444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Liquefied Natural Gas (LNG) Infrastructure Market plays a pivotal role in the global energy landscape, facilitating the transportation, storage, and distribution of liquefied natural gas. LNG is a versatile and clean-burning fuel used in various sectors, including energy generation, transportation, and industrial applications. This market’s growth is driven by the increasing demand for cleaner energy sources, the expansion of LNG production and export facilities, and advancements in LNG infrastructure technologies.

Meaning

LNG infrastructure encompasses the entire supply chain for liquefied natural gas, including liquefaction plants, storage tanks, shipping vessels, regasification terminals, and distribution networks. It enables the efficient production, transportation, and utilization of LNG as an energy source. The LNG Infrastructure Market not only contributes to reducing carbon footprints but also plays a central role in diversifying and enhancing energy accessibility and reliability on a global scale. As it continues to expand and evolve, the market reinforces the transition towards cleaner and more sustainable energy systems, ultimately promoting a greener and more resilient future for energy generation and distribution worldwide.

Executive Summary

The LNG Infrastructure Market is expanding rapidly as LNG gains prominence as a cleaner and more flexible energy source. The LNG Infrastructure Market not only contributes to reducing carbon footprints but also plays a central role in diversifying and enhancing energy accessibility and reliability on a global scale. Investment in LNG infrastructure is critical to meet the growing demand for natural gas worldwide and achieve emissions reduction goals.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

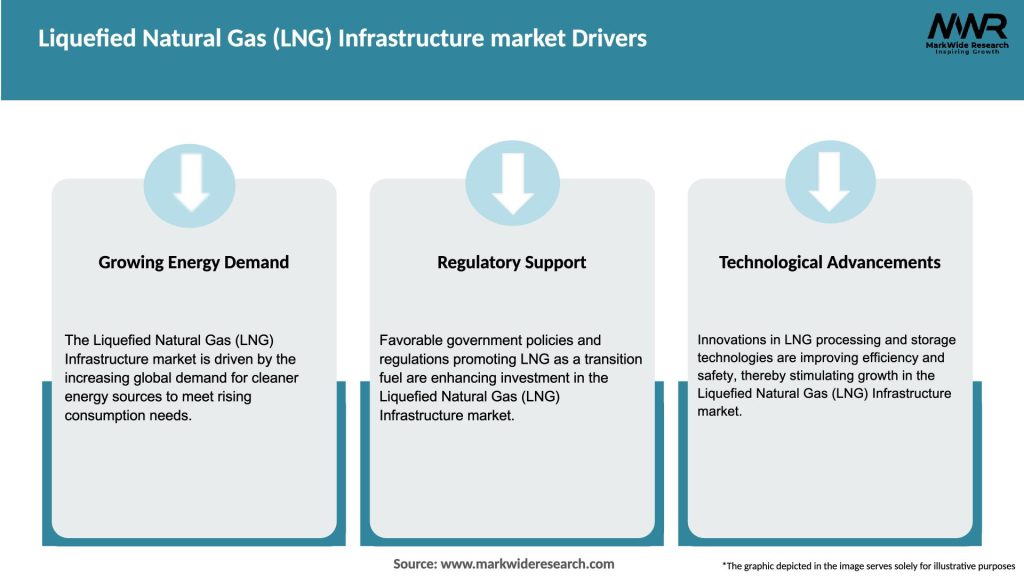

Market Drivers

The following factors are driving the growth of the LNG Infrastructure Market:

Market Restraints

Despite its growth, the market faces certain challenges:

Market Opportunities

The LNG Infrastructure Market offers several growth opportunities:

Market Dynamics

The market’s dynamics are influenced by global energy demand, environmental concerns, government policies, and technological advancements. Collaboration between energy companies, governments, and investors is crucial for the development of LNG infrastructure.

Regional Analysis

The LNG Infrastructure Market is global, with LNG infrastructure found in regions such as North America, Europe, Asia-Pacific, and the Middle East. Regional variations may exist in terms of LNG production capacity, import/export dynamics, and infrastructure development.

Competitive Landscape

Leading Companies in the Liquefied Natural Gas (LNG) Infrastructure Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

