444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Leucovorin Calcium market is undergoing remarkable expansion as medical therapies increasingly recognize its vital role in counteracting the toxic effects of certain medications. Leucovorin Calcium, a folate derivative, serves as a rescue agent in cancer treatments and methotrexate poisoning. Its ability to enhance the efficacy of chemotherapy while mitigating side effects positions it as an indispensable component in modern medical interventions.

Meaning

Leucovorin Calcium, derived from folic acid, acts as a folate substitute in medical treatments. It serves as an essential rescue agent in chemotherapy, particularly for cancer types affected by methotrexate. Leucovorin Calcium’s ability to protect healthy cells while boosting the effectiveness of cancer treatments has made it a cornerstone in oncology and toxicology.

Executive Summary

The Leucovorin Calcium market is witnessing robust growth driven by the increasing adoption of chemotherapy and the need to mitigate its adverse effects. Medical practitioners recognize the value of Leucovorin Calcium in enhancing the therapeutic index of anticancer agents. Its ability to rescue healthy cells while amplifying treatment impact positions it as a pivotal player in cancer care.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Generic Competition and Cost Pressure: As patents expire, many markets see increasing generic leucovorin calcium entries, pushing down per-unit pricing and profit margins.

Oncology Regimen Trend Influence: Uptake of high-dose methotrexate regimens, combination chemotherapies involving 5-FU, and evolving cancer treatment protocols directly impact leucovorin demand.

Emerging Market Growth Potential: In many developing and middle-income countries, improved access to cancer care and chemotherapy supports faster growth for leucovorin use.

Formulation and Delivery Preference Shifts: Injectable formulations remain dominant in hospital settings, but oral forms may gain traction in supportive therapy protocols where appropriate.

Supply Chain Resilience: The reliance on pharmaceutical‑grade folate raw materials raises sensitivity to supply disruptions, quality regulations, and regulatory compliance (e.g., GMP standards).

Market Drivers

Rising Cancer Incidence: As cancer prevalence and chemotherapy usage expand, demand for adjunct rescue agents like leucovorin grows.

Increased Access to Oncology Care Globally: Health system improvements, insurance coverage, and donor programs in emerging markets broaden chemotherapy availability.

Protocol Advancements: Use of leucovorin in combination regimens and rescue protocols remains standard, sustaining demand.

Generic Availability Reducing Cost Barriers: Lower-cost generics make leucovorin more accessible, expanding use in price-sensitive markets.

Supportive Care Focus: Growing emphasis on mitigating side effects and improving patient safety in chemotherapy regimens supports adjunctive agent use.

Market Restraints

Margin Squeeze from Generic Competition: Generic versions, aggressive pricing, and tendering can compress manufacturer returns.

Regulatory Hurdles: Diverse regulatory requirements and approvals for formulations, especially in less regulated markets, slow market entry.

Supply Chain & Raw Material Risks: Any disruption in sourcing folate derivatives or production inputs affects availability.

Alternative Rescue Strategies: In some protocols or research settings, alternative folate interventions or novel agents might reduce leucovorin share.

Clinical Constraints: Not all cancer regimens require leucovorin; use is protocol‑specific, limiting universal demand.

Market Opportunities

Oral Formulation Expansion: Where clinically appropriate, oral leucovorin could expand uptake in ambulatory or supportive settings.

Emerging and Underserved Geographies: Countries in Latin America, Africa, Asia, and parts of Eastern Europe may see upticks in adoption as chemotherapy infrastructure improves.

Fixed-Dose Combinations or Co-Packaging: Packaging leucovorin alongside chemotherapy agents (e.g., 5-FU) could simplify therapy and boost uptake.

Biosafe, High-Purity Grades: Supplying pharmaceutical-grade, high-purity leucovorin suitable for sensitive regimens (e.g., pediatric oncology) offers premium opportunities.

Support Services & Logistics: Cold-chain, dosing aids, adherence packaging, and distribution support can complement supply offerings.

Market Dynamics

Supply-Side Factors:

Pharmaceutical firms may vertically integrate or source raw folate derivatives to secure cost control.

Manufacturers invest in capacity expansion, quality systems, and regulatory registrations across multiple markets.

Tiered pricing strategies (developed vs. emerging market segmentation) help maintain volumes.

Demand-Side Factors:

Oncology clinics, hospital pharmacies, and cancer treatment centers remain primary customers.

Government and donor tender programs in lower-income markets procure generics in bulk.

Clinical guidelines and standard-of-care protocols influence consistent usage.

Economic & Policy Factors:

Reimbursement policies, health insurance coverage, and government drug procurement practices shape uptake.

Intellectual property and regulatory exclusivity in certain markets can temporarily shield innovator margins.

Public health initiatives that increase cancer diagnosis and treatment access drive volume demand.

Regional Analysis

North America: Mature market with high per-patient usage, generics dominance, and stable pricing, but limited volume growth.

Europe: Strong protocols, national health systems, and moderate growth potential; regulatory harmonization helps cross-border supply.

Asia Pacific: One of fastest-growing regions due to rising cancer incidence, improving healthcare access, and generic adoption.

Latin America & Middle East/Africa: High latent demand, supply access challenges, and rapid growth potential as oncology infrastructure strengthens.

Emerging Markets: The steepest growth potential exists in emerging markets where chemotherapy access is expanding and generics are affordable.

Competitive Landscape

Leading Companies in the Leucovorin Calcium Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

By Formulation / Delivery Mode:

Injectable (intravenous or intramuscular)

Oral Tablets or Capsules

By Indication / Application:

Methotrexate Rescue in Oncology

Fluorouracil Modulation in Cancer Therapy

Folate Deficiency Treatment / Supportive Therapy

Other off‑label or adjunctive uses

By End-User Segment:

Hospitals & Oncology Centers

Cancer Treatment Clinics

Specialty Pharmacies

Government Procurement & Tender Programs

By Region / Market:

North America

Europe

Asia Pacific

Latin America

Middle East / Africa

Category-wise Insights

Injectable Formulations: Remain dominant in hospital-based oncology where rapid plasma levels and controllability are needed.

Oral Formulations: Useful in supportive or outpatient settings; adoption depends on adherence efficacy, stability, and bioavailability.

Methotrexate Rescue Use: Steady demand in high-dose methotrexate protocols and pediatric oncology.

Fluorouracil Modulation Use: In colorectal, gastric, breast cancer regimens where leucovorin enhances 5-FU efficacy, especially in developed markets.

Supportive / Off-label Uses: Some use in folinic acid deficiency, certain anemia therapies, or salvage therapy settings.

Key Benefits for Industry Participants and Stakeholders

Therapeutic Companion Role: Supports safer, more effective chemotherapy regimens, making it indispensable in oncology hospitals.

Predictable Volume Demand: Tied to chemotherapy cycles, which occur in regular, volume‑predictable patterns.

Generic Margin Scale: High volumes in generics enable scale economies, especially in contract manufacturing.

Regional Penetration Potential: Many emerging markets still have under-served need that can be served with generics.

Value-Added Service Opportunities: Clinical support, dosing kits, packaging, and distribution services strengthen differentiation.

SWOT Analysis

Strengths:

Essential role in standard chemotherapy protocols ensuring baseline demand.

Multiple indications supporting diversified use across regimens.

Generic availability enabling competitive pricing and accessibility.

Weaknesses:

High margin erosion due to generic competition.

Regulatory complexity across many national health systems.

Raw material supply vulnerability and production cost sensitivity.

Opportunities:

Growth in developing regions with expanding oncology services.

Innovation in oral formulations, co-packaging, and patient-friendly delivery.

Integration with supportive care services (e.g., dosing aids, adherence packaging).

Premium, high‑purity grades for sensitive pediatric or specialty oncology use.

Threats:

Novel rescue and modulation therapies might reduce demand in certain regimens.

Intense generic price competition reducing viability in some markets.

Regulatory changes, import barriers, and supply disruptions interfering with access.

Clinical shifts in chemotherapy protocols affecting use patterns.

Market Key Trends

Increasing Generic Penetration: As more countries allow generics, pricing pressure intensifies.

Growing Oncology Access in Emerging Markets: Improved healthcare infrastructure and cancer diagnosis fuel demand.

Formulation Innovation: Moves toward more stable oral forms, better excipients, or packaging that improves shelf life.

Co‑packages & Support Kits: Bundling leucovorin with chemotherapy agents or dosing instructions for better compliance.

Regulatory Harmonization: Efforts in bloc markets (e.g., ASEAN, African Union) to harmonize approvals may ease market entry.

Key Industry Developments

Several market reports estimate varying market sizes: e.g. “USD 26.98 million in 2024” growing to USD 187.87 million by 2037 under some forecasts. researchnester.com

Others project market valuations closer to USD 300 million in 2024, with growth to USD 500 million by 2033. Verified Market Reports+1

Some industry consultants report a CAGR in the 5–6% range over forecast periods. Verified Market Reports+2Market Research Intellect+2

Strategic development by manufacturers is focusing on expanding registration across emerging markets, improving formulation stability, and introducing efficient packaging.

Analyst Suggestions

Focus on Emerging Markets: Prioritize registrations and partnerships in regions with increasing chemotherapy access (Latin America, Africa, South Asia).

Differentiate Through Quality: Offer high-purity, GMP-compliant, traceable leucovorin suitable for sensitive oncology protocols.

Develop Oral & Co-Packaged Options: Where clinically feasible, broaden adoption beyond hospital settings.

Value-Add Services: Provide dosing kits, stability support, recall programs, and supply reliability assurances to key hospital clients.

Risk Mitigation in Supply Chain: Secure raw material sourcing, redundancy in manufacturing, and ensure robust quality oversight.

Future Outlook

Over the coming decade, the leucovorin calcium market is expected to continue growing, especially in emerging markets, with generic competition further intensifying. Oral formulations and co-pack options may see enhanced uptake where supportive protocols permit. The balance of regional growth, clinical guideline adoption, and supply chain robustness will shape which manufacturers succeed.

Meanwhile, demand volatility may arise from shifts in chemotherapy regimens or introduction of alternative rescue agents. Companies that emphasize quality, regulatory compliance, localized registration, and service differentiation will be better positioned to sustain margins and influence prescription patterns in a competitive landscape.

Conclusion

The leucovorin calcium market occupies a critical niche in modern oncology and supportive therapy regimens. Though generic competition and clinical changes pose challenges, the underlying necessity of leucovorin in methotrexate rescue and 5-FU modulation ensures core demand stability. Growth will be anchored in emerging oncology markets, formulation innovation, service offerings, and strategic market registrations. Manufacturers and suppliers that combine technical excellence, regulatory foresight, and localized market strategies will most likely thrive as cancer treatment access broadens globally.

In conclusion, the Leucovorin Calcium market stands as a critical component in the realm of oncology and pharmaceuticals. This analysis provided a comprehensive exploration of the market, highlighting its current landscape, key trends, drivers, challenges, and future prospects. The market’s significance in supporting cancer treatment and its potential in other therapeutic areas underscore its importance in the medical field. With advancements in research and technology, Leucovorin Calcium continues to demonstrate its efficacy in mitigating the adverse effects of certain chemotherapy regimens. Collaboration among pharmaceutical companies, healthcare providers, and research institutions will be vital in further unlocking its potential.

What is Leucovorin Calcium?

Leucovorin Calcium is a medication used to reduce the toxic effects of certain chemotherapy drugs, particularly methotrexate. It is also utilized in the treatment of folate deficiency and to enhance the effectiveness of certain cancer treatments.

What are the key players in the Leucovorin Calcium market?

Key players in the Leucovorin Calcium market include companies such as Teva Pharmaceutical Industries, Mylan N.V., and Fresenius Kabi, among others. These companies are involved in the production and distribution of Leucovorin Calcium for various medical applications.

What are the growth factors driving the Leucovorin Calcium market?

The growth of the Leucovorin Calcium market is driven by the increasing incidence of cancer and the rising demand for effective chemotherapy adjuncts. Additionally, advancements in drug formulations and the growing awareness of cancer treatment options contribute to market expansion.

What challenges does the Leucovorin Calcium market face?

The Leucovorin Calcium market faces challenges such as stringent regulatory requirements and potential side effects associated with its use. Moreover, competition from alternative therapies and generic drug manufacturers can impact market dynamics.

What opportunities exist in the Leucovorin Calcium market?

Opportunities in the Leucovorin Calcium market include the development of new formulations and combination therapies that enhance its efficacy. Additionally, increasing research into personalized medicine and targeted therapies presents avenues for growth.

What trends are shaping the Leucovorin Calcium market?

Trends in the Leucovorin Calcium market include a focus on biosimilars and the integration of digital health technologies in treatment protocols. Furthermore, there is a growing emphasis on patient-centered care and the optimization of chemotherapy regimens.

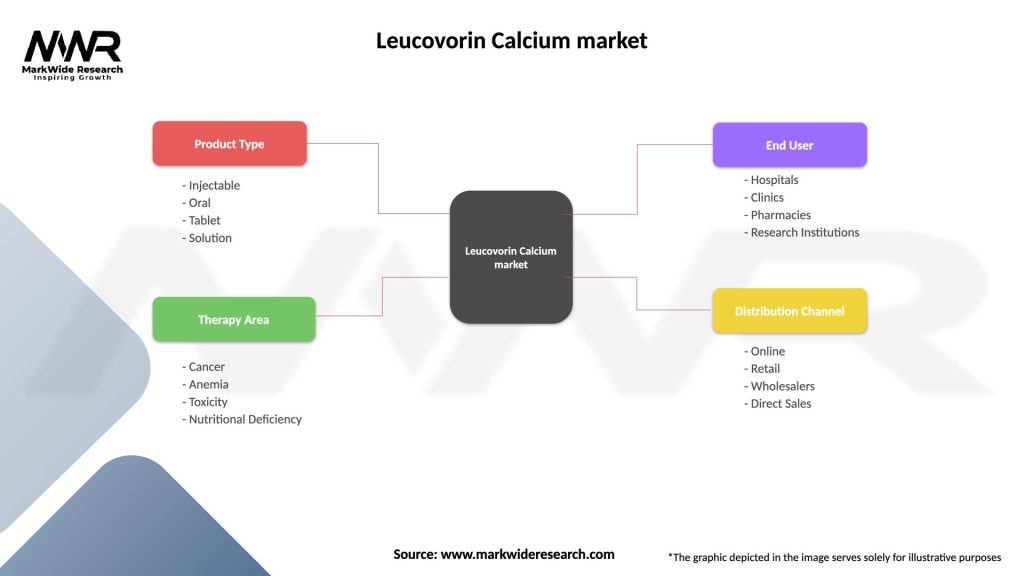

Leucovorin Calcium market

| Segmentation Details | Description |

|---|---|

| Product Type | Injectable, Oral, Tablet, Solution |

| Therapy Area | Cancer, Anemia, Toxicity, Nutritional Deficiency |

| End User | Hospitals, Clinics, Pharmacies, Research Institutions |

| Distribution Channel | Online, Retail, Wholesalers, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Leucovorin Calcium Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at