444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Detective Service Market encompasses a range of professional investigative services aimed at uncovering facts, gathering evidence, and providing insights to support legal, corporate, or personal matters. From private investigations to corporate security consulting, detective services play a crucial role in uncovering the truth and ensuring justice in various contexts. With the increasing complexity of legal and business environments, the demand for specialized investigative services continues to grow.

Meaning

Detective services refer to professional investigative services offered by trained professionals known as detectives or private investigators. These services typically involve gathering information, conducting surveillance, and analyzing evidence to support legal proceedings, corporate decision-making, or personal matters such as marital disputes or missing persons cases. Detectives use a variety of techniques and tools, including surveillance equipment, databases, and interviews, to uncover facts and provide actionable insights to their clients.

Executive Summary

The Detective Service Market has witnessed significant growth in recent years, driven by factors such as increasing security concerns, corporate fraud, and the need for legal support in litigation cases. Private individuals, businesses, law firms, insurance companies, and government agencies rely on detective services to uncover evidence, mitigate risks, and ensure compliance with legal and regulatory requirements. As the demand for investigative services continues to rise, the market presents lucrative opportunities for detective agencies and professionals.

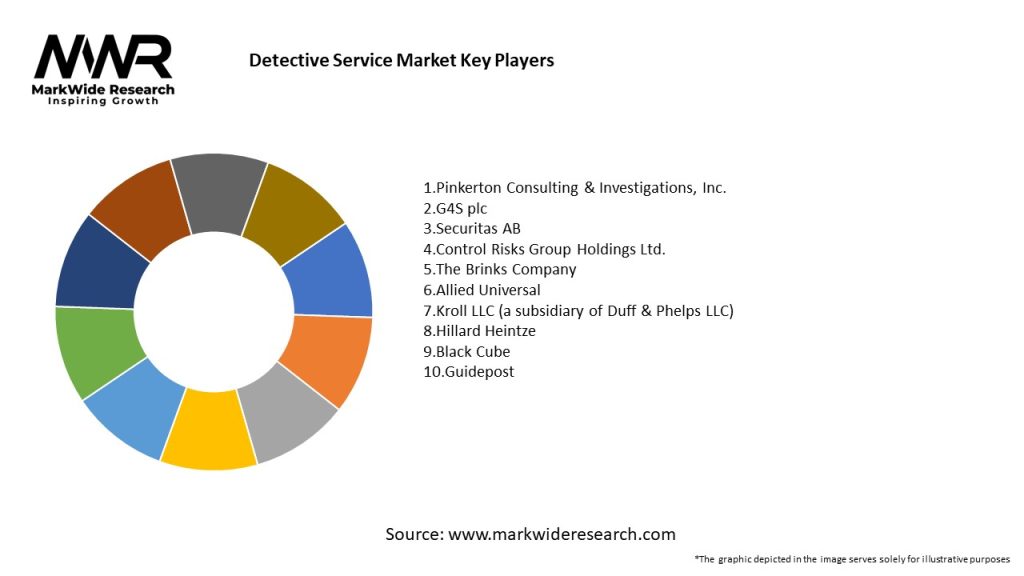

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Detective Service Market operates in a dynamic environment influenced by factors such as technological advancements, regulatory changes, market competition, and evolving client needs. Detectives must stay abreast of industry trends, invest in training and technology, and adapt their services to meet the changing demands of their clients and the broader market.

Regional Analysis

The Detective Service Market exhibits regional variations in terms of regulatory frameworks, cultural norms, economic conditions, and security threats. While developed markets such as North America and Europe have well-established detective agencies and stringent regulatory requirements, emerging markets in Asia Pacific, Latin America, and Africa offer growth opportunities driven by increasing security concerns, corporate fraud, and regulatory compliance needs.

Competitive Landscape

Leading Companies in the Detective Service Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Detective Service Market can be segmented based on various factors including:

Segmentation enables detective agencies to tailor their services to specific client needs, industry requirements, and geographic preferences, ensuring relevance and competitiveness in the market.

Category-wise Insights

These category-wise insights highlight the diverse range of detective services available to clients across various industries and personal situations, addressing specific investigative needs and objectives.

