444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The major home appliances market refers to the industry that encompasses the production, sale, and distribution of essential household appliances. These appliances are designed to make daily tasks more efficient and convenient, catering to various needs within a household. This market comprises a wide range of products, including refrigerators, washing machines, dishwashers, ovens, and more.

Meaning

Major home appliances are considered fundamental in modern households, providing essential functions that simplify daily chores. These appliances not only save time but also contribute to the overall comfort and convenience of individuals and families. They have become an integral part of our lives, making tasks like cooking, cleaning, and preserving food more manageable and efficient.

Executive Summary

The major home appliances market has witnessed significant growth over the years, driven by technological advancements, changing lifestyles, and increasing disposable incomes. As more consumers prioritize convenience and seek time-saving solutions, the demand for innovative and efficient home appliances continues to rise. This executive summary provides key insights into the market, highlighting its drivers, restraints, opportunities, and dynamics.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Replacement Demand Outpaces New Sales in Mature Markets: In developed economies, growth is driven mainly by replacement cycles in aging home stocks.

Energy Efficiency is a Differentiator: Many consumers now judge based on energy label ratings, operational cost reduction, and environmental footprint.

Smart Features Add Value but Must Be Reliable: IoT connectivity, voice controls, predictive maintenance, and remote control are increasingly standard—but must be robust.

Service Infrastructure Matters: Consumer willingness to invest in premium appliances depends heavily on strong installation, maintenance, and warranty support.

Regional Growth Disparities: High-income regions show slow but predictable growth; developing markets offer volume opportunity as incomes rise and electrification spreads.

Sustainability & Circular Strategies Drive Brand Trust: Brands that support recyclability, spare parts, refurbishment, and emission compliance gain consumer favor.

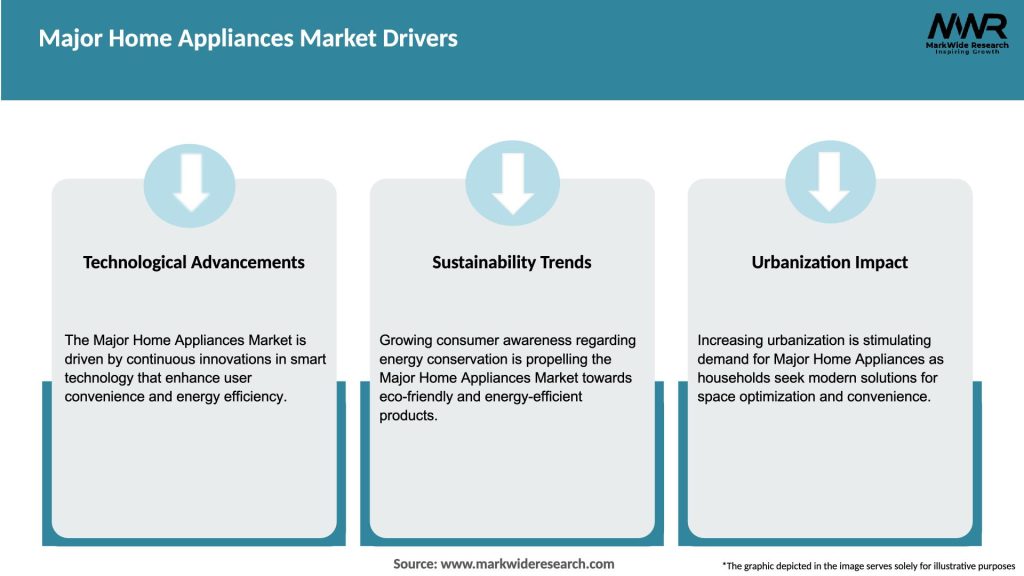

Market Drivers

Rising Household Incomes & Urbanization: As more households enter the middle class, demand for durable appliances increases.

Renovation & Home Upgrade Cycles: Homeowners refurbish kitchens, bathrooms, and HVAC systems, driving appliance replacement and upsizing.

