444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Malaysia data center storage market represents a rapidly expanding segment of the nation’s digital infrastructure landscape, driven by accelerating digital transformation initiatives and increasing demand for cloud-based services. Malaysia’s strategic position as a Southeast Asian technology hub has positioned the country as a preferred destination for data center investments, with storage solutions forming the backbone of these critical facilities.

Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 12.8% as organizations across various industries prioritize data storage modernization. The market encompasses diverse storage technologies including solid-state drives (SSDs), hard disk drives (HDDs), and emerging hybrid storage solutions that cater to different performance and capacity requirements.

Government initiatives such as the Malaysia Digital Economy Blueprint and the National Fourth Industrial Revolution Policy have created a conducive environment for data center development. These policies emphasize the importance of digital infrastructure in supporting economic growth, with data storage capabilities being fundamental to achieving these objectives. The market benefits from favorable regulatory frameworks and incentives designed to attract international technology investments.

Enterprise adoption of cloud services has accelerated significantly, with approximately 68% of Malaysian businesses now utilizing some form of cloud-based storage solution. This trend has created substantial demand for scalable, high-performance storage systems that can support diverse workloads ranging from traditional enterprise applications to modern artificial intelligence and machine learning implementations.

The Malaysia data center storage market refers to the comprehensive ecosystem of storage hardware, software, and services deployed within data center facilities across Malaysia to store, manage, and retrieve digital information for various applications and users. This market encompasses both traditional storage architectures and modern software-defined storage solutions that enable organizations to efficiently handle growing data volumes.

Data center storage in the Malaysian context includes primary storage systems for active workloads, secondary storage for backup and archival purposes, and emerging technologies such as hyper-converged infrastructure that integrate compute, storage, and networking resources. The market serves diverse sectors including financial services, telecommunications, government agencies, and multinational corporations establishing regional operations.

Storage solutions within this market range from high-performance all-flash arrays designed for mission-critical applications to cost-effective object storage systems suitable for long-term data retention. The integration of artificial intelligence and machine learning capabilities into storage management platforms has become increasingly important, enabling predictive analytics and automated optimization of storage resources.

Malaysia’s data center storage market demonstrates exceptional growth momentum, supported by the country’s strategic positioning as a regional digital hub and increasing enterprise demand for scalable storage solutions. The market landscape is characterized by rapid technological evolution, with organizations transitioning from traditional storage architectures to modern, software-defined platforms that offer enhanced flexibility and cost-effectiveness.

Key market drivers include the accelerating pace of digital transformation across Malaysian industries, with 78% of organizations reporting increased data storage requirements over the past two years. The rise of edge computing and Internet of Things (IoT) applications has created new storage paradigms, requiring solutions that can handle diverse data types and access patterns while maintaining optimal performance levels.

Competitive dynamics within the market feature a mix of international technology leaders and regional service providers, each offering specialized solutions tailored to local market requirements. The emphasis on sustainability and energy efficiency has become a critical differentiator, with storage vendors increasingly focusing on solutions that minimize power consumption and environmental impact.

Investment trends indicate strong confidence in Malaysia’s data center infrastructure development, with significant capital allocation toward next-generation storage technologies. The market benefits from government support through various incentive programs and the establishment of digital free trade zones that facilitate technology adoption and innovation.

Market segmentation analysis reveals distinct growth patterns across different storage categories, with flash-based storage solutions experiencing the highest adoption rates due to their superior performance characteristics and declining cost per gigabyte. According to MarkWide Research analysis, the shift toward all-flash arrays represents approximately 45% of new storage deployments in Malaysian data centers.

Industry vertical analysis demonstrates varying storage requirements across sectors, with financial services leading in terms of performance demands while media and entertainment organizations prioritize capacity and throughput capabilities. The healthcare sector shows increasing adoption of specialized storage solutions designed to handle medical imaging and patient data with appropriate compliance frameworks.

Digital transformation initiatives across Malaysian enterprises serve as the primary catalyst for data center storage market expansion. Organizations are modernizing their IT infrastructure to support cloud-first strategies, requiring storage solutions that can seamlessly integrate with both on-premises and cloud environments while maintaining optimal performance levels.

