444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Malaysia diabetes medicine industry market represents a critical healthcare sector experiencing substantial transformation driven by rising diabetes prevalence and advancing pharmaceutical innovations. Malaysia’s healthcare landscape has witnessed significant evolution in diabetes management, with the market demonstrating robust growth patterns across multiple therapeutic categories. The industry encompasses various treatment modalities including insulin therapies, oral antidiabetic drugs, and emerging biotechnology solutions designed to address the growing diabetic population.

Market dynamics indicate that Malaysia’s diabetes medicine sector is expanding at a compound annual growth rate of 8.2%, reflecting the urgent need for comprehensive diabetes management solutions. The market’s growth trajectory is supported by increasing healthcare awareness, government initiatives promoting diabetes prevention, and the introduction of innovative therapeutic options. Healthcare providers across Malaysia are increasingly adopting advanced diabetes treatment protocols, contributing to market expansion and improved patient outcomes.

Regional healthcare infrastructure development has significantly enhanced diabetes medicine accessibility, with urban centers like Kuala Lumpur and Penang leading adoption rates. The market encompasses both prescription medications and over-the-counter diabetes management products, creating a comprehensive ecosystem for diabetic care. Pharmaceutical companies are investing heavily in research and development to introduce next-generation diabetes treatments tailored to Malaysian patient demographics and healthcare requirements.

The Malaysia diabetes medicine industry market refers to the comprehensive sector encompassing all pharmaceutical products, medical devices, and therapeutic solutions specifically designed for diabetes prevention, management, and treatment within Malaysia’s healthcare system. This market includes insulin products, oral hypoglycemic agents, glucose monitoring devices, and emerging biotechnology treatments that address various forms of diabetes mellitus affecting the Malaysian population.

Industry scope extends beyond traditional pharmaceutical products to include digital health solutions, continuous glucose monitoring systems, and integrated diabetes management platforms. The market serves both Type 1 and Type 2 diabetes patients, representing different therapeutic approaches and treatment protocols. Healthcare stakeholders within this market include pharmaceutical manufacturers, medical device companies, healthcare providers, and government health agencies working collaboratively to address Malaysia’s diabetes epidemic.

Market definition encompasses the entire value chain from research and development through manufacturing, distribution, and patient care delivery. The industry operates within Malaysia’s regulatory framework, ensuring compliance with National Pharmaceutical Regulatory Agency standards while meeting international quality benchmarks for diabetes treatment products.

Malaysia’s diabetes medicine market demonstrates exceptional growth potential driven by demographic shifts, lifestyle changes, and advancing medical technologies. The market’s expansion reflects Malaysia’s commitment to addressing the growing diabetes burden through comprehensive healthcare solutions and innovative treatment approaches. Key market drivers include rising diabetes prevalence, aging population demographics, and increasing healthcare expenditure allocation toward chronic disease management.

Market segmentation reveals diverse opportunities across insulin therapies, oral antidiabetic medications, and emerging biotechnology solutions. The industry benefits from strong government support through healthcare policy initiatives and public health programs promoting diabetes awareness and prevention. Competitive landscape features both international pharmaceutical giants and local healthcare companies developing tailored solutions for Malaysian patients.

Strategic market positioning indicates significant opportunities for growth, with diabetes medication adoption rates increasing by 12.5% annually across urban and rural healthcare facilities. The market’s future outlook remains positive, supported by continuous innovation in diabetes treatment technologies and expanding healthcare infrastructure throughout Malaysia.

Market intelligence reveals several critical insights shaping Malaysia’s diabetes medicine industry landscape. The following key insights provide comprehensive understanding of market dynamics and growth opportunities:

Primary market drivers propelling Malaysia’s diabetes medicine industry growth encompass demographic, lifestyle, and healthcare infrastructure factors. The rising prevalence of diabetes across Malaysia creates sustained demand for comprehensive treatment solutions, with diabetes cases increasing at unprecedented rates due to urbanization and dietary pattern changes.

Government healthcare initiatives serve as significant market catalysts, including national diabetes prevention programs and healthcare policy reforms promoting chronic disease management. The Ministry of Health Malaysia has implemented comprehensive diabetes care guidelines that standardize treatment protocols and ensure consistent medication access across healthcare facilities. These initiatives drive market expansion by creating structured demand for diabetes medications and related healthcare products.

Technological advancement in diabetes treatment represents another crucial driver, with innovative drug delivery systems and biotechnology solutions enhancing treatment efficacy. Healthcare digitization initiatives are integrating diabetes management platforms with traditional treatment approaches, creating new market opportunities for technology-enabled healthcare solutions.

