444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Latin America telecom tower market represents a dynamic and rapidly evolving sector that serves as the backbone of the region’s telecommunications infrastructure. This market encompasses the construction, maintenance, and operation of cellular towers, broadcast towers, and other telecommunications infrastructure across countries including Brazil, Mexico, Argentina, Colombia, Chile, and Peru. The region’s telecom tower landscape is experiencing unprecedented transformation driven by the accelerated deployment of 5G networks, increasing mobile data consumption, and the growing demand for enhanced connectivity solutions.

Market dynamics indicate that Latin America’s telecom tower sector is witnessing substantial growth, with expansion rates reaching approximately 8.5% CAGR across key markets. The region’s unique geographical challenges, including vast rural areas and diverse topographical conditions, create significant opportunities for tower infrastructure development. Mobile network operators are increasingly partnering with independent tower companies to optimize their infrastructure investments and accelerate network coverage expansion.

Infrastructure sharing has emerged as a critical trend, with tower companies facilitating cost-effective solutions for multiple operators. The market is characterized by a mix of traditional macro towers, small cells, and distributed antenna systems that collectively support the region’s growing connectivity demands. Digital transformation initiatives across Latin American countries are driving substantial investments in telecommunications infrastructure, positioning the telecom tower market as a fundamental enabler of economic growth and technological advancement.

The Latin America telecom tower market refers to the comprehensive ecosystem of telecommunications infrastructure assets, services, and technologies that enable wireless communication across the Latin American region. This market encompasses the design, construction, ownership, operation, and maintenance of various types of telecommunications towers, including macro cell towers, small cell installations, distributed antenna systems, and broadcast transmission facilities that support mobile network operators, internet service providers, and broadcasting companies.

Telecom towers serve as the physical foundation for wireless communication networks, housing antennas, transmitters, receivers, and other essential equipment that facilitate voice, data, and multimedia services. The market includes both traditional steel lattice towers and modern monopole structures, as well as innovative solutions such as concealed towers and rooftop installations that address aesthetic and zoning requirements in urban environments.

Tower infrastructure in Latin America supports multiple technologies simultaneously, including 2G, 3G, 4G LTE, and emerging 5G networks. The market encompasses various business models, from traditional operator-owned towers to independent tower companies that lease space to multiple tenants, creating shared infrastructure solutions that optimize capital efficiency and accelerate network deployment across the region’s diverse geographical landscape.

Latin America’s telecom tower market is experiencing robust expansion driven by accelerating digital transformation, increasing mobile penetration, and the urgent need for enhanced network capacity. The market benefits from favorable regulatory environments, growing foreign investment, and strategic partnerships between international tower companies and local operators. Infrastructure sharing models are gaining significant traction, with approximately 72% of new tower deployments incorporating multi-tenant capabilities to maximize operational efficiency.

Key market drivers include the rapid rollout of 4G networks across underserved regions, preparation for 5G deployment, and increasing demand for high-speed mobile broadband services. The market is witnessing substantial consolidation as major tower companies expand their portfolios through strategic acquisitions and build-to-suit agreements with mobile network operators. Rural connectivity initiatives supported by government programs are creating new opportunities for tower deployment in previously underserved areas.

Technology evolution is reshaping the market landscape, with smart towers incorporating advanced monitoring systems, renewable energy solutions, and edge computing capabilities. The integration of Internet of Things (IoT) sensors and artificial intelligence is enabling predictive maintenance and optimized network performance. Sustainability considerations are becoming increasingly important, with tower companies investing in green technologies and energy-efficient solutions to reduce operational costs and environmental impact.

Strategic market insights reveal several critical trends shaping the Latin America telecom tower landscape. The following key insights provide comprehensive understanding of market dynamics:

Primary market drivers propelling the Latin America telecom tower market include the exponential growth in mobile data consumption, accelerated by streaming services, social media usage, and remote work trends. The region’s mobile data traffic is experiencing annual growth rates exceeding 35%, necessitating continuous network capacity expansion and infrastructure upgrades. Digital inclusion initiatives supported by governments across the region are creating substantial demand for new tower installations in underserved communities.

