444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Malaysia container glass market represents a dynamic and evolving sector within the country’s manufacturing landscape, driven by increasing demand from beverage, food, pharmaceutical, and cosmetic industries. Container glass manufacturing in Malaysia has experienced steady growth, supported by the nation’s strategic position as a manufacturing hub in Southeast Asia and its robust industrial infrastructure.

Market dynamics indicate that Malaysia’s container glass industry is benefiting from rising consumer preferences for sustainable packaging solutions and the growing emphasis on recyclable materials. The sector encompasses various product categories including bottles, jars, vials, and specialty containers, serving both domestic consumption and export markets across the region.

Industrial growth in Malaysia’s container glass sector is characterized by technological advancement and capacity expansion, with manufacturers investing in modern furnace technologies and automated production systems. The market demonstrates strong resilience with consistent demand from key end-user industries, particularly the food and beverage sector which accounts for approximately 75% of total container glass consumption in the country.

Regional positioning plays a crucial role in Malaysia’s container glass market development, as the country serves as a strategic manufacturing base for multinational companies seeking to establish operations in Southeast Asia. The market benefits from favorable government policies supporting manufacturing sector growth and environmental sustainability initiatives that promote glass packaging adoption.

The Malaysia container glass market refers to the comprehensive ecosystem encompassing the production, distribution, and consumption of glass containers used for packaging various products including beverages, food items, pharmaceuticals, cosmetics, and industrial chemicals within Malaysia’s domestic and export markets.

Container glass products in this market context include a diverse range of packaging solutions such as beverage bottles, food jars, pharmaceutical vials, cosmetic containers, and specialty glass packaging designed for specific industrial applications. The market encompasses both clear and colored glass containers, with varying sizes and specifications tailored to meet specific industry requirements.

Manufacturing processes within Malaysia’s container glass market involve sophisticated production techniques including batch mixing, melting, forming, annealing, and quality control procedures. The industry utilizes both traditional press-and-blow and blow-and-blow manufacturing methods, depending on the specific container requirements and production volumes.

Market participants include domestic glass manufacturers, international companies with local operations, raw material suppliers, equipment providers, and end-user industries. The ecosystem also encompasses recycling facilities and waste management companies that support the circular economy aspects of glass container production and consumption.

Malaysia’s container glass market demonstrates robust growth potential driven by expanding industrial sectors and increasing consumer awareness regarding sustainable packaging solutions. The market benefits from the country’s strategic geographic location, well-developed infrastructure, and supportive regulatory environment that encourages manufacturing investment and export activities.

Key growth drivers include the expanding food and beverage industry, rising pharmaceutical sector demand, growing cosmetics market, and increasing emphasis on environmentally friendly packaging alternatives. The market shows particular strength in beverage bottle production, which represents the largest segment with approximately 60% market share of total container glass production.

Technological advancement remains a critical factor in market development, with manufacturers investing in energy-efficient furnace technologies, automated production systems, and quality control mechanisms. These investments enhance production efficiency while reducing environmental impact and operational costs.

Market challenges include raw material price volatility, energy cost fluctuations, and competition from alternative packaging materials such as plastic and aluminum. However, the growing emphasis on sustainability and recyclability provides significant opportunities for market expansion and innovation.

Future prospects indicate continued market growth supported by increasing domestic consumption, export opportunities, and ongoing industrial development. The market is expected to benefit from government initiatives promoting sustainable manufacturing practices and circular economy principles.

Market segmentation reveals distinct patterns in Malaysia’s container glass industry, with beverage containers dominating production volumes and revenue generation. The following key insights highlight the market’s current state and development trajectory:

Production capacity utilization in Malaysia’s container glass market demonstrates healthy demand levels with manufacturers operating at approximately 85% capacity utilization rates. This indicates strong market fundamentals while maintaining room for growth and expansion.

Industrial expansion serves as a primary driver for Malaysia’s container glass market, with the country’s growing manufacturing sector creating sustained demand for packaging solutions. The food and beverage industry’s expansion particularly supports market growth, as companies require reliable glass packaging for product preservation and brand differentiation.

Sustainability initiatives increasingly influence packaging decisions across industries, with glass containers offering superior recyclability and environmental benefits compared to alternative materials. Consumer awareness regarding environmental impact drives demand for glass packaging, particularly in premium product segments where sustainability messaging enhances brand value.

Export opportunities provide significant growth potential for Malaysian container glass manufacturers, as the country’s strategic location and competitive manufacturing costs enable effective market penetration across Southeast Asia and beyond. Regional trade agreements and favorable logistics infrastructure support export market development.

