444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The LNG bunkering market has been witnessing significant growth in recent years, driven by the increasing adoption of LNG as a marine fuel. LNG, or liquefied natural gas, is a cleaner and more environmentally friendly alternative to traditional marine fuels such as heavy fuel oil and diesel. It offers various advantages, including lower emissions of greenhouse gases and pollutants, making it an attractive choice for ship owners and operators.

Meaning

LNG bunkering refers to the process of supplying liquefied natural gas to ships for use as fuel. It involves transferring LNG from storage facilities or dedicated bunkering vessels to the ship’s fuel tanks. LNG bunkering can be carried out using different methods, including ship-to-ship transfer, truck-to-ship transfer, and shore-to-ship transfer. The choice of method depends on various factors such as infrastructure availability, vessel type, and location.

Executive Summary

The LNG bunkering market has witnessed substantial growth in recent years, driven by the increasing focus on reducing emissions from the shipping industry. The market is expected to continue its growth trajectory in the coming years, driven by stringent environmental regulations, rising demand for cleaner fuels, and supportive government initiatives. However, challenges such as the high initial investment required for infrastructure development and limited bunkering infrastructure in certain regions pose obstacles to market growth.

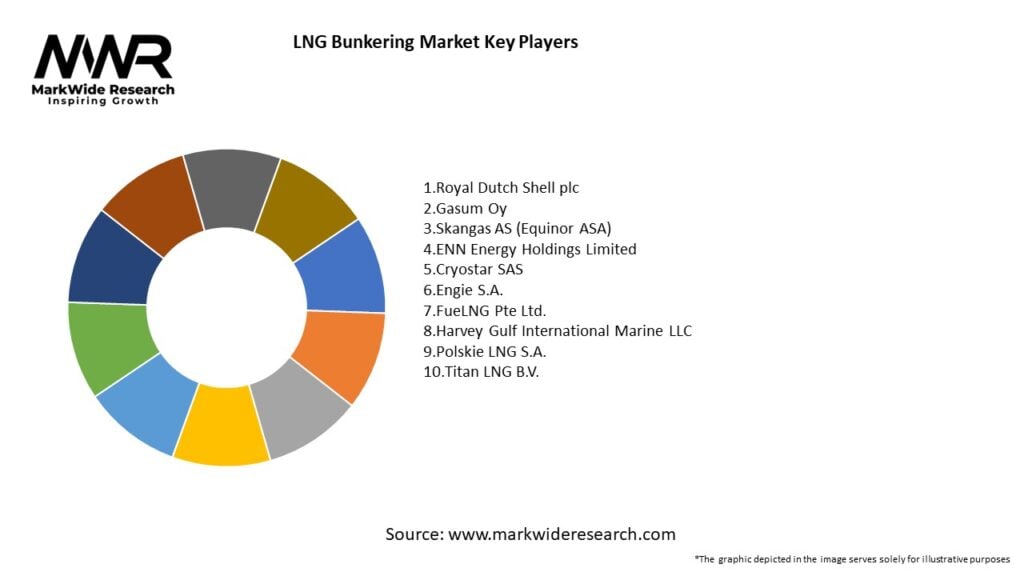

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

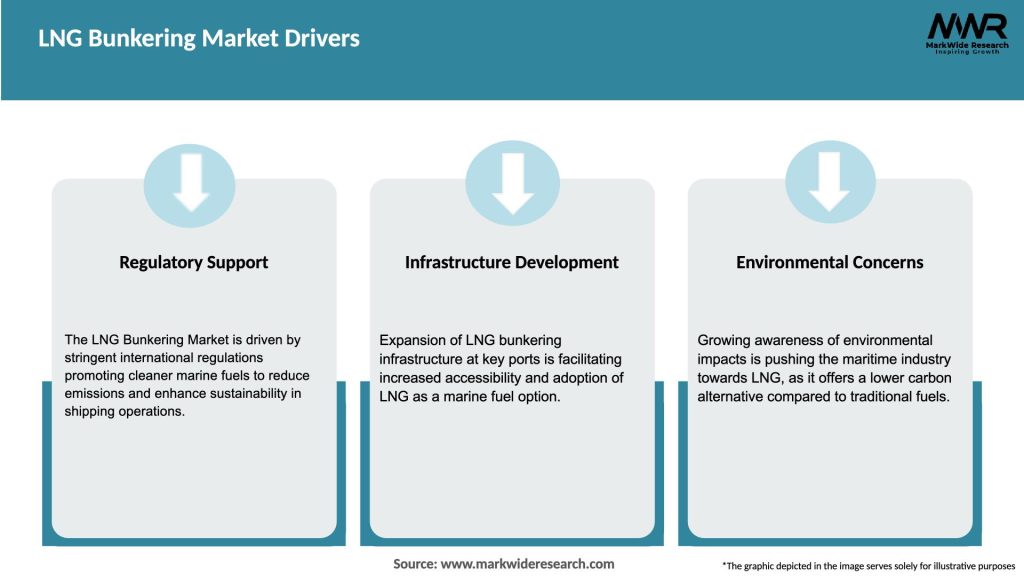

Market Drivers

The LNG bunkering market is driven by several key factors:

Market Restraints

Despite the positive growth prospects, the LNG bunkering market faces several challenges:

Market Opportunities

The LNG bunkering market offers several opportunities for growth:

Market Dynamics

The LNG bunkering market is driven by a combination of regulatory, economic, and technological factors. The demand for LNG as a marine fuel is influenced by environmental concerns, fuel cost differentials, infrastructure availability, and industry collaboration. The market dynamics are shaped by the interaction of these factors, which determine the growth and development of the LNG bunkering market.

Regional Analysis

The LNG bunkering market exhibits regional variations based on factors such as infrastructure development, regulatory frameworks, and the level of LNG adoption in the shipping industry. The key regions for LNG bunkering include:

Competitive Landscape

Leading Companies in the LNG Bunkering Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

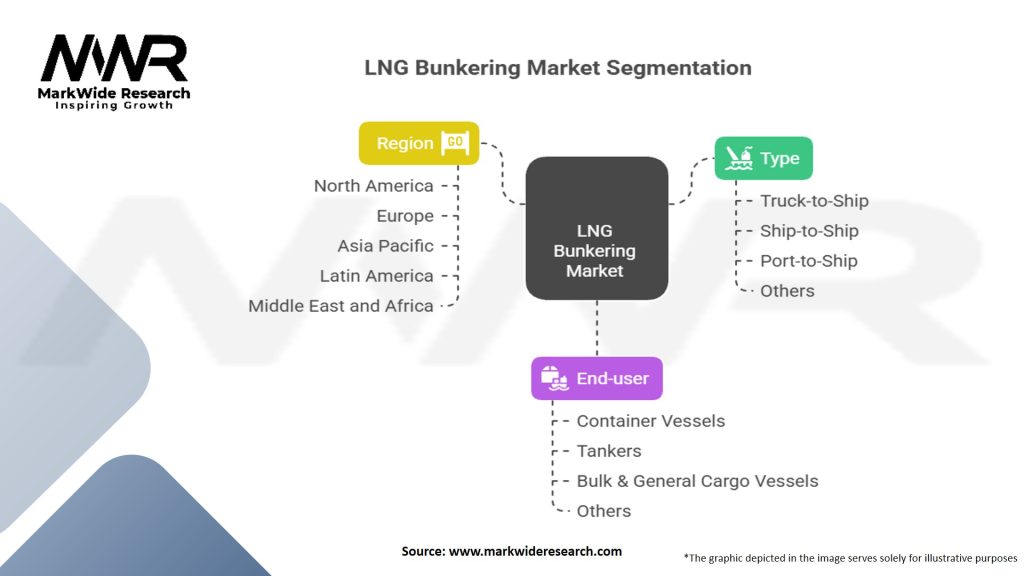

Segmentation

The LNG bunkering market can be segmented based on various factors, including:

Category-wise Insights

The LNG bunkering market can be further analyzed by considering specific categories:

