444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The lawn mower market is a thriving industry that caters to the needs of homeowners, landscapers, and professionals involved in the maintenance of lawns and gardens. Lawnmowers are essential tools used to cut grass evenly and maintain the aesthetic appeal of outdoor spaces. With the increasing focus on landscaping and the growing number of residential and commercial properties, the demand for lawnmowers has witnessed significant growth in recent years.

Meaning

A lawn mower is a machine designed to trim grass and vegetation in lawns, gardens, parks, sports fields, and other outdoor spaces. It typically consists of a cutting blade or blades powered by an engine, which may be gasoline or electrically powered. Lawnmowers come in various types, including push mowers, self-propelled mowers, ride-on mowers, and robotic mowers. These machines offer convenience and efficiency in maintaining lawns and are widely used across the globe.

Executive Summary

The lawn mower market has experienced steady growth over the years, driven by factors such as increasing urbanization, rising disposable income, and growing interest in outdoor activities. The market is highly competitive, with several manufacturers offering a wide range of lawn mowers to meet diverse consumer preferences. Innovation and technological advancements have also played a significant role in shaping the market, with features like self-propelled mowers, cordless electric mowers, and robotic mowers gaining popularity.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Several factors are driving the growth of the lawn mower market:

Market Restraints

Despite the positive market outlook, there are certain challenges that the lawn mower market faces:

Market Opportunities

Despite the challenges, the lawn mower market presents several opportunities for growth:

Market Dynamics

The lawn mower market is driven by various factors, including changing consumer preferences, technological advancements, and macroeconomic trends. These dynamics influence market demand, competition, and the overall growth trajectory of the industry.

Consumer preferences play a crucial role in shaping the market, with factors such as convenience, environmental sustainability, and ease of use driving purchasing decisions. Technological advancements in battery technology, robotics, and connectivity have opened up new possibilities for innovation and product development. Manufacturers are continuously investing in research and development to introduce new features and improve the performance of lawn mowers.

Macroeconomic trends, such as urbanization, disposable income levels, and the emphasis on outdoor aesthetics, also impact the market. Urbanization leads to smaller lawn sizes and increased demand for compact and maneuverable mowers. Rising disposable incomes enable consumers to invest in landscaping services and purchase high-quality lawn mowers. The emphasis on outdoor aesthetics and leisure activities further drives the demand for well-maintained lawns and gardens.

Regional Analysis

The lawn mower market exhibits regional variations in terms of market size, growth rate, and consumer preferences. North America and Europe have traditionally been the largest markets for lawn mowers, driven by factors such as high disposable income levels, extensive lawns, and a strong culture of gardening. However, emerging economies in Asia Pacific, Latin America, and the Middle East are witnessing rapid urbanization and rising income levels, which are expected to drive market growth in these regions.

In North America, the United States has the largest market share, owing to its large population, high disposable income, and a strong focus on outdoor aesthetics. Europe, particularly countries like Germany and the United Kingdom, also has a significant market share due to the popularity of gardening and landscaping activities.

Asia Pacific is expected to be the fastest-growing region in the lawn mower market, driven by rapid urbanization, increasing disposable incomes, and changing consumer preferences. Countries like China and India present significant opportunities for market players, given their large populations and expanding middle class.

Latin America and the Middle East are also expected to contribute to market growth, fueled by economic development, rising urbanization, and an increasing interest in outdoor activities.

Competitive Landscape

Leading companies in the Lawn Mower Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

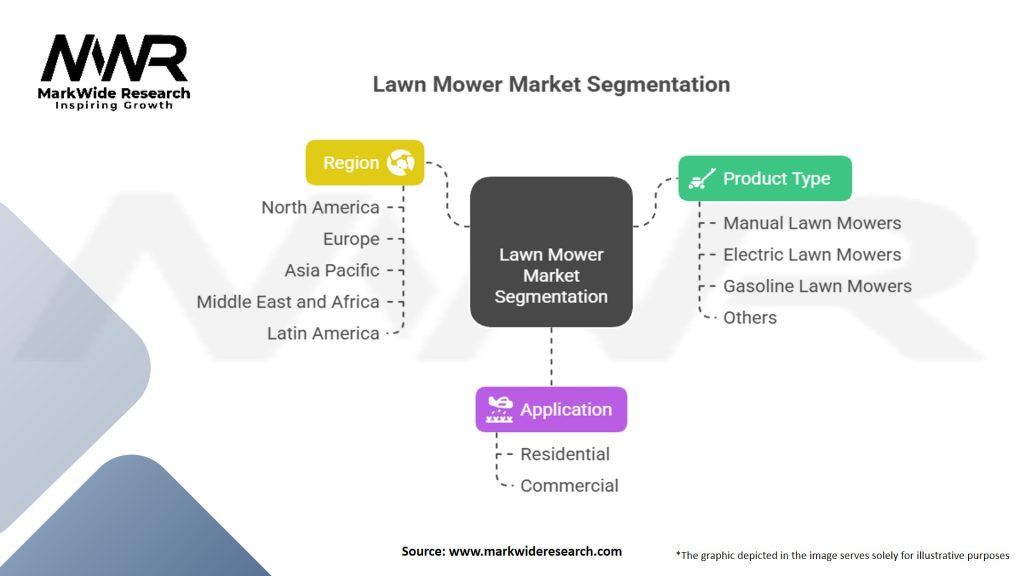

Segmentation

The lawn mower market can be segmented based on various factors, including product type, power source, end-user, and distribution channel.