Data proliferation represents another significant driver, with Malaysian businesses generating approximately 35% more data annually compared to previous years. This exponential growth in data volumes necessitates scalable storage architectures capable of handling diverse workloads including big data analytics, artificial intelligence, and machine learning applications.

Regulatory compliance requirements in sectors such as banking, healthcare, and telecommunications drive demand for specialized storage solutions that incorporate advanced security features and data governance capabilities. The implementation of data protection regulations has created additional requirements for storage systems that can demonstrate compliance with various regulatory frameworks.

Edge computing adoption across Malaysia’s industrial sectors has created new storage paradigms, requiring distributed storage solutions that can operate effectively in diverse environmental conditions while maintaining connectivity with centralized data centers. The growth of IoT applications in manufacturing, smart cities, and agriculture sectors further amplifies these storage requirements.

Cost optimization pressures encourage organizations to adopt more efficient storage technologies that deliver improved performance per dollar invested. The declining costs of flash storage combined with enhanced reliability and performance characteristics make these solutions increasingly attractive for a broader range of applications.

High initial investment costs associated with modern data center storage infrastructure present significant barriers for smaller organizations and startups. The capital requirements for implementing enterprise-grade storage systems can be substantial, particularly when considering the need for redundancy, backup systems, and professional services for deployment and ongoing management.

Skills shortage in the Malaysian market represents a critical constraint, with limited availability of qualified professionals capable of designing, implementing, and managing complex storage environments. The rapid evolution of storage technologies requires continuous training and certification, creating additional challenges for organizations seeking to maintain optimal storage operations.

Legacy system integration complexities often impede storage modernization initiatives, as organizations struggle to migrate data from older systems while maintaining business continuity. The coexistence of traditional storage architectures with modern solutions creates operational challenges and potential performance bottlenecks.

Power and cooling infrastructure limitations in some Malaysian data centers constrain the deployment of high-density storage systems. The energy requirements of modern storage solutions, particularly high-performance flash arrays, may exceed the capacity of existing facility infrastructure, necessitating costly upgrades.

Vendor lock-in concerns discourage some organizations from adopting proprietary storage solutions, preferring instead to maintain flexibility through open-source alternatives or vendor-neutral approaches. This preference can limit access to advanced features and optimizations available in commercial storage platforms.

Government digitalization initiatives present substantial opportunities for storage solution providers, as public sector organizations modernize their IT infrastructure to support citizen services and administrative efficiency. The Malaysia Digital Government strategy emphasizes the importance of robust data management capabilities, creating demand for scalable storage solutions.

Emerging technology adoption including artificial intelligence, blockchain, and augmented reality applications generates new storage requirements that traditional solutions cannot adequately address. These technologies demand specialized storage architectures optimized for specific data access patterns and performance characteristics.

Regional expansion opportunities exist as Malaysian data centers serve as regional hubs for multinational corporations establishing Southeast Asian operations. The country’s strategic location and robust telecommunications infrastructure make it an attractive destination for organizations seeking to consolidate regional data storage operations.

Sustainability initiatives create opportunities for vendors offering energy-efficient storage solutions that align with corporate environmental goals. The growing emphasis on green data centers drives demand for storage technologies that minimize power consumption and heat generation while maintaining performance levels.

Managed services growth presents opportunities for service providers offering comprehensive storage management solutions, enabling organizations to focus on core business activities while ensuring optimal storage performance and reliability. The trend toward Storage-as-a-Service models creates new revenue streams and customer engagement opportunities.

Competitive intensity within Malaysia’s data center storage market continues to escalate as both international vendors and local service providers vie for market share. The landscape features established technology leaders alongside emerging companies offering innovative solutions tailored to specific market segments and use cases.

Technology convergence trends are reshaping market dynamics, with storage, compute, and networking resources increasingly integrated into unified platforms. This convergence enables more efficient resource utilization and simplified management while creating new competitive dynamics among traditional storage vendors and infrastructure providers.

Customer expectations have evolved significantly, with organizations demanding storage solutions that deliver cloud-like agility and consumption-based pricing models even for on-premises deployments. This shift has prompted vendors to develop more flexible licensing and deployment options that align with customer preferences.

