444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview:

The M Commerce Payment market has experienced significant growth in recent years, driven by the increasing adoption of mobile devices and the growing preference for online shopping. M Commerce, or Mobile Commerce, refers to the use of mobile devices such as smartphones and tablets for making financial transactions. It allows consumers to make payments conveniently and securely through mobile applications or mobile-optimized websites. This market analysis will delve into the various aspects of the M Commerce Payment industry, providing valuable insights and trends.

Meaning:

M Commerce Payment refers to the electronic transactions conducted through mobile devices, enabling users to make purchases, transfer funds, and engage in other financial activities using mobile applications or websites. It offers a seamless and convenient payment experience, allowing consumers to shop anytime and anywhere. The rapid advancements in mobile technology and the increasing penetration of smartphones have revolutionized the way payments are made, making M Commerce Payment a crucial segment of the digital payments landscape.

Executive Summary:

The M Commerce Payment market has witnessed substantial growth, driven by the proliferation of smartphones and the growing acceptance of mobile-based transactions. The convenience and ease of use associated with M Commerce Payment solutions have contributed to their popularity among consumers. The market has attracted numerous players, including financial institutions, technology companies, and mobile network operators, resulting in a highly competitive landscape. This analysis aims to provide comprehensive insights into the market drivers, restraints, opportunities, and trends, as well as a regional analysis and competitive landscape overview.

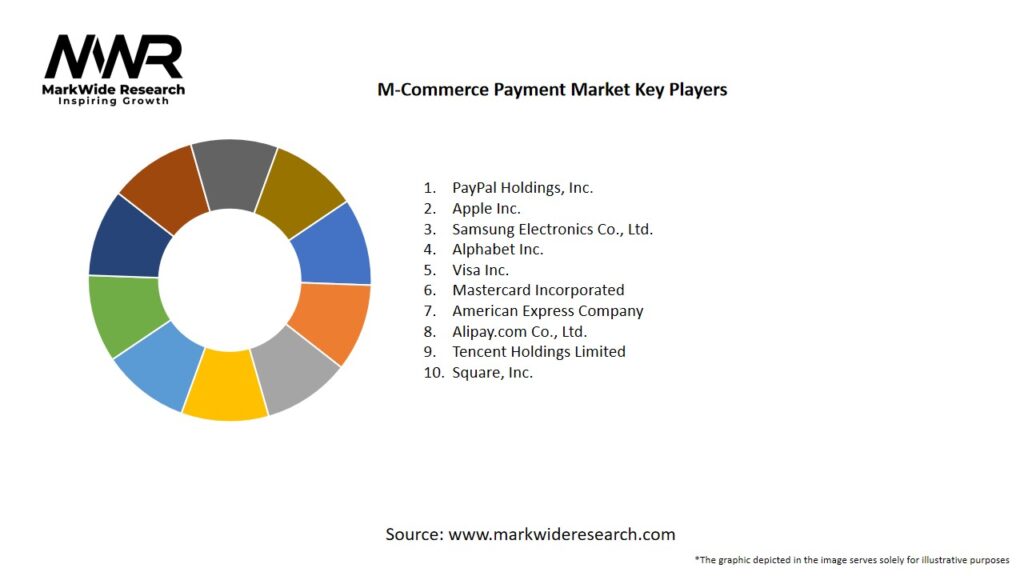

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Mobile Payment Adoption: The adoption of mobile payments is accelerating across various regions, particularly in North America, Europe, and Asia-Pacific. Key drivers include the rise in smartphone penetration, ease of use, and greater access to financial services via mobile devices.

Rising E-commerce Activity: With the increasing shift to online shopping, m-commerce payments are becoming integral to e-commerce platforms, providing a seamless and efficient way for consumers to make purchases.

Contactless Payment Solutions: The growing demand for contactless payments, especially post-COVID-19, is fueling the market. Consumers and retailers are increasingly favoring NFC-based mobile payment methods due to their convenience and speed.

