444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Malaysia oil and gas industry market represents one of Southeast Asia’s most dynamic and strategically important energy sectors, serving as a cornerstone of the nation’s economic development and regional energy security. Malaysia’s petroleum industry has evolved from traditional upstream exploration and production activities to encompass sophisticated downstream processing, petrochemical manufacturing, and emerging renewable energy integration initiatives.

Market dynamics indicate robust growth potential driven by technological advancement, strategic geographical positioning, and government policy support. The industry benefits from Malaysia’s location along major shipping routes and its established infrastructure network connecting key production facilities with international markets. Upstream activities continue to dominate the sector, with significant offshore exploration projects in the South China Sea and Peninsular Malaysia contributing to sustained production levels.

Downstream operations have experienced substantial expansion, with refining capacity growing at approximately 4.2% annually over recent years. The sector encompasses multiple integrated facilities processing crude oil into refined products including gasoline, diesel, jet fuel, and specialized petrochemical feedstocks. Natural gas processing represents another critical component, with liquefied natural gas (LNG) exports contributing significantly to Malaysia’s energy trade balance.

Industry transformation reflects Malaysia’s commitment to sustainable energy development while maintaining its position as a regional energy hub. The integration of digital technologies, enhanced recovery techniques, and environmental compliance measures demonstrates the sector’s adaptation to evolving market demands and regulatory requirements.

The Malaysia oil and gas industry market refers to the comprehensive ecosystem of petroleum-related activities encompassing exploration, production, refining, distribution, and marketing of crude oil, natural gas, and derivative products within Malaysia’s territorial boundaries and exclusive economic zones. This market includes upstream exploration and production operations, midstream transportation and storage infrastructure, and downstream refining and petrochemical manufacturing facilities.

Upstream activities involve geological surveys, seismic studies, drilling operations, and hydrocarbon extraction from both onshore and offshore reserves. Midstream operations encompass pipeline networks, storage terminals, and transportation systems facilitating the movement of crude oil and natural gas from production sites to processing facilities. Downstream processes include crude oil refining, petrochemical production, and the manufacturing of finished petroleum products for domestic consumption and export markets.

The market also incorporates supporting services including engineering, procurement, construction, maintenance, and specialized technical services essential for industry operations. Regulatory frameworks governing exploration licenses, production sharing contracts, environmental compliance, and safety standards form integral components of the market structure.

Malaysia’s oil and gas industry demonstrates resilient performance characterized by strategic diversification, technological innovation, and sustainable development initiatives. The sector maintains its position as a significant contributor to national economic growth while adapting to evolving global energy transition trends and market dynamics.

Key performance indicators reveal sustained production levels with offshore fields contributing approximately 78% of total crude oil output. Natural gas production has shown consistent growth, with unconventional gas resources representing emerging opportunities for future development. Refining capacity utilization remains robust, supporting both domestic energy security and export market participation.

Investment flows continue to support sector expansion, with particular emphasis on enhanced oil recovery technologies, digitalization initiatives, and environmental sustainability projects. The industry’s commitment to reducing carbon intensity while maintaining operational efficiency reflects Malaysia’s broader energy transition strategy.

Market positioning benefits from Malaysia’s strategic location, established infrastructure, skilled workforce, and supportive regulatory environment. These advantages enable the country to serve as a regional energy hub while pursuing opportunities in emerging energy technologies and sustainable development initiatives.

Strategic market insights reveal several critical factors shaping Malaysia’s oil and gas industry development and future growth trajectory:

Primary market drivers propelling Malaysia’s oil and gas industry growth encompass both domestic demand factors and international market opportunities that create sustained momentum for sector development.

Domestic energy demand continues to expand driven by economic growth, industrial development, and population increases. Manufacturing sector expansion, particularly in petrochemicals and energy-intensive industries, generates consistent demand for refined products and natural gas feedstocks. Transportation fuel consumption grows steadily with vehicle fleet expansion and infrastructure development projects.

Export market opportunities provide significant growth drivers as regional energy demand increases across Southeast Asia and broader Asian markets. Malaysia’s established trade relationships and logistical capabilities position the country advantageously to serve growing regional energy needs. LNG export capacity expansion responds to increasing global demand for cleaner-burning natural gas.