Economic factors including rising disposable income and expanding health insurance coverage enable broader access to premium diabetes treatments. The growing awareness of diabetes complications and long-term health impacts motivates patients to seek comprehensive treatment solutions, driving demand for advanced therapeutic options and preventive care products.

Market challenges within Malaysia’s diabetes medicine industry include regulatory complexities, cost constraints, and healthcare infrastructure limitations. Regulatory approval processes for new diabetes medications can be lengthy and complex, potentially delaying market entry for innovative treatments and limiting patient access to cutting-edge therapeutic options.

Cost considerations represent significant barriers for certain patient segments, particularly regarding premium insulin products and advanced diabetes management technologies. While government healthcare programs provide basic diabetes medication coverage, out-of-pocket expenses for specialized treatments can limit accessibility for lower-income populations, creating market segmentation challenges.

Healthcare infrastructure disparities between urban and rural areas create uneven market development, with rural regions experiencing limited access to specialized diabetes care and advanced treatment options. Healthcare provider shortages in certain regions further constrain market growth by limiting patient access to comprehensive diabetes management services.

Generic competition pressures pricing strategies for branded diabetes medications, potentially impacting profit margins for pharmaceutical companies operating in Malaysia. The market’s price-sensitive nature requires careful balance between affordability and innovation investment, creating strategic challenges for market participants seeking sustainable growth.

Emerging opportunities within Malaysia’s diabetes medicine market encompass technological innovation, market expansion, and strategic partnerships. The growing adoption of digital health solutions creates opportunities for integrated diabetes management platforms that combine medication management with lifestyle monitoring and healthcare provider connectivity.

Rural market expansion represents substantial untapped potential, with government initiatives aimed at improving healthcare access in underserved regions. Telemedicine integration and mobile health applications offer innovative approaches to reach rural diabetic patients, creating new distribution channels and service delivery models for diabetes medicine companies.

Preventive healthcare trends present opportunities for companies developing early intervention solutions and lifestyle management products. The increasing focus on diabetes prevention rather than solely treatment creates market demand for nutritional supplements, monitoring devices, and educational healthcare products targeting pre-diabetic populations.

Strategic partnerships with healthcare providers, technology companies, and government agencies offer collaborative opportunities for market expansion and innovation development. Public-private partnerships in diabetes care delivery can create sustainable business models while addressing Malaysia’s public health objectives, generating mutual benefits for industry participants and healthcare outcomes.

Market dynamics within Malaysia’s diabetes medicine industry reflect complex interactions between healthcare demand, regulatory environment, and competitive pressures. The market demonstrates cyclical patterns influenced by government healthcare budget allocations, seasonal health awareness campaigns, and pharmaceutical product launch cycles that create varying demand patterns throughout the year.

Supply chain dynamics play crucial roles in market stability, with pharmaceutical companies maintaining strategic inventory levels to ensure consistent medication availability. Distribution networks spanning urban and rural healthcare facilities require sophisticated logistics management to maintain product quality and accessibility across Malaysia’s diverse geographic landscape.

Competitive dynamics feature both price competition and innovation-based differentiation, with companies pursuing various strategies to capture market share. Market consolidation trends are emerging as larger pharmaceutical companies acquire specialized diabetes treatment developers, creating more comprehensive product portfolios and enhanced market coverage capabilities.

Regulatory dynamics continue evolving with updated healthcare policies and international standard alignments, requiring market participants to maintain compliance flexibility while pursuing growth objectives. According to MarkWide Research analysis, these dynamic factors contribute to market resilience and sustained growth potential despite periodic challenges and regulatory adjustments.

Research methodology employed for analyzing Malaysia’s diabetes medicine industry market incorporates comprehensive primary and secondary research approaches designed to provide accurate market intelligence and strategic insights. Primary research components include structured interviews with healthcare providers, pharmaceutical industry executives, and diabetes patients to gather firsthand market perspectives and treatment preference data.

Secondary research encompasses analysis of government healthcare statistics, pharmaceutical industry reports, and academic medical research publications relevant to diabetes treatment in Malaysia. Data collection methods utilize both quantitative surveys and qualitative focus group discussions to capture diverse stakeholder viewpoints and market trend indicators.

Market analysis techniques include competitive benchmarking, regulatory impact assessment, and demographic trend analysis to identify growth opportunities and potential market challenges. Statistical modeling approaches incorporate historical market data with current trend indicators to project future market development scenarios and growth trajectories.

