444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The lithium-ion battery metal market is experiencing significant growth, driven by the increasing adoption of electric vehicles (EVs), growing demand for energy storage systems (ESS), and expanding renewable energy generation. Lithium-ion batteries serve as crucial energy storage solutions in various applications, including automotive, consumer electronics, and grid-scale storage, driving the demand for key metals such as lithium, cobalt, nickel, and graphite.

Meaning

The lithium-ion battery metal market refers to the global trade and consumption of metals used in the production of lithium-ion batteries. These metals include lithium, cobalt, nickel, and graphite, among others, which play essential roles in the performance and efficiency of lithium-ion battery cells. As the demand for electric vehicles, portable electronics, and renewable energy storage continues to rise, the lithium-ion battery metal market is witnessing substantial growth and investment.

Executive Summary

The lithium-ion battery metal market is witnessing rapid expansion, fueled by the global transition towards clean energy and sustainable transportation. Key market players are investing in mining operations, refining technologies, and battery manufacturing facilities to meet the growing demand for lithium-ion batteries. With advancements in battery chemistry, recycling technologies, and supply chain optimization, the market is poised for continued growth and innovation.

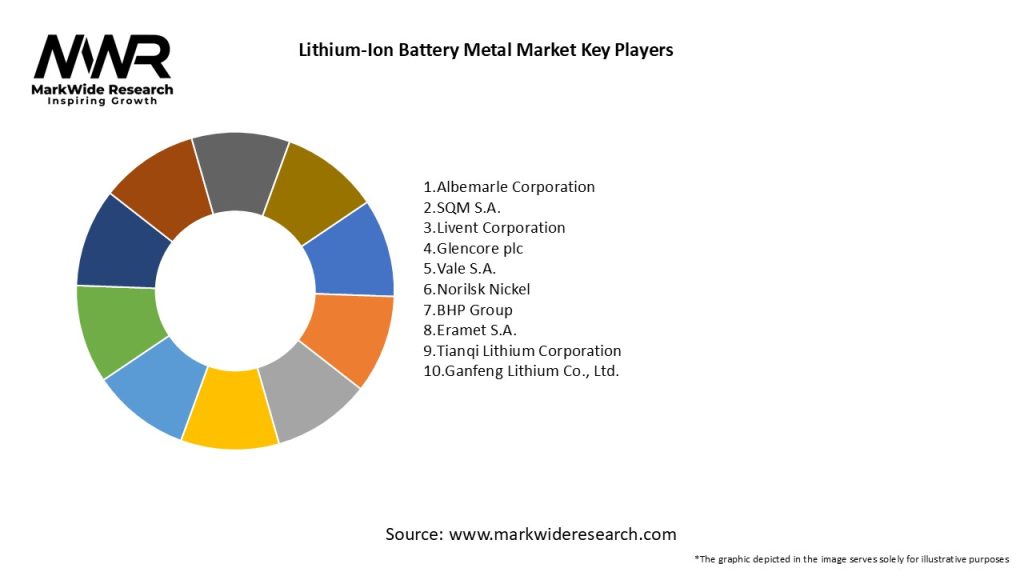

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Several factors are driving the growth of the lithium-ion battery metal market:

Market Restraints

Despite its promising growth prospects, the lithium-ion battery metal market faces certain challenges:

Market Opportunities

The lithium-ion battery metal market presents several opportunities for growth and innovation:

Market Dynamics

The lithium-ion battery metal market is characterized by dynamic trends and factors shaping its growth trajectory:

Regional Analysis

The lithium-ion battery metal market is distributed globally, with key production hubs and consumption centers in regions such as Asia-Pacific, North America, Europe, and Latin America. China dominates the market, accounting for a significant share of lithium-ion battery production, raw material processing, and electric vehicle manufacturing. North America and Europe are also important markets, driven by government incentives, technological innovation, and consumer demand for electric vehicles and renewable energy storage solutions.

