444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Liquidity Asset Liability Management Solutions market is a dynamic and rapidly evolving sector within the financial industry. It encompasses a range of solutions and strategies that enable financial institutions to manage their assets and liabilities effectively, ensuring liquidity and mitigating risk. This market has gained significant traction in recent years as financial institutions strive to optimize their balance sheets and navigate complex regulatory environments. Liquidity Asset Liability Management Solutions play a crucial role in helping institutions maintain stability and meet their financial obligations.

Meaning

Liquidity Asset Liability Management Solutions refer to a set of strategies and tools used by financial institutions to manage and optimize their balance sheets. These solutions involve the assessment and management of the institution’s liquidity risk, interest rate risk, and other factors that impact its financial stability. By employing Liquidity Asset Liability Management Solutions, financial institutions can ensure that they have sufficient liquidity to meet their short-term obligations while also managing long-term risks and maintaining profitability.

Executive Summary

The Liquidity Asset Liability Management Solutions market is witnessing substantial growth, driven by the increasing need for financial institutions to manage their assets and liabilities effectively. These solutions provide institutions with the tools and strategies necessary to optimize their balance sheets, ensuring stability and mitigating risk. The market is characterized by intense competition among key players, who are constantly innovating to offer more advanced and tailored solutions. The COVID-19 pandemic has also had a significant impact on the market, highlighting the importance of liquidity and risk management for financial institutions.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Liquidity Asset Liability Management Solutions market is characterized by dynamic and interrelated factors that shape its growth and evolution. Key dynamics include regulatory developments, technological advancements, market volatility, customer expectations, and industry competition. These dynamics create both challenges and opportunities for market participants, driving innovation, collaboration, and strategic decision-making.

Regulatory developments play a crucial role in shaping the Liquidity Asset Liability Management Solutions market. Regulatory requirements, such as liquidity stress testing, capital adequacy ratios, and risk reporting, drive the adoption of these solutions. Financial institutions are under pressure to comply with regulations, which fuels the demand for sophisticated Liquidity Asset Liability Management Solutions that can facilitate compliance and enhance risk management.

Technological advancements are another significant dynamic in the market. Advanced analytics, artificial intelligence, machine learning, and cloud computing technologies are transforming the way financial institutions manage liquidity and risk. These technologies enable institutions to analyze large volumes of data, generate real-time insights, and automate processes, enhancing efficiency and effectiveness in liquidity and risk management.

Market volatility and changing customer expectations also influence the Liquidity Asset Liability Management Solutions market. Financial institutions face challenges in managing liquidity and mitigating risk in a rapidly changing and unpredictable market environment. Customers expect institutions to have robust risk management frameworks in place, which drives the demand for advanced Liquidity Asset Liability Management Solutions.

Intense competition among market players is another dynamic that shapes the market. Key players constantly innovate and differentiate themselves by developing new products, expanding their service offerings, and enhancing their technological capabilities. This competition drives the development of more sophisticated and tailored Liquidity Asset Liability Management Solutions.

Regional Analysis

The Liquidity Asset Liability Management Solutions market exhibits regional variations, influenced by factors such as regulatory environments, market maturity, and economic conditions. While the market is global in nature, certain regions show significant growth and opportunities.

North America has traditionally been a key market for Liquidity Asset Liability Management Solutions, driven by the presence of large financial institutions and stringent regulatory requirements. The region’s mature financial industry and emphasis on risk management contribute to the demand for advanced Liquidity Asset Liability Management Solutions.

Europe is another significant market for Liquidity Asset Liability Management Solutions, with a strong regulatory framework and a focus on financial stability. European financial institutions are required to comply with regulations such as Basel III and Solvency II, driving the adoption of Liquidity Asset Liability Management Solutions.

Asia Pacific is an emerging market for Liquidity Asset Liability Management Solutions, fueled by the region’s economic growth, expanding financial sector, and increasing regulatory focus. As financial institutions in the region become more sophisticated, the demand for advanced Liquidity Asset Liability Management Solutions is expected to rise.

Latin America and the Middle East also present opportunities for market players, as financial institutions in these regions strive to enhance their liquidity and risk management capabilities. Factors such as regulatory reforms, increasing market complexity, and a growing emphasis on risk management create opportunities for Liquidity Asset Liability Management Solutions providers.