Validation processes ensure research accuracy through cross-referencing multiple data sources and expert consultation with healthcare industry specialists. The methodology maintains objectivity while providing actionable insights for market participants seeking strategic guidance in Malaysia’s diabetes medicine industry landscape.

Regional market analysis reveals significant variations in diabetes medicine adoption and healthcare infrastructure across Malaysia’s diverse geographic regions. Peninsular Malaysia demonstrates the highest market concentration, accounting for approximately 75% of total diabetes medicine consumption, driven by urban population density and advanced healthcare facility networks in major cities.

Kuala Lumpur and Selangor represent the most mature diabetes medicine markets, featuring comprehensive healthcare infrastructure and high adoption rates of advanced treatment options. These regions demonstrate premium product preference with patients showing willingness to invest in innovative diabetes management solutions and continuous glucose monitoring technologies.

East Malaysia including Sabah and Sarawak presents emerging market opportunities with growing healthcare infrastructure development and increasing diabetes awareness programs. Rural healthcare initiatives in these regions are expanding access to essential diabetes medications, creating new distribution opportunities for pharmaceutical companies targeting underserved populations.

Northern and Southern regions of Peninsular Malaysia show balanced market development with steady growth in diabetes medicine adoption. Healthcare accessibility improvements in these areas contribute to market expansion, with government programs ensuring consistent medication availability across different socioeconomic segments and geographic locations.

Competitive landscape within Malaysia’s diabetes medicine industry features diverse market participants ranging from multinational pharmaceutical corporations to local healthcare companies. The market structure demonstrates healthy competition across different therapeutic categories and price segments, promoting innovation and accessibility improvements.

Leading market participants include:

Market competition strategies encompass product differentiation, pricing optimization, and strategic partnerships with healthcare providers. Innovation investment remains crucial for maintaining competitive advantage, with companies pursuing research and development initiatives targeting Malaysian patient demographics and healthcare requirements.

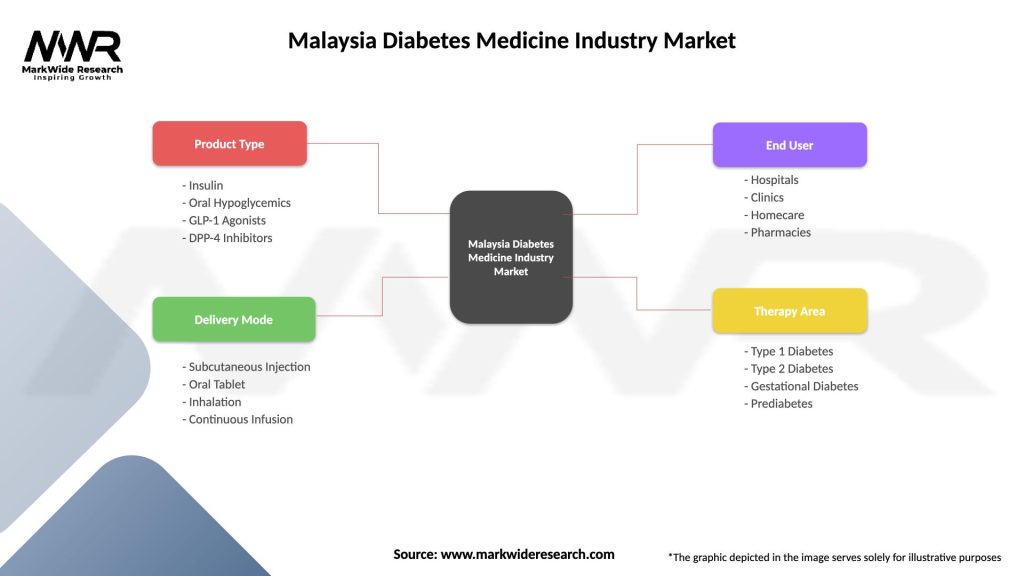

Market segmentation within Malaysia’s diabetes medicine industry encompasses multiple classification approaches including product type, application, distribution channel, and patient demographics. Product-based segmentation represents the primary categorization method, dividing the market into distinct therapeutic categories serving different diabetes management requirements.

By Product Type:

By Application:

By Distribution Channel:

Insulin therapy category represents the largest segment within Malaysia’s diabetes medicine market, accounting for approximately 45% of total market share due to essential treatment requirements for Type 1 diabetes patients and advanced Type 2 diabetes cases. Long-acting insulin formulations demonstrate particularly strong growth, driven by improved patient compliance and better glycemic control outcomes.

