444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Latin America tourism vehicle rental market represents a dynamic and rapidly evolving sector that serves as a cornerstone of the region’s travel and hospitality infrastructure. This market encompasses a comprehensive range of vehicle rental services specifically designed to cater to tourists, business travelers, and leisure visitors across Latin American countries. The sector has experienced remarkable transformation in recent years, driven by increasing international tourism, growing domestic travel trends, and evolving consumer preferences for flexible transportation solutions.

Market dynamics indicate that the tourism vehicle rental industry in Latin America is experiencing robust growth, with the sector expanding at a compound annual growth rate (CAGR) of 8.2% over the forecast period. This growth trajectory is supported by several key factors, including improved infrastructure development, rising disposable incomes, and the increasing popularity of self-drive tourism experiences among both domestic and international visitors.

Regional diversity characterizes this market, with countries like Brazil, Mexico, Argentina, and Colombia leading the charge in terms of market penetration and service availability. The sector encompasses various vehicle categories, from economy cars and SUVs to luxury vehicles and specialized tourism transport, each serving distinct market segments and customer preferences. Digital transformation has also played a crucial role in market evolution, with online booking platforms and mobile applications revolutionizing how tourists access and utilize rental services.

The Latin America tourism vehicle rental market refers to the comprehensive ecosystem of businesses and services that provide temporary vehicle access to tourists and travelers visiting Latin American destinations. This market encompasses traditional car rental companies, peer-to-peer vehicle sharing platforms, specialized tourism transport providers, and emerging mobility solutions that cater specifically to the travel and tourism sector.

Core components of this market include passenger car rentals, recreational vehicle rentals, motorcycle and scooter rentals, and specialized adventure tourism vehicles. The market serves diverse customer segments, from budget-conscious backpackers seeking economical transportation options to luxury travelers requiring premium vehicle experiences. Service integration with hotels, airlines, and tourism packages has become increasingly common, creating comprehensive travel solutions for visitors.

Geographic scope covers major Latin American countries including Brazil, Mexico, Argentina, Chile, Colombia, Peru, and Costa Rica, each with unique market characteristics, regulatory environments, and consumer preferences. The market operates through various channels, including airport locations, city centers, hotel partnerships, and increasingly through digital platforms that enable advance booking and seamless customer experiences.

Strategic positioning of the Latin America tourism vehicle rental market reveals a sector poised for sustained growth and innovation. The market benefits from Latin America’s position as a premier global tourism destination, attracting millions of international visitors annually who require flexible and reliable transportation solutions. Market penetration currently stands at approximately 35% of total tourism transportation needs, indicating significant room for expansion and service enhancement.

Key market drivers include the region’s growing reputation as an adventure tourism destination, increasing infrastructure investments, and rising consumer preference for independent travel experiences. The sector has demonstrated remarkable resilience, adapting to changing travel patterns and implementing innovative solutions to meet evolving customer demands. Digital adoption has accelerated significantly, with online bookings now accounting for 68% of total rental transactions.

Competitive landscape features a mix of international rental giants, regional players, and emerging local companies that leverage technology and local market knowledge to capture market share. The market is characterized by increasing consolidation, strategic partnerships, and the emergence of new business models that integrate vehicle rental with broader tourism services. Sustainability initiatives are gaining traction, with electric and hybrid vehicle options becoming more prevalent across major markets.

Market intelligence reveals several critical insights that shape the Latin America tourism vehicle rental landscape. The sector demonstrates strong seasonal patterns, with peak demand periods coinciding with major holiday seasons, cultural festivals, and optimal weather conditions for tourism activities. Customer behavior analysis indicates a growing preference for longer rental periods, with average rental duration increasing to support extended exploration of multiple destinations within single trips.

Technology integration has emerged as a fundamental differentiator, with successful companies investing heavily in mobile applications, GPS navigation systems, and contactless service delivery. The following key insights define market dynamics:

Primary growth drivers propelling the Latin America tourism vehicle rental market stem from both macroeconomic trends and sector-specific developments. The region’s increasing recognition as a world-class tourism destination has created sustained demand for flexible transportation solutions that enable visitors to explore diverse landscapes, cultural attractions, and adventure opportunities at their own pace.