5G network deployment represents a transformative driver, requiring significant infrastructure investments and tower densification to support higher frequency bands and enhanced network capabilities. Mobile network operators are partnering with tower companies to accelerate 5G rollout while optimizing capital allocation. Internet of Things adoption across industries is driving demand for enhanced connectivity solutions, requiring expanded tower coverage and improved network reliability.

Economic digitization initiatives are compelling businesses and governments to invest in robust telecommunications infrastructure. The COVID-19 pandemic has accelerated digital transformation across Latin America, highlighting the critical importance of reliable connectivity for economic continuity. E-commerce growth and digital payment adoption are creating sustained demand for high-quality mobile networks, driving continuous tower infrastructure expansion and modernization efforts throughout the region.

Significant market restraints include complex regulatory environments and lengthy permitting processes that can delay tower construction projects. Environmental regulations and community opposition to tower installations create challenges for site acquisition and development. Zoning restrictions in urban areas limit available locations for new towers, requiring innovative solutions such as concealed installations and rooftop deployments that increase project costs and complexity.

Economic volatility across Latin American countries affects capital investment decisions and financing availability for infrastructure projects. Currency fluctuations and inflation concerns impact long-term investment planning and project profitability. Political instability in certain regions creates uncertainty for international investors and may delay infrastructure development initiatives.

Technical challenges include the need for specialized equipment and expertise to support advanced technologies such as 5G networks. The shortage of skilled technicians and engineers in some markets constrains project execution capabilities. Security concerns related to critical infrastructure protection require additional investments in physical security and cybersecurity measures, increasing operational costs and complexity for tower operators throughout the region.

Substantial market opportunities emerge from the growing demand for edge computing infrastructure, with telecom towers serving as ideal locations for edge data centers and content delivery networks. The integration of edge computing capabilities into tower infrastructure creates new revenue streams and enhances service offerings for mobile network operators and enterprise customers.

Smart city initiatives across major Latin American metropolitan areas present significant opportunities for tower companies to provide integrated infrastructure solutions. These projects require comprehensive connectivity solutions that combine traditional cellular coverage with IoT networks, public Wi-Fi, and smart traffic management systems. Public-private partnerships are emerging as effective mechanisms for financing and implementing large-scale infrastructure projects.

Renewable energy integration offers opportunities for tower companies to reduce operational costs while supporting sustainability goals. Solar power systems, wind generation, and hybrid energy solutions can significantly reduce electricity expenses and improve environmental performance. Tower sharing expansion into new verticals, including broadcasting, public safety, and utility companies, creates additional revenue opportunities and improves infrastructure utilization efficiency across diverse market segments.

Market dynamics in the Latin America telecom tower sector are characterized by increasing consolidation as major international tower companies expand their regional presence through strategic acquisitions. The market is witnessing a shift from operator-owned infrastructure to independent tower company models, with infrastructure sharing becoming the preferred approach for network expansion. This transformation is driven by the need to optimize capital efficiency and accelerate network deployment timelines.

Competitive dynamics are intensifying as tower companies differentiate their offerings through value-added services, including site acquisition, network planning, and maintenance services. The emergence of neutral host solutions is enabling smaller operators to access high-quality infrastructure without significant capital investments. Technology partnerships between tower companies and equipment vendors are accelerating innovation in areas such as small cell deployment and network optimization.

Regulatory dynamics are evolving to support infrastructure sharing and streamline tower deployment processes. Governments are recognizing the strategic importance of telecommunications infrastructure for economic development and are implementing policies to facilitate investment and reduce barriers to entry. MarkWide Research analysis indicates that regulatory harmonization across the region is improving market accessibility for international investors and promoting cross-border infrastructure development initiatives.

Comprehensive research methodology employed for analyzing the Latin America telecom tower market incorporates both primary and secondary research approaches to ensure accuracy and reliability of market insights. Primary research includes extensive interviews with industry executives, tower company representatives, mobile network operators, and regulatory officials across key Latin American markets to gather firsthand perspectives on market trends and challenges.

Secondary research encompasses analysis of industry reports, regulatory filings, financial statements, and government publications to establish market baselines and validate primary research findings. The methodology includes quantitative analysis of tower deployment data, network coverage statistics, and investment flows to identify market patterns and growth trajectories. Market modeling techniques are applied to project future market developments and assess the impact of various scenarios on market growth.