Oral antidiabetic medications constitute the second-largest category, with metformin-based treatments maintaining dominant market position due to cost-effectiveness and proven efficacy. Newer medication classes including SGLT-2 inhibitors and DPP-4 inhibitors are gaining market traction among patients seeking advanced treatment options with reduced side effect profiles.

Combination therapy products represent the fastest-growing category, with adoption rates increasing by 15.3% annually as healthcare providers recognize benefits of simplified dosing regimens and improved patient adherence. These products address multiple diabetes management aspects simultaneously, offering convenience and enhanced treatment outcomes.

Injectable non-insulin treatments including GLP-1 receptor agonists demonstrate emerging growth potential, particularly among patients seeking weight management benefits alongside glycemic control. Premium pricing for these advanced treatments creates opportunities for pharmaceutical companies while requiring careful market positioning to ensure accessibility across different patient segments.

Industry participants within Malaysia’s diabetes medicine market benefit from multiple strategic advantages including market stability, growth potential, and supportive regulatory environment. Pharmaceutical companies enjoy sustained demand driven by chronic disease nature and expanding patient populations requiring long-term treatment management.

Healthcare providers benefit from comprehensive treatment options enabling personalized diabetes care approaches tailored to individual patient requirements. Clinical outcomes improvement through advanced diabetes medications enhances healthcare provider reputation and patient satisfaction, creating positive feedback loops for continued market growth.

Patients receive significant benefits through improved treatment accessibility, diverse therapeutic options, and enhanced quality of life outcomes. Government healthcare programs ensure essential medication availability while private healthcare options provide access to premium treatment alternatives for patients seeking advanced diabetes management solutions.

Economic stakeholders including healthcare insurers and employers benefit from reduced long-term healthcare costs through effective diabetes management and complication prevention. MWR data indicates that comprehensive diabetes treatment programs generate positive return on investment through reduced hospitalization rates and improved workforce productivity outcomes.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend reshaping Malaysia’s diabetes medicine industry, with digital health platforms integrating medication management, glucose monitoring, and healthcare provider communication. Mobile applications for diabetes management are experiencing rapid adoption, with usage rates increasing by 28% annually among tech-savvy patients seeking comprehensive care solutions.

Personalized medicine approaches are gaining momentum, with pharmaceutical companies developing targeted therapies based on genetic markers and individual patient characteristics. Precision diabetes care enables optimized treatment selection and dosing strategies, improving clinical outcomes while reducing adverse effects and treatment costs.

Preventive healthcare emphasis is driving market expansion beyond traditional treatment approaches toward early intervention and lifestyle management solutions. Pre-diabetes management programs are creating new market segments for pharmaceutical companies developing products targeting diabetes prevention and progression delay.

Sustainability initiatives within pharmaceutical manufacturing and packaging are becoming increasingly important, with companies adopting environmentally responsible practices to meet regulatory requirements and consumer expectations. Green healthcare trends influence product development and marketing strategies across Malaysia’s diabetes medicine industry landscape.

Recent industry developments within Malaysia’s diabetes medicine market include significant regulatory approvals, strategic partnerships, and technological innovations enhancing treatment accessibility and efficacy. National Pharmaceutical Regulatory Agency has streamlined approval processes for essential diabetes medications, reducing market entry timelines and improving patient access to innovative treatments.

Strategic acquisitions and partnerships between international pharmaceutical companies and local Malaysian healthcare providers are expanding market reach and improving distribution capabilities. Technology integration initiatives including artificial intelligence-powered diabetes management platforms are transforming patient care delivery and treatment monitoring approaches.

Government healthcare initiatives including expanded diabetes screening programs and medication subsidy enhancements are driving market growth while improving population health outcomes. Public-private partnerships in diabetes care delivery are creating sustainable business models that benefit both industry participants and healthcare system objectives.

Research and development investments in diabetes treatment innovation continue expanding, with multiple clinical trials underway for next-generation therapies targeting Malaysian patient populations. Biotechnology advancement in insulin production and delivery systems promises improved treatment options and enhanced patient quality of life outcomes.

Market analysts recommend strategic focus on digital health integration and rural market expansion to capitalize on emerging growth opportunities within Malaysia’s diabetes medicine industry. Technology adoption strategies should prioritize user-friendly platforms that enhance medication adherence and patient engagement while providing healthcare providers with comprehensive monitoring capabilities.

Pricing strategies require careful balance between affordability and innovation investment, with analysts suggesting tiered product portfolios serving different market segments effectively. Generic competition management through value-added services and patient support programs can maintain competitive advantage while preserving profit margins.

