444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The logistics industry Australia market represents one of the most dynamic and rapidly evolving sectors within the nation’s economy, serving as the backbone for domestic and international trade operations. Australia’s logistics sector encompasses a comprehensive range of services including transportation, warehousing, distribution, freight forwarding, and supply chain management solutions that connect businesses across the continent and beyond. The industry has experienced remarkable transformation driven by technological advancement, e-commerce expansion, and evolving consumer expectations for faster, more efficient delivery services.

Market dynamics indicate substantial growth momentum, with the sector demonstrating resilience and adaptability in response to changing economic conditions and global supply chain disruptions. The industry benefits from Australia’s strategic geographic position as a gateway to Asia-Pacific markets, robust mining and agricultural exports, and increasing domestic consumption patterns. Digital transformation initiatives have revolutionized traditional logistics operations, introducing automation, artificial intelligence, and data analytics to optimize route planning, inventory management, and customer service delivery.

Key market drivers include the rapid expansion of e-commerce platforms, growing demand for same-day and next-day delivery services, and increasing focus on sustainable logistics practices. The sector has witnessed significant investment in infrastructure development, including automated warehouses, advanced transportation networks, and integrated technology platforms. MarkWide Research analysis indicates that the industry is experiencing accelerated adoption of innovative solutions, with companies investing heavily in digital capabilities to maintain competitive advantage and meet evolving customer demands.

The logistics industry Australia market refers to the comprehensive ecosystem of companies, services, and infrastructure dedicated to the efficient movement, storage, and management of goods throughout the Australian continent and its international trade corridors. This sector encompasses multiple interconnected segments including freight transportation via road, rail, air, and sea, warehousing and distribution facilities, supply chain management services, and specialized logistics solutions for various industries including mining, agriculture, retail, and manufacturing.

Modern logistics operations in Australia integrate advanced technology platforms, automated systems, and data-driven decision-making processes to optimize the flow of goods from point of origin to final destination. The industry serves as a critical enabler for economic growth, facilitating domestic commerce, international trade, and supporting the efficient operation of supply chains across diverse sectors. Logistics service providers offer comprehensive solutions ranging from basic transportation and storage to complex supply chain consulting, inventory optimization, and integrated logistics management.

Australia’s logistics industry stands as a cornerstone of the nation’s economic infrastructure, facilitating billions of dollars in trade annually while supporting the operational needs of businesses across all sectors. The market has demonstrated exceptional resilience and growth potential, driven by increasing e-commerce penetration, infrastructure investment, and technological innovation. Industry transformation is being accelerated by digital adoption, with companies implementing advanced warehouse management systems, route optimization software, and real-time tracking capabilities.

Competitive landscape features a mix of established multinational corporations, regional specialists, and emerging technology-focused providers, creating a dynamic environment that fosters innovation and service excellence. The sector benefits from strong government support for infrastructure development, including investments in port facilities, rail networks, and highway systems that enhance connectivity and operational efficiency. Sustainability initiatives are becoming increasingly important, with companies adopting green logistics practices, alternative fuel vehicles, and carbon reduction strategies to meet environmental regulations and customer expectations.

Market opportunities are expanding rapidly, particularly in areas such as last-mile delivery solutions, cold chain logistics for pharmaceutical and food products, and specialized services for the growing renewable energy sector. The industry’s strategic importance has been highlighted by recent global supply chain disruptions, emphasizing the need for robust, flexible logistics networks capable of adapting to changing market conditions and maintaining business continuity.

Strategic market analysis reveals several critical insights that define the current state and future trajectory of Australia’s logistics industry. The sector has experienced significant consolidation, with major players expanding their service portfolios through acquisitions and strategic partnerships to offer comprehensive end-to-end solutions.

Primary market drivers propelling the growth of Australia’s logistics industry stem from fundamental changes in consumer behavior, technological advancement, and economic development patterns. The exponential growth of e-commerce has created unprecedented demand for efficient, reliable logistics services capable of handling increased package volumes while meeting customer expectations for rapid delivery times.