Stringent Energy & Appliance Regulations: Minimum efficiency standards, refrigerant phase‑outs, and emission targets force manufacturers to innovate.

Smart Home Integration: The growth of IoT and connected-living ecosystems encourages consumers to upgrade legacy appliances.

After-Sales Business Models: Subscription-based maintenance, extended warranties, and remote service capabilities support premium pricing and loyalty.

Market Restraints

High Capital Cost to Consumers: Premium and smart units often come with higher upfront prices, limiting adoption in cost-sensitive segments.

Supply Chain Disruptions & Raw Material Prices: Volatility in steel, semiconductors, polymers, and shipping disrupts margins and delivery schedules.

Product Lifespan Saturation: In mature markets, many homes already have basic appliances—incremental growth must come from upgrades or replacements.

Warranty & Service Complexity: Poor service or lack of spare parts can damage brand reputation and reduce consumer confidence.

Regulatory Costs & Compliance: Adhering to multiple region-specific rules for energy, refrigerants, and safety adds complexity and cost.

Market Opportunities

Smart Appliance Ecosystems: Integration with energy management, home automation, predictive maintenance, and app-based control.

Energy Storage & Peak Management Integration: Appliances that integrate with home batteries or load shifting add value in grids with variable renewables.

Refurbishment & Aftermarket Services: Certified used markets, appliance trade-in programs, spare parts services, and circular business models.

Emerging Market Expansion: Rapid urbanization and rising incomes in Africa, Southeast Asia, Latin America offer growth routes.

Sustainability Differentiation: Marketing ultra-efficient, low-impact materials, recyclable parts, and transparent carbon footprints.

Market Dynamics

Supply-Side Factors:

Manufacturers invest in lean manufacturing, supply-chain resilience, and modular product platforms.

Strategic partnerships with electronics, smart devices, and software firms enhance product features.

Global OEMs source components globally but must localize for logistics and compliance.

Demand-Side Factors:

Consumers expect high durability, brand reputation, connectivity, and service support.

Retailers and e-commerce channels influence consumer choice via bundling, financing, and promotional strategies.

Economic & Policy Factors:

Incentive schemes (rebates, tax credits) for energy‑efficient appliances boost demand.

Trade policies, tariffs, and localization requirements influence pricing and supply strategies.

Environmental and waste directives (e-waste, refrigerants) drive product redesign and end-of-life programs.

Regional Analysis

North America & Western Europe: Mature, replacement-driven markets; leading in connectivity and high efficiencies.

Asia-Pacific: High-volume growth region—China, India, ASEAN dominate in new household formation and appliance upgrades.

Latin America & Middle East: Mixed growth rates—some consumers still acquiring basic appliances while others upgrade to smart units.

Africa: Emerging market frontier; initial growth in essential appliances before smart adoption takes hold.

Competitive Landscape

Leading Companies in the Major Home Appliances Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