Infrastructure development across Latin American countries has significantly improved road networks, making self-drive tourism more accessible and appealing to international visitors. Government investments in highway systems, signage improvements, and tourism infrastructure have reduced barriers to independent travel, encouraging more tourists to opt for rental vehicles over traditional guided tours or public transportation.

Economic factors contribute substantially to market growth, including rising middle-class populations in key source markets, increased disposable income levels, and favorable exchange rates that make Latin American destinations more attractive to international visitors. The growing popularity of adventure tourism and eco-tourism has created specific demand for specialized vehicles capable of accessing remote destinations and natural attractions.

Digital revolution in travel planning and booking has transformed how tourists access rental services. Mobile applications, online comparison platforms, and integrated booking systems have made vehicle rental more convenient and transparent, reducing traditional barriers to adoption. Social media influence and travel blogging have also promoted self-drive tourism experiences, inspiring more travelers to explore destinations independently.

Operational challenges present significant constraints to market expansion, particularly regarding regulatory complexities and varying legal requirements across different Latin American countries. International tourists often face bureaucratic hurdles related to driving license recognition, insurance requirements, and cross-border travel restrictions that can discourage rental vehicle usage.

Safety and security concerns remain prominent restraints, as some regions within Latin America experience higher crime rates or infrastructure challenges that make tourists hesitant to drive independently. Concerns about vehicle theft, road safety standards, and emergency support availability can limit market penetration, particularly among first-time visitors to the region.

Economic volatility characteristic of some Latin American markets creates uncertainty for both operators and customers. Currency fluctuations, inflation pressures, and economic instability can impact pricing strategies and customer purchasing power, creating challenges for sustainable business operations and long-term planning.

Infrastructure limitations in certain areas, including inadequate road maintenance, limited fuel station networks, and poor signage systems, can restrict the geographic scope of rental operations. These limitations particularly affect access to remote tourism destinations and adventure travel opportunities that could otherwise drive market growth.

Emerging opportunities within the Latin America tourism vehicle rental market present substantial potential for growth and innovation. The increasing popularity of sustainable tourism creates demand for electric and hybrid vehicle options, positioning environmentally conscious rental companies to capture growing market segments focused on reducing carbon footprints during travel.

Technology integration offers numerous opportunities for service enhancement and operational efficiency improvements. Advanced GPS systems, real-time traffic updates, mobile payment solutions, and artificial intelligence-driven customer service can differentiate companies and improve customer experiences. Internet of Things (IoT) applications enable better fleet management, predictive maintenance, and enhanced security features.

Market expansion into underserved regions and emerging tourism destinations presents significant growth potential. As Latin American countries develop new tourism infrastructure and promote previously unexplored destinations, rental companies can establish early market presence and build competitive advantages. Adventure tourism growth creates specific opportunities for specialized vehicle offerings, including off-road vehicles, camping equipment rentals, and expedition support services.

Partnership development with airlines, hotels, tourism boards, and local attractions can create integrated service offerings that enhance customer value and increase market penetration. Corporate travel represents an underexplored segment, with opportunities to serve business travelers and corporate events requiring flexible transportation solutions.

Complex interactions between various market forces shape the Latin America tourism vehicle rental landscape, creating a dynamic environment characterized by rapid change and continuous adaptation. Supply and demand fluctuations driven by seasonal tourism patterns, economic conditions, and external factors such as global events significantly impact market operations and strategic planning.

Competitive dynamics involve intense rivalry between international rental chains, regional operators, and emerging local companies, each leveraging different competitive advantages. International companies bring brand recognition and standardized services, while local operators offer cultural expertise and specialized knowledge of regional tourism patterns. Market consolidation trends indicate that successful companies are those that combine global resources with local market understanding.