Based on product type, the market can be segmented into:

Based on power source, the market can be segmented into:

Based on end-user, the market can be segmented into:

Based on distribution channel, the market can be segmented into:

Segmentation allows manufacturers and marketers to target specific customer segments with tailored products and marketing strategies, catering to their unique needs and preferences.

Category-wise Insights

Understanding the different categories of lawn mowers helps consumers make informed purchasing decisions based on their specific requirements and preferences.

Key Benefits for Industry Participants and Stakeholders

The lawn mower market offers several benefits for industry participants and stakeholders:

Overall, the lawn mower market offers a favorable landscape for industry participants and stakeholders to thrive, innovate, and contribute to the industry’s growth.

SWOT Analysis

A SWOT analysis provides insights into the strengths, weaknesses, opportunities, and threats within the lawn mower market:

Strengths:

Weaknesses:

Opportunities:

Threats:

A SWOT analysis helps industry participants identify their strengths and weaknesses, capitalize on opportunities, and mitigate threats to ensure sustainable growth in the market.

Market Key Trends

These key trends shape the evolving landscape of the lawn mower market and provide insights into the direction of future developments.

Covid-19 Impact

The COVID-19 pandemic had both positive and negative impacts on the lawn mower market:

Positive impact:

Negative impact:

Overall, while the pandemic presented challenges, the increased focus on outdoor activities and home improvement projects provided opportunities for the lawn mower market to grow and adapt to changing consumer behaviors.

Key Industry Developments

These key industry developments reflect the ongoing efforts of manufacturers to meet evolving consumer demands, drive innovation, and contribute to a more sustainable future.

Analyst Suggestions

Based on market trends and industry dynamics, analysts suggest the following strategies for industry participants:

By implementing these suggestions, industry participants can position themselves for growth, adapt to market changes, and meet the evolving needs of consumers.

Future Outlook

The future outlook for the lawn mower market is positive, with steady growth anticipated in the coming years. Several factors contribute to this optimistic outlook:

Conclusion

The lawn mower market is a dynamic and competitive industry driven by factors such as urbanization, rising disposable incomes, and increasing interest in outdoor activities. The market offers a wide range of lawn mowers, including push mowers, self-propelled mowers, ride-on mowers, and robotic mowers, catering to the diverse needs of residential users, commercial users, and professional landscapers.

Despite challenges such as high competition and environmental concerns, the market presents significant opportunities for growth. Manufacturers can capitalize on the growing demand for battery-powered and robotic mowers, expand into emerging markets with rising disposable incomes, and differentiate their products through advanced features and smart technologies. The integration of online retail channels and the focus on lightweight, ergonomic designs further enhance market prospects.

What is a lawn mower?

A lawn mower is a machine used to mow grass, typically for maintaining lawns, gardens, and parks. It comes in various types, including push mowers, riding mowers, and robotic mowers, each designed for different applications and user preferences.

Who are the key players in the Lawn Mower Market?

Key players in the Lawn Mower Market include companies like Husqvarna, John Deere, and Toro, which are known for their innovative designs and reliable performance. These companies compete in various segments, including residential and commercial lawn care, among others.

What are the main drivers of growth in the Lawn Mower Market?

The Lawn Mower Market is driven by factors such as increasing urbanization, rising disposable incomes, and a growing preference for well-maintained outdoor spaces. Additionally, advancements in technology, such as electric and robotic mowers, are enhancing consumer interest.

What challenges does the Lawn Mower Market face?

Challenges in the Lawn Mower Market include environmental regulations regarding emissions from gas-powered mowers and the high cost of advanced models. Additionally, competition from alternative landscaping solutions can impact market growth.

What opportunities exist in the Lawn Mower Market?

Opportunities in the Lawn Mower Market include the increasing demand for eco-friendly and battery-operated mowers, as well as the potential for smart technology integration in lawn care. These trends are likely to attract new consumers and expand market reach.

What trends are shaping the Lawn Mower Market?

Current trends in the Lawn Mower Market include the rise of robotic mowers, which offer convenience and efficiency, and the growing popularity of electric mowers due to their lower environmental impact. Additionally, smart technology features are becoming more prevalent, enhancing user experience.

Lawn Mower Market

| Segmentation | Details |

|---|---|

| Product Type | Manual Lawn Mowers, Electric Lawn Mowers, Gasoline Lawn Mowers, Others |

| Application | Residential, Commercial |

| Region | North America, Europe, Asia Pacific, Middle East and Africa, Latin America |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Lawn Mower Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at