Technological advancement drives operational efficiency improvements and enables access to previously uneconomical reserves. Enhanced oil recovery techniques, deepwater drilling capabilities, and digital technologies reduce operational costs while increasing production potential. Innovation adoption supports competitive positioning and operational sustainability.

Government policy support through favorable fiscal frameworks, infrastructure investment, and regulatory stability creates an enabling environment for industry expansion. Strategic development programs and international cooperation initiatives facilitate market access and technology transfer opportunities.

Market restraints facing Malaysia’s oil and gas industry include structural challenges, regulatory complexities, and external market pressures that may limit growth potential or operational efficiency.

Mature field challenges present ongoing concerns as many of Malaysia’s established oil and gas fields experience natural production decline rates. Maintaining production levels requires significant investment in enhanced recovery technologies and exploration of more challenging reserves. Depletion rates in conventional fields necessitate continuous exploration and development activities to sustain long-term production capacity.

Environmental regulations impose increasing compliance costs and operational constraints as Malaysia strengthens environmental protection measures and carbon reduction commitments. Emission standards and waste management requirements demand substantial investment in environmental control technologies and monitoring systems.

Global market volatility affects revenue stability and investment planning as international oil and gas prices fluctuate based on geopolitical events, supply-demand dynamics, and economic conditions. Price uncertainty complicates long-term project financing and strategic planning processes.

Competition intensity from regional energy producers and alternative energy sources creates market share pressures and margin compression challenges. Market competition requires continuous improvement in operational efficiency and cost competitiveness to maintain market position.

Significant market opportunities emerge from technological innovation, regional market expansion, and energy transition trends that create new avenues for growth and development within Malaysia’s oil and gas sector.

Deepwater exploration presents substantial opportunities as advanced drilling technologies enable access to previously unreachable offshore reserves. Malaysia’s extensive continental shelf and deepwater areas offer potential for major discoveries that could significantly expand the country’s hydrocarbon resource base. Exploration success in deepwater areas could transform Malaysia’s long-term production outlook.

Natural gas monetization opportunities expand through LNG export capacity development, domestic gas-to-power projects, and petrochemical feedstock applications. Growing regional demand for cleaner energy sources positions Malaysia’s natural gas resources advantageously for both domestic utilization and export market development. Gas infrastructure expansion supports multiple monetization pathways.

Digital transformation initiatives offer opportunities for operational optimization, cost reduction, and safety enhancement through artificial intelligence, Internet of Things applications, and advanced analytics. Technology adoption can significantly improve exploration success rates, production efficiency, and maintenance effectiveness while reducing operational risks.

Regional energy hub development leverages Malaysia’s strategic location and infrastructure capabilities to serve growing Asian energy markets. Hub services including trading, storage, blending, and distribution create value-added revenue streams beyond traditional production activities.

Market dynamics within Malaysia’s oil and gas industry reflect complex interactions between supply and demand factors, regulatory influences, technological developments, and global energy market trends that shape sector performance and strategic direction.

Supply-side dynamics are influenced by production capacity utilization, reserve replacement rates, and exploration success in both conventional and unconventional resources. Malaysia’s production profile demonstrates resilience through diversified asset portfolios and strategic field development programs. Production optimization initiatives have achieved efficiency improvements of approximately 12% annually through enhanced recovery techniques and operational excellence programs.

Demand-side factors encompass domestic consumption patterns, export market requirements, and seasonal variations in energy utilization. Industrial demand growth, particularly from petrochemical and manufacturing sectors, provides stable consumption base while transportation fuel demand shows steady expansion. Export demand from regional markets creates additional growth opportunities and revenue diversification.

Regulatory dynamics shape market operations through licensing frameworks, environmental standards, fiscal policies, and international trade agreements. Malaysia’s regulatory environment balances industry development objectives with environmental protection and revenue optimization goals. Policy stability supports long-term investment planning and strategic development initiatives.

Competitive dynamics reflect both domestic market competition and international market positioning challenges. Malaysian companies compete effectively through operational efficiency, technological capability, and strategic partnerships that enhance market access and operational capabilities.

Comprehensive research methodology employed in analyzing Malaysia’s oil and gas industry market incorporates multiple data sources, analytical frameworks, and validation processes to ensure accuracy and reliability of market insights and projections.