Partnership ecosystems play an increasingly important role in market dynamics, with storage vendors collaborating with cloud service providers, system integrators, and managed service providers to deliver comprehensive solutions. These partnerships enable access to specialized expertise and expanded market reach while providing customers with integrated solutions.

Innovation cycles have accelerated, with new storage technologies and capabilities being introduced at an unprecedented pace. The rapid evolution of flash memory, storage-class memory, and computational storage technologies creates both opportunities and challenges for market participants seeking to maintain competitive advantages.

Primary research activities encompassed comprehensive interviews with key stakeholders across Malaysia’s data center storage ecosystem, including technology vendors, system integrators, end-user organizations, and industry analysts. These interviews provided valuable insights into market trends, challenges, and opportunities from multiple perspectives.

Secondary research involved extensive analysis of industry reports, vendor documentation, government publications, and academic studies related to data center storage technologies and market dynamics. This research provided historical context and quantitative data supporting market analysis and projections.

Market sizing methodologies employed both top-down and bottom-up approaches to ensure accuracy and reliability of market estimates. The analysis considered various factors including technology adoption rates, replacement cycles, and capacity growth requirements across different industry segments.

Data validation processes included cross-referencing information from multiple sources and conducting follow-up interviews to verify key findings. The research methodology emphasized the importance of obtaining diverse perspectives to ensure comprehensive market understanding.

Trend analysis incorporated both quantitative and qualitative assessment techniques to identify emerging patterns and future market directions. This analysis considered technological developments, regulatory changes, and evolving customer requirements that may impact market dynamics.

Kuala Lumpur metropolitan area dominates Malaysia’s data center storage market, accounting for approximately 52% of total market activity due to its concentration of financial services organizations, multinational corporations, and government agencies. The region benefits from robust telecommunications infrastructure and proximity to key business districts.

Selangor state represents the second-largest market segment, with significant data center developments in areas such as Cyberjaya and Shah Alam. The state’s strategic positioning and government support for technology initiatives have attracted substantial investments in data center infrastructure and storage solutions.

Johor state has emerged as a growing market for data center storage, particularly in Iskandar Malaysia, where proximity to Singapore creates opportunities for regional data center services. The area benefits from competitive land costs and government incentives for technology investments.

Penang maintains a strong presence in the data center storage market, supported by its established technology sector and manufacturing base. The state’s focus on Industry 4.0 initiatives has created additional demand for storage solutions supporting industrial IoT and automation applications.

Emerging regions including Sabah and Sarawak show increasing interest in data center storage solutions, driven by government digitalization initiatives and growing business activity. These regions present opportunities for distributed storage architectures supporting edge computing applications.

Market leadership in Malaysia’s data center storage sector is characterized by intense competition among established international vendors and emerging local service providers. The competitive landscape reflects diverse approaches to addressing market requirements, from comprehensive enterprise solutions to specialized niche offerings.

Competitive strategies focus on differentiation through technology innovation, local support capabilities, and partnership ecosystems. Vendors increasingly emphasize software-defined storage capabilities and cloud integration features to address evolving customer requirements.

Market positioning varies significantly among competitors, with some focusing on high-performance applications while others target cost-sensitive segments. The emergence of hyper-converged infrastructure vendors has created additional competitive dynamics within the traditional storage market.

Technology-based segmentation reveals distinct market dynamics across different storage categories, with flash-based solutions experiencing the highest growth rates due to declining costs and superior performance characteristics. Traditional hard disk drive systems maintain relevance for capacity-oriented applications requiring cost-effective storage.

By Storage Type:

By Deployment Model:

By Industry Vertical:

All-Flash Array segment demonstrates exceptional growth momentum, with adoption rates increasing by approximately 28% annually as organizations prioritize performance and reliability for critical applications. These systems offer significant advantages in terms of latency reduction, energy efficiency, and space utilization compared to traditional storage architectures.

Hybrid storage solutions maintain strong market presence by offering balanced approaches to performance and cost optimization. These systems combine flash storage for frequently accessed data with high-capacity drives for less critical information, enabling organizations to optimize storage investments while meeting diverse application requirements.