Security and Fraud Prevention: Enhanced security features, such as biometrics, two-factor authentication (2FA), and tokenization, are increasing consumer confidence in using mobile payments, thus driving adoption.

Market Drivers

Rising Smartphone Penetration: As smartphones become more accessible and affordable, a larger portion of the global population is using mobile devices for online shopping and payment transactions, significantly expanding the m-commerce payment market.

Growth of Digital Wallets: The rise of digital wallets such as Apple Pay, Google Pay, and Samsung Pay has simplified mobile payment transactions, driving consumer adoption and accelerating market growth.

Increasing E-commerce Adoption: The growth of e-commerce, especially mobile commerce, is driving the demand for mobile payment systems that provide quick and secure transactions for consumers on-the-go.

COVID-19 Pandemic: The pandemic has accelerated the shift to contactless payments and digital transactions, as consumers seek safer and more hygienic methods of payment, further driving mobile payment adoption.

Convenience and Speed: The increasing consumer preference for the convenience, speed, and ease of use offered by mobile payment solutions is another key driver for the growth of the m-commerce payment market.

Market Restraints

Security and Privacy Concerns: While mobile payments offer convenience, concerns over data privacy and cybersecurity risks, such as data breaches and fraud, may hinder some consumers from fully adopting mobile payment solutions.

Lack of Trust in Mobile Payments: In some regions, consumers may be hesitant to trust mobile payment systems, especially those that involve linking financial information to mobile devices, potentially limiting market growth.

Infrastructure Challenges in Emerging Markets: Although m-commerce payments are growing rapidly in developed markets, infrastructure challenges and low smartphone penetration in certain emerging markets may slow down adoption in these regions.

Regulatory Challenges: The lack of standardization in mobile payment regulations across countries can create barriers for service providers, impacting the market’s expansion, particularly in international markets.

Market Opportunities

Expansion of Mobile Payment Platforms: The increasing number of mobile payment platforms, especially those supporting P2P payments, mobile banking, and integrated e-commerce transactions, offers new opportunities for service providers to tap into a growing customer base.

Adoption in Developing Markets: Emerging markets, especially in Asia-Pacific, Latin America, and Africa, represent significant growth opportunities as mobile payment adoption continues to grow in these regions, driven by increased smartphone usage and mobile internet access.

Integration with IoT and Smart Devices: The increasing integration of mobile payments with IoT-enabled devices and smart technologies, such as smartwatches and wearables, presents new opportunities for enhancing the mobile payment experience and expanding the market.

Blockchain and Cryptocurrency: The rise of blockchain technology and cryptocurrencies presents opportunities for innovative mobile payment solutions. The integration of these technologies can provide enhanced security and transparency in mobile transactions.

Market Dynamics

The M-Commerce Payment Market is influenced by several key dynamics:

Technological Advancements: Continuous advancements in mobile technology, including the rise of 5G networks, NFC technology, biometric authentication, and AI-driven payment solutions, are driving the evolution of the m-commerce payment market.

Regulatory and Compliance Frameworks: Governments and regulatory bodies are working towards creating frameworks to ensure the security and safety of mobile payment systems, driving consumer confidence and market growth.

Consumer Behavior: The shift in consumer behavior towards mobile-first services, including shopping, banking, and payments, is pushing businesses to adopt mobile payment systems to meet the evolving demands of their customers.

Mobile Wallet Integration: The integration of mobile payment solutions into e-commerce platforms, loyalty programs, and other mobile apps is expanding the reach of mobile payments and creating more opportunities for growth.

Regional Analysis

North America: North America holds the largest share of the m-commerce payment market, driven by the widespread adoption of smartphones, digital wallets, and mobile banking apps. The presence of major players like PayPal, Apple Pay, and Google Pay further contributes to market dominance.

Europe: Europe is another key market, driven by the high adoption of mobile payment platforms and the increasing shift towards digital payments in countries like the UK, Germany, and France. The European Union’s focus on regulatory frameworks like PSD2 is also boosting market growth.