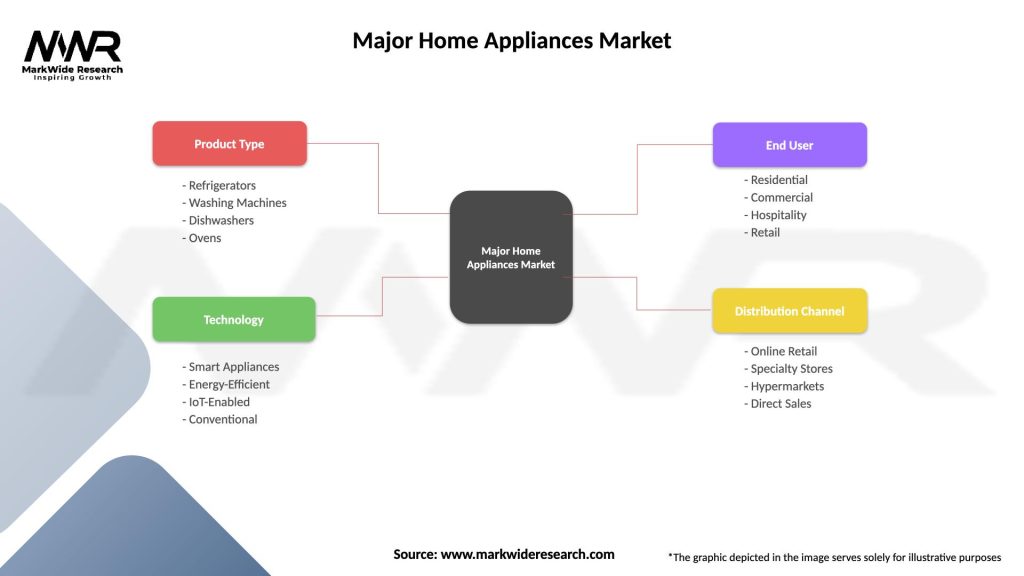

Segmentation

By Product Type:

Refrigeration & Freezers

Washing Machines / Dryers

Dishwashers

Cooking Appliances (Ranges, Ovens, Hobs)

Air Conditioners / HVAC units

Other Large Appliances (Hoods, Ventilation)

By Technology / Feature Level:

Basic / Conventional

Energy-Efficient / Inverter / Variable-Speed

Smart / Connected / IoT-enabled

By Distribution Channel:

Offline Retail / Appliance Chains

E-commerce / Online Retail

Direct-to-Consumer / Brand Stores

B2B / Contractor & Developer Channels

By End-User Segment:

New Home Buyers / Furnishing

Replacement / Upgrade Market

Rental / Multi‑Unit Residential

Commercial / Hospitality Residences

By Geography:

Developed Markets

Emerging Growth Markets

Urban vs. Rural Markets

Category-wise Insights

Refrigeration: High share due to essential use; energy labeling and inverter compressors are margin differentiators.

Washing Machines / Dryers: Front-load, stacked units, and smart features are rising; demand for water-saving models.

Dishwashers: Growing uptake in markets where labor cost or water scarcity is a factor.

Cooking Appliances: Connectivity (remote pre-heating), induction, and smart ovens gain adoption in premium segments.

Air Conditioners / HVAC: Often high-growth in tropical climates; energy efficiency and smart control are crucial.

Other Large Appliances: Ventilation, range hoods, and integrated systems see incremental upgrade demand.

Key Benefits for Industry Participants and Stakeholders

Stable Recurring Demand: High replacement cycles support steady revenue for quality brands.

Cross-Selling & Bundling: Kits (kitchen suites), extended warranties, and maintenance subscriptions add margin.

Brand Loyalty & Lifetime Value: Good after-sales support cultivates repeated purchases.

Energy & Utility Partnerships: Appliances that help manage load or peak demand attract partnerships with utility providers.

Sustainability Branding: Eco-efficient products enhance brand image and appeal to conscious consumers.

SWOT Analysis

Strengths:

Long-standing incumbents with consumer trust and service infrastructure.

Technology adoption in smart home ecosystems.

Ongoing demand even in economic downturns—appliances are household essentials.

Weaknesses:

High sensitivity to raw material cost and supply chain disruptions.

Price competition from low-cost regional manufacturers.

Complexity of servicing advanced smart models in remote areas.

Opportunities:

Growth in emerging markets still undergoing appliance adoption.

Subscription or “appliance as a service” models.

Retrofit supplementation (smart modules for legacy appliances).

Circular economy models (refurbished appliances, spare parts ecosystems).

Threats:

Rapid technology shifts making current models obsolete.

Disruptive new materials or form factors (e.g. flexible, modular appliances).

Environmental regulation changes (e.g. refrigerant bans) forcing redesigns.

Increased competition from direct-to-consumer or purely digital appliance brands.

Market Key Trends

Smart & Connected Appliances: IoT integration, user analytics, voice assistants, and remote control.

Inverter and Variable-Speed Technology: Higher efficiency and lower noise are differentiators.

Sustainability & Circular Models: Modular designs, recycling programs, and efficient use of materials.

Subscription & Service Models: Warranties, maintenance plans, performance-based contracts.