Primary research activities include structured interviews with industry executives, government officials, and technical specialists across upstream, midstream, and downstream segments. Field surveys and facility visits provide firsthand operational insights and performance data validation. Expert consultations with petroleum engineers, economists, and policy analysts contribute specialized knowledge and market perspective.

Secondary research encompasses analysis of government publications, industry reports, financial statements, and regulatory filings from major market participants. Data compilation from multiple authoritative sources ensures comprehensive market coverage and cross-validation of key findings. Historical trend analysis and statistical modeling support projection accuracy and scenario development.

Analytical frameworks include quantitative modeling of production trends, demand forecasting, and competitive positioning analysis. Market segmentation analysis examines performance across different industry segments, geographical regions, and product categories. Financial analysis evaluates investment flows, profitability trends, and capital allocation patterns.

Validation processes involve cross-referencing multiple data sources, expert review panels, and sensitivity analysis to ensure research reliability and accuracy. Quality assurance protocols maintain consistency and objectivity throughout the research process.

Regional analysis of Malaysia’s oil and gas industry reveals distinct geographical patterns in resource distribution, infrastructure development, and market dynamics across different states and offshore areas.

Peninsular Malaysia hosts significant onshore and nearshore production facilities, with Terengganu and Kelantan states contributing approximately 35% of total onshore production. The region benefits from established infrastructure networks, proximity to major population centers, and integrated refining and petrochemical facilities. Downstream activities concentrate in industrial corridors that leverage transportation networks and skilled workforce availability.

East Malaysia encompasses Sabah and Sarawak states, which contribute substantially to both oil and gas production through extensive offshore operations. Sarawak’s offshore fields account for approximately 42% of Malaysia’s natural gas production, while Sabah’s operations focus on both crude oil and natural gas extraction. The region’s deepwater potential offers significant opportunities for future exploration and development.

Offshore areas represent Malaysia’s most productive hydrocarbon regions, with operations extending across multiple basins including the Malay Basin, Sarawak Basin, and Sabah Basin. Deepwater exploration activities continue to expand operational boundaries and access previously untapped reserves. Advanced offshore infrastructure supports complex production operations and efficient resource transportation.

Infrastructure distribution reflects regional production patterns with pipeline networks, processing facilities, and export terminals strategically located to optimize operational efficiency and market access. Regional specialization enables focused development of specific capabilities and competitive advantages.

Malaysia’s oil and gas industry features a competitive landscape characterized by both national champions and international operators, creating a dynamic environment that drives innovation, efficiency, and market development.

Competitive dynamics emphasize operational excellence, technological innovation, and strategic partnerships that enhance market positioning and operational capabilities. Market leadership reflects companies’ ability to execute complex projects, maintain operational efficiency, and adapt to evolving market conditions.

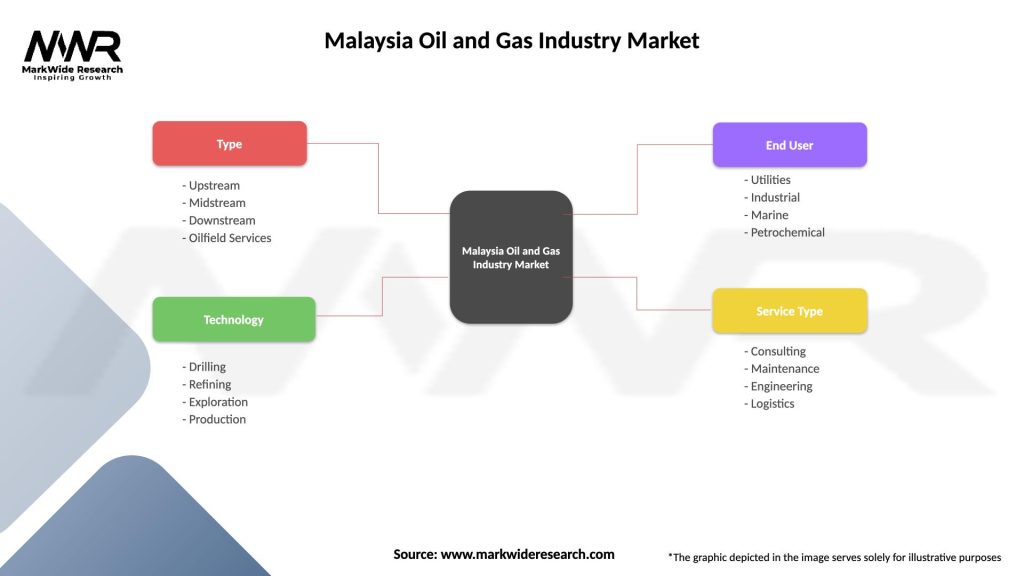

Market segmentation of Malaysia’s oil and gas industry provides detailed analysis of different operational categories, product types, and application areas that comprise the comprehensive industry ecosystem.