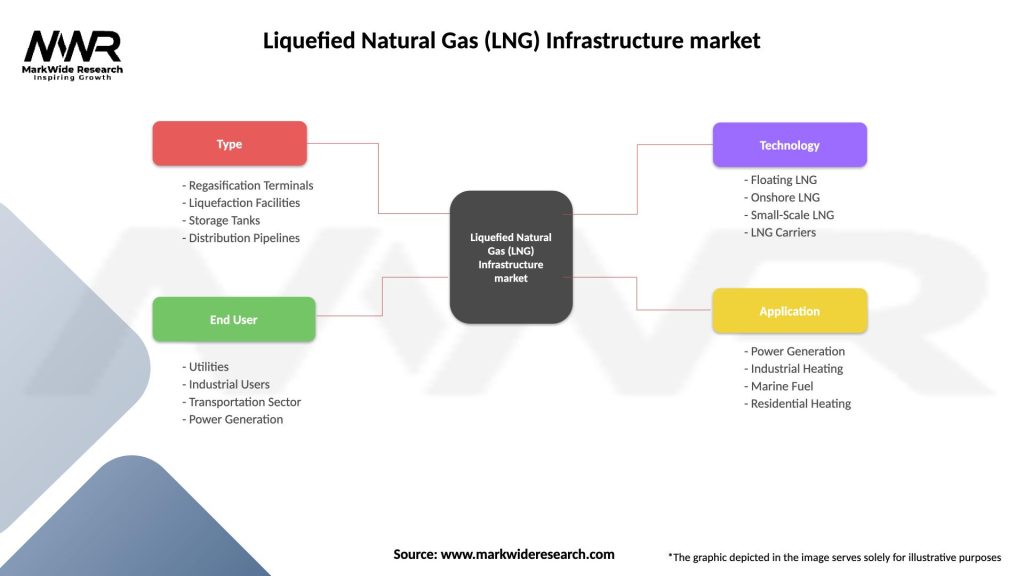

Segmentation

The LNG Infrastructure Market can be segmented based on various factors, including:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths

Weaknesses

Opportunities

Threats

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic led to fluctuations in energy demand and disrupted LNG supply chains. However, LNG remained a crucial energy source for power generation and industrial processes, contributing to energy stability during the pandemic.

Key Industry Developments

Analyst Suggestions

Future Outlook

The LNG Infrastructure Market is expected to continue growing as LNG gains prominence as a cleaner energy source and an essential component of the global energy mix. Advancements in LNG infrastructure technologies, expanding LNG production capacity, and the promotion of LNG for transportation and industrial applications will further drive market expansion. The future outlook for the LNG Infrastructure Market is exceptionally promising, with opportunities for expansion, technology advancements, and infrastructure development. Industry stakeholders should continue to invest in research, innovation, and collaboration to meet the evolving energy needs of nations and drive the adoption of LNG as a versatile and eco-friendly energy solution.

Conclusion

The LNG Infrastructure Market is integral to meeting the world’s growing energy demand while reducing greenhouse gas emissions. LNG infrastructure development, including liquefaction, transportation, regasification, and distribution, is crucial for ensuring a sustainable and reliable energy supply. Collaboration among governments, energy companies, and investors is key to achieving a cleaner and more diversified energy landscape through LNG.

In conclusion, the LNG (Liquefied Natural Gas) Infrastructure Market stands at the forefront of the global energy transition, serving as a critical enabler for the efficient storage, transportation, and utilization of natural gas. This comprehensive analysis underscores the market’s pivotal role in facilitating the shift towards cleaner and more sustainable energy sources.

What is Liquefied Natural Gas (LNG) Infrastructure?

Liquefied Natural Gas (LNG) Infrastructure refers to the facilities and systems involved in the production, storage, transportation, and regasification of LNG. This includes LNG terminals, pipelines, and storage tanks that enable the efficient distribution of natural gas in its liquefied form.

What are the key players in the Liquefied Natural Gas (LNG) Infrastructure market?

Key players in the Liquefied Natural Gas (LNG) Infrastructure market include companies like Cheniere Energy, Shell, and TotalEnergies, which are involved in various aspects of LNG production and distribution. These companies play significant roles in developing infrastructure to support LNG supply chains, among others.

What are the growth factors driving the Liquefied Natural Gas (LNG) Infrastructure market?

The Liquefied Natural Gas (LNG) Infrastructure market is driven by increasing global energy demand, the shift towards cleaner energy sources, and the expansion of natural gas as a fuel for transportation and power generation. Additionally, investments in LNG export facilities and regasification terminals are contributing to market growth.

What challenges does the Liquefied Natural Gas (LNG) Infrastructure market face?

The Liquefied Natural Gas (LNG) Infrastructure market faces challenges such as high capital costs for infrastructure development, regulatory hurdles, and competition from alternative energy sources. Additionally, geopolitical factors can impact supply chains and investment decisions.

What opportunities exist in the Liquefied Natural Gas (LNG) Infrastructure market?

Opportunities in the Liquefied Natural Gas (LNG) Infrastructure market include the potential for new LNG projects in emerging markets, advancements in technology for more efficient LNG processing, and the growing demand for LNG as a transition fuel in the energy sector. These factors can lead to increased investment and development in the sector.

What trends are shaping the Liquefied Natural Gas (LNG) Infrastructure market?

Trends shaping the Liquefied Natural Gas (LNG) Infrastructure market include the rise of small-scale LNG facilities, increased focus on sustainability and carbon capture technologies, and the integration of digital technologies for monitoring and optimizing LNG operations. These trends are influencing how LNG is produced and distributed globally.

Liquefied Natural Gas (LNG) Infrastructure market

| Segmentation Details | Description |

|---|---|

| Type | Regasification Terminals, Liquefaction Facilities, Storage Tanks, Distribution Pipelines |

| End User | Utilities, Industrial Users, Transportation Sector, Power Generation |

| Technology | Floating LNG, Onshore LNG, Small-Scale LNG, LNG Carriers |

| Application | Power Generation, Industrial Heating, Marine Fuel, Residential Heating |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Liquefied Natural Gas (LNG) Infrastructure Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at