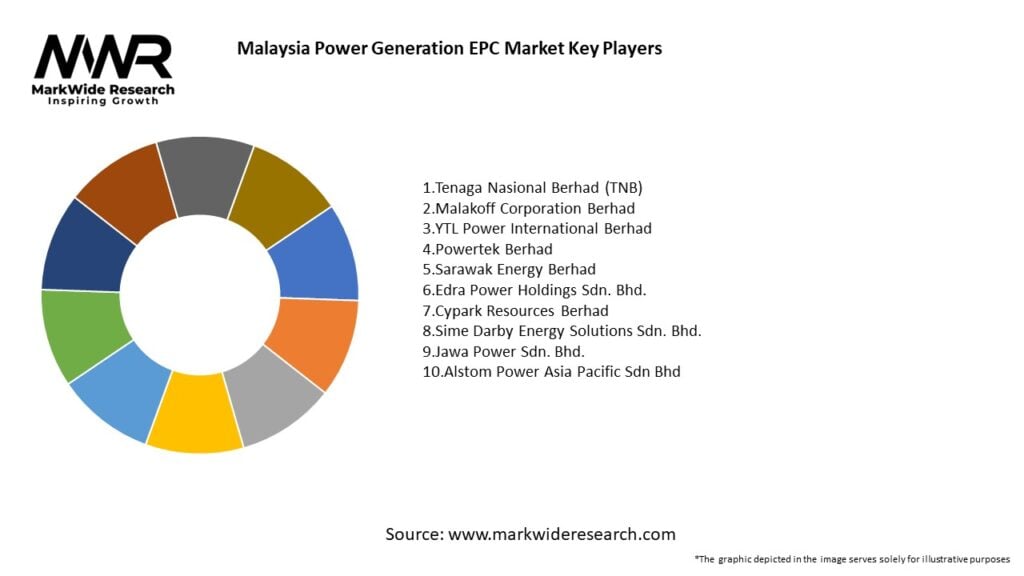

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

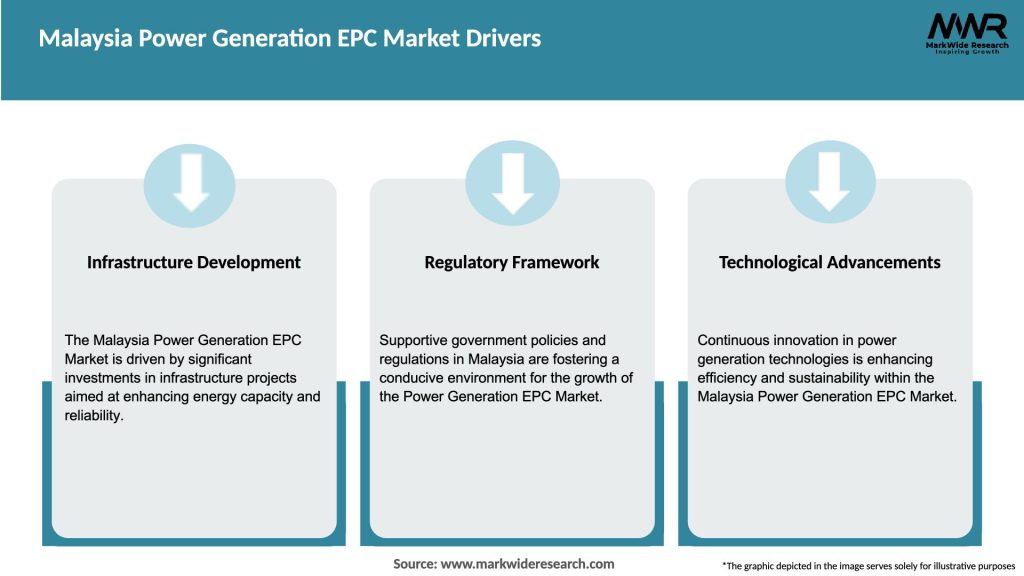

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Malaysia Power Generation EPC market operates in a dynamic environment influenced by various factors such as government policies, economic conditions, technological advancements, and environmental concerns. These dynamics shape the market landscape, impacting the growth, opportunities, and challenges faced by EPC companies.

Regional Analysis

The power generation EPC market in Malaysia exhibits regional variations in terms of power demand, resource availability, and infrastructure development. Key regions include Peninsular Malaysia, Sabah, and Sarawak. Peninsular Malaysia accounts for the majority of power demand and infrastructure, while Sabah and Sarawak offer significant potential for renewable energy projects.