By Operational Segment:

By Product Type:

By Application Area:

Category-wise analysis reveals distinct performance patterns, growth trajectories, and strategic considerations across different segments of Malaysia’s oil and gas industry.

Upstream Category Performance: Exploration and production activities demonstrate resilient performance with offshore operations contributing the majority of hydrocarbon output. Enhanced recovery techniques have improved production efficiency by approximately 15% over recent years, while deepwater exploration continues to expand operational boundaries. Reserve replacement activities maintain long-term production sustainability through strategic exploration programs and advanced reservoir management techniques.

Midstream Infrastructure: Transportation and storage infrastructure supports efficient hydrocarbon movement from production sites to processing facilities and export terminals. Pipeline utilization rates remain high at approximately 82% average capacity, reflecting strong demand and operational efficiency. Storage capacity expansion projects enhance supply chain flexibility and market responsiveness.

Downstream Processing: Refining operations maintain competitive performance through operational optimization and product mix enhancement. Capacity utilization rates average approximately 85% across major refineries, supporting both domestic market supply and export opportunities. Petrochemical integration creates value-added revenue streams and operational synergies.

Service Sector Performance: Supporting services including engineering, construction, and maintenance demonstrate growth aligned with overall industry expansion. Local content participation has increased to approximately 68% in major projects, reflecting successful capability development and technology transfer initiatives.

Industry participants and stakeholders in Malaysia’s oil and gas sector realize multiple strategic benefits through participation in this dynamic and well-established market ecosystem.

Operational Benefits:

Strategic Benefits:

Financial Benefits:

Comprehensive SWOT analysis examines the strategic position of Malaysia’s oil and gas industry through evaluation of internal strengths and weaknesses alongside external opportunities and threats.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping Malaysia’s oil and gas industry reflect technological advancement, sustainability initiatives, and evolving market dynamics that influence strategic direction and operational priorities.

Digital Transformation Acceleration: Industry adoption of artificial intelligence, machine learning, and Internet of Things technologies drives operational efficiency improvements and predictive maintenance capabilities. Digital initiatives have achieved cost reductions of approximately 8-12% in operational expenses while enhancing safety performance and environmental compliance. Data analytics applications optimize exploration success rates and production performance.

Sustainability Integration: Environmental stewardship initiatives encompass carbon footprint reduction, waste minimization, and ecosystem protection measures. Carbon intensity reduction programs target emission reductions while maintaining operational efficiency. Circular economy principles guide waste management and resource utilization strategies.

Enhanced Recovery Focus: Advanced recovery techniques including chemical flooding, thermal recovery, and gas injection methods extend field life and improve recovery factors. Technology deployment in mature fields demonstrates significant production enhancement potential and economic viability.

Regional Integration Expansion: Cross-border pipeline projects, joint exploration initiatives, and integrated supply chain development strengthen regional energy connectivity. Collaboration frameworks facilitate technology sharing and market access optimization across Southeast Asian markets.

Energy Transition Adaptation: Industry strategies incorporate natural gas as a transition fuel while exploring opportunities in hydrogen production, carbon capture, and renewable energy integration. Portfolio diversification balances traditional hydrocarbon operations with emerging energy technologies.

Recent industry developments demonstrate Malaysia’s oil and gas sector’s dynamic evolution through strategic investments, technological advancement, and market expansion initiatives that strengthen competitive positioning and operational capabilities.

Major Project Developments: Several significant upstream projects have commenced operations, including deepwater exploration programs and enhanced recovery initiatives in mature fields. Infrastructure expansion projects encompass pipeline network extensions, processing facility upgrades, and export terminal capacity enhancements that support increased production and market access.

Technology Implementation: Advanced exploration technologies including 3D seismic imaging, horizontal drilling, and hydraulic fracturing techniques enable access to previously uneconomical reserves. Digital transformation initiatives incorporate artificial intelligence and machine learning applications that optimize operational performance and reduce costs.