Competitive Landscape

Leading Companies in the Liquidity Asset Liability Management Solutions Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

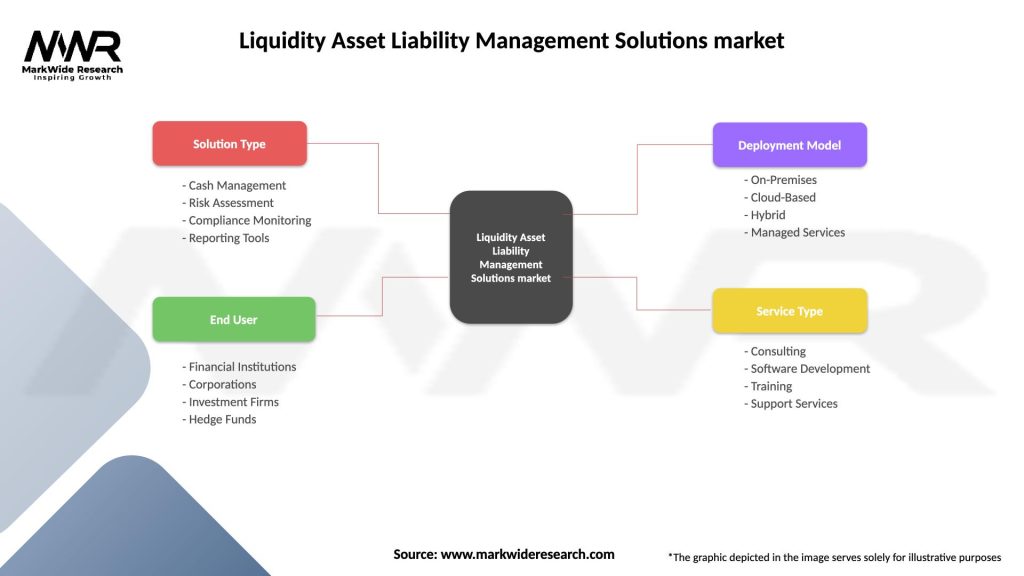

Segmentation

The Liquidity Asset Liability Management Solutions market can be segmented based on various factors, including solution type, deployment mode, end-user, and region. Common segmentation categories include:

Segmentation allows market players to target specific customer segments and tailor their solutions to meet the unique requirements of each segment. It also helps in analyzing market trends, understanding customer preferences, and making informed business decisions.

Category-wise Insights

Category-wise insights allow market players and stakeholders to understand the specific features and benefits offered by different types of Liquidity Asset Liability Management Solutions. This understanding helps in making informed decisions regarding solution selection and implementation.

Key Benefits for Industry Participants and Stakeholders

Key benefits for industry participants and stakeholders highlight the value and advantages offered by Liquidity Asset Liability Management Solutions. These benefits drive the adoption of these solutions and contribute to the growth of the market.

SWOT Analysis

A SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis provides an overview of the internal and external factors that impact the Liquidity Asset Liability Management Solutions market.

Strengths:

Weaknesses:

Opportunities:

Threats:

A SWOT analysis helps market participants and stakeholders understand the market’s strengths, weaknesses, opportunities, and threats. This analysis provides insights for strategic decision-making, risk assessment, and market positioning.

Market Key Trends

Market key trends highlight the evolving nature of Liquidity Asset Liability Management Solutions and the key factors driving innovation and adoption in the market. Understanding these trends allows market participants to stay ahead of the curve and meet the evolving needs of financial institutions.

Covid-19 Impact

The COVID-19 pandemic has had a profound impact on the Liquidity Asset Liability Management Solutions market. The pandemic exposed vulnerabilities in liquidity management and risk mitigation strategies, highlighting the importance of effective Liquidity Asset Liability Management.

During the initial phase of the pandemic, financial institutions faced significant liquidity challenges as markets experienced heightened volatility and disruptions. The sudden economic downturn and uncertain market conditions emphasized the need for robust liquidity risk management and stress testing capabilities. Institutions were required to assess their liquidity positions, model various stress scenarios, and develop contingency plans to ensure their continued operations.

Regulatory bodies also responded to the pandemic by introducing temporary measures and relief programs to support financial institutions. These measures included changes to liquidity requirements, capital buffers, and reporting deadlines. Liquidity Asset Liability Management Solutions played a crucial role in enabling institutions to comply with these regulatory changes and manage their liquidity positions effectively.

The pandemic also accelerated the adoption of digital technologies in Liquidity Asset Liability Management. Remote work environments and the need for real-time monitoring and decision-making highlighted the value of cloud-based solutions, advanced analytics, and automation. Financial institutions quickly adapted to digital solutions to enhance their liquidity and risk management capabilities and ensure business continuity.

Overall, the COVID-19 pandemic underscored the importance of liquidity and risk management for financial institutions. It drove increased demand for Liquidity Asset Liability Management Solutions and highlighted the need for agile and resilient liquidity risk management frameworks.