Data validation processes ensure research accuracy through cross-referencing multiple sources and conducting follow-up interviews with key stakeholders. The research methodology incorporates geographic analysis to account for regional variations in market conditions, regulatory environments, and competitive landscapes. Trend analysis examines historical market performance to identify cyclical patterns and emerging opportunities that may influence future market development across the Latin American telecommunications infrastructure sector.

Brazil dominates the Latin America telecom tower market, accounting for approximately 42% of regional tower installations, driven by its large population, extensive geographical area, and advanced telecommunications infrastructure. The Brazilian market benefits from favorable regulatory conditions and significant foreign investment in tower infrastructure. Mexico represents the second-largest market, with robust growth driven by 4G network expansion and preparation for 5G deployment across urban and rural areas.

Argentina and Colombia are experiencing accelerated tower deployment to support network modernization and coverage expansion initiatives. These markets benefit from government programs promoting digital inclusion and rural connectivity. Chile and Peru are witnessing increased investment in tower infrastructure to support mining operations and improve connectivity in remote regions. The unique geographical challenges in these countries create opportunities for specialized tower solutions.

Central American markets, including Costa Rica, Panama, and Guatemala, are emerging as attractive investment destinations due to their strategic locations and growing economies. These markets offer opportunities for regional tower companies to establish presence and support cross-border connectivity initiatives. Caribbean markets present unique opportunities for tower deployment to support tourism infrastructure and improve disaster resilience through enhanced communication networks.

The competitive landscape in the Latin America telecom tower market is characterized by the presence of major international tower companies alongside regional players and operator-owned infrastructure. Key market participants include:

Competitive strategies focus on geographic expansion, technology innovation, and value-added services to differentiate market offerings. Companies are investing in smart tower technologies and renewable energy solutions to improve operational efficiency and reduce environmental impact.

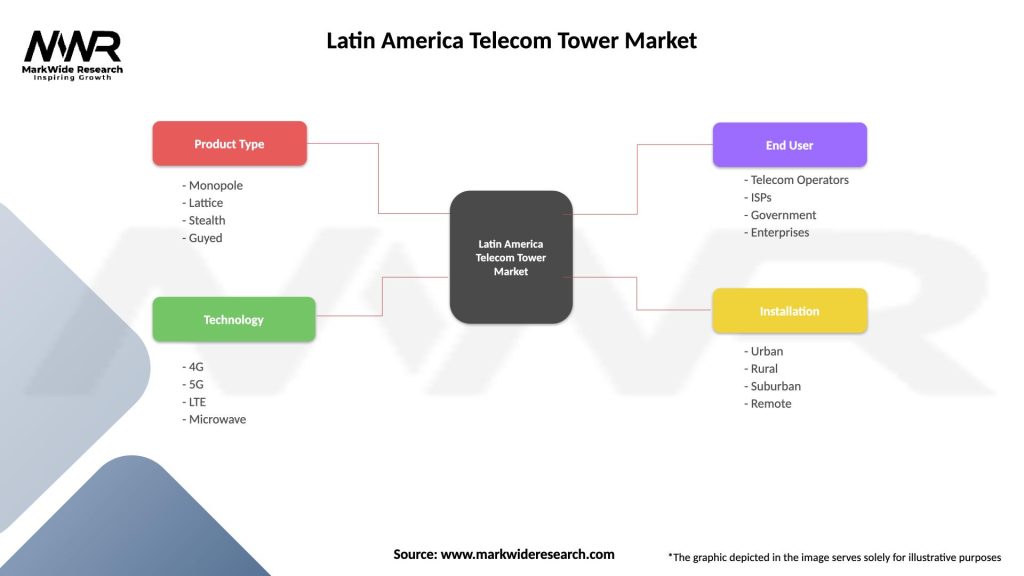

Market segmentation analysis reveals distinct categories based on tower type, technology support, ownership model, and application. The segmentation provides comprehensive understanding of market dynamics and growth opportunities across different infrastructure categories.

By Tower Type:

By Technology Support:

By Ownership Model:

Macro tower installations continue to represent the largest segment of the Latin America telecom tower market, driven by the need for wide-area coverage across the region’s vast geographical areas. These installations are experiencing modernization to support multiple technologies and increased tenant capacity. Tower sharing ratios for macro towers are improving, with average tenancy rates reaching approximately 2.3 tenants per tower across major markets.