Software-defined storage platforms experience rapid adoption as organizations seek greater flexibility and vendor independence. These solutions enable storage virtualization, automated management, and policy-driven optimization while supporting diverse hardware platforms and deployment models.

Object storage systems show increasing relevance for modern applications including content management, backup and archival, and big data analytics. The scalability and cost-effectiveness of object storage make it particularly attractive for organizations managing large volumes of unstructured data.

Hyper-converged infrastructure represents an emerging category that integrates storage, compute, and networking resources into unified platforms. According to MWR analysis, this segment shows 22% growth rates as organizations seek simplified management and reduced infrastructure complexity.

Technology vendors benefit from Malaysia’s growing data center storage market through expanded revenue opportunities and the ability to establish regional presence for Southeast Asian operations. The market provides access to diverse customer segments with varying requirements, enabling vendors to demonstrate solution versatility and build reference architectures.

System integrators gain opportunities to develop specialized expertise in storage technologies while building long-term customer relationships through professional services and ongoing support. The complexity of modern storage environments creates demand for integration services that combine multiple technologies into cohesive solutions.

End-user organizations benefit from increased vendor competition and solution diversity, resulting in more favorable pricing and enhanced feature sets. The availability of multiple deployment options enables organizations to select storage approaches that align with their specific requirements and budget constraints.

Service providers can leverage Malaysia’s data center storage market growth to develop managed services offerings and expand their customer base. The trend toward Storage-as-a-Service models creates opportunities for recurring revenue streams and deeper customer engagement.

Government agencies benefit from improved digital service capabilities and enhanced data management practices that support citizen services and administrative efficiency. Modern storage solutions enable better data analytics and decision-making capabilities across government operations.

Economic stakeholders gain from job creation, technology transfer, and increased foreign investment in Malaysia’s technology sector. The data center storage market contributes to the country’s positioning as a regional technology hub and supports broader digital economy objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents a transformative trend in Malaysia’s data center storage market, with AI-powered storage management platforms becoming increasingly prevalent. These solutions enable predictive analytics, automated optimization, and proactive maintenance capabilities that significantly improve storage efficiency and reliability.

Edge computing proliferation drives demand for distributed storage architectures that can operate effectively in diverse environments while maintaining connectivity with centralized data centers. The growth of IoT applications across manufacturing, smart cities, and agriculture sectors creates new storage paradigms requiring specialized solutions.

Sustainability initiatives increasingly influence storage technology selection, with organizations prioritizing energy-efficient solutions that minimize environmental impact. The trend toward green data centers drives adoption of storage technologies that optimize power consumption and heat generation.

Multi-cloud strategies become more prevalent as organizations seek to avoid vendor lock-in and optimize costs across different cloud platforms. This trend creates demand for storage solutions that can seamlessly integrate with multiple cloud environments while maintaining consistent management and data mobility capabilities.

Containerization and microservices architectures influence storage requirements, with organizations needing solutions that can support dynamic, scalable applications with varying performance characteristics. The adoption of Kubernetes and container orchestration platforms creates new storage consumption patterns.

Data sovereignty concerns drive interest in local storage solutions and data residency capabilities, particularly among government agencies and regulated industries. This trend creates opportunities for domestic service providers and storage solutions that can demonstrate compliance with local data protection requirements.

Major infrastructure investments continue to reshape Malaysia’s data center storage landscape, with several international companies announcing significant expansions of their Malaysian operations. These investments include both new data center facilities and upgrades to existing infrastructure to support next-generation storage technologies.

Strategic partnerships between international storage vendors and local system integrators have accelerated market development, enabling better customer support and solution customization. These collaborations combine global technology expertise with local market knowledge and customer relationships.

Government digitalization projects have created substantial demand for storage solutions, with various agencies modernizing their IT infrastructure to support improved citizen services. The Malaysia Digital Government initiative has been particularly influential in driving storage technology adoption across public sector organizations.

Technology innovations including storage-class memory, computational storage, and quantum storage research have begun to influence market dynamics, with early adopters exploring these emerging technologies for specific use cases. These developments suggest significant evolution in storage architectures over the coming years.

