Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

-

Volume Dominance: Lead acid holds the largest market share by volume due to automotive and stationary storage applications.

-

Recycling Infrastructure: Over 95% recycling rate ensures sustainable lead recovery, lowering raw material costs.

-

Technological Advances: Hybrid lead‑carbon and improved AGM designs extend cycle life up to 1,500 cycles.

-

Cost Competitiveness: Lowest cost per kWh among rechargeable chemistries, crucial for large‑scale stationary applications.

-

Regulatory Push: Emission reduction policies indirectly boost lead acid use in micro‑hybrid vehicles and start‑stop systems.

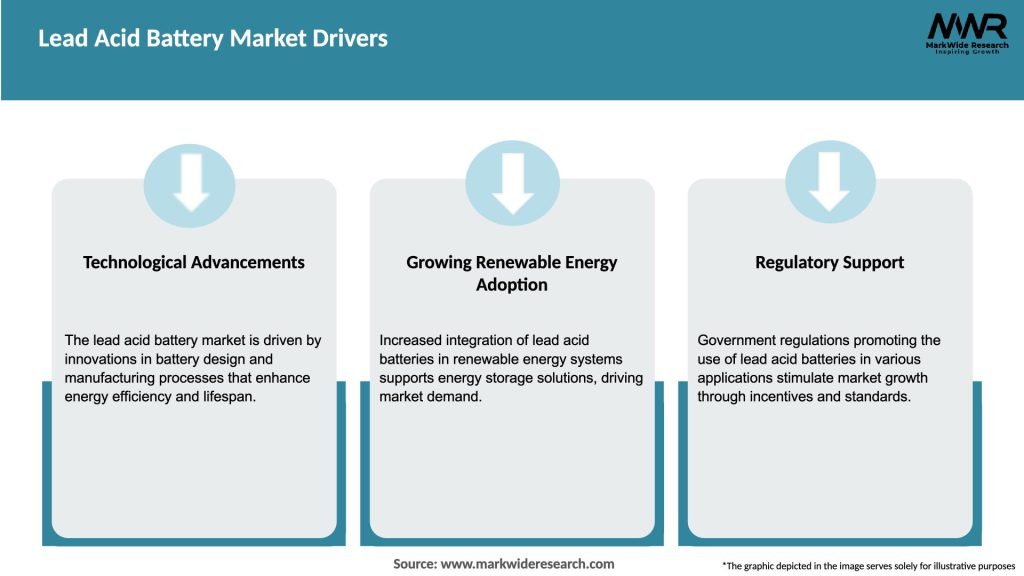

Market Drivers

-

Automotive Production: Rising car sales drive starter battery demand.

-

Renewable Integration: Need for low‑cost bulk storage in solar and wind farms.

-

Telecom Growth: Expansion of data centers and 5G infrastructure increases UPS requirements.

-

Micro‑Hybrid Technologies: Start‑stop vehicle systems use VRLA batteries extensively.

-

Grid Resilience Initiatives: Governments investing in reliable backup power boost market uptake.

Market Restraints

-

Energy Density Limitations: Heavier and bulkier compared to lithium‑ion, limiting certain mobile applications.

-

Maintenance Requirements: Flooded types require regular electrolyte checks and topping up.

-

Environmental Concerns: Lead toxicity risks if recycling and disposal aren’t properly managed.

-

Competition from Lithium‑Ion: Faster adoption in EVs and portable electronics due to higher energy density.

-

Cycle Life Constraints: Flooded and standard AGM batteries have limited deep‑cycle durability.

Market Opportunities

-

Advanced Hybrid Designs: Lead‑carbon hybrids offer improved charge acceptance and longer life.

-

Second‑Life Applications: Reusing retired automotive batteries for stationary storage.

-

Emerging Markets: Infrastructure development in Asia‑Pacific and Latin America creates new demand.

-

Smart Battery Systems: IoT‑enabled battery management systems (BMS) optimize performance.