Partnership development with healthcare providers, technology companies, and government agencies represents crucial success factors for sustained market growth. Collaborative approaches to diabetes care delivery can create win-win scenarios benefiting all stakeholders while addressing Malaysia’s public health objectives.

Innovation investment in personalized medicine and preventive care solutions positions companies for future market leadership as healthcare trends evolve toward precision medicine approaches. MarkWide Research analysts emphasize the importance of maintaining research and development momentum while building strategic market positioning for long-term success.

Future market outlook for Malaysia’s diabetes medicine industry remains highly positive, with sustained growth projected across all major therapeutic categories and geographic regions. Market expansion is expected to continue at a robust pace of 8.5% annually over the next five years, driven by demographic trends, healthcare infrastructure development, and continuous innovation in diabetes treatment approaches.

Technology integration will fundamentally transform diabetes care delivery, with digital health solutions becoming standard components of comprehensive treatment protocols. Artificial intelligence and machine learning applications in diabetes management are expected to enhance treatment personalization and improve clinical outcomes significantly.

Regulatory environment evolution toward streamlined approval processes and international standard alignment will facilitate faster market entry for innovative treatments while maintaining safety and efficacy standards. Government healthcare policy support for diabetes care accessibility ensures sustained market demand and growth potential.

Emerging market segments including preventive diabetes care and personalized medicine approaches will create new revenue opportunities for industry participants willing to invest in innovation and market development. The future landscape promises enhanced patient outcomes, improved healthcare efficiency, and sustainable business growth for strategic market participants.

Malaysia’s diabetes medicine industry market represents a dynamic and rapidly evolving healthcare sector with exceptional growth potential driven by demographic trends, technological innovation, and supportive government policies. The market demonstrates resilience and adaptability, successfully addressing increasing diabetes prevalence while maintaining focus on accessibility and treatment efficacy across diverse patient populations.

Strategic opportunities within the market encompass digital health integration, rural expansion, preventive care development, and personalized medicine advancement. Industry participants positioned to capitalize on these trends through innovation investment and strategic partnerships will achieve sustainable competitive advantage and contribute meaningfully to Malaysia’s diabetes care objectives.

Market outlook remains highly favorable, with continued growth expected across all therapeutic categories and geographic regions. The industry’s future success depends on maintaining balance between innovation and accessibility while addressing evolving patient needs and healthcare system requirements. Malaysia’s diabetes medicine market stands poised for continued expansion and transformation, offering significant opportunities for stakeholders committed to improving diabetic patient outcomes and advancing healthcare excellence.

What is Diabetes Medicine?

Diabetes Medicine refers to the various pharmaceutical products and treatments used to manage diabetes, including insulin, oral hypoglycemics, and other medications that help control blood sugar levels.

What are the key players in the Malaysia Diabetes Medicine Industry Market?

Key players in the Malaysia Diabetes Medicine Industry Market include companies like Sanofi, Novo Nordisk, and Merck, which are known for their innovative diabetes treatments and extensive product portfolios, among others.

What are the main drivers of growth in the Malaysia Diabetes Medicine Industry Market?

The main drivers of growth in the Malaysia Diabetes Medicine Industry Market include the rising prevalence of diabetes, increasing awareness about diabetes management, and advancements in diabetes treatment technologies.

What challenges does the Malaysia Diabetes Medicine Industry Market face?

Challenges in the Malaysia Diabetes Medicine Industry Market include high treatment costs, regulatory hurdles, and the need for continuous innovation to meet the evolving needs of patients.

What opportunities exist in the Malaysia Diabetes Medicine Industry Market?

Opportunities in the Malaysia Diabetes Medicine Industry Market include the development of new drug formulations, the expansion of telemedicine for diabetes management, and increasing investment in diabetes research and development.

What trends are shaping the Malaysia Diabetes Medicine Industry Market?

Trends shaping the Malaysia Diabetes Medicine Industry Market include the growing adoption of continuous glucose monitoring systems, the rise of personalized medicine, and the integration of digital health solutions in diabetes care.

Malaysia Diabetes Medicine Industry Market

| Segmentation Details | Description |

|---|---|

| Product Type | Insulin, Oral Hypoglycemics, GLP-1 Agonists, DPP-4 Inhibitors |

| Delivery Mode | Subcutaneous Injection, Oral Tablet, Inhalation, Continuous Infusion |

| End User | Hospitals, Clinics, Homecare, Pharmacies |

| Therapy Area | Type 1 Diabetes, Type 2 Diabetes, Gestational Diabetes, Prediabetes |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Malaysia Diabetes Medicine Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at