Regulatory environment varies significantly across Latin American countries, creating complex operational requirements for companies operating in multiple markets. Changes in tourism policies, environmental regulations, and transportation laws can rapidly alter market conditions and competitive positioning. Government support for tourism development generally benefits the sector, but regulatory uncertainty can create challenges for long-term investment planning.

Customer behavior evolution reflects changing travel preferences, with tourists increasingly seeking authentic, flexible, and personalized experiences. The rise of digital natives as a primary customer segment has accelerated demand for seamless online experiences, mobile integration, and instant service delivery. Sustainability awareness among travelers is driving demand for eco-friendly vehicle options and carbon-neutral rental services.

Comprehensive research approach employed in analyzing the Latin America tourism vehicle rental market combines quantitative and qualitative methodologies to provide accurate and actionable market intelligence. Primary research activities include extensive surveys of industry participants, customer interviews, and direct engagement with key stakeholders across the tourism and transportation sectors.

Data collection methods encompass multiple sources to ensure comprehensive market coverage and analytical depth. Industry databases, government tourism statistics, trade association reports, and company financial disclosures provide quantitative foundations for market analysis. Field research conducted across major Latin American tourism destinations offers insights into operational realities and customer experiences.

Analytical frameworks utilize advanced statistical methods and market modeling techniques to identify trends, forecast growth patterns, and assess competitive dynamics. Cross-referencing multiple data sources ensures accuracy and reliability of findings, while sensitivity analysis accounts for various market scenarios and potential disruptions.

Expert consultation with industry leaders, tourism officials, and market specialists provides qualitative insights that complement quantitative analysis. Regular engagement with MarkWide Research industry networks ensures access to current market intelligence and emerging trend identification. Validation processes include peer review and stakeholder feedback to ensure research findings accurately reflect market realities.

Brazil dominates the Latin America tourism vehicle rental market, accounting for approximately 42% of regional market share due to its large domestic tourism market, extensive road infrastructure, and significant international visitor volumes. The country’s diverse tourism offerings, from beach destinations to urban centers and natural attractions, create sustained demand for rental vehicles across multiple market segments.

Mexico represents the second-largest market, with 28% market share, driven by its proximity to North American markets and well-developed tourism infrastructure. The country benefits from established rental networks, strong international brand presence, and diverse tourism offerings that appeal to various customer segments. Resort destinations like Cancun and Puerto Vallarta generate significant rental demand from international visitors.

Argentina captures approximately 12% of market share, with Buenos Aires serving as a major hub for both domestic and international tourism. The country’s emphasis on cultural tourism and wine country experiences creates specific demand for rental vehicles that enable exploration of diverse regions. Economic volatility has created challenges but also opportunities for companies that can adapt to changing conditions.

Colombia and Chile each represent emerging markets with 6% and 5% market shares respectively, showing rapid growth potential as tourism infrastructure develops and international recognition increases. Costa Rica, Peru, and other markets collectively account for the remaining market share, with each offering unique opportunities related to eco-tourism, adventure travel, and cultural experiences.

Market leadership in the Latin America tourism vehicle rental sector is characterized by a diverse mix of international corporations, regional chains, and local operators, each competing through different value propositions and market strategies. The competitive environment has intensified with the entry of technology-driven companies and peer-to-peer platforms that challenge traditional business models.

Major international players maintain significant market presence through established brand recognition, standardized service offerings, and extensive airport and urban location networks. These companies leverage global resources, fleet management expertise, and international customer loyalty programs to compete effectively across multiple Latin American markets.

Emerging competitors include technology-driven platforms and local companies that leverage digital innovation, cultural expertise, and specialized service offerings to capture market share from established players.

Market segmentation analysis reveals distinct customer groups and service categories that define the Latin America tourism vehicle rental landscape. Understanding these segments enables companies to develop targeted strategies and optimize service offerings for specific market needs and preferences.