Digital transformation initiatives across industries are driving demand for sophisticated logistics solutions that can integrate seamlessly with enterprise resource planning systems, customer relationship management platforms, and real-time tracking applications. Companies are increasingly recognizing logistics as a strategic competitive advantage rather than simply a cost center, leading to greater investment in advanced capabilities and service differentiation.

Infrastructure development projects, including port expansions, highway improvements, and rail network enhancements, are creating new opportunities for logistics providers while improving overall system efficiency. The growing emphasis on supply chain visibility and transparency is driving adoption of advanced tracking technologies, data analytics platforms, and integrated communication systems that provide real-time insights into shipment status and performance metrics.

Globalization trends continue to expand Australia’s trade relationships, particularly with Asia-Pacific partners, creating increased demand for international freight forwarding, customs clearance, and cross-border logistics services. The diversification of Australia’s economy beyond traditional mining and agriculture is generating new logistics requirements for manufacturing, technology, and service sectors that require specialized handling and distribution capabilities.

Significant challenges facing Australia’s logistics industry include rising operational costs, regulatory complexity, and infrastructure constraints that can limit growth potential and operational efficiency. Labor shortages in key areas such as truck driving, warehouse operations, and logistics management are creating capacity constraints and driving up wage costs across the sector.

Geographic challenges inherent to Australia’s vast landmass and dispersed population centers create unique logistical complexities that increase transportation costs and delivery times, particularly for regional and remote areas. The concentration of major population centers along the eastern seaboard creates imbalanced freight flows and underutilized capacity in certain corridors.

Regulatory compliance requirements across multiple jurisdictions, including safety standards, environmental regulations, and customs procedures, create administrative burden and operational complexity for logistics providers. The fragmented nature of some regulatory frameworks can result in inconsistent requirements across different states and territories, complicating interstate operations.

Technology adoption costs and the complexity of integrating new systems with existing infrastructure can create barriers for smaller logistics providers seeking to compete with larger, more technologically advanced competitors. The rapid pace of technological change requires continuous investment in system upgrades, staff training, and process optimization to maintain competitive positioning.

Emerging opportunities within Australia’s logistics industry are being driven by technological innovation, changing consumer preferences, and new business models that create demand for specialized services and capabilities. The rapid growth of e-commerce platforms presents significant opportunities for logistics providers to develop innovative last-mile delivery solutions, including same-day delivery, click-and-collect services, and flexible delivery options that cater to diverse customer preferences.

Cold chain logistics represents a high-growth opportunity segment, driven by increasing demand for fresh food products, pharmaceutical distribution, and temperature-sensitive goods that require specialized handling and transportation capabilities. The expansion of Australia’s pharmaceutical and biotechnology sectors creates opportunities for specialized logistics providers with expertise in regulatory compliance and controlled environment transportation.

Sustainable logistics solutions are becoming increasingly important as companies seek to reduce their environmental footprint and meet corporate sustainability goals. Opportunities exist for providers offering electric vehicle fleets, carbon-neutral shipping options, and packaging optimization services that reduce waste and environmental impact while maintaining service quality.

Regional expansion opportunities are emerging as improved infrastructure and growing regional economies create demand for enhanced logistics services in previously underserved areas. The development of new mining projects, agricultural initiatives, and regional manufacturing facilities creates opportunities for specialized logistics providers with expertise in remote area operations and bulk commodity handling.

Complex market dynamics shape the competitive landscape and operational environment within Australia’s logistics industry, influenced by technological disruption, changing customer expectations, and evolving regulatory frameworks. Digital transformation is fundamentally altering traditional business models, with companies investing heavily in automation, artificial intelligence, and data analytics to improve operational efficiency and service quality.