Key Benefits for Industry Participants and Stakeholders

These key benefits underscore the value proposition of detective services for industry participants and stakeholders, enabling them to address challenges, mitigate risks, and achieve their objectives effectively and efficiently.

SWOT Analysis

A SWOT analysis provides insights into the strengths, weaknesses, opportunities, and threats of the Detective Service Market:

Understanding these factors through a SWOT analysis helps detective agencies identify their competitive advantages, address weaknesses, capitalize on opportunities, and mitigate threats in the Detective Service Market.

Market Key Trends

These key trends reflect the evolving nature of detective services, driven by technological advancements, market dynamics, and changing client expectations, shaping the future of the Detective Service Market.

Covid-19 Impact

The COVID-19 pandemic has had a mixed impact on the Detective Service Market. While the pandemic has led to disruptions in traditional investigative activities such as surveillance and fieldwork, it has also created new opportunities for detectives to leverage technology, remote work, and digital forensics in their investigative work. The shift towards remote work, online transactions, and virtual communication has also created new challenges and security risks, increasing the demand for detective services to address cybersecurity threats, employee misconduct, and compliance issues in the remote work environment.

Key Industry Developments

These key industry developments reflect the resilience, adaptability, and innovation of detective agencies in responding to changing market conditions and client needs in the post-pandemic era.

Analyst Suggestions

These analyst suggestions provide guidance for detective agencies to navigate industry challenges, capitalize on emerging opportunities, and drive innovation and growth in the Detective Service Market.

Future Outlook

The future outlook for the Detective Service Market is positive, driven by factors such as increasing security concerns, regulatory requirements, technological advancements, and globalization trends. As businesses and individuals seek to protect their interests, assets, and information in an increasingly complex and interconnected world, the demand for professional investigative services is expected to continue growing. Detective agencies that invest in technology, specialization, compliance, and strategic partnerships will be well-positioned to capitalize on emerging opportunities and drive growth in the Detective Service Market.

Conclusion

The Detective Service Market plays a vital role in uncovering facts, gathering evidence, and providing insights to support legal, corporate, and personal matters. With increasing security concerns, regulatory requirements, and technological advancements, the demand for professional investigative services continues to grow. Detective agencies that invest in technology, specialization, compliance, and strategic partnerships will be well-positioned to capitalize on emerging opportunities and drive growth in the Detective Service Market, ensuring the continued integrity, safety, and security of individuals, businesses, and society as a whole.

What is Liquidation Service?

Liquidation Service refers to the process of selling off a company’s assets to pay creditors when a business is closing or restructuring. This can involve auctions, sales of inventory, and disposal of equipment.

What are the key players in the Liquidation Service Market?

Key players in the Liquidation Service Market include companies like Gordon Brothers, Hilco Global, and Ritchie Bros. Auctioneers, which specialize in asset liquidation and recovery services, among others.

What are the main drivers of growth in the Liquidation Service Market?

The main drivers of growth in the Liquidation Service Market include increasing business closures, the rise of e-commerce leading to excess inventory, and the need for companies to recover funds during financial distress.

What challenges does the Liquidation Service Market face?

Challenges in the Liquidation Service Market include fluctuating asset values, competition from online auction platforms, and regulatory hurdles that can complicate the liquidation process.

What opportunities exist in the Liquidation Service Market?

Opportunities in the Liquidation Service Market include expanding services to e-commerce businesses, leveraging technology for better asset valuation, and increasing demand for sustainable liquidation practices.

What trends are shaping the Liquidation Service Market?

Trends shaping the Liquidation Service Market include the growing use of online platforms for auctions, increased focus on sustainability in asset disposal, and the integration of technology for efficient inventory management.

Liquidation Service Market

| Segmentation Details | Description |

|---|---|

| Service Type | Retail Liquidation, Wholesale Liquidation, Auction Services, Online Liquidation |

| Client Type | Retailers, Manufacturers, Distributors, E-commerce Platforms |

| Product Type | Consumer Electronics, Apparel, Home Goods, Industrial Equipment |

| Sales Channel | Direct Sales, Online Marketplaces, Liquidation Auctions, Clearance Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Liquidation Service Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at