Regulatory developments including data protection and cybersecurity requirements have influenced storage solution selection, with organizations prioritizing platforms that incorporate advanced security features and compliance capabilities. The implementation of new regulations has created additional market opportunities for specialized security-focused storage solutions.

Merger and acquisition activity among storage vendors has consolidated market dynamics while creating opportunities for new entrants. These transactions have resulted in expanded product portfolios and enhanced capabilities for serving Malaysian market requirements.

Investment prioritization should focus on storage technologies that offer the greatest flexibility and future-proofing capabilities, particularly software-defined storage platforms that can adapt to evolving requirements. Organizations should evaluate solutions based on their ability to support diverse workloads and deployment models rather than focusing solely on current needs.

Vendor selection criteria should emphasize local support capabilities, partnership ecosystems, and long-term viability rather than purely technical specifications. The importance of ongoing support and professional services in the Malaysian market makes vendor presence and commitment critical factors in solution success.

Skills development initiatives represent essential investments for organizations seeking to maximize storage technology benefits. The rapid evolution of storage technologies requires continuous training and certification programs to ensure optimal system performance and management.

Security considerations should be integrated into storage planning from the outset, with organizations implementing comprehensive data protection strategies that address both technical and regulatory requirements. The increasing sophistication of cyber threats makes security a critical differentiator in storage solution selection.

Sustainability planning should incorporate energy efficiency and environmental impact considerations into storage technology decisions. Organizations should evaluate the total cost of ownership including power consumption, cooling requirements, and end-of-life disposal considerations.

Partnership strategies can help organizations access specialized expertise and reduce implementation risks. Collaboration with experienced system integrators and managed service providers can accelerate storage modernization initiatives while ensuring optimal outcomes.

Market evolution over the next five years will be characterized by continued growth in storage capacity requirements, with Malaysian organizations expected to increase their storage footprints by approximately 85% as digital transformation initiatives mature. This growth will be driven by expanding data generation, regulatory requirements, and new application categories.

Technology advancement will focus on artificial intelligence integration, edge computing optimization, and sustainability improvements that address evolving customer requirements. The convergence of storage, compute, and networking technologies will create new solution categories that simplify infrastructure management while improving performance.

Competitive dynamics will intensify as both established vendors and emerging companies compete for market share in Malaysia’s growing data center storage sector. The emphasis on local presence, customer support, and solution customization will become increasingly important differentiators in vendor selection processes.

Regulatory influence will continue to shape market development, with data protection, cybersecurity, and environmental regulations creating new requirements for storage solutions. Organizations will need to ensure their storage architectures can adapt to evolving regulatory frameworks while maintaining operational efficiency.

Investment patterns will shift toward solutions that offer consumption-based pricing models and cloud-like operational characteristics, even for on-premises deployments. The trend toward Storage-as-a-Service models will accelerate as organizations seek to optimize capital allocation and operational flexibility.

Innovation focus will center on technologies that enable autonomous storage management, predictive optimization, and seamless integration with emerging application architectures. The development of self-managing storage systems will reduce operational complexity while improving performance and reliability.

Malaysia’s data center storage market represents a dynamic and rapidly evolving sector that plays a crucial role in the country’s digital transformation journey. The market demonstrates strong growth potential driven by government initiatives, enterprise digitalization, and Malaysia’s strategic positioning as a regional technology hub.

Key success factors for market participants include the ability to adapt to rapidly changing technology landscapes, provide comprehensive local support, and develop solutions that address specific Malaysian market requirements. The emphasis on sustainability, security, and operational efficiency will continue to influence storage technology selection and vendor partnerships.

Future market development will be characterized by continued innovation in storage technologies, evolving customer requirements, and increasing integration with cloud and edge computing platforms. Organizations that invest in flexible, scalable storage architectures will be best positioned to capitalize on emerging opportunities and navigate market challenges.

Strategic recommendations for stakeholders include focusing on long-term technology partnerships, investing in skills development, and prioritizing solutions that offer the greatest adaptability to future requirements. The Malaysian data center storage market offers substantial opportunities for growth and innovation, supported by favorable government policies and strong demand fundamentals that position the sector for continued expansion and technological advancement.

What is Data Center Storage?

Data Center Storage refers to the systems and technologies used to store and manage data in data centers. This includes various storage solutions such as hard drives, solid-state drives, and cloud storage that support the operations of businesses and organizations.

What are the key players in the Malaysia Data Center Storage Market?

Key players in the Malaysia Data Center Storage Market include companies like Dell Technologies, Hewlett Packard Enterprise, and IBM, which provide a range of storage solutions and services to meet the growing data demands, among others.

What are the growth factors driving the Malaysia Data Center Storage Market?

The growth of the Malaysia Data Center Storage Market is driven by the increasing demand for data storage due to the rise of cloud computing, big data analytics, and the Internet of Things (IoT). Additionally, the need for data security and compliance is pushing organizations to invest in advanced storage solutions.

What challenges does the Malaysia Data Center Storage Market face?

Challenges in the Malaysia Data Center Storage Market include the high costs associated with advanced storage technologies and the complexity of managing large volumes of data. Additionally, concerns regarding data privacy and security can hinder market growth.

What opportunities exist in the Malaysia Data Center Storage Market?

Opportunities in the Malaysia Data Center Storage Market include the growing adoption of hybrid cloud solutions and the increasing need for scalable storage options. As businesses continue to digitize their operations, there is potential for innovative storage technologies to emerge.

What trends are shaping the Malaysia Data Center Storage Market?

Trends in the Malaysia Data Center Storage Market include the shift towards software-defined storage and the integration of artificial intelligence for data management. Additionally, there is a growing emphasis on sustainability and energy-efficient storage solutions.

Malaysia Data Center Storage Market

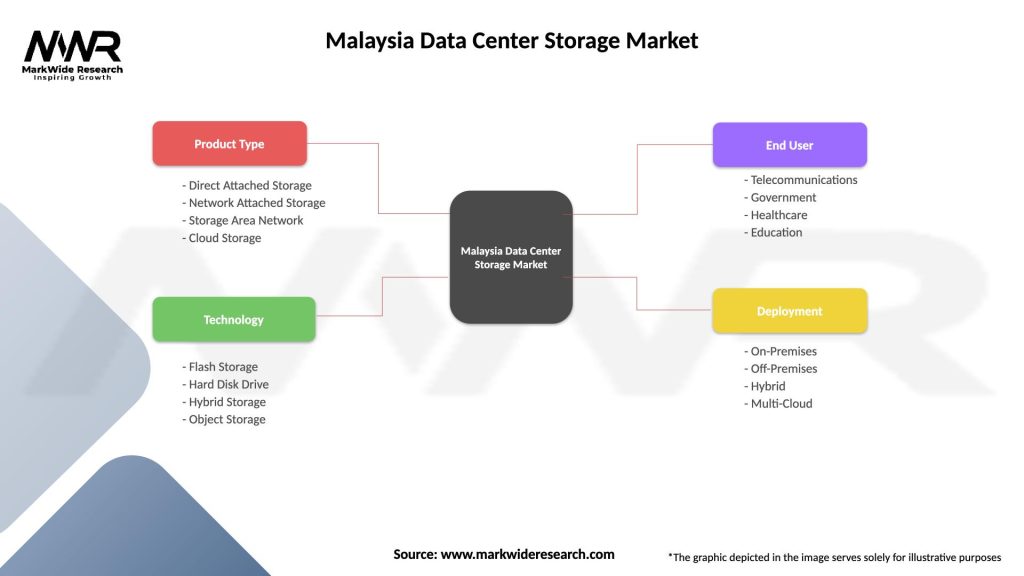

| Segmentation Details | Description |

|---|---|

| Product Type | Direct Attached Storage, Network Attached Storage, Storage Area Network, Cloud Storage |

| Technology | Flash Storage, Hard Disk Drive, Hybrid Storage, Object Storage |

| End User | Telecommunications, Government, Healthcare, Education |

| Deployment | On-Premises, Off-Premises, Hybrid, Multi-Cloud |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Malaysia Data Center Storage Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at