Asia-Pacific: The Asia-Pacific region is expected to witness the highest growth rate due to the rising mobile internet penetration, increasing smartphone adoption, and growing consumer acceptance of digital payment methods in countries like China, India, and Japan.

Latin America: Latin America is seeing rapid growth in mobile payment adoption, particularly in Brazil and Mexico, where mobile wallets and P2P payment solutions are gaining traction among consumers.

Middle East & Africa: The Middle East and Africa are witnessing a steady increase in mobile payment adoption, driven by the growth of mobile banking, e-commerce, and smartphone usage, particularly in countries like the UAE and South Africa.

Competitive Landscape

Leading Companies in the M-Commerce Payment Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

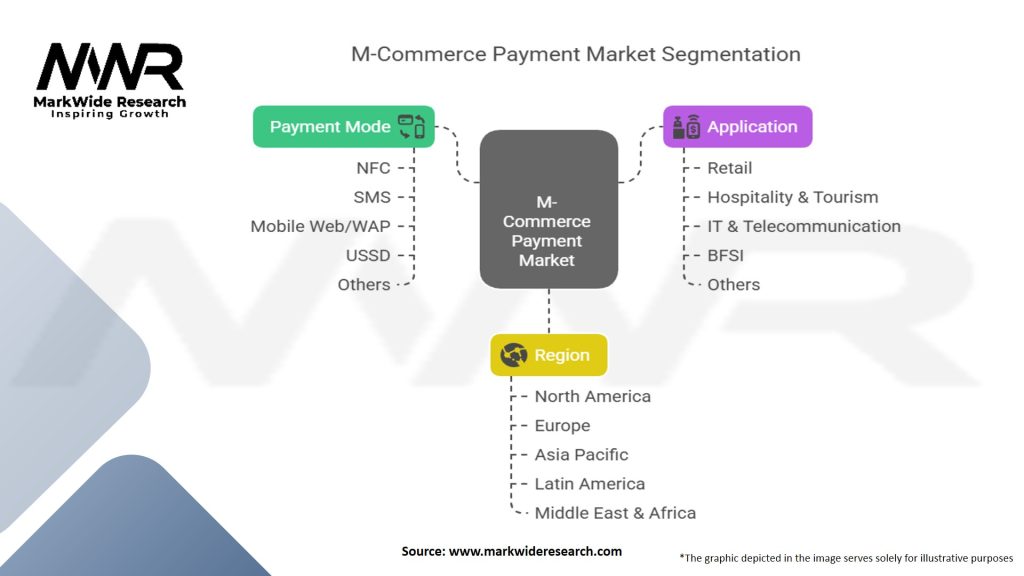

Segmentation

The M-Commerce Payment Market can be segmented based on the following:

By Payment Type:

Mobile Wallets

P2P Payments

Mobile Banking

QR Code Payments

By End-User:

Consumers

Merchants

By Platform:

Android

iOS

Category-wise Insights

Mobile Wallets: Mobile wallets, such as Apple Pay, Google Pay, and Samsung Pay, are the leading category in the m-commerce payment market, offering users a secure and convenient method for making transactions via their smartphones.

P2P Payments: Peer-to-peer (P2P) payment systems like Venmo, Zelle, and PayPal are gaining popularity, particularly among younger consumers, as they provide a quick and easy way to send money to family and friends.

Key Benefits for Industry Participants and Stakeholders

Convenience: M-commerce payments provide a convenient, fast, and secure way for consumers to make transactions on the go, enhancing customer satisfaction and loyalty.

Global Reach: Mobile payment solutions offer businesses the ability to reach customers globally, especially as smartphone penetration and internet access continue to grow worldwide.

Security: Enhanced security features such as biometrics, tokenization, and two-factor authentication improve trust and reduce fraud in mobile payment transactions.

SWOT Analysis

Strengths:

Widespread adoption of smartphones and mobile devices.

Growing preference for contactless and cashless payments.

Weaknesses:

Security concerns related to data privacy and fraud.

Dependence on mobile internet connectivity.