Small cell deployment is accelerating in urban areas, particularly in Brazil and Mexico, where network densification is required to support high data consumption and prepare for 5G services. These installations offer higher revenue per square meter but require different deployment strategies and regulatory approaches. Urban small cell networks are experiencing growth rates exceeding 25% annually in major metropolitan areas.

Distributed antenna systems are gaining traction in commercial buildings, airports, and large venues where traditional tower coverage is insufficient. These systems require specialized technical expertise and closer integration with building infrastructure. Enterprise DAS solutions are becoming increasingly important for supporting business continuity and digital transformation initiatives across various industry sectors throughout the region.

Mobile network operators benefit significantly from tower sharing arrangements that reduce capital expenditure requirements and accelerate network deployment timelines. Infrastructure sharing enables operators to focus resources on core competencies such as customer service and network optimization while leveraging specialized tower company expertise for infrastructure management. Operators gain access to prime tower locations and benefit from economies of scale in maintenance and operations.

Tower companies benefit from diversified revenue streams through multi-tenant business models that improve asset utilization and financial performance. The recurring revenue nature of tower leasing provides stable cash flows and attractive returns on investment. Operational efficiencies achieved through portfolio management and standardized processes create competitive advantages and improved profitability across diverse market conditions.

Government stakeholders benefit from improved telecommunications infrastructure that supports economic development, digital inclusion, and emergency communications capabilities. Enhanced connectivity facilitates e-government services, educational initiatives, and healthcare delivery in remote areas. Infrastructure investment creates employment opportunities and stimulates economic activity in construction, engineering, and technology sectors throughout the region.

Strengths:

Weaknesses:

Opportunities:

Threats:

Infrastructure sharing acceleration represents the most significant trend reshaping the Latin America telecom tower market, with operators increasingly adopting neutral host models to optimize capital efficiency. This trend is driving consolidation among tower companies and creating opportunities for specialized infrastructure providers. Multi-tenant tower utilization is improving across the region, with some markets achieving tenancy ratios exceeding 3.0 tenants per tower.

Green tower initiatives are gaining momentum as companies focus on sustainability and operational cost reduction. Solar power integration, energy-efficient equipment, and hybrid power systems are becoming standard features in new tower deployments. Renewable energy adoption in tower operations is reducing electricity costs by up to 60% in suitable locations while supporting corporate sustainability goals.

Smart tower technology integration is transforming traditional infrastructure into intelligent assets capable of supporting multiple services beyond basic connectivity. IoT sensors, remote monitoring systems, and predictive maintenance capabilities are improving operational efficiency and reducing downtime. MWR research indicates that smart tower deployments are experiencing rapid adoption, with implementation rates growing by approximately 45% annually across major Latin American markets.

Recent industry developments include major international tower companies expanding their Latin American portfolios through strategic acquisitions and partnerships with local operators. These transactions are consolidating the market and bringing advanced technologies and operational expertise to regional markets. Cross-border infrastructure projects are emerging to improve connectivity between countries and support regional economic integration initiatives.

Technology partnerships between tower companies and equipment vendors are accelerating innovation in areas such as small cell deployment, network optimization, and energy management. These collaborations are enabling faster deployment of advanced technologies and improving service quality for mobile network operators. 5G pilot programs are being launched across major cities to test network capabilities and prepare for commercial deployment.

Regulatory developments include streamlined permitting processes and infrastructure sharing mandates that are facilitating market growth and competition. Government initiatives promoting digital inclusion are creating new opportunities for tower deployment in underserved areas. Public-private partnerships are being established to finance and implement large-scale connectivity projects in rural and remote regions throughout Latin America.

Industry analysts recommend that tower companies focus on geographic diversification and technology innovation to capitalize on emerging market opportunities. Companies should prioritize investments in 5G-ready infrastructure and smart tower technologies to differentiate their offerings and create competitive advantages. Strategic partnerships with mobile network operators and technology vendors are essential for accessing new markets and accelerating service innovation.

Operational excellence should be a primary focus, with companies investing in advanced monitoring systems, predictive maintenance capabilities, and energy-efficient technologies to improve profitability and service quality. Sustainability initiatives are becoming increasingly important for attracting investment and meeting corporate responsibility objectives. Companies should develop comprehensive environmental strategies that include renewable energy adoption and carbon footprint reduction.

