444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The livestock industry plays a vital role in the global economy, providing a source of income and sustenance for millions of people. With the increasing demand for animal products, such as meat, dairy, and poultry, the need for livestock insurance has become more important than ever. Livestock insurance provides protection to farmers and ranchers against financial losses resulting from various risks associated with animal farming.

Meaning

Livestock insurance can be defined as a specialized form of insurance that covers the risks faced by farmers and ranchers in raising livestock. It provides coverage for risks such as animal mortality, diseases, accidents, natural disasters, and theft. The aim of livestock insurance is to protect the livelihoods of farmers and ensure the stability of the livestock industry.

Executive Summary

The livestock insurance market has witnessed significant growth in recent years due to the increasing awareness of the importance of risk management in animal farming. The market is driven by factors such as the growing demand for animal products, the need for financial protection against unforeseen events, and government support in promoting the adoption of livestock insurance.

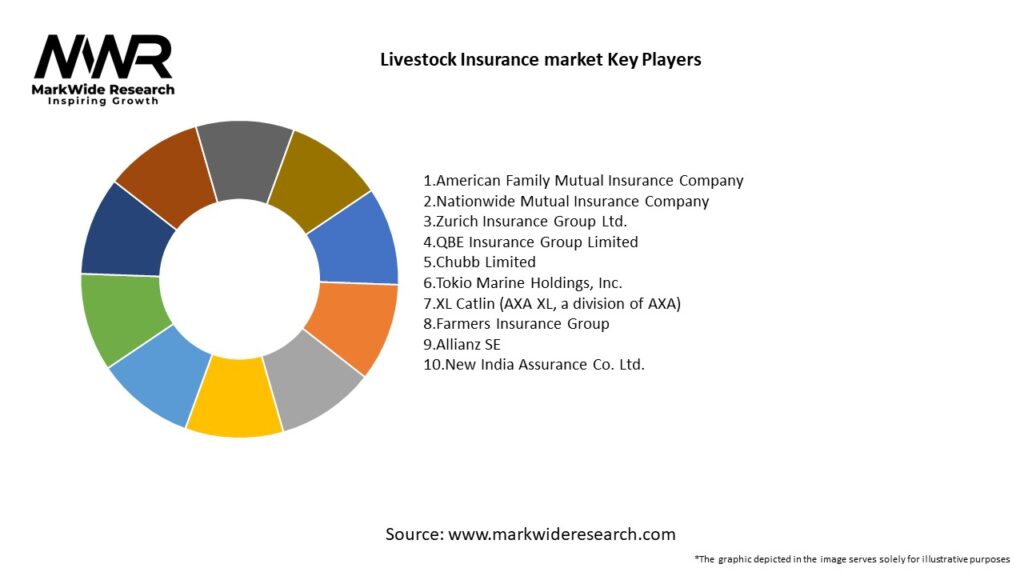

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The livestock insurance market operates in a dynamic environment influenced by various factors. The demand for livestock insurance is driven by the need for risk management in the livestock industry and the increasing awareness of its benefits. Government support and technological advancements further contribute to market growth. However, challenges such as lack of awareness, affordability, and complex claims processes need to be addressed to unlock the market’s full potential. The market presents opportunities for growth in emerging economies and through product innovation.

Regional Analysis

The livestock insurance market is geographically diverse, with significant variations across different regions. North America and Europe are the leading regions in terms of market share, driven by the presence of well-established livestock industries and high awareness of risk management practices. Asia Pacific and Latin America are expected to witness substantial growth due to the expanding livestock sectors in these regions. Africa also holds great potential for market development, with governments recognizing the importance of livestock insurance in promoting agricultural growth and food security.

Competitive Landscape

Leading Companies in the Livestock Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