Competitive pressures are intensifying as new entrants, including technology-focused startups and international players, challenge established providers with innovative service offerings and disruptive business models. The rise of platform-based logistics solutions is creating new competitive dynamics, enabling smaller providers to access advanced technology capabilities and compete more effectively with larger established players.

Customer expectations continue to evolve, driven by experiences with leading e-commerce platforms that have set new standards for delivery speed, tracking visibility, and service flexibility. Companies are responding by investing in customer-facing technology platforms, expanding service options, and developing more responsive customer service capabilities to meet these heightened expectations.

Supply chain resilience has become a critical focus area following recent global disruptions, with companies seeking logistics partners capable of providing flexible, adaptable solutions that can maintain service continuity during challenging conditions. This emphasis on resilience is driving investment in redundant capacity, alternative routing options, and risk management capabilities throughout the logistics network.

Comprehensive research methodology employed in analyzing Australia’s logistics industry incorporates multiple data collection and analysis techniques to ensure accuracy, reliability, and depth of insights. Primary research activities include structured interviews with industry executives, logistics managers, and key stakeholders across different segments of the market to gather firsthand insights into current trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, government statistics, trade publications, and company financial statements to establish market context and validate primary research findings. Data triangulation methods are employed to cross-verify information from multiple sources and ensure the reliability of market assessments and projections.

Quantitative analysis techniques include statistical modeling, trend analysis, and comparative benchmarking to identify patterns and relationships within the market data. Qualitative research methods such as focus groups and expert panels provide deeper insights into market dynamics, competitive positioning, and future development scenarios.

Market segmentation analysis examines different service categories, geographic regions, and customer segments to identify specific growth opportunities and competitive dynamics within each area. The research methodology incorporates both historical data analysis and forward-looking projections to provide comprehensive market intelligence for strategic decision-making.

Regional market dynamics within Australia’s logistics industry reflect the diverse economic characteristics, infrastructure capabilities, and demographic patterns across different states and territories. New South Wales dominates the market with approximately 35% market share, driven by Sydney’s position as a major international gateway and the state’s concentration of manufacturing, retail, and service industries that generate significant logistics demand.

Victoria represents the second-largest regional market, accounting for approximately 28% market share, with Melbourne serving as a critical distribution hub for southeastern Australia and hosting major logistics facilities that serve both domestic and international markets. The state’s diverse economy and strategic location make it a key logistics center for automotive, food processing, and retail sectors.

Queensland captures approximately 20% market share, with Brisbane functioning as the primary logistics gateway for northern Australia and a critical hub for mining, agricultural, and tourism-related freight movements. The state’s extensive coastline and multiple port facilities support significant import and export activities that drive logistics demand.

Western Australia holds approximately 12% market share, with Perth serving as the logistics center for the state’s mining and energy sectors. The region’s resource-based economy creates unique logistics requirements for bulk commodity handling and specialized equipment transportation. South Australia and Tasmania together account for the remaining market share, with Adelaide and Hobart serving as regional distribution centers for their respective markets.

Competitive dynamics within Australia’s logistics industry feature a diverse mix of multinational corporations, regional specialists, and emerging technology-focused providers that compete across different service segments and geographic markets. Market leadership is distributed among several key players, each with distinct competitive advantages and strategic positioning.

Competitive strategies focus on technology differentiation, service expansion, and strategic partnerships to capture market share and improve operational efficiency. Companies are investing heavily in automation, digital platforms, and specialized capabilities to differentiate their service offerings and meet evolving customer requirements.

Market segmentation within Australia’s logistics industry reflects the diverse service requirements, operational characteristics, and customer needs across different sectors and applications. Service-based segmentation provides the primary framework for understanding market dynamics and competitive positioning within specific logistics categories.

By Service Type:

By End-User Industry:

Transportation services represent the largest segment within Australia’s logistics industry, encompassing road freight, rail transport, air cargo, and maritime shipping operations that form the backbone of goods movement across the continent. Road freight dominates domestic transportation with approximately 75% modal share, driven by flexibility, door-to-door service capability, and extensive highway infrastructure that connects major population centers and industrial areas.