Technological advancement in glass manufacturing processes enhances production efficiency, product quality, and cost competitiveness. Modern furnace technologies, automated handling systems, and quality control mechanisms enable manufacturers to meet increasing demand while maintaining competitive pricing structures.

Government support through industrial development policies, infrastructure investment, and environmental regulations creates a favorable operating environment for container glass manufacturers. Initiatives promoting sustainable manufacturing practices and circular economy principles align with industry development objectives.

Raw material costs present ongoing challenges for Malaysia’s container glass manufacturers, as price volatility in key inputs such as silica sand, soda ash, and limestone can significantly impact production economics. Energy costs, particularly natural gas and electricity required for furnace operations, also influence overall manufacturing competitiveness.

Competition from alternatives poses a persistent challenge, as plastic containers, aluminum cans, and flexible packaging solutions often provide cost advantages and convenience benefits. The weight and fragility characteristics of glass containers can limit adoption in certain applications where transportation costs and breakage risks are significant concerns.

Capital intensity requirements for glass manufacturing operations create barriers to entry and limit expansion opportunities for smaller players. The substantial investment required for furnace construction, maintenance, and modernization can strain financial resources and limit market participation.

Environmental regulations while generally supportive of glass packaging, can impose additional compliance costs and operational constraints on manufacturers. Emission control requirements, waste management obligations, and energy efficiency standards require ongoing investment and operational adjustments.

Market cyclicality in key end-user industries can create demand fluctuations that challenge production planning and capacity utilization. Economic downturns or shifts in consumer preferences can impact order volumes and pricing dynamics across different market segments.

Premium packaging demand creates significant opportunities for Malaysian container glass manufacturers to develop specialized products for high-value applications. The growing luxury goods market, premium beverages, and artisanal food products require distinctive glass packaging that commands higher margins and strengthens customer relationships.

Pharmaceutical sector growth presents substantial expansion opportunities, as Malaysia’s developing pharmaceutical industry requires specialized glass containers for drug packaging and medical applications. The sector’s emphasis on quality, safety, and regulatory compliance aligns well with glass packaging capabilities.

Regional market expansion offers considerable potential for Malaysian manufacturers to serve growing Southeast Asian markets where container glass demand is increasing. Strategic partnerships, joint ventures, and direct investment opportunities enable market penetration and revenue diversification.

Circular economy initiatives create opportunities for manufacturers to develop comprehensive recycling programs and closed-loop production systems. Collaboration with waste management companies and end-users can create sustainable business models that enhance environmental credentials while generating additional revenue streams.

Technology innovation enables the development of lightweight glass containers, smart packaging solutions, and specialized coatings that enhance product performance and market appeal. Investment in research and development can create competitive advantages and premium market positioning.

Supply chain integration characterizes Malaysia’s container glass market dynamics, with manufacturers developing strategic relationships with raw material suppliers, equipment providers, and end-user customers. Vertical integration strategies enable better cost control and quality assurance throughout the production process.

Demand patterns show seasonal variations aligned with beverage consumption cycles and holiday periods when gift packaging demand increases. Manufacturers adapt production schedules and inventory management strategies to accommodate these cyclical patterns while maintaining operational efficiency.

Pricing dynamics reflect the balance between raw material costs, energy expenses, and competitive pressures from alternative packaging materials. Manufacturers employ value-based pricing strategies that emphasize glass packaging benefits while maintaining cost competitiveness in price-sensitive market segments.

Innovation cycles drive continuous product development and process improvement initiatives within the market. Manufacturers invest approximately 3-5% of revenue in research and development activities focused on product innovation, process optimization, and sustainability enhancement.

Market consolidation trends create opportunities for operational synergies, technology sharing, and market expansion through strategic acquisitions and partnerships. Larger players leverage economies of scale while smaller manufacturers focus on niche markets and specialized applications.

Primary research methodologies employed in analyzing Malaysia’s container glass market include comprehensive interviews with industry executives, manufacturers, suppliers, and end-user customers. Direct engagement with market participants provides insights into current trends, challenges, and future development plans that shape market dynamics.

Secondary research encompasses analysis of industry reports, government statistics, trade association data, and company financial statements to establish market size, growth patterns, and competitive positioning. Regulatory filings, environmental impact assessments, and technology patents provide additional context for market analysis.

Data validation processes ensure accuracy and reliability through cross-referencing multiple sources, conducting follow-up interviews, and employing statistical analysis techniques. Quantitative data undergoes rigorous verification procedures to maintain research integrity and analytical credibility.

Market modeling utilizes econometric techniques, trend analysis, and scenario planning to project future market developments and identify key growth drivers. Regression analysis and correlation studies help establish relationships between market variables and external factors.