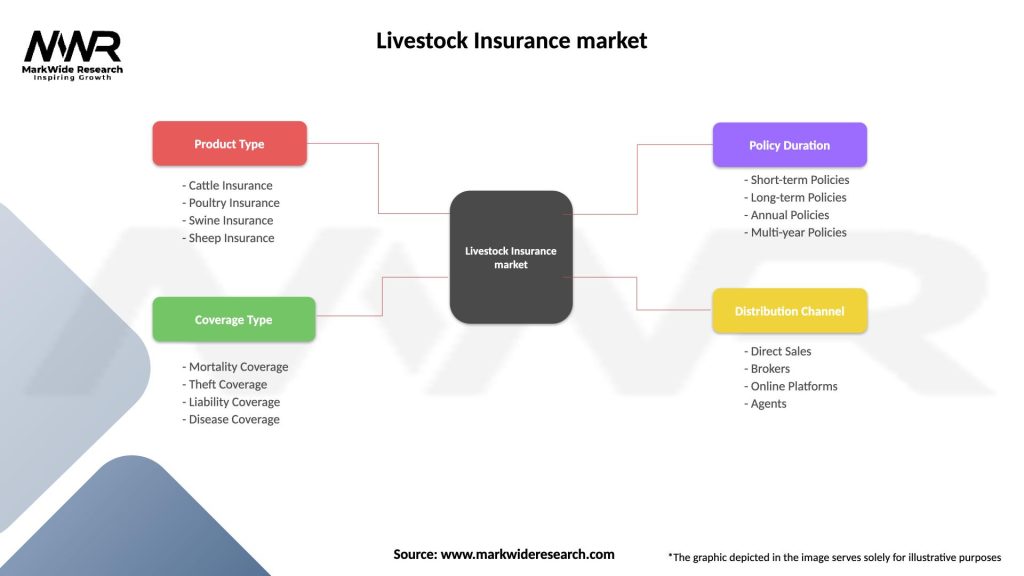

Segmentation

The livestock insurance market can be segmented based on the type of coverage, livestock species, and geography. The coverage types include animal mortality insurance, disease outbreak insurance, accident insurance, and natural disaster insurance. Livestock species may include cattle, poultry, swine, sheep, and others. Geographically, the market can be divided into North America, Europe, Asia Pacific, Latin America, and Africa.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

Livestock insurance offers several benefits to industry participants and stakeholders:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a significant impact on the livestock insurance market. The pandemic exposed vulnerabilities in the global food supply chain, leading to disruptions in livestock production and distribution. This highlighted the importance of risk management and financial protection in the livestock industry.

Farmers and ranchers faced challenges such as reduced demand, supply chain disruptions, and increased operational costs. Livestock insurance played a crucial role in providing financial support and stability during this challenging period. It helped farmers manage the financial impact of reduced sales, animal mortalities, and increased input costs.

The pandemic also accelerated the adoption of technology in the livestock insurance sector. Remote sensing, satellite imagery, and data analytics became even more important in assessing risks and monitoring the health and well-being of livestock remotely. This enabled insurers to continue providing services and support to farmers despite movement restrictions and social distancing measures.

Overall, the COVID-19 pandemic emphasized the importance of livestock insurance as a risk management tool and highlighted the need for increased awareness and adoption in the industry.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the livestock insurance market looks promising, driven by the increasing awareness of risk management practices in the livestock industry. The demand for animal products is expected to continue rising, creating a favorable market environment. Technological advancements will play a crucial role in shaping the industry, enabling more accurate risk assessment, personalized coverage options, and efficient claims processing.

There will be a growing focus on product innovation, with insurance providers developing customized solutions to address specific risks faced by farmers. Collaboration and partnerships with technology providers, agricultural organizations, and government agencies will be key in driving market growth and expanding the reach of livestock insurance services.

However, challenges such as lack of awareness, affordability, and complex claims processes need to be addressed to unlock the full potential of the market. Efforts to increase awareness, improve accessibility, and simplify claims processes will be essential to encourage wider adoption of livestock insurance.

Conclusion

The livestock insurance market is an essential component of the agricultural sector, providing farmers and ranchers with financial protection against various risks. As the global demand for animal products continues to rise, the need for livestock insurance becomes increasingly important.

This comprehensive analysis of the livestock insurance market highlighted its meaning, executive summary, key market insights, drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, benefits for industry participants and stakeholders, SWOT analysis, key trends, COVID-19 impact, key industry developments, analyst suggestions, future outlook, and concluded with the overall significance of livestock insurance.

What is Livestock Insurance?

Livestock Insurance is a type of insurance that provides financial protection to farmers and ranchers against the loss of livestock due to various risks such as disease, accidents, or natural disasters. This insurance helps ensure the sustainability of farming operations by mitigating potential financial losses.

What are the key players in the Livestock Insurance market?

Key players in the Livestock Insurance market include companies like Nationwide, American Farm Bureau Insurance, and Zurich Insurance Group, which offer various policies tailored to protect livestock. These companies compete by providing diverse coverage options and specialized services to meet the needs of farmers and ranchers, among others.

What are the main drivers of growth in the Livestock Insurance market?

The main drivers of growth in the Livestock Insurance market include increasing awareness of risk management among farmers, the rising incidence of livestock diseases, and the growing demand for sustainable farming practices. Additionally, government support and subsidies for insurance products are also contributing to market expansion.

What challenges does the Livestock Insurance market face?

The Livestock Insurance market faces challenges such as the high cost of premiums, limited awareness among small-scale farmers, and the complexity of policy terms. Additionally, fluctuating market prices for livestock can impact the perceived value of insurance, making it difficult for some farmers to justify the expense.

What opportunities exist in the Livestock Insurance market?

Opportunities in the Livestock Insurance market include the development of innovative insurance products that cater to emerging risks, such as climate change impacts. There is also potential for expanding coverage to include new livestock species and integrating technology for better risk assessment and management.

What trends are shaping the Livestock Insurance market?

Trends shaping the Livestock Insurance market include the increasing use of technology for data collection and risk assessment, as well as a growing emphasis on sustainability and animal welfare. Additionally, the rise of precision agriculture is influencing how insurance products are designed and marketed to farmers.

Livestock Insurance market

| Segmentation Details | Description |

|---|---|

| Product Type | Cattle Insurance, Poultry Insurance, Swine Insurance, Sheep Insurance |

| Coverage Type | Mortality Coverage, Theft Coverage, Liability Coverage, Disease Coverage |

| Policy Duration | Short-term Policies, Long-term Policies, Annual Policies, Multi-year Policies |

| Distribution Channel | Direct Sales, Brokers, Online Platforms, Agents |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Livestock Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at