By Vehicle Type:

By Customer Segment:

Economy vehicle segment represents the largest category by volume, accounting for approximately 45% of total rentals, driven by price-sensitive tourists and budget travel trends. This segment benefits from high demand among backpackers, young travelers, and cost-conscious families seeking basic transportation for urban and short-distance travel. Competitive pricing and fuel efficiency are primary decision factors for this customer group.

SUV and 4WD category shows the fastest growth rate at 12.5% annually, reflecting increasing popularity of adventure tourism and eco-tourism experiences that require vehicles capable of accessing remote destinations. This segment commands premium pricing and higher profit margins, making it attractive for rental companies despite lower overall volume compared to economy options.

Luxury vehicle segment maintains steady demand among affluent travelers and business customers, representing approximately 8% of total market volume but contributing disproportionately to revenue due to premium pricing. This category benefits from growing wealth in source markets and increasing demand for experiential luxury travel.

Specialty vehicles including motorcycles, RVs, and adventure equipment represent emerging categories with significant growth potential. Motorcycle rentals are particularly popular in countries like Colombia and Costa Rica, where scenic routes and favorable weather conditions support two-wheel tourism experiences. RV rentals are gaining traction among travelers seeking extended exploration capabilities and accommodation flexibility.

Tourism operators benefit significantly from robust vehicle rental markets through enhanced destination accessibility and visitor satisfaction. Reliable transportation options enable tourists to explore diverse attractions, extend their stays, and increase overall spending within destinations. Partnership opportunities with rental companies create integrated service packages that improve customer experiences and generate additional revenue streams.

Government stakeholders realize substantial benefits through increased tourism revenue, job creation, and economic development in both urban and rural areas. Vehicle rental services enable tourists to access previously underexplored regions, distributing economic benefits more broadly across territories. Tax revenue generation from rental transactions and related tourism spending contributes to public finances and infrastructure development.

Local communities benefit from increased tourist accessibility, which drives demand for accommodation, dining, and activity services in areas that might otherwise be difficult to reach. Employment opportunities in vehicle rental operations, maintenance, and support services provide direct economic benefits, while increased tourism spending supports broader community development.

Rental companies themselves benefit from growing market demand, opportunities for service diversification, and potential for geographic expansion. Technology integration enables operational efficiency improvements, cost reduction, and enhanced customer service capabilities. Fleet utilization optimization through data analytics and demand forecasting improves profitability and competitive positioning.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend reshaping the Latin America tourism vehicle rental market, with companies investing heavily in mobile applications, online booking platforms, and contactless service delivery. Artificial intelligence and machine learning applications are optimizing fleet management, pricing strategies, and customer service operations, enabling more efficient and responsive business models.

Sustainability initiatives are gaining momentum as environmental consciousness among travelers increases and governments implement stricter emission regulations. Rental companies are expanding their electric and hybrid vehicle offerings, with some markets showing 25% annual growth in eco-friendly vehicle demand. Carbon offset programs and sustainable tourism partnerships are becoming standard offerings for environmentally conscious customers.

Subscription and flexible rental models are emerging as alternatives to traditional daily and weekly rental structures. These models cater to changing travel patterns, including longer stays, remote work arrangements, and flexible itineraries. Peer-to-peer platforms are also gaining traction, enabling private vehicle owners to participate in the rental market and increasing overall vehicle availability.

Integration with smart city initiatives and urban mobility solutions is creating new opportunities for rental companies to participate in comprehensive transportation ecosystems. Multi-modal transportation partnerships combine vehicle rental with public transit, ride-sharing, and other mobility options to provide seamless travel experiences for tourists and residents alike.

Strategic acquisitions and partnerships have accelerated across the Latin America tourism vehicle rental market as companies seek to expand geographic coverage and enhance service capabilities. Major international players are acquiring local operators to gain market access and cultural expertise, while regional companies are forming alliances to compete more effectively against global brands.

Technology investments have reached unprecedented levels, with companies implementing advanced fleet management systems, predictive maintenance capabilities, and enhanced customer interface technologies. MarkWide Research analysis indicates that technology spending in the sector has increased by 40% annually over the past three years, reflecting the critical importance of digital capabilities for competitive success.