-

Greenfield Recycling Plants: Expanding recycling capacity in regions with inadequate facilities.

Market Dynamics

-

Supply Side: Improvements in lead smelting, plate manufacturing, and AGM production lower costs and improve consistency.

-

Demand Side: Continuous need for reliable, low‑cost storage in transportation, industry, and utilities.

-

Economic Factors: Stabilizing lead prices and government incentives for energy storage strengthen market fundamentals.

Regional Analysis

-

Asia‑Pacific: Largest market by volume, led by China and India’s automotive and solar sectors.

-

North America: High adoption of VRLA in telecom and renewables; growth in grid‑scale storage.

-

Europe: Stricter emissions regulations drive start‑stop systems; recycling infrastructure is advanced.

-

Latin America & MEA: Emerging markets with growing telecom and power backup needs, though recycling gaps persist.

Competitive Landscape

Leading companies in the Lead Acid Battery Market:

- EnerSys

- Johnson Controls International plc

- Exide Technologies

- East Penn Manufacturing Co.

- GS Yuasa Corporation

- Crown Battery Manufacturing Company

- C&D Technologies, Inc.

- NorthStar Battery Company, LLC

- Narada Power Source Co., Ltd.

- Leoch International Technology Limited

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

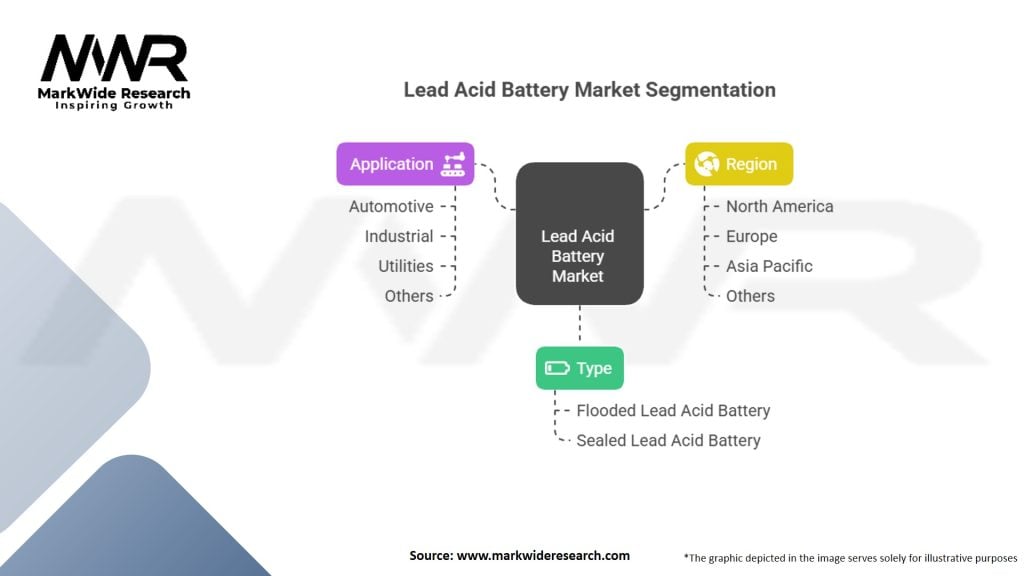

Segmentation

-

By Battery Type: Flooded, AGM, Gel, Hybrid Lead‑Carbon.

-

By Application: Automotive starter, stationary (UPS, telecom, renewables), motive power (electric vehicles, forklifts).

-

By End User: Automotive OEMs, telecom operators, data centers, utilities, industrial enterprises.

-

By Region: North America, Europe, Asia‑Pacific, Latin America, Middle East & Africa.

Category-wise Insights

-

Automotive Starter: Largest segment; steady replacement cycle every 3–5 years.

-

Stationary Storage: Rapid growth in UPS and solar off‑grid systems, especially AGM and gel batteries.

-

Motive Power: Niche but growing in material handling (AGM deep‑cycle) and floor‑cleaning machines.

