444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview: The Malaysia Life and Annuity Insurance Market: Navigating Financial Security

In the vibrant landscape of Malaysia, life and annuity insurance have emerged as critical pillars of financial security. This dynamic market is a testament to the country’s growing economy and the increasing awareness among its population about the importance of safeguarding their future. The Malaysia Life and Annuity Insurance Market is a multifaceted domain that not only offers protection but also serves as an investment avenue. This comprehensive exploration delves into the intricacies of the market, shedding light on its meaning, executive summary, key insights, drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, segmentation, industry benefits, SWOT analysis, key trends, the impact of Covid-19, industry developments, analyst suggestions, future outlook, and a thoughtful conclusion.

Meaning: Life and Annuity Insurance: Securing Tomorrows, Today

Life and annuity insurance, in essence, offer peace of mind to individuals and their families by providing financial protection against the uncertainties of life. These insurance products are designed to offer a safety net that ensures beneficiaries receive financial support in the event of the policyholder’s demise or when the policy matures. Life insurance, specifically, serves as a way to provide for dependents, cover outstanding debts, and even act as an investment tool. Annuity insurance, on the other hand, guarantees a regular stream of income for the policyholder during their retirement years. In the Malaysian context, these insurance offerings play a pivotal role in nurturing a culture of financial prudence.

Executive Summary: Safeguarding Lives, Ensuring Legacies: A Glimpse into Malaysia’s Insurance Market

The executive summary of the Malaysia Life and Annuity Insurance Market underscores the significance of this sector in the country’s economic landscape. It encapsulates the market’s growth trajectory, the key players driving innovation, and the evolving preferences of consumers. By understanding the executive summary, stakeholders gain a snapshot of the current state of the market and the opportunities that lie ahead.

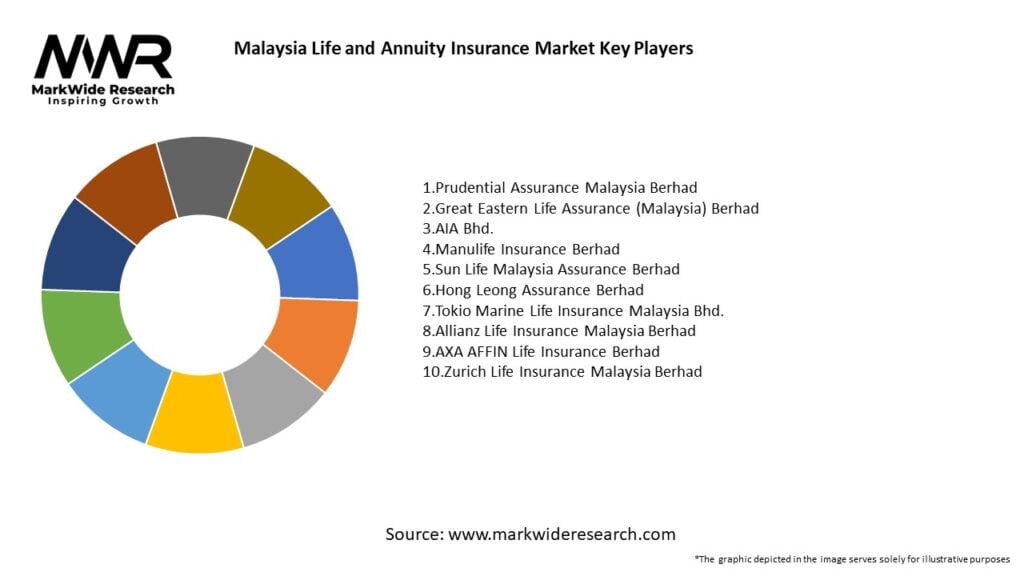

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

Regional Analysis

The Malaysia Life and Annuity Insurance Market is primarily driven by urban centers such as Kuala Lumpur, Penang, and Johor Bahru, where higher income levels and greater access to insurance products are prevalent. The market is also expanding into rural areas, supported by government initiatives to increase insurance penetration.

Malaysia’s insurance market benefits from its strategic position in Southeast Asia, where it is an attractive destination for both local and international insurers. The market is expected to see strong growth in both urban and rural regions as consumers become more financially aware and demand more comprehensive insurance products.

Competitive Landscape

Leading Companies in the Malaysia Life and Annuity Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

By Type of Product

By Distribution Channel

By End-User

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has accelerated the adoption of digital insurance solutions, as consumers seek to manage their life and annuity insurance products online. The pandemic has also highlighted the importance of financial planning, leading to an increased focus on life and annuity insurance products that provide long-term security and stability.

Key Industry Developments

Analyst Suggestions

Future Outlook:

The future outlook of the Malaysia Life and Annuity Insurance Market is promising, characterized by sustained growth, innovative offerings, and enhanced customer experiences. Technological advancements, changing demographics, and evolving consumer behaviors will continue to influence the industry’s trajectory. By anticipating these trends and adapting proactively, stakeholders can steer the market toward a prosperous future.

Conclusion:

In conclusion, the Malaysia Life and Annuity Insurance Market is a vibrant tapestry of financial security, innovation, and growth. As consumers recognize the paramount importance of safeguarding their future and loved ones, the insurance industry continues to evolve, offering tailored solutions that address diverse needs. This comprehensive exploration has unveiled the meaning, dynamics, drivers, challenges, and opportunities that characterize this industry. By embracing innovation, fostering collaboration, and staying attuned to market dynamics, stakeholders can not only thrive in this ever-changing landscape but also play a pivotal role in securing the financial futures of individuals and families across Malaysia.

What is Life and Annuity Insurance?

Life and Annuity Insurance refers to financial products that provide protection against the risk of death and offer a steady income stream during retirement. These products are essential for financial planning and risk management, catering to individuals and families seeking security and investment growth.

What are the key players in the Malaysia Life and Annuity Insurance Market?

Key players in the Malaysia Life and Annuity Insurance Market include AIA Group, Prudential Assurance Malaysia, and Great Eastern Life, among others. These companies offer a range of products tailored to meet the diverse needs of consumers in the region.

What are the growth factors driving the Malaysia Life and Annuity Insurance Market?

The growth of the Malaysia Life and Annuity Insurance Market is driven by increasing awareness of financial planning, a growing middle class, and the rising demand for retirement solutions. Additionally, government initiatives promoting insurance literacy contribute to market expansion.

What challenges does the Malaysia Life and Annuity Insurance Market face?

The Malaysia Life and Annuity Insurance Market faces challenges such as regulatory compliance, competition from alternative investment products, and consumer skepticism regarding insurance products. These factors can hinder market penetration and growth.

What opportunities exist in the Malaysia Life and Annuity Insurance Market?

Opportunities in the Malaysia Life and Annuity Insurance Market include the introduction of innovative products, digital transformation in service delivery, and expanding distribution channels. These factors can enhance customer engagement and broaden market reach.

What trends are shaping the Malaysia Life and Annuity Insurance Market?

Trends shaping the Malaysia Life and Annuity Insurance Market include the increasing adoption of technology for customer service, personalized insurance solutions, and a focus on sustainability in product offerings. These trends reflect changing consumer preferences and market dynamics.

Malaysia Life and Annuity Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Term Life, Whole Life, Endowment, Universal Life |

| Distribution Channel | Direct Sales, Brokers, Banks, Online Platforms |

| Customer Type | Individual, Corporate, Group, Affinity |

| Policy Duration | Short-term, Medium-term, Long-term, Renewable |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Malaysia Life and Annuity Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at