Fleet electrification initiatives are expanding rapidly, with several major operators announcing commitments to achieve significant electric vehicle penetration within their fleets by 2030. These initiatives are supported by government incentives, charging infrastructure development, and growing customer demand for sustainable transportation options.

Service diversification trends include expansion into related services such as tourism planning, accommodation booking, and activity coordination. Companies are positioning themselves as comprehensive travel solution providers rather than simple vehicle rental operators, creating additional revenue streams and customer touchpoints.

Market entry strategies should prioritize partnerships with established local operators rather than attempting independent market penetration, particularly for international companies seeking to expand into new Latin American markets. Cultural adaptation and local market expertise are critical success factors that can be more effectively obtained through strategic alliances than organic development.

Technology investment should focus on mobile-first customer experiences and operational efficiency improvements rather than attempting to compete solely on price. Companies that successfully integrate digital capabilities with personalized service delivery will achieve sustainable competitive advantages in increasingly crowded markets.

Fleet composition optimization requires careful analysis of local market preferences and tourism patterns. Demand forecasting systems should account for seasonal variations, economic conditions, and emerging travel trends to optimize vehicle availability and minimize operational costs. Sustainability considerations should be integrated into fleet planning to anticipate future regulatory requirements and customer preferences.

Partnership development with tourism ecosystem participants including hotels, airlines, and attraction operators can create differentiated value propositions and improve customer acquisition efficiency. Revenue sharing models and integrated booking systems enable seamless customer experiences while expanding market reach for all participants.

Growth trajectory for the Latin America tourism vehicle rental market remains positive, with industry analysts projecting sustained expansion driven by increasing tourism volumes, infrastructure improvements, and evolving travel preferences. Market maturation in established destinations will be balanced by growth opportunities in emerging tourism regions and specialized market segments.

Technology evolution will continue to reshape market dynamics, with autonomous vehicle technologies, advanced connectivity features, and artificial intelligence applications creating new service possibilities and operational efficiencies. Customer expectations will increasingly center on seamless digital experiences, personalized service delivery, and integrated travel solutions that extend beyond basic vehicle rental.

Sustainability requirements will become more stringent, driving accelerated adoption of electric and hybrid vehicles across rental fleets. Companies that proactively address environmental concerns and integrate sustainability into their core business models will achieve competitive advantages and regulatory compliance benefits. MWR projections indicate that electric vehicles could represent 30% of rental fleets in major markets by 2030.

Market consolidation is expected to continue as companies seek scale advantages and geographic expansion capabilities. Successful operators will be those that combine global resources with local market expertise, technology leadership with personalized service delivery, and operational efficiency with customer experience excellence. Innovation in service delivery and business model adaptation will determine long-term competitive positioning in this dynamic market environment.

The Latin America tourism vehicle rental market stands at a pivotal juncture, characterized by robust growth potential, technological transformation, and evolving customer expectations. Market dynamics indicate a sector that has successfully adapted to changing travel patterns while positioning itself for sustained expansion through innovation and strategic development. Regional diversity creates multiple growth opportunities, with each market offering unique characteristics and competitive advantages for well-positioned operators.

Success factors in this market increasingly center on technology integration, sustainability initiatives, and comprehensive service offerings that extend beyond traditional vehicle rental. Companies that embrace digital transformation while maintaining focus on customer experience and local market expertise will achieve competitive advantages in an increasingly sophisticated marketplace. Partnership strategies and ecosystem integration represent critical pathways for sustainable growth and market leadership.

The future outlook remains optimistic, with MarkWide Research analysis indicating continued market expansion driven by tourism growth, infrastructure development, and changing mobility preferences. Companies that proactively address sustainability requirements, invest in technology capabilities, and develop comprehensive service offerings will be best positioned to capitalize on emerging opportunities and achieve long-term success in the dynamic Latin America tourism vehicle rental market.

What is Tourism Vehicle Rental?