Strategic Partnerships: International collaboration agreements facilitate technology transfer, joint exploration programs, and market development initiatives. Partnership arrangements leverage complementary capabilities and resources to enhance project execution and risk management.

Regulatory Updates: Government policy initiatives include fiscal incentive programs, environmental compliance frameworks, and international cooperation agreements that support industry development. Regulatory modernization efforts streamline approval processes while maintaining safety and environmental standards.

Market Expansion: Export market development initiatives target growing regional demand while domestic market programs support energy security and industrial development objectives. Commercial agreements establish long-term supply relationships and market access arrangements.

Strategic analyst recommendations for Malaysia’s oil and gas industry focus on optimizing competitive positioning, operational efficiency, and sustainable development while addressing market challenges and capitalizing on emerging opportunities.

Operational Excellence Priorities: Companies should prioritize digital transformation initiatives that enhance operational efficiency, reduce costs, and improve safety performance. Technology adoption in exploration, production, and processing operations can deliver significant competitive advantages and operational improvements. Predictive maintenance programs and advanced analytics applications optimize asset utilization and reduce unplanned downtime.

Portfolio Optimization: Strategic focus on high-return assets and efficient capital allocation enhances profitability and competitive positioning. Asset portfolio evaluation should consider production potential, operational costs, and market access advantages. Divestment strategies for non-core assets can improve overall portfolio performance and resource allocation efficiency.

Sustainability Integration: Environmental stewardship initiatives and carbon reduction programs align with global energy transition trends while maintaining operational competitiveness. Sustainability metrics should be integrated into operational planning and performance evaluation processes. Stakeholder engagement on environmental issues enhances social license to operate and regulatory compliance.

Market Development: Regional market expansion strategies leverage Malaysia’s strategic location and infrastructure advantages to access growing Asian energy demand. Export market development requires long-term supply agreements and strategic partnerships that ensure market access and price stability.

Innovation Investment: Research and development programs focusing on enhanced recovery techniques, digital technologies, and environmental solutions support long-term competitiveness and operational sustainability. Technology partnerships with international companies and research institutions accelerate innovation adoption and capability development.

Future outlook for Malaysia’s oil and gas industry indicates continued growth potential supported by strategic positioning, technological advancement, and evolving market dynamics that create opportunities for sustainable development and competitive advantage.

Production Projections: Industry analysis by MarkWide Research suggests sustained production levels through enhanced recovery implementation and deepwater exploration success. Natural gas production is projected to grow at approximately 3.5% annually driven by domestic demand expansion and export market development. Crude oil production stabilization through advanced recovery techniques and new field development maintains Malaysia’s energy security and export capabilities.

Market Expansion Potential: Regional energy demand growth creates substantial opportunities for Malaysian oil and gas exports, particularly in natural gas and refined products. LNG export capacity expansion aligns with growing Asian demand for cleaner energy sources. Petrochemical integration offers value-added revenue streams and operational synergies.

Technology Integration: Digital transformation and advanced recovery techniques are expected to deliver operational efficiency improvements of approximately 10-15% over the next five years. Artificial intelligence and machine learning applications will optimize exploration success rates and production performance while reducing operational costs.

Sustainability Evolution: Industry adaptation to environmental regulations and carbon reduction commitments will drive innovation in clean technologies and operational practices. Energy transition strategies incorporating natural gas as a bridge fuel and renewable energy integration support long-term sustainability objectives.

Investment Outlook: Continued investment in infrastructure development, technology advancement, and market expansion supports industry growth and competitive positioning. Capital allocation priorities focus on high-return projects and sustainable development initiatives that enhance long-term value creation.

Malaysia’s oil and gas industry market represents a dynamic and strategically important sector that continues to evolve through technological innovation, operational excellence, and sustainable development initiatives. The industry’s strong foundation built on diversified resource base, established infrastructure, and skilled workforce positions Malaysia advantageously in the regional energy landscape.

Market fundamentals remain robust despite global challenges, with sustained production levels, growing regional demand, and strategic government support creating favorable conditions for continued industry development. The sector’s ability to adapt to changing market conditions while maintaining operational efficiency demonstrates resilience and strategic flexibility.

