444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The LiDAR (Light Detection and Ranging) in Construction Market represents a transformative shift within the construction industry. LiDAR technology, which uses laser pulses to measure distances and create detailed 3D maps of environments, has revolutionized construction processes. It has found applications in site surveying, mapping, building information modeling (BIM), and quality control. This comprehensive analysis delves into the intricacies of the LiDAR in Construction Market, covering its meaning, executive summary, key market insights, drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, benefits for industry participants, SWOT analysis, key trends, the impact of Covid-19, industry developments, analyst suggestions, future outlook, and a conclusive summary.

Meaning

LiDAR (Light Detection and Ranging) uses pulsed laser light to measure variable distances to the Earth’s surface or man-made structures. In construction, airborne, terrestrial, and mobile LiDAR platforms scan sites to produce point clouds—dense, georeferenced 3D datasets that reveal surface contours, structural details, and object positions to within centimeters. These digital twins enhance planning, design verification, earthworks calculation, and as-built comparisons, reducing rework and improving safety.

Executive Summary

The LiDAR in Construction Market represents a paradigm shift in the way construction projects are planned, executed, and monitored. With the ability to generate highly accurate 3D models of construction sites and structures, LiDAR technology has become an indispensable tool for construction professionals. The market is driven by the need for improved project efficiency, safety, and cost-effectiveness.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Terrestrial LiDAR scanners remain dominant, but UAV-mounted LiDAR is the fastest-growing segment due to flexibility in difficult terrain and large-area mapping.

Integration of LiDAR with photogrammetry and 360° imaging enables richer context in BIM deliverables and virtual walkthroughs.

Cloud-based point-cloud processing platforms are enhancing collaboration among stakeholders by providing near real-time access to scan data.

Cost reductions in sensor production and emergence of entry-level scanners are opening adoption among mid-sized contractors and survey firms.

Demand for digital twins and “as-built” verification in smart-city initiatives is driving governmental and large commercial project uptake.

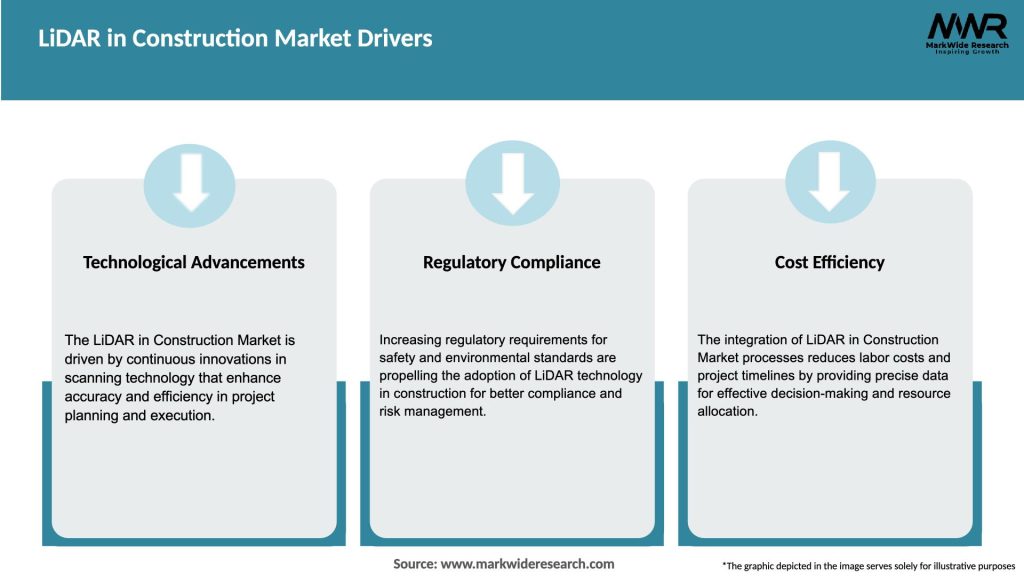

Market Drivers

Digital Transformation: The push for BIM compliance and digital twin creation compels contractors to adopt LiDAR for precise, data-rich models.

Safety & Efficiency: Automated, remote data capture reduces on-site survey time and risk to personnel, while improving earthwork volume calculations.

Regulatory Requirements: Stricter accuracy standards for as-built documentation and permit approval processes favor LiDAR over traditional survey methods.

Project Complexity: Large-scale infrastructure, tunnels, and renovation of heritage structures benefit from non-contact scanning in confined or hazardous environments.

Cost Savings: Early detection of design clashes and real-time progress tracking minimize rework, saving time and materials.

Market Restraints

High Initial Investment: Premium scanners and software licenses require significant CAPEX, deterring smaller firms.

Data Processing Bottlenecks: Large point-cloud datasets demand robust computing resources and specialized expertise to extract actionable insights.

Skill Gap: A shortage of trained LiDAR operators and BIM modelers slows implementation.

Environmental Limitations: Heavy rain, fog, and dense vegetation can degrade scan quality and completeness.

Integration Challenges: Legacy project workflows and incompatible software platforms hinder seamless data exchange.

Market Opportunities

UAV-LiDAR Synergy: Growth of drone services equipped with lightweight LiDAR payloads unlocks rapid topographic mapping in constricted urban environments.

Turnkey Services: End-to-end scan-to-BIM offerings—including capture, modeling, and analytics—appeal to contractors seeking turnkey solutions.

Edge Processing: On-device data filtering and compression reduce transfer times and reliance on central servers.

Augmented Reality (AR) Integration: Overlaying LiDAR-derived models in AR headsets enhances on-site coordination and clash detection.

Emerging Markets: Infrastructure investments in Asia Pacific and Latin America present substantial demand for advanced surveying technologies.

Market Dynamics

Consolidation & Partnerships: Scanner OEMs are partnering with software vendors and service bureaus to deliver integrated solutions.

Innovation Cycle: Rapid iteration on sensor design and software algorithms is improving range, accuracy, and point-cloud classification.

Subscription Models: SaaS pricing for point-cloud processing and BIM plugins lowers entry barriers.

Data Standards: Industry bodies are defining common exchange formats (e.g., E57, LAS) to facilitate interoperability.

Sustainability Focus: Precise cut/fill calculations enabled by LiDAR reduce material waste and environmental impact.

Regional Analysis

North America: Leading adoption, driven by large infrastructure programs, advanced surveying firms, and strong UAV-LiDAR ecosystem.

Europe: Early BIM mandates in the UK and Scandinavia propel use in public and private construction projects; mature service market.

Asia Pacific: Fastest CAGR, as rapid urbanization and government smart-city initiatives in China, India, and Southeast Asia spur demand.

Latin America: Growing interest in LiDAR for highway and rail modernization, though uptake is limited by budget constraints.

Middle East & Africa: Mega-projects (e.g., Expo sites, new cities) drive selective deployments; market remains nascent elsewhere.

Competitive Landscape

Leading Companies in LiDAR in Construction Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

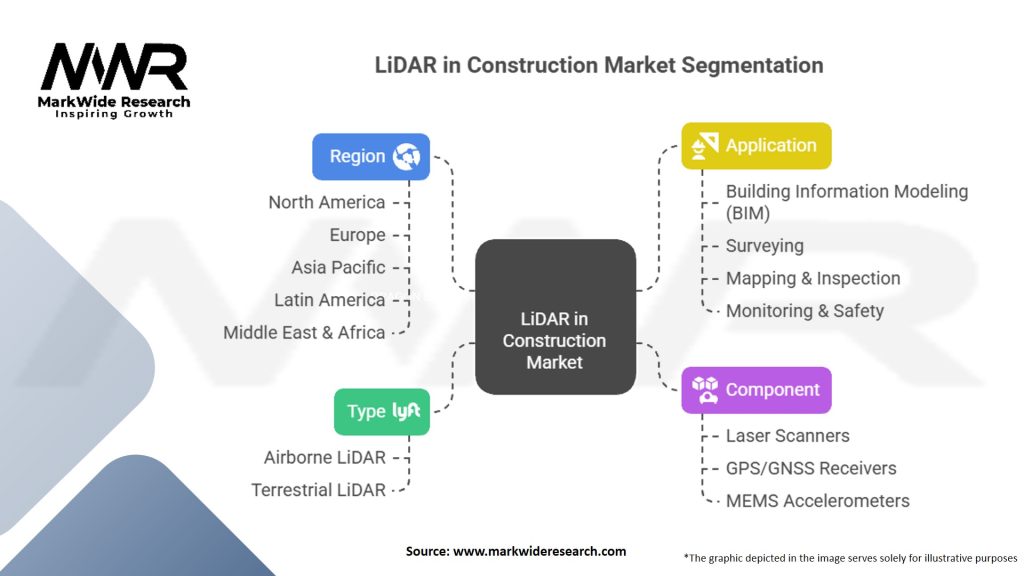

Segmentation

The LiDAR in Construction Market can be segmented based on various factors, including technology type, application, and region.

By Technology Type

By Application

By Region

Segmentation based on regions allows for a more detailed analysis of regional LiDAR adoption and market dynamics.

Category-wise Insights

Terrestrial Scanners: Deliver centimeter-level accuracy ideal for structural façade scans and interior as-built.

UAV-LiDAR: Enables rapid orthometric mapping, especially for earthworks and corridor projects.

Mobile LiDAR: Mounted on vehicles for linear infrastructure surveys—roads, railways, and pipelines—at high speeds.

Handheld Systems: Portable units facilitate rapid spot checks and interior scans where tripods are impractical.

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths

Weaknesses

Opportunities

Threats

Market Key Trends

Miniaturization: Solid-state and chip-scale LiDAR modules are reducing size, weight, and power consumption.

Edge Analytics: On-sensor preprocessing is filtering noise and classifying point clouds before upload.

Hybrid Workflows: Combining LiDAR with photogrammetry and thermal imaging enriches BIM data layers.

Real-Time Visualization: Live point-cloud streaming to tablets and headsets for immediate on-site feedback.

Subscription Licensing: Ongoing service fees for data storage, processing, and software updates support continuous revenue.

Covid-19 Impact

The pandemic accelerated contactless survey adoption as travel restrictions and social distancing made traditional survey methods impractical. Contractors turned to UAV-LiDAR services to maintain project momentum, leading to rapid onboarding of remote scanning providers. Although supply chain disruptions led to hardware delays, the overall increase in digital surveying investments has continued post-pandemic.

Key Industry Developments

Trimble’s X7 Scanner Launch: Automated calibration and rapid scan registration streamline terrestrial workflows.

Leica’s RTC360 Integration: Real-time registration and colorization merging LiDAR with panoramic imagery for seamless as-built capture.

FARO’s Scene WebShare Cloud: Enhanced collaborative platform for sharing and annotating point clouds across project teams.

RIEGL’s VUX-1UAV: Ultra-lightweight UAV sensor enabling high-altitude, long-range corridor mapping.

Topcon & Microsoft HoloLens Collaboration: AR overlay of LiDAR point clouds in mixed reality headsets for immersive site walkthroughs.

Analyst Suggestions

Develop Turnkey Service Packages: Offer bundled hardware, software, and training to lower barriers for mid-sized contractors.

Invest in Education: Partner with universities and trade schools to build a pipeline of LiDAR-skilled operators and BIM modelers.

Expand Cloud Offerings: Enhance processing speed and analytics tools in the cloud to reduce on-premise IT burden.

Pursue Strategic Alliances: Collaborate with drone service providers and AR/VR vendors to deliver end-to-end digital construction solutions.

Future Outlook

The LiDAR in Construction market is projected to grow at a double-digit CAGR over the next five years as the construction industry deepens its digital transformation. Integration with AI-driven analytics, AR-based field tools, and IoT-enabled project monitoring will further enhance the value proposition. As hardware costs decline and service-based models proliferate, even smaller contractors will be able to leverage LiDAR’s accuracy and efficiency, making it a standard in modern construction workflows.

Conclusion

LiDAR technology is reshaping the construction landscape by delivering unprecedented levels of accuracy, speed, and safety in surveying and site management. From initial topographic mapping to as-built verification and progress monitoring, LiDAR’s versatility is driving its transition from niche tool to essential component of digital construction. Stakeholders who embrace integrated LiDAR workflows—supported by cloud platforms, AR/VR interfaces, and service partnerships—will gain a competitive edge in delivering projects on time, on budget, and to exacting quality standards.

What is LiDAR in Construction?

LiDAR in Construction refers to the use of Light Detection and Ranging technology to create precise, three-dimensional information about the physical characteristics of a construction site. This technology is utilized for surveying, mapping, and monitoring projects, enhancing accuracy and efficiency in construction processes.

What are the key companies in the LiDAR in Construction Market?

Key companies in the LiDAR in Construction Market include Leica Geosystems, Trimble, and Faro Technologies, which provide advanced LiDAR solutions for various construction applications. These companies are known for their innovative technologies and contributions to improving construction workflows, among others.

What are the growth factors driving the LiDAR in Construction Market?

The growth of the LiDAR in Construction Market is driven by the increasing demand for accurate surveying and mapping solutions, the rise in infrastructure development projects, and the need for enhanced safety and efficiency in construction processes. Additionally, the integration of LiDAR with other technologies like BIM is further propelling market growth.

What challenges does the LiDAR in Construction Market face?

The LiDAR in Construction Market faces challenges such as high initial costs of equipment and the need for skilled personnel to operate LiDAR systems. Additionally, data processing and management can be complex, which may hinder widespread adoption in some construction projects.

What opportunities exist in the LiDAR in Construction Market?

Opportunities in the LiDAR in Construction Market include the expansion of smart city initiatives and the increasing adoption of autonomous construction equipment. Furthermore, advancements in drone technology for aerial LiDAR applications are opening new avenues for efficiency and data collection in construction.

What trends are shaping the LiDAR in Construction Market?

Trends shaping the LiDAR in Construction Market include the growing integration of artificial intelligence for data analysis, the use of mobile LiDAR systems for real-time data collection, and the increasing focus on sustainability in construction practices. These trends are enhancing the capabilities and applications of LiDAR technology in the industry.

LiDAR in Construction Market

| Segmentation Details | Description |

|---|---|

| Type | Airborne LiDAR, Terrestrial LiDAR |

| Component | Laser Scanners, GPS/GNSS Receivers, MEMS Accelerometers, Others |

| Application | Building Information Modeling (BIM), Surveying, Mapping & Inspection, Monitoring & Safety, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in LiDAR in Construction Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at