Warehousing and distribution services have experienced significant transformation through automation and technology integration, with modern facilities incorporating advanced warehouse management systems, robotics, and data analytics to optimize inventory management and order fulfillment processes. The segment benefits from growing e-commerce demand and companies’ focus on supply chain efficiency and customer service improvement.

Express and courier services represent the fastest-growing segment, driven by e-commerce expansion and consumer expectations for rapid delivery times. Same-day delivery services are experiencing particularly strong growth, with providers investing in local distribution networks, alternative delivery methods, and technology platforms to meet increasing demand for immediate fulfillment.

Freight forwarding services play a critical role in Australia’s international trade, with providers offering comprehensive solutions for import and export operations including customs clearance, documentation, and multimodal transportation coordination. The segment benefits from Australia’s growing trade relationships with Asia-Pacific partners and increasing complexity of international supply chains.

Supply chain management services are becoming increasingly sophisticated, with providers offering integrated solutions that encompass procurement, inventory optimization, demand planning, and performance analytics. MWR analysis indicates that companies are increasingly seeking strategic logistics partners capable of providing comprehensive supply chain consulting and management services rather than simply transactional logistics services.

Industry participants within Australia’s logistics sector benefit from multiple value-creation opportunities that enhance operational efficiency, competitive positioning, and financial performance. Logistics service providers gain access to expanding market opportunities driven by e-commerce growth, infrastructure investment, and increasing demand for specialized services across diverse industry sectors.

Technology integration benefits include improved operational efficiency, enhanced customer service capabilities, and better decision-making through real-time data analytics and performance monitoring systems. Companies investing in advanced technology platforms can differentiate their service offerings, optimize resource utilization, and respond more effectively to changing market conditions and customer requirements.

Strategic partnerships and collaboration opportunities enable logistics providers to expand their service portfolios, access new markets, and leverage complementary capabilities without significant capital investment. These relationships can include technology partnerships, capacity sharing agreements, and joint venture arrangements that create mutual benefits for participating organizations.

Stakeholder benefits extend beyond direct industry participants to include customers, suppliers, and the broader economy. Businesses benefit from improved supply chain efficiency, reduced logistics costs, and enhanced service reliability that supports their operational objectives and customer satisfaction goals. Economic benefits include job creation, infrastructure development, and improved connectivity that supports regional development and international trade competitiveness.

Sustainability advantages are increasingly important, with efficient logistics operations contributing to reduced environmental impact through optimized transportation routes, consolidated shipments, and adoption of clean technology solutions. These benefits align with corporate sustainability objectives and regulatory requirements while potentially reducing operational costs through improved efficiency.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformational trends reshaping Australia’s logistics industry reflect broader technological, social, and economic changes that are fundamentally altering how goods are moved, stored, and delivered across the continent. Automation and robotics are becoming increasingly prevalent in warehouse operations, with companies implementing automated storage and retrieval systems, robotic picking solutions, and autonomous material handling equipment to improve efficiency and reduce labor dependency.

Last-mile delivery innovation represents a critical trend area, with providers experimenting with alternative delivery methods including drone delivery, autonomous vehicles, and crowd-sourced delivery networks to meet growing consumer expectations for convenience and speed. The development of micro-fulfillment centers and urban consolidation hubs is enabling more efficient urban distribution and reducing delivery times for e-commerce orders.

Sustainability initiatives are gaining momentum across the industry, with companies adopting electric and hybrid vehicle fleets, implementing carbon offset programs, and developing circular economy solutions that minimize waste and environmental impact. Green logistics practices are becoming competitive differentiators as customers increasingly consider environmental factors in their logistics provider selection decisions.