Future success will depend on continued investment in technology advancement, sustainability initiatives, and market development strategies that enhance competitive positioning and operational performance. The industry’s commitment to environmental stewardship and energy transition adaptation aligns with global trends while preserving Malaysia’s role as a regional energy hub. Strategic positioning through operational excellence, technological innovation, and sustainable development practices will determine long-term success in an evolving global energy market.

What is Oil and Gas?

Oil and gas refer to natural resources that are extracted from the earth and used for energy production, transportation, and various industrial applications. The oil and gas sector plays a crucial role in the global economy, providing fuel for vehicles, heating, and electricity generation.

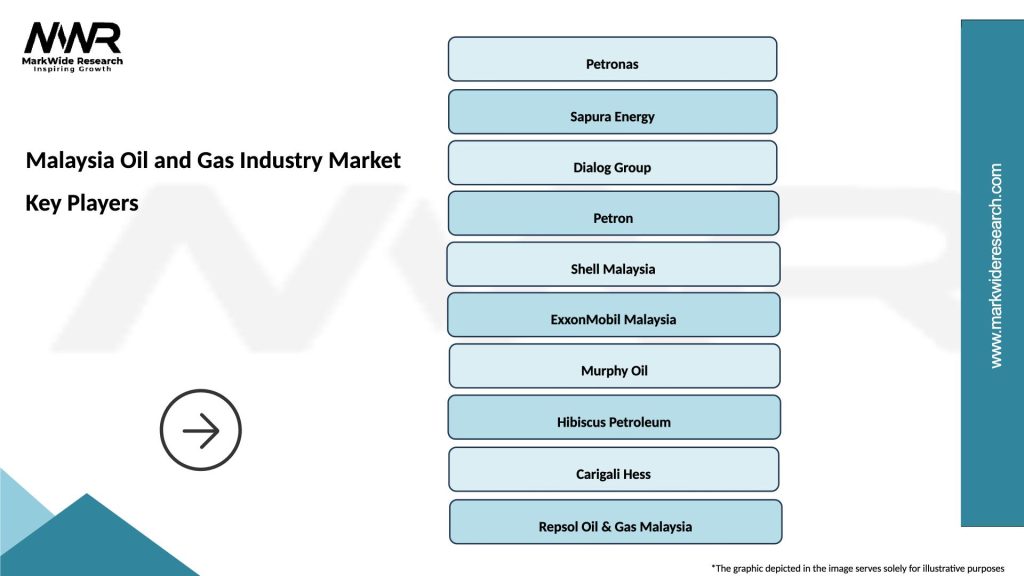

What are the key players in the Malaysia Oil and Gas Industry Market?

Key players in the Malaysia Oil and Gas Industry Market include Petronas, Shell Malaysia, and ExxonMobil. These companies are involved in exploration, production, and distribution of oil and gas, contributing significantly to the country’s energy supply and economic growth.

What are the growth factors driving the Malaysia Oil and Gas Industry Market?

The growth of the Malaysia Oil and Gas Industry Market is driven by increasing energy demand, technological advancements in extraction methods, and the country’s rich natural resources. Additionally, investments in infrastructure and exploration activities are enhancing production capabilities.

What challenges does the Malaysia Oil and Gas Industry Market face?

The Malaysia Oil and Gas Industry Market faces challenges such as fluctuating oil prices, regulatory changes, and environmental concerns. These factors can impact profitability and operational efficiency for companies in the sector.

What opportunities exist in the Malaysia Oil and Gas Industry Market?

Opportunities in the Malaysia Oil and Gas Industry Market include the development of renewable energy projects, enhanced oil recovery techniques, and partnerships with international firms. These avenues can help diversify energy sources and improve sustainability.

What trends are shaping the Malaysia Oil and Gas Industry Market?

Trends shaping the Malaysia Oil and Gas Industry Market include the shift towards digitalization, increased focus on sustainability, and the adoption of advanced technologies such as artificial intelligence and automation. These trends are transforming operations and improving efficiency in the sector.

Malaysia Oil and Gas Industry Market

| Segmentation Details | Description |

|---|---|

| Type | Upstream, Midstream, Downstream, Oilfield Services |

| Technology | Drilling, Refining, Exploration, Production |

| End User | Utilities, Industrial, Marine, Petrochemical |

| Service Type | Consulting, Maintenance, Engineering, Logistics |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Malaysia Oil and Gas Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at