Retrofit & IoT Upgrades: Enabling smart functionality on existing appliances via add-on modules.

Key Industry Developments

Major Brand Partnerships with Smart Platforms: Appliance makers partnering with home automation ecosystems.

Launch of Energy-Efficient Lines: New products meeting stricter energy labels and environmental standards.

Refurbishment Programs: Brands offering trade-in refurbish resale models to support circular economy practices.

Utility Incentive Programs: Some regions offer rebates or discounts for purchasing certified energy-efficient appliances.

Startup Disruption: New entrants offering digitally-native or direct-to-consumer appliance models.

Analyst Suggestions

Differentiate with Service & Reliability: Invest in strong after-sales networks, spare part availability, and software updates.

Accelerate Smart & Sustainable Innovation: Focus R&D on energy, connectivity, and modular design.

Explore Subscription / Appliance-as-a-Service Models: Reduce consumer entry cost and build recurring revenue.

Strengthen Circular Capabilities: Develop refurbishment, spare parts, and end-of-life collection programs.

Tap Emerging Markets Aggressively: Capitalize on rising adoption patterns in less saturated geographies.

Future Outlook

The Major Home Appliances Market is expected to evolve steadily, shifting toward high-efficiency, connected, and service-oriented products. Growth in mature markets will center on replacement and upgrade cycles; emerging markets will drive volume expansion. Subscription models, retrofit ecosystems, and circular strategies will increasingly influence consumer choices.

Appliance manufacturers that blend durability, sustainability, digital features, and robust support infrastructure will be well positioned to win. As consumer expectations rise about smart living, energy savings, and long-term value, the major appliances of tomorrow will also be platforms—not just hardware.

Conclusion

The Major Home Appliances Market remains central to household functioning and household spending. In a transforming global environment, appliance providers must innovate beyond products, integrating services, software, sustainability, and lifecycle thinking. Brands that embrace smart design, circular economy principles, and world-class support will shape the future of home living and capture sustained market leadership.

By understanding market drivers, addressing restraints, and capitalizing on opportunities, industry participants can stay ahead of the competition. The future outlook for the market is promising, driven by factors such as the adoption of smart technologies, increasing disposable incomes, and the growing focus on sustainable living. With continuous innovation and strategic planning, manufacturers can successfully navigate this evolving market landscape.

What is Major Home Appliances?

Major home appliances refer to large machines used for household tasks such as cooking, cleaning, and food preservation. Common examples include refrigerators, washing machines, ovens, and dishwashers.

Who are the key players in the Major Home Appliances Market?

Key players in the Major Home Appliances Market include Whirlpool Corporation, LG Electronics, Samsung Electronics, and Electrolux, among others.

What are the main drivers of growth in the Major Home Appliances Market?

The growth of the Major Home Appliances Market is driven by factors such as increasing urbanization, rising disposable incomes, and advancements in technology that enhance energy efficiency and smart home integration.

What challenges does the Major Home Appliances Market face?

The Major Home Appliances Market faces challenges such as intense competition, fluctuating raw material prices, and the need for continuous innovation to meet changing consumer preferences.

What opportunities exist in the Major Home Appliances Market?

Opportunities in the Major Home Appliances Market include the growing demand for energy-efficient appliances, the rise of smart home technologies, and the expansion into emerging markets with increasing consumer spending.

What trends are shaping the Major Home Appliances Market?

Trends in the Major Home Appliances Market include the increasing popularity of smart appliances, a focus on sustainability and eco-friendly products, and the integration of advanced technologies such as IoT and AI for enhanced user experience.

Major Home Appliances Market

| Segmentation Details | Description |

|---|---|

| Product Type | Refrigerators, Washing Machines, Dishwashers, Ovens |

| Technology | Smart Appliances, Energy-Efficient, IoT-Enabled, Conventional |

| End User | Residential, Commercial, Hospitality, Retail |

| Distribution Channel | Online Retail, Specialty Stores, Hypermarkets, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Major Home Appliances Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at