Data analytics and artificial intelligence are transforming logistics decision-making, with companies leveraging predictive analytics for demand forecasting, route optimization algorithms for transportation planning, and machine learning systems for inventory management. These technologies enable more proactive, responsive logistics operations that can adapt quickly to changing conditions and customer requirements.

Platform-based business models are emerging as significant disruptors, connecting shippers directly with carriers and logistics service providers through digital marketplaces that increase transparency, reduce costs, and improve service accessibility for smaller businesses that previously lacked access to sophisticated logistics solutions.

Recent industry developments highlight the dynamic nature of Australia’s logistics sector and the rapid pace of change driven by technological innovation, market consolidation, and evolving customer requirements. Major infrastructure projects including port expansions, rail network upgrades, and highway improvements are enhancing the capacity and efficiency of Australia’s logistics network while creating new opportunities for service providers.

Strategic acquisitions and partnerships have reshaped the competitive landscape, with major logistics companies expanding their capabilities through targeted acquisitions of technology providers, specialized service companies, and regional operators. These transactions reflect the industry’s focus on building comprehensive service portfolios and expanding geographic coverage to meet customer demands for integrated solutions.

Technology investments by leading logistics providers include implementation of advanced warehouse management systems, deployment of Internet of Things sensors for real-time tracking, and development of customer-facing digital platforms that provide enhanced visibility and control over logistics operations. These investments demonstrate the industry’s commitment to digital transformation and service innovation.

Regulatory developments including new safety standards, environmental regulations, and trade facilitation measures are influencing operational practices and investment priorities across the industry. Companies are adapting their operations to comply with evolving requirements while seeking opportunities to leverage regulatory changes for competitive advantage.

International expansion activities by Australian logistics companies reflect growing confidence in the domestic market and recognition of opportunities in regional markets, particularly throughout the Asia-Pacific region where Australia’s expertise and geographic position provide natural advantages for logistics service provision.

Strategic recommendations for logistics industry participants focus on leveraging technology, developing specialized capabilities, and building resilient operations that can adapt to changing market conditions and customer requirements. Investment priorities should emphasize digital transformation initiatives that enhance operational efficiency, improve customer experience, and create sustainable competitive advantages in an increasingly competitive marketplace.

Technology adoption strategies should prioritize solutions that deliver measurable returns on investment while positioning companies for future growth opportunities. MarkWide Research analysis suggests that companies should focus on integrated technology platforms that connect different aspects of their operations and provide comprehensive visibility into performance metrics and customer satisfaction indicators.

Service differentiation opportunities exist in specialized market segments including healthcare logistics, e-commerce fulfillment, and sustainable transportation solutions where companies can command premium pricing and build strong customer relationships. Developing expertise in these high-value segments can provide protection against commoditization pressures in traditional logistics services.

Partnership strategies should focus on building collaborative relationships with technology providers, complementary service companies, and key customers that create mutual value and support long-term growth objectives. These partnerships can provide access to new capabilities, markets, and technologies without requiring significant capital investment.

Workforce development initiatives are critical for addressing labor shortages and building the skills necessary to support technological advancement and operational excellence. Companies should invest in training programs, competitive compensation packages, and career development opportunities that attract and retain qualified personnel in key operational and management roles.

Future prospects for Australia’s logistics industry remain highly positive, supported by continued economic growth, infrastructure investment, and technological advancement that will drive demand for sophisticated logistics services across diverse market segments. Growth projections indicate sustained expansion at approximately 6-8% annually over the next five years, driven primarily by e-commerce growth, international trade expansion, and increasing demand for specialized logistics services.

Technology evolution will continue to reshape industry operations, with artificial intelligence, machine learning, and automation technologies becoming increasingly sophisticated and accessible to logistics providers of all sizes. The integration of these technologies will enable more efficient operations, improved customer service, and new business models that create value for both providers and customers.

