444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Letter of Credit Confirmation market is a crucial aspect of international trade and finance. It plays a significant role in facilitating transactions between buyers and sellers across different countries. Letter of Credit Confirmation refers to a guarantee issued by a bank to the seller on behalf of the buyer. This guarantee ensures that the seller will receive payment for the goods or services provided, as long as they comply with the terms and conditions specified in the letter of credit.

Meaning

A Letter of Credit Confirmation is a financial instrument that minimizes the risk for both buyers and sellers involved in international trade. It provides assurance to the seller that they will receive payment for their goods or services, even if the buyer fails to fulfill their obligations. On the other hand, it protects the buyer by ensuring that the payment is only made once the seller meets the agreed-upon terms and conditions.

Executive Summary

The Letter of Credit Confirmation market has witnessed significant growth in recent years, driven by the increasing volume of international trade and the need for secure and reliable payment mechanisms. The market offers numerous opportunities for banks, financial institutions, and other participants involved in global trade finance. However, it also faces challenges such as regulatory compliance and the emergence of alternative payment methods.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Letter of Credit Confirmation market operates in a dynamic environment influenced by various factors, including economic conditions, technological advancements, and regulatory changes. Understanding and adapting to these dynamics is essential for market participants to stay competitive and capitalize on emerging opportunities.

Regional Analysis

The Letter of Credit Confirmation market exhibits regional variations due to differences in trade volumes, economic development, and regulatory frameworks. The Asia-Pacific region, driven by China’s increasing role in global trade, holds a significant share of the market. North America and Europe also have well-established markets for letter of credit confirmation, while emerging economies in Africa and Latin America offer growth potential.

Competitive Landscape

Leading Companies in the Letter of Credit Confirmation Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

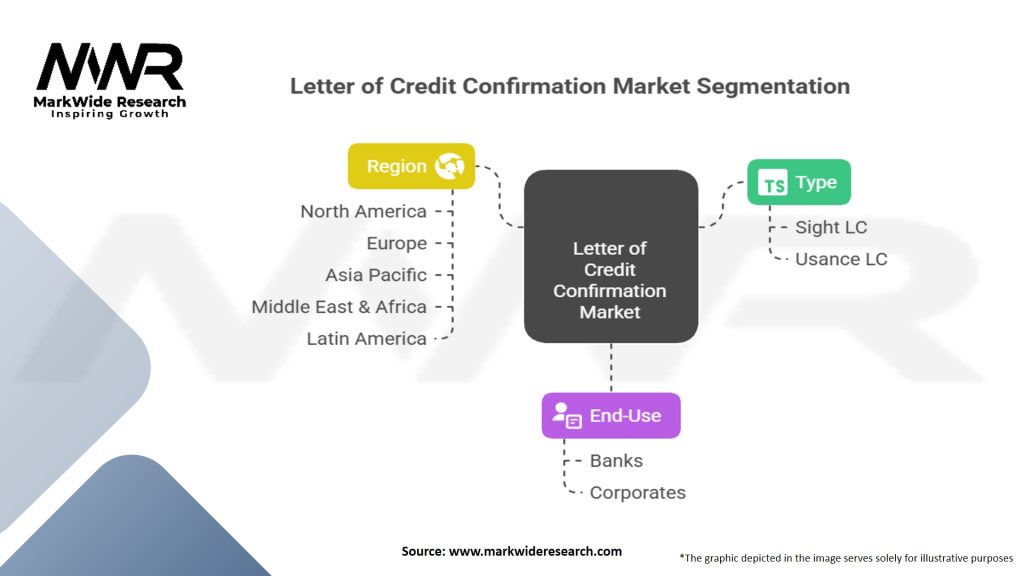

Segmentation

The Letter of Credit Confirmation market can be segmented based on various factors, including the type of letter of credit, end-user industry, and geography. The two primary types of letter of credit are commercial letter of credit and standby letter of credit. The market serves various industries, including manufacturing, oil and gas, healthcare, and agriculture.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a significant impact on global trade and the Letter of Credit Confirmation market. Lockdowns, travel restrictions, and disrupted supply chains affected international trade volumes. However, the market demonstrated resilience, with increased demand for secure payment mechanisms and digital solutions. The pandemic accelerated the adoption of technology, such as online document verification and electronic signatures, in the letter of credit confirmation process.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Letter of Credit Confirmation market is expected to continue its growth trajectory in the coming years. The increasing volume of international trade, advancements in technology, and the need for secure payment mechanisms will drive market expansion. However, market participants should remain agile and adapt to evolving customer expectations, regulatory changes, and emerging technologies to stay relevant and capitalize on future opportunities.

Conclusion

The Letter of Credit Confirmation market plays a vital role in facilitating secure and reliable payment mechanisms for international trade. It offers numerous benefits for buyers and sellers, including risk mitigation, financial security, and access to global markets. The market is evolving with technological advancements, regulatory changes, and shifting customer preferences. By embracing innovation, expanding global networks, and enhancing customer service, market participants can navigate the dynamic landscape and capitalize on the opportunities that lie ahead.

What is a Letter of Credit Confirmation?

A Letter of Credit Confirmation is a financial instrument that provides an additional guarantee to the beneficiary, ensuring that payment will be made even if the issuing bank fails to fulfill its obligations. This confirmation is typically provided by a second bank, adding an extra layer of security in international trade transactions.

Who are the key players in the Letter of Credit Confirmation Market?

Key players in the Letter of Credit Confirmation Market include major banks such as HSBC, JPMorgan Chase, and Citibank, which offer various trade finance solutions. Additionally, specialized financial institutions and fintech companies are increasingly participating in this space, providing innovative services and technologies, among others.

What are the main drivers of growth in the Letter of Credit Confirmation Market?

The growth of the Letter of Credit Confirmation Market is driven by the increasing globalization of trade, the rising need for secure payment methods in international transactions, and the expansion of e-commerce. Additionally, the demand for risk mitigation in cross-border trade is contributing to the market’s expansion.

What challenges does the Letter of Credit Confirmation Market face?

The Letter of Credit Confirmation Market faces challenges such as regulatory compliance issues, the complexity of trade finance processes, and the potential for fraud. Additionally, the reliance on traditional banking systems can hinder the adoption of more efficient digital solutions.

What opportunities exist in the Letter of Credit Confirmation Market?

Opportunities in the Letter of Credit Confirmation Market include the adoption of blockchain technology to enhance transparency and efficiency, the development of digital platforms for trade finance, and the growing demand for sustainable financing solutions. These innovations can streamline processes and reduce costs for businesses engaged in international trade.

What trends are shaping the Letter of Credit Confirmation Market?

Trends shaping the Letter of Credit Confirmation Market include the increasing use of digital and automated solutions, the rise of alternative financing options, and a focus on sustainability in trade finance. Additionally, there is a growing emphasis on enhancing customer experience through technology-driven services.

Letter of Credit Confirmation Market

| Segmentation Details | Description |

|---|---|

| Type | Sight LC, Usance LC |

| End-Use | Banks, Corporates |

| Region | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Letter of Credit Confirmation Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at