Key Industry Developments

Key industry developments highlight the evolving nature of the Liquidity Asset Liability Management Solutions market. These developments are driven by regulatory changes, technological advancements, industry collaboration, and the growing emphasis on ESG factors in risk management.

Analyst Suggestions

Analyst suggestions provide guidance and recommendations for financial institutions and market participants to enhance their Liquidity Asset Liability Management practices. By implementing these suggestions, institutions can improve risk management, optimize their balance sheets, and navigate the evolving market landscape effectively.

Future Outlook

The Liquidity Asset Liability Management Solutions market is expected to witness significant growth in the coming years. Factors such as increasing regulatory requirements, technological advancements, and the growing importance of effective liquidity and risk management will drive the demand for these solutions.

Regulatory compliance will continue to be a key driver for the adoption of Liquidity Asset Liability Management Solutions. Financial institutions will be required to meet regulatory requirements, such as liquidity stress testing, reporting, and capital adequacy ratios. This will fuel the demand for solutions that facilitate compliance and enhance risk management.

Technological advancements, such as artificial intelligence, machine learning, and cloud computing, will further transform the Liquidity Asset Liability Management landscape. These technologies will enable institutions to analyze large volumes of data, generate real-time insights, and automate manual processes, enhancing efficiency and effectiveness in liquidity and risk management.

The integration of ESG factors into liquidity and risk management frameworks will gain momentum. Financial institutions will increasingly consider ESG risks and opportunities in their decision-making processes, necessitating solutions that can incorporate ESG considerations into liquidity and risk assessments.

Collaborations and partnerships between financial institutions and technology providers will continue to drive innovation in the Liquidity Asset Liability Management Solutions market. These collaborations will enable the development of tailored solutions that address the specific needs of institutions and facilitate industry-wide best practices.

Conclusion

The Liquidity Asset Liability Management Solutions market is witnessing significant growth and transformation, driven by regulatory requirements, technological advancements, and the evolving needs of financial institutions. These solutions play a crucial role in helping institutions manage their assets and liabilities effectively, ensuring liquidity, mitigating risk, and meeting regulatory compliance.

Financial institutions are increasingly prioritizing Liquidity Asset Liability Management to optimize their balance sheets, enhance risk management frameworks, and improve operational efficiency. The integration of advanced technologies, such as artificial intelligence, machine learning, and cloud computing, has revolutionized the market by providing institutions with sophisticated analytics tools and automation capabilities.

What is Liquidity Asset Liability Management Solutions?

Liquidity Asset Liability Management Solutions refer to strategies and tools used by financial institutions to manage their liquidity and balance sheet risks. These solutions help organizations ensure they have sufficient cash flow to meet obligations while optimizing asset allocation.

What are the key players in the Liquidity Asset Liability Management Solutions market?

Key players in the Liquidity Asset Liability Management Solutions market include FIS, Moody’s Analytics, and Oracle Financial Services, among others. These companies provide software and consulting services to help organizations manage their liquidity and financial risks effectively.

What are the main drivers of growth in the Liquidity Asset Liability Management Solutions market?

The growth of the Liquidity Asset Liability Management Solutions market is driven by increasing regulatory requirements, the need for improved risk management practices, and the growing complexity of financial products. Additionally, advancements in technology are enabling more efficient liquidity management.

What challenges does the Liquidity Asset Liability Management Solutions market face?

Challenges in the Liquidity Asset Liability Management Solutions market include the high cost of implementation, the complexity of integrating new solutions with existing systems, and the need for continuous updates to comply with evolving regulations. These factors can hinder adoption among smaller institutions.

What opportunities exist in the Liquidity Asset Liability Management Solutions market?

Opportunities in the Liquidity Asset Liability Management Solutions market include the increasing demand for real-time data analytics, the rise of fintech innovations, and the expansion of services to emerging markets. These trends present avenues for growth and development in liquidity management.

What trends are shaping the Liquidity Asset Liability Management Solutions market?

Current trends in the Liquidity Asset Liability Management Solutions market include the adoption of cloud-based solutions, the integration of artificial intelligence for predictive analytics, and a focus on sustainability in financial practices. These trends are transforming how institutions manage liquidity and risk.

Liquidity Asset Liability Management Solutions market

| Segmentation Details | Description |

|---|---|

| Solution Type | Cash Management, Risk Assessment, Compliance Monitoring, Reporting Tools |

| End User | Financial Institutions, Corporations, Investment Firms, Hedge Funds |

| Deployment Model | On-Premises, Cloud-Based, Hybrid, Managed Services |

| Service Type | Consulting, Software Development, Training, Support Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Liquidity Asset Liability Management Solutions Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at