Competitive Landscape

Leading Companies in the Lithium-Ion Battery Metal Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The lithium-ion battery metal market can be segmented based on various factors, including:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had mixed effects on the lithium-ion battery metal market. While disruptions to supply chains, manufacturing operations, and consumer demand have impacted short-term growth and profitability, the pandemic has also underscored the importance of clean energy, electrification, and energy storage solutions in building resilient and sustainable societies. As governments and businesses prioritize green recovery initiatives and stimulus packages, the demand for electric vehicles, renewable energy projects, and energy storage systems is expected to rebound, driving long-term growth in the lithium-ion battery metal market.

Key Industry Developments

Analyst Suggestions

Future Outlook

The lithium-ion battery metal market is poised for continued growth and transformation, driven by the global transition towards clean energy, electrification of transportation, and digitalization of society. As the demand for electric vehicles, renewable energy projects, and energy storage systems continues to rise, the market for lithium, cobalt, nickel, and other battery-grade metals is expected to expand rapidly, creating opportunities for mining companies, battery manufacturers, and technology providers. With ongoing advancements in battery chemistry, manufacturing processes, and recycling technologies, the lithium-ion battery metal market is set to play a pivotal role in shaping the future of energy storage, mobility, and sustainability.

Conclusion

In conclusion, the lithium-ion battery metal market represents a dynamic and rapidly evolving segment of the global energy landscape, with significant implications for transportation, renewable energy, and industrial sectors. As the world transitions towards clean energy and sustainable development, the demand for lithium, cobalt, nickel, and other battery-grade metals is expected to soar, driving investment, innovation, and market growth. By embracing technological advancements, sustainability principles, and collaborative partnerships, industry participants and stakeholders can capitalize on emerging opportunities, address common challenges, and contribute to a more resilient, efficient, and sustainable energy future.

What is Lithium-Ion Battery Metal?

Lithium-Ion Battery Metal refers to the various metals used in the production of lithium-ion batteries, including lithium, cobalt, nickel, and manganese. These metals are essential for the battery’s performance, energy density, and longevity.

What are the key companies in the Lithium-Ion Battery Metal Market?

Key companies in the Lithium-Ion Battery Metal Market include Albemarle Corporation, SQM, Livent Corporation, and Glencore, among others. These companies are involved in the extraction, processing, and supply of metals critical for lithium-ion battery production.

What are the main drivers of the Lithium-Ion Battery Metal Market?

The main drivers of the Lithium-Ion Battery Metal Market include the increasing demand for electric vehicles, the growth of renewable energy storage solutions, and advancements in battery technology. These factors are propelling the need for high-quality battery metals.

What challenges does the Lithium-Ion Battery Metal Market face?

The Lithium-Ion Battery Metal Market faces challenges such as supply chain disruptions, fluctuating metal prices, and environmental concerns related to mining practices. These issues can impact the availability and sustainability of battery metals.

What opportunities exist in the Lithium-Ion Battery Metal Market?

Opportunities in the Lithium-Ion Battery Metal Market include the development of new recycling technologies, the exploration of alternative materials, and the expansion of battery production facilities. These advancements can enhance sustainability and reduce reliance on traditional metal sources.

What trends are shaping the Lithium-Ion Battery Metal Market?

Trends shaping the Lithium-Ion Battery Metal Market include the increasing focus on sustainable sourcing, the rise of solid-state batteries, and the integration of artificial intelligence in battery manufacturing. These trends are expected to influence future market dynamics.

Lithium-Ion Battery Metal Market

| Segmentation Details | Description |

|---|---|

| Product Type | Lithium Carbonate, Lithium Hydroxide, Cobalt, Nickel |

| End User | Electric Vehicles, Consumer Electronics, Energy Storage Systems, Industrial Applications |

| Application | Power Tools, Electric Bicycles, Drones, Grid Storage |

| Technology | Solid-State, Lithium-Sulfur, Lithium-Air, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Lithium-Ion Battery Metal Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at