Market consolidation trends are expected to continue, with larger logistics companies acquiring specialized providers and technology companies to build comprehensive service portfolios and expand their competitive capabilities. This consolidation will create opportunities for innovative smaller companies while challenging traditional mid-market providers to differentiate their offerings or seek strategic partnerships.

Sustainability requirements will become increasingly important, with customers, regulators, and investors placing greater emphasis on environmental performance and social responsibility. Logistics companies that proactively adopt sustainable practices and technologies will be better positioned to capture market opportunities and meet evolving stakeholder expectations.

International expansion opportunities will continue to emerge as Australian logistics companies leverage their expertise and geographic advantages to serve growing markets throughout the Asia-Pacific region. These expansion activities will support domestic growth while diversifying revenue sources and reducing dependence on local market conditions.

Australia’s logistics industry represents a dynamic, rapidly evolving sector that plays a critical role in supporting the nation’s economic growth and international competitiveness. The market demonstrates strong fundamentals driven by technological innovation, infrastructure investment, and growing demand for sophisticated logistics services across diverse industry segments. Key success factors for industry participants include embracing digital transformation, developing specialized capabilities, and building resilient operations that can adapt to changing market conditions.

Strategic opportunities abound for companies that can effectively leverage technology, develop innovative service offerings, and build strong customer relationships in high-growth segments such as e-commerce fulfillment, healthcare logistics, and sustainable transportation solutions. The industry’s future prospects remain highly favorable, supported by continued economic expansion, infrastructure development, and evolving customer requirements that create demand for advanced logistics capabilities.

Long-term success in Australia’s logistics industry will require continuous adaptation to technological change, regulatory evolution, and shifting customer expectations while maintaining operational excellence and financial performance. Companies that can successfully navigate these challenges while capitalizing on emerging opportunities will be well-positioned to achieve sustainable growth and market leadership in this essential sector of the Australian economy.

What is Logistics Industry Australia?

The Logistics Industry Australia encompasses the processes involved in the transportation, warehousing, and distribution of goods across the country. It plays a crucial role in supply chain management, ensuring that products reach consumers efficiently and effectively.

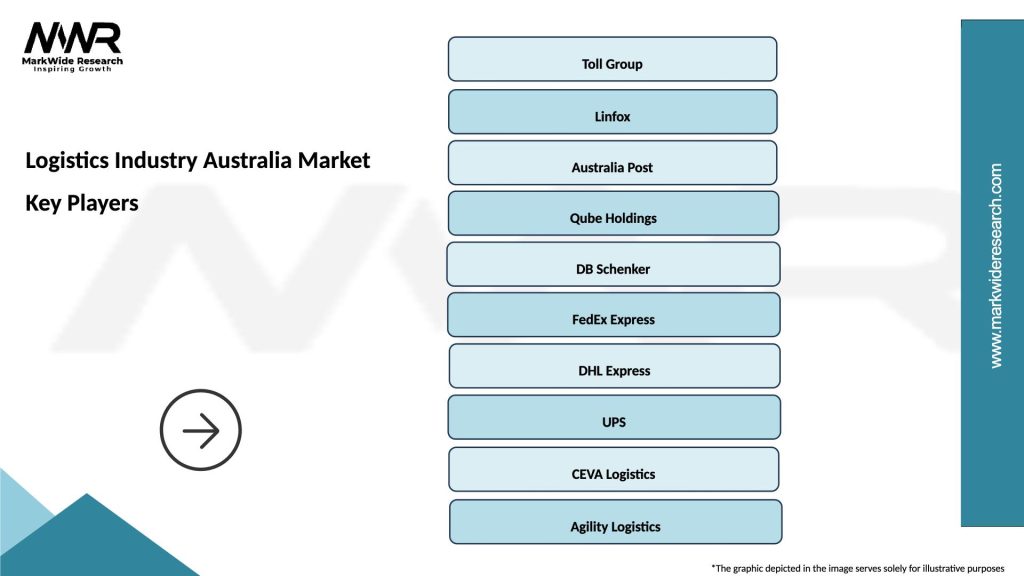

What are the key players in the Logistics Industry Australia Market?