Market expansion strategies should consider the unique characteristics of different Latin American markets, including regulatory environments, competitive landscapes, and customer requirements. Companies should develop local partnerships and expertise to navigate complex market conditions and optimize their expansion approaches. MarkWide Research analysis suggests that companies with strong local presence and cultural understanding achieve superior performance in Latin American markets.

The future outlook for the Latin America telecom tower market remains highly positive, with continued growth expected across all major market segments. The transition to 5G networks will drive substantial infrastructure investment and create opportunities for tower densification and technology upgrades. Market growth projections indicate sustained expansion at rates approaching 9.2% CAGR over the next five years, driven by increasing connectivity demands and digital transformation initiatives.

Technology evolution will continue reshaping the market landscape, with edge computing, IoT integration, and artificial intelligence becoming standard features of modern tower infrastructure. The convergence of telecommunications and computing infrastructure will create new revenue opportunities and service models for tower companies. Smart city development across major Latin American metropolitan areas will drive demand for comprehensive connectivity solutions that combine traditional cellular coverage with advanced digital services.

Sustainability considerations will become increasingly important, with environmental performance and energy efficiency becoming key differentiators in the market. Companies that successfully integrate renewable energy solutions and implement circular economy principles will achieve competitive advantages and attract environmentally conscious investors. The market is expected to witness continued consolidation as companies seek to achieve economies of scale and expand their geographic presence across the diverse Latin American telecommunications landscape.

The Latin America telecom tower market represents a dynamic and rapidly evolving sector that serves as the foundation for the region’s digital transformation. With robust growth driven by increasing mobile data consumption, 5G network deployment, and government initiatives promoting digital inclusion, the market offers substantial opportunities for tower companies, mobile network operators, and technology providers. The shift toward infrastructure sharing models and the integration of advanced technologies are reshaping traditional business approaches and creating new value propositions.

Market participants must navigate complex regulatory environments, diverse geographical challenges, and varying economic conditions across different Latin American countries. Success in this market requires strategic partnerships, local expertise, and continuous innovation in technology and service delivery. The emphasis on sustainability and operational efficiency is driving adoption of renewable energy solutions and smart tower technologies that improve both environmental performance and financial returns.

Looking forward, the Latin America telecom tower market is positioned for continued expansion as digital transformation accelerates across the region. Companies that successfully adapt to changing market conditions, invest in advanced technologies, and develop strong local partnerships will be best positioned to capitalize on the substantial growth opportunities in this critical infrastructure sector that enables connectivity, economic development, and social progress throughout Latin America.

What is Telecom Tower?

Telecom towers are structures that support antennas and other equipment for telecommunications services, enabling wireless communication for mobile networks, broadcasting, and data transmission.

What are the key players in the Latin America Telecom Tower Market?

Key players in the Latin America Telecom Tower Market include American Tower Corporation, Crown Castle, and SBA Communications, among others.

What are the main drivers of growth in the Latin America Telecom Tower Market?

The growth of the Latin America Telecom Tower Market is driven by increasing mobile data consumption, the expansion of 5G networks, and the rising demand for improved connectivity in urban and rural areas.

What challenges does the Latin America Telecom Tower Market face?

Challenges in the Latin America Telecom Tower Market include regulatory hurdles, high infrastructure costs, and the need for land acquisition, which can delay tower deployment.

What opportunities exist in the Latin America Telecom Tower Market?

Opportunities in the Latin America Telecom Tower Market include the potential for partnerships with local governments, the growth of IoT applications, and the increasing need for smart city infrastructure.

What trends are shaping the Latin America Telecom Tower Market?

Trends in the Latin America Telecom Tower Market include the adoption of small cell technology, the integration of renewable energy sources, and the focus on enhancing network resilience and coverage.

Latin America Telecom Tower Market

| Segmentation Details | Description |

|---|---|

| Product Type | Monopole, Lattice, Stealth, Guyed |

| Technology | 4G, 5G, LTE, Microwave |

| End User | Telecom Operators, ISPs, Government, Enterprises |

| Installation | Urban, Rural, Suburban, Remote |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Latin America Telecom Tower Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at