Competitive Landscape

Leading Companies in the Malaysia Power Generation EPC Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

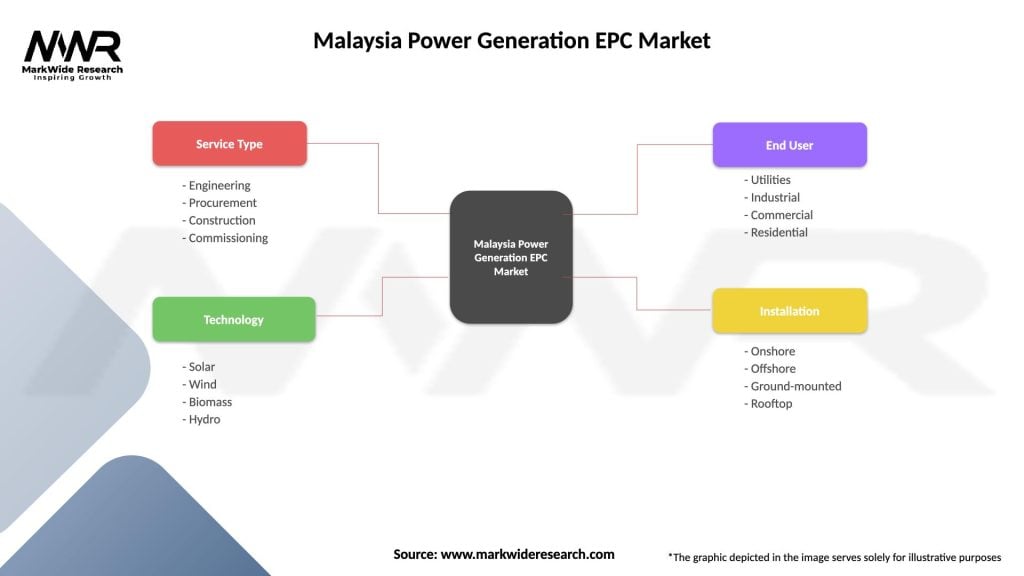

Segmentation

The Malaysia Power Generation EPC market can be segmented based on project type, power source, and end-user industry. Project types include thermal power plants, renewable energy projects, and transmission and distribution infrastructure. Power sources comprise fossil fuels, renewable energy sources, and nuclear power. End-user industries encompass utilities, manufacturing, commercial, and residential sectors.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths

Weaknesses

Opportunities

Threats

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had both short-term and long-term impacts on the Malaysia Power Generation EPC market. In the short term, project delays, disruptions in the supply chain, and labor shortages were witnessed due to movement restrictions and lockdown measures. However, the pandemic has also highlighted the importance of a reliable and resilient power sector, leading to increased investments in renewable energy and grid modernization as part of economic recovery plans.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Malaysia Power Generation EPC market is expected to continue growing in the coming years, driven by increasing power demand, renewable energy targets, and infrastructure development. The government’s commitment to reducing carbon emissions and enhancing energy security will further support the market’s growth. EPC companies that adapt to the changing landscape, invest in renewable energy, and adopt digital technologies are likely to thrive in this evolving market.

Conclusion

The Malaysia Power Generation EPC market presents significant opportunities for companies involved in the engineering, procurement, and construction of power generation projects. Factors such as economic growth, urbanization, renewable energy expansion, and the need to upgrade aging power infrastructure drive the market’s growth. However, challenges related to regulatory complexities, environmental concerns, and project financing must be addressed. By embracing renewable energy, adopting digital technologies, and prioritizing sustainability, EPC companies can position themselves for success in the evolving power generation market in Malaysia.

What is Power Generation EPC?

Power Generation EPC refers to the Engineering, Procurement, and Construction services involved in the development of power generation facilities, including renewable and conventional energy sources.

What are the key players in the Malaysia Power Generation EPC Market?

Key players in the Malaysia Power Generation EPC Market include Tenaga Nasional Berhad, Siemens Malaysia, and YTL Power International, among others.

What are the main drivers of growth in the Malaysia Power Generation EPC Market?

The main drivers of growth in the Malaysia Power Generation EPC Market include increasing energy demand, government initiatives for renewable energy, and investments in infrastructure development.

What challenges does the Malaysia Power Generation EPC Market face?

Challenges in the Malaysia Power Generation EPC Market include regulatory hurdles, competition from alternative energy sources, and the need for skilled labor in the construction sector.

What opportunities exist in the Malaysia Power Generation EPC Market?

Opportunities in the Malaysia Power Generation EPC Market include the expansion of renewable energy projects, advancements in energy storage technologies, and potential partnerships with international firms.

What trends are shaping the Malaysia Power Generation EPC Market?

Trends shaping the Malaysia Power Generation EPC Market include a shift towards sustainable energy solutions, increased adoption of smart grid technologies, and a focus on reducing carbon emissions.

Malaysia Power Generation EPC Market

| Segmentation Details | Description |

|---|---|

| Service Type | Engineering, Procurement, Construction, Commissioning |

| Technology | Solar, Wind, Biomass, Hydro |

| End User | Utilities, Industrial, Commercial, Residential |

| Installation | Onshore, Offshore, Ground-mounted, Rooftop |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Malaysia Power Generation EPC Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at