Key Benefits for Industry Participants and Stakeholders

The LNG bunkering market offers several benefits for industry participants and stakeholders:

SWOT Analysis

A SWOT analysis of the LNG bunkering market can provide insights into its strengths, weaknesses, opportunities, and threats:

Market Key Trends

Several key trends are shaping the LNG bunkering market:

Covid-19 Impact

The COVID-19 pandemic has had both positive and negative impacts on the LNG bunkering market:

Positive Impact:

Negative Impact:

Key Industry Developments

The LNG bunkering market has witnessed several notable industry developments:

Analyst Suggestions

Based on the analysis of the LNG bunkering market, analysts make the following suggestions:

Future Outlook

The future outlook for the LNG bunkering market is optimistic. The market is expected to witness sustained growth driven by environmental regulations, the increasing adoption of LNG as a marine fuel, and the expansion of LNG bunkering infrastructure.

As more countries and ports recognize the benefits of LNG, investments in infrastructure and bunkering capabilities are likely to increase. LNG bunkering will become more accessible and widespread, catering to a broader range of vessel types and geographical areas.

Innovations in bunkering technologies, the standardization of procedures, and the development of small-scale LNG infrastructure will further support the growth of the market. Collaboration among stakeholders will remain crucial to address challenges, leverage opportunities, and foster a sustainable and efficient LNG bunkering ecosystem.

Conclusion

The LNG bunkering market is experiencing significant growth as the shipping industry seeks cleaner and more sustainable fuel alternatives. LNG offers numerous environmental benefits and cost advantages over traditional marine fuels. The market is driven by stringent environmental regulations, increasing LNG production and infrastructure development, and technological advancements.

While the market presents opportunities for industry participants and stakeholders, challenges such as high infrastructure costs and limited bunkering infrastructure need to be addressed. Collaboration, government support, and innovation will be key to overcoming these challenges and driving the future growth of the LNG bunkering market. The industry’s future outlook is positive, with the potential for widespread adoption of LNG as a marine fuel and the expansion of bunkering infrastructure worldwide.

What is LNG Bunkering?

LNG Bunkering refers to the process of supplying liquefied natural gas (LNG) as fuel to ships and vessels. This method is gaining popularity due to its environmental benefits and compliance with international regulations on emissions.

What are the key players in the LNG Bunkering Market?

Key players in the LNG Bunkering Market include companies like Shell, TotalEnergies, and Gasum, which are actively involved in developing infrastructure and services for LNG bunkering. These companies are focusing on expanding their operations to meet the growing demand for cleaner marine fuels, among others.

What are the growth factors driving the LNG Bunkering Market?

The LNG Bunkering Market is driven by factors such as stricter emissions regulations, the increasing adoption of LNG as a marine fuel, and the need for sustainable shipping solutions. Additionally, the rising awareness of environmental issues is pushing the maritime industry towards cleaner alternatives.

What challenges does the LNG Bunkering Market face?

Challenges in the LNG Bunkering Market include the high initial investment required for infrastructure development and the limited availability of LNG bunkering facilities in certain regions. Furthermore, the fluctuating prices of natural gas can impact the market’s growth.

What opportunities exist in the LNG Bunkering Market?

Opportunities in the LNG Bunkering Market include the expansion of LNG infrastructure in emerging markets and the development of innovative bunkering technologies. As the shipping industry seeks to reduce its carbon footprint, there is potential for growth in LNG-powered vessels.

What trends are shaping the LNG Bunkering Market?

Trends in the LNG Bunkering Market include the increasing collaboration between shipping companies and fuel suppliers, as well as advancements in LNG storage and delivery technologies. Additionally, the push for decarbonization in the maritime sector is leading to a greater focus on LNG as a viable alternative fuel.

LNG Bunkering Market

| Segmentation Details | Description |

|---|---|

| Type | Truck-to-Ship, Ship-to-Ship, Port-to-Ship, Others |

| End-user | Container Vessels, Tankers, Bulk & General Cargo Vessels, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the LNG Bunkering Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at