Tourism Vehicle Rental refers to the service of renting vehicles specifically for travel and tourism purposes, allowing travelers to explore destinations at their own pace. This includes a variety of vehicles such as cars, vans, and SUVs tailored for tourists.

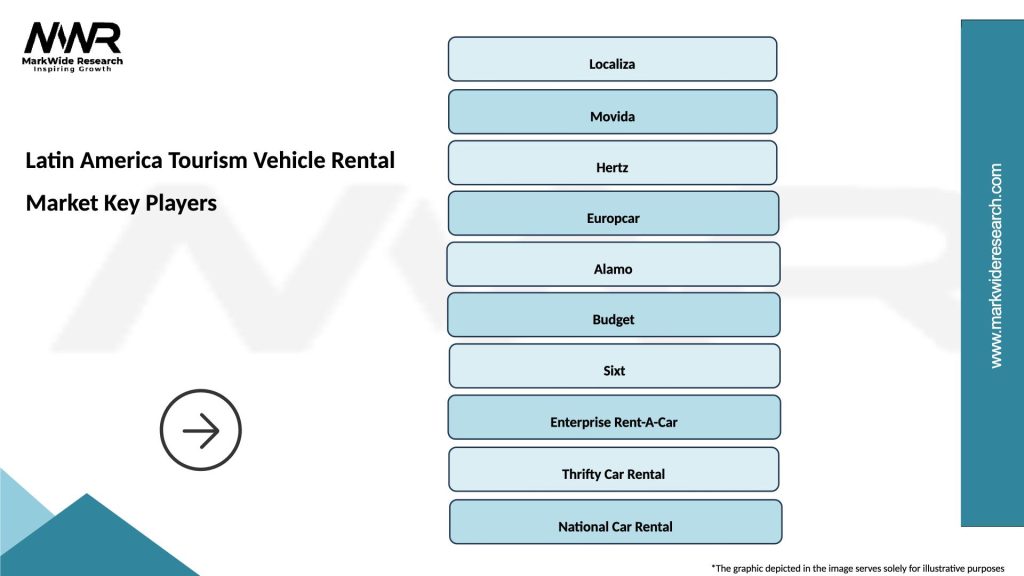

What are the key players in the Latin America Tourism Vehicle Rental Market?

Key players in the Latin America Tourism Vehicle Rental Market include companies like Localiza, Movida, and Hertz, which offer a range of rental options for tourists. These companies compete on factors such as pricing, vehicle availability, and customer service, among others.

What are the growth factors driving the Latin America Tourism Vehicle Rental Market?

The Latin America Tourism Vehicle Rental Market is driven by increasing tourism activities, a growing middle class with disposable income, and the rise of online booking platforms. Additionally, the demand for flexible travel options contributes to market growth.

What challenges does the Latin America Tourism Vehicle Rental Market face?

Challenges in the Latin America Tourism Vehicle Rental Market include regulatory hurdles, fluctuating fuel prices, and competition from ride-sharing services. These factors can impact profitability and operational efficiency for rental companies.

What opportunities exist in the Latin America Tourism Vehicle Rental Market?

Opportunities in the Latin America Tourism Vehicle Rental Market include the expansion of eco-friendly vehicle options, partnerships with travel agencies, and the integration of technology for enhanced customer experiences. These trends can help companies capture a larger market share.

What trends are shaping the Latin America Tourism Vehicle Rental Market?

Trends in the Latin America Tourism Vehicle Rental Market include the increasing popularity of electric vehicles, the use of mobile apps for booking and customer service, and a focus on sustainable practices. These innovations are reshaping how rental services operate and attract customers.

Latin America Tourism Vehicle Rental Market

| Segmentation Details | Description |

|---|---|

| Vehicle Type | SUV, Sedan, Minivan, Pickup |

| Booking Channel | Online, Travel Agency, Direct, Mobile App |

| Customer Type | Leisure, Business, Group, Corporate |

| Rental Duration | Short-term, Long-term, Weekend, Weekly |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Latin America Tourism Vehicle Rental Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at