Key Benefits for Industry Participants and Stakeholders

-

Lower Capital Costs: Lead acid’s low upfront cost per kWh enables broad deployment.

-

Recycling Revenue: High recovery rates provide secondary income streams.

-

Technology Maturity: Proven reliability and predictable lifecycle.

-

Regulatory Compliance: Established standards and certifications simplify market entry.

-

Ecosystem Synergies: Integration with renewables, telecom, and automotive sectors.

SWOT Analysis

-

Strengths: Cost leadership, mature recycling, proven reliability.

-

Weaknesses: Lower energy density, weight, maintenance needs.

-

Opportunities: Hybrid designs, second‑life reuse, smart BMS integration.

-

Threats: Disruption from lithium‑ion, environmental regulations, raw material price volatility.

Market Key Trends

-

Hybrid Lead‑Carbon Batteries: Combining lead acid’s cost advantage with carbon’s cycle life improvements.

-

Second‑Life Storage Projects: Automotive batteries repurposed for residential and commercial energy storage.

-

Smart BMS Adoption: IoT‑driven monitoring to extend battery life and optimize performance.

-

Regulatory Incentives: Subsidies for renewable integration and grid resilience projects.

-

Regional Recycling Expansion: New facilities in Southeast Asia, Latin America, and Africa.

Covid-19 Impact

-

Supply Chain Disruption: Temporary lead oxide and plate shortages inhibited production.

-

Demand Fluctuations: Automotive OEM shutdowns reduced starter battery sales, but telecom and data center backups saw increased uptake.

-

Acceleration of Renewables: Post-pandemic recovery packages boosted solar and storage investments, benefiting stationary lead acid sales.

-

Health & Safety Measures: Contactless monitoring and remote BMS became priorities in manufacturing and deployment.

Key Industry Developments

-

Johnson Controls’ New AGM Plant: Expanded capacity in Europe to meet telecom and renewable storage demand.

-

Exide’s Hybrid Lead‑Carbon Launch: Aimed at micro‑hybrid vehicle applications with improved cycle life.

-

Government Grants: US DOE funding second‑life battery research focusing on lead acid reuse.

-

Digitalization Initiatives: Enersys rolled out an IoT‑enabled BMS platform for real‑time monitoring.

-

Recycling Joint Ventures: Major OEMs partnering with recyclers in ASEAN to improve local circularity.

Analyst Suggestions

-

Invest in Hybrid Technologies: Support R&D for lead‑carbon and gel improvements.

-

Expand Recycling Footprint: Prioritize new recycling plants in high‑growth emerging markets.

-

Promote Second‑Life Models: Collaborate with utilities and solar installers to repurpose retired batteries.

-

Enhance Digital Capabilities: Deploy advanced BMS and predictive analytics to reduce warranty costs.

-

Monitor Regulatory Changes: Stay ahead of evolving environmental and transportation emissions standards.

Future Outlook

The Lead Acid Battery Market is expected to grow at a 3–4% CAGR through 2030, driven by sustainable stationary storage, automotive micro‑hybrid applications, and expanding recycling infrastructure. Hybrid lead‑carbon innovations and smart BMS integration will narrow performance gaps with lithium‑ion, preserving lead acid’s cost leadership. Emerging economies will offer new growth corridors, while second‑life repurposing creates circular economy opportunities. Despite lithium‑ion’s rise in EVs, lead acid remains indispensable for high‑power starter applications and bulk energy storage.

Conclusion

The global Lead Acid Battery Market continues to thrive as a cornerstone of energy storage, balancing cost, reliability, and sustainability. With over a century of use, itaconic acid batteries benefit from mature manufacturing, extensive recycling, and broad application diversity. Innovations—such as hybrid chemistries, digital monitoring, and second‑life programs—are revitalizing the market, ensuring lead acid batteries remain a competitive choice for stationary storage, automotive, industrial, and backup power applications. Stakeholders who invest in technological enhancements, expand recycling footprints, and leverage new market segments will secure long-term success in this evolving landscape.