Opportunities:

Expansion in emerging markets with low mobile payment adoption.

Integration with IoT and wearables for enhanced payment experiences.

Threats:

Regulatory challenges and lack of uniformity in global mobile payment standards.

Competition from alternative payment systems, including cryptocurrency.

Market Key Trends

Increased Use of Biometric Authentication: The integration of biometric authentication methods, such as fingerprint scanning and facial recognition, in mobile payment systems is enhancing security and user experience.

Rise of Contactless Payments: Consumers increasingly prefer contactless mobile payment solutions, driven by their convenience, speed, and hygiene, especially post-pandemic.

Covid-19 Impact:

The global pandemic has had a profound impact on various industries, including the M Commerce Payment market. This section will analyze the effects of the Covid-19 pandemic on consumer behavior, market dynamics, and the adoption of M Commerce Payment solutions. It will highlight the challenges faced by the industry and the strategies adopted to navigate the crisis.

Key Industry Developments:

This section will provide an overview of significant industry developments, such as mergers and acquisitions, product launches, collaborations, and partnerships. These developments signify the industry’s evolution and reflect the strategies adopted by key players to strengthen their market position and drive innovation.

Analyst Suggestions:

Based on the market analysis and insights, this section will offer recommendations and suggestions for industry participants to capitalize on the market opportunities, address challenges, and enhance their competitive advantage. These suggestions aim to guide businesses in making informed decisions and formulating effective strategies.

Future Outlook:

The future outlook section will provide a forward-looking perspective on the M Commerce Payment market, including growth projections, emerging trends, and potential disruptions. It will offer insights into the factors that are likely to shape the market’s trajectory and provide businesses with a strategic roadmap for future success.

Conclusion:

In conclusion, the M Commerce Payment market is experiencing significant growth driven by the increasing adoption of smartphones, the convenience of mobile payments, and the rise of e-commerce. While security concerns and regulatory challenges remain, the market presents numerous opportunities for industry participants and stakeholders. By understanding the market dynamics, regional variations, and key trends, businesses can navigate the competitive landscape, capitalize on emerging opportunities, and drive innovation in the M Commerce Payment industry.

What is M Commerce Payment?

M Commerce Payment refers to mobile commerce payment systems that enable consumers to make purchases using mobile devices. This includes transactions through mobile apps, mobile wallets, and SMS payments, facilitating a seamless shopping experience on smartphones and tablets.

Who are the key players in the M Commerce Payment Market?

Key players in the M Commerce Payment Market include PayPal, Square, Stripe, and Apple Pay, among others. These companies provide various mobile payment solutions that cater to both consumers and businesses, enhancing the overall mobile shopping experience.

What are the main drivers of growth in the M Commerce Payment Market?

The growth of the M Commerce Payment Market is driven by the increasing adoption of smartphones, the rise of mobile internet usage, and the growing preference for contactless payments. Additionally, advancements in mobile payment technologies and consumer demand for convenience are significant factors.

What challenges does the M Commerce Payment Market face?

The M Commerce Payment Market faces challenges such as security concerns, regulatory compliance issues, and the need for interoperability among different payment systems. These factors can hinder consumer trust and slow down market adoption.

What opportunities exist in the M Commerce Payment Market?

Opportunities in the M Commerce Payment Market include the expansion of mobile payment solutions in emerging markets, the integration of advanced technologies like blockchain, and the potential for personalized marketing through mobile platforms. These trends can enhance user engagement and drive sales.

What trends are shaping the M Commerce Payment Market?

Trends shaping the M Commerce Payment Market include the rise of mobile wallets, the integration of artificial intelligence for fraud detection, and the increasing use of QR codes for payments. These innovations are transforming how consumers interact with mobile commerce.

M-Commerce Payment Market

| Segmentation | Details |

|---|---|

| Payment Mode | NFC (Near Field Communication), SMS, Mobile Web/WAP, USSD, Others |

| Application | Retail, Hospitality & Tourism, IT & Telecommunication, BFSI, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the M-Commerce Payment Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at