Key players in the Logistics Industry Australia Market include companies like Toll Group, Linfox, and DB Schenker, which provide a range of logistics services such as freight forwarding, warehousing, and supply chain solutions, among others.

What are the main drivers of growth in the Logistics Industry Australia Market?

The main drivers of growth in the Logistics Industry Australia Market include the rise of e-commerce, increasing demand for efficient supply chain solutions, and advancements in technology that enhance logistics operations. These factors contribute to a more streamlined and responsive logistics environment.

What challenges does the Logistics Industry Australia Market face?

The Logistics Industry Australia Market faces challenges such as rising fuel costs, regulatory compliance issues, and the need for sustainable practices. These challenges can impact operational efficiency and profitability for logistics providers.

What opportunities exist in the Logistics Industry Australia Market?

Opportunities in the Logistics Industry Australia Market include the adoption of automation and digital technologies, growth in the cold chain logistics sector, and the expansion of last-mile delivery services. These trends can enhance service offerings and improve customer satisfaction.

What trends are shaping the Logistics Industry Australia Market?

Trends shaping the Logistics Industry Australia Market include the increasing use of data analytics for supply chain optimization, the rise of sustainable logistics practices, and the integration of artificial intelligence in logistics operations. These trends are transforming how logistics companies operate and deliver services.

Logistics Industry Australia Market

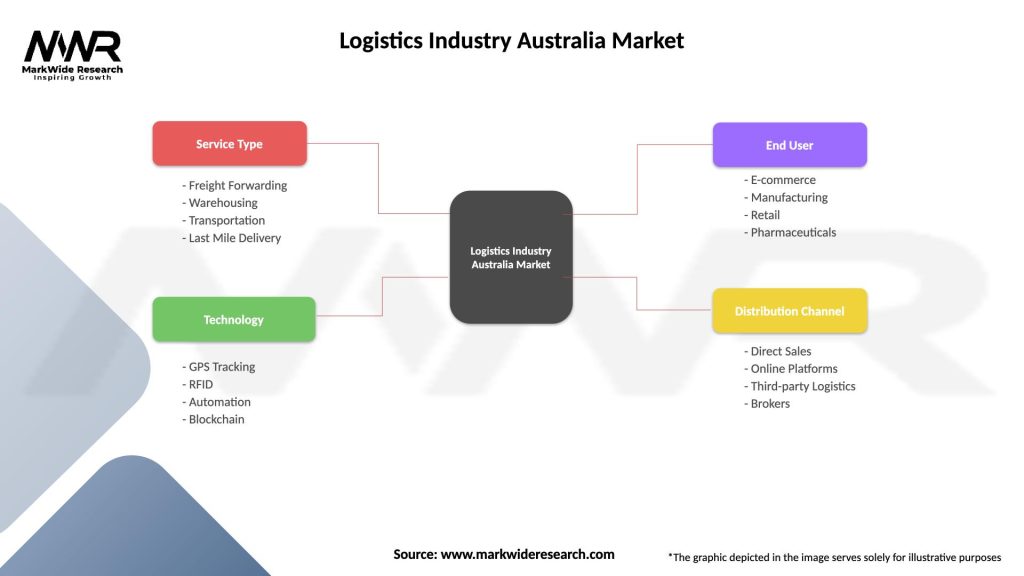

| Segmentation Details | Description |

|---|---|

| Service Type | Freight Forwarding, Warehousing, Transportation, Last Mile Delivery |

| Technology | GPS Tracking, RFID, Automation, Blockchain |

| End User | E-commerce, Manufacturing, Retail, Pharmaceuticals |

| Distribution Channel | Direct Sales, Online Platforms, Third-party Logistics, Brokers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Logistics Industry Australia Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at