Industry expert consultation provides specialized knowledge and technical expertise that enhances research depth and analytical accuracy. Collaboration with technology providers, equipment manufacturers, and industry consultants ensures comprehensive market understanding and forward-looking perspectives.

Peninsular Malaysia dominates the country’s container glass market, accounting for approximately 80% of total production capacity due to its concentrated industrial base, established infrastructure, and proximity to major consumer markets. The region benefits from well-developed transportation networks and access to key raw material sources.

Selangor and Kuala Lumpur represent the primary manufacturing hub for container glass production, hosting major facilities and supporting industries. The region’s industrial parks provide integrated manufacturing ecosystems that enhance operational efficiency and supply chain coordination.

Johor state demonstrates significant growth potential due to its strategic location near Singapore and established manufacturing infrastructure. The region attracts investment from multinational companies seeking to serve both domestic and export markets through efficient logistics networks.

Northern regions including Penang and Perak contribute to market development through specialized manufacturing capabilities and export-oriented production facilities. These areas benefit from established industrial zones and government incentives supporting manufacturing investment.

East Malaysia presents emerging opportunities for market expansion, particularly in Sabah and Sarawak where growing consumer markets and industrial development create demand for container glass products. Regional development initiatives support infrastructure improvement and manufacturing sector growth.

Market leadership in Malaysia’s container glass sector is characterized by a mix of domestic manufacturers and international companies with local operations. The competitive environment emphasizes technological capability, production efficiency, and customer service excellence.

Competitive strategies focus on technological innovation, operational efficiency, and customer relationship management. Companies invest in advanced manufacturing equipment, quality control systems, and sustainability initiatives to maintain competitive advantages.

Market positioning varies among competitors, with some focusing on high-volume commodity products while others emphasize specialized applications and premium market segments. Differentiation strategies include custom design capabilities, technical support services, and comprehensive supply chain solutions.

By Product Type: Malaysia’s container glass market encompasses diverse product categories serving different industry requirements and applications. Each segment demonstrates distinct growth patterns and market characteristics.

By End-User Industry: Market segmentation by end-user reveals the diverse applications and demand drivers across different sectors.

Beverage Container Category demonstrates the strongest market performance with consistent demand growth driven by Malaysia’s expanding beverage industry. Beer bottles represent the largest sub-segment, benefiting from both domestic consumption and export opportunities to regional markets.

Food Packaging Category shows steady growth supported by the processed food industry’s expansion and consumer preferences for glass packaging in premium food products. Specialty jars for artisanal and organic food products create higher-margin opportunities for manufacturers.

Pharmaceutical Container Category exhibits the highest growth potential with increasing demand for specialized glass packaging solutions. The segment requires significant technical expertise and regulatory compliance, creating barriers to entry that benefit established manufacturers.

Cosmetic Container Category focuses on premium applications where packaging aesthetics and brand differentiation are critical success factors. The segment demonstrates resilience during economic downturns as luxury goods maintain demand levels.

Industrial Application Category serves specialized markets requiring chemical resistance, durability, and specific performance characteristics. While smaller in volume, this category often provides stable, long-term customer relationships and predictable demand patterns.

Manufacturers benefit from Malaysia’s strategic geographic location, competitive labor costs, and well-developed infrastructure that support efficient production operations and export market access. The country’s stable political environment and supportive government policies create favorable conditions for long-term investment and business development.

Raw material suppliers gain from the growing container glass market through increased demand for silica sand, soda ash, limestone, and other essential inputs. Local sourcing opportunities reduce transportation costs while supporting domestic mining and chemical industries.

End-user industries benefit from reliable local supply sources that reduce procurement costs, minimize supply chain risks, and enable faster response times for packaging requirements. Proximity to manufacturers facilitates collaboration on custom packaging solutions and technical support services.

Technology providers find opportunities to supply advanced manufacturing equipment, automation systems, and process optimization solutions to Malaysian container glass manufacturers seeking to enhance competitiveness and operational efficiency.

Environmental stakeholders benefit from glass packaging’s superior recyclability and sustainability characteristics compared to alternative materials. The circular economy potential of glass containers supports waste reduction initiatives and environmental protection objectives.

Export market participants leverage Malaysia’s container glass production capabilities to serve regional markets efficiently while benefiting from competitive pricing and quality standards that meet international requirements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as the dominant trend shaping Malaysia’s container glass market, with manufacturers and end-users increasingly prioritizing environmental considerations in packaging decisions. MarkWide Research indicates that sustainability factors influence approximately 65% of packaging procurement decisions across major industries.

Lightweight design innovation drives product development initiatives as manufacturers seek to reduce material usage while maintaining structural integrity and performance characteristics. Advanced glass formulations and optimized container designs achieve weight reductions of up to 20% compared to traditional products.

Smart packaging integration represents an emerging trend where glass containers incorporate digital technologies such as QR codes, NFC chips, and temperature-sensitive indicators. These innovations enhance product traceability, consumer engagement, and supply chain visibility.

Customization demand increases as brands seek distinctive packaging solutions that support differentiation strategies and premium positioning. Manufacturers invest in flexible production capabilities that accommodate smaller batch sizes and specialized design requirements.

Circular economy adoption accelerates through comprehensive recycling programs, closed-loop production systems, and collaboration with waste management partners. Industry initiatives target 90% recycling rates for glass containers within the next five years.

Digital transformation encompasses production planning, quality control, and customer service processes through advanced analytics, IoT sensors, and automated systems. These technologies improve operational efficiency while reducing costs and enhancing product quality.

Capacity expansion projects across Malaysia’s container glass industry reflect growing market confidence and demand projections. Major manufacturers announce significant investment programs to increase production capabilities and serve expanding domestic and export markets.

Technology partnerships between Malaysian manufacturers and international equipment suppliers accelerate the adoption of advanced glass-forming technologies, energy-efficient furnaces, and automated handling systems. These collaborations enhance competitiveness while reducing operational costs.

Sustainability initiatives gain momentum through industry-wide commitments to reduce carbon emissions, increase recycled content usage, and develop circular economy business models. Manufacturers target 30% reduction in carbon intensity over the next decade.

Market consolidation activities include strategic acquisitions, joint ventures, and partnership agreements that create operational synergies and expand market reach. These developments strengthen industry structure while improving competitive positioning.

Export market development initiatives focus on penetrating high-growth regional markets through strategic partnerships, quality certifications, and logistics optimization. Malaysian manufacturers increasingly serve markets across Southeast Asia, the Middle East, and Australia.

Research and development investments accelerate innovation in glass formulations, container designs, and production processes. Industry collaboration with universities and research institutions supports technology advancement and knowledge transfer.

Strategic positioning recommendations emphasize the importance of developing specialized capabilities in high-growth market segments such as pharmaceutical containers and premium beverage packaging. Companies should focus on building technical expertise and regulatory compliance capabilities that create competitive barriers and customer loyalty.

Technology investment priorities should focus on energy-efficient production systems, automated quality control, and flexible manufacturing capabilities that accommodate customization requirements. Investment in digital technologies can enhance operational efficiency while reducing costs and improving customer service.

Market diversification strategies should balance domestic market development with export opportunities, particularly in growing Southeast Asian markets where Malaysian manufacturers can leverage geographic proximity and competitive advantages.

Sustainability leadership presents opportunities for differentiation and premium positioning through comprehensive environmental programs, circular economy initiatives, and transparent sustainability reporting. Companies should develop measurable sustainability targets and communicate progress effectively to stakeholders.

Partnership development with key customers, suppliers, and technology providers can create competitive advantages through improved supply chain integration, innovation collaboration, and market access. Strategic alliances should focus on long-term value creation rather than short-term cost reduction.

Talent development investments in technical training, process optimization, and digital skills ensure workforce capabilities align with evolving industry requirements and technology advancement needs.

Market growth prospects for Malaysia’s container glass industry remain positive, supported by expanding end-user industries, increasing export opportunities, and growing emphasis on sustainable packaging solutions. MWR analysis projects continued market expansion driven by both domestic consumption growth and regional export development.

Technology evolution will continue transforming production processes through advanced automation, artificial intelligence applications, and smart manufacturing systems. These developments promise improved efficiency, quality consistency, and cost competitiveness while reducing environmental impact.

Sustainability integration will become increasingly central to market development, with circular economy principles, carbon neutrality targets, and comprehensive recycling programs becoming standard industry practices. Companies that lead sustainability initiatives will gain competitive advantages and premium market positioning.

Regional market expansion offers significant growth potential as Southeast Asian economies develop and consumer markets mature. Malaysian manufacturers are well-positioned to serve these growing markets through strategic investments and partnership development.

Innovation acceleration in product development, manufacturing processes, and customer service capabilities will drive market differentiation and value creation. Investment in research and development will become increasingly important for maintaining competitive positioning.

Market maturation will likely lead to industry consolidation, with larger players acquiring specialized capabilities and smaller companies while focusing on niche markets and technical expertise. This evolution will create a more efficient and competitive industry structure.

Malaysia’s container glass market demonstrates strong fundamentals and promising growth prospects supported by diverse end-user industries, strategic geographic positioning, and increasing emphasis on sustainable packaging solutions. The market benefits from well-developed infrastructure, government support, and access to regional export opportunities that enhance long-term viability.

Key success factors for market participants include technological innovation, operational efficiency, sustainability leadership, and strategic market positioning. Companies that invest in advanced manufacturing capabilities while developing specialized expertise in high-growth segments will achieve competitive advantages and superior financial performance.

Future development will be shaped by sustainability trends, technology advancement, and regional market expansion opportunities. The industry’s evolution toward circular economy principles and smart manufacturing systems will create new value propositions while enhancing environmental performance and operational efficiency.

Strategic recommendations emphasize the importance of balanced growth strategies that combine domestic market development with export expansion, technology investment with sustainability initiatives, and operational excellence with innovation capabilities. Success in Malaysia’s container glass market requires long-term commitment to quality, customer service, and continuous improvement across all business dimensions.

What is Container Glass?

Container glass refers to glass products designed for packaging and storing various goods, including beverages, food, and pharmaceuticals. It is known for its durability, recyclability, and ability to preserve the quality of its contents.

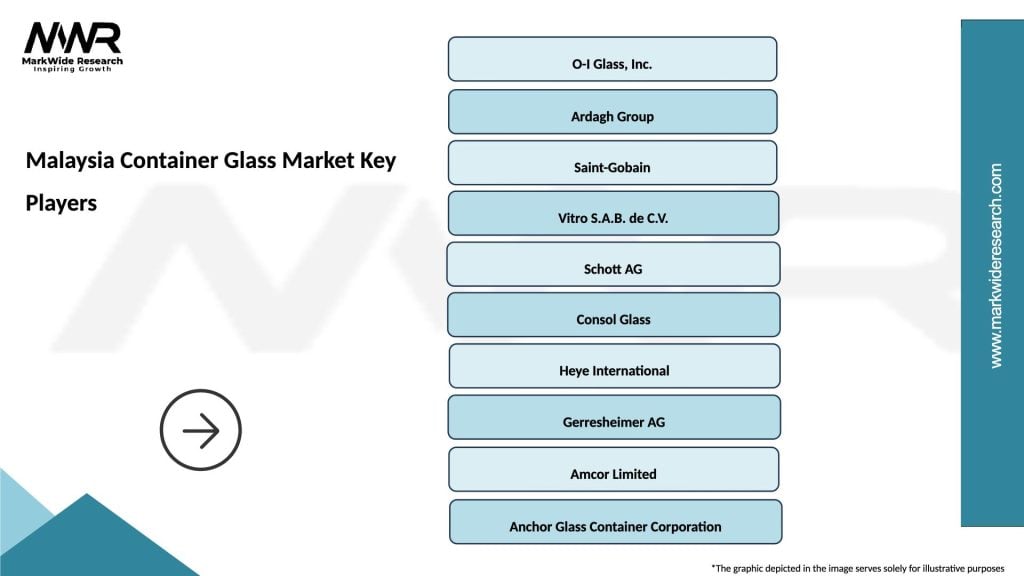

What are the key players in the Malaysia Container Glass Market?

Key players in the Malaysia Container Glass Market include companies like O-I Glass, Berhad, and Southern Glass, which are known for their production of high-quality glass containers for various industries, among others.

What are the growth factors driving the Malaysia Container Glass Market?

The growth of the Malaysia Container Glass Market is driven by increasing demand for sustainable packaging solutions, the rise in the beverage industry, and consumer preferences for glass over plastic due to health and environmental concerns.

What challenges does the Malaysia Container Glass Market face?

The Malaysia Container Glass Market faces challenges such as high production costs, competition from alternative packaging materials, and the need for continuous innovation to meet changing consumer preferences.

What opportunities exist in the Malaysia Container Glass Market?

Opportunities in the Malaysia Container Glass Market include the expansion of the food and beverage sector, increasing investments in recycling technologies, and the growing trend towards eco-friendly packaging solutions.

What trends are shaping the Malaysia Container Glass Market?

Trends in the Malaysia Container Glass Market include the rise of personalized packaging, advancements in glass manufacturing technologies, and a growing emphasis on sustainability and circular economy practices.

Malaysia Container Glass Market

| Segmentation Details | Description |

|---|---|

| Product Type | Bottles, Jars, Containers, Vials |

| End User | Food & Beverage, Pharmaceuticals, Cosmetics, Chemicals |

| Packaging Type | Rigid, Flexible, Bulk, Specialty |

| Grade | Food Grade, Pharmaceutical Grade, Industrial Grade, Recycled |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Malaysia Container Glass Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at