444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

In an increasingly complex and interconnected world, the importance of leak detection equipment cannot be overstated. These sophisticated devices play a crucial role in identifying and preventing leaks in various industrial sectors, safeguarding infrastructures, protecting the environment, and ensuring operational efficiency. The leak detection equipment market has been witnessing significant growth due to the escalating need for early leak detection and prevention across industries.

Meaning

Leak detection equipment refers to a range of specialized tools and technologies designed to identify leaks in pipelines, tanks, and other systems that transport fluids or gases. These leaks can have far-reaching consequences, from environmental damage to financial losses and even posing safety hazards. Leak detection equipment encompasses a diverse array of solutions, ranging from acoustic sensors and infrared thermography to cable-based systems and pressure sensors.

Executive Summary

The leak detection equipment market has experienced substantial expansion in recent years due to mounting concerns about resource conservation, safety, and regulatory compliance. This growth can be attributed to the increasing adoption of automated leak detection systems across industries. As businesses recognize the potential risks associated with leaks, they are investing in advanced equipment to mitigate these dangers effectively.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Regulation and Safety Pressures: Governments around the world are tightening regulations around emissions, fugitive spills, pipeline integrity, and environmental protection, pushing companies to deploy leak detection systems more aggressively.

Shift from Periodic Inspection to Continuous Monitoring: Rather than relying solely on periodic manual inspections, industries are increasingly adopting continuous, real-time leak detection to catch small leaks early and avoid major failures.

Technological Convergence with IoT & Analytics: Modern leak detection systems are increasingly integrated with IoT sensors, wireless communication, cloud analytics, and digital platforms, enabling predictive leak detection, anomaly detection, trend forecasting, and remote operations.

Portable & Rapid Inspection Tools Gain Traction: Handheld and mobile leak detectors (acoustic, infrared cameras, sniffer probes) are widely deployed for spot checks, maintenance, and region scanning due to their flexibility and lower cost.

Emergence of Drone/UAV-Based Leak Detection: Drones equipped with optical gas imaging (OGI), thermal, or gas sensors allow safe, fast inspections over pipelines, storage yards, and remote regions, especially in difficult terrain or hazardous zones.

Retrofit Demand in Aging Infrastructure: Many industrial facilities and pipelines are several decades old; retrofitting advanced leak detection to existing assets is a significant market segment.

Sector-Wise Growth Patterns: The oil & gas, petrochemical, and utilities sectors lead adoption. The water and wastewater leak detection segment (for pipes, networks, reservoirs) is also a rapidly growing offshoot, particularly in urban areas pushing for water conservation.

Market Drivers

Stringent Environmental and Safety Regulations: Regulations targeting fugitive emissions, greenhouse gases (e.g. methane), volatile organic compounds (VOCs), and chemical spills force industries to adopt leak detection systems.

Cost Savings from Loss Reduction: Detecting leaks early minimizes product losses (gas, chemicals, liquids), reduces downtime, and lowers repair costs.

Risk Mitigation & Safety Assurance: Leaks can lead to explosions, health hazards, and environmental damage; detection systems are part of safety and integrity management programs.

Growth in Industrial Capex & Infrastructure Projects: As industries expand—petrochemicals, LNG, pipelines, chemical plants, water utilities—new infrastructure demands integrated leak detection.

Digital Transformation in Industry (Industry 4.0): Companies are seeking smarter, data-driven operations. Leak detection becomes a connected node in plant analytics, predictive maintenance, and digital twins.

Focus on Sustainability & ESG Goals: Investors and governance boards press firms to manage emissions, leaks, and water losses, making leak detection part of ESG compliance.

Market Restraints

High CapEx & Opex Costs: Advanced detection systems, especially continuous monitoring and fiber-optic sensors, carry high initial investment and maintenance costs.

Technical Complexity & False Alarms: Harsh environments, background noise, sensitivity calibration, interference, and cross-sensitivities can hamper reliable detection, causing false positives or missed leaks.

Retrofitting Challenges: Integrating detection hardware into existing plants, pipelines, and legacy systems can be difficult (space, compatibility, access).

Power & Communication Constraints: Remote or off-grid installations may struggle with power supply, signal transmission, or connectivity to central monitoring systems.

Data Overload & Analytics Needs: Large volumes of sensor data require robust processing, filtering, and analytics to avoid alert fatigue and meaningful signals hiding in noise.

Market Opportunities

Continuous & Predictive Leak Monitoring: Systems that predict leak onset based on subtle anomalies before full leaks occur are a high-margin opportunity.

Drone/UAV Inspections and Robotics: Deployment of autonomous or semi-autonomous inspection drones or robots to access hard-to-reach pipelines, storage tanks, or remote conduits.

Integration with Digital Platforms: Bundling detection hardware with analytics platforms, dashboards, and AI-based insights to upsell services and recurring revenue.

Water Network Leak Detection: Expansion in municipal water distribution leak detection, pipeline integrity monitoring, and utility network loss control.

Hydrogen & New Fuel Infrastructure: As industries invest in hydrogen pipelines or CO₂ capture networks, leak detection adapted to these media is an emergent niche.

Retrofit & Retrofit-as-a-Service Models: Offering turnkey retrofits, system upgrades, and managed detection services to existing facilities.

Market Dynamics

Supply-Side Factors:

Major technology providers push innovations (miniaturization, low-power sensors, wireless, multispectral)

Partnerships between detector OEMs, analytics firms, and integrators to offer end-to-end solutions

Emphasis on scalable modules, ease-of-deployment, and interoperability with control systems

Demand-Side Factors:

Large industrial clients demand integrated systems, safety certifications, and minimal maintenance

Utilities and municipalities emphasize low-cost, reliable detection to reduce non-revenue water

Smaller firms adopt portable or handheld systems first, gradually upgrading to continuous solutions

Economic & Regulatory Factors:

Public environmental policies, emissions taxes, and permit pressures create demand pull

Capital allocation cycles in heavy industry affect timing of upgrades

Incentives or subsidies for emission control or environmental compliance may accelerate adoption

Regional Analysis

North America: Leading region due to strong regulatory frameworks, mature pipeline network, and early adoption of continuous monitoring systems.

Europe: A strong market with emphasis on emissions reduction, environmental protection, and utility leak detection.

Asia-Pacific: Fastest-growing region driven by infrastructure development, energy sector growth, and increasing environmental oversight.

Middle East & Africa: Growth tied to oil & gas infrastructure, pipeline expansion, and retrofits in aging assets.

Latin America: Significant opportunity in pipeline and water infrastructure upgrades, especially for energy and municipal sectors.

Competitive Landscape

Leading Companies in the Leak Detection Equipment Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

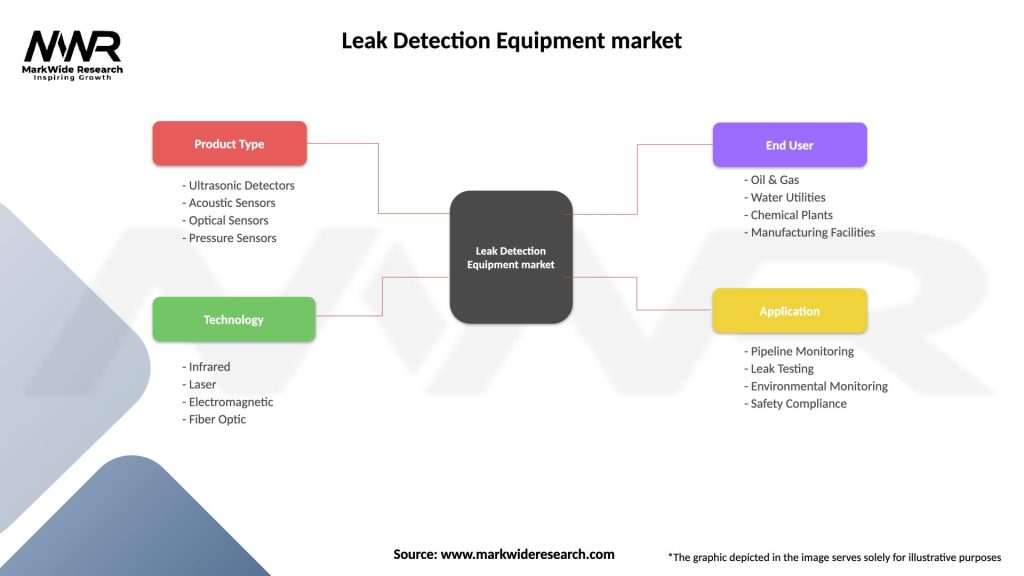

Segmentation

By Equipment Type:

Fixed detectors and stationary monitoring systems

Portable/handheld devices

UAV-based or mobile inspection systems

Fiber-optic distributed sensing systems

By Technology:

Acoustic / Ultrasonic

Infrared / Optical Gas Imaging

Tracer Gas (helium, hydrogen)

Mass/Volume Balance & Differential Pressure

Thermal imaging

Laser / Absorption spectroscopy

Intelligent sensors / IoT sensor networks

By End-Use Industry:

Oil & Gas / Pipeline Infrastructure

Petrochemical & Chemical Processing

Water & Wastewater Utilities

HVAC / Refrigeration / Chillers

Pharmaceuticals & Electronics

Automotive & Manufacturing

By Application Mode:

Indoor process equipment (valves, joints, vessels)

Pipeline & transmission lines

Storage tanks and terminals

Distribution networks

Infrastructure and utility networks

By Service Offering:

Equipment sales

Installation & commissioning

Calibration & maintenance

Monitoring & analytics services

Retrofit & upgrade services

Category-wise Insights

Fixed Monitoring Systems: Widely used for critical pipelines, long-distance segments, and continuous safety monitoring, often integrated with control systems.

Portable Instruments: Used by field technicians for inspections, spot checks, maintenance rounds, and troubleshooting.

Drone / UAV-Based Systems: Offer flexibility, speed, and safety for large-scale pipelines and remote inspection areas.

Fiber-Optic Distributed Sensing: Emerging for very long pipelines, enabling distributed leak localization over kilometers using optical fibers.

Tracer Gas Systems: Provide high-sensitivity leak detection in tight environments (e.g. vacuum systems, refrigeration, semiconductor fabs).

Key Benefits for Industry Participants and Stakeholders

Safety Enhancement: Early leak detection helps avoid potentially explosive or toxic releases and protects personnel and communities.

Cost Savings & Loss Reduction: Prevents product loss, reduces unplanned downtime, and limits repair damage.

Regulatory Compliance & Environmental Protection: Meets emissions, leak, and environmental protection standards and avoids fines.

Operational Reliability: Monitors integrity of pipelines, vessels, and systems to maintain continuity.

Data & Analytics Value: Historical leak data, trending, and predictive insights support maintenance planning and asset management.

Brand Reputation & Stakeholder Confidence: Demonstrates commitment to safety, environment, and operational excellence.

SWOT Analysis

Strengths:

Essential function across many regulated, safety-critical industries

Technology innovation and convergence with IoT and analytics

Growing awareness of the cost and risk of undetected leaks

Retrofits and existing infrastructure provide large addressable base

Weaknesses:

High cost for advanced continuous systems

Technical challenges due to background noise, environmental interference, calibration

Integration complexity with legacy infrastructure

Maintenance and service burden for field devices

Opportunities:

Expansion into water network leak detection and municipal utilities

Hydrogen, CO₂, and alternative fuel pipeline detection market niches

Smart city and urban utility network monitoring

Leasing, managed detection-as-a-service, and subscription models

Threats:

Alternate control technologies or passive systems (e.g. ultra-tight containment)

Oversight or regulatory costs increasing per-location demand thresholds

Cybersecurity risk for connected sensor networks

Capital cycles or downturns in core industries (oil & gas, petrochemical)

Market Key Trends

IoT & Wireless Sensor Networks: Low-power, wireless sensors enabling dense monitoring networks rather than sparse points.

Edge Analytics & Anomaly Detection: Processing data locally to reduce latency, filter noise, and generate smart alerts.

Drone / UAV Inspection Growth: Rapid adoption for large, remote, or inaccessible infrastructure segments.

Predictive & Prescriptive Leak Analytics: Using machine learning on historical sensor data to predict leak risk and recommend maintenance.

Multimodal Sensing: Combining acoustic, optical, temperature, and pressure sensors in one system to reduce false positives and improve detection confidence.

Hydrogen / Green Fuel Adaptation: Technology adaptation for leak detection in hydrogen, natural gas blends, CO₂ pipelines, and future fuel networks.

Key Industry Developments

Deployment of continuous leak monitoring systems in major pipeline networks with integration to SCADA and asset management systems.

Acquisition and partnerships between sensor OEMs and analytics or IoT platform providers to deliver bundled solutions.

Use of drones with gas imaging cameras for aerial pipeline scan projects.

Entrance of specialized startups offering leak detection-as-a-service or subscription models.

Upgrades and retrofits in aging infrastructure, especially in regulated sectors, to comply with environmental mandates.

Analyst Suggestions

Bundle Detection + Analytics: Sell hardware with analytics and service contracts for recurring revenue and differentiation.

Focus on High-Risk Zones First: Target pipelines, storage tanks, or high-pressure zones where leaks are costliest and most dangerous.

Offer Retrofit Services: Many existing installations lack modern leak detection; retrofits present a large opportunity.

Develop Low-Cost Sensor Platforms: Especially for water utilities and municipal networks where margins are tighter.

Specialize for New Fuels: Prepare for hydrogen, CO₂, and other gas mixtures in future infrastructure markets.

Ensure Reliability & Low Maintenance: Emphasize ruggedness, calibration stability, and low false alarm rates to gain operator confidence.

Future Outlook

Leak detection equipment will become progressively ubiquitous as continuous monitoring, predictive analytics, and autonomous inspection techniques mature. In many regions, manual inspection will shift to sensor networks and drone-assisted scans. The emergence of hydrogen, CO₂, and renewable gas infrastructure will expand demand for tailored detection systems. Integration with digital twins, plant health models, and cross-domain sensing (vibration, thermal, pressure) will further elevate leak detection from a safety tool to a core operational intelligence asset.

Over time, the economics of leak control will shift: rather than reacting to major failures, organizations will proactively maintain integrity using real‑time data, predictive insights, and smart maintenance scheduling.

Conclusion

The Leak Detection Equipment Market is a critical enabler of safety, cost efficiency, environmental compliance, and operational resilience in many industries. Its growth is propelled by regulation, infrastructure expansion, digital transformation, and increasing awareness of the risks posed by undetected leaks. Companies that combine robust hardware, intelligent analytics, ease-of-deployment, and service models will lead the way as leak detection becomes integrated rather than incidental in industrial operations.

What is Leak Detection Equipment?

Leak Detection Equipment refers to tools and technologies used to identify and locate leaks in various systems, such as plumbing, HVAC, and industrial processes. These devices help prevent damage and ensure safety by detecting leaks early.

What are the key players in the Leak Detection Equipment market?

Key players in the Leak Detection Equipment market include companies like Honeywell, FLIR Systems, and Siemens, which offer a range of solutions for leak detection in different applications, including oil and gas, water management, and building maintenance, among others.

What are the main drivers of growth in the Leak Detection Equipment market?

The growth of the Leak Detection Equipment market is driven by increasing environmental regulations, the need for safety in industrial operations, and advancements in technology that enhance detection accuracy. Additionally, the rising awareness of water conservation and energy efficiency contributes to market expansion.

What challenges does the Leak Detection Equipment market face?

The Leak Detection Equipment market faces challenges such as high initial costs of advanced detection systems and the need for skilled personnel to operate and maintain these technologies. Additionally, the variability in leak detection requirements across different industries can complicate standardization.

What opportunities exist in the Leak Detection Equipment market?

Opportunities in the Leak Detection Equipment market include the development of smart leak detection systems that integrate with IoT technologies and the expansion of services in emerging markets. Furthermore, increasing investments in infrastructure and maintenance present significant growth potential.

What trends are shaping the Leak Detection Equipment market?

Trends in the Leak Detection Equipment market include the adoption of wireless and remote monitoring technologies, the integration of artificial intelligence for predictive maintenance, and a growing focus on sustainability and reducing environmental impact. These innovations are transforming how leaks are detected and managed.

Leak Detection Equipment market

| Segmentation Details | Description |

|---|---|

| Product Type | Ultrasonic Detectors, Acoustic Sensors, Optical Sensors, Pressure Sensors |

| Technology | Infrared, Laser, Electromagnetic, Fiber Optic |

| End User | Oil & Gas, Water Utilities, Chemical Plants, Manufacturing Facilities |

| Application | Pipeline Monitoring, Leak Testing, Environmental Monitoring, Safety